Assignment Of Partnership Interest: Definition & Sample

Jump to section.

ContractsCounsel has assisted 27 clients with assignments of partnership interest and maintains a network of 38 business lawyers available daily.

What is an Assignment Of Partnership Interest?

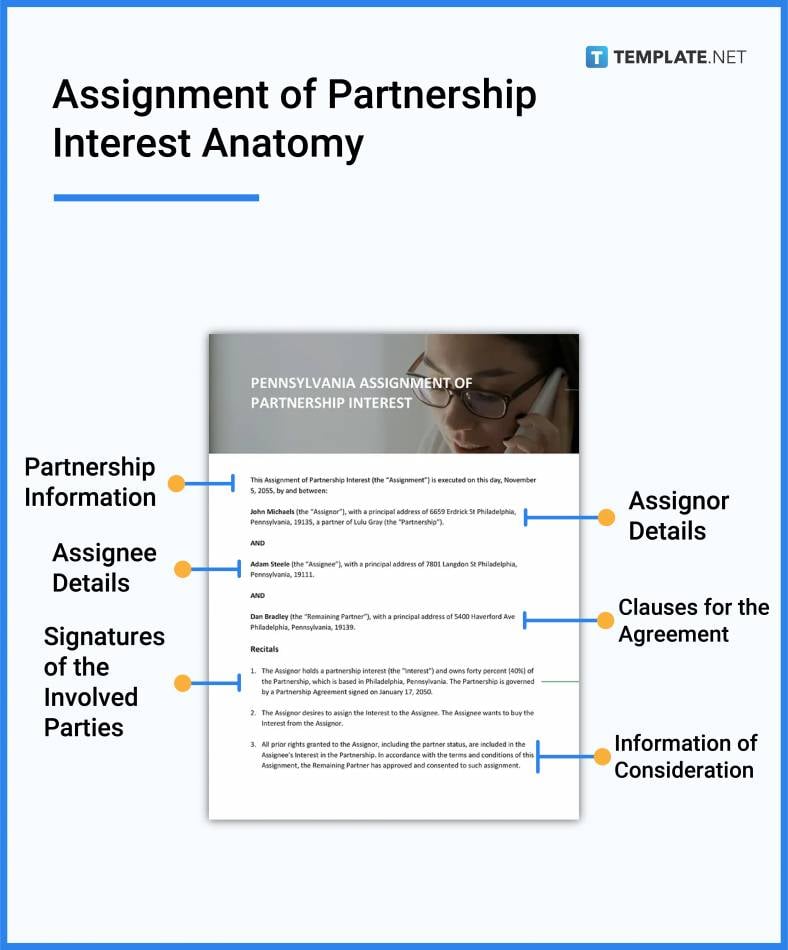

- Information about the partnership like the name of the business

- The type of interest being transferred

- The names and information of both the assignor and the assignee

- Information about the remaining partners

Common Sections in Assignments Of Partnership Interest

Below is a list of common sections included in Assignments Of Partnership Interest. These sections are linked to the below sample agreement for you to explore.

Assignment Of Partnership Interest Sample

Reference : Security Exchange Commission - Edgar Database, EX-10.37 15 dex1037.htm FORM OF AGREEMENT AND ASSIGNMENT OF PARTNERSHIP INTEREST , Viewed October 25, 2021, View Source on SEC .

Who Helps With Assignments Of Partnership Interest?

Lawyers with backgrounds working on assignments of partnership interest work with clients to help. Do you need help with an assignment of partnership interest?

Post a project in ContractsCounsel's marketplace to get free bids from lawyers to draft, review, or negotiate assignments of partnership interest. All lawyers are vetted by our team and peer reviewed by our customers for you to explore before hiring.

ContractsCounsel is not a law firm, and this post should not be considered and does not contain legal advice. To ensure the information and advice in this post are correct, sufficient, and appropriate for your situation, please consult a licensed attorney. Also, using or accessing ContractsCounsel's site does not create an attorney-client relationship between you and ContractsCounsel.

Need help with an Assignment Of Partnership Interest?

Meet some of our assignment of partnership interest lawyers.

Tim advises small businesses, entrepreneurs, and start-ups on a wide range of legal matters. He has experience with company formation and restructuring, capital and equity planning, tax planning and tax controversy, contract drafting, and employment law issues. His clients range from side gig sole proprietors to companies recognized by Inc. magazine.

My name is Ryenne Shaw and I help business owners build businesses that operate as assets instead of liabilities, increase in value over time and build wealth. My areas of expertise include corporate formation and business structure, contract law, employment/labor law, business risk and compliance and intellectual property. I also serve as outside general counsel to several businesses across various industries nationally. I spent most of my early legal career assisting C.E.O.s, General Counsel, and in-house legal counsel of both large and smaller corporations in minimizing liability, protecting business assets and maximizing profits. While working with many of these entities, I realized that smaller entities are often underserved. I saw that smaller business owners weren’t receiving the same level of legal support larger corporations relied upon to grow and sustain. I knew this was a major contributor to the ceiling that most small businesses hit before they’ve even scratched the surface of their potential. And I knew at that moment that all of this lack of knowledge and support was creating a huge wealth gap. After over ten years of legal experience, I started my law firm to provide the legal support small to mid-sized business owners and entrepreneurs need to grow and protect their brands, businesses, and assets. I have a passion for helping small to mid-sized businesses and startups grow into wealth-building assets by leveraging the same legal strategies large corporations have used for years to create real wealth. I enjoy connecting with my clients, learning about their visions and identifying ways to protect and maximize the reach, value and impact of their businesses. I am a strong legal writer with extensive litigation experience, including both federal and state (and administratively), which brings another element to every contract I prepare and the overall counsel and value I provide. Some of my recent projects include: - Negotiating & Drafting Commercial Lease Agreements - Drafting Trademark Licensing Agreements - Drafting Ambassador and Influencer Agreements - Drafting Collaboration Agreements - Drafting Service Agreements for service-providers, coaches and consultants - Drafting Master Service Agreements and SOWs - Drafting Terms of Service and Privacy Policies - Preparing policies and procedures for businesses in highly regulated industries - Drafting Employee Handbooks, Standard Operations and Procedures (SOPs) manuals, employment agreements - Creating Employer-employee infrastructure to ensure business compliance with employment and labor laws - Drafting Independent Contractor Agreements and Non-Disclosure/Non-Competition/Non-Solicitation Agreements - Conducting Federal Trademark Searches and filing trademark applications - Preparing Trademark Opinion Letters after conducting appropriate legal research - Drafting Letters of Opinion for Small Business Loans - Drafting and Responding to Cease and Desist Letters I service clients throughout the United States across a broad range of industries.

I am an attorney located in Denver, Colorado with 13 years of experience working with individuals and businesses of all sizes. My primary areas of practice are general corporate/business law, real estate, commercial transactions and agreements, and M&A. I strive to provide exceptional representation at a reasonable price.

Fractional General Counsel for growing companies, mainly in the financial sector, including companies operating in Mexico or Latin America. My niche includes companies who need day to day legal services, but are not ready to hire an in-house lawyer, and companies whose in-house legal team needs additional support. I am admitted to practice law in the District of Columbia and Mexico. With a bicultural legal education and background, and an extensive network of contacts in both jurisdictions, I’m able to provide efficient and high-quality services to my clients. With more than 18 years of legal experience, I have: - Led the Legal Department of a financial institution held by a public company - Led the Legal Department of a family office holding investments in diverse sectors - Participated on several M&A transactions - Participated on an IPO process - Participated in the purchase of a banking institution in the U.S. by a foreign group of investors - Worked at law firms with international presence Legal experience mainly in Corporate Governance, Securities Regulations, M&A, Corporate Development, Contracts, Corporate Law, Compensation, Policy Development, Investor Relations, among others. Non-for-profit Board and pro-bono experience.

Find the best lawyer for your project

Quick, user friendly and one of the better ways I've come across to get ahold of lawyers willing to take new clients.

Business lawyers by top cities

- Austin Business Lawyers

- Boston Business Lawyers

- Chicago Business Lawyers

- Dallas Business Lawyers

- Denver Business Lawyers

- Houston Business Lawyers

- Los Angeles Business Lawyers

- New York Business Lawyers

- Phoenix Business Lawyers

- San Diego Business Lawyers

- Tampa Business Lawyers

Assignment Of Partnership Interest lawyers by city

- Austin Assignment Of Partnership Interest Lawyers

- Boston Assignment Of Partnership Interest Lawyers

- Chicago Assignment Of Partnership Interest Lawyers

- Dallas Assignment Of Partnership Interest Lawyers

- Denver Assignment Of Partnership Interest Lawyers

- Houston Assignment Of Partnership Interest Lawyers

- Los Angeles Assignment Of Partnership Interest Lawyers

- New York Assignment Of Partnership Interest Lawyers

- Phoenix Assignment Of Partnership Interest Lawyers

- San Diego Assignment Of Partnership Interest Lawyers

- Tampa Assignment Of Partnership Interest Lawyers

ContractsCounsel User

business partnership agreement

Location: florida, turnaround: less than a week, service: drafting, doc type: assignment of partnership interest, number of bids: 6, bid range: $300 - $1,500, junbug contract, location: washington, turnaround: a week, service: contract review, page count: 8, number of bids: 5, bid range: $400 - $950, want to speak to someone.

Get in touch below and we will schedule a time to connect!

Find lawyers and attorneys by city

Sign up for an account

Sign in to your account, reset password.

Assignment Of Partnership Interest

When you want to transfer the stake in a partnership to a new member, you’ll use an Assignment of Partnership Interest to outline the terms of the transaction.

- About document

Related documents

How it works.

Members of a partnership often need to transfer some or all of their stake to a new partner. Doing so can be a delicate process because it impacts the partnership as a whole, not just the seller and buyer.

To make the transaction as transparent as possible and to satisfy potential requirements in the partnership articles, the transfer should be recorded in an Assignment of Partnership Interest. As the document's name implies, its successful execution transfers a portion of the interest in the partnership from a current partner to a new partner.

What Is an Assignment of Partnership Interest?

An Assignment of Partnership Interest is a legal document establishing the terms under which stake in a partnership is transferred from an assignor to an assignee. In other words, the new partner (assignee) acquires the right to receive benefits from the partnership per the stake granted.

The particulars of the Assignment of Partnership respond, in large part, to the type of partnership in question. In some cases, the Partnership Agreement under which the partnership is formed doesn't allow for a transfer of interest to new members or does so only under specific circumstances.

It's also worth noting that a partnership carries both rights and responsibilities. A new partner who receives an interest in the partnership assumes all the Partnership Agreement obligations, including liabilities. However, some states place limitations on assignees' rights that don't recognize them on equal footing as the founding partners.

Other Names for Assignment of Partnership Interest

Depending on your state, an Assignment of Partnership Interest may also be known as:

Transfer of Partnership Interest

Partnership Interest Transfer Form

Transfer of Share in Partnership

Who Needs an Assignment of Partnership Interest

Most of the time, an Assignment of Partnership Interest is drafted by a partnership member who's looking to transfer their stake in a partnership. However, the interest assignee could also create the form if they believe specific clauses need to be included.

Other current members of the partnership are also typically involved in creating the document to ensure it's in line with the terms established in the Partnership Agreement. The terms of the agreement frequently place restrictions on the type and amount of interest transferred by each partner.

Situations calling for a transfer of interest may include the business's cash flow requirements, a need to reallocate business assets, changes in the overall partnership strategy, and changes in the regulatory landscape, among others.

Why Use 360 Legal Forms for Your Assignment of Partnership Interest

Customized for you, by you.

Create your own documents by answering our easy-to-understand questionnaires to get exactly what you need out of your Assignment of Partnership Interest.

Specific to Your Jurisdiction

Laws vary by location. Each document on 360 Legal Forms is customized for your state.

Fast and easy

All you have to do is fill out a simple questionnaire, print, and sign. No printer? No worries. You and other parties can even sign online.

How to Create an Assignment of Partnership Interest with 360 Legal Forms

An Assignment of Partnership Interest needs to satisfy several parties. The assignor and assignee need to have their rights protected, and it must fall within the terms of the original Partnership Agreement. It's essential to use a form addressing all the details involved.

Let 360 Legal Forms help with our extensive library of attorney-vetted legal forms. The process is fast and easy. All you have to do is fill out our easy-to-understand questionnaire. Once complete, simply download your form as a PDF or Word document from your secure online account.

What Information Will I Need to Create My Assignment of Partnership Interest

To create your document, please provide:

Assignor: Full name and address of the partner transferring the business interest

Assignee: Full name and address of the incoming partner receiving the business interest

Partnership Details: Legal name and address of the partnership in which interest is being transferred, along with business purposes and other details

Remaining Partners: Names and addresses of the other members of the partnership

Consideration: Payment that the assignor will receive for the transfer of interest

Closing Date: When the assignment of interest will be executed

Assignment of Partnership Interest Terms

Warranties: A section of the Assignment of Partnership Interest clearly stating what the assignor promises are right about the interest and the terms of the partnership

Indemnification clause: A clause releasing each party from responsibility created by the other party's failure to act as the document requires

Implied terms: Terms and clauses including an agreement under law or custom even if they're not spelled out directly in the agreement

Exclusion clauses: A part of an agreement releasing a party from responsibility under a specific circumstance

Assignment of Partnership Interest Signing Requirements

To be legally enforceable, an Assignment of Partnership Interest must be signed by the assignor, the assignee, and all the remaining members of the partnership. If applicable, witnesses to the signing need to sign the document as well.

The signatures do not need to be notarized to be valid. However, you may choose to notarize the signatures to prevent any challenge arising at a later time.

What to Do with Your Assignment of Partnership Interest

Once the Assignment of Partnership Interest is signed (and signatures notarized if you so choose), distribute signed copies to every partnership member and the assignee. Keep a copy for your records and make sure the partnership's secretary records the transfer of interest in the minutes of the partnership. In some states, it may be necessary to file a document with the Commissioner of Corporations, and tax liabilities may arise based on the value of the interest.

Frequently Asked Questions

No. You can choose to notarize the signatures on the assignment document, but it’s not required for it to be legal and valid.

In theory, yes. However, this is not only inadvisable but could also result in legal issues down the line. Without the document to establish each party’s obligations, either may choose to back out of the transaction. Furthermore, it puts the partnership at risk, since the assignee ends up with a controlling stake in the business without explicitly being bound to the terms of the original Partnership Agreement.

When partnership interest is transferred, the assignor’s proceeds are typically treated as a capital gain/loss. But, some or all of the capital gains may end up as ordinary income if the assignor attributes it to unrealized receivables. State and local laws may also play a role and you’re well-advised to consult a tax attorney or CPA licensed to practice in your state.

Yes, the document can be used to transfer a partner’s interest to natural or legal persons in a general sense. However, it should be noted that federal tax audit rules may be affected for a partnership if one or more members is itself a partnership and the original agreement may prohibit this type of transfer specifically.

Why choose 360 Legal Forms?

Our exhaustive library of documents covers your personal, business, and real estate needs with all of your DIY legal forms.

Easy legal documents at your fingertips

Create professional documents for thousands of purposes.

Easily customized

Make unlimited documents and revisions. Sign online in seconds.

Applicable to all 50 states

Our documents are vetted by lawyers and are applicable to all 50 states.

Know someone who needs this document?

Users that make a Assignment Of Partnership Interest sometimes need additional documents.

- Shareholders’ Organizational Meeting Minutes

- LLC Operating Agreement Amendment

- Partnership Agreement Amendment

- Partnership Dissolution Agreement

- Partnership Agreement

Marcum Announces Acquisition Agreement to Join CBIZ Learn More

- Newsletters

- Client Portal

- Make Payment

- (855) Marcum1

Search our Services and Industries

Tax issues to consider when a partnership interest is transferred.

By Colleen McHugh - Co‑Partner‑in‑Charge, Alternative Investments

There can be several tax consequences as a result of a transfer of a partnership interest during the year. This article discusses some of those tax issues applicable to the partnership.

Adjustments to the Basis of Partnership Property Upon a transfer of a partnership interest, the partnership may elect to, or be required to, increase/decrease the basis of its assets. The basis adjustments will be for the benefit/detriment of the transferee partner only.

- If the partnership has a special election in place, known as an IRS Section 754 election, or will make one in the year of the transfer, the partnership will adjust the basis of its assets as a result of the transfer. IRS Section 754 allows a partnership to make an election to “step-up” the basis of the assets within a partnership when one of two events occurs: distribution of partnership property or transfer of an interest by a partner.

- The partnership will be required to adjust the basis of its assets when an interest in the partnership is transferred if the total adjusted basis of the partnership’s assets is greater than the total fair market value of the partnership’s assets by more than $250,000 at the time of the transfer.

Ordinary Income Recognized by the Transferor on the Sale of a Partnership Interest Typically, when a partnership interest is sold, the transferor (seller) will recognize capital gain/loss. However, a portion of the gain/loss could be treated as ordinary income to the extent the transferor partner exchanges all or a part of his interest in the partnership attributable to unrealized receivables or inventory items. (This is known as “Section 751(a) Property” or “hot” assets).

- Unrealized receivables – includes, to the extent not previously included in income, any rights (contractual or otherwise) to payment for (i) goods delivered, or to be delivered, to the extent the proceeds would be treated as amounts received from the sale or exchange of property other than a capital asset, or (ii) services rendered, or to be rendered.

- Property held primarily for sale to customers in the ordinary course of a trade or business.

- Any other property of the partnership which would be considered property other than a capital asset and other than property used in a trade or business.

- Any other property held by the partnership which, if held by the selling partner, would be considered of the type described above.

Example – Partner A sells his partnership interest to D and recognizes gain of $500,000 on the sale. The partnership holds some inventory property. If the partnership sold this inventory, Partner A would be allocated $100,000 of that gain. As a result, Partner A will recognize $100,000 of ordinary income and $400,000 of capital gain.

The partnership needs to provide the transferor with sufficient information in order to determine the amount of ordinary income/loss on the sale, if any.

Termination/Technical Termination of the Partnership A transfer of a partnership interest could result in an actual or technical termination of the partnership.

- The partnership will terminate on the date of transfer if there is one tax owner left after the transfer.

- The partnership will have a technical termination for tax purposes if within a 12-month period there is a sale or exchange of 50% or more of the total interest in the partnership’s capital and profits.

Example – D transfers its 55% interest to E. The transfer will result in the partnership having a technical termination because 50% or more of the total interest in the partnership was transferred. The partnership will terminate on the date of transfer and a “new” partnership will begin on the day after the transfer.

Allocation of Partnership Income to Transferor/Transferee Partners When a partnership interest is transferred during the year, there are two methods available to allocate the partnership income to the transferor/transferee partners: the interim closing method and the proration method.

- Interim closing method – Under this method, the partnership closes its books with respect to the transferor partner. Generally, the partnership calculates the taxable income from the beginning of the year to the date of transfer and determines the transferor’s share of that income. Similarly, the partnership calculates the taxable income from the date after the transfer to the end of the taxable year and determines the transferee’s share of that income. (Note that certain items must be prorated.)

Example – Partner A transfers his 10% interest to H on June 30. The partnership’s taxable income for the year is $150,000. Under the interim closing method, the partnership calculates the taxable income from 1/1 – 6/30 to be $100,000 and from 7/1-12/31 to be $50,000. Partner A will be allocated $10,000 [$100,000*10%] and Partner H will be allocated $5,000 [$50,000*10%].

- Proration method – this method is allowed if agreed to by the partners (typically discussed in the partnership agreement). Under this method, the partnership allocates to the transferor his prorata share of the amount of partnership items that would be included in his taxable income had he been a partner for the entire year. The proration may be based on the portion of the taxable year that has elapsed prior to the transfer or may be determined under any other reasonable method.

Example – Partner A transfers his 10% interest to H on June 30. The partnership’s taxable income for the year is $150,000. Under the proration method, the income is treated as earned $74,384 from 1/1 – 6/30 [181 days/365 days*$150,000] and $75,616 from 7/1-12/31 [184 days/365 days*$150,000]. Partner A will be allocated $7,438 [$74,384*10%] and Partner H will be allocated $7,562 [$75,616*10%]. Note that this is one way to allocate the income. The partnership may use any reasonable method.

Change in Tax Year of the Partnership The transfer could result in a mandatory change in the partnership’s tax year. A partnership’s tax year is determined by reference to its partners. A partnership may not have a taxable year other than:

- The majority interest taxable year – this is the taxable year which, on each testing day, constituted the taxable year of one or more partners having an aggregate interest in partnership profits and capital of more than 50%.

Example – Partner A, an individual, transfers his 55% partnership interest to Corporation D, a C corporation with a year-end of June 30. Prior to the transfer, the partnership had a calendar year-end. As a result of the transfer, the partnership will be required to change its tax year to June 30 because Corporation D now owns the majority interest.

- If there is no majority interest taxable year or principal partners, (a partner having a 5% or more in the partnership profits or capital) then the partnership adopts the year which results in the least aggregate deferral.

Change in Partnership’s Accounting Method A transfer of a partnership interest may require the partnership to change its method of accounting. Generally, a partnership may not use the cash method of accounting if it has a C corporation as a partner. Therefore, a transfer of a partnership interest to a C corporation could result in the partnership being required to change from the cash method to the accrual method.

As described in this article, a transfer of a partnership interest involves an analysis of several tax consequences. An analysis should always be done to ensure that any tax issues are dealt with timely.

If you or your business are involved in a transfer described above, please contact your Marcum Tax Professional for guidance on tax treatment.

Related Insights & News

Presidential Election 2024: What Trump vs. Harris Could Mean for Federal Business Taxes

The outcome of the upcoming presidential election may significantly affect the changes in federal income taxes on businesses.

Clearing the Fog: Anticipating the Impact of the 2025 Tax Cliff

Maximize savings and sustainability: exploring the ira’s comprehensive energy incentives, employee retention tax credit (ertc) claims under scrutiny: key irs developments explained, irs update: ertc claim processing amid moratorium and increased scrutiny, upcoming events.

Budgeting, Debt & Credit Management

Maximizing Philanthropy: Navigating the New Crypto Landscape for Donors and Charities

Streamlining the Financial Close Process: How Close Management Software Transforms Efficiency

Cocktails & Conversations

Path to Prosperity: Preparing Your Business for the Future

Providence, RI

Innovate for Impact

Philadelphia, PA

Wrigley Cyber Classic

Chicago, IL

Marcum Women’s Initiative: Coffee and Conversations

Nashville, TN

Open Enrollment for Employee Benefits – Things to Consider

Mission Possible: Nonprofits in the Age of Digital Finance

Washington, DC

Cyber Threats and Prevention: A Growing Concern for Businesses

Burlington, MA

Robotic Process Automation and AI: The Next Frontier in Finance Transformation

Marcum New England Life Science & Biotech Summit

New Haven, CT

Marcum New England Construction Summit

Marcum Manufacturing Forum

Cleveland, OH

Marcum Mid-South Construction Summit

Economic & Market Update

Marcum Ohio Construction Summit

Warrensville Heights, OH

Client Kickoff: Hawkeye Tailgate & Game Day

Iowa City, IA

Foundations of Estate Planning – Wills, Trusts and other Essentials

Related service.

Tax & Business

Have a Question? Ask Marcum

- Legal GPS for Business

- All Contracts

- Member-Managed Operating Agreement

- Manager-Managed Operating Agreement

- S Corp LLC Operating Agreement

- Multi-Member LLC Operating Agreement

- Multi-Member LLC Operating Agreement (S Corp)

Assignment of Membership Interest: The Ultimate Guide for Your LLC

LegalGPS : July 24, 2024 at 12:10 PM

As a business owner, there may come a time when you need to transfer ownership of your company or acquire additional members. In these situations, an assignment of membership interest is a critical step in the process. This blog post aims to provide you with a comprehensive guide on everything you need to know about the assignment of membership interest and how to navigate the procedure efficiently. So, let's dive into the world of LLC membership interest transfers and learn how to secure your business!

Assignment of Membership Interest Template

Legal GPS templates are drafted by top startup attorneys and fully customizable.

Table of Contents

Necessary approvals and consent, impact on ownership, voting, and profit rights, complete assignment, partial assignment.

- Key elements to include

Step 1: Gather Relevant Information

Step 2: review the llc's operating agreement, step 3: obtain necessary approvals and consents, step 4: outline the membership interest being transferred, step 5: determine the effective date of the assignment, step 6: specify conditions and representations, step 7: address tax and liability issues, step 8: draft the entire agreement and governing law clauses, step 9: review and sign the assignment agreement.

- Advantages of using a professionally-created template

- How our contract templates stand out from the rest

Frequently Asked Questions (FAQs) about Assignment of Membership Interest

Do you need a lawyer for this, what is an assignment of membership interest.

An assignment of membership interest is a document that allows a member of an LLC to transfer their ownership share in the company to another person or entity. This can be done in the form of a sale or gift, which are two different scenarios that generally require different types of paperwork. An assignment is typically signed by the parties involved and delivered to the Secretary of State's office for filing. However, this process can vary depending on where you live and whether your LLC has members other than yourself as well as additional documents required by state law.

Before initiating the assignment process, it's essential to review the operating agreement of your LLC, as it may contain specific guidelines on how to assign membership interests.

Often, these agreements require the express consent of the other LLC members before any assignment can take place. To avoid any potential disputes down the line, always seek the required approvals before moving forward with the assignment process.

It's essential to understand that assigning membership interests can affect various aspects of the LLC, including ownership, voting rights, and profit distribution. A complete assignment transfers all ownership rights and obligations to the new member, effectively removing the original member from the LLC. For example, if a member assigns his or her interest, the new member inherits all ownership rights and obligations associated with that interest. This includes any contractual obligations that may be attached to the membership interest (e.g., a mortgage). If there is no assignment of interests clause in your operating agreement, then you will need to get approval from all other members for an assignment to take place.

On the other hand, a partial assignment permits the original member to retain some ownership rights while transferring a portion of their interest to another party. To avoid unintended consequences, it's crucial to clearly define the rights and responsibilities of each party during the assignment process.

Types of Membership Interest Transfers

Membership interest transfers can be either complete or partial, depending on the desired outcome. Understanding the differences between these two types of transfers is crucial in making informed decisions about your LLC.

A complete assignment occurs when a member transfers their entire interest in the LLC to another party, effectively relinquishing all ownership rights and obligations. This type of transfer is often used when a member exits the business or when a new individual or entity acquires the LLC.

For example, a member may sell their interest to another party that is interested in purchasing their share of the business. Complete assignment is also used when an individual or entity wants to purchase all of the interests in an LLC. In this case, the seller must receive unanimous approval from the other members before they can transfer their entire interest.

Unlike a complete assignment, a partial assignment involves transferring only a portion of a member's interest to another party. This type of assignment enables the member to retain some ownership in the business, sharing rights, and responsibilities proportionately with the new assignee. Partial assignments are often used when adding new members to an LLC or when existing members need to redistribute their interests.

A common real-world example is when a member receives an offer from another company to purchase their interest in the LLC. They might want to keep some ownership so that they can continue to receive profits from the business, but they also may want out of some of the responsibilities. By transferring only a partial interest in their membership share, both parties can benefit: The seller receives a lump sum payment for their share of the LLC and is no longer liable for certain financial obligations or other tasks.

Legal GPS Subscription

Protect your business with our complete legal subscription service, designed by top startup attorneys.

- ✅ Complete Legal Toolkit

- ✅ 100+ Editable Contracts

- ✅ Affordable Legal Guidance

- ✅ Custom Legal Status Report

How to Draft an Assignment of Membership Interest Agreement

A well-drafted assignment of membership interest agreement can help ensure a smooth and legally compliant transfer process. Here is a breakdown of the key elements to include in your agreement, followed by a step-by-step guide on drafting the document.

Key elements to include:

The names of the assignor (the person transferring their interest) and assignee (the person receiving the interest)

The name of your LLC and the state where it was formed

A description of the membership interest being transferred (percentage, rights, and obligations)

Any required approvals or consents from other LLC members

Effective date of the assignment

Signatures of all parties involved, including any relevant witnesses or notary public

Before you begin drafting the agreement, gather all pertinent data about the parties involved and the membership interest being transferred. You'll need information such as:

The names and contact information of the assignor (the person transferring their interest) and assignee (the person receiving the interest)

The name and formation details of your LLC, including the state where it was registered

The percentage and value of the membership interest being transferred

Any specific rights and obligations associated with the membership interest

Examine your LLC's operating agreement to ensure you adhere to any predetermined guidelines on assigning membership interests. The operating agreement may outline specific procedures, required approvals, or additional documentation necessary to complete the assignment process.

If your LLC doesn't have an operating agreement or if it's silent on this matter, follow your state's default LLC rules and regulations.

Before drafting the assignment agreement, obtain any necessary approvals or consents from other LLC members as required by the operating agreement or state law. You may need to hold a members' meeting to discuss the proposed assignment and document members' consent in the form of a written resolution.

Detail the membership interest being transferred in the Assignment of Membership Interest Agreement. Specify whether the transfer is complete or partial, and include:

The percentage of ownership interest being assigned

Allocated profits and losses, if applicable

Voting rights associated with the transferred interest

The assignor's rights and obligations that are being transferred and retained

Any capital contribution requirements

Set an effective date for the assignment, which is when the rights and obligations associated with the membership interest will transfer from the assignor to the assignee.

This date is crucial for legal and tax purposes and helps both parties plan for the transition. If you don’t specify an effective date in the assignment agreement, your state's law may determine when the transfer takes effect.

In the agreement, outline any conditions that must be met before the assignment becomes effective. These could include obtaining certain regulatory approvals, fulfilling specific obligations, or making required capital contributions.

Additionally, you may include representations from the assignor attesting that they have the legal authority to execute the assignment. Doing this is important because it can prevent a third party from challenging the assignment on grounds of lack of authority. If the assignor is an LLC or corporation, be sure to specify that it must be in good standing with all necessary state and federal regulatory agencies.

Clearly state that the assignee will assume responsibility for any taxes, liabilities, and obligations attributable to the membership interest being transferred from the effective date of the assignment. You may also include indemnification provisions that protect each party from any potential claims arising from the other party's actions.

For example, you can include a provision that provides the assignor with protection against any claims arising from the transfer of membership interests. This is especially important if your LLC has been sued by a member, visitor, or third party while it was operating under its current management structure.

In the closing sections of the assignment agreement, include clauses stating that the agreement represents the entire understanding between the parties concerning the assignment and supersedes any previous agreements or negotiations. Specify that any modifications to the agreement must be made in writing and signed by both parties. Finally, identify the governing law that will apply to the agreement, which is generally the state law where your LLC is registered.

This would look like this:

|

|

Once you've drafted the Assignment of Membership Interest Agreement, ensure that all parties carefully review the document to verify its accuracy and completeness. Request a legal review by an attorney, if necessary. Gather the assignor, assignee, and any necessary witnesses or notary public to sign the agreement, making it legally binding.

Sometimes the assignor and assignee will sign the document at different times. If this is the case, then you should specify when each party must sign in your Assignment Agreement.

Importance of a Professionally-drafted Contract Template

To ensure a smooth and error-free assignment process, it's highly recommended to use a professionally-drafted contract template. While DIY options might seem tempting, utilizing an expertly-crafted template provides several distinct advantages.

Advantages of using a professionally-created template:

Accuracy and Compliance: Professionally-drafted templates are designed with state-specific regulations in mind, ensuring that your agreement complies with all necessary legal requirements.

Time and Cost Savings: With a pre-written template, you save valuable time and resources that can be better spent growing your business.

Reduced Legal Risk: Legal templates created by experienced professionals significantly reduce the likelihood of errors and omissions that could lead to disputes or litigations down the road.

Get Your Assignment of Membership Interest Template with a Legal GPS Subscription

How our contract templates stand out from the rest:

We understand the unique needs of entrepreneurs and business owners. Our contract templates are designed to provide a straightforward, user-friendly experience that empowers you with the knowledge and tools you need to navigate complex legal processes with ease. By choosing our Assignment of Membership Interest Agreement template, you can rest assured that your business is in safe hands. Click here to get started!

As you embark on the journey of assigning membership interest in your LLC, here are some frequently asked questions to help address any concerns you may have:

Is an assignment of membership interest the same as a sale of an LLC? No. While both processes involve transferring interests or assets, a sale of an LLC typically entails the sale of the entire business, whereas an assignment of membership interest relates to the transfer of some or all membership interests between parties.

Do I need an attorney to help draft my assignment of membership interest agreement? While not mandatory, seeking legal advice ensures that your agreement complies with all relevant regulations, minimizing potential legal risks. If you prefer a more cost-effective solution, consider using a professionally-drafted contract template like the ones we offer at [Your Company Name].

Can I assign my membership interest without the approval of other LLC members? This depends on your LLC's operating agreement and state laws. It's essential to review these regulations and obtain any necessary approvals or consents before proceeding with the assignment process.

The biggest question now is, "Do you need to hire a lawyer for help?" Sometimes, yes ( especially if you have multiple owners ). But often for single-owner businesses, you don't need a lawyer to start your business .

Many business owners instead use tools like Legal GPS for Business , which includes a step-by-step, interactive platform and 100+ contract templates to help you start and grow your company.

Get Legal GPS's Assignment of Membership Interest Template Now

Understanding the Membership Interest Purchase Agreement for Single Owners

Welcome to another of our informative blog posts aimed at demystifying complex legal topics. Today, we're addressing something that many solo...

Why Your Company Absolutely Needs a Membership Interest Pledge Agreement

When it comes to running a business, it's essential to cover all your bases to ensure the smooth operation of your company and the protection of your...

Why Every Company Needs a Media Consent and Release Form

Picture this: you’re a business owner, and you’ve just wrapped up a fantastic marketing campaign featuring your clients’ success stories. You're...

What Is Transfer of Partnership Interest?

A transfer of partnership interest happens when a business partner relinquishes their ownership rights and responsibilities to another individual or company. 3 min read updated on September 19, 2022

A transfer of partnership interest takes place when a partner in a business relinquishes their ownership rights and responsibilities to another individual or company.

What Is a Partnership?

General partnerships are formed automatically in the eyes of the state when two individuals or business entities go into business together with the intent to share both the losses and profits of the venture. When one of those two parties decides to no longer be involved in the partnership, they may either transfer it to another person or entity or terminate the partnership altogether.

If a partnership agreement is formed at the start of the business, this will govern how any transfers or terminations take place. If no agreement exists, the partners will follow provisions made by the state for the governing of general partnerships .

Transferring Interest

The interest that a partner holds in a partnership represents their shares of profits and losses as well as voting rights and managerial or financial responsibilities. According to state laws, partnership interests are free to transfer, so the only way a partner might run into difficulties is if there are restrictions in the partnership agreement .

If the transfer of interest in a partnership would cause the membership in the business to change, the state views the original partnership as dissolved. A new partnership will be formed between the member to whom the interest was transferred and the remaining members of the first partnership. This new partnership will be expected to continue on in the business of the first partnership.

Transfer of interest in a partnership is usually restricted in some form if a partnership agreement exists. Usually, the restriction found in the agreement is a right of first refusal . This means that a partner wishing to leave the partnership must first offer their interest to the other members in the company before offering it to an outside party. If all of the members refuse this offer, the partner is then allowed to transfer interest to anyone they choose.

Sale of Partnership Assets

If instead of one partner transferring interest, all of the partners decide to dissolve the partnership, they may sell the assets of the company to an individual or entity outside of the partnership. Any income earned from a sale of assets can be used to settle any outstanding debts the partnership may have had.

Assets may be sold to any of the following:

- An individual

- Another partnership

- A corporation

- A limited liability company (LLC)

Selling or transferring the assets of a partnership can be beneficial to the members, but they need to keep in mind that it is hard to transfer the intangible aspects of the business, like goodwill. Goodwill is a company's worth based on its reputation and customer or client base.

Dissolving a Partnership

Each state provides rules and regulations for the dissolving of a general partnership. Certain aspects of the state regulations apply to any and all partnerships, but others only apply if there is no partnership agreement governing the dissolution.

The Uniform Partnership Act states that all of the partners will share the profits and losses of the business equally in the case of dissolution if there are no provisions detailed in a partnership agreement. Most states enforce this regulation.

Even if there is a partnership agreement governing the dissolution of a business, that business is required to first satisfy any of its outstanding debts before distributing any assets to partners. Distributions should be proportional to the ownership percentages of each of the members. Ownership percentages are usually based on capital contributions or managerial responsibilities.

Liability of Partnership Dissolution

In the event that a partnership is being dissolved, certain liabilities remain with the partners. If debts are not paid to creditors, the partners may be held financially liable, even if they aren't actively conducting business. A partner in a general partnership risks losing personal assets if the business leaves any financial obligations unresolved.

Even if one partner binds the business to a financial obligation, the entire partnership can be held liable. This means that any partner can be held liable for financial promises made by another partner on behalf of the business.

If you need help with the transfer of partnership interest, you can post your job on UpCounsel's marketplace. UpCounsel accepts only the top 5 percent of lawyers to its site. Lawyers on UpCounsel come from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb.

Hire the top business lawyers and save up to 60% on legal fees

Content Approved by UpCounsel

- Limited Partnership Rules: Everything You Need To Know

- General Partnership

- Dissolving a Partnership in Texas

- Can a Partnership Be Incorporated: Everything to Know

- Purpose of Partnership: Everything You Need To Know

- Disadvantages of Partnership

- What Is Partnership Agreement California?

- California General Partnership Law

- Limited Company Partnership Agreement

- General Partnership Liability

Assignment of Partnership Interest Agreement

by admin | Nov 28, 2022 | Agreements

An assignment of partnership interest agreement occurs when a partner sells their stake in a partnership to a third party. The assignment document records the details of the transfer to the new partner. The new partner will receive the business partnership’s benefits and obligations (including profits and losses) in exchange for compensation to the previous partner.

An assignment of partnership interest agreement is a type of business structure in which two or more people or entities own and operate a business. When one owner sells their stake in the partnership to a third party, an assignment of partnership interest records the transaction to the new partner. The assignment of partnership interest involves two parties: the assignor or the partner transferring their stake and the assignee, the new partner. The document that details the transaction needs to include the following information:

- Information about the partnership like the name of the business

- The type of interest being transferred

- The names and information of both the assignor and the assignee

- Information about the remaining partners

Members of an assignment of partnership interest agreement often need to transfer some or all of their stake to a new partner. Doing so can be a delicate process because it affects the partnership as a whole, not just the seller and the buyer. To make the transaction as transparent as possible and to satisfy potential requirements in the partnership articles, the transfer should be recorded in an assignment of partnership interest agreement. As the document’s name implies, its successful execution transfers a portion of the interest in the partnership from a current partner to a new partner.

The assignment of partnership interest agreement definition is a portion of the common law that is in charge of transferring the rights of an individual or party to another person or party. Moreover, the assignment of partnership interest agreement is often seen in real estate but can occur in other contexts as well. An assignment is just the contractual transfer of benefits that will accrue or have accrued. Obligations don’t transfer with the benefits of an assignment. The assignor will always keep the obligations.

What is an assignment of partnership interest agreement?

The assignment of partnership interest agreement is a legal document establishing the terms under which stake in a partnership is transferred from an assignor to an assignee. In other words, the new partner (assignee) acquired the right to receive benefits from the partnership per stake granted.

The particulars of the assignment of partnership interest agreement respond, in large part, to the type of partnership in question. In some case, the assignment of the partnership agreement under which the partnership is formed doesn’t allow for a transfer of interest to new members or does so only under specific circumstances. It is also worth noting that a partnership carries both rights and responsibilities. A new partner who receives an interest in the partnership assumes all the assignment of partnership interest agreement obligations. Nonetheless, some states place limitations on assignees’ rights that don’t recognize them on equal footing as the founding partners.

An assignment of partnership interest agreement occurs when one party to an existing contract (the “assignor”) hand off the contract’s obligations and benefits to another party (the “assignee”). Ideally, the assignor wants the assignee to step into his shoes and assume all of his contractual obligations and rights. In order to do that, the other party to the contract must be properly notified. Read on to learn how assignments work, including how to keep an assignment option out of your contract.

What is a partnership?

A partnership is a type of business organization where two or more individuals or business entities operate a business with the goal of making a profit. Each partner typically has rights and obligations enforced by a Partnership Agreement including liabilities and rights to profits of the business.

Who are the parties in an assignment of partnership interest agreement?

There are two parties in the assignment of partnership interest agreement: assignor and assignee. The assignor is the business partner who is transferring their rights in the partnership in exchange for compensation. The assignee is a new partner who purchases the previous partner’s interest in the partnership.

Do other partners have a say in who buys the interest in a partnership?

If there is an assignment of partnership interest agreement in place the answer is most likely, yes. An assignment of partnership interest agreement governing the activities of the partnership and conduct of the partners will often place some restrictions on the nature of the interest which may be acquired.

For example, the transferring partner might be limited to transferring only their economic interests and rights which would prevent the recipient of transferred interest from becoming a full partner (with voting rights and managerial input) by assignment alone. Full admission to the partnership would be decided by the remaining partners based on the terms of the assignment of partnership interest agreement.

The category of assignee is something else the partnership might have good reason for restricting. For example, federal tax audit rules introduced in 2018 mean that partnerships will be treated as taxable entities if one or more of the partners is itself a partnership, a trust, or an LLC. To avoid such tax consequences, and preserve individual tax treatment for the partners, the partnership agreement might prohibit assignments of partnership interest may be sold to any such business entity.

How is an assignment of partnership interest under an assignment of partnership interest agreement created?

To create an assignment of partnership interest under an assignment of partnership interest agreement, there should be a drafted document that records the transfer of rights and benefits from one partner to another and the exchange of compensation.

The partnership interest document under the assignment of partnership interest agreement should include:

- Type of interest: either full partnership interest or limited to the economic rights in distribution

- Partnership information: partnership name (e.g., Smith and Associates), establishment date, and purpose

- Assignor details: name, address, and type of party (individual or business entity) of the partner transferring rights and benefits to a new partner

- Assignee details: name, address, and type of party of the new partner receiving rights and benefits of the assignor

- Remaining partner details (if applicable): name, address, and type of party of other partners still part of the partnership

- Consideration details: a description of the price and agreed value to be exchanged for interest in the partnership (e.g., a monetary value or shares in stock)

- Signing details: witness signatures (if applicable), party signatures, and the signing date

Common sections in assignment of partnership interest agreements

Below is a list of common sections included in assignment of partnership interest agreement. These sections are linked to the below sample agreement for you to explore.

- Assignment of Partnership Interest

- Consideration

- Agreement to be Bound

- Registration of Partnership Interests

- Representations and Warranties of Assignee

- Binding Effect

- Severability

- Counterparts

- Governing Law

Security agreement under assignment of partnership interest agreement

A part of contract law that is responsible for financial transactions is a security agreement which is often under the assignment of partnership interest agreement. These are also called a secured transaction and include a grantor that promises collateral to the grantee. In contract law, the security under the assignment of partnership interest agreement doesn’t cover actual real estate or land. Instead, this agreement covers stock, vehicle, livestock, or another type of personal property. In a security agreement under the assignment of partnership interest agreement, in the case where a grantee already has the collateral, the grantor can verbally acquire the transaction.

However, it’s preferred to have a security agreement under the assignment of partnership interest agreement that is written down instead of having a verbal agreement, just in case there’s a disagreement among the parties. Both a security agreement and an assignment may apply to a variety of property rights.

Example of using assignment of partnership interest agreement and security agreements in property rights

As an example, the assignment of partnership interest agreement may cover the promise to use stocks as collateral or to transfer the rights of stock investments. It may also be possible for the agreements to include properties that are less tangible. The assignment of partnership interest agreement may apply to creative rights, such as film production or written works. If it is a case of creative rights, any benefits often include future revenue that may be earned from the distribution or sale of said works.

Assistance from an attorney regarding an assignment of partnership interest agreement

You may want to hire an attorney to help you draft a security agreement, legal assignment, and assignment of partnership interest agreement. There are other services that you might want to use that don’t cost as much but will still help you draft your contracts. The following are ways to save money while drafting a contract:

- Buy software with a template that creates security agreements and assignments.

- Buy a generic contract form at the bookstore.

- Buy a book with advice.

- Unless your background includes knowing particular legal knowledge about security agreements and assignments, you’ll want to talk to an attorney before you use any contract forms that are self-generated. Both security agreements and assignments are complicated areas of contract law.

Lease under assignment of partnership interest agreement

An agent is someone who is licensed by the state where a property is established to aid in real-estate transactions such as leases, assignments, and property sales. An agent is usually either an attorney, sales agent, or real estate broker. The tenant from the initial lease is the assignor, and he transfers his whole interest to another person. The assignee obtains the lease interest from the assignor or original tenant and will become the new tenant.

Consideration is what the assignor gets from the assignee for transferring the lease interest to the assignee. The consideration is often a certain amount of money. Interests that other people hold are encumbrances, and they can affect the title and possibly the possession and use of the property by the assignee and the assignor.

If the property in question is a residential unit that’s above a commercial property, the lease is considered to be a residential one, even though the property is in a commercial building. The governing law is that of the jurisdiction in which the property is located, no matter what jurisdiction the landlord, assignee, and assignor reside in. The assignee is allowed to receive a copy of the master lease. The assignor can either give the assignee a copy directly or include the copy with the lease assignment.

If the assignor isn’t liable for the assignee’s conduct, the landlord will need to go after the assignee if he or she causes property damage. However, if the assignor has liability for the conduct of the assignee, the landlord may then ask for compensation from both the assignee and assignor should the assignee cause any damage to the property.

How an assignment of partnership interest agreement works

How an assignment of partnership interest agreement plays out depends on many factors, especially the language of the contract. Some contracts may contain a clause prohibiting assignment; other contracts may require the other party to consent to the assignment.

Here’s an example of a basic assignment of partnership interest agreement: Tom contracts with a dairy to deliver a bottle of half-and-half to Tom’s house every day. The dairy assigns Tom’s contract to another dairy, and–provided Tom is notified of the change and continues to get his daily half-and-half–his contract is now with the new dairy.

An assignment of partnership interest agreement doesn’t always relieve the assignor of liability. Some contracts may include a guarantee that, regardless of an assignment, the original parties (or one of them) guarantees performance (that is, that the assignee will fulfill the terms of the contract).

When assignment of partnership interest agreement will not be enforced

An assignment of partnership interest agreement will not be enforced in the following situations. The contract prohibits assignment. Contract language, typically referred to as an anti-assignment clause, can prohibit (and “void”) any assignments. We provide a sample, below.

The assignment of partnership interest agreement materially alters what’s expected under the contract

If the assignment of partnership interest agreement affects the performance due under the contract, decreases the value or return anticipated, or increases the risks for the other party to the contract (the party who is not assigning contractual rights), courts are unlikely to enforce the arrangement. For instance, if Tom’s local, organic dairy assigned the contract to a factory farm dairy, this would be considered a material alteration.

The assignment of partnership interest agreement violates the law or public policy

Some laws limit or prohibit assignments. For example, many states prohibit the assignment of future wages by an employee, and the federal government prohibits the assignment of certain claims against the government. Other assignments, though not prohibited by a statute, may violate public policy. For example, personal injury claims cannot be assigned because doing so may encourage litigation.

Delegation or assignment of partnership interest agreement

In some cases, a party may not wish to assign the contract but only to get somebody else to fulfill its duties. Obviously, not all duties can be delegated–for example, some personal services are usually not delegated because they are so specific in nature. For example, if you hired Ted Nugent to perform at your event, he could not arbitrarily delegate his performing duties to Lady Gaga. To prohibit one party from delegating the responsibilities of the contract, the parties should include specific language to that effect in the agreement. For example, an anti-assignment clause might state, “Neither party shall assign or delegate its rights.”

Steps in the creation of an assignment of partnership interest agreement

There are three steps to follow if you want to assign a contract.

Step 1: Examine the assignment of partnership interest agreement for any limitations or prohibitions. Check for anti-assignment clauses. Sometimes the prohibition is not a separate clause but is included in another provision. Look for language that states, “This agreement may not be assigned.” If you find such language, you may not be able to assign the agreement unless the other party consents.

Step 2: Execute an assignment of partnership interest agreement. If you are not prohibited from assigning the contract, prepare and enter into an assignment of contract: an agreement that transfers the parties’ rights and obligations.

Step 3: Provide notice to the obligor. After you have assigned your contract rights to the assignee, you should provide notice to the other original contracting party (referred to as the obligor). This notice will effectively relieve you of any liability under the contract, unless the contract says differently (for instance, if the contracts says that the assignor guarantees the performance of the assigned contract or the contract prohibits an assignment) or the assignment is prohibited by law.

Anti-assignment clauses

If you’re making a contract and you don’t want assignment to be an option, you need to clearly state that in your agreement. Below are three variations of anti-assignment clauses that can be used in a contract.

Example 1: Consent required for assignment of partnership interest agreement

Assignment. Neither party may assign or delegate its rights or obligations pursuant to this Agreement without the prior written consent of the other. Any assignment or delegation in violation of this section shall be void.

Example 2: Consent not needed for affiliates or new owners

Assignment. Neither party may assign or delegate its rights or obligations pursuant to this Agreement without the prior written consent of the other. However, no consent is required for an assignment that occurs (a) to an entity in which the transferring party owns more than 50% of the assets, or (b) as part of a transfer of all or substantially all of the assets of the transferring party to any party. Any assignment or delegation in violation of this section shall be void.

Example 3: Consent not unreasonably withheld

Assignment. Neither party may assign or delegate its rights or obligations pursuant to this Agreement without the prior written consent of the other. Such consent shall not be unreasonably withheld. Any assignment or delegation in violation of this section shall be void.

Anti-assignment clauses can also be modified to prohibit only one of the parties from assigning rights. Also, when preparing an anti-assignment clause, keep in mind that you can prevent only “voluntary” assignments; you cannot prevent assignments that are ordered by a court or that are mandatory under law–for example, in a bankruptcy proceeding.

Examples of assignment of partnership interest agreement

Assignment of partnership interest agreements is great tools for contract parties to use when they wish to transfer their commitments to a third party. Here are some examples of contract assignments to help you better understand them:

Anna signs a contract with a local trash company that entitles her to have her trash picked up twice a week. A year later, the trash company transferred her contract to a new trash service provider. This contract assignment effectively makes Anna’s contract now with the new service provider.

Hasina enters a contract with a national phone company for cell phone service. The company goes into bankruptcy and needs to close its doors but decides to transfer all current contracts to another provider who agrees to honor the same rates and level of service. The contract assignment is completed, and Hasina now has a contract with the new phone company as a result.

Assignment of partnership interest agreements in real estate

Assignment of partnership interest agreement is also used in real estate to make money without going the well-known routes of buying and flipping houses. When real estate LLC investors use an assignment of contract, they can make money off properties without ever actually buying them by instead opting to transfer real estate contracts. This process is called real estate wholesaling.

Real estate wholesaling under assignment of partnership interest agreement

Real estate wholesaling consists of locating deals on houses that you don’t plan to buy but instead plan to enter a contract to reassign the house to another buyer and pocket the profit. The process is simple: real estate wholesalers negotiate purchase contracts with sellers. Then, they present these contracts to buyers who pay them an assignment fee for transferring the contract.

This process works because a real estate purchase agreement does not come with the obligation to buy a property. Instead, it sets forth certain purchasing parameters that must be fulfilled by the buyer of the property. In a nutshell, whoever signs the purchase contract has the right to buy the property, but those rights can usually be transferred by means of an assignment of contract.

This means that as long as the buyer who’s involved in the assignment of contract agrees with the purchasing terms, they can legally take over the contract. But how do real estate wholesalers find these properties?

It is easier than you might think. Here are a few examples of ways that wholesalers find cheap houses to turn a profit on:

- Direct mailers

- Place newspaper ads

- Make posts in online forums

- Social media posts

The key to finding the perfect home for an assignment of partnership interest agreement is to locate sellers that are looking to get rid of their properties quickly. This might be a family who is looking to relocate for a job opportunity or someone who needs to make repairs on a home but can’t afford it. Either way, the quicker the wholesaler can close the deal, the better.

Once a property is located, wholesalers immediately go to work getting the details ironed out about how the sale will work. Transparency is key when it comes to wholesaling. This means that when a wholesaler intends to use an assignment of contract to transfer the rights to buy to another person, they are always upfront about during the preliminary phases of the sale.

In addition to this practice just being good business, it makes sure the process goes as smoothly as possible later down the line. Wholesalers are clear in their intent and make sure buyers know that the contract could be transferred to another buyer before the closing date arrives.

After their offer is accepted and warranties are determined, wholesalers move to complete a title search. Title searches ensure that sellers have the right to enter into a purchase agreement on the property. They do this by searching for any outstanding tax payments, liens, or other roadblocks that could prevent the sale from going through. Wholesalers also often work with experienced real estate lawyers who ensure that all of the legal paperwork is forthcoming and will stand up in court. Lawyers can also assist in the contract negotiation process if needed but often don’t come in until the final stages. If the title search comes back clear and the real estate lawyer gives the green light, the wholesaler will immediately move to locate an entity to transfer the rights to buy.

One of the most attractive advantages of real estate wholesaling is that very little money is needed to get started. The process of finding a seller, negotiating a price, and performing a title search is an extremely cheap process that almost anyone can do.

On the other hand, it is not always a positive experience. It can be hard for wholesalers to find sellers who will agree to sell their homes for less than the market value. Even when they do, there is always a chance that the transferred buyer will back out of the sale, which leaves wholesalers obligated to either purchase the property themselves or scramble to find a new person to complete an assignment of contract with.

Who handles assignment of contract?

The best person to handle an assignment of partnership interest agreement is an attorney. Since these are detailed legal documents that deal with thousands of dollars, it is never a bad idea to have a professional on your side.

Sample of an assignment of partnership interest agreement

This assignment agreement (this “Assignment Agreement”) is entered into as of [—], 2013, by and between Newcastle Investment Corp., a Maryland corporation (the “Assignor”), and New Media Investment Group, Inc., a Delaware corporation (the “Assignee”). Capitalized terms used but not defined herein shall have the meanings ascribed to them in that certain Stock Purchase Agreement, dated as of June 28, 2013 (as it may be amended in accordance with its terms, the “Stock Purchase Agreement”), by and among Dow Jones Ventures VII, Inc. (“Seller”), Dow Jones Local Media Group, Inc. (the “Company”), the Assignor, and, solely with respect to its obligations under Sections 7.3, 7.7, 7.13, 7.14, 9.2, 9.3 and 10.2 of the Stock Purchase Agreement, Dow Jones & Company, Inc.

WHEREAS, the Assignor wishes to transfer and assign to the Assignee all of the Assignor’s rights and interests in and to, and obligations under, the Stock Purchase Agreement, and the Assignee wishes to be the assignee and transferee of such rights, interests and obligations;

WHEREAS, pursuant to Section 12.11 of the Stock Purchase Agreement, the Assignor may not assign any of its rights, interests or obligations under the Stock Purchase Agreement, directly or indirectly (by operation of Law or otherwise), without the prior written approval of Seller; and

WHEREAS, on September [—], 2013, Seller provided its written approval to the assignment by the Assignor of all of its rights, interests and obligations in the Stock Purchase Agreement to the Assignee.

NOW, THEREFORE, the parties hereto, intending to be legally bound, do hereby agree as follows:

- Assignment and Assumption. The Assignor hereby transfers and assigns to the Assignee, and the Assignee hereby acquires from the Assignor all of the Assignor’s rights, and interests in and to the Stock Purchase Agreement, of whatever kind or nature, and the Assignee hereby assumes and agrees to perform all obligations, duties, liabilities and commitments of the Assignor under the Stock Purchase Agreement, of whatever kind or nature.

- Retention of Obligations. Notwithstanding anything in this Assignment Agreement to the contrary, the Assignor shall remain obligated, as a principal and not a guarantor, to Seller with respect to all of the Assignor’s obligations, duties, liabilities and commitments under the Stock Purchase Agreement, of whatever kind or nature.

- Effectiveness. This Assignment Agreement shall be effective as of the date set first set forth above.

- Governing Law; Binding Effect. This Assignment Agreement shall be governed by and construed in accordance with the laws of the State of Delaware applicable to contracts made and performed in such state without giving effect to the choice of law principles of such state that would require or permit the application of the laws of another jurisdiction.

- Counterparts. This Assignment Agreement may be executed in one or more counterparts, including facsimile counterparts, each of which shall be deemed to be an original copy of this Assignment Agreement, and all of which, when taken together, shall be deemed to constitute one and the same agreement. Delivery of such counterparts by facsimile or electronic mail (in PDF or .tiff format) shall be deemed effective as manual delivery.

https://www.rocketlawyer.com/business-and-contracts/business-operations/contract-management/document/assignment-agreement

https://www.contractscounsel.com/b/assignment-of-contract

https://eforms.com/assignment/

https://www.sec.gov/Archives/edgar/data/1579684/000119312513435497/d603516dex1031.htm

https://www.upcounsel.com/assignment-agreement-definition#:~:text=The%20assignment%20agreement%20definition%20is%20a%20portion%20of%20the%20common,in%20other%20contexts%20as%20well .

https://www.nolo.com/legal-encyclopedia/assignment-of-contract-basics-32643.html

https://law.lis.virginia.gov/vacode/title50/chapter2.1/section50-73.45/

https://www.lawinsider.com/clause/assignment-of-partnership-interests

https://law.justia.com/codes/indiana/2012/title23/article16/chapter8

https://malegislature.gov/Laws/GeneralLaws/PartI/TitleXV/Chapter109/Section40

https://www.googleadservices.com/pagead/aclk?sa=L&ai=DChcSEwid3qm5_M77AhXFDAYAHdCHAKEYABAAGgJ3cw&ohost=www.google.com&cid=CAESbeD2va9R09-GFddnmxxSa88fkzjuwje7mEvH-KyXlO68Nbaa90Eqy-QERilf7ySpZDCcfxA1VL60uPf2F3D1UIHs3fVe0tW5zYTyGpF1RnMu56nsB0RT5oqcCklDtbGWwcDXyq2vL30PkEwoOuw&sig=AOD64_248HONbK5J6wiDGdS78kDPSqOTcw&q&adurl&ved=2ahUKEwj8yaO5_M77AhWvT6QEHaqsBA0Q0Qx6BAgIEAE

At Legal writing experts, we would be happy to assist in preparing any legal document you need. We are international lawyers and attorneys with significant experience in legal drafting, Commercial-Corporate practice and consulting. In the last few years, we have successfully undertaken similar assignments for clients from different jurisdictions. If given this opportunity, we will be able to prepare the legal document within the shortest time possible. You can send us your quick enquiry here

Recent Posts

- CONSTITUTION

- what governs the operation of the partnership?

- Class Action Lawsuit

- Groupon merchant agreement

- divorce paperwork

Assignment of Partnership Interest

Transfer of a partner’s interest does not

- Result in loss of rights (other than the right to transfer the interest)

- Excuse a partner’s performance of duties and obligations

- Make the recipient (e.g., a person or estate) a partner

- Dissociate or dissolve the partnership

Partnership rights may be assigned without the dissolution of the partnership. The assignee is entitled only to the profits the assignor would normally receive. The assignee does not automatically become a partner and would not have the right to participate in managing the business or to inspect the books and records of the partnership.

A partner’s transferable interest consists of a partner’s share of partnership profits and losses and the right to receive distributions. Partners may sell or otherwise transfer (assign) their interests to the partnership, another partner, or a third party without loss of the rights and duties of a partner (except the interest transferred). Moreover, unless all the other partners agree to accept the assignee as a new partner, the assignee does not become a partner in the firm. Without partnership status, the assignee has no obligation for partnership debts.

A partner may assign his or her interest in the partnership but is not allowed to assign rights in specific partnership property. A partner’s individual creditors may not attach partnership property but may charge a partner’s interest in the partnership. Only a claim against the entire partnership allows specific partnership property to be attached.

The assignment transfers the assignor’s interest in partnership profits and losses and the right to distributions.

Related posts:

- Dissociation and Dissolution of Partnership

- Limited Liability Partnership

- Related Party Sales