Assignment Of Loan: Definition & Sample

Jump to section, what is an assignment of loan.

Under an assignment of loan, a lender (the assignor) assigns its rights relating to a loan agreement to a new lender (the assignee). Only the assignor's rights under the loan agreement are assigned. The assignor will still have to perform any obligations it has under the facility agreement.

The debtor, the recipient of the loan, must be notified when a debt is assigned. When there is an assignment of a loan, a Notice of Assignment (NOA) is sent out to the debtor informing them that a new party is now responsible for collecting any outstanding amount.

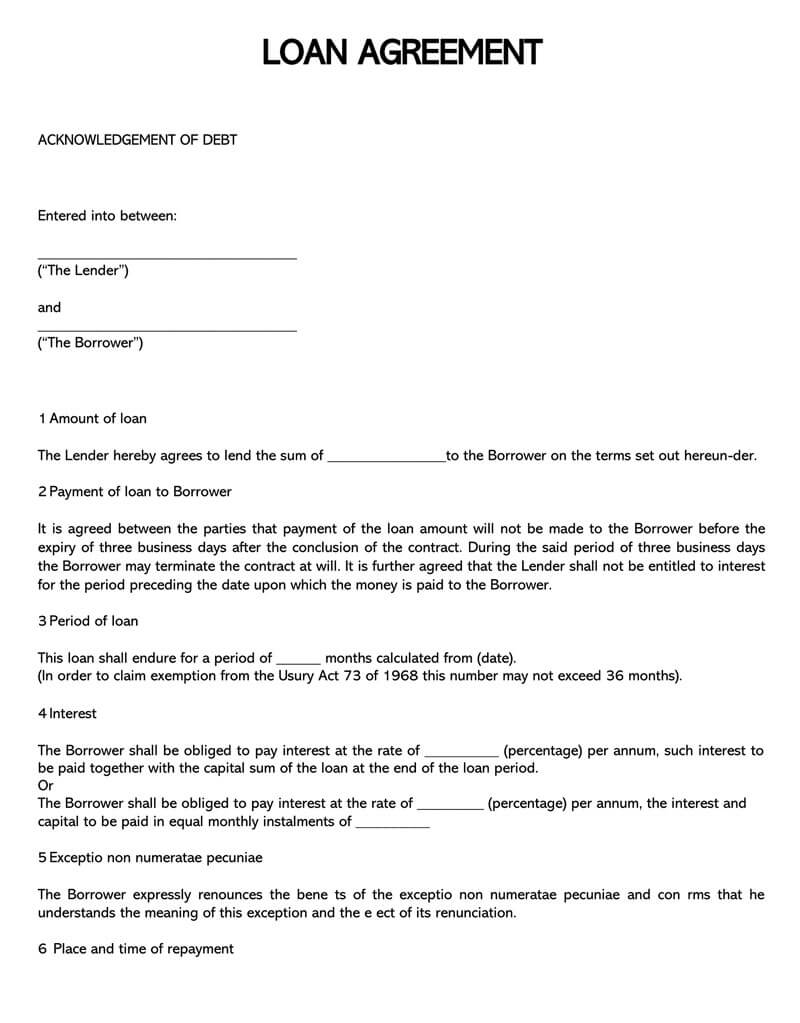

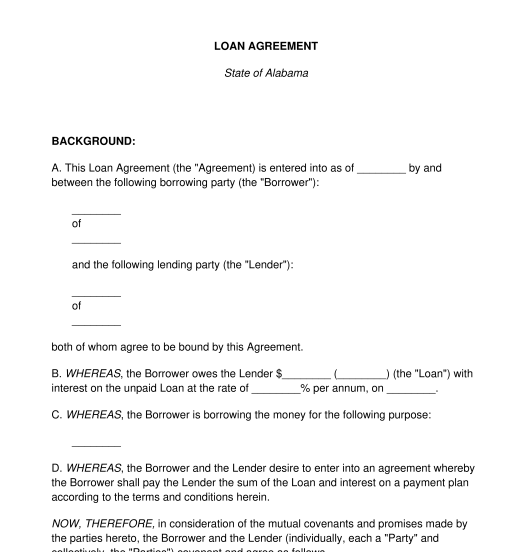

Assignment Of Loan Sample

Reference : Security Exchange Commission - Edgar Database, EX-10.14 5 dex1014.htm ASSIGNMENT OF LOAN DOCUMENTS , Viewed October 21, 2021, View Source on SEC .

Who Helps With Assignment Of Loans?

Lawyers with backgrounds working on assignment of loans work with clients to help. Do you need help with an assignment of loan?

Post a project in ContractsCounsel's marketplace to get free bids from lawyers to draft, review, or negotiate assignment of loans. All lawyers are vetted by our team and peer reviewed by our customers for you to explore before hiring.

ContractsCounsel is not a law firm, and this post should not be considered and does not contain legal advice. To ensure the information and advice in this post are correct, sufficient, and appropriate for your situation, please consult a licensed attorney. Also, using or accessing ContractsCounsel's site does not create an attorney-client relationship between you and ContractsCounsel.

Meet some of our Assignment Of Loan Lawyers

My career interests are to practice Transactional Corporate Law, including Business Start Up, and Mergers and Acquisitions, as well as Real Estate Law, Estate Planning Law, Tax, and Intellectual Property Law. I am currently licensed in Arizona, Pennsylvania and Utah, after having moved to Phoenix from Philadelphia in September 2019. I currently serve as General Counsel for a bioengineering company. I handle everything from their Mergers & Acquisitions, Private Placement Memorandums, and Corporate Structures to Intellectual Property Assignments, to Employment Law and Beach of Contract settlements. Responsibilities include writing and executing agreements, drafting court pleadings, court appearances, mergers and acquisitions, transactional documents, managing expert specialized legal counsel, legal research and anticipating unique legal issues that could impact the Company. Conducted an acquisition of an entire line of intellectual property from a competitor. In regards to other clients, I am primarily focused on transactional law for clients in a variety of industries including, but not limited to, real estate investment, property management, and e-commerce. Work is primarily centered around entity formation and corporate structure, corporate governance agreements, PPMs, opportunity zone tax incentives, and all kinds of business to business agreements. I have also recently gained experience with Estate Planning law, drafting numerous Estate Planning documents for people such as Wills, Powers of Attorney, Healthcare Directives, and Trusts. I was selected to the 2024 Super Lawyers Southwest Rising Stars list. Each year no more than 2.5% of the attorneys in Arizona and New Mexico are selected to the Rising Stars. I am looking to further gain legal experience in these fields of law as well as expand my legal experience assisting business start ups, mergers and acquisitions and also trademark registration and licensing.

Atilla Z. Baksay is a Colorado-based attorney practicing corporate and securities attorney. Atilla represents clients in the negotiation and drafting of transactional (e.g. master service, purchase and sale, license, IP, and SaaS agreements) and corporate (e.g. restricted stock transfers, stock options plans, convertible notes/SAFE/SAFT agreements, bylaws/operating agreements, loan agreements, personal guarantees, and security agreements) contracts, in-house documents (e.g. employment policies, separation agreements, employment/independent contractor/consultant agreements, NDAs, brokerage relationship policies, and office policy memoranda), and digital policies (e.g. terms of service, privacy policies, CCPA notices, and GDPR notices). Atilla also reviews, and issues legal opinions concerning, the security status of digital currencies and assets. Following law school, Atilla practiced international trade law at the Executive Office of the President, Office of the United States Trade Representative, where his practice spanned economic sanctions enacted against goods originating in the People’s Republic of China valued at $500 billion. Afterwards, Atilla joined a Colorado law firm practicing civil litigation, where the majority of his practice comprised of construction defect suits. Today, Atilla's practice spans all corporate matters for clients in Colorado and the District of Columbia.

I love contracts - and especially technology-related contracts written in PLAIN ENGLISH! I've worked extensively with intellectual property contracts, and specifically with IT contracts (SaaS, Master Subscriptions Agreements, Terms of Service, Privacy Policies, License Agreements, etc.), and I have built my own technology solutions that help to quickly and thoroughly draft, review and customize complex contracts.

I am a software developer turned lawyer with 7+ years of experience drafting, reviewing, and negotiating SaaS agreements, as well as other technology agreements. I am a partner at Freeman Lovell PLLC, where I lead commercial contracts practice group. I work with startups, growing companies, and the Fortune 500 to make sure your legal go-to-market strategy works for you.

After graduating from The University of Chicago Law School in 2002, Clara spent eight years in private practice representing clients in complex commercial real estate, merger and acquisition, branding, and other transactional matters. Clara then worked as in-house counsel to a large financial services company, handling intellectual property, vendor contracts, technology, privacy, cybersecurity, licensing, marketing, and otherwise supporting general operations. She opened her own practice in September of 2017 and represents hedge funds, financial services companies, and technology companies in a range of transactional matters.

Founder and owner of Grant Phillips Law.. Practicing and licensed in NY, NJ & Fl with focus on small businesses across the country that are stuck in predatory commercial loans. The firm specializes in representing business owners with Merchant Cash Advances or Factoring Arrangments they can no longer afford. The firms clients include restaurants, truckers, contractors, for profit schools, doctors and corner supermarkets to name a few. GRANT PHILLIPS LAW, PLLC. is at the cutting edge of bringing affordable and expert legal representation on behalf of Merchants stuck with predatory loans or other financial instruments that drain the companies revenues. Grant Phillips Law will defend small businesses with Merchant Cash Advances they can no longer afford. Whether you have been sued, a UCC lien filed against your receivables or your bank account is levied or frozen, we have your back. See more at www.grantphillipslaw.com

Jonathan K.

Pico & Kooker provides hands on legal advice in structuring, drafting, negotiating, interpreting, managing and enforcing complex high value commercial transactions. Adept at navigating complex environments, Jonathan has extensive expertise advising clients on a wide range of long- and medium-term cross border and financial engagements, including public tender participation, PPPs, export sales agreements as well as policy and regulatory formulation. Jonathan and his co-founder, Eva Pico have represented and acted on behalf of lenders, global corporations and other market participants across a range of industries including financial services, infrastructure and transportation. As outside counsel, Pico & Kooker, has developed a strong rapport and working relationship with their clients and appropriately work with their in-house teams to increase consistency, processes and procedures. The company employs a unique approach as practical, business minded outside legal counsel who believe in proactively partnering with their clients to achieve desired results while managing and engaging key stakeholders. They listen to their clients to develop customized solutions that best meet their needs while aligning with their objectives, vision and values. Some representative transactions include advising the World Bank on project finance and portfolio options to address the costs and risks associated with integrating renewable power sources. Also advising them as legal counsel, Jonathan developed policies, regulation and models for emerging market governments entering into public-private partnerships. In addition to his work with the World Bank, Jonathan has worked with some of the world’s largest consulting firms, financial institutions and governmental organizations, including the United Nations, the governments of the US, UK and select African countries. Through out his career, he has worked with large, multinational corporations both by consulting in-house and acting as outside counsel on large cross-border transactions. He graduated from Georgetown University’s law school and was admitted practice as a lawyer in New York, England and Wales and, as a foreign lawyer, in Germany. He has written several articles for trade journals and has been cited by several business publications in worldwide. Jonathan is a native English speaker and has high proficiency in German and a functional understanding of Spanish.

Find the best lawyer for your project

Quick, user friendly and one of the better ways I've come across to get ahold of lawyers willing to take new clients.

How It Works

Post Your Project

Get Free Bids to Compare

Hire Your Lawyer

Financial lawyers by top cities

- Austin Financial Lawyers

- Boston Financial Lawyers

- Chicago Financial Lawyers

- Dallas Financial Lawyers

- Denver Financial Lawyers

- Houston Financial Lawyers

- Los Angeles Financial Lawyers

- New York Financial Lawyers

- Phoenix Financial Lawyers

- San Diego Financial Lawyers

- Tampa Financial Lawyers

Assignment Of Loan lawyers by city

- Austin Assignment Of Loan Lawyers

- Boston Assignment Of Loan Lawyers

- Chicago Assignment Of Loan Lawyers

- Dallas Assignment Of Loan Lawyers

- Denver Assignment Of Loan Lawyers

- Houston Assignment Of Loan Lawyers

- Los Angeles Assignment Of Loan Lawyers

- New York Assignment Of Loan Lawyers

- Phoenix Assignment Of Loan Lawyers

- San Diego Assignment Of Loan Lawyers

- Tampa Assignment Of Loan Lawyers

Contracts Counsel was incredibly helpful and easy to use. I submitted a project for a lawyer's help within a day I had received over 6 proposals from qualified lawyers. I submitted a bid that works best for my business and we went forward with the project.

I never knew how difficult it was to obtain representation or a lawyer, and ContractsCounsel was EXACTLY the type of service I was hoping for when I was in a pinch. Working with their service was efficient, effective and made me feel in control. Thank you so much and should I ever need attorney services down the road, I'll certainly be a repeat customer.

I got 5 bids within 24h of posting my project. I choose the person who provided the most detailed and relevant intro letter, highlighting their experience relevant to my project. I am very satisfied with the outcome and quality of the two agreements that were produced, they actually far exceed my expectations.

Want to speak to someone?

Get in touch below and we will schedule a time to connect!

Find lawyers and attorneys by city

WTO / Legal / Loan Agreement / 38 Free Loan Agreement Templates & Forms (Word | PDF)

38 Free Loan Agreement Templates & Forms (Word | PDF)

Obtaining a loan can be a significant financial decision that requires careful consideration and understanding of the loan agreement. Loan agreements are legally binding contracts that outline the terms and conditions of a loan, including repayment terms, interest rates, and other crucial details. For borrowers, it’s crucial to fully comprehend the complexities of loan agreements to make informed decisions and ensure successful borrowing.

In this article, we will provide a comprehensive guide to explain loan agreements, covering key elements such as loan terms, interest rates, collateral, repayment schedules , and more. Whether you are a first-time borrower or seeking to refine your understanding of loan agreements, this article aims to provide valuable insights and practical tips to navigate the loan agreement process with confidence and clarity.

What is Loan Agreement?

A loan agreement is a legally binding contract between a lender and a borrower that outlines the terms and conditions of a loan.

It serves as a written agreement that establishes the rights and responsibilities of both parties in relation to the loan transaction.

The agreement typically includes the following key elements:

- Loan Amount: It specifies the amount of money that is being borrowed by the borrower from the lender.

- Interest Rate: It outlines the interest rate that will be charged on the loan, which is the cost of borrowing the money.

- Repayment Terms: It includes the repayment terms, such as the installment amounts, due dates, and duration of the loan, which specify how and when the borrower is required to repay the loan.

- Security or collateral: If the loan is secured, the agreement will specify the collateral or security that the borrower is providing to the lender to secure the loan. This can be a property, a vehicle, or any other valuable asset that the lender can seize in the event of default.

- Default and Remedies: It may include provisions related to events of default, such as failure to repay the loan or breach of other terms, and the remedies available to the lender in case of default, such as late fees, penalties, or the right to accelerate the loan and demand immediate repayment.

- Governing Law and Jurisdiction: It may specify the governing law and jurisdiction that will govern the interpretation and enforcement of the agreement, which can be important in the event of disputes between the parties.

- Representations and Warranties: It may include representations and warranties made by the borrower to the lender, such as statements about the borrower’s financial condition, creditworthiness, and the purpose of the loan.

- Covenants: It may include covenants or promises made by the borrower to the lender, such as maintaining certain financial ratios, providing financial statements, or obtaining the lender’s consent for certain actions during the term of the loan.

- Other Terms: Depending on the nature of the loan, the agreement may include other terms and conditions, such as prepayment penalties, loan fees, dispute resolution mechanisms, and other provisions that are negotiated and agreed upon by the parties.

Loan Agreement Templates

Types of Loan Agreements

There are several different types of loan agreements, each with its own unique features and purposes.

Some common types of these agreements include:

Personal loan agreement

A personal loan agreement is a contract between an individual borrower and a lender for a loan used for personal purposes, such as funding education, home improvements, or other personal expenses.

Business loan agreement

It is a contract between a business borrower and a lender for a loan used for business purposes, such as financing working capital, purchasing equipment, or expanding operations.

Mortgage loan agreement

It is a contract between a borrower and a lender for a loan used to finance the purchase of a property, with the property itself serving as collateral for the loan.

Auto loan agreement

It is a contract between a borrower and a lender for a loan used to finance the purchase of a vehicle, with the vehicle serving as collateral for the loan.

Student loan agreement

It is a contract between a borrower and a lender for a loan used to finance education expenses, such as tuition, books, and living expenses, and is typically offered by financial institutions or government entities.

Payday loan agreement

It is a short-term loan agreement typically used for small amounts of money with high interest rates and fees and intended to be repaid by the borrower’s next paycheck.

Revolving credit agreement

A revolving credit agreement is a type of loan agreement that provides the borrower with a pre-approved credit limit that can be used repeatedly, with the borrower repaying and borrowing against the credit line as needed, similar to a credit card .

Bridge loan agreement

It is a short-term loan agreement that provides temporary financing to bridge the gap between two transactions, such as the purchase of a new property before the sale of an existing property.

Construction loan agreement

It is a type of the agreement used to finance the construction or renovation of a property, with the loan typically dispersed in stages, or “draws,” as the construction progresses.

These are just a few examples of the various types of loan agreements that exist. Each type of the agreement may have its own unique terms, conditions, and requirements, and it is important to carefully review and understand the specific terms and conditions of any contract before entering into it and to seek legal or financial advice if needed.

When is a Loan Agreement Necessary?

The agreements are signed for the purposes of clarifying the terms and conditions of the loan.

Here are some of the reasons why they are written:

Legal protection

An agreement serves as a legally binding contract that outlines the terms and conditions of the loan, including repayment terms, interest rate (if applicable), security or collateral (if any), late payment or default provisions, and other important provisions. Having a written contract helps protect the rights and interests of both the borrower and the lender and provides a legal framework for resolving any disputes that may arise during the loan term.

Clarity and understanding

An agreement helps ensure that both the borrower and the lender have a clear understanding of the terms and conditions of the loan. It outlines the loan amount, repayment schedule, interest rate (if applicable), and other relevant terms, which helps prevent misunderstandings or miscommunications between the parties. This can help foster a healthy borrower-lender relationship based on transparency and trust.

Compliance with applicable laws

The agreements are subject to various laws and regulations, depending on the jurisdiction and type. Writing an agreement helps ensure that the transaction complies with applicable laws, such as usury laws, consumer protection laws, and other relevant regulations.

Customization and flexibility

The agreement can be customized to suit the specific needs and requirements of the parties involved. This allows for flexibility in negotiating and documenting the terms of the loan, including repayment terms, interest rate, security or collateral, and other provisions. A written agreement provides a clear record of the agreed-upon terms, which helps avoid confusion or disagreements in the future.

Record keeping and documentation

A written agreement serves as an important piece of documentation that can be used for record keeping and evidence purposes. It provides a written record of the loan transaction, including the terms and conditions agreed upon, which can be referred to in case of any disputes or legal proceedings.

Lender’s requirements

In some cases, a lender may require a written agreement as a condition for providing a loan. Lenders may have their own internal policies or requirements for documenting loan transactions, and a written agreement may be necessary to comply with these requirements.

Components of Standard Loan Agreement

The elements of a loan agreement are as follows:

- Detailed contact information: The details of the borrower, the lender, the guarantors, if any, and referees and witnesses are required. The information is given on their official names, nationalities, physical postal addresses, gender, ages, and dependents.

- Maturity date: The maturity date in the agreement refers to the date on which the loan is due and payable in full. It is the date by which the borrower is obligated to repay the loan amount, including any accrued interest, fees, and other applicable charges, to the lender according to the terms and conditions of the agreement.

- Acceleration: These are details that give the lender protection from defaulting. Here the details of the payment mode, the interest, and the principal amounts are indicated.

- The principal amount: This is the money that the borrower receives. It does not include the interest or any other charges that the loans might attract.

- The interest: Lenders make their profits through interest. This is the amount added to the principal amount as payback for the loan given. Interest is always a percentage of the given amount spread across the paying period.

- Collateral: Loan security is important. Collateral is usually an asset that the borrower commits to using to recover the loan should they fail to repay it.

- Amendments: Amendments occur when, in the future, there are changes in the form of payment. Sometimes the lending institution might change localities or management, and the new information must be updated in the agreement to ensure the accuracy of the details.

- Default: Information on what constitutes defaulting, as well as associated fines, is provided here. These details are important, especially when legal action is needed later.

- The repayment schedule: If there is a possibility to pay back in installments, a repayment schedule is also indicated. The information about what happens in case of default is also mentioned. There are two types of schedules: even total and even principal payments. The lender chooses the schedule.

- Late repayment: In cases of prepayment or late payments, the agreement outlines exactly what is expected by both parties. There might be charges in some cases.

- The applicable laws: Every country has its own laws on lending money. Companies and firms also have their own that are tailored to meet legal requirements. These details are also included in some agreements as legal references.

- Loan transfer: Loan transfer, also known as loan assignment or loan assumption, refers to the transfer of an existing loan from one party (the original borrower) to another party (the new borrower). In other words, it involves changing the borrower on an existing loan without changing the terms and conditions of the loan itself.

- Joint Liability: In cases of joint and several liability, every involved party is given the details of their roles and the terms and conditions of participating.

- Security Details: The details about any collateral must be mentioned. Both parties should approve the security specifics.

- Dates and signatures: Accurate dates are given, and spaces for signatures and names are provided.

Frequently Asked Questions

In some cases, a loan agreement may contain provisions for early termination, such as prepayment options or acceleration clauses. However, such provisions, if any, should be clearly stated in the agreement. It typically requires mutual agreement and compliance with the terms and conditions of the contract.

Interest rates for loans are determined based on various factors, including the lender’s assessment of the borrower’s creditworthiness, prevailing market rates, and the type of loan being offered.

Defaulting on a loan agreement typically triggers consequences outlined in the agreement, such as late fees, penalties, acceleration of repayment, or other remedies available to the lender. Understanding the default provisions in the agreement and being aware of the potential consequences of default are important.

Loaning money to someone with bad credit is a risk that one should really think through before going ahead with it. If someone has a bad credit rating, they are likely to default on the loan if it is granted. However, there are people who have been badly rated for genuine reasons. Before lending, it is good to do background research on why the person was poorly rated. Here, an informed decision can be made.

It may be possible to obtain a loan even with a bad credit rating, but it can be more challenging. Lenders typically consider credit ratings as an indicator of a borrower’s creditworthiness, and a low credit score can affect the terms and conditions of a loan. Borrowers with a bad credit rating may face higher interest rates, stricter loan terms, or may need to provide additional collateral or guarantors to secure a loan. However, some lenders specialize in offering loans to borrowers with poor credit ratings, often referred to as “bad credit loans” or “subprime loans.” These loans may have higher interest rates or fees, but they can provide an option for borrowers who have difficulty obtaining loans from traditional lenders due to their credit histories.

A subsidized loan is a type of federal student loan available to undergraduate students with financial need. It is offered by the U.S. Department of Education and is designed to help students cover the cost of their education. Unlike unsubsidized loans, which accrue interest while the borrower is in school, a subsidized loan does not accrue interest during certain periods, making it a more cost-effective borrowing option for eligible students.

Sharking occurs when money is given to individuals or companies to manage a business or work on income and profit-generating ideas. The sharks give money and expect returns after investments. The sharks additionally hold full or partial ownership of the company until the amount agreed on is fully paid, along with the estimated profits.

When one consolidates a loan, all of their outstanding debts are combined and paid off together under new loan terms and conditions. Loan consolidations are considered for their low interest rates and the ability to focus on one loan rather than many. Larger loans are used to pay small ones in this case.

A Parent PLUS loan is a type of federal student loan available to parents of dependent undergraduate students who are enrolled in eligible colleges or universities. It is designed to help parents cover the cost of their child’s education. The Parent PLUS loan is offered by the U.S. Department of Education and requires a separate application process from other federal student loans.

About This Article

Was this helpful?

Great! Tell us more about your experience

Not up to par help us fix it, keep reading.

Legal , Loan Agreement

Free personal guarantee forms for loan (word | pdf).

Applications , Forms

40 free credit application forms and samples.

Legal , Release

Free release of liability forms (hold harmless) | pdf – word.

Loan Agreement

Release of Personal Guarantee: Request Letters & Forms

35+ IOU Forms and Acknowledgment of Debt Forms

Free Personal Loan Agreement Templates (Word | PDF)

Agreements , Debt

22 free (i owe you) iou templates and forms | word, pdf.

Agreements , Legal , Loan Agreement

Free family loan agreement templates (word | pdf).

40 Free Payment Agreement Templates (Samples) – Word | PDF

Thank you for your feedback.

Your Voice, Our Progress. Your feedback matters a lot to us.

This site uses cookies to deliver and enhance the quality of its services and to analyze traffic.

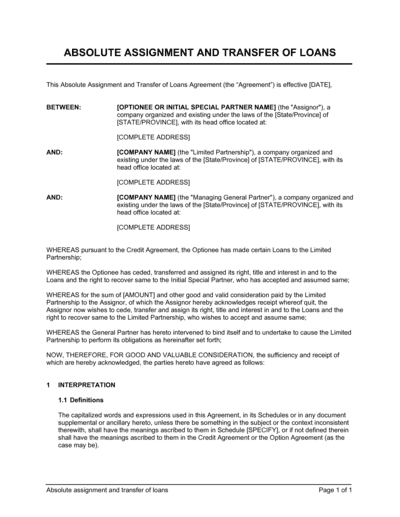

Absolute Assignment and Transfer of Loans Template

Document description.

This absolute assignment and transfer of loans template has 6 pages and is a MS Word file type listed under our finance & accounting documents.

Sample of our absolute assignment and transfer of loans template:

ABSOLUTE ASSIGNMENT AND TRANSFER OF LOANS This Absolute Assignment and Transfer of Loans Agreement (the �Agreement�) is effective [DATE], BETWEEN: [OPTIONEE OR INITIAL SPECIAL PARTNER NAME] (the "Assignor"), a company organized and existing under the laws of the [State/Province] of [STATE/PROVINCE], with its head office located at: [COMPLETE ADDRESS] AND: [COMPANY NAME] (the "Limited Partnership"), a company organized and existing under the laws of the [State/Province] of [STATE/PROVINCE], with its head office located at: [COMPLETE ADDRESS] AND: [COMPANY NAME] (the "Managing Genera

Related documents

3,000+ templates & tools to help you start, run & grow your business, all the templates you need to plan, start, organize, manage, finance & grow your business, in one place., templates and tools to manage every aspect of your business., 8 business management modules, in 1 place., document types included.

How does it work?

1. choose this template.

Start by clicking on "Fill out the template"

2. Complete the document

Answer a few questions and your document is created automatically.

3. Save - Print

Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

Loan Agreement

Rating: 4.8 - 1,358 votes

What is a loan agreement?

A loan agreement is a contract between a lender and a borrower where the lender agrees to lend the borrower money and the borrower agrees to pay the lender back according to a schedule as described in the agreement. Its primary function is to serve as written evidence of the amount of the debt and the terms under which it will be repaid.

What is the difference between a loan agreement and a promissory note?

Though they are both documents used to outline the details of a loan, a loan agreement and a promissory note are different in several respects. The main difference is that a loan agreement is much more detailed and complex . It includes extensive provisions about when and how the borrower will repay the loan and what sorts of penalties will be incurred if the borrower does not follow through with repayment. Loan agreements are usually used when large sums of money are involved, such as student loans, mortgages, car loans, and business loans.

Promissory notes are much simpler documents that are more akin to an IOU. Unlike a loan agreement, which is binding on both the lender and the borrower, promissory notes are a one-sided document where the borrower agrees to repay the lender. Promissory notes are typically used for more informal arrangements between friends and family members or very small businesses.

What is the difference between a loan agreement and a guaranty agreement?

These two documents are related but are used at different points in the loan process and involves different parties.

The loan agreement sets out the initial terms of the money being lent and involves just the borrower and the lender. The guaranty agreement is an optional additional agreement that is added to the loan agreement. It involves a third party, known as the guarantor, agreeing to pay back the loan if the person who takes out the loan defaults or does not pay. In the guaranty agreement, only one party is signing the actual document, the guarantor, but the agreement is made among the lender, who is lending the money, the borrower, who is borrowing the money, and the guarantor who is committing to repay the loan if the borrower cannot.

Is it mandatory to have a loan agreement?

No, it is not absolutely mandatory for a loan agreement to be used when one party loans money to another in most states. However, since loan agreements usually involve large sums of money, such as car loans, mortgages, or business loans, it is highly recommended that the party use a written loan agreement. Using a written agreement means that both parties understand exactly what they agree to and are able to refer to their written agreement later on in case of future disagreement or dispute.

There are some states which have laws saying that loans over a certain amount must be in writing . Refer to state law to find out more about these requirements.

What is "interest"?

In the context of a loan, interest is the monetary charge for the privilege of borrowing money , typically expressed as an annual percentage rate. An interest rate is a pre-determined percentage of the total loan that accumulates over time and is added onto the original loan amount at the end of each year. It is not mandatory to apply interest to a loan.

What is a "balloon payment"?

A balloon payment is a large sum of money that the borrower must pay at the end of the term of the loan to decrease their scheduled installment payments over the life of the loan. For example, if a borrower wanted to borrow $10,000 at 8% interest and repay the loan over five years, but the standard monthly payments of $202.76 were too high, the borrower and lender could agree to a balloon payment. The borrower could pay $175 each month and then, when the five years had passed, make a final balloon payment of the remaining $2,000. The payment makes up for the decreased monthly payments and may be more manageable for the borrower.

What is "collateral"?

Collateral is the use of personal property or real estate to secure a loan . If a borrower is using collateral, they agree to give up ownership or title of the property to the lender in the event that they are unable to pay back the loan. Unlike a guaranty, which involves a third party agreeing to repay a loan, collateral involves the borrower using their own property to secure the loan.

What is an "acceleration clause"?

An acceleration clause is a term in a loan agreement that requires the borrower pay off the entirety of the loan immediately if certain conditions are not met . Most commonly, this would come into play if a borrower stopped making payments on the loan using the agreed upon schedule.

What is not allowed in a loan agreement?

Though the lender may charge the borrower interest, most states have laws regarding the maximum amount of interest that they may charge. These laws are known as usury laws and vary from state to state.

What can the duration of a loan agreement be?

The duration of a loan can vary widely depending on the circumstances. For example, a small loan of several hundred dollars could be repaid over the course of several months. Larger loans, such as mortgages or student loans, are often paid off over the course of decades. There is no limit to the duration of a loan agreement.

What should be done after the loan agreement is written?

Once all the provisions of the contract have been filled out, both the borrower and the lender should print out and sign the document , each saving a copy for their records in case of future misunderstanding or dispute. The document does not need to be notarized or witnessed to be legally binding. If the loan is being secured by real estate used as collateral, the borrower should be sure to properly register this collateral according to the laws of the state in which it is located.

What must a loan agreement contain?

A valid loan agreement must contain at least the following mandatory sections:

- Description of loan: The loan agreement, first and foremost, must include the amount of money being loaned, as well as whether the borrower will be required to pay interest on the loan. If the borrower must pay interest on the loan, the agreement includes the interest rate being charged.

- Repayment details: The loan agreement outlines the specifics of when and how the loan will be repaid by the borrower to the lender. The borrower can repay the loan using installments (i.e., multiple payments over time), a lump sum (i.e., paying back the entire loan at once on one due date), or due on demand (i.e., paying back the loan all at once on any future date that the lender chooses). The agreement also details whether a balloon payment will be used and whether the interest rate, if any, will increase at any point during the loan.

- Method of repayment: The loan agreement explains which methods, such as cash, check, or direct deposit, are acceptable for the borrower to use to repay the loan.

- Default conditions: The loan agreement lays out the conditions under which the borrower will be considered to be in default of the loan. These conditions include the borrower's failure to repay the loan when payments are due, the borrower's insolvency, or the borrower's filing of bankruptcy.

Which laws are applicable to a loan agreement?

Loan agreements are a matter of both state and federal law. Loan agreements are primarily controlled by Article III of the Uniform Commercial Code (the "UCC") . The UCC governs commercial transactions and article III specifically applies to loan agreements, specifically those that involve the use of collateral.

The Truth in Lending Act ("TILA") is a federal law that requires lenders to provide borrowers clear and thorough information about the terms of the loan into which they are entering, including the interest rate and any fees associated with the loan.

State-specific usury laws dictate the maximum amount of interest that may be charged on a loan. Statutes of frauds , also state-specific, require that loans over a certain amount be memorialized in writing to be enforceable.

How to modify the template?

You fill out a form. The document is created before your eyes as you respond to the questions.

At the end, you receive it in Word and PDF formats. You can modify it and reuse it.

Guides to help you

- How to Get your Debtor to Pay

- What is the Difference Between a Promissory Note and Loan Agreement?

- Mortgage Deed vs. Deed of Trust

- Should I Use a Promissory Note for a Friendly Loan?

Loan Agreement - FREE - Sample, template - Word and PDF

Country: United States

General Business Documents - Other downloadable templates of legal documents

- Amendment to Agreement

- Loan Agreement Modification

- Release of Loan Agreement

- Non-Compete Agreement

- Partnership Dissolution Agreement

- Notice of Withdrawal from Partnership

- Power Of Attorney

- Debt Acknowledgment Form

- Meeting Minutes

- Request to Alter Contract

- Release Agreement

- Guaranty Agreement

- Joint Venture Agreement

- Contract Assignment Agreement

- Debt Settlement Agreement

- Breach of Contract Notice

- Corporate Proxy

- Mutual Rescission and Release Agreement

- Notice for Non-Renewal of Contract

- Meeting Notice

- Other downloadable templates of legal documents

Understanding an assignment and assumption agreement

Need to assign your rights and duties under a contract? Learn more about the basics of an assignment and assumption agreement.

Get your assignment of agreement

by Belle Wong, J.D.

Belle Wong, is a freelance writer specializing in small business, personal finance, banking, and tech/SAAS. She ...

Read more...

Updated on: November 24, 2023 · 3 min read

The assignment and assumption agreement

The basics of assignment and assumption, filling in the assignment and assumption agreement.

While every business should try its best to meet its contractual obligations, changes in circumstance can happen that could necessitate transferring your rights and duties under a contract to another party who would be better able to meet those obligations.

If you find yourself in such a situation, and your contract provides for the possibility of assignment, an assignment and assumption agreement can be a good option for preserving your relationship with the party you initially contracted with, while at the same time enabling you to pass on your contractual rights and duties to a third party.

An assignment and assumption agreement is used after a contract is signed, in order to transfer one of the contracting party's rights and obligations to a third party who was not originally a party to the contract. The party making the assignment is called the assignor, while the third party accepting the assignment is known as the assignee.

In order for an assignment and assumption agreement to be valid, the following criteria need to be met:

- The initial contract must provide for the possibility of assignment by one of the initial contracting parties.

- The assignor must agree to assign their rights and duties under the contract to the assignee.

- The assignee must agree to accept, or "assume," those contractual rights and duties.

- The other party to the initial contract must consent to the transfer of rights and obligations to the assignee.

A standard assignment and assumption contract is often a good starting point if you need to enter into an assignment and assumption agreement. However, for more complex situations, such as an assignment and amendment agreement in which several of the initial contract terms will be modified, or where only some, but not all, rights and duties will be assigned, it's a good idea to retain the services of an attorney who can help you draft an agreement that will meet all your needs.

When you're ready to enter into an assignment and assumption agreement, it's a good idea to have a firm grasp of the basics of assignment:

- First, carefully read and understand the assignment and assumption provision in the initial contract. Contracts vary widely in their language on this topic, and each contract will have specific criteria that must be met in order for a valid assignment of rights to take place.

- All parties to the agreement should carefully review the document to make sure they each know what they're agreeing to, and to help ensure that all important terms and conditions have been addressed in the agreement.

- Until the agreement is signed by all the parties involved, the assignor will still be obligated for all responsibilities stated in the initial contract. If you are the assignor, you need to ensure that you continue with business as usual until the assignment and assumption agreement has been properly executed.

Unless you're dealing with a complex assignment situation, working with a template often is a good way to begin drafting an assignment and assumption agreement that will meet your needs. Generally speaking, your agreement should include the following information:

- Identification of the existing agreement, including details such as the date it was signed and the parties involved, and the parties' rights to assign under this initial agreement

- The effective date of the assignment and assumption agreement

- Identification of the party making the assignment (the assignor), and a statement of their desire to assign their rights under the initial contract

- Identification of the third party accepting the assignment (the assignee), and a statement of their acceptance of the assignment

- Identification of the other initial party to the contract, and a statement of their consent to the assignment and assumption agreement

- A section stating that the initial contract is continued; meaning, that, other than the change to the parties involved, all terms and conditions in the original contract stay the same

In addition to these sections that are specific to an assignment and assumption agreement, your contract should also include standard contract language, such as clauses about indemnification, future amendments, and governing law.

Sometimes circumstances change, and as a business owner you may find yourself needing to assign your rights and duties under a contract to another party. A properly drafted assignment and assumption agreement can help you make the transfer smoothly while, at the same time, preserving the cordiality of your initial business relationship under the original contract.

You may also like

What Does 'Inc.' Mean in a Company Name?

'Inc.' in a company name means the business is incorporated, but what does that entail, exactly? Here's everything you need to know about incorporating your business.

October 9, 2023 · 10min read

How to Write a Will: A Comprehensive Guide to Will Writing

Writing a will is one of the most important things you can do for yourself and for your loved ones, and it can be done in just minutes. Are you ready to get started?

July 21, 2024 · 11min read

How to Start an LLC in 7 Easy Steps (2024 Guide)

2024 is one of the best years ever to start an LLC, and you can create yours in only a few steps.

July 29, 2024 · 22min read

End of the Year Sale: Get up to 35% Off on all our Plans.

Loan Agreement Template

Free Loan Agreement Templates and Sample

- • Borrower details

- • Loan terms

- • Repayment schedule

What is a loan contract, and why is it important?

A signed contract mitigates such risks to help all parties to fulfill their responsibilities reasonably.

DISCLAIMER : We are not lawyers or a law firm and we do not provide legal, business or tax advice. We recommend you consult a lawyer or other appropriate professional before using any templates or agreements from this website.

Download our free Loan Agreement Forms

When to use a loan agreement, the elements of a great loan agreement, 1. capturing details, 2. loan terms, 3. repayment schedule, 4. late charges, 5. signatures, download our free loan agreement form, faq about loan agreements, loan agreement, information, acknowledgement, promise to pay, late charges, governing law, alternative dispute resolution, entire agreement, severability, signature and date, related proposals and templates.

- Payment Agreement Template

- Accounting Contract Template

© 2024 Signaturely

- Privacy Policy

- Terms and Conditions

- Cookie Statement

- Practical Law

Assignment of loan

Practical law uk standard document 9-500-4767 (approx. 31 pages), get full access to this document with a free trial.

Try free and see for yourself how Practical Law resources can improve productivity, efficiency and response times.

About Practical Law

This document is from Thomson Reuters Practical Law, the legal know-how that goes beyond primary law and traditional legal research to give lawyers a better starting point. We provide standard documents, checklists, legal updates, how-to guides, and more.

650+ full-time experienced lawyer editors globally create and maintain timely, reliable and accurate resources across all major practice areas.

83% of customers are highly satisfied with Practical Law and would recommend to a colleague.

81% of customers agree that Practical Law saves them time.

- Lending - General

- Corporate lending

- Skip to primary navigation

- Skip to main content

- Skip to primary sidebar

- Skip to footer

Legal Templates

Home Resources Real Estate Assignment vs. Sublease

Assignment vs. Sublease: What Are the Key Differences?

Updated September 26, 2024 | Written by Sara Hostelley Reviewed by Brooke Davis

When leasing property, you might encounter situations where you need to transfer your lease or share your rented space. Assigning a lease and subletting are potential solutions, but you should first understand their implications.

In this article, we explore the differences between a lease assignment and sublease, explain how these arrangements work, and discuss the rights and responsibilities they entail.

What Is a Lease Assignment?

A lease assignment is when the tenant transfers all their rights and obligations under a lease agreement to another party. The new tenant (the “assignee”) accepts all of the responsibilities and benefits of the leased property.

The assignment of a lease helps you when you need to get out of a lease before it expires. For example, suppose you’ve signed a 12-month lease for a commercial space. If your business relocates after six months and needs to get out of the commercial lease early, you can assign the lease to another entity to relieve your company from the lease responsibility.

What Is a Sublease?

A sublease agreement lets a tenant rent out all or part of their rented property to another person (the “subtenant” or “sublessee”). This arrangement is beneficial when you (as the direct tenant) need to temporarily vacate your rental unit or share the space with someone else. Subletting offers flexibility for short-term housing needs and can help you avoid breaking your lease .

When you enter a sublease, you’ll still be responsible for fulfilling the terms of your original lease, including paying rent and maintaining your unit. Additionally, you’ll assume landlord-like duties toward your subtenant, such as addressing maintenance issues and collecting rent.

Assignment vs. Sublease: Key Differences

Here are the key differences between a lease assignment and a sublease:

- Assignment: Three main parties—the landlord, the original tenant (the assignor), and the new tenant (the assignee).

- Sublease: Two main parties—the original tenant (the “sublessor”) and the subtenant (the “sublessee”). The landlord isn’t a direct party in a sublease.

- Assignment: The original tenant transfers all their rights under the rental agreement to the new tenant. The assignee takes over the lease for the rest of the term.

- Sublease: The original tenant keeps their lease rights but grants the subtenant rights to use an entire rental unit (or part of it) for a certain period. The subtenant’s rights are secondary to the original tenant’s.

- Assignment: The new tenant assumes liability for the lease, but the original tenant may remain secondarily answerable to the landlord if the assignee defaults.

- Sublease: The original tenant remains fully liable to the landlord for the lease’s obligations. The subtenant is only responsible to the original tenant.

- Assignment: The assignee pays rent to the landlord.

- Sublease: The subtenant pays rent to the sublessor; they have no financial obligation to the landlord. The sublessor must make full rent payments to the landlord.

- Assignment: The assignee can use the leased premises in the manner outlined in the original lease. Any conditions or restrictions that applied to the original tenant now apply to the assignee.

- Sublease: The subtenant uses the property as described in the sublease, which may or may not be consistent with the original lease’s terms. The original tenant must ensure that the sublease’s terms don’t violate the original lease.

- Assignment: The original lease agreement stays in effect, but all responsibilities transfer to the assignee. Any changes to the lease may require the landlord’s consent.

- Sublease: The original lease governs the sublessor’s obligations, while the sublease dictates the sublessor-subtenant relationship. The sublease cannot override the original lease’s terms.

- Assignment: The landlord must typically issue approval before the original tenant can assign the lease to a new tenant. Most leases have clauses that allow the landlord to approve or reject an assignment based on reasonable grounds.

- Sublease: A sublease also typically requires the landlord’s consent . Some leases may allow subletting without further consent from the landlord, as landlords have fewer concerns because the original tenant keeps their promises in the lease.

- Assignment: The landlord and the new tenant (the assignee) enter a relationship.

- Sublease: The landlord has no direct involvement with the subtenant. The subtenant answers to the tenant, while the tenant answers to the landlord.

How to Choose Between Assigning a Lease and Subletting

Here are some factors that may influence your choice between assigning a lease and subletting:

- Duration of Need: Consider how long you plan to vacate the property. If you want the option to return, choose subletting. If you plan not to return, choose assigning the lease.

- Liability: Think about how much responsibility you want to have. Assigning a lease minimizes your liability, while subletting keeps you liable if the subtenant defaults.

- Lease Terms: Check your lease for an assignment or sublease clause. If your lease favors subletting and restricts assignments, you may opt for a sublease.

- Landlord’s Approval: If your landlord is willing to let you assign the lease to someone else, you may choose this option because it provides a cleaner break. However, it might be easier to get approval for a sublease than for an assignment.

- Control Over the Property: Subletting may be right for you if you wish to retain some control over the property. However, if you no longer have an interest in using or benefiting from the property, you may pursue a lease assignment.

- Market Conditions: In a renter’s market, you may be able to sublease to another individual and charge payments that cover your monthly rent and let you profit. If the rental market is weak in your area, you may opt to assign the lease instead.

Privity of Contract and Privity of Estate in Lease Assignments and Subleases

You can further distinguish between lease assignments and subleases by determining the presence or absence of the privity of contract and privity of estate between the involved parties:

- Privity of contract: A relationship between two parties that lets them enforce the terms of their contract against each other.

- Privity of estate: A relationship between two parties with an interest in the same property.

This table summarizes whether privity of contract and privity of estate exists between the parties in an assignment:

| Yes | No | |

| No | Yes | |

| Yes | No |

This table summarizes whether privity of contract and privity of estate exists between the parties in a sublease:

| Yes | Yes | |

| No | No | |

| Yes | Yes |

Example of Privity of Contract and Estate in an Assignment

Sophia owns Riverside Apartments. She leases Riverside Apartments to Mark for a term of 4 years. In the third year of the lease, Mark decides to assign his interest in Riverside Apartments to Jordan.

Here’s whether privity of contract and privity of estate exist between the parties:

- Sophia and Mark: Sophia and Mark retain privity of contract but not privity of estate because the original lease is still valid, but the interest in the property goes to Jordan.

- Sophia and Jordan: Sophia and Jordan maintain privity of estate because Jordan now holds the present interest in the property. Sophia doesn’t have privity of contract with Jordan, as the original lease agreement remains between Sophia and Mark.

- Mark and Jordan: Mark and Jordan share privity of contract because of their agreement regarding the lease assignment. However, they don’t have privity of estate because Mark no longer has a possessory interest in Riverside Apartments; he has fully transferred his rights to Jordan.

Example of Privity of Contract and Estate in a Sublease

David owns Greenfield Plaza. He leases Greenfield Plaza to Brittany for a five-year term. In the fourth year of the lease, Brittany decides to sublease her rights to Emily for the remaining year.

- David and Brittany: David keeps privity of contract with Brittany because their original lease is still in effect. David also has privity of estate with Brittany, as she keeps a legal interest in the property.

- David and Emily: David and Emily don’t have privity of contract because the sublease is a separate agreement between Brittany and Emily. As a result, David has no direct legal obligations or rights concerning Emily. Furthermore, David and Emily have no privity of estate.

- Brittany and Emily: Brittany and Emily have privity of contract and privity of estate because of the sublease they entered into together.

Understanding the Differences Between Assignments and Subleases

Understanding the nuances between assignments and subleases can significantly impact tenants navigating their rental agreements. This knowledge helps them make informed decisions when circumstances require them to transfer or share their leased space.

Review your original lease, talk to your landlord, and talk to a lawyer to protect your interests and create flexibility in your living or business arrangements.

Sara Hostelley

Legal Content Editor

Sara Hostelley is a legal and SEO content editor with a bachelor's degree in English from the University of South Florida. She has ample experience writing informative content pieces within various...

- Legal Resources

- Partner With Us

- Terms of Use

- Privacy Policy

- Cookie Policy

- Do Not Sell My Personal Information

IMAGES

COMMENTS

Updated October 04, 2021. A loan assignment agreement is when another entity agrees to take over the debt of someone else. This is when the debtor has changed for any type of event such as when a business or real estate is purchased. The new owner will agree to assume the debts of the past debtholder and release them from any further obligation ...

II. ASSIGNMENT OF DEBT. It is known that the Debtor is indebted to the Cre ditor, under a separate agreement, for the current principal sum of $_____, plus any interest ("Debt"). Under this Agreement, the Assuming Party agrees to assume: (choose one) ☐- All. of the Debt. ☐- Portion. of the Debt.

Loan Assignment Agreement sample contracts and agreements. THIS LOAN ASSIGNMENT AGREEMENT (this "Agreement") is made and entered into as of this 26th day of March 2014 (the "Effective Date") by and among HELPFUL CAPITAL GROUP LLC, a Florida corporation having its address at 3732 SW 30 Avenue, Suite 204, Fort Lauderdale, FL 33312 ("Assignor") and HELPFUL ALLIANCE COMPANY a Florida ...

Assignment Agreement Template. Use our assignment agreement to transfer contractual obligations. An assignment agreement is a legal document that transfers rights, responsibilities, and benefits from one party (the "assignor") to another (the "assignee"). You can use it to reassign debt, real estate, intellectual property, leases ...

Under an assignment of loan, a lender (the assignor) assigns its rights relating to a loan agreement to a new lender (the assignee). Only the assignor's rights under the loan agreement are assigned. The assignor will still have to perform any obligations it has under the facility agreement. The debtor, the recipient of the loan, must be ...

Size 3 to 4 pages. Download a basic template (FREE) Create a customized document. A Debt Assignment and Assumption Agreement is a very simple document whereby one party assigns their debt to another party, and the other party agrees to take that debt on. The party that is assigning the debt is the original debtor; they are called the assignor.

This agreement must clearly establish the calendar date when the assignment of the debt to the Assuming Party becomes active. (2) Debtor Name And Mailing Address. The current Holder of the debt should be identified as the Debtor in this agreement. To this end, record the Debtor's name and address. (3) Assuming Party.

This Agreement contains the entire agreement between the Parties hereto with respect to the subject matter hereof, and supersedes all prior negotiations, understandings and agreements. XII. MODIFICATION AND WAIVER. This Agreement may be amended or modified only by a written agreement signed by both of the Parties.

A loan agreement is a legally binding contract between a lender and a borrower that outlines the terms and conditions of a ... Power Loan Agreement Sample. Reimbursable Loan Agreement. Reverse Mortgage Loan Agreement. ... also known as loan assignment or loan assumption, refers to the transfer of an existing loan from one party (the original ...

Download. Business in a Box templates are used by over 250,000 companies in United States, Canada, United Kingdom, Australia, South Africa and 190 countries worldwide. Download your Absolute Assignment and Transfer of Loans Template in MS Word (.docx). Everything you need to plan, manage, finance, and grow your business.

4.8 - 105 votes. Download a basic template (FREE) Create a customized document. This Contract Assignment Agreement document is used to transfer rights and responsibilities under an original contract from one Party, known as the Assignor, to another, known as the Assignee. The Assignor who was a Party to the original contract can use this ...

Start by clicking on "Fill out the template". 2. Complete the document. Answer a few questions and your document is created automatically. 3. Save - Print. Your document is ready! You will receive it in Word and PDF formats. You will be able to modify it.

Step 7 - Accept the Loan. If you receive loan offers after applying, review them carefully. Pay attention to the loan amount, interest rate, repayment term, and associated fees, and read and understand the fine print. If all the details meet your needs, you can accept the offer and sign the loan agreement.

Loan Assignment Agreement. Page 1 of 11. LOAN ASSIGNMENT AGREEMENT. I. THE PARTIES. This Loan Assignment Agreement ("Agreement") is effective and created on [DATE] ("Effective Date") is by and between: Debtor: [DEBTOR'S NAME], with a mailing address of [DEBTOR'S MAILING ADDRESS] ("Debtor"),

An assignment and assumption agreement is used after a contract is signed, in order to transfer one of the contracting party's rights and obligations to a third party who was not originally a party to the contract. The party making the assignment is called the assignor, while the third party accepting the assignment is known as the assignee.

Let's look at some examples below.t. 1. Capturing details. The first step in any quality loan contract is getting the information from both lenders and borrowers in your agreement. This includes details such as name and contacts, and in the case of borrowers, relevant references, and collateral for security.

The Assignment and Assumption Agreement, dated the Closing Date, between Residential Funding and the Company relating to the transfer and assignment of the Mortgage Loans. Sample 1 Sample 2 Sample 3 See All (379) Assignment Agreement. The parties to each assignment shall execute and deliver to the Administrative Agent an Assignment Agreement ...

Sample Clauses. Loan Assignment. At the request of Borrower in connection with any full prepayment or repayment of the Loan in accordance with the terms of this Agreement and the other Loan Documents, Lender shall: (i) assign one or more of the Mortgages to any new lender in connection with a refinance of the Loan in accordance with the terms ...

Write the assignment agreement including the property details and sales price. Include any other agreed-upon terms and conditions. Step 4 - Take Control. No matter the type of property (real, personal, etc.) after an agreement is signed, the property should be delivered to the assignee's possession. Sample Assignment Agreement

Please contact Technical Support at +44 345 600 9355 for assistance. A standard form deed of assignment under which a lender (the assignor) assigns its rights relating to a facility agreement (also known as a loan agreement) to a new lender (the assignee). Only the assignor's rights under the facility agreement (such as to receive repayment of ...

Related to LOAN ASSIGNMENT AGREEMENT. Modification; Assignment No amendment or other modification, rescission, release, or assignment of any part of this Agreement shall be effective except pursuant to a written agreement subscribed by the duly authorized representatives of the parties hereto.. Non-Assignment of Agreement The Grantee may not assign, sublicense or otherwise transfer its rights ...

Washington. Create Document. Updated July 20, 2024. A mortgage assignment agreement is between a holder of debt (assignor) and a party that assumes the debt (assignee). Under most mortgages, the borrower has no rights to object. Since a mortgage is centered upon a specific borrower's credit profile, it is difficult to replace with a new borrower.

Assignment of Agreement. The Purchaser shall not assign this Agreement without the express written consent of the Seller. The Seller may assign this Agreement at its sole discretion without prior notice to, or consent of, the Purchaser. Sample 1 Sample 2 Sample 3 See All (56) Assignment of Agreement. This Agreement shall terminate automatically ...

What Is a Lease Assignment? A lease assignment is when the tenant transfers all their rights and obligations under a lease agreement to another party. The new tenant (the "assignee") accepts all of the responsibilities and benefits of the leased property. The assignment of a lease helps you when you need to get out of a lease before it ...