Assignment of Rents – What, Why, and How?

Article by:

Madelaine prescott, esq., share this post:.

- November 29, 2023

These days, almost all commercial loans include an Assignment of Rents as part of the Deed of Trust or Mortgage. But what is an Assignment of Rents, why is this such an important tool, and how are they enforced?

An Assignment of Rents (“AOR”) is used to grant the lender on a transaction a security interest in existing and future leases, rents, issues, or profits generated by the secured property, including cash proceeds, in the event a borrower defaults on their loan. The lender can use the AOR to step in and directly collect rental payments made by the tenant. For an AOR to be effective, the lender’s interest must be perfected, which has a few fairly simple requirements. The AOR must be in writing, executed by the borrower, and recorded with the county where the property is located. Including an AOR in the recorded Deed of Trust or Mortgage is the easiest and most common way to ensure the AOR meets these requirements should it ever need to be utilized.

When a borrower defaults, lenders can take advantage of AORs as an alternative to foreclosure to recoup their investment. With a shorter timeline and significantly lower costs, it is certainly an attractive option for lenders looking to get defaulted borrowers back on track with payments, without the potential of having to take back a property and attempting to either manage it or sell it in hopes of getting your money back out of the property. AORs can be a quick and easy way for the lender to get profits generated by the property with the goal of bringing the borrower out of default. But lenders should carefully monitor how much is owed versus how much has been collected. If the AOR generates enough funds so that the borrower is no longer in default, the lender must stop collecting rents generated by the property.

Enforcement of an AOR can also incentivize borrowers to work with the lender to formulate a plan, as many borrowers rely on rental income to cover expenses related to the property or their businesses. Borrowers are generally more willing to come to the table and negotiate a mutual, amicable resolution with the lender in order to protect their own investment. A word of warning to lenders though: since rental income is frequently used to pay expenses on the property, such as the property manager, maintenance, taxes, and other expenses, the lender needs to ensure they do not unintentionally hurt the value of the property by letting these important expenses fall behind. This may hurt the lender’s investment as well, as the property value could suffer, liens could be placed on the property, or the property may fall into disrepair if not properly maintained. It is also important for lenders to be aware of the statutes surrounding the payment of these expenses when an AOR is being used, as some state’s statutes require the lender to pay certain property expenses out of the collected rents if requested by the borrower.

In addition to being shorter and cheaper than foreclosure, AORs can be much easier to enforce. In California, the enforcement of an AOR is governed by California Civil Code §2938. This statute specifies enforcement methods lenders can use and restrictions on use of these funds by the lender, among other things. Under CA Civil Code §2938(c), there are 4 ways to enforce an AOR:

- The appointment of a receiver;

- Obtaining possession of the rents, issues, profits;

- Delivery to tenant of a written demand for turnover of rents, issues, and profits in the correct form; or

- Delivery to assignor of a written demand for the rents, issues, or profits.

One or more of these methods can be used to enforce an AOR. First, a receiver can be appointed by the court, and granted specific powers related to the AOR such as managing the property and collecting rents. They can have additional powers though; it just depends on what the court orders. This is not the simplest or easiest option as it requires court involvement, but this is used to enforce an AOR, especially when borrowers or tenants are uncooperative. Next is obtaining possession of the rents, issues, profits, which is exactly as it seems; lenders can simply obtain actual possession of these and apply the funds to the loan under their AOR.

The third and fourth options each require delivery of a written demand to certain parties, directing them to pay rent to the lender instead of to the landlord. Once the demand is made, the tenant pays their rent directly to the lender, who then applies the funds to the defaulted loan. These are both great pre-litigation options, with advantages over the first two enforcement methods since actual possession can be difficult to obtain and courts move slowly with high costs to litigate. The written demands require a specific form to follow called the “Demand To Pay Rent to Party Other Than Landlord”, as found at CA Civil Code §2938(k). There are other notice requirements to be followed here, so it is essential to consult with an experienced attorney if you are considering either of these options. California Civil Code §2938 specifically provides that none of the four enforcement methods violate California’s One Action Rule nor the Anti-Deficiency Rule, so lenders can confidently enforce their AORs using the above methods with peace of mind that they are not violating other California laws.

Whether you are looking to originate a new loan, or you are facing a default by your borrower, understanding what an Assignment of Rents is and how it operates can be extremely beneficial. Enforcing an AOR can be an easier option than foreclosure and can help promote a good relationship with your borrower when handled correctly. If you have any questions about AORs, or need further details on how to enforce them, Geraci is here to help.

Conversion of Investment in Loan Receivables to an REO Via Foreclosure

By Staford François, Partner, CohnReznick The recent macro-economic environment has led to significant changes in the private credit space. Most loan operators have seen their

Things to Avoid in your Debt Funds

The popularity of funds in private lending has surged significantly in recent years. Geraci LLP, known for its expertise in this realm, has been instrumental

Distressed Debt Funds – Why they’re different?

In the past year, many private lenders have inquired about pursuing a non-performing debt fund strategy. However, they have many misconceptions that these funds can

Compliance Guidelines for Fund Filings and Operations

Private lenders, real estate developers, and other private investors often raise capital through private offerings using SEC registration exemptions such as Regulation D of the

- (949) 379-2600

- 90 Discovery, Irvine, CA 92618

Subscribe to our Newsletters

Receive attorney-authored articles, legislative updates, webinar reminders, magazines, and more straight to your inbox. Choose the newsletters below you’d like to receive.

CONNECT WITH US

Copyright 2024 geraci llp.

- Our Real Estate Practice

- Our Real Estate Attorneys

Assigning/Assuming the Benefits and Burdens of Rental Property

No comments :.

Post a Comment

- Bankruptcy & Finance

In God We Trust, All Others Pay Cash Collateral: Can Chapter 11 Bankruptcy Debtors Use Assigned Rents for Business Reorganizations under Ohio Law?

- As COVID-19 accelerates changes to how and where people work, bankruptcy courts could see a rise in Chapter 11 bankruptcy filings by office parks and office building owners.

- With these increased filings, creditor and debtor attorneys should expect to encounter more litigation over the proper treatment of rents from mortgaged property in business reorganizations, which varies by state depending on where the property sits.

- Although many Ohio bankruptcy courts treat assigned rents as cash collateral even when the contract language transfers the rents and leases them back to the debtor, a close review of Ohio case law and Sixth Circuit precedent may call that practice into question.

The COVID-19 pandemic has turned nearly every facet of American life on its head, and the long-term social changes it will bring about remain up in the air. * Even after the economy recovers from the disease’s current impact, many employers could permanently enact far-reaching changes to how—and where—people work. As more employers discover that employees can adequately perform their duties remotely, they may reevaluate the need for expensive office space, which could lead to increased Chapter 11 filings by the owners of office buildings, office parks, and single-asset real estate debtors.

Against this backdrop, bankruptcy courts can expect increased litigation over the use of post-petition rents as cash collateral to pay administrative expenses and fund business reorganizations plans. Most commercial landlords have mortgages encumbering the space leased to tenants, and the mortgages typically include an assignment-of-rents clause. A common dispute in Chapter 11 bankruptcies centers around whether the assignment-of-rents clause transfers immediate ownership of rents to the lender or merely gives the lender a security interest in the rents. State law controls the issue. See, e.g., Butner v. United States , 440 U.S. 48, 55 (1978).

The Sixth Circuit has not considered how bankruptcy courts should treat assigned rents under Ohio law. However, it overruled a bankruptcy court’s treatment of the rents as property of the bankruptcy estate under Michigan law, finding that the debtor’s assignment-of-rents to the lender transferred ownership before the debtor filed its bankruptcy petition. See Town Center Flats v. ECP Commercial , 855 F.3d 721 (6th Cir. 2017). A close review of Ohio state court opinions suggests that similar reasoning may apply to property in Ohio depending on the assignment’s specific language. See, e.g., Banks v. Heritage , 2014-Ohio-991 (12th Dist.). This would effectively bar Chapter 11 debtors in Ohio from using post-petition rents to fund reorganization plans or otherwise utilize the resources during the bankruptcy, and it could drastically limit debtors’ options when those rents represent their only source of revenue.

Bankruptcy Code Provisions Governing Rents as Cash Collateral

With some exceptions, when a business debtor files a Chapter 11 bankruptcy, all of its property becomes part of the bankruptcy estate, including rents earned from its property. See 11 U.S.C. §§ 541(a)(1), (6), 1115(a). The debtor, acting as the bankruptcy estate’s trustee (the “debtor in possession”), may continue to operate the business, and it can use property of the estate—including unencumbered future rents—in the ordinary course of business without the bankruptcy court’s approval. 11 U.S.C. §§ 363(c)(1), 1108. It can also use unencumbered rents that are property of the estate to pay administrative expenses and to fund its reorganization plans. See, e.g., First Fidelity Bank v. Jason Realty , 59 F.3d 423, 426 (3rd Cir. 1995).

If any entity other than the debtor has an interest in cash or “cash equivalents” earned from the debtor’s pre-petition property, the Bankruptcy Code deems the cash or its equivalents “cash collateral.” See 11 U.S.C. § 363(a). The Code includes post-petition rents earned from mortgaged pre-petition property as cash collateral “to the extent provided in [the] security agreement, except to any extent that the court, after notice and a hearing and based on the equities of the case, orders otherwise.” 11 U.S.C. § 552(b)(2). The debtor cannot use cash collateral without the lender’s consent unless the bankruptcy court authorizes the use. 11 U.S.C. § 363(c)(3). If the lender requests, the court must require the debtor to provide the lender with adequate protection to use the cash collateral. 11 U.S.C. § 363(e).

Of course, rents qualify as cash collateral only if they are also property of the bankruptcy estate. See, e.g., 11 U.S.C. § 363(a). Thus, if the debtor transferred ownership of the rents to another entity before it filed the bankruptcy petition, then the rents are not the estate’s property, and the debtor cannot use them as cash collateral regardless of whether it provides the lender adequate protection. See, e.g., Jason Realty , 59 F.3d at 427. In the assignment-of-rents context, the question typically boils down to whether the assignment granted the lender a security interest in the rents or transferred ownership of the rents to the lender. Id.

General Types of Assignment-of-Rents Clauses

Assignments of rents in a commercial mortgage generally take two different forms. See, e.g. In re South Side House , 474 B.R. 391, 402-03 (E.D.N.Y. Bankr. 2012). The mortgage’s granting clause may include language to the effect of “[mortgagor] hereby grants, bargains, sells, and conveys to [lender] all estates, right, title and interest in [property], together with all privileges and appurtenances to the same, and all rents, issues, and profits thereof.” Under this language, the mortgagor conveys the rents to the lender along with the property as security for the mortgage loan, but title to the rents remains with the mortgagor. Id. at 403.

The mortgage—or a separate document executed with the mortgage—may also assign the rents to the lender immediately, and the lender then leases the right to collect and use the rents back to the mortgagor. Id. The lease-back provision ordinarily terminates automatically without any action required by the lender if the mortgagor defaults. Some mortgages include both types of language, i.e., a pledge of the rents as additional security for the debt and an immediate transfer of the rents with a lease-back provision.

The Sixth Circuit’s Assignment-of-Rents Rulings

The Sixth Circuit has not considered whether assigned rents qualify as property of the bankruptcy estate under Ohio law. However, it has considered the issue under Kentucky and Michigan law, reaching different conclusions for each state. See Town Center , 855 F.3d at 724–28; In re Buttermilk Towne Center , 442 B.R. 558, 562–64 (6th Cir. B.A.P. 2010). Applying the Sixth Circuit’s analysis of Kentucky and Michigan law to Ohio state court rulings on assignments of rent suggests that bankruptcy courts applying Ohio law should not treat assigned rents as estate property for absolute assignments that then lease the rents back to the debtor.

In Buttermilk , the owner of a commercial real estate development project that leased space to rent-paying tenants in Kentucky entered into a construction financing agreement with the lender. In connection with the financing agreement, the owner assigned the rents derived from the project to the lender subject to a license allowing the owner to collect and use the rents so long as he did not default on his obligations under the financing agreement.

After defaulting on the agreement, the owner filed Chapter 11 bankruptcy and sought to use the rents as cash collateral. The lender objected, arguing that the bankruptcy court should not treat the rents as property of the bankruptcy estate. The bankruptcy court disagreed, holding that the rents belonged to the estate and constituted cash collateral. It later ruled that a replacement lien on the rents would adequately protect the lender’s security interest. The Sixth Circuit’s Bankruptcy Appellate Panel affirmed the bankruptcy court’s treatment of the rents as estate property, but it reversed the court’s allowance of a replacement lien as adequate protection.

On the rent ownership issue, the panel relied on an earlier Sixth Circuit ruling discussing Kentucky law and holding that “the entire tenor and affect of an instrument pledging rents” in Kentucky “is that such a pledge is deemed secondary security, with the lien continuing as an inchoate right which will be and must be perfected or consummated by . . . some definite action looking toward possession and subjection.” The panel noted that the lender could not provide any Kentucky law contradicting the Sixth Circuit’s previous discussion, and it held that “[e]ven if the assignment gave [the lender] a right to possess the rents pre-petition, the assignment . . . did not give [the lender] an absolute ownership of the rents.”

More recently, the Sixth Circuit interpreted Michigan law to reverse a bankruptcy court’s ruling that included assigned rents in the bankruptcy estate. See Town Center , 855 F.3d at 728. In Town Center , a company owned a large residential complex that it built with a construction loan. The company secured the loan with a mortgage and an assignment of rents. Under the assignment, the company “irrevocably, absolutely, and unconditionally [agreed to] transfer, sell, assign, pledge, and convey” the rents to the lender. The agreement also “grant[ed] a license to [the company] to collect and retain rents until an event of default, at which point the license would ‘automatically terminate without notice to [the company].’”

After the company defaulted on the loan, the lender filed a foreclosure action in state court, and the company filed a Chapter 11 bankruptcy petition. The lender moved to prohibit the company from using post-petition rents on the grounds that they were not property of the bankruptcy estate. The bankruptcy court denied the motion, ruling that the rents qualified as cash collateral and requiring the company to provide adequate protection to the lender. The Sixth Circuit reversed, interpreting the contract language to have assigned the lender ownership of the rents.

The Sixth Circuit began by analyzing Michigan law on assignment of rents, which had traditionally forbade mortgage assignment-of-rents clauses until the state legislature enacted a law specifically allowing them. Noting that “Michigan courts generally discuss assignments of rents under [the applicable statute] as ownership transfers,” the Sixth Circuit discussed two appellate-level Michigan opinions holding that “the assignor loses any right to collect the rents after the assignee has perfected its rights [under the statute] following an event of default.” The court therefore held that the rents belonged to the lender, and the bankruptcy court wrongly considered them property of the estate, despite also recognizing that the ruling limited single-asset real estate debtors’ options under Chapter 11.

As noted, the Sixth Circuit has not addressed the assignment-of-rents issue under Ohio law. State courts in Ohio appear to treat general assignments of rents included in the mortgage’s granting clause differently from assignments that immediately transfer ownership and lease the rents back to the mortgagor. Compare, e.g., Hutchinson v. Straub , 64 Ohio St. 413 (1901) with Banks v. Heritage , 2014-Ohio-991. Accordingly, bankruptcy courts applying Ohio law should arrive at different results depending on the specific type of assignment-of-rents clause.

Ohio Law on General Rent Assignments in the Granting Clause

Ohio courts interpreting mortgages that convey rents as additional security in the granting clause mostly hold that mortgagors retain ownership of the rents until the lender takes possession of the property or otherwise asserts its rights to the rents. See, e.g., In re Pfleiderer , 123 B.R. 768, 769–70 (N.D. Ohio Bankr. 1987). In Ohio, rents are not included in the mortgage unless specifically pledged, and the lender must still take some action to exert control over the rents even when the mortgage specifically pledges them. Id. (quoting 69 O. Jur. 3d Mortgages § 151 (1986)).

In Hutchinson , the debtor gave her lender a mortgage conveying property to secure the debt “and all the rents, issues and profits thereof.” In state court insolvency proceedings, the plaintiff took assignment of the property for the benefit of creditors, and it collected rents from the property during a land sale action in the probate court. After the sale, the trial court ordered the plaintiff to pay the rents to the lender to satisfy the mortgage rather than the unsecured creditors. The plaintiff appealed, and the Ohio Supreme Court affirmed.

The court rejected the plaintiff’s position that the lender had no right to the rents because it never took actual possession of the property or sought to have a receiver appointed as plausible but unsound. The court acknowledged the traditional rule that “the mortgagor has the right to receive as his own the rents of real estate so long as he remains in possession,” but it found that “the [debtor] in this case yielded possession to one who took the property burdened with the duty to administer it for the benefit of creditors.” The court further noted that although lenders ordinarily seek a receiver to enforce their right to the rents, the pending probate action precluded the lender from doing so, and the assignee for the benefit of creditors served the same function of a receiver. See also In re Cordesman-Rechtin , 66 Ohio App. 25, 27–28 (1st Dist. 1940) (discussing Hutchinson and distinguishing cases where the mortgage did not assign rents). Accordingly, the court upheld the trial court’s order requiring the plaintiff to pay the rents it collected to the lender.

Ohio courts interpreting Hutchinson confirm that its rule applies regardless of whether a separate legal proceeding prevents the lender from seeking to appoint a receiver. See Perin v. N-Ren , CA87-09-014, 1988 Ohio App. LEXIS 2089 *10 (12th Dist. May 31, 1988). In Perin , a farmer sold land to a purchaser, who gave the farmer a mortgage pledging “rents, issues and profits” to secure the purchase price. The purchaser then agreed with a third party to allow him to grow tobacco on the land in exchange for a portion of the proceeds from the tobacco. The purchaser filed bankruptcy after defaulting on her mortgage to the farmer, and the farmer secured permission from the bankruptcy court to proceed with foreclosure.

Although the foreclosure remained pending, the farmer obtained a preliminary injunction preventing the third-party tobacco grower from paying the proceeds of the tobacco sales to the purchaser, but she did not seek a receiver. After the foreclosure sale, the trial court found that the tobacco proceeds constituted rents, and it ordered them paid to the farmer. The purchaser appealed, and the appellate court affirmed.

The court rejected the purchaser’s argument that the farmer had no right to the rents because she never had a receiver appointed. It found that even though nothing prevented the farmer from seeking a receiver, the Ohio Supreme Court’s ruling in Hutchinson still controlled. Noting that “[r]eceivership is not the only process by which a court can take control of mortgaged property,” it held that “[a] mortgagee of real property is entitled to the rents and profits of the mortgaged premises when he takes actual possession of the property, when possession is taken on his behalf by a receiver, or when he demands such possession.” The court determined that the farmer’s motion for a temporary injunction “was an act compatible with the right she claimed [to the rents] and equivalent to a demand for possession.”

Ohio Law on Immediate Rent Assignments with Lease-Back Provisions

In contrast to these rulings, Ohio courts have construed assignments that immediately transfer the rents to the lender differently. See, e.g., Banks , 2014-Ohio-991, ¶¶ 22–24. In Banks , mobile home residents brought a class action against the management company that owned three separate mobile home parks. The lender for one of the parks intervened and had a receiver appointed to collect the residents’ rents after the management company defaulted on its mortgage loan for one the parks. The lender subsequently accepted a deed in lieu of foreclosure. When the lender sought the rents the receiver collected, the trial court refused, finding that the deed in lieu of foreclosure satisfied the lender’s mortgage loan. The appellate court reversed.

Under the language in the assignment of rents, the management company conveyed “all right, title and interest of [the company] . . . together with . . . all rents, receipts, revenues, income, and profits which may now or hereafter be or become due.” (Emphasis removed.) The agreement further provided that “[t]his Assignment is absolute and is effective immediately,” but it allowed the management company to “receive, collect, and enjoy the rents” until “a default has occurred, and has not been cured.” (Emphasis removed.) Upon default, the lender could “at its option, without notice to [the management company], receive and collect all such rents . . . as long as such default or defaults shall exist.” (Emphasis removed.)

Construing this language, the appellate court found that the rents “became the exclusive property of [the lender] upon [the mortgage company’s] default.” Accordingly, given that the lender “owned the funds that were held by the receiver pursuant to the Assignment of Rents agreement, the deed in lieu of foreclosure did not release [the lender]’s ownership interest in such funds.” The court therefore ordered the receiver to turn over the rents it had collected since its appointment, which was all the funds at issue in the case, because the rents “were the property of [the lender].” See also U.S. Bank v. Gotham King Fee Owner , 2013-Ohio-1983, ¶ 21 (8th Dist.) (mortgagor not entitled to notice of receiver’s changes to leases because “its license in the rents and leases automatically terminated upon default”).

Effectuating the terms of more specific assignment-of-rents clauses over general language from the mortgage’s granting clause also conforms to well-established contract rules recognized in Ohio. Ohio courts consistently treat the more specific terms of a contract as controlling over the more general terms. See, e.g., Vanderink v. Vanderink , 2018-Ohio-3328, ¶ 26 (5th Dist.); Pierce Point Cinema v. Perin-Tyler , 2012-Ohio-5008, ¶ 17 (12th Dist.). Thus, the more specific assignment terms immediately transferring the rents and leasing them back to the mortgagor should control over any more general terms pledging rents as additional security.

Even if the more specific terms did not control, Ohio—like most states—construes contracts as a whole and gives effect to all of their terms if possible. See, e.g., Prudential Ins. Co. v. Corporate Circle , 103 Ohio App. 3d 93, 98 (8th Dist.). Mortgage-granting clauses typically grant the mortgagor’s rights in the property to the lender along with any profits or rents flowing from the property. Assigning the rents subject to a lease-back provision does not invalidate that language in the granting clause. It simply removes the right to collect and use the rents from the “bundle of sticks” the mortgagor conveyed to secure the debt. After the assignment, that right belongs to the lender, who leases it back to the mortgagor with a lease that automatically terminates if the mortgagor defaults. Interpreting the mortgage to only pledge the rents as additional security would improperly read the more specific assignment-of-rents term out of the mortgage altogether.

Harmonizing Ohio’s Assignment-of-Rents Caselaw

Reading these cases together suggests that Ohio law treats three different assignment-of-rents scenarios differently. In the first scenario, the mortgage contains no pledge of rents or separate assignment-of-rents clause. There, the rents still follow title to the property, but the lender would not have a right to rents while a foreclosure action remained pending and the mortgagor still had a right to redeem. See Commercial Bank v. Woodville , 126 Ohio St. 587, 592 (1933). The same rule may follow if the lender took legal possession of the property through ejectment. Id. at 591 (“the right to rents . . . follows the legal title and right to possession”) (internal quotations omitted).

Notably, this line of reasoning also conforms to longstanding Ohio mortgage foreclosure law. In Ohio, title to the property as between the mortgagor and the lender passes to the lender upon default, but title as between the mortgagor and the rest of the world remains with the mortgagor until the lender completes a foreclosure action or takes possession through ejectment. See, e.g., Hausman v. City of Dayton , 73 Ohio St. 3d 671, 675–76 (1995). Inasmuch as rents arise from title between the mortgagor and its tenants, not between the mortgagor and the lender, the title giving rise to the rents remains with the mortgagor until the lender either forecloses or ejects.

In the second scenario, the mortgage specifically pledges the rents as additional security for the debt, but it has no separate assignment immediately transferring the rents to the lender. There, the lender has rights to the rents before foreclosing the mortgagor’s redemption rights, but it must have a receiver appointed or take some other action to exert dominion over the rents. See, e.g., Perin , 1988 Ohio App. LEXIS 2089 *10. Inasmuch as at least one Ohio court holds that a lender “is entitled to the rents and profits of the mortgaged premises . . . when he demands [ ] possession,” a simple demand letter to the mortgagor could suffice to meet this requirement. Id.

In the third scenario, the mortgage—or a separate contemporaneous document—immediately assigns the rents to the lender and leases them back to the mortgagor with the lease to expire upon default without additional action needed from the lender. There, the lender owns the rents immediately upon default without needing to foreclose or eject, seek appointment of a receiver, or take any other action to exert dominion over the rents. See, e.g., Banks , 2014-Ohio-991, ¶ 22; Gotham , 2013-Ohio-1983, ¶ 19. Cf. GLIC Real Estate v. Bicentennial Plaza , 2012-Ohio-2269, ¶ 26 (10th Dist.) (refusing to extend the general rule that courts treat a conveyance made for security as a mortgage to an assignment of leases that transferred immediate ownership).

Importantly, a receiver collected the rents at issue in both the Banks and Gotham cases cited above, which could support the position that lenders must still take possession or appoint a receiver before owning the rents, notwithstanding the specific contract language to the contrary. However, Banks and Gotham did not treat the receiver as the determinative fact. Instead, both relied on Ohio contract law and specifically held that the rents became the lender’s property when the mortgagor defaulted. See Banks , 2014-Ohio-991, ¶ 22 (“Pursuant to [the contract], the funds became the exclusive property of [the lender] upon [the mortgagor]’s default on the promissory note.”); Gotham , 2013-Ohio-1983, 19 (mortgagor “lost any interest it had in the leases and rents” when its license to the rents “terminated automatically upon default”).

Ohio’s Assignment-of-Rents Case Law in the Chapter 11 Context

Applying this law in the context of a Chapter 11 debtor’s ability to use rents for reorganization should yield different results for each scenario. In the first scenario, bankruptcy courts should allow debtors to use the rents without court authorization regardless of whether the lender consents. Title to the property that produced the rents belonged to the debtor when it filed the bankruptcy petition, and the rents are not provided for “by [the] security agreement” under Ohio law because the debtors did not specifically pledge them as additional security. Thus, they belong to the bankruptcy estate and are not cash collateral. See 11 U.S.C. §§ 541(a)(1), 552(b)(2).

In the second scenario, bankruptcy courts applying Ohio law should treat the rents as part of the bankruptcy estate and the lender’s cash collateral, unless the lender successfully had a receiver appointed or made a demand for the rents before the debtor filed the bankruptcy petition. The debtor conveyed the rents in the mortgage as additional security for the debt, but it continues to own the rents until the lender has a receiver appointed or takes other appropriate action. See, e.g., Perin , 1988 Ohio App. LEXIS 2089 *10. However, if the lender took such action before the debtor filed the petition, the court should not treat the rents as property of the estate under Ohio law because the debtor no longer owned them when it filed the petition. Id. at *7.

In the third scenario, bankruptcy courts applying Ohio law should treat the rents as belonging to the lender and therefore not property of the bankruptcy estate, regardless of whether the lender had a receiver appointed or took any other action to exercise control over the rents. The debtor assigned the rents to the lender immediately upon executing the mortgage, and its only remaining interest in the rents consisted of the lender’s lease back to the debtor. See, e.g., Banks , 2014-Ohio-991, ¶ 22. That lease expired upon default, and the debtor therefore held no interest in the rents when it filed the bankruptcy petition. Id.

This reasoning should hold under Town Center and Buttermilk, regardless of Ohio’s status as a so-called lien theory state. The Sixth Circuit’s analysis in Town Center rested on its determination that Michigan law “allow[ed] for assignments of rents to be transfers of ownership once the statutory steps for perfection have been completed.” Town Center , 855 F.3d at 726. Accordingly, given that the court read the mortgage language as “assign[ing] the rents to the maximum extent permitted by Michigan law,” it held that the debtor transferred ownership of the rents. In contrast, the court specifically noted in Buttermilk that the lender could “not present[ ] any Kentucky case law that contradict[ed]” its earlier ruling that assignments of rents under Kentucky law constituted only “secondary security” the lender must perfect by taking “some definite action looking toward possession and subjection.” (Internal quotations omitted.)

Like Kentucky, Ohio case law recognizes a general rule that treats assignments of rents in the granting clause as additional security requiring the lender to take some action to perfect before acquiring ownership. See, e.g., Hutchinson , 64 Ohio St. at 415–17. However, like Michigan, Ohio case law also allows assignments of rents to constitute immediate transfers of ownership depending on the language in the mortgage contract. See, e.g., Banks , 2014-Ohio-991, ¶ 22; Gotham , 2013-Ohio-1983, ¶ 19; GLIC Real Estate , 2012-Ohio-2269, ¶ 26. Thus, applying the Sixth Circuit’s analysis in Town Center , the more specific language in immediate assignments with lease back provisions should control, and bankruptcy courts should not consider the rents estate property.

Many Ohio bankruptcy courts treat assigned rents as cash collateral even when the contract language immediately transfers the rents and leases them back to the debtor. Yet, a close review of Ohio case law read with Sixth Circuit precedent may call that practice into question. As bankruptcy filings increase from owners of commercial office property, parties can expect to litigate these issues more, and some Chapter 11 debtors may find themselves without cash collateral to pay expenses and fund reorganization.

* This article is not intended as and should not be considered legal advice.

MORE FROM THIS AUTHOR

Business regulation & regulated industries.

Facing the Future: Challenging Strict Compliance for HUD Face-to-Face Meetings Under Illinois Law

Mortgage foreclosure cases sometimes yield surprising and unexpected results,[1] and the recent opinion…

Bankruptcy & Finance

Much Obliged: Massachusetts Lenders Shouldn’t Have to Lose It Over Lost Notes

Like it or not, the real estate market relies on mortgage lenders trading mortgage loans like kids used…

Corporations, LLCs & Partnerships

Recklessly Disregarding a Nonexistent Risk of Harm: Does Including the Expiration Date on…

The Fair and Accurate Credit Transactions Act (FACTA), 15 U.S.C. § 1681 et seq., prohibits merchants…

MERS’s “Maine” Purpose: Recognizing Key Differences Between MERS Mortgages

Maine’s Supreme Court recently held that a foreclosing lender’s equitable interest in the mortgage…

Foreclosing FHA-Insured Mortgages in Ohio: Answers to Common Questions Posed in Contested Litigation

Lenders foreclosing FHA-insured mortgages in Ohio often face challenges that contest the lender’s compliance…

A Tale of Two Fishers: Unsettling Ohio’s “Well-Settled Law” on the Proper Statute of…

In the bankruptcy case of In re Fisher, 584 B.R. 185, 199–200 (N.D. Ohio Bankr. 2018), the United States…

Connect with a global network of over 30,000 business law professionals

Login or Registration Required

You need to be logged in to complete that action..

- Client Login

The content you are accessing may be considered attorney advertising material in certain jurisdictions and is for general information only. It should not be construed as and is not intended to constitute legal advice, and should not be used as a basis for action without obtaining legal advice from a qualified attorney. Prior results do not guarantee similar outcomes.

- Publications

- Client Training

- Scott R. Lesser

- Gergana S. Sivrieva

- Bankruptcy, Restructuring and Insolvency

- Financial Services

- Real Estate

Foreclosure Does Not Extinguish Assignment of Rents

Previously, we alerted you that Michigan had passed its version of the Uniform Assignment of Rents Act (MUARA). Among other things, this law clarifies that an assignment of rents is not extinguished by a foreclosure sale itself, but instead terminates either at the end of the redemption period or when the property is redeemed.

Before the MUARA, this was not clear. On the one hand, some cases suggested that an assignment of rents continued at least to the end of the redemption period. For example, a strict reading of Security Trust Co v Sloman suggests that an assignment of rents continues until the debt is paid in full or the redemption period expires without a redemption—meaning it might continue if there is a redemption. [1] On the other hand, others—such as dictum in Dunitz v Woodford Apartments Co [2] stating that “foreclosure of a mortgage extinguishes it”—suggest that the mortgage as a whole, including any assignment of rents it contains, might be extinguished by a foreclosure sale itself. Unless a separate instrument was recorded embodying an assignment of rents, this could allow a foreclosed commercial owner to collect rents for months before the purchaser at the foreclosure sale could step in. Unsurprisingly, this confusion has led to conflicting decisions by different courts.

The MUARA resolves this uncertainty. Now, an assignment of rents automatically terminates when either (i) the redemption period expires, or (ii) an earlier redemption occurs. [3] Moreover, if a third party submits the winning bid at a foreclosure sale, the assignment of rents transfers to it “to the extent of the remaining secured obligation” by operation of law, regardless of what the foreclosure notice says. [4] These important clarifications add certainty to an ambiguous area of law that can have a real financial impact.

This is one of a series of articles Miller Canfield is releasing about the MUARA. For questions about the issues addressed in this alert, or for more information on the MUARA, please feel free to contact us.

[1] 252 Mich. 266; 233 N.W. 216 (1930).

[2] 236 Mich. 45, 49; 209 N.W. 809 (1926).

[3] Public Act No. 115 of 2022 . The MUARA takes effect September 22, 2022.

[4] Id. § 4(4)(a).

We use cookies to improve the functionality of our website and make your web experience better. For more information, please visit our privacy policy .

Necessary Cookies

Necessary cookies enable core functionality such as security, network management, and accessibility. You may disable these by changing your browser settings, but this may affect how the website functions.

Analytical Cookies

Analytical cookies help us improve our website by collecting and reporting information on its usage. We access and process information from these cookies at an aggregate level.

subscribe to our blogs

Connect with us, advanced search.

- Presentations

- In The News

- Press Releases

- Newsletters

Media Contacts

Charles B. Jimerson Managing Partner Nikos Westmoreland Director of Business Development --> Jimerson Birr welcomes inquiries from the media and do our best to respond to deadlines. If you are interested in speaking to a Jimerson Birr lawyer or want general information about the firm, our practice areas, lawyers, publications, or events, please contact us via email or telephone for assistance at (904) 389-0050 .

Other Articles in Banking & Financial Services Industry Legal Blog

- The Whole Truth – Defending Against Claims That a Debtor Failed to Disclose in Bankruptcy Court

- New Options for Pursuing Judgment Liens in Florida

- Recent Trends and Common Allegations in FCCPA Litigation

- Defending Against Alleged Violations of the FCCPA and the FRLTA

- Bad Faith Dismissals in Bankruptcy, Part 2: Chapter 7 Debtors with Primarily Consumer Debts

Properly Enforcing an Assignment of Rents

Reading Time: 5 minutes

In Florida, lenders typically obtain an “assignment of rents” if the property produces income by collecting rent, such as an apartment complex, rental home, rental space, or office building. An “assignment of rents” allows the lender to collect the rent payments, if the borrower defaults on their loan payments. Although the lender and borrower may agree to the assignment of rents in the loan documents, the procedure for enforcing the assignment of rent is governed by Section 697.07, Florida Statutes .

The Assignment of Rents Should be Recorded

If a lender and borrower agree to the assignment of rents as security for repayment of debt in a mortgage document, the lender will hold a lien on the rent payments. However, to perfect its rents lien against third parties, the lender must record the mortgage in the public records of the county in which the real property is located. Fla. Stat. § 697.07 (2).

How Can a Lender Enforce the Assignment of Rents?

Section 697.07 provides two methods for the lender to enforce the assignment of rent: (i) the actual assignment of rent to the lender, and (ii) the sequestration of rents into the court registry. Wane v. U.S. Bank, Nat’l Ass’n , 128 So. 3d 932, 934 (Fla. 2d DCA 2013) (“Section 697.07 draws a clear line between a motion seeking sequestration of rents into the court registry [under subsection (4)] and a motion seeking an actual assignment of rents to the lender pending foreclosure [under subsection (3)].”).

(i) Actual Assignment of Rent to the Lender

The first method, the actual assignment of rent to the lender, is provided in Section 697.07 (3). If the borrower defaults on the loan, the lender can make a written demand to the borrower to turn over “all rents in possession or control of the [borrower] at the time of the written demand or collected thereafter,” minus any expenses authorized by the lender in writing. Fla. Stat. § 697.07 (3). If the borrower does not turn over rent payments after the lender has made a written demand, the lender may foreclose on the rents lien and collect rent payments, without having to foreclose on the underlying mortgage. Ginsberg v. Lennar Fla. Holdings, Inc. , 645 So. 2d 490, 498 (Fla. 3d DCA 1994) (“[A]n assignment of rent creates a lien on the rents in favor of the mortgagee, and the mortgagee will have the right to foreclose that lien and collect the rents, without the necessity of foreclosing on the underlying mortgage.”).

To receive a court order for the actual assignment of rent, the lender will have to prove that there was a default, and that it made a written demand to the borrower to turn over rent payment. Wane , 128 So. 3d at 934. Additionally, an evidentiary hearing will be required.

(ii) Sequestration of Rent Into the Court Registry

The second method, the sequestration of rent into the court registry, is provided in Section 697.07 (4). This method can only be used if there is a pending mortgage foreclosure lawsuit. Unlike the first method, the lender does not have to prove that there was a default or make a written demand, and an evidentiary hearing is not required.

Either the borrower or lender may make a motion to the court for sequestration of rent into the court registry. Upon such a motion, a court, pending final judgment of foreclosure, may require the borrower to deposit the collected rents into the court, or in such other depository as the court may designate. The court must hear the motion on an expedited basis, and the moving party will only be required to show that there is a pending foreclosure lawsuit, and that there is a provision in the loan documents for the assignment of rent. Wane , 128 So. 3d at 934.

Moreover, a borrower cannot avoid sequestration of rents by raising defenses or counterclaims. Id. ; Fla. Stat. § 697.07 (4). In addition, the borrower will be required to submit records of receipt of rent to the court and lender, typically on a monthly basis throughout the lawsuit. The rents will remain in the court registry until conclusion of the foreclosure action.

To properly enforce the assignment of rents, the first thing lenders should do is record the assignment of rents in the public records of the county in which the real property is located. In the event the borrower defaults on their loan, the lender will have two options to enforce the assignment of rents: the actual assignment of rent to the lender (Section 697.07 (3)), or the sequestration of rents into the court registry (Section 697.07 (4)). If the lender is seeking the actual assignment of rent, the lender must send a written demand to the borrower to turn over the rent payments and provide proof of default. On the other hand, the lender may seek sequestration without proof of default or written demand. Showing the existence of an assignment of rents provision in the loan documents is sufficient to obtain sequestration of rents into the court registry.

- Austin B. Calhoun, Esq.

- Melissa G. Murrin, JD Candidate

Other Articles

Join our mailing list., call our experienced team., we’re here to help, connect with us., call our experienced team..

- Federal Issues

- State Issues

- Ohio Housing Trust Fund

- Racial Equity

- SOAR Ohio Videos

- Training Materials

- Youth T&TA

- ODH Youth Homelessness Program

- Ohio Department of Education Youth Homelessness Program

- Housing Now for Homeless Families

- Replication & Expansion Advocacy

- Research & Reports

- Governance & Policies

- Housing Information Line

- Fair Housing

- Housing Preservation

- Landlord Tenant Law

- Governance and Policies

- CoC Program

- Homelessness Prevention

- Coordinated Entry

- HIC and PIT

- Performance and Monitoring

- Special Initiatives

- Training and Templates

- Conference Archives

- Board of Directors

- Work With Us

- Membership Information

- Workers Compensation

Report Highlights Growing Gap Between Rents and Wages

June 27, 2024.

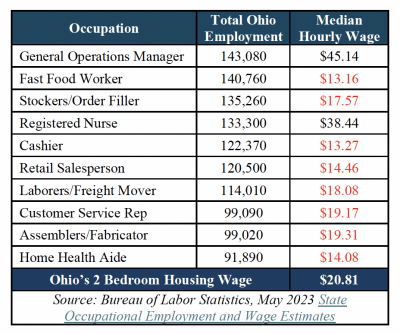

Full-time workers need to earn at least $20.81/hour just to afford a modest two-bedroom apartment in Ohio, according to a report jointly released Thursday by the National Low Income Housing Coalition and the Coalition on Homelessness and Housing in Ohio.

The 2024 Out of Reach Ohio report reveals a significant gap between renters’ income and the cost of rent, which has increased rapidly in recent years. Of the 10 jobs with the most employees in Ohio, only two earn more than the statewide $20.81/hour 2-bedroom Housing Wage – general operations managers and registered nurses.

In some areas, the 2-bedroom Housing Wage is considerably higher than the statewide average. For example, renter households living in the Columbus area need to earn at least $25.04/hour to afford a two-bedroom apartment. The Housing Wage in Cincinnati is $22.98/hour and in Cleveland it’s $21.31/hour.

COHHIO Executive Director Amy Riegel said Ohio’s statewide Housing Wage increased nine percent since last year’s report.

Rapidly increasing rents are directly related to rising rates of housing insecurity. Last year, Ohio landlords filed nearly 108,000 eviction cases – more than any year since 2015. And homelessness in Ohio increased seven percent in 2023 over the previous year.

“Aging Ohioans and people with disabilities living on a fixed income are especially vulnerable to rent shock,” Riegel said, noting that Social Security payments have increased only minimally in recent years. “Ohioans who worked hard for 40 years or more should be enjoying their golden years. Instead, many are rationing medications and wondering how they’re going to feed themselves and pay the rent.”

Riegel said state policymakers took some initial steps to address Ohio’s housing affordability crisis in last year’s budget, but she urged them to do more. For example, lawmakers should consider ways to strengthen the Ohio Housing Trust Fund, the primary source of state funding for local housing and homelessness programs.

NLIHC President and CEO Diane Yentel urged Congress to tackle the housing affordability crisis afflicting the entire country.

“This year’s Out of Reach report shows that despite rising wages, cooling inflation, and low unemployment, low-wage workers and other renters continue to struggle with the high cost of rent,” she said.

“Addressing the challenge requires long-term federal investments in affordable housing. As evidenced during the COVID-19 pandemic, federal policies and resources play a pivotal role in establishing a robust housing safety net, preventing evictions and homelessness, and mitigating housing instability among renters with the lowest incomes,” Yentel added. “Likewise, federal renter protections are needed to ensure decent, safe, and accessible living conditions for tenants around the country.”

Additional information: NLIHC’s Out of Reach page

Share This Story, Choose Your Platform!

Related posts.

See where Columbus, other Ohio cities rank in latest national rent report

COLUMBUS, Ohio (WKRC) — Columbus has been ranked among the 100 most expensive cities in which to rent in the Zumper National Rent Report .

Zumper is a digital real estate marketplace that lists apartments and houses for purchase or rent. The company boasts its National Rent Report as the best indicator of housing Consumer Price Index (CPI), the average change over time in prices paid for goods and services, including rent.

Overall, the CPI rose 0.4% last month, marking four months of increase in a row. According to its National Rent Report, Zumper reports one-bedroom apartments increased by 1.5% while two-bedroom apartments increased by 1.9%.

To no big surprise, the city at the top of the National Rent Report is New York City, which boasts a hefty $4,300 for a one-bedroom apartment and $4,750 for a two-bedroom. The top three haven't changed since the last report, with New York, Jersey City, and San Francisco still dominating (in that order), for better or worse.

The most expensive Ohio cities on the rent report are Columbus and Cleveland, which sit next to each other at 65 and 67, respectively (Cleveland is tied with Syracuse for 67, so Cleveland is technically 66).

Average rent prices for one- and two-bedroom apartments both dropped in Columbus. A 1BR costs $1,220 and a 2BR costs $1,390, according to the Zumper report.

Columbus was ranked 59th in the last report, but the rent drops pushed Columbus down to 65.

Cincinnati ranks as the cheapest of Ohio's big three cities, coming in at No. 85. For comparison, Cincinnati is a mere $1,000, more than 20% less than Columbus and Cleveland. Cincinnati has dropped three ranks since the last report, where it clocked in at 82.

The only other Ohio city that made the list was Akron, which landed at the lowest rank of 99 in a tie with Wichita, Kansas.

Gov. Mike DeWine says he would sign transgender bathroom bill if it lands on his desk

- Updated: Jun. 28, 2024, 11:40 a.m. |

- Published: Jun. 28, 2024, 11:38 a.m.

Gov. Mike DeWine speaks during a June 28, 2024 news conference during which he ceremonially signed the multi-billion dollar capital budget bill that lawmakers passed earlier in the week. Andrew J. Tobias, cleveland.com

- Andrew J. Tobias, cleveland.com

COLUMBUS, Ohio — Gov. Mike DeWine said Friday that he would sign a bill Republican lawmakers passed earlier this week that bans K-12 schools and public universities from allowing transgender students to use bathrooms that align with their gender identities – if he’s given the opportunity.

DeWine described his position as being “for children being able to go to a bathroom that has that gender assignment.” He also said his position only applies to the current version of the bill.

Stories by Andrew Tobias

- Gov. Mike DeWine signs $4.2 billion capital budget that provides millions to northeast Ohio projects

- Catching up on this week’s mini-Lame Duck session in the Ohio legislature: Capitol Letter

- Ohio Senate approves bill meant to protect elections workers from personal threats

If you purchase a product or register for an account through a link on our site, we may receive compensation. By using this site, you consent to our User Agreement and agree that your clicks, interactions, and personal information may be collected, recorded, and/or stored by us and social media and other third-party partners in accordance with our Privacy Policy.

IMAGES

VIDEO

COMMENTS

An Assignment of Rents ("AOR") is used to grant the lender on a transaction a security interest in existing and future leases, rents, issues, or profits generated by the secured property, including cash proceeds, in the event a borrower defaults on their loan. The lender can use the AOR to step in and directly collect rental payments made ...

Section 5301.33 | Cancellation, release, and assignment of leases. Section 5301.33. |. Cancellation, release, and assignment of leases. Except in counties where deeds or other separate instruments are required as provided in this section, a lease, whether or not renewable forever, that is recorded in any county recorder's office, may be ...

When selling or buying rental real estate, insist upon an assignment/assumption agreement to ensure the benefits and burdens of rental real estate are fairly apportioned to buyer and seller, after the sale. Published by Stephen D. Richman, Esq. on Monday, May 04, 2015. Email This BlogThis!

Standard A: Yes, unless other facts in the recorded instruments indicate a contrary intention and only if such release was recorded after the recording of the assignment of rents and/or leases and the legal description for the corresponding mortgage describes the same real property set forth in the assignment of rents and/or leases. (Effective ...

Ohio's Assignment-of-Rents Case Law in the Chapter 11 Context. Applying this law in the context of a Chapter 11 debtor's ability to use rents for reorganization should yield different results for each scenario. In the first scenario, bankruptcy courts should allow debtors to use the rents without court authorization regardless of whether ...

Chapter 5309 Registration Of Land Titles. Effective: February 1, 2002. Latest Legislation: House Bill 279 - 124th General Assembly. PDF: Download Authenticated PDF. The holder of any mortgage, encumbrance, lease, charge, or lien upon registered land may execute to a transferee an assignment for the whole or any part of the mortgage, encumbrance ...

In lieu of the recording of a lease, there may be recorded a memorandum of that lease, executed and acknowledged in accordance with section 5301.01 of the Revised Code. The memorandum of lease shall contain the names of the lessor and the lessee and their addresses as set forth in the lease, a reference to the lease with its date of execution, a description of the leased premises with such ...

1940-1869. 164. OPINIONS. 1869. ASSIGNMENTS-RENTS, PROFITS AND ROYALTIES INCI DENT TO ESTATES IN LANDS ARE HEREDITAMENTS-RE CORDABLE INSTRUMENTS-SECTIONS 2757, 8543 G. C.-IF SUCH ASSIGNMENT ABSOLUTE AND UNCONDITIONAL CONVEYANCE, RECORDED IN RECORDS OF DEEDS-IF CON DITIONA:L, RECORDED, IN RECORD OF MORTGAGES. SYLLABUS: Rents, profits and royalties.

There are several ways to release/discharge an assignment of leases and rents in Ohio, this one is (by Separate Instrument) (Oh statute 5301.33) 5301.33 Cancellation, release, and assignment of leases. Except in counties where deeds or other separate instruments are required as provided in this section, a lease, whether or not renewable forever ...

Agreement for assignment by Borrower to Lender of leases and rent therefrom in order to repay Borrower's debt to Lender. The assignee agrees to extend a loan to the assignor secured by a deed of trust and security agreement. The agreement will satisfy state statutory law. An assignment is the transfer of a property right or title to some ...

In terms of submitting Ohio Assignment of Lease and Rent from Borrower to Lender, you almost certainly think about an extensive procedure that involves finding a suitable sample among hundreds of similar ones and after that needing to pay out legal counsel to fill it out to suit your needs. Generally, that's a slow-moving and expensive option.

The Ohio Assignment of Leases and Rents Form typically includes several key elements, ensuring a comprehensive and legally binding agreement. These elements may vary slightly depending on the specific circumstances, but generally include the following: 1. Identification of Parties: The form starts by identifying the assignor (the party ...

The crazy quilt of assignment-of-rents decisions issued by both state and federal (including bankruptcy) courts over the past several years with respect to the enforceability of assignment-of-rents provisions in mortgage-loan documents highlights the desirability of adopting - sooner rather than later -- the Uniform Assignment of Rents Act ...

June 29, 2022. Previously, we alerted you that Michigan had passed its version of the Uniform Assignment of Rents Act (MUARA). Among other things, this law clarifies that an assignment of rents is not extinguished by a foreclosure sale itself, but instead terminates either at the end of the redemption period or when the property is redeemed.

In the event the borrower defaults on their loan, the lender will have two options to enforce the assignment of rents: the actual assignment of rent to the lender (Section 697.07 (3)), or the sequestration of rents into the court registry (Section 697.07 (4)). If the lender is seeking the actual assignment of rent, the lender must send a ...

When the debt has been fulfilled this form is recorded by the holder of the "Assignment of Leases and Rents" to discharge the document. There are several ways to release/discharge an assignment of leases and rents in Ohio, this one is (by Separate Instrument) (Oh statute 5301.33) 5301.33 Cancellation, release, and assignment of leases.

ASSIGNMENT OF LEASES AND RENTS . THIS ASSIGNMENT OF LEASES AND RENTS (as the same may from time to time be amended, restated or otherwise modified, this "Assignment") is made as of the 29 th day of June, 2001, by ABX AIR, INC., a corporation organized under the laws of Delaware ("ABX"), having its principal place of business at 145 Hunter Drive, Wilmington, Ohio 45177, WILMINGTON AIR PARK, INC ...

As additional security for the Loan, Macedonia executed an assignment of leases . 2 and rents ("Assignment") assigning its rights to all present and future leases, rents, and income for the Property to Berkshire. Macedonia also executed a commercial security agreement granting ... 2020-Ohio-3913, ¶ 16 (providing that a party cannot raise a ...

Ohio Assignment of Rents by Lessor involves a legal arrangement where a lessor (property owner) assigns their right to collect rental income from a property to another party, typically a lender or a landlord. This assignment serves as collateral for a loan or to ensure lease compliance. The Ohio Assignment of Rents by Lessor is commonly used in ...

The 2024 Out of Reach Ohio report reveals a significant gap between renters' income and the cost of rent, which has increased rapidly in recent years. Of the 10 jobs with the most employees in Ohio, only two earn more than the statewide $20.81/hour 2-bedroom Housing Wage - general operations managers and registered nurses.

Grava v. Parkman Twp., 73 Ohio St.3d 379 (1995), syllabus. Res judicata prevents the litigation of issues that were raised on appeal or could have been raised on appeal. In re R.B., 12th Dist. Butler Nos. CA2022-01-003 and CA 2022-01-004, 2022-Ohio-1705, ¶ 17. Any issue that could have been raised on direct appeal and was not is res judicata ...

COLUMBUS, Ohio (WKRC) — Columbus has been ranked among the 100 most expensive cities in which to rent in the Zumper National Rent Report. Zumper is a digital real estate marketplace that lists ...

COLUMBUS, Ohio — Gov. Mike DeWine said Friday that he would sign a bill Republican lawmakers passed earlier this week that bans K-12 schools and public universities from allowing transgender ...

When the debt has been fulfilled this form is recorded by the holder of the "Assignment of Leases and Rents" to discharge the document. There are several ways to release/discharge an assignment of leases and rents in Ohio, this one is (by Separate Instrument) (Oh statute 5301.33) 5301.33 Cancellation, release, and assignment of leases.

Meanwhile, Cincinnati optioned Yosver Zulueta to Triple-A Louisville. They also returned Noelvi Marte from his rehab assignment. Marte is eligible to return to the big league club on Thursday ...

Milan Ball moved to Indianapolis in 2022. She pays less than $1,700 in rent, landed a job there, and finds downtown beautiful.

When the debt has been fulfilled this form is recorded by the holder of the "Assignment of Leases and Rents" to discharge the document. There are several ways to release/discharge an assignment of leases and rents in Ohio, this one is (by Separate Instrument) (Oh statute 5301.33) 5301.33 Cancellation, release, and assignment of leases.

When the debt has been fulfilled this form is recorded by the holder of the "Assignment of Leases and Rents" to discharge the document. There are several ways to release/discharge an assignment of leases and rents in Ohio, this one is (by Separate Instrument) (Oh statute 5301.33) 5301.33 Cancellation, release, and assignment of leases.