- Sources of Business Finance

- Small Business Loans

- Small Business Grants

- Crowdfunding Sites

- How to Get a Business Loan

- Small Business Insurance Providers

- Best Factoring Companies

- Types of Bank Accounts

- Best Banks for Small Business

- Best Business Bank Accounts

- Open a Business Bank Account

- Bank Accounts for Small Businesses

- Free Business Checking Accounts

- Best Business Credit Cards

- Get a Business Credit Card

- Business Credit Cards for Bad Credit

- Build Business Credit Fast

- Business Loan Eligibility Criteria

- Small-Business Bookkeeping Basics

- How to Set Financial Goals

- Business Loan Calculators

- How to Calculate ROI

- Calculate Net Income

- Calculate Working Capital

- Calculate Operating Income

- Calculate Net Present Value (NPV)

- Calculate Payroll Tax

12 Key Elements of a Business Plan (Top Components Explained)

Starting and running a successful business requires proper planning and execution of effective business tactics and strategies .

You need to prepare many essential business documents when starting a business for maximum success; the business plan is one such document.

When creating a business, you want to achieve business objectives and financial goals like productivity, profitability, and business growth. You need an effective business plan to help you get to your desired business destination.

Even if you are already running a business, the proper understanding and review of the key elements of a business plan help you navigate potential crises and obstacles.

This article will teach you why the business document is at the core of any successful business and its key elements you can not avoid.

Let’s get started.

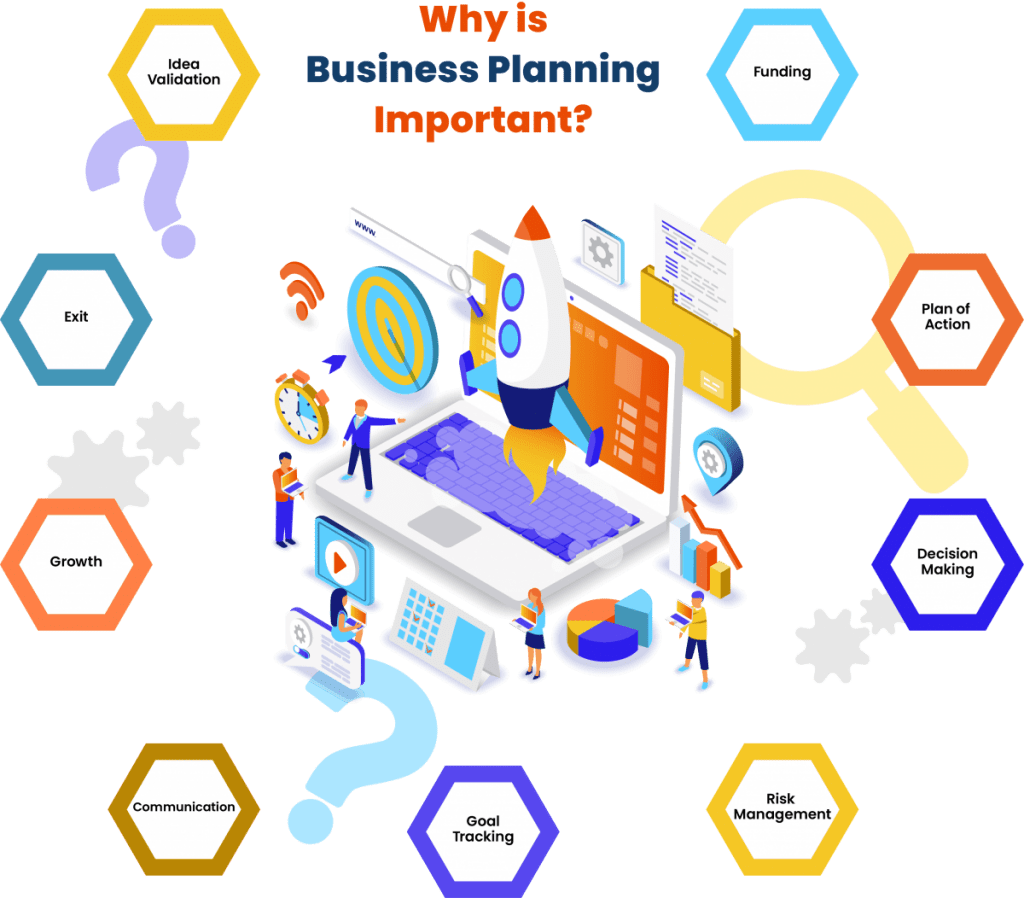

Why Are Business Plans Important?

Business plans are practical steps or guidelines that usually outline what companies need to do to reach their goals. They are essential documents for any business wanting to grow and thrive in a highly-competitive business environment .

1. Proves Your Business Viability

A business plan gives companies an idea of how viable they are and what actions they need to take to grow and reach their financial targets. With a well-written and clearly defined business plan, your business is better positioned to meet its goals.

2. Guides You Throughout the Business Cycle

A business plan is not just important at the start of a business. As a business owner, you must draw up a business plan to remain relevant throughout the business cycle .

During the starting phase of your business, a business plan helps bring your ideas into reality. A solid business plan can secure funding from lenders and investors.

After successfully setting up your business, the next phase is management. Your business plan still has a role to play in this phase, as it assists in communicating your business vision to employees and external partners.

Essentially, your business plan needs to be flexible enough to adapt to changes in the needs of your business.

3. Helps You Make Better Business Decisions

As a business owner, you are involved in an endless decision-making cycle. Your business plan helps you find answers to your most crucial business decisions.

A robust business plan helps you settle your major business components before you launch your product, such as your marketing and sales strategy and competitive advantage.

4. Eliminates Big Mistakes

Many small businesses fail within their first five years for several reasons: lack of financing, stiff competition, low market need, inadequate teams, and inefficient pricing strategy.

Creating an effective plan helps you eliminate these big mistakes that lead to businesses' decline. Every business plan element is crucial for helping you avoid potential mistakes before they happen.

5. Secures Financing and Attracts Top Talents

Having an effective plan increases your chances of securing business loans. One of the essential requirements many lenders ask for to grant your loan request is your business plan.

A business plan helps investors feel confident that your business can attract a significant return on investments ( ROI ).

You can attract and retain top-quality talents with a clear business plan. It inspires your employees and keeps them aligned to achieve your strategic business goals.

Key Elements of Business Plan

Starting and running a successful business requires well-laid actions and supporting documents that better position a company to achieve its business goals and maximize success.

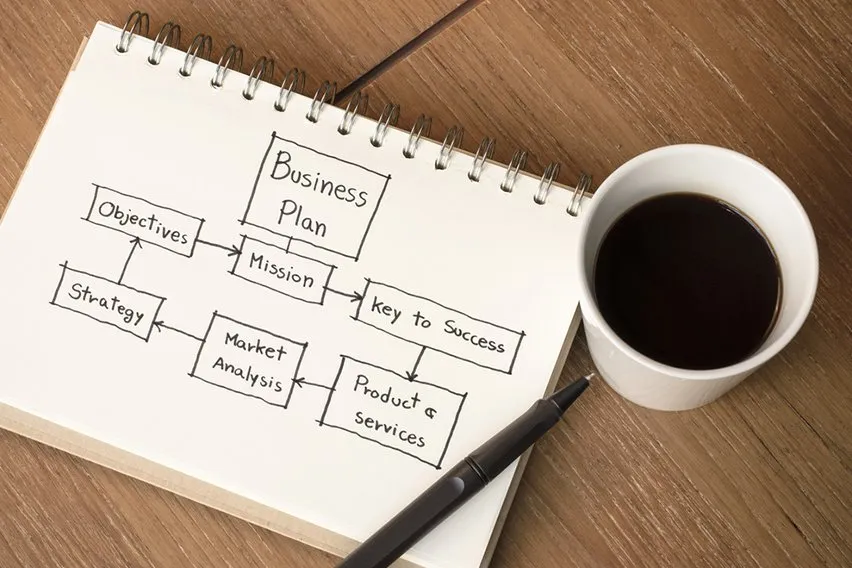

A business plan is a written document with relevant information detailing business objectives and how it intends to achieve its goals.

With an effective business plan, investors, lenders, and potential partners understand your organizational structure and goals, usually around profitability, productivity, and growth.

Every successful business plan is made up of key components that help solidify the efficacy of the business plan in delivering on what it was created to do.

Here are some of the components of an effective business plan.

1. Executive Summary

One of the key elements of a business plan is the executive summary. Write the executive summary as part of the concluding topics in the business plan. Creating an executive summary with all the facts and information available is easier.

In the overall business plan document, the executive summary should be at the forefront of the business plan. It helps set the tone for readers on what to expect from the business plan.

A well-written executive summary includes all vital information about the organization's operations, making it easy for a reader to understand.

The key points that need to be acted upon are highlighted in the executive summary. They should be well spelled out to make decisions easy for the management team.

A good and compelling executive summary points out a company's mission statement and a brief description of its products and services.

An executive summary summarizes a business's expected value proposition to distinct customer segments. It highlights the other key elements to be discussed during the rest of the business plan.

Including your prior experiences as an entrepreneur is a good idea in drawing up an executive summary for your business. A brief but detailed explanation of why you decided to start the business in the first place is essential.

Adding your company's mission statement in your executive summary cannot be overemphasized. It creates a culture that defines how employees and all individuals associated with your company abide when carrying out its related processes and operations.

Your executive summary should be brief and detailed to catch readers' attention and encourage them to learn more about your company.

Components of an Executive Summary

Here are some of the information that makes up an executive summary:

- The name and location of your company

- Products and services offered by your company

- Mission and vision statements

- Success factors of your business plan

2. Business Description

Your business description needs to be exciting and captivating as it is the formal introduction a reader gets about your company.

What your company aims to provide, its products and services, goals and objectives, target audience , and potential customers it plans to serve need to be highlighted in your business description.

A company description helps point out notable qualities that make your company stand out from other businesses in the industry. It details its unique strengths and the competitive advantages that give it an edge to succeed over its direct and indirect competitors.

Spell out how your business aims to deliver on the particular needs and wants of identified customers in your company description, as well as the particular industry and target market of the particular focus of the company.

Include trends and significant competitors within your particular industry in your company description. Your business description should contain what sets your company apart from other businesses and provides it with the needed competitive advantage.

In essence, if there is any area in your business plan where you need to brag about your business, your company description provides that unique opportunity as readers look to get a high-level overview.

Components of a Business Description

Your business description needs to contain these categories of information.

- Business location

- The legal structure of your business

- Summary of your business’s short and long-term goals

3. Market Analysis

The market analysis section should be solely based on analytical research as it details trends particular to the market you want to penetrate.

Graphs, spreadsheets, and histograms are handy data and statistical tools you need to utilize in your market analysis. They make it easy to understand the relationship between your current ideas and the future goals you have for the business.

All details about the target customers you plan to sell products or services should be in the market analysis section. It helps readers with a helpful overview of the market.

In your market analysis, you provide the needed data and statistics about industry and market share, the identified strengths in your company description, and compare them against other businesses in the same industry.

The market analysis section aims to define your target audience and estimate how your product or service would fare with these identified audiences.

Market analysis helps visualize a target market by researching and identifying the primary target audience of your company and detailing steps and plans based on your audience location.

Obtaining this information through market research is essential as it helps shape how your business achieves its short-term and long-term goals.

Market Analysis Factors

Here are some of the factors to be included in your market analysis.

- The geographical location of your target market

- Needs of your target market and how your products and services can meet those needs

- Demographics of your target audience

Components of the Market Analysis Section

Here is some of the information to be included in your market analysis.

- Industry description and statistics

- Demographics and profile of target customers

- Marketing data for your products and services

- Detailed evaluation of your competitors

4. Marketing Plan

A marketing plan defines how your business aims to reach its target customers, generate sales leads, and, ultimately, make sales.

Promotion is at the center of any successful marketing plan. It is a series of steps to pitch a product or service to a larger audience to generate engagement. Note that the marketing strategy for a business should not be stagnant and must evolve depending on its outcome.

Include the budgetary requirement for successfully implementing your marketing plan in this section to make it easy for readers to measure your marketing plan's impact in terms of numbers.

The information to include in your marketing plan includes marketing and promotion strategies, pricing plans and strategies , and sales proposals. You need to include how you intend to get customers to return and make repeat purchases in your business plan.

5. Sales Strategy

Sales strategy defines how you intend to get your product or service to your target customers and works hand in hand with your business marketing strategy.

Your sales strategy approach should not be complex. Break it down into simple and understandable steps to promote your product or service to target customers.

Apart from the steps to promote your product or service, define the budget you need to implement your sales strategies and the number of sales reps needed to help the business assist in direct sales.

Your sales strategy should be specific on what you need and how you intend to deliver on your sales targets, where numbers are reflected to make it easier for readers to understand and relate better.

6. Competitive Analysis

Providing transparent and honest information, even with direct and indirect competitors, defines a good business plan. Provide the reader with a clear picture of your rank against major competitors.

Identifying your competitors' weaknesses and strengths is useful in drawing up a market analysis. It is one information investors look out for when assessing business plans.

The competitive analysis section clearly defines the notable differences between your company and your competitors as measured against their strengths and weaknesses.

This section should define the following:

- Your competitors' identified advantages in the market

- How do you plan to set up your company to challenge your competitors’ advantage and gain grounds from them?

- The standout qualities that distinguish you from other companies

- Potential bottlenecks you have identified that have plagued competitors in the same industry and how you intend to overcome these bottlenecks

In your business plan, you need to prove your industry knowledge to anyone who reads your business plan. The competitive analysis section is designed for that purpose.

7. Management and Organization

Management and organization are key components of a business plan. They define its structure and how it is positioned to run.

Whether you intend to run a sole proprietorship, general or limited partnership, or corporation, the legal structure of your business needs to be clearly defined in your business plan.

Use an organizational chart that illustrates the hierarchy of operations of your company and spells out separate departments and their roles and functions in this business plan section.

The management and organization section includes profiles of advisors, board of directors, and executive team members and their roles and responsibilities in guaranteeing the company's success.

Apparent factors that influence your company's corporate culture, such as human resources requirements and legal structure, should be well defined in the management and organization section.

Defining the business's chain of command if you are not a sole proprietor is necessary. It leaves room for little or no confusion about who is in charge or responsible during business operations.

This section provides relevant information on how the management team intends to help employees maximize their strengths and address their identified weaknesses to help all quarters improve for the business's success.

8. Products and Services

This business plan section describes what a company has to offer regarding products and services to the maximum benefit and satisfaction of its target market.

Boldly spell out pending patents or copyright products and intellectual property in this section alongside costs, expected sales revenue, research and development, and competitors' advantage as an overview.

At this stage of your business plan, the reader needs to know what your business plans to produce and sell and the benefits these products offer in meeting customers' needs.

The supply network of your business product, production costs, and how you intend to sell the products are crucial components of the products and services section.

Investors are always keen on this information to help them reach a balanced assessment of if investing in your business is risky or offer benefits to them.

You need to create a link in this section on how your products or services are designed to meet the market's needs and how you intend to keep those customers and carve out a market share for your company.

Repeat purchases are the backing that a successful business relies on and measure how much customers are into what your company is offering.

This section is more like an expansion of the executive summary section. You need to analyze each product or service under the business.

9. Operating Plan

An operations plan describes how you plan to carry out your business operations and processes.

The operating plan for your business should include:

- Information about how your company plans to carry out its operations.

- The base location from which your company intends to operate.

- The number of employees to be utilized and other information about your company's operations.

- Key business processes.

This section should highlight how your organization is set up to run. You can also introduce your company's management team in this section, alongside their skills, roles, and responsibilities in the company.

The best way to introduce the company team is by drawing up an organizational chart that effectively maps out an organization's rank and chain of command.

What should be spelled out to readers when they come across this business plan section is how the business plans to operate day-in and day-out successfully.

10. Financial Projections and Assumptions

Bringing your great business ideas into reality is why business plans are important. They help create a sustainable and viable business.

The financial section of your business plan offers significant value. A business uses a financial plan to solve all its financial concerns, which usually involves startup costs, labor expenses, financial projections, and funding and investor pitches.

All key assumptions about the business finances need to be listed alongside the business financial projection, and changes to be made on the assumptions side until it balances with the projection for the business.

The financial plan should also include how the business plans to generate income and the capital expenditure budgets that tend to eat into the budget to arrive at an accurate cash flow projection for the business.

Base your financial goals and expectations on extensive market research backed with relevant financial statements for the relevant period.

Examples of financial statements you can include in the financial projections and assumptions section of your business plan include:

- Projected income statements

- Cash flow statements

- Balance sheets

- Income statements

Revealing the financial goals and potentials of the business is what the financial projection and assumption section of your business plan is all about. It needs to be purely based on facts that can be measurable and attainable.

11. Request For Funding

The request for funding section focuses on the amount of money needed to set up your business and underlying plans for raising the money required. This section includes plans for utilizing the funds for your business's operational and manufacturing processes.

When seeking funding, a reasonable timeline is required alongside it. If the need arises for additional funding to complete other business-related projects, you are not left scampering and desperate for funds.

If you do not have the funds to start up your business, then you should devote a whole section of your business plan to explaining the amount of money you need and how you plan to utilize every penny of the funds. You need to explain it in detail for a future funding request.

When an investor picks up your business plan to analyze it, with all your plans for the funds well spelled out, they are motivated to invest as they have gotten a backing guarantee from your funding request section.

Include timelines and plans for how you intend to repay the loans received in your funding request section. This addition keeps investors assured that they could recoup their investment in the business.

12. Exhibits and Appendices

Exhibits and appendices comprise the final section of your business plan and contain all supporting documents for other sections of the business plan.

Some of the documents that comprise the exhibits and appendices section includes:

- Legal documents

- Licenses and permits

- Credit histories

- Customer lists

The choice of what additional document to include in your business plan to support your statements depends mainly on the intended audience of your business plan. Hence, it is better to play it safe and not leave anything out when drawing up the appendix and exhibit section.

Supporting documentation is particularly helpful when you need funding or support for your business. This section provides investors with a clearer understanding of the research that backs the claims made in your business plan.

There are key points to include in the appendix and exhibits section of your business plan.

- The management team and other stakeholders resume

- Marketing research

- Permits and relevant legal documents

- Financial documents

Was This Article Helpful?

Martin luenendonk.

Martin loves entrepreneurship and has helped dozens of entrepreneurs by validating the business idea, finding scalable customer acquisition channels, and building a data-driven organization. During his time working in investment banking, tech startups, and industry-leading companies he gained extensive knowledge in using different software tools to optimize business processes.

This insights and his love for researching SaaS products enables him to provide in-depth, fact-based software reviews to enable software buyers make better decisions.

For the Love of Business

800.929.RELY

314.209-8299

What are key elements of a business plan and why are they important?

When you're writing a business plan, there are several elements that are important to the overall document. These elements help lay out the most important parts of your business, helping you find direction, secure financing and be successful in your enterprise.

Here's a quick look at some of the most important elements of a business plan and the reasons why they're so important.

Executive Summary

This is an overview of what your business is and where it will go. It should peak the interest of the reader, making them want to continue reading and take an interest in helping your company succeed.

Company Description

This describes what your company is, how you'll operate and your overall goals. It tells readers about your business' growth, operations and projections are, as well as the problems it solves for customers.

Products and Services Description

This goes into depth on your products and/or services. It focuses on the benefits to the customers, which will help convince the reader that your company is a good risk.

Market Analysis

The market analysis covers your target customers, their demographics and market size, the industry's outlook, projections for past, current and future marketing data, and an in-depth look at your competition.

Sales and Marketing Strategy

This will go into your sales and marketing plans and how they fall into place with your operation. It shows the reader that you have a solid, realistic strategy to successfully gain a portion of your market share.

Organization and Management

This outlines your business' management organization and key leadership. It gives you the opportunity to showcase your talent and how they'll help your company succeed.

Financial Plan and Income Projections

This helps show the expected income for your business and how it will come about. It's often developed with an accountant's assistance to ensure the accuracy of the projections.

Knowing why these elements are important means you can give them the attention they deserve while developing your business plan. But what if you're not sure how to go forward or are concerned you're not getting it right? At AccountRely, our business services professionals have helped countless entrepreneurs plan a businesses and are ready to help you. Please feel free to contact us today to get started.

Featured Posts

Why you should insist on using a CPA with your business

The value of reassurance: How much insurance does your company need?

How to Start Integrating Cloud Computing Into Your Business Operations

How to Set up Your Business' Accounting Processes to Run Smoothly

How Will the New Operating Lease Accounting Standard Impact Your Company?

Digitization Planning: Vital Priorities to Consider

Gifting and Charitable Contributions

Recent Posts

Going Paperless: How to Create a Strategy for an All-Digital Office

5 Hot Business Trends for the Upcoming Year

Employee, Contract Worker, Freelancer: Which is Best for Your Open Position?

Going Remote: Managing a Telecommuting Workforce

How to Work Through a Grant Proposal for Your Business

Does Your Business Need Standard Operating Procedures? Here's How to Create Them

Letting Go: How to Handle the Process of Firing an Employee

Promote from Within: Developing a Training Program for Your Business

Boom and Bust: Taking Advantage of Market Cycles in Business

How to Add Value-Added to Your Sales Cycle

Search By Tags

Nice to meet you.

Enter your email to receive our weekly G2 Tea newsletter with the hottest marketing news, trends, and expert opinions.

Elements of a Business Plan: What to Include to Turn Heads

June 26, 2019

by Mary Clare Novak

Good things come to those who wait.

No matter the business size , industry, or location, planning is necessary for any company. The standard business plan can seem mundane and unexciting, but those that choose to skip this step when starting a business can count on being disorganized, frazzled, and wishing they had made one in the first place.

What is a business plan?

A business plan is a formal document that contains the goals of a business and a timeline stating when they need to be achieved. Business plans also include details like the background of the business, financial projections, and strategies that will be used to achieve the goals.

Think of a business plan as a road map. They both show direction and need to include certain things to be considered valid. When laid out properly, a business plan can be used to create relationships with investors, employees, vendors, and interested partners.

While maps must show rivers, cities, and countries, a business plan has other requirements.

Elements of a business plan

- Executive summary

Company description

Market analysis, organization and management, product or service description.

- Sales and marketing strategies

Funding requirements

Financial projections.

The length of your business plan doesn’t matter. As long as it includes those eight items, you should be good to go.

Business plan elements

Let’s take a closer look at what each of these business plan elements mean, and why they are important to the overall plan.

Executive summary

An executive summary is a brief summary of your plan. It gives readers a general idea of the most important parts of the business plan so they know what to expect.

While you want to keep it concise, as most summaries are, there are certain things you will need to include. Provide a brief history of the start of the business, describe the mission you wish to achieve, and briefly state a few goals you need to reach to get there.

It is usually best to write this last so you have time to get to know the business plan, which will help you properly summarize it.

The company description is self-explanatory: you describe your company. It is a good time to ask yourself some who, what, when, where, and why questions.

This background shows readers how you view your business and what you will choose to focus on.

Next, you will prove to your readers that you have properly analyzed your market before starting this business venture.

Conducting market research is a necessary step when starting a new business or restructuring an existing one. It gives you an idea of who your audience and competitors are so you can craft a product or service that is superior to others in the same market.

What is currently being offered? Where do you fit in the market? A good way to do this is with G2 Reports , which can show readers where you stand against your competitors based on un-biased, third party reviews.

This section of the business plan will show readers how you plan to organize business leadership, and who those leaders actually are.

Not only does nobody want to invest in or work for a company that has poor management and organization, but you need it to be successful in the first place. Highlight the qualifications of each team member and mention how they will contribute to the success of a business.

Show them what your team is made of and give them a reason to get involved.

The product or service description is where take a closer look at what it is you are selling. This is your opportunity to get people on board with your business. If they don’t like what is being offered themselves, they won’t have a reason to get involved.

Thoroughly describe what you are offering, the associated benefits, and why your product or service is, for lack of a better word, better than that of your competitors.

While you are probably convinced that your product or service is the best in the market, those reading your business plan will want proof. Data. Numbers. They don’t need to be exact, but providing some estimates will only help you prove your case further.

Marketing and sales strategies

After you give a thorough description of the product or service, which is the heart and soul of the business, it’s time to talk about sales and marketing. Think of sales and marketing as the voice of reason for your business. It explains why people should become involved with your business, in one way or another.

This section includes the nitty-gritty details of your business’ function. And the only way for a business to function is to make money. How do you plan on making a profit? Talk about how much your product or service costs to produce, and then how much you plan on selling it for. This is also known as your gross profit , which proves that your company is capable of making money.

It is also helpful to show readers that your business uses a software management tool, like G2 Track , to stay organized and avoid wasted Saas spending.

In the competitive world that is the American economy, you not only need a product or service that stands out, but you also need some solid marketing to prove that to your audiences.

Include your marketing plan in this section. Describe your marketing strategies, tactics that will be used to carry them out, and what company goals you will achieve with marketing.

Now that you’ve shown readers the hypothetical money, it is time for you to ask for the real deal: funding .

Outline how much money you need to make your business a reality. Be realistic and honest. Don’t be afraid to throw out a big number if that is what it will take to get your business off the ground. Think of certain situations that will help or hinder your business and create a range of funding requirements based on their aftermaths.

Wrap up your plan with some financial projections. Put simply, financial projections are predictions of revenue and expenses.

You will want to include financial projections for both short, mid, and long term time periods. Break it down by month, quarter, and year.

Here are a couple of basics you should include to make sure your financial projections are thorough enough:

You will also want to include cash flow and a balance sheet .

Keeping your finances organized will help if you are looking to gain investors or receive a loan.

Prioritize planning

Whether you are just starting a small business or reworking your company, any new venture requires a strong business plan. Not only do they help keep you organized as the owner, but they give others a behind-the-scenes look at what the business is and why it matters, opening the doors for growth.

Want to start a business but don’t know where to begin? Check out the most profitable small businesses to get those ideas flowing.

Mary Clare Novak is a Content Marketing Specialist at G2 based in Burlington, Vermont, where she is currently exploring topics related to sales and customer relationship management. In her free time, you can find her doing a crossword puzzle, listening to cover bands, or eating fish tacos. (she/her/hers)

Recommended Articles

How to Start a Cleaning Business + Sweep Away the Competition

The cleaning business is a lucrative one.

by Deirdre O'Donoghue

Creating the Perfect Project Plan Template

Having a plan helps you reach your goals, stay under budget, and meet your deadlines.

by Grace Pinegar

What Is a Small Business? Breaking Down Conditions by Industry

A small business can be a lot of things: a local bakery, an auto repair shop, a hotel...

Never miss a post.

Subscribe to keep your fingers on the tech pulse.

By submitting this form, you are agreeing to receive marketing communications from G2.

- Search Search Please fill out this field.

What Is a Business Plan?

Understanding business plans, how to write a business plan, common elements of a business plan, how often should a business plan be updated, the bottom line, business plan: what it is, what's included, and how to write one.

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

- How to Start a Business: A Comprehensive Guide and Essential Steps

- How to Do Market Research, Types, and Example

- Marketing Strategy: What It Is, How It Works, How To Create One

- Marketing in Business: Strategies and Types Explained

- What Is a Marketing Plan? Types and How to Write One

- Business Development: Definition, Strategies, Steps & Skills

- Business Plan: What It Is, What's Included, and How to Write One CURRENT ARTICLE

- Small Business Development Center (SBDC): Meaning, Types, Impact

- How to Write a Business Plan for a Loan

- Business Startup Costs: It’s in the Details

- Startup Capital Definition, Types, and Risks

- Bootstrapping Definition, Strategies, and Pros/Cons

- Crowdfunding: What It Is, How It Works, and Popular Websites

- Starting a Business with No Money: How to Begin

- A Comprehensive Guide to Establishing Business Credit

- Equity Financing: What It Is, How It Works, Pros and Cons

- Best Startup Business Loans

- Sole Proprietorship: What It Is, Pros & Cons, and Differences From an LLC

- Partnership: Definition, How It Works, Taxation, and Types

- What is an LLC? Limited Liability Company Structure and Benefits Defined

- Corporation: What It Is and How to Form One

- Starting a Small Business: Your Complete How-to Guide

- Starting an Online Business: A Step-by-Step Guide

- How to Start Your Own Bookkeeping Business: Essential Tips

- How to Start a Successful Dropshipping Business: A Comprehensive Guide

A business plan is a document that details a company's goals and how it intends to achieve them. Business plans can be of benefit to both startups and well-established companies. For startups, a business plan can be essential for winning over potential lenders and investors. Established businesses can find one useful for staying on track and not losing sight of their goals. This article explains what an effective business plan needs to include and how to write one.

Key Takeaways

- A business plan is a document describing a company's business activities and how it plans to achieve its goals.

- Startup companies use business plans to get off the ground and attract outside investors.

- For established companies, a business plan can help keep the executive team focused on and working toward the company's short- and long-term objectives.

- There is no single format that a business plan must follow, but there are certain key elements that most companies will want to include.

Investopedia / Ryan Oakley

Any new business should have a business plan in place prior to beginning operations. In fact, banks and venture capital firms often want to see a business plan before they'll consider making a loan or providing capital to new businesses.

Even if a business isn't looking to raise additional money, a business plan can help it focus on its goals. A 2017 Harvard Business Review article reported that, "Entrepreneurs who write formal plans are 16% more likely to achieve viability than the otherwise identical nonplanning entrepreneurs."

Ideally, a business plan should be reviewed and updated periodically to reflect any goals that have been achieved or that may have changed. An established business that has decided to move in a new direction might create an entirely new business plan for itself.

There are numerous benefits to creating (and sticking to) a well-conceived business plan. These include being able to think through ideas before investing too much money in them and highlighting any potential obstacles to success. A company might also share its business plan with trusted outsiders to get their objective feedback. In addition, a business plan can help keep a company's executive team on the same page about strategic action items and priorities.

Business plans, even among competitors in the same industry, are rarely identical. However, they often have some of the same basic elements, as we describe below.

While it's a good idea to provide as much detail as necessary, it's also important that a business plan be concise enough to hold a reader's attention to the end.

While there are any number of templates that you can use to write a business plan, it's best to try to avoid producing a generic-looking one. Let your plan reflect the unique personality of your business.

Many business plans use some combination of the sections below, with varying levels of detail, depending on the company.

The length of a business plan can vary greatly from business to business. Regardless, it's best to fit the basic information into a 15- to 25-page document. Other crucial elements that take up a lot of space—such as applications for patents—can be referenced in the main document and attached as appendices.

These are some of the most common elements in many business plans:

- Executive summary: This section introduces the company and includes its mission statement along with relevant information about the company's leadership, employees, operations, and locations.

- Products and services: Here, the company should describe the products and services it offers or plans to introduce. That might include details on pricing, product lifespan, and unique benefits to the consumer. Other factors that could go into this section include production and manufacturing processes, any relevant patents the company may have, as well as proprietary technology . Information about research and development (R&D) can also be included here.

- Market analysis: A company needs to have a good handle on the current state of its industry and the existing competition. This section should explain where the company fits in, what types of customers it plans to target, and how easy or difficult it may be to take market share from incumbents.

- Marketing strategy: This section can describe how the company plans to attract and keep customers, including any anticipated advertising and marketing campaigns. It should also describe the distribution channel or channels it will use to get its products or services to consumers.

- Financial plans and projections: Established businesses can include financial statements, balance sheets, and other relevant financial information. New businesses can provide financial targets and estimates for the first few years. Your plan might also include any funding requests you're making.

The best business plans aren't generic ones created from easily accessed templates. A company should aim to entice readers with a plan that demonstrates its uniqueness and potential for success.

2 Types of Business Plans

Business plans can take many forms, but they are sometimes divided into two basic categories: traditional and lean startup. According to the U.S. Small Business Administration (SBA) , the traditional business plan is the more common of the two.

- Traditional business plans : These plans tend to be much longer than lean startup plans and contain considerably more detail. As a result they require more work on the part of the business, but they can also be more persuasive (and reassuring) to potential investors.

- Lean startup business plans : These use an abbreviated structure that highlights key elements. These business plans are short—as short as one page—and provide only the most basic detail. If a company wants to use this kind of plan, it should be prepared to provide more detail if an investor or a lender requests it.

Why Do Business Plans Fail?

A business plan is not a surefire recipe for success. The plan may have been unrealistic in its assumptions and projections to begin with. Markets and the overall economy might change in ways that couldn't have been foreseen. A competitor might introduce a revolutionary new product or service. All of this calls for building some flexibility into your plan, so you can pivot to a new course if needed.

How frequently a business plan needs to be revised will depend on the nature of the business. A well-established business might want to review its plan once a year and make changes if necessary. A new or fast-growing business in a fiercely competitive market might want to revise it more often, such as quarterly.

What Does a Lean Startup Business Plan Include?

The lean startup business plan is an option when a company prefers to give a quick explanation of its business. For example, a brand-new company may feel that it doesn't have a lot of information to provide yet.

Sections can include: a value proposition ; the company's major activities and advantages; resources such as staff, intellectual property, and capital; a list of partnerships; customer segments; and revenue sources.

A business plan can be useful to companies of all kinds. But as a company grows and the world around it changes, so too should its business plan. So don't think of your business plan as carved in granite but as a living document designed to evolve with your business.

Harvard Business Review. " Research: Writing a Business Plan Makes Your Startup More Likely to Succeed ."

U.S. Small Business Administration. " Write Your Business Plan ."

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1456193345-2cc8ef3d583f42d8a80c8e631c0b0556.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

We earn commissions if you shop through the links below. Read more

8 Components of a Business Plan

Back to Business Plans

Written by: Carolyn Young

Carolyn Young is a business writer who focuses on entrepreneurial concepts and the business formation. She has over 25 years of experience in business roles, and has authored several entrepreneurship textbooks.

Edited by: David Lepeska

David has been writing and learning about business, finance and globalization for a quarter-century, starting with a small New York consulting firm in the 1990s.

Published on February 19, 2023 Updated on February 27, 2024

A key part of the business startup process is putting together a business plan , particularly if you’d like to raise capital. It’s not going to be easy, but it’s absolutely essential, and an invaluable learning tool.

Creating a business plan early helps you think through every aspect of your business, from operations and financing to growth and vision. In the end, the knowledge you’ll gain could be the difference between success and failure.

But what exactly does a business plan consist of? There are eight essential components, all of which are detailed in this handy guide.

1. Executive Summary

The executive summary opens your business plan , but it’s the section you’ll write last. It summarizes the key points and highlights the most important aspects of your plan. Often investors and lenders will only read the executive summary; if it doesn’t capture their interest they’ll stop reading, so it’s important to make it as compelling as possible.

The components touched upon should include:

- The business opportunity – what problem are you solving in the market?

- Your idea, meaning the product or service you’re planning to offer, and why it solves the problem in the market better than other solutions.

- The history of the business so far – what have you done to this point? When you’re just getting started, this may be nothing more than coming up with the idea, choosing a business name , and forming a business entity.

- A summary of the industry, market size, your target customers, and the competition.

- A strong statement about how your company is going to stand out in the market – what will be your competitive advantage?

- A list of specific goals that you plan to achieve in the short term, such as developing your product, launching a marketing campaign, or hiring a key person.

- A summary of your financial plan including cost and sales projections and a break-even analysis.

- A summary of your management team, their roles, and the relevant experience that they have to serve in those roles.

- Your “ask”, if applicable, meaning what you’re requesting from the investor or lender. You’ll include the amount you’d like and how it will be spent, such as “We are seeking $50,000 in seed funding to develop our beta product”.

Remember that if you’re seeking capital, the executive summary could make or break your venture. Take your time and make sure it illustrates how your business is unique in the market and why you’ll succeed.

The executive summary should be no more than two pages long, so it’s important to capture the reader’s interest from the start.

- 2. Company Description/Overview

In this section, you’ll detail your full company history, such as how you came up with the idea for your business and any milestones or achievements.

You’ll also include your mission and vision statements. A mission statement explains what you’d like your business to achieve, its driving force, while a vision statement lays out your long-term plan in terms of growth.

A mission statement might be “Our company aims to make life easier for business owners with intuitive payroll software”, while a vision statement could be “Our objective is to become the go-to comprehensive HR software provider for companies around the globe.”

In this section, you’ll want to list your objectives – specific short-term goals. Examples might include “complete initial product development by ‘date’” or “hire two qualified sales people” or “launch the first version of the product”.

It’s best to divide this section into subsections – company history, mission and vision, and objectives.

3. Products/Services Offered

Here you’ll go into detail about what you’re offering, how it solves a problem in the market, and how it’s unique. Don’t be afraid to share information that is proprietary – investors and lenders are not out to steal your ideas.

Also specify how your product is developed or sourced. Are you manufacturing it or does it require technical development? Are you purchasing a product from a manufacturer or wholesaler?

You’ll also want to specify how you’ll sell your product or service. Will it be a subscription service or a one time purchase? What is your target pricing? On what channels do you plan to sell your product or service, such as online or by direct sales in a store?

Basically, you’re describing what you’re going to sell and how you’ll make money.

- 4. Market Analysis

The market analysis is where you’re going to spend most of your time because it involves a lot of research. You should divide it into four sections.

Industry analysis

You’ll want to find out exactly what’s happening in your industry, such as its growth rate, market size, and any specific trends that are occurring. Where is the industry predicted to be in 10 years? Cite your sources where you can by providing links.

Then describe your company’s place in the market. Is your product going to fit a certain niche? Is there a sub-industry your company will fit within? How will you keep up with industry changes?

Competitor analysis

Now you’ll dig into your competition. Detail your main competitors and how they differentiate themselves in the market. For example, one competitor may advertise convenience while another may tout superior quality. Also highlight your competitors’ weaknesses.

Next, describe how you’ll stand out. Detail your competitive advantages and how you’ll sustain them. This section is extremely important and will be a focus for investors and lenders.

Target market analysis

Here you’ll describe your target market and whether it’s different from your competitors’. For example, maybe you have a younger demographic in mind?

You’ll need to know more about your target market than demographics, though. You’ll want to explain the needs and wants of your ideal customers, how your offering solves their problem, and why they will choose your company.

You should also lay out where you’ll find them, where to place your marketing and where to sell your products. Learning this kind of detail requires going to the source – your potential customers. You can do online surveys or even in-person focus groups.

Your goal will be to uncover as much about these people as possible. When you start selling, you’ll want to keep learning about your customers. You may end up selling to a different target market than you originally thought, which could lead to a marketing shift.

SWOT analysis

SWOT stands for strengths, weaknesses, opportunities, and threats, and it’s one of the more common and helpful business planning tools.

First describe all the specific strengths of your company, such as the quality of your product or some unique feature, such as the experience of your management team. Talk about the elements that will make your company successful.

Next, acknowledge and explore possible weaknesses. You can’t say “none”, because no company is perfect, especially at the start. Maybe you lack funds or face a massive competitor. Whatever it is, detail how you will surmount this hurdle.

Next, talk about the opportunities your company has in the market. Perhaps you’re going to target an underserved segment, or have a technology plan that will help you surge past the competition.

Finally, examine potential threats. It could be a competitor that might try to replicate your product or rapidly advancing technology in your industry. Again, discuss your plans to handle such threats if they come to pass.

5. Marketing and Sales Strategies

Now it’s time to explain how you’re going to find potential customers and convert them into paying customers.

Marketing and advertising plan

When you did your target market analysis, you should have learned a lot about your potential customers, including where to find them. This should help you determine where to advertise.

Maybe you found that your target customers favor TikTok over Instagram and decided to spend more marketing dollars on TikTok. Detail all the marketing channels you plan to use and why.

Your target market analysis should also have given you information about what kind of message will resonate with your target customers. You should understand their needs and wants and how your product solves their problem, then convey that in your marketing.

Start by creating a value proposition, which should be no more than two sentences long and answer the following questions:

- What are you offering

- Whose problem does it solve

- What problem does it solve

- What benefits does it provide

- How is it better than competitor products

An example might be “Payroll software that will handle all the payroll needs of small business owners, making life easier for less.”

Whatever your value proposition, it should be at the heart of all of your marketing.

Sales strategy and tactics

Your sales strategy is a vision to persuade customers to buy, including where you’ll sell and how. For example, you may plan to sell only on your own website, or you may sell from both a physical location and online. On the other hand, you may have a sales team that will make direct sales calls to potential customers, which is more common in business-to-business sales.

Sales tactics are more about how you’re going to get them to buy after they reach your sales channel. Even when selling online, you need something on your site that’s going to get them to go from a site visitor to a paying customer.

By the same token, if you’re going to have a sales team making direct sales, what message are they going to deliver that will entice a sale? It’s best for sales tactics to focus on the customer’s pain point and what value you’re bringing to the table, rather than being aggressively promotional about the greatness of your product and your business.

Pricing strategy

Pricing is not an exact science and should depend on several factors. First, consider how you want your product or service to be perceived in the market. If your differentiator is to be the lowest price, position your company as the “discount” option. Think Walmart, and price your products lower than the competition.

If, on the other hand, you want to be the Mercedes of the market, then you’ll position your product as the luxury option. Of course you’ll have to back this up with superior quality, but being the luxury option allows you to command higher prices.

You can, of course, fall somewhere in the middle, but the point is that pricing is a matter of perception. How you position your product in the market compared to the competition is a big factor in determining your price.

Of course, you’ll have to consider your costs, as well as competitor prices. Obviously, your prices must cover your costs and allow you to make a good profit margin.

Whatever pricing strategy you choose, you’ll justify it in this section of your plan.

- 6. Operations and Management

This section is the real nuts and bolts of your business – how it operates on a day-to-day basis and who is operating it. Again, this section should be divided into subsections.

Operational plan

Your plan of operations should be specific , detailed and mainly logistical. Who will be doing what on a daily, weekly, and monthly basis? How will the business be managed and how will quality be assured? Be sure to detail your suppliers and how and when you’ll order raw materials.

This should also include the roles that will be filled and the various processes that will be part of everyday business operations . Just consider all the critical functions that must be handled for your business to be able to operate on an ongoing basis.

Technology plan

If your product involves technical development, you’ll describe your tech development plan with specific goals and milestones. The plan will also include how many people will be working on this development, and what needs to be done for goals to be met.

If your company is not a technology company, you’ll describe what technologies you plan to use to run your business or make your business more efficient. It could be process automation software, payroll software, or just laptops and tablets for your staff.

Management and organizational structure

Now you’ll describe who’s running the show. It may be just you when you’re starting out, so you’ll detail what your role will be and summarize your background. You’ll also go into detail about any managers that you plan to hire and when that will occur.

Essentially, you’re explaining your management structure and detailing why your strategy will enable smooth and efficient operations.

Ideally, at some point, you’ll have an organizational structure that is a hierarchy of your staff. Describe what you envision your organizational structure to be.

Personnel plan

Detail who you’ve hired or plan to hire and for which roles. For example, you might have a developer, two sales people, and one customer service representative.

Describe each role and what qualifications are needed to perform those roles.

- 7. Financial Plan

Now, you’ll enter the dreaded world of finance. Many entrepreneurs struggle with this part, so you might want to engage a financial professional to help you. A financial plan has five key elements.

Startup Costs

Detail in a spreadsheet every cost you’ll incur before you open your doors. This should determine how much capital you’ll need to launch your business.

Financial projections

Creating financial projections, like many facets of business, is not an exact science. If your company has no history, financial projections can only be an educated guess.

First, come up with realistic sales projections. How much do you expect to sell each month? Lay out at least three years of sales projections, detailing monthly sales growth for the first year, then annually thereafter.

Calculate your monthly costs, keeping in mind that some costs will grow along with sales.

Once you have your numbers projected and calculated, use them to create these three key financial statements:

- Profit and Loss Statement , also known as an income statement. This shows projected revenue and lists all costs, which are then deducted to show net profit or loss.

- Cash Flow Statement. This shows how much cash you have on hand at any given time. It will have a starting balance, projections of cash coming in, and cash going out, which will be used to calculate cash on hand at the end of the reporting period.

- Balance Sheet. This shows the net worth of the business, which is the assets of the business minus debts. Assets include equipment, cash, accounts receivables, inventory, and more. Debts include outstanding loan balances and accounts payable.

You’ll need monthly projected versions of each statement for the first year, then annual projections for the following two years.

Break-even analysis

The break-even point for your business is when costs and revenue are equal. Most startups operate at a loss for a period of time before they break even and start to make a profit. Your break-even analysis will project when your break-even point will occur, and will be informed by your profit and loss statement.

Funding requirements and sources

Lay out the funding you’ll need, when, and where you’ll get it. You’ll also explain what those funds will be used for at various points. If you’re in a high growth industry that can attract investors, you’ll likely need various rounds of funding to launch and grow.

Key performance indicators (KPIs)

KPIs measure your company’s performance and can determine success. Many entrepreneurs only focus on the bottom line, but measuring specific KPIs helps find areas of improvement. Every business has certain crucial metrics.

If you sell only online, one of your key metrics might be your visitor conversion rate. You might do an analysis to learn why just one out of ten site visitors makes a purchase.

Perhaps the purchase process is too complicated or your product descriptions are vague. The point is, learning why your conversion rate is low gives you a chance to improve it and boost sales.

8. Appendices

In the appendices, you can attach documents such as manager resumes or any other documents that support your business plan.

As you can see, a business plan has many components, so it’s not an afternoon project. It will likely take you several weeks and a great deal of work to complete. Unless you’re a finance guru, you may also want some help from a financial professional.

Keep in mind that for a small business owner, there may be no better learning experience than writing a detailed and compelling business plan. It shouldn’t be viewed as a hassle, but as an opportunity!

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- Executive Summary

- Products/Services Offered

- Marketing and Sales Strategies

Subscribe to Our Newsletter

Featured resources.

Crafting the Perfect Business Plan: A Deep Dive with Upmetrics’ Vinay Kevadiya

Carolyn Young

Published on October 13, 2023

In the first segment of our conversation with Vinay Kevadiya, the visionary behind Upmetrics, we explored the platform’s origins and itsunique ...

LivePlan Software Review

Published on September 15, 2023

When you’re starting a business, a business plan is essential whether you’re going to obtain financing or not. Creating a business plan helpsyou ...

What to Include in Your Business Plan Appendix?

Published on September 13, 2023

Launching a business involves countless tasks, and one of the crucial early hurdles is writing a business plan. Many entrepreneurs who aren’tlooki ...

No thanks, I don't want to stay up to date on industry trends and news.

- Starting a Business

- Growing a Business

- Small Business Guide

- Business News

- Science & Technology

- Money & Finance

- For Subscribers

- Write for Entrepreneur

- Entrepreneur Store

- United States

- Asia Pacific

- Middle East

- South Africa

Copyright © 2024 Entrepreneur Media, LLC All rights reserved. Entrepreneur® and its related marks are registered trademarks of Entrepreneur Media LLC

Elements of a Business Plan There are seven major sections of a business plan, and each one is a complex document. Read this selection from our business plan tutorial to fully understand these components.

Now that you understand why you need a business plan and you've spent some time doing your homework gathering the information you need to create one, it's time to roll up your sleeves and get everything down on paper. The following pages will describe in detail the seven essential sections of a business plan: what you should include, what you shouldn't include, how to work the numbers and additional resources you can turn to for help. With that in mind, jump right in.

Executive Summary

Within the overall outline of the business plan, the executive summary will follow the title page. The summary should tell the reader what you want. This is very important. All too often, what the business owner desires is buried on page eight. Clearly state what you're asking for in the summary.

The statement should be kept short and businesslike, probably no more than half a page. It could be longer, depending on how complicated the use of funds may be, but the summary of a business plan, like the summary of a loan application, is generally no longer than one page. Within that space, you'll need to provide a synopsis of your entire business plan. Key elements that should be included are:

- Business concept. Describes the business, its product and the market it will serve. It should point out just exactly what will be sold, to whom and why the business will hold a competitive advantage.

- Financial features. Highlights the important financial points of the business including sales, profits, cash flows and return on investment.

- Financial requirements. Clearly states the capital needed to start the business and to expand. It should detail how the capital will be used, and the equity, if any, that will be provided for funding. If the loan for initial capital will be based on security instead of equity, you should also specify the source of collateral.

- Current business position. Furnishes relevant information about the company, its legal form of operation, when it was formed, the principal owners and key personnel.

- Major achievements. Details any developments within the company that are essential to the success of the business. Major achievements include items like patents, prototypes, location of a facility, any crucial contracts that need to be in place for product development, or results from any test marketing that has been conducted.

When writing your statement of purpose, don't waste words. If the statement of purpose is eight pages, nobody's going to read it because it'll be very clear that the business, no matter what its merits, won't be a good investment because the principals are indecisive and don't really know what they want. Make it easy for the reader to realize at first glance both your needs and capabilities.

Business Description

Tell them all about it.

The business description usually begins with a short description of the industry. When describing the industry, discuss the present outlook as well as future possibilities. You should also provide information on all the various markets within the industry, including any new products or developments that will benefit or adversely affect your business. Base all of your observations on reliable data and be sure to footnote sources of information as appropriate. This is important if you're seeking funding; the investor will want to know just how dependable your information is, and won't risk money on assumptions or conjecture.

When describing your business, the first thing you need to concentrate on is its structure. By structure we mean the type of operation, i.e. wholesale, retail, food service, manufacturing or service-oriented. Also state whether the business is new or already established.

In addition to structure, legal form should be reiterated once again. Detail whether the business is a sole proprietorship, partnership or corporation, who its principals are, and what they will bring to the business.

You should also mention who you will sell to, how the product will be distributed, and the business's support systems. Support may come in the form of advertising, promotions and customer service.

Once you've described the business, you need to describe the products or services you intend to market. The product description statement should be complete enough to give the reader a clear idea of your intentions. You may want to emphasize any unique features or variations from concepts that can typically be found in the industry.

Be specific in showing how you will give your business a competitive edge. For example, your business will be better because you will supply a full line of products; competitor A doesn't have a full line. You're going to provide service after the sale; competitor B doesn't support anything he sells. Your merchandise will be of higher quality. You'll give a money-back guarantee. Competitor C has the reputation for selling the best French fries in town; you're going to sell the best Thousand Island dressing.

How Will I Profit?

Now you must be a classic capitalist and ask yourself, "How can I turn a buck? And why do I think I can make a profit that way?" Answer that question for yourself, and then convey that answer to others in the business concept section. You don't have to write 25 pages on why your business will be profitable. Just explain the factors you think will make it successful, like the following: it's a well-organized business, it will have state-of-the-art equipment, its location is exceptional, the market is ready for it, and it's a dynamite product at a fair price.

If you're using your business plan as a document for financial purposes, explain why the added equity or debt money is going to make your business more profitable.

Show how you will expand your business or be able to create something by using that money.

Show why your business is going to be profitable. A potential lender is going to want to know how successful you're going to be in this particular business. Factors that support your claims for success can be mentioned briefly; they will be detailed later. Give the reader an idea of the experience of the other key people in the business. They'll want to know what suppliers or experts you've spoken to about your business and their response to your idea. They may even ask you to clarify your choice of location or reasons for selling this particular product.

The business description can be a few paragraphs in length to a few pages, depending on the complexity of your plan. If your plan isn't too complicated, keep your business description short, describing the industry in one paragraph, the product in another, and the business and its success factors in three or four paragraphs that will end the statement.

While you may need to have a lengthy business description in some cases, it's our opinion that a short statement conveys the required information in a much more effective manner. It doesn't attempt to hold the reader's attention for an extended period of time, and this is important if you're presenting to a potential investor who will have other plans he or she will need to read as well. If the business description is long and drawn-out, you'll lose the reader's attention, and possibly any chance of receiving the necessary funding for the project.

Market Strategies

Define your market.

Market strategies are the result of a meticulous market analysis. A market analysis forces the entrepreneur to become familiar with all aspects of the market so that the target market can be defined and the company can be positioned in order to garner its share of sales. A market analysis also enables the entrepreneur to establish pricing, distribution and promotional strategies that will allow the company to become profitable within a competitive environment. In addition, it provides an indication of the growth potential within the industry, and this will allow you to develop your own estimates for the future of your business.

Begin your market analysis by defining the market in terms of size, structure, growth prospects, trends and sales potential.

The total aggregate sales of your competitors will provide you with a fairly accurate estimate of the total potential market. Once the size of the market has been determined, the next step is to define the target market. The target market narrows down the total market by concentrating on segmentation factors that will determine the total addressable market--the total number of users within the sphere of the business's influence. The segmentation factors can be geographic, customer attributes or product-oriented.

For instance, if the distribution of your product is confined to a specific geographic area, then you want to further define the target market to reflect the number of users or sales of that product within that geographic segment.

Once the target market has been detailed, it needs to be further defined to determine the total feasible market. This can be done in several ways, but most professional planners will delineate the feasible market by concentrating on product segmentation factors that may produce gaps within the market. In the case of a microbrewery that plans to brew a premium lager beer, the total feasible market could be defined by determining how many drinkers of premium pilsner beers there are in the target market.

It's important to understand that the total feasible market is the portion of the market that can be captured provided every condition within the environment is perfect and there is very little competition. In most industries this is simply not the case. There are other factors that will affect the share of the feasible market a business can reasonably obtain. These factors are usually tied to the structure of the industry, the impact of competition, strategies for market penetration and continued growth, and the amount of capital the business is willing to spend in order to increase its market share.

Projecting Market Share

Arriving at a projection of the market share for a business plan is very much a subjective estimate. It's based on not only an analysis of the market but on highly targeted and competitive distribution, pricing and promotional strategies. For instance, even though there may be a sizable number of premium pilsner drinkers to form the total feasible market, you need to be able to reach them through your distribution network at a price point that's competitive, and then you have to let them know it's available and where they can buy it. How effectively you can achieve your distribution, pricing and promotional goals determines the extent to which you will be able to garner market share.

For a business plan, you must be able to estimate market share for the time period the plan will cover. In order to project market share over the time frame of the business plan, you'll need to consider two factors:

- Industry growth which will increase the total number of users. Most projections utilize a minimum of two growth models by defining different industry sales scenarios. The industry sales scenarios should be based on leading indicators of industry sales, which will most likely include industry sales, industry segment sales, demographic data and historical precedence.

- Conversion of users from the total feasible market. This is based on a sales cycle similar to a product life cycle where you have five distinct stages: early pioneer users, early users, early majority users, late majority users and late users. Using conversion rates, market growth will continue to increase your market share during the period from early pioneers to early majority users, level off through late majority users, and decline with late users.

Defining the market is but one step in your analysis. With the information you've gained through market research, you need to develop strategies that will allow you to fulfill your objectives.

Positioning Your Business

When discussing market strategy, it's inevitable that positioning will be brought up. A company's positioning strategy is affected by a number of variables that are closely tied to the motivations and requirements of target customers within as well as the actions of primary competitors.

Before a product can be positioned, you need to answer several strategic questions such as:

- How are your competitors positioning themselves?

- What specific attributes does your product have that your competitors' don't?

- What customer needs does your product fulfill?

Once you've answered your strategic questions based on research of the market, you can then begin to develop your positioning strategy and illustrate that in your business plan. A positioning statement for a business plan doesn't have to be long or elaborate. It should merely point out exactly how you want your product perceived by both customers and the competition.

How you price your product is important because it will have a direct effect on the success of your business. Though pricing strategy and computations can be complex, the basic rules of pricing are straightforward:

- All prices must cover costs.

- The best and most effective way of lowering your sales prices is to lower costs.

- Your prices must reflect the dynamics of cost, demand, changes in the market and response to your competition.

- Prices must be established to assure sales. Don't price against a competitive operation alone. Rather, price to sell.

- Product utility, longevity, maintenance and end use must be judged continually, and target prices adjusted accordingly.

- Prices must be set to preserve order in the marketplace.

There are many methods of establishing prices available to you:

- Cost-plus pricing. Used mainly by manufacturers, cost-plus pricing assures that all costs, both fixed and variable, are covered and the desired profit percentage is attained.

- Demand pricing. Used by companies that sell their product through a variety of sources at differing prices based on demand.

- Competitive pricing. Used by companies that are entering a market where there is already an established price and it is difficult to differentiate one product from another.

- Markup pricing. Used mainly by retailers, markup pricing is calculated by adding your desired profit to the cost of the product. Each method listed above has its strengths and weaknesses.

- Distribution

Distribution includes the entire process of moving the product from the factory to the end user. The type of distribution network you choose will depend upon the industry and the size of the market. A good way to make your decision is to analyze your competitors to determine the channels they are using, then decide whether to use the same type of channel or an alternative that may provide you with a strategic advantage.

Some of the more common distribution channels include:

- Direct sales. The most effective distribution channel is to sell directly to the end-user.

- OEM (original equipment manufacturer) sales. When your product is sold to the OEM, it is incorporated into their finished product and it is distributed to the end user.