Home > Finance > Accounting

How to Prepare a Profit and Loss Statement

We are committed to sharing unbiased reviews. Some of the links on our site are from our partners who compensate us. Read our editorial guidelines and advertising disclosure .

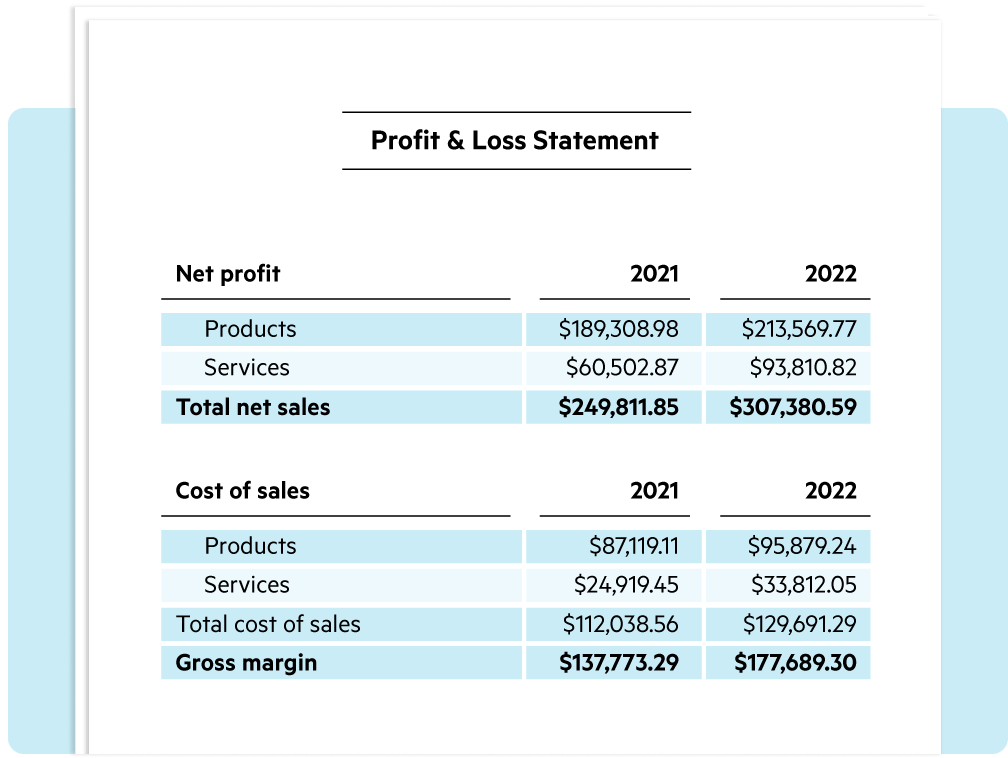

Your goal as a business owner is to keep your business financially solvent, and to do that, you absolutely must know how much you're making and how much you're losing. A profit and loss (P&L) statement, otherwise called an income statement , breaks down your profit and loss line by line so you can determine your net income and make wise decisions about business opportunities.

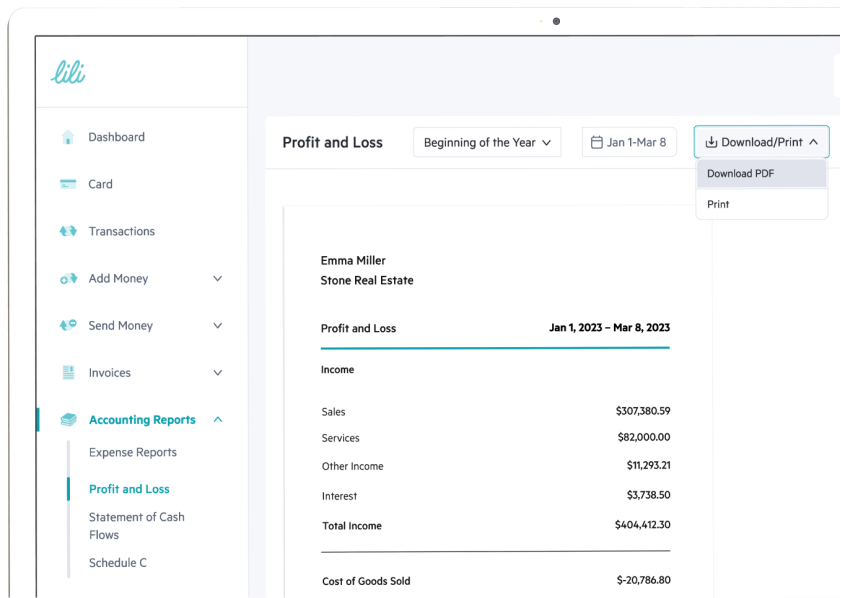

Since an income statement gives you a close look at your total profits, liabilities, and expenses, it's one of the most important financial documents in your roster. Because P&L statements are so important, even the most basic accounting software programs generate them for you at the click of a button. But if you want to draw up your own P&L statements (or if you want to understand exactly what goes into generating income statements), we have a short guide below.

How to prepare an income statement in 7 steps

- Choose an income statement format

- Decide on a time period to calculate net income

- List your revenue

- Calculate your direct costs

- Calculate your gross profit

- Calculate your operating and non-operating expenses

- Determine your net income

If you're searching for accounting software that's user-friendly, full of smart features, and scales with your business, Quickbooks is a great option.

What is an income statement?

Before we start creating income statements, let's talk a bit more about why understanding profit and loss is essential to running a successful business.

Profit obviously refers to the amount of money your business is making—and yes, it's critical to know what your income is at any given moment. But revenue alone doesn't accurately represent your business's profits. After all, expenses like rent, employee paychecks, damaged inventory, bank fees, and a host of other expenses and liabilities come out of your bottom line.

To accurately understand your business's fiscal position, then, you need to calculate both profit and loss to find your total net income. And that's exactly what the profit and loss sheet does for you: lists your total revenue, total expenses, and total equity line by line to show how much cash your business is really bringing in.

P&L statements are also important for banks, lenders, and other investors. Lenders will almost always look at your income statement before deciding if your business is profitable enough to invest in. P&L sheets also demonstrate your own financial know-how—if you as a business owner don't have a good understanding of how to effectively manage profit and loss, lenders will be less likely to trust that your business can give them a good return on investment.

Again, you don’t have to prepare a P&L statement on your own. Plenty of accounting software will do it for you. And if you want more information on how to create an income statement specific to your business, we always recommend talking to your financial advisor. Virtual accountants and bookkeepers can help, as can business bankers, CPAs, or other trusted financial professionals.

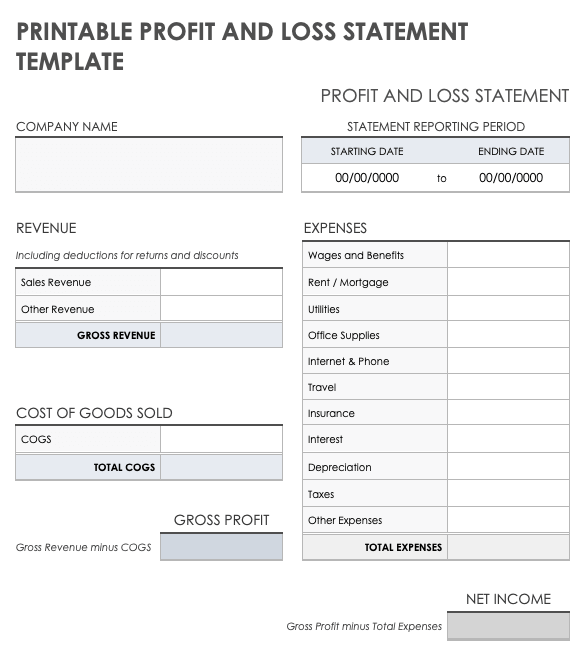

1. Choose an income statement format

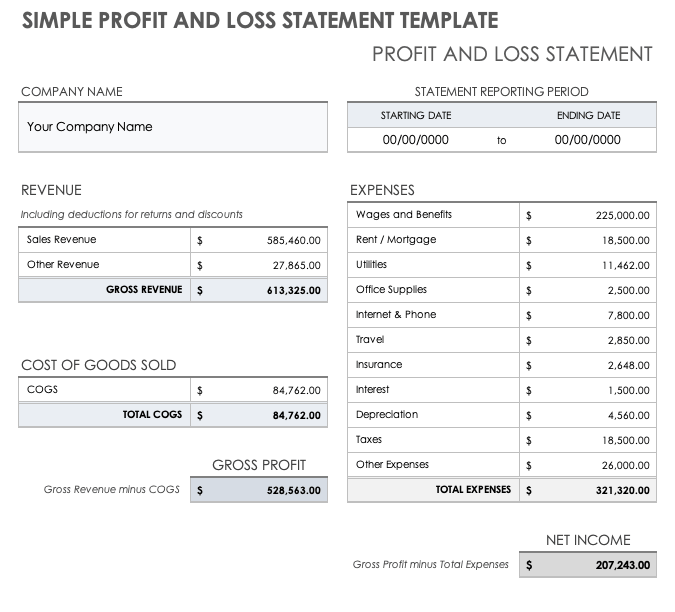

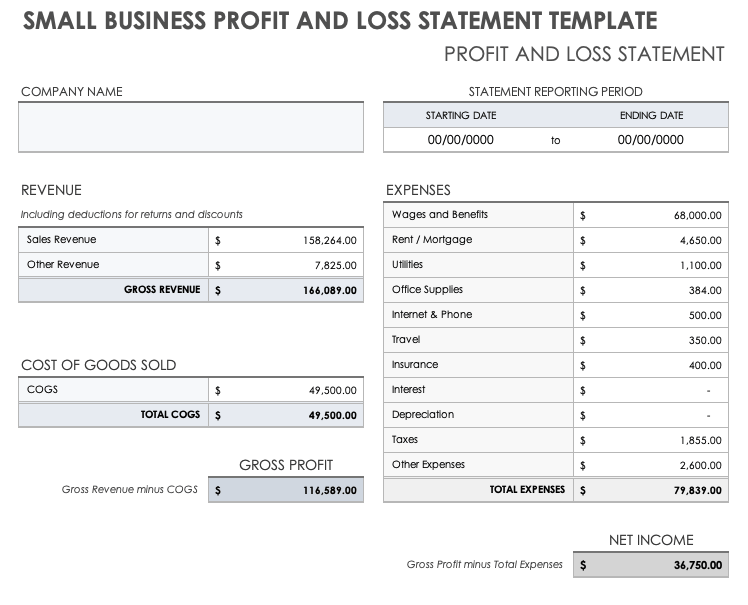

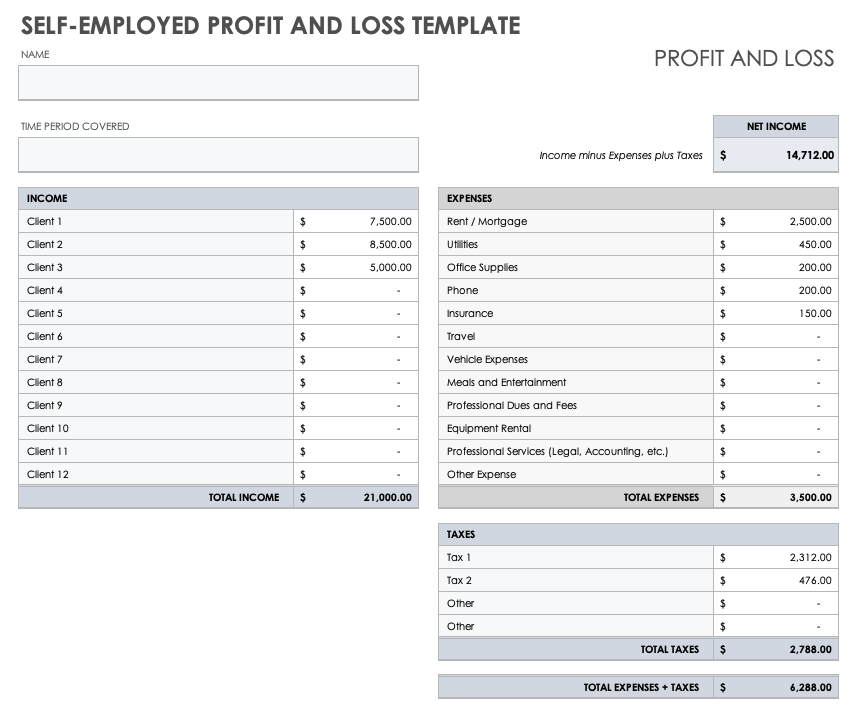

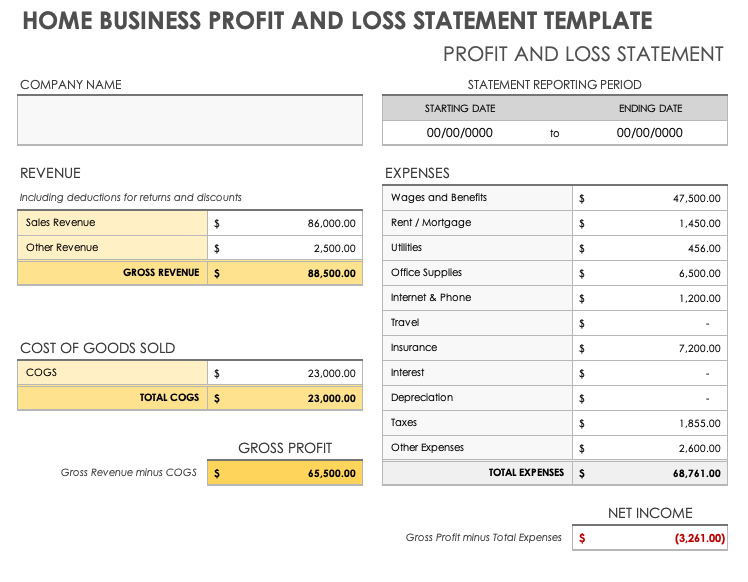

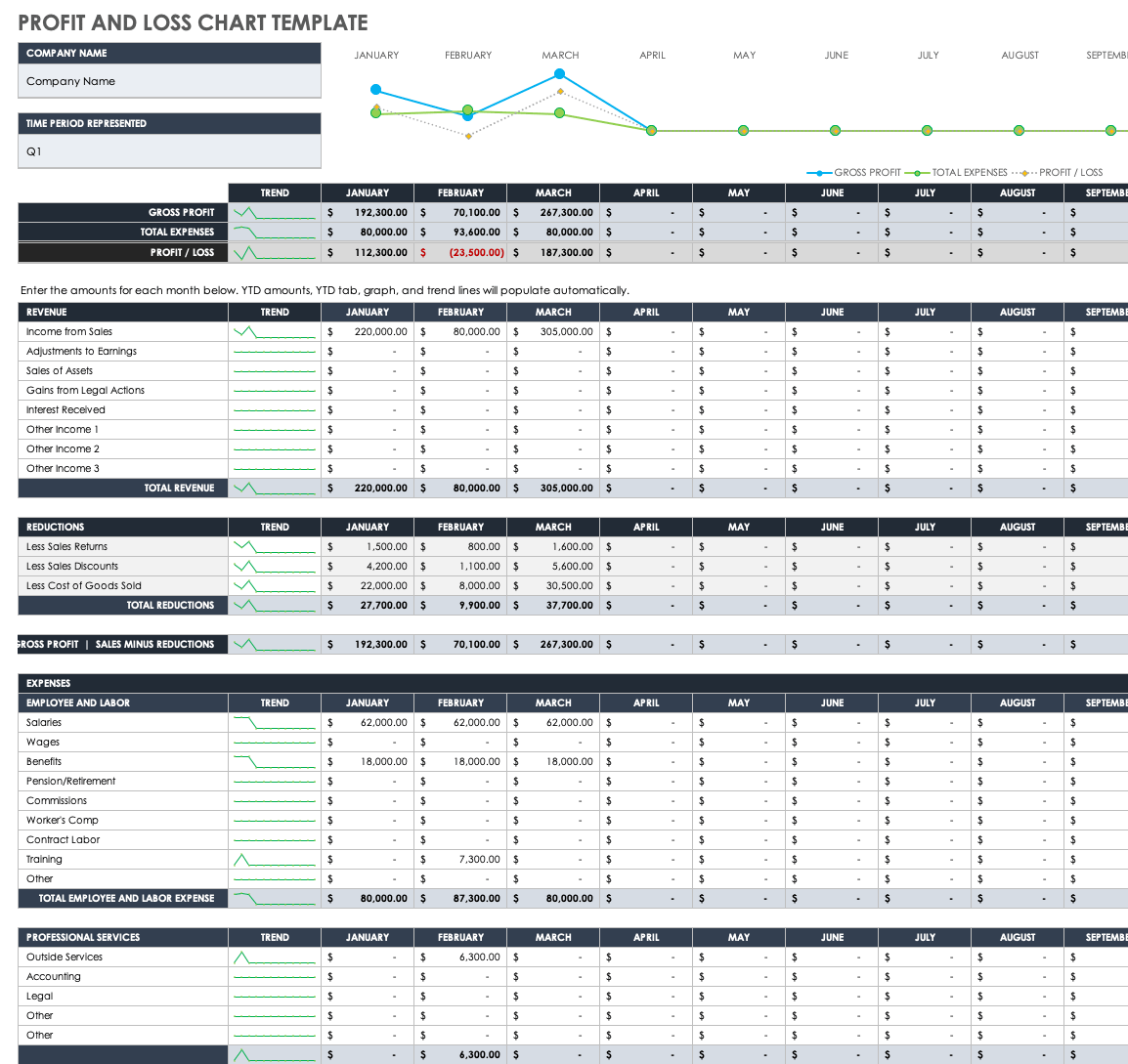

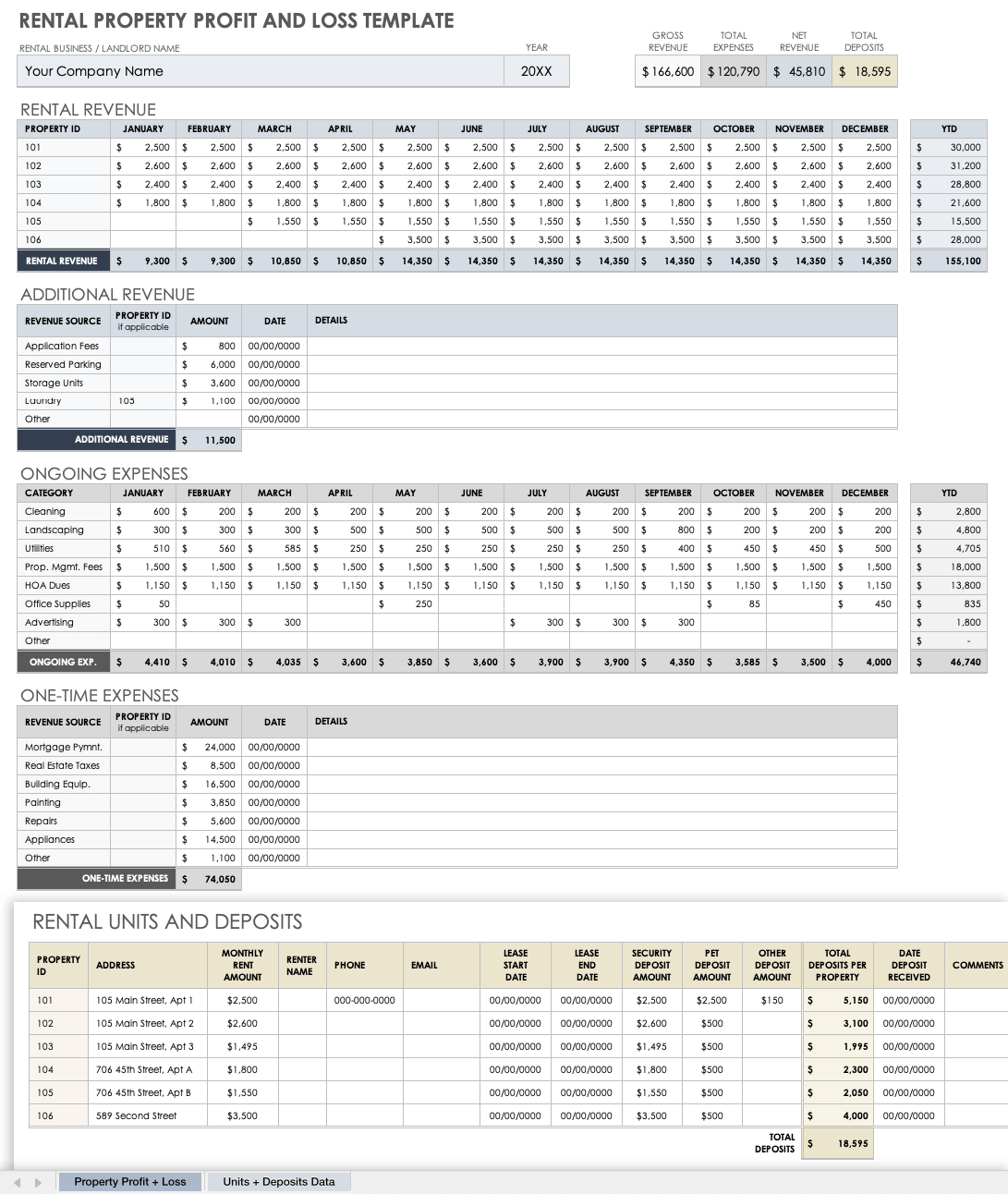

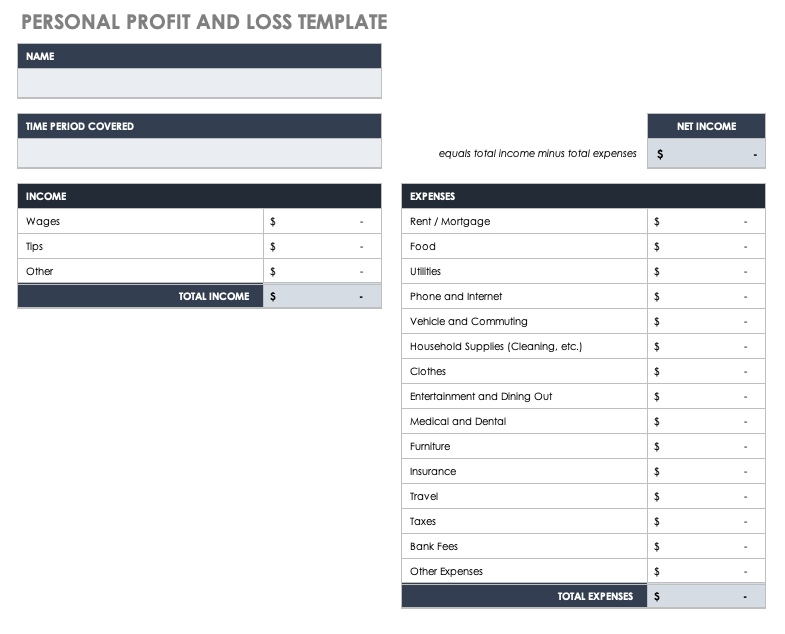

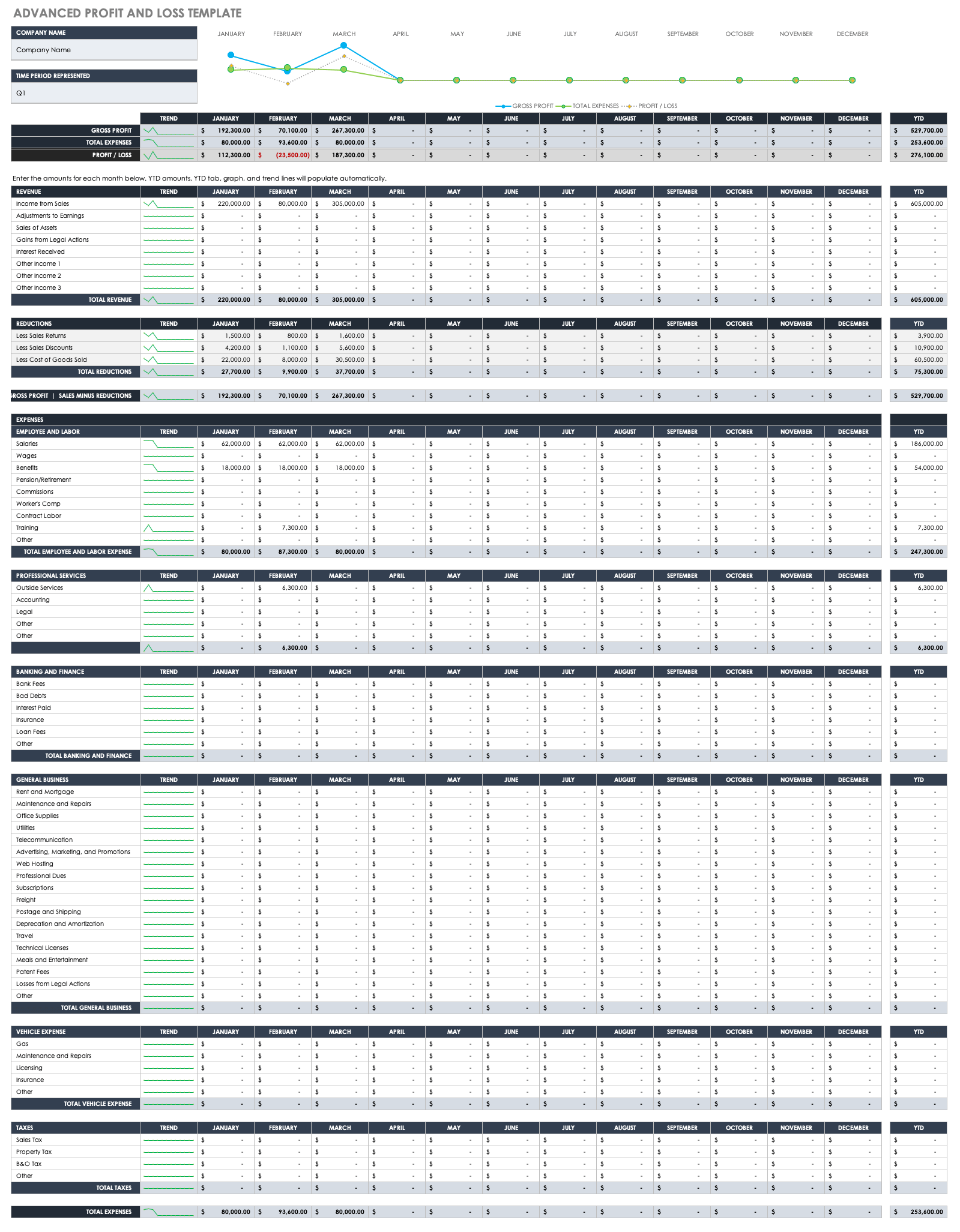

If you're creating an income statement by hand, using a spreadsheet program like Excel or Google Sheets will help you keep the process simple. Depending on the product you use, you can find an easy template instead of building a document from the ground up. For instance, Microsoft Office offers a series of Excel templates for P&L statements.

The U.S. Small Business Association also offers a simple income statement template you can easily download, print, and fill out.

Your accountant can also show you how they draw up a profit and loss statement. And, again, most accounting or bookkeeping software can automatically create a P&L statement for you or provide you with a template for you to fill in.

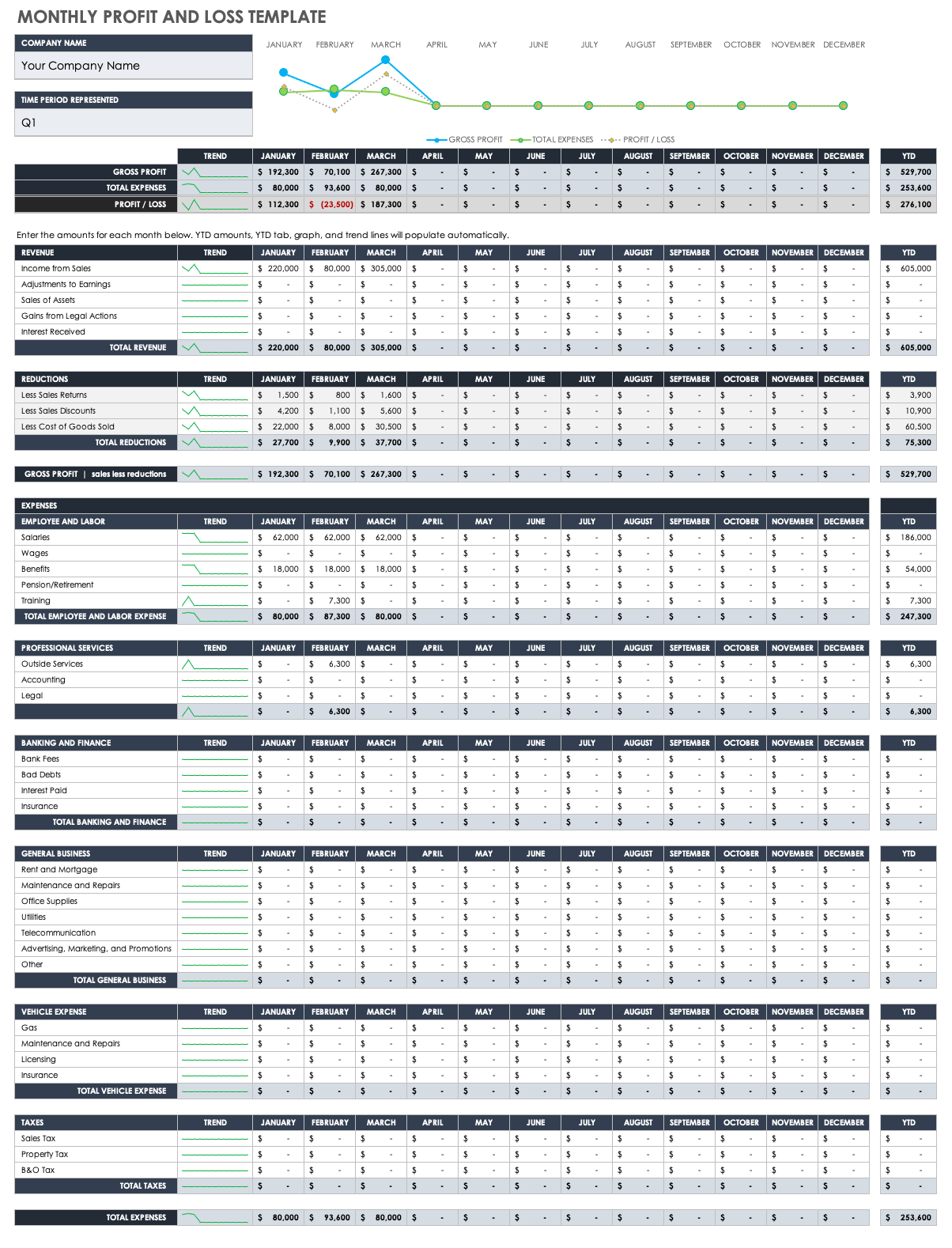

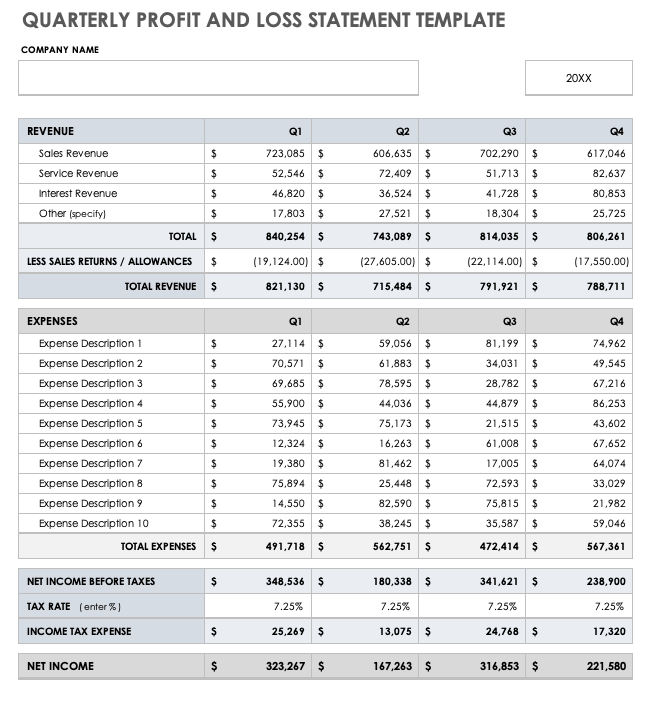

2. Decide on a time period to calculate net income

Most businesses calculate their profits and losses on a monthly, quarterly, or annual basis. If a lender or investor asks you for a P&L statement, they should specify the time period they need to see. Otherwise, just make sure to choose a time frame that shows you a general trend without overwhelming you with too much data; less than a month is probably too little time to reveal trends, while more than a year is probably too much.

By signing up I agree to the Terms of Use and Privacy Policy .

3. List your revenue

For most product-based small businesses, revenue equals sales, or the amount goods sold—such as the amount of hair products sold by your salon, the number of baked goods sold by your cafe, or the number of printouts sold by your copy shop. But depending on the business, revenue could also include things like rent money, tax returns, or licensing agreements.

List each revenue source as its own line on your profit and loss statement. Then, once you’ve listed each source, total the amount to find your gross revenue.

4. Calculate your direct costs

After adding up your revenue, it's time to add up your direct costs, or costs related directly to producing the products or services you sell. If you sell a physical product, direct costs can also be called COGS, or cost of goods sold .

Not sure what expenses count as COGS? Let’s say you sell holiday-themed oven mitts on Etsy. To make your goods, you have to buy fabric, thread, a sewing machine, scissors, pins, patterns, and a host of other materials. The money you spend purchasing those items is your direct cost.

What if your business provides a service instead of goods? Since you don’t sell a physical product, you don’t have COGS, but you do still have direct costs. For instance, if you’re a psychologist, your office space is essential to the service you provide: without an office, you can’t offer services. So in this case, the money you pay for the office would be one of your primary direct costs.

Direct costs can also include the costs of the labor that goes directly into your product or service. Let’s imagine you’re the owner of a small lawn mowing company. Purchasing a lawn mower isn’t your only direct cost—the amount of money you pay an employee to push the lawn mower is also a direct cost.

Here's the basic formula for calculating your cost of goods sold:

Cost of goods sold = beginning inventory + purchases – ending inventory

For a more detailed breakdown of the COGS formula, check out our page on calculating COGS .

Consider using an accounting software

5. calculate your gross profit.

So now you know what your direct costs are. But do they outweigh what you charge customers for your products or services? Let’s find out: subtract your direct costs from your total revenue to get your gross profit . Hopefully, you’re left with a positive number that shows how much your business is making.

Once you've calculated your gross profit, you can also calculate your gross margin, which represents your gross profit as a percentage. Just subtract your direct costs from your gross revenue, and then divide that number by the gross revenue. Then simply multiply that number by 100.

Hint: a higher gross margin indicates higher efficiency, which is excellent for any small business.

Here's a simplified equation for calculating gross profit:

Gross profit = Gross revenue – direct costs

And if you want to turn that number into a percentage, here's how to calculate your gross margin:

Gross margin = { [Gross revenue – direct costs] / gross revenue } x 100

6. Calculate your operating and non-operating expenses

Operating expenses (OPEX) are any expenses necessary to your business that aren’t direct costs. In other words, these expenses refer to any money that doesn’t go directly into creating goods or supplying services, which is why you'll also see operating expenses referred to as indirect expenses.

Depending on the type of business you run, these could include monthly utilities, business internet and phone plans, hardware and equipment, marketing costs, office supplies, building maintenance, and equipment repairs and maintenance.

Basically, anything that impacts your day-to-day business operations should be listed as an operating expense on your income statement.

Since there are so many types of operating expenses, most income statements break down your OPEX by category. Here are a few of the most common.

Administrative expenses

Administrative expenses, also called general expenses, are any expenses you incur in the general administration of your business. You can also think of administrative expenses as costs you'd pay even if you weren't producing goods or selling services—for instance, even on a day you don't sell a single product, you're still paying for inventory storage space.

Overhead expenses

Overheads can refer to the fixed costs of running a business that don’t vary from month to month (in contrast with operating costs, which can fluctuate). If you pay the same monthly fee for your accounting software, that would count as a fixed cost , or overhead.

Depending on your business and type of income statement, overhead costs can also encompass all indirect labor and production costs. This contrasts with operating costs, which can mean the costs of actually running a business. Your accountant can help you understand more about what overheads look like at your unique business.

Additional operating costs

A few other main OPEX categories include payroll expenses, marketing costs, and sales costs. Once again, we recommend asking an accountant for personalized recommendations about how to break down your operating expenses on an income statement.

SG&A stands for selling, general, and administrative expense, and it's yet another term you might see used as a synonym for OPEX. Basically, the term encompasses everything except for COGS, direct costs, research and development expenses, and interest on business loans.

Non-operating expenses

Non-operating expenses are (hopefully) one-time expenses like legal fees, tax penalties, or interest on a business loan. Once you've calculated your operating expenses, make sure to include your non-operating expenses on your P&L statement as well.

7. Determine your net income

It’s time for the moment of truth: is your business profitable or not? Steel yourself, take a deep breath, and subtract your total expenses from your gross profit to get your net profit.

Is your net profit positive? Nice! You’re on track for financial health. Is it low, zero, or in the negatives? It’s time to reevaluate some business practices. That could mean cutting down your OPEX (operating expenses), downsizing departments, or switching raw materials manufacturers to reduce your COGS (cost of goods sold).

Other considerations: EBIT, EBT, and EBITDA

The steps above show you how to create a simple, straightforward income statement. You won’t need any more data than what we’ve listed here to fill out the U.S. Small Business Association’s template.

But maybe you’re doing in-depth business forecasting, or maybe your bank asked for more info before approving your loan. In that case, you want a longer, more detailed, and more accurate P&L statement, which means getting familiar with these abbreviations:

- Earnings before interest and taxes (EBIT): The total of your business’s net income without accounting for income taxes and loan interest.

- Earnings before tax (EBT): The total of your business’s net income plus the taxes you expect to pay (based on your business’s projected tax liabilities).

- Earnings before interest, taxes, depreciation, and amortization (EBITDA): The total of your business’s net income without accounting for income taxes, loan interest, or depreciation and amortization.

Depreciation refers to the constantly lowering value of your business’s physical assets, like a company car or office building. The more you drive the car, the more its value depreciates.

Amortization refers to the constantly lowering value of your business’s non-physical (or intangible) assets, like patents, copyrights, and trademarks.

Compare the year's best accounting software

14 days | Unlimited ($2.50/user/mo.) | ||||

30 days** | Unlimited ($10.00/user/mo.) | ||||

N/A | Unlimited | ||||

30 days | Unlimited | ||||

30 days* | Up to 25 |

Data as of 3/9/23. Offers and availability may vary by location and are subject to change. *Only available for businesses with an annual revenue beneath $50K USD **Current offer: 90% off for 3 mos. or 30-day free trial †Current offer: 50% off for three months or 30-day free trial ‡Current offer: 75% off for 3 mos. Available for new customers only

The takeaway

With the right financial documents on hand and sheer confidence in your Excel formula skills, creating a simple profit and loss statement is totally doable. Once you have the process down, feel free to pull data for a P&L statement whenever you need to—it’s the best, fastest, and cheapest way to quickly evaluate your small business’s financial health.

Want to learn more about how calculating profit and loss can help you grow your business? Check out our piece on how to effectively manage your company’s profit and loss .

Related reading

- The 6 Most Useful Financial Documents for Small Businesses

- The Best Tools for Creating a Financial Statement

- How to Calculate Net Operating Income (NOI)

- The Difference between Bookkeeping and Accounting

P&L statement FAQ

The answer largely depends on the size of your business, but P&L statement generation is one key aspect of most accounting job descriptions. Whether you have an in-house accountant, have a CPA on retainer, or pay a local accountant by the hour, the accountant you work with should be able to handily throw together an income statement in no time.

We always recommend meeting with an accountant or other financial advisor at least once when you first start creating financial documents for your business. From there, you can create your own P&L statements if you'd like to. Accounting software, including free accounting software , can draw up income statements for you with little effort on your part.

There’s a lot of financial data for you to include in your P&L statement. Like, a lot . Finding a starting point can be intimidating, but it’s much less so if you already have a great bookkeeping system in place. If you do, you should have easy access to your company’s receipts, invoices, pay stubs, credit card payments, tax data, accrued interest, and more so you can sit down and start running the numbers.

If you don’t have a great bookkeeping system in place yet, cut yourself some slack—and then get right on creating one now. (Literally now. Right now. Step away from this page and get thee to a bookkeeper.)

If you do cash transactions, start keeping receipts and storing them in a logical, orderly way. Organize your general ledger. Hire a part-time bookkeeper for a small fee or invest in bookkeeping software that keeps all your data in the same place.

Getting organized—including entering all your information into new accounting software—can be a steep learning curve. But apart from creating excellent products and services and hiring fantastic employees, there’s next to nothing more important to your business than accurate, detailed financial records, profit and loss statements included.

Are there multiple types of income statements?

Yes. There’s the typical P&L statement detailed above, and there’s a pro forma P&L, which is an income statement you fill out when you first start a business. How do you figure out revenue for a business that only just started? Well, to put it frankly, you give it your best guess—that makes it a projected profit and loss sheet, not a record of current profit and loss.

If this is your first P&L (or pro forma P&L), make sure to lowball your revenue and highball your expenses. This is a great time to detail all of your expenses in full, from the electricity bill to the replacement staplers you just bought. Having a full list of expenses can help you moderate overheads and operating costs, which helps you build frugal business practices into your company right from the start.

At Business.org, our research is meant to offer general product and service recommendations. We don't guarantee that our suggestions will work best for each individual or business, so consider your unique needs when choosing products and services.

5202 W Douglas Corrigan Way Salt Lake City, UT 84116

Accounting & Payroll

Point of Sale

Payment Processing

Inventory Management

Human Resources

Other Services

Best Small Business Loans

Best Inventory Management Software

Best Small Business Accounting Software

Best Payroll Software

Best Mobile Credit Card Readers

Best POS Systems

Best Tax Software

Stay updated on the latest products and services anytime anywhere.

By signing up, you agree to our Terms of Use and Privacy Policy .

Disclaimer: The information featured in this article is based on our best estimates of pricing, package details, contract stipulations, and service available at the time of writing. All information is subject to change. Pricing will vary based on various factors, including, but not limited to, the customer’s location, package chosen, added features and equipment, the purchaser’s credit score, etc. For the most accurate information, please ask your customer service representative. Clarify all fees and contract details before signing a contract or finalizing your purchase.

Our mission is to help consumers make informed purchase decisions. While we strive to keep our reviews as unbiased as possible, we do receive affiliate compensation through some of our links. This can affect which services appear on our site and where we rank them. Our affiliate compensation allows us to maintain an ad-free website and provide a free service to our readers. For more information, please see our Privacy Policy Page . |

© Business.org 2024 All Rights Reserved.

How to Create a Profit and Loss Forecast

Angelique O'Rourke

7 min. read

Updated May 10, 2024

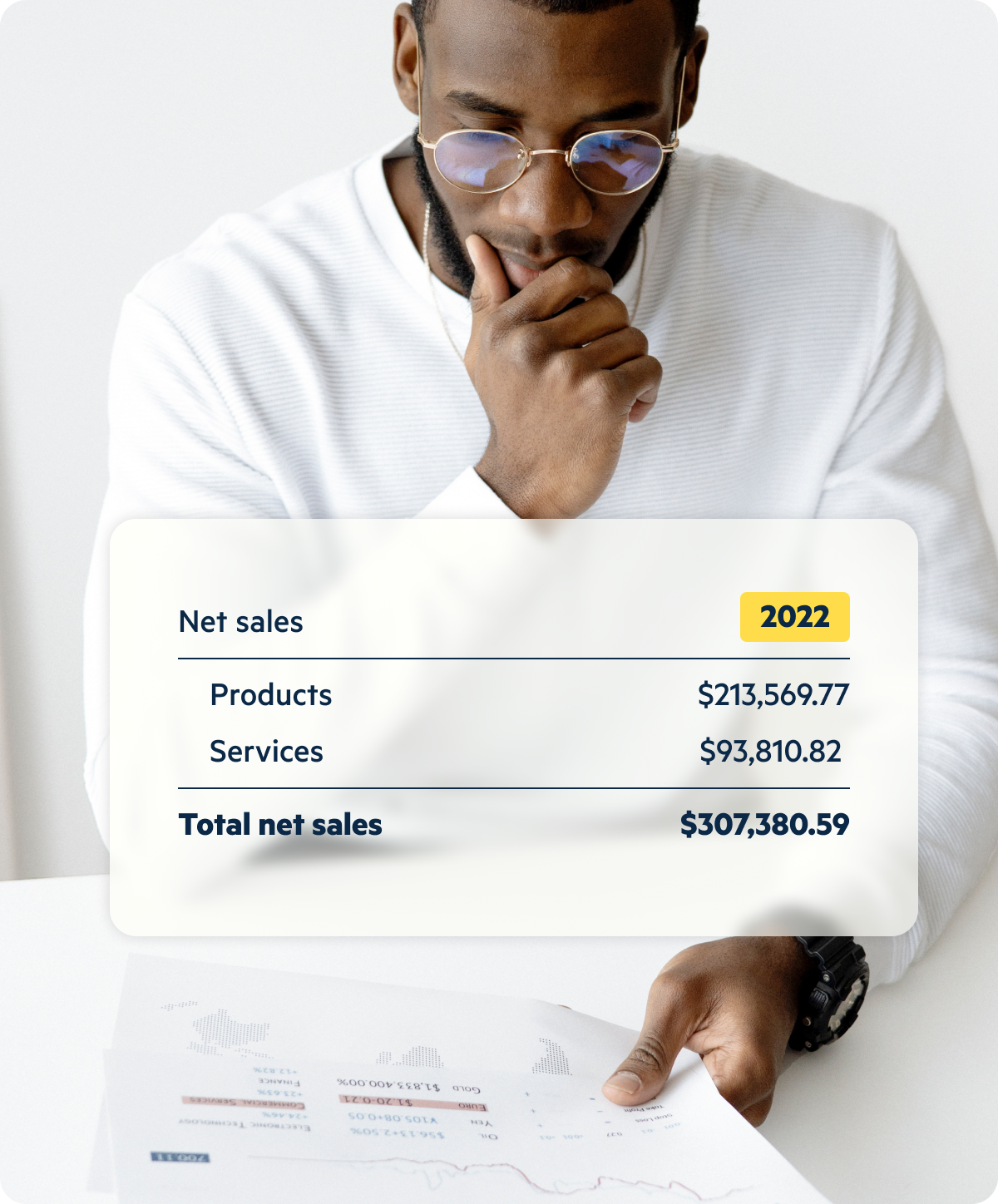

An income statement, also called a profit and loss statement (or P&L), is a fundamental tool for understanding how the revenue and expenses of your business stack up.

Simply put, it tells anyone at-a-glance if your business is profitable or not. Typically, an income statement is a list of revenue and expenses, with the company’s net profit listed at the end (check out the section on income statement examples below to see what it looks like).

Have you ever heard someone refer to a company’s “bottom line”? They’re talking about the last line in an income statement, the one that tells a reader the net profit of a company, or how profitable the company is over a given period of time (usually quarterly or annually) after all expenses have been accounted for.

This is the “profit” referred to when people say “profit and loss statement,” or what the “p” stands for in “P & L.” The “loss” is what happens when your expenses exceed your revenue; when a company is not profitable and therefore running at a loss.

As you read on, keep in mind that cash and profits aren’t the same thing. For more on how they’re different, check out this article .

What’s included in an income statement?

The top line of your profit and loss statement will be the money that you have coming in, or your revenue from sales. This number should be your initial revenue from sales without any deductions.

The top line of your income statement is really just as important as the bottom line; all of the direct costs and expenses will be taken out of this beginning number. The smaller it is, the smaller the expenses have to be if you’re going to stay in the black.

If you’re writing a business plan document and don’t yet have money coming in, you might be wondering how you would arrive at a sales number for a financial forecast. It’s normal for the financials of a business plan to be your best educated guess at what the next few years of numbers will be. No one can predict the future, but you can make a reasonable plan.

Check out this article about forecasting sales for more information.

Direct costs

Direct costs, also referred to as the cost of goods sold, or COGS, is just what it sounds like: How much does it cost you to make the product or deliver the service related to that sale? You wouldn’t include items such as rent for an office space in this area, but the things that directly contribute to the product you sell.

For example, to a bookstore, the direct cost of sales is what the store paid for the books it sold; but to a publisher, its direct costs include authors’ royalties, printing, paper, and ink. A manufacturer’s direct costs include materials and labor. A reseller’s direct costs are what the reseller paid to purchase the products it’s selling.

If you only sell services, it’s possible that you have no direct costs or very low direct costs as a percentage of sales; but even accountants and attorneys have subcontractors, research, and photocopying that can be included in direct costs.

Here’s a simple rule of thumb to distinguish between direct costs and regular expenses: If you pay for something, regardless of whether you make 1 sale or 100 sales, that’s a regular expense. Think salaries, utilities, insurance, and rent. If you only pay for something when you make a sale, that’s a direct cost. Think inventory and paper reports you deliver to clients.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

Gross margin

Gross margin is also referred to as gross profit. This number refers to the difference between the revenue and direct costs on your income statement.

Revenue – Direct Costs = Gross Margin

This number is very important because it conveys two critical pieces of information: 1.) how much of your revenue is being funneled into direct costs (the smaller the number, the better), and 2.) how much you have left over for all of the company’s other expenses. If the number after direct costs is smaller than the total of your operating expenses, you’ll know immediately that you’re not profitable.

Operating expenses

Operating expenses are where you list all of your regular expenses as line items, excluding your costs of goods sold.

So, you have to take stock of everything else your company pays for to keep the doors open: rent, payroll, utilities, marketing—include all of those fixed expenses here.

Remember that each individual purchase doesn’t need its own line item. For ease of reading, it’s better to group things together into categories of expenses—for example, office supplies, or advertising costs.

Operating income

Operating income is also referred to as EBITDA, or earnings before interest, taxes, depreciation, and amortization. You calculate your operating income by subtracting your total operating expenses from your gross margin.

Gross Margin – Operating Expenses = Operating Income

Operating income is considered the most reliable number reflecting a company’s profitability. As such, this is a line item to keep your eye on, especially if you’re presenting to investors . Is it a number that inspires confidence?

This is fairly straightforward—here you would include any interest payments that the company is making on its loans. If this doesn’t apply to you, skip it.

Depreciation and amortization

These are non-cash expenses associated with your assets, both tangible and intangible. Depreciation is an accounting concept based on the idea that over time, a tangible asset, like a car or piece of machinery, loses its value, or depreciates. After several years, the asset will be worth less and you record that change in value as an expense on your P&L.

With intangible assets, you’ll use a concept called amortization to write off their cost over time. An example here would be a copyright or patent that your business might purchase from another company. If the patent lasts for 20 years and it cost your company $1 million to purchase the patent, you would then expense 1/20th of the cost every year for the life of the patent. This expense for an intangible asset would be included in the amortization row of the income statement.

This will reflect the income tax amount that has been paid, or the amount that you expect to pay, depending on whether you are recording planned or actual values. Some companies set aside an estimated amount of money to cover this expected expense.

Total expenses

Total expenses is exactly what it sounds like: it’s the total of all of your expenses, including interest, taxes, depreciation, and amortization.

The simplest way to calculate your total expenses is to just take your direct costs, add operating expenses, and then add the additional expenses of interest, taxes, depreciation, and amortization:

Total Expenses = Direct Costs + Operating Expenses + Interest + Taxes + Depreciation + Amortization

Net profit, also referred to as net income or net earnings, is the proverbial bottom line. This is the at-a-glance factor that will determine the answer to the question, are you in the red? You calculate net profit by subtracting total expenses from revenue:

Net Profit = Revenue – Total Expenses

Remember that this number started at the top line, with your revenue from sales. Then everything else was taken out of that initial sum. If this number is negative, you’ll know that you’re running at a loss. Either your expenses are too high, you’re revenue is in a slump, or both—and it might be time to reevaluate strategy.

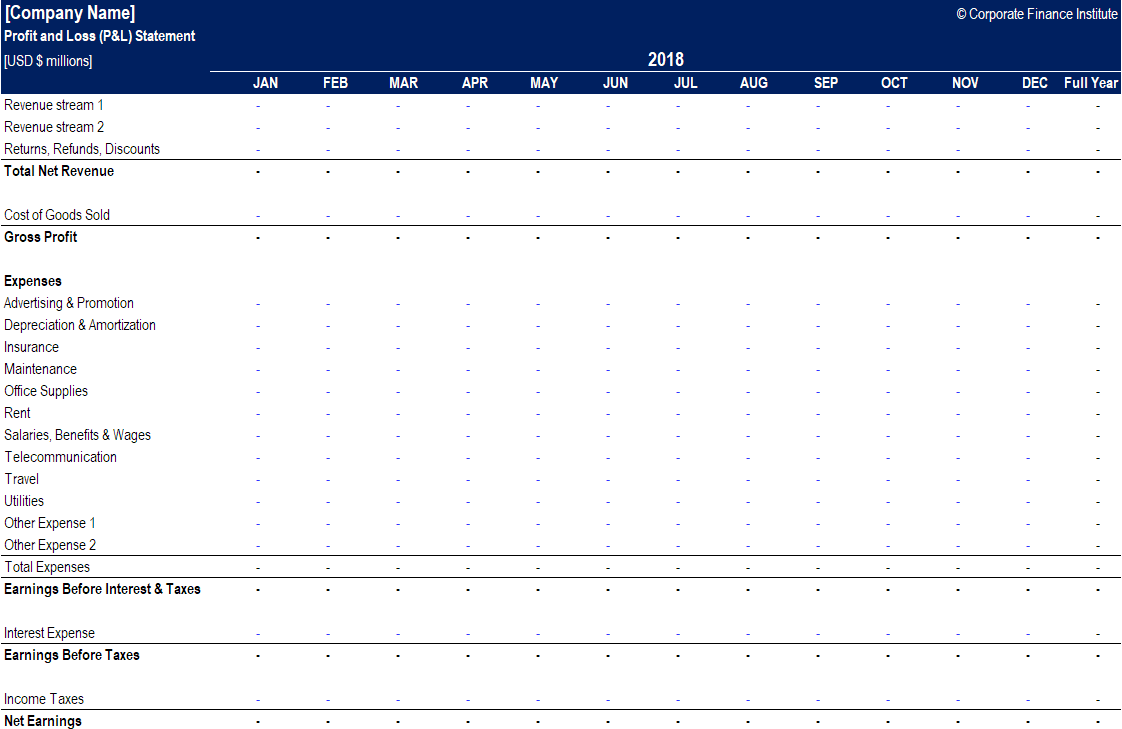

- Income statement examples

Because the terminology surrounding income statements is variable and all businesses are different, not all of them will look exactly the same, but the core information of revenue minus all expenses (including direct costs) equals profit will be present in each one.

Here is an income statement from Nike, to give you a general idea:

An income statement from Nike .

As you can see, while Nike uses a variety of terms to explain what their expenses are and name each line item as clearly as possible, the takeaway is still the bottom line, their net income.

Angelique is a skilled writer, editor, and social media specialist, as well as an actor and model with a demonstrated history of theater, film, commercial and print work.

Table of Contents

- What’s included in an income statement?

Related Articles

8 Min. Read

How to Plan Your Exit Strategy

3 Min. Read

What Is a Break-Even Analysis?

1 Min. Read

How to Calculate Return on Investment (ROI)

5 Min. Read

How to Highlight Risks in Your Business Plan

The LivePlan Newsletter

Become a smarter, more strategic entrepreneur.

Your first monthly newsetter will be delivered soon..

Unsubscribe anytime. Privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

Planning, Startups, Stories

Tim berry on business planning, starting and growing your business, and having a life in the meantime., standard business plan financials: projected profit and loss.

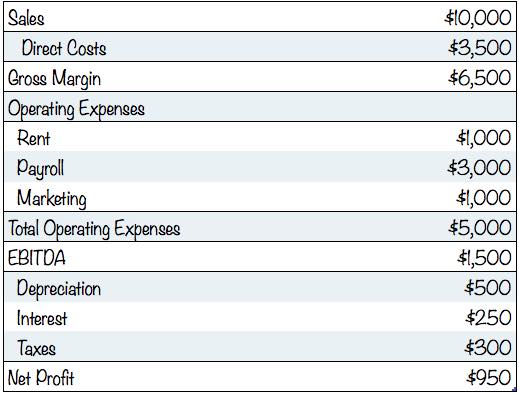

Continuing with my series here on standard business plan financials, all taken from my Lean Business Planning site, the Profit and Loss, also called Income Statement, is probably the most standard of all financial statements. And the projected profit and loss, or projected income (or pro-forma profit and loss or pro-forma income) is also the most standard of the financial projections in a business plan.

- It starts with Sales, which is why business people who like buzzwords will sometimes refer to sales as “the top line.”

- It then shows Direct Costs (or COGS, or Unit Costs).

- Then Gross Margin, Sales less Direct Costs.

- Then operating expenses.

- Gross margin less operating expenses is gross profit, also called EBITDA for “earnings before interest, taxes, depreciation and amortization.” I use EBITDA instead of the more traditional EBIT (earnings before interest and taxes). I explained that choice and depreciation and amortization as well in Financial Projection Tips and Traps , in the previous section.

- Then it shows depreciation, interest expenses, and then taxes…

- Then, at the very bottom, Net Profit; this is why so many people refer to net profit as “the bottom line,” which has also come to mean the conclusion, or main point, in a discussion.

The following illustration shows a simple Projected Profit and Loss for the bicycle store I’ve been using as an example. This example doesn’t divide operating expenses into categories. The format and math start with sales at the top. You’ll find that same basic layout in everything from small business accounting statements to the financial disclosures of large enterprises whose stock is traded on public markets. Companies vary widely on how much detail they include. And projections are always different from statements, because of Planning not accounting . But still this is standard.

A lean business plan will normally include sales, costs of sales, and expenses. To take it from there to a more formal projected Profit and Loss is a matter of collecting forecasts from the lean plan. The sales and costs of sales go at the top, then operating expenses. Calculating net profit is simple math.

Keep your assumptions simple. Remember our principle about planning and accounting. Don’t try to calculate interest based on a complex series of debt instruments; just average your interest over the projected debt. Don’t try to do graduated tax rates; use an average tax percentage for a profitable company.

Notice that the Profit and Loss involves only four of the Six Key Financial Terms . While a Profit and Loss Statement or Projected Profit and Loss affects the Balance Sheet because earnings are part of capital, it includes only sales, costs, expenses, and profit.

Hi, In case of bank financing for machineries and working capital, how can it be broken down in to the expense stream? ( capital + interest)

When you spend on assets is not deductible from income, and is therefore not an expense. What you spent to repay the principle of a loan is not deductible, and therefore not an expense. The interest on a loan is deductible, and is an expense.

Excuse me, may I know if the project profit & loss should plan for the first year only or for year 1-3 in business plan of a new company?

Kattie Wan, I recommend for normal cases the projected profit and loss monthly for the first 12 months, and two years annually after that. There are always special cases, though; every business is different.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

How to Prepare a Profit and Loss (P&L) Statement for Your Startup

| Written by

Monitoring your startup’s finances is an integral part of knowing how to sustain and grow your business. A profit and loss (P&L) statement is one key element to measuring the health of your startup’s finances.

This guide walks you through what a P&L statement is, why your company needs it, and how to prepare a profit and loss statement for your startup.

P&L Statements for Startups

Tracking a company’s profit and loss provides entrepreneurs with insight into their startup’s financial wellness and performance over a period of time, allowing them to make better decisions for their business.

While it is possible to prepare a P&L statement using financial management software such as QuickBooks , knowing how to manually issue one can be valuable for entrepreneurs. Especially if they are looking to deeply familiarize themselves with their company’s financial position.

What Is a Profit and Loss statement?

A profit and loss (P&L) statement, commonly referred to as an income statement , is a summary of the net profit and loss of a company over a period of time. This is one of three financial reports businesses are required to prepare annually and quarterly, along with a cash flow statement and balance sheet .

The P&L statement, specifically, indicates whether a business is profitable or not, how much profit is being made, and helps when filing taxes.

Why Do I Need a P&L Statement for My Startup?

As mentioned above, P&L statements are one of the three reports businesses are required to issue. However, these statements also provide value for entrepreneurs and their teams to better their company’s financial position.

Tax Preparation

Not only is a P&L used by startup founders to gauge the financial performance of their company, but the Internal Revenue Service (IRS) uses these statements to make tax assessments as well.

Generates Feedback

The amount of profit versus expenses may help you better understand how your product or service is performing. This feedback may help you troubleshoot and adapt to better reach your target market.

How to Create a P&L statement

Many businesses choose to use software to track their finances that can easily issue a profit and loss statement. However, if you’d rather prepare one manually, here are six easy steps to create a P&L statement for your startup.

1. Choose Your Time Period

Whether you’re issuing an annual, quarterly, or monthly P&L sheet, your first step is to determine the reporting period you’re calculating for. Then, gather all of the information required to calculate revenue, expenses, and any other financial information from that period to create your statement.

2. Calculate Revenue

Next, calculate your company’s revenue for your reporting period. This will include any money you gain from the sale of your company’s profits or services.

It is helpful to keep these sales documented and organized as they occur.

3. Calculate Expenses

After you have determined the amount of money you have coming in, you need to calculate the money your company is spending, otherwise known as expenses or costs of goods sold .

This, however, does not include salaries, leases, or any other fixed expenses.

4. Find the Gross Profit

Your next step is to determine your gross profit by subtracting your operating expenses (Step 2) from your revenue (Step 3) listed above.

5. Add In Overhead Costs

Then, add your overhead costs . These are the fixed expenses that typically don’t change based on your revenue, such as salaries, rent, insurance, and other continuous expenses.

Subtract the total of your overhead costs from your gross profits to determine your operating income.

Keep in mind that if you have any non-operational expenses or revenue, such as interest or dividends, these will need to be added or subtracted from your operating income.

6. Assess the Net Profit

Once you have your operating income , you will know your net profit. This is how much profit or loss your company had over the reporting period after revenue and expenses.

You can use this number to assess the financial health of your company and make changes if needed to avoid losses in the future.

P&L Statement Tools for Startups

While it is possible to issue profit and loss statements manually, using financial management or accounting software makes the process easier and faster. Here are some great options for startup profit and loss statement tools.

1. QuickBooks

With QuickBooks ’ suite of accounting software tools, startups can easily manage their finances as well as prepare profit and loss statements with ease.

If you’re looking for a free P&L template as well as additional resources, Lili offers a variety of information. Plus, if you utilize Lili’s accounting software, profit and loss statements are automatically generated for you.

Lili is a financial technology company, not a bank. Banking services provided by Sunrise Banks N.A., Member FDIC.

3. FreshBooks

Finally, FreshBooks offers a free downloadable P&L template that is compatible with Google Sheets, Google Docs, PDFs, and more.

Further Reading

- Best Financial Tools to Track Startup Growth July 2, 2024

- Guide to Financial Modeling for Startups July 25, 2024

- Startup Costs Entrepreneurs Should Know July 25, 2024

Topics to Explore

- Startup Ideas

- Startup Basics

- Startup Leadership

- Startup Marketing

- Startup Funding

Browse Tags

Profit and loss statements explained (+ templates and examples)

Wouldn’t it be great if you could know what the future holds for your business?

Well, you kind of can, and we aren’t talking about magic here!

What we’re referring to is the profit and loss statement (P&L), which gives you insight into how well your business is doing. Or how badly , for that matter.

In fact, experts consider a profit and loss statement one of the most common financial documents in any sector and business plan. You may even call it mission-critical.

In this in-depth guide, we’ll cover the essential elements of profit and loss statements, including:

- Profit and loss statements most common types,

- Examples of profit and loss statements,

- Profit and loss statement templates,

- Tested tips for making better P&L statements, and more.

Let’s start with a few general remarks that you need to know first!

Table of Contents

What is a profit and loss statement?

A profit and loss statement is a financial statement that typically covers the following items:

- Revenues,

- Costs, and

Moreover, a profit and loss statement usually consists of company revenues, costs, and expenses within a specific period, like a month, a quarter, a fiscal year — or even a week.

When done properly, a P&L can help protect the financial bottom line of a company by offering deeper insights into how a business can reduce costs and increase revenue.

In other words, a profit and loss statement is a handy tool that allows you to scrutinize the financial health (or lack thereof) of your company.

Interestingly, a P&L statement goes by many names, depending on the experts you talk to. Here’s a quick list of some of the terms:

- Expense statement,

- Statement of profit and loss,

- Income statement, etc.

In any case, P&L statements summarize a company’s revenues, expenses, and costs in one form or another and are typically performed by in-house or outsourced accountants. But, if you’re a finance-savvy manager, you can even perform one yourself — at least the less detailed P&L statements.

Sidenote: Public companies are required by law to make their P&L statements publicly available — specifically, on their web page’s investor relations section.

Because of the insight they offer, profit and loss statements allow managers, leaders, and investors to make better investing decisions or spot underperforming business areas.

To get you on the same page with creating your P&L statements the right way, let’s take a quick look at 2 universal methods for creating profit and loss statements.

FREE FOREVER • UNLIMITED USERS

Free time tracking software

Track time and calculate payroll with Clockify, time tracker used by millions.

2 Universal methods for creating a P&L statement

A profit and loss statement comes into existence thanks to 2 types of accounting methods — either the accrual method or the cash method. In simple terms, these universal accounting methods are tools for tracking and recording expenses in certain ways.

Still, the method you choose can make all the difference.

For illustration, investors often inspect corresponding types of P&L statements published by same-sector companies of similar size. After crunching the numbers, they spot trends in managing expenses and decide to invest in one company rather than another.

For clarity’s sake, suppose a company decides to use the cash method, although using the accrual method would have provided more insight into the company’s financial performance. In this case, the investors may disapprove of the inappropriate use of accounting methods, leading to the investor deciding not to invest in the company.

To explore further, we’ll next discuss the accrual and cash method in more detail.

Accounting method #1: Cash method

Accountants often call this “the cash accounting method.” Companies use the cash method only when they need to record instances of cash changing hands — that is, when cash actually enters or leaves the business.

An example of this would be if a business counts their cash on hand and the money they paid for expenses.

Accountant Francis Fabrizi of Keirstone Limited explained that smaller companies typically prefer the cash method of accounting:

“Some small businesses may choose to use the cash method for accounting purposes, as the accrual method can be more complex and time-consuming to use.”

Yet, this approach comes with a major downside, as it accounts for cash only when it is either paid or received.

Accounting method #2: Accrual method

Unlike the cash method, the accrual method records profit only when it’s earned. In a nutshell, this means that a company records expenses or revenue after the service has been provided, regardless of the fact that it hasn’t received the cash for offering the service.

Simply put, companies typically use the accrual method for funds that they expect to receive at a future date.

In the subscription age, the accrual method is a much-loved method for recording revenue and sales.

For example, picture an on-demand streaming service like HBO GO or Netflix. These companies use the accrual method to record revenue on their P&L statements, although they haven’t collected the payment for the service — but expect to receive it at a given subscription renewal period.

In fact, the accountant we mentioned previously, Francis Fabrizi, clarified that the accrual-based method is the preferred method for financial accounting:

“The reason is that the accrual method provides a more accurate picture of a company’s financial performance. This is because it recognizes revenue and expenses in the period in which they are actually incurred, rather than when cash is exchanged. The accrual method helps to ensure that revenues and expenses are matched in the same accounting period.”

As we have seen, the cash and accrual methods of accounting come with their pros and cons. So, choose the one that fits your needs, your company’s reporting, and your client’s requirements.

🎓 Clockify Pro Tip

Whichever accounting method you pick, bear in mind that the process of collecting data for your profit and loss statement is best done using accounting software. Take a look at some of the best on the market:

- 15 best free accounting software tools

What is the structure of a profit and loss statement?

By now, you might wonder what is in a profit and loss statement . To answer your question, the structure of a typical P&L statement looks something like this:

- Revenue: the total amount of money that the business has earned during a given accounting period (a week, month, quarter, calendar year, or fiscal year).

- Cost of goods sold (COGS): the cost of the services or products sold by the company; includes items like materials and direct labor.

- Gross profit : the difference between revenue and cost of goods sold; also known as gross margin and gross income.

- Operating expenses: the cost of operating the company, including rent, utilities, payroll, general and administrative costs; includes anything not covered by the cost of goods sold.

- Operating income: the difference between gross profit and operating expenses; shows how much profit a business makes from its activities prior to deducting interest and taxes.

- Non-operating items: interest expenses, interest income, gains or losses from selling assets, and other non-operating expenses or non-operating income.

- Net income, net profit, or bottom line: the profit after the company has deducted all expenses; represents the company’s final figure or overall loss or profit for the corresponding period.

Sure, with all this information in mind, a P&L statement may not infuse you with enthusiasm, but it’s critical that you still prepare it regularly.

Anyway, don’t worry about it — we’ll provide you with a few examples and templates that’ll help you craft your own profit and loss statement. But before we get into that, let’s check out a few common types of P&L statements.

Explore the difference between gross salary and net salary in our blog post:

- Gross pay vs. net pay — Definition, calculation, key differences

What are the common types of profit and loss statements?

For your convenience, here’s a list of a few types of P&L statements you can use, depending on whether you’re a small, medium, or large company.

| Name of the statement | How it benefits your business | Ideal for |

|---|---|---|

| Calculates net income by deducting total expenses from total revenue in a single step | Smaller companies, like service companies and sole proprietorships | |

| Breaks down expenses into categories like operating expenses and cost of goods sold, giving a thorough insight into financial performance | Complex, large businesses, like construction companies and factory facilities | |

| Lets you compare your current revenues, costs, and expenses with those in prior financial statements | Any-sized companies, including small, medium, and large businesses | |

| Enables you to forecast the financial status of your company under speculative circumstances | Any-sized companies, including small, medium, and large businesses | |

| Helps you see how particular products or services contribute to the profit of your business | Any-sized companies, including small, medium, and large businesses | |

| Provides a snapshot of the financial performance across the business’s subsidiaries | Mid-sized and large companies |

Regardless of the period for which you choose to implement your P&L statement — weekly, monthly, quarterly, or yearly — make sure to pick the right format from the list above that fits your company preferences and needs.

Speaking of time periods, we’ll next explore 2 criteria that you must not lose sight of when creating your profit and loss statement.

2 Criteria to consider before crafting a P&L statement

At this point, you need to know some types of P&L statements can be extraordinarily simple, and others can be incredibly complex. Certainly, some of them fall somewhere in between, and we’ll get to those.

For now, we can classify types of profit and loss statements based on 2 criteria:

- Period the statement covers, and

- Depth of data the statement provides.

In essence, we can refer to them as periodic and detailed P&L statements, but the actual format varies based on a company’s preferences and reporting standards.

Let’s go over each of those 2 criteria of profit and loss statements in more detail.

Criterion #1: Period the statement covers

In terms of timeframes, P&L statements are categorized into 4 types:

- Weekly P&L statements allow you to get a sneak preview of your company’s financial health for the past week,

- Monthly P&L statements deliver insight into a company’s profitability or losses in the course of a calendar month,

- Quarterly P&L statements illustrate financial performance (or lack thereof) over a 3-month period, and

- Yearly P&L statements provide a snapshot of a company’s financial performance over the span of a fiscal year.

Make sure you choose one or more for optimal business results — because, in contrast, a lack of periodic P&L statements can stifle your business growth.

For instance, even though people may be queueing up in front of your business to buy your product, that doesn’t necessarily mean that you’re making great profits. In fact, only after conducting a periodic P&L statement can you compare your profits with your costs.

Understandably, all P&L statements need to cover some period of time, whether a week, month, or year. So, let’s consider the depth of your profit and loss statement next.

Criterion #2: Depth of data the statement provides

You can divide the types of profit and loss statements in terms of the depth they go into to describe the financial status of a company.

Rule of thumb — the more depth you go into, the better your chances of spotting inconsistencies and issues.

In short, a smaller company can easily analyze its bottom line with the single-step profit and loss statement. In contrast, a large multinational corporation may need to turn to a comparative profit and loss statement for maximum benefits.

For example, elaborate P&L statements can benefit companies looking to cut their general expenses, like amortization and depreciation costs, when they conduct a profit and loss statement.

Depreciation and amortization refer to the practice of estimating the value of company assets over time. Yet, some businesses neglect to factor in these items, leading to failure in projecting long-term growth.

With these important criteria out of the way, let’s explore 3 examples to make the process of creating profit and loss statements more tangible.

Examples of a profit and loss statement

Now you’re familiar with the structure and types of P&L statements — kudos!

So, let’s dive into a few real-world scenarios where you can implement P&L reporting. For illustration, here are the 3 profit and loss statement examples we’ll cover:

- Small bakery P&L statement,

- Product/service company P&L statement, and

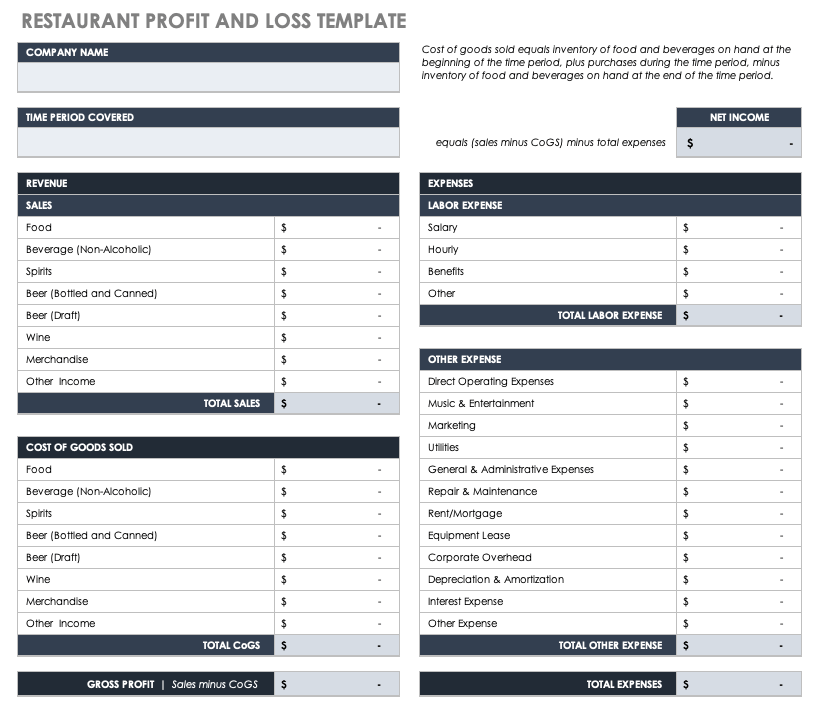

- Restaurant P&L statement.

Let’s up your financial game with a few real-life examples!

#1 Example of profit and loss statement: Small bakery

Suppose you want to start a business in Alabama , and you decide it’s going to be a small bakery. For a while, you successfully operate your company. After a few months, it’s high time you requested a profit and loss statement to be done to assess how well you’re doing.

In this case, you’ll use the single-step P&L statement because it neatly and simply analyzes the bottom line of a small business. For this example, it suffices to use the cash method of accounting, as this method records instances when cash actually enters or leaves the business.

To start things off in the right direction, begin by looking at baked goods and beverages — that’s the entire company revenue at this stage. How much the bakery makes and sells, i.e., your revenue, impacts the financial bottom line.

Next, you need to consider costs, like utilities, wages, and ingredients. Finally, you’ll get the net income that depicts the loss or profit of the business for the given period.

For practical purposes, we’ll offer a simplified version of the single-step P&L statement for your small bakery.

Note that the list of revenue items and costs listed below isn’t exhaustive, as you’ll probably have more things to add. Therefore, the overview below serves as an example.

| Period covered: June 2024 | |

|---|---|

| : Bread Unlimited | Currency: USD |

| : Baked goods and beverages sold (A) | 3,000 |

| : Ingredients, utilities, employee wages (B) | 2,500 |

| Bakery’s profit after deducting costs from revenue (A – B) | 500 |

#2 Example of profit and loss statement: Product/service company

A profit and loss statement isn’t confined to small businesses, like a bakery in Alabama. You can use it for complex organizations as well.

For this example, it’s recommended that you use the accrual method of accounting. The reason is that this method records expenses or revenue after they’ve provided the service — although the company hasn’t received the cash yet.

The accrual method is used for companies that need to get a more detailed overview of their financial performance. In other words — when the stakes are high.

To create a P&L statement for a software company, you first need to consider the revenue from subscriptions or product sales. After that, it’s appropriate to look into costs (COGS), like licensing, hosting, and customer support costs — all leading you to your gross profit. In short, you get the gross profit by deducting COGS from revenue.

Also, you need to consider the staff’s salaries, rent, and marketing expenses — all operating expenses. When you’re done with that, you need to evaluate the operating profit by deducting operating expenses from gross profit. The next step is to examine your taxes, interest on loans, and other necessary expenditures — your non-operating items.

Finally, you get the net profit — that is, the final figures showing you how well your business is performing.

To make it even more concrete, here’s a simplified breakdown of a multi-step P&L statement you could use for a software company — let’s call them InvincibleDevs .

| Period covered: Q1 2024 | |

|---|---|

| : InvincibleDevs | Currency: USD |

| : Subscriptions (or product sales) | 10,000 |

| : Licensing, customer support, software development | 3,000 |

| : Revenue – costs | 7,000 |

| : Salaries, office rent, marketing | 5,000 |

| : Gross profit – operating expenses (A) | 2,000 |

| Taxes, interest on loans, depreciation, amortization, etc. (B) | 500 |

| (or net loss): A – B, the final financial result after deducting non-operating items from operating profit | 1,500 |

#3 Example of profit and loss statement: Restaurant

With millions of restaurants spread throughout the world, it might be interesting to explore how a P&L statement can impact their profitability.

For illustration, we can take a single month’s worth of meals and pull it through a comparative P&L statement. In particular, let’s do a summary of the revenue and costs for January and February 2024. For this example, it’s best to use the cash method of accounting, as accountants typically record revenues and expenses only when the cash changes hands.

First, all the meals you typically sell during a month amount to your revenue. After you deduct the cost of goods sold — like ingredients — and labor costs from the revenue, you get a gross margin. Bear in mind that the cost of goods sold and labor costs are often jointly referred to as prime cost .

Second, you need to subtract the operating expenses, including wages of the entire kitchen and wait staff, plus the rent. These expenses are typically fixed.

Third, you have to cover the utilities, marketing expenses, and depreciation — all represented as general and administrative expenses (often also called non-operating expenses ).

In the end, our imaginary restaurant is left with the net income on that single month’s worth of meals for January and February 2024.

To make it more concrete, here’s what the restaurant budget for a single month’s worth of meals may look like in a comparative P&L statement:

| January 2024 | February 2024 | |

|---|---|---|

| Palate Paradise | Currency: USD | Currency: USD |

| : Meals and beverages sold (A) | 1,000 | 950 |

| : Food and ingredients (B) | 200 | 220 |

| Wait and kitchen staff salaries, payroll taxes (C) | 220 | 220 |

| : A – B — C | 580 | 510 |

| Rent | 290 | 290 |

| Depreciation, utility charges, marketing | 220 | 240 |

| Restaurant’s profit after deducting all costs and expenses from revenue | 70 | –20 |

Speaking of managing restaurants, here’s a list of the 10 of the best management software to operate any restaurant:

- 10 Best restaurant management software in 2022

3 Tested tips to make better P&L statements

As a business owner, it’s sometimes difficult to remember to do everything that needs to be done — from paying employees and contractors to recording and submitting all the required information to the authorities.

That’s why we’ve laid out 3 simple yet effective ways to make your profit and loss statements more akin to a walk in the park.

Tip #1: Track your time to better manage labor costs

You can’t possibly know everything that’s going on in your business if you don’t track what and when employees are doing. So, to improve your bottom line, you’ll have to keep tabs on the labor cost of people involved in your company.

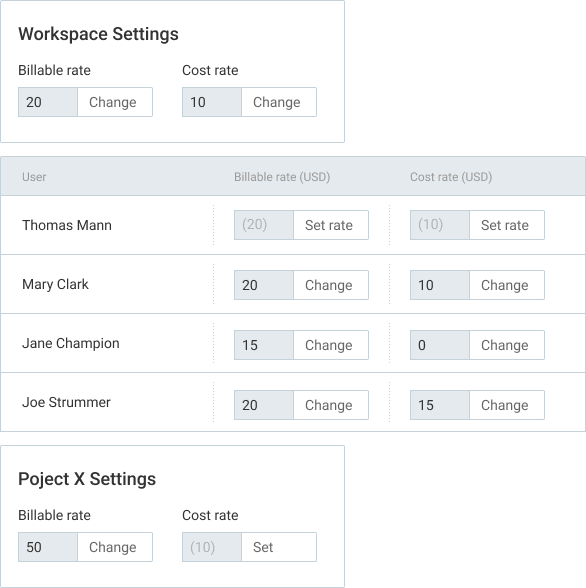

For example, a time-tracking system like Clockify lets you add billable rates for your clients — and define cost rates for your workforce. In Clockify reports, you get to compare your billable amounts (what you charge your clients) with your cost amounts (what you pay your employees).

As a result, you can better track profitability.

As soon as you enable cost rates in Workspace settings, you can apply billable rates and cost rates to any project, client, and employee. This allows you to create more detailed profit and loss statements because you’ll know exactly how much you charge your clients and pay your workforce.

So, the next time you want to make sure you’re meeting your financial goals, remember to start tracking your productivity and doing the same for your employees. Doing so will help you see where time is slipping through the cracks — and thereby ruining your business.

Tip #2: Keep tabs on expenses to protect your bottom line

A study that surveyed more than 200 Nordic organizations found that around 20% of receipts don’t make it into expense reports . That’s a sad reality for many companies nowadays. Yet, the cure to this problem is simple: Digitize your receipts!

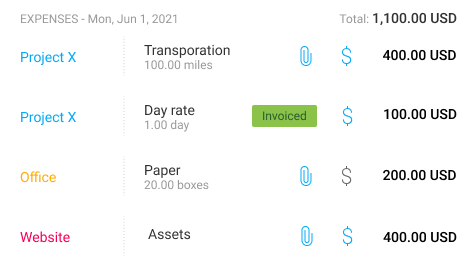

For example, you can use an expense-tracking app like Clockify to track costs for project fixed fees by categories, like sum or unit. After inserting expenses, Clockify generates a fitting invoice that reflects all the expenses by category.

To tie it up with your P&L statement, you can track how much your team is spending on operating expenses, like marketing or purchasing office supplies.

In fact, you can organize your expenses per many items, including:

- Team member,

- Project,

- Category, and more.

Whether you work as an accountant or just want to get a head start on tracking your expenses, check out our informative article on this topic:

- How to keep track of expenses

Tip #3: Manage your time better to increase productivity

This point bears repeating in any sector — create an impenetrable time management system.

If your accountants and workforce are exhausted, they can make errors in their work, including what goes into your P&L statement.

But suppose you decide to make time management a priority. In this case, one of the intended consequences will be an improvement in your company’s bottom line.

Free time management app

Take control of your time and maximize productivity with effortless time tracking.

So, here are a few practical tips for managing your time well when crafting a P&L statement:

- Type in the title of your task in your time-tracking app,

- Click on the dollar sign to mark your time as billable,

- Start the timer to track your billable hours,

- Record expenses in your dedicated time billing software, and

- Create invoices for the services you provided.

As soon as you implement these techniques, you’ll be on your way to creating better financial statements and a work environment that drives stellar performance.

Get bite-sized advice on how to manage your time even better in our comprehensive guide:

- Everything you need to know about time management (+ tips)

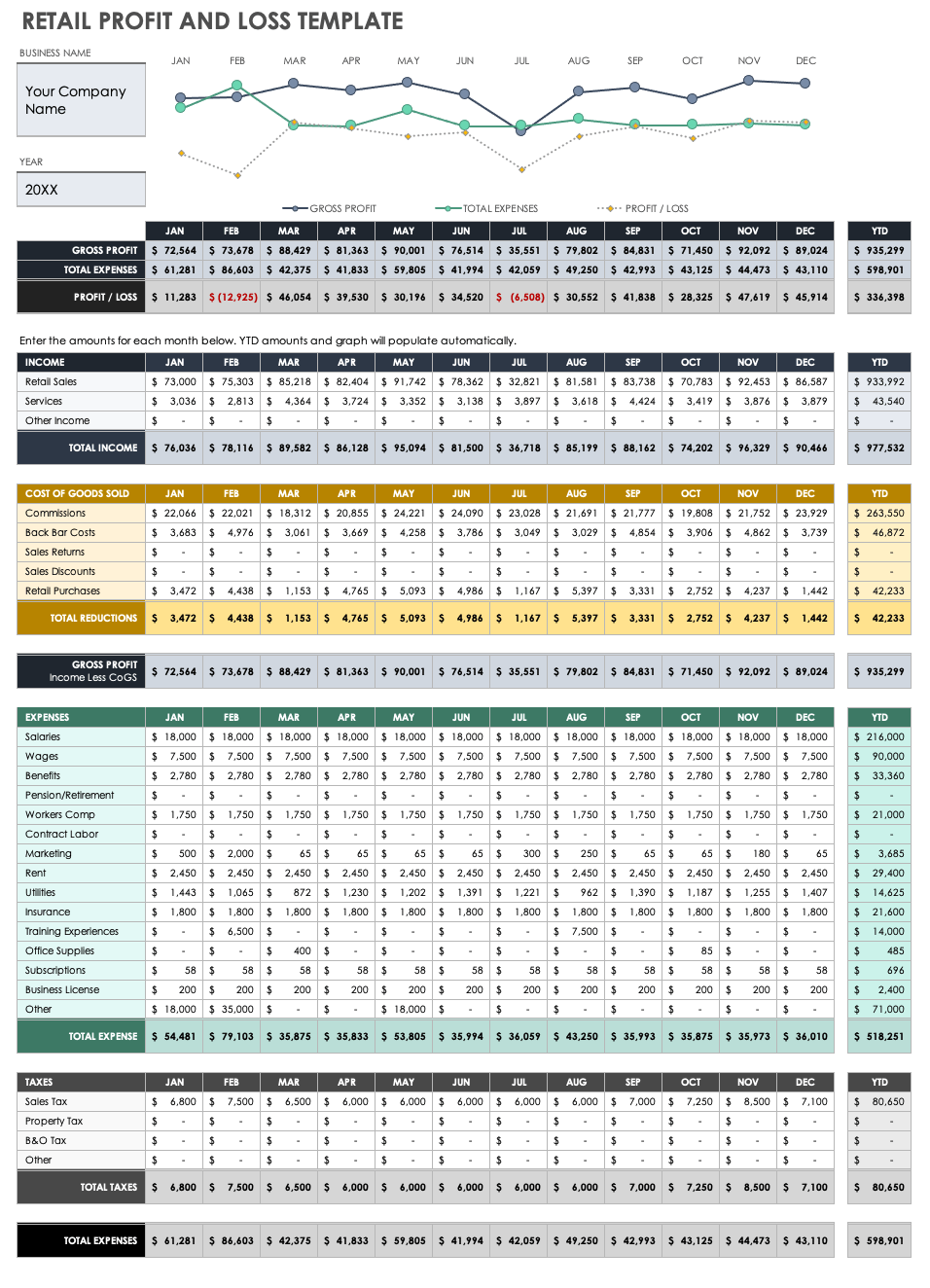

Profit and loss statement templates

Now you have everything you need to grow your knowledge about P&L statements. But it’s prime time we get to a few useful templates you can use to craft your own profit and loss statement.

In this section, we’ll look into 3 templates of profit and loss statements:

- Single-step P&L statement template,

- Multi-step P&L statement template, and

- Comparative P&L statement template.

We hope you’re excited as we are — let’s dig in!

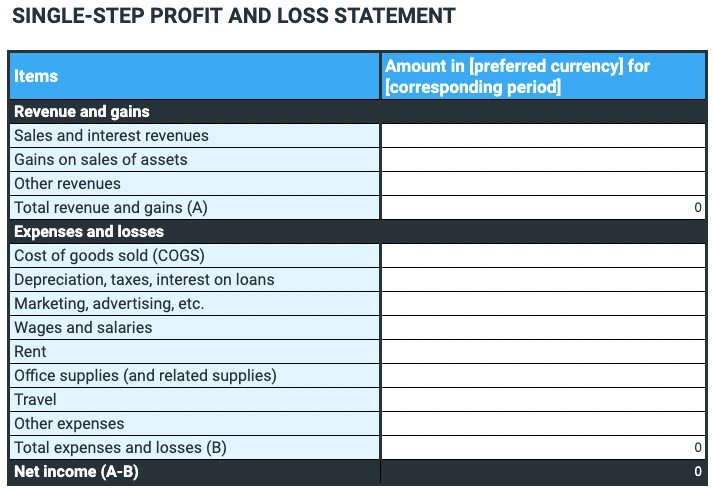

Profit and loss template #1: Single-step P&L statement

The single-step P&L statement is a simple financial tool that lets you get a bird’s-eye view of how much money your business is making or losing. Yet, its use doesn’t spread beyond small businesses — like our small bakery in Alabama. Larger companies typically avoid this when making long-term decisions.

The Single-step P&L statement template is useful if you’re just starting out and you’d like to calculate your total income without having to create a single-step P&L statement from scratch.

This template is also practical for getting a snapshot of your expenses and cost of goods sold. In fact, it’s called single-step because it gives you a picture of the loss or profit in a single step. Yet, it doesn’t list things like operating and non-operating costs — things that still impact the bottom line.

Pros of the Single-step P&L statement template :

- Makes record-keeping easy due to its simplicity, and

- Focuses on the company’s financial bottom line.

Cons of the Single-step P&L statement template :

- Doesn’t distinguish between operating costs and non-operating costs, and

- Makes it hard to determine the sources of many activities, which discourages investors from investing in the business.

How best to use the Single-step P&L statement template?

You have 2 formats to choose from for your template: a Google Sheets file and an Excel spreadsheet.

If you click on the Google Sheets link below, a new screen will appear with the prompt: Would you like to make a copy of the Single-step P&L statement template?

Click on Make a copy, and you’ll get an editable copy of the Single-step P&L statement template.

If you go with the Excel spreadsheet, clicking on the link will save the document to your device.

In any case, the document will be empty, with many zeroes. As soon as you begin inserting your digits, it will start to take shape.

After you’ve inserted your company’s details and the period you want to cover, start by filling in the Revenue and gains column by adding details such as:

- Sales and interest revenues,

- Gains on sales of assets, and other revenues.

Next, you need to populate data in the Expenses and losses column, including:

- Cost of goods sold,

- Depreciation,

- Office supplies,

- Rent, and other expenses.

To get the net income, you’ll need to subtract the Total of expenses and losses from the Total revenue and gains .

⬇️ Download the Single-step P&L statement template (Google Sheets)

⬇️ Download the Single-step P&L statement template (Excel)

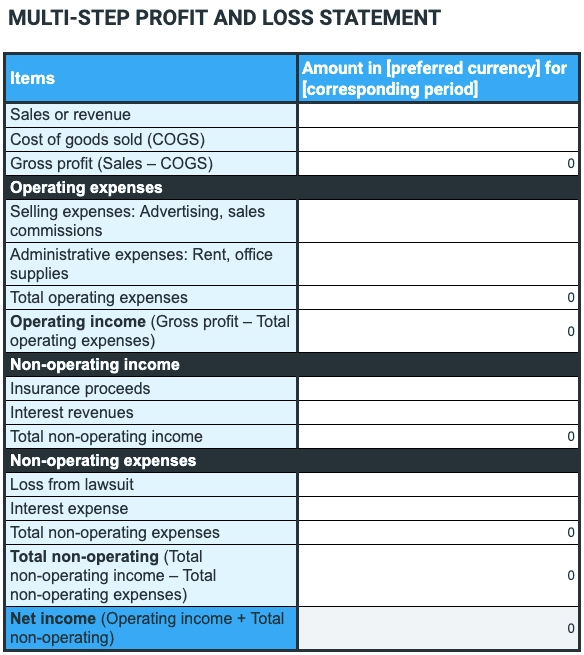

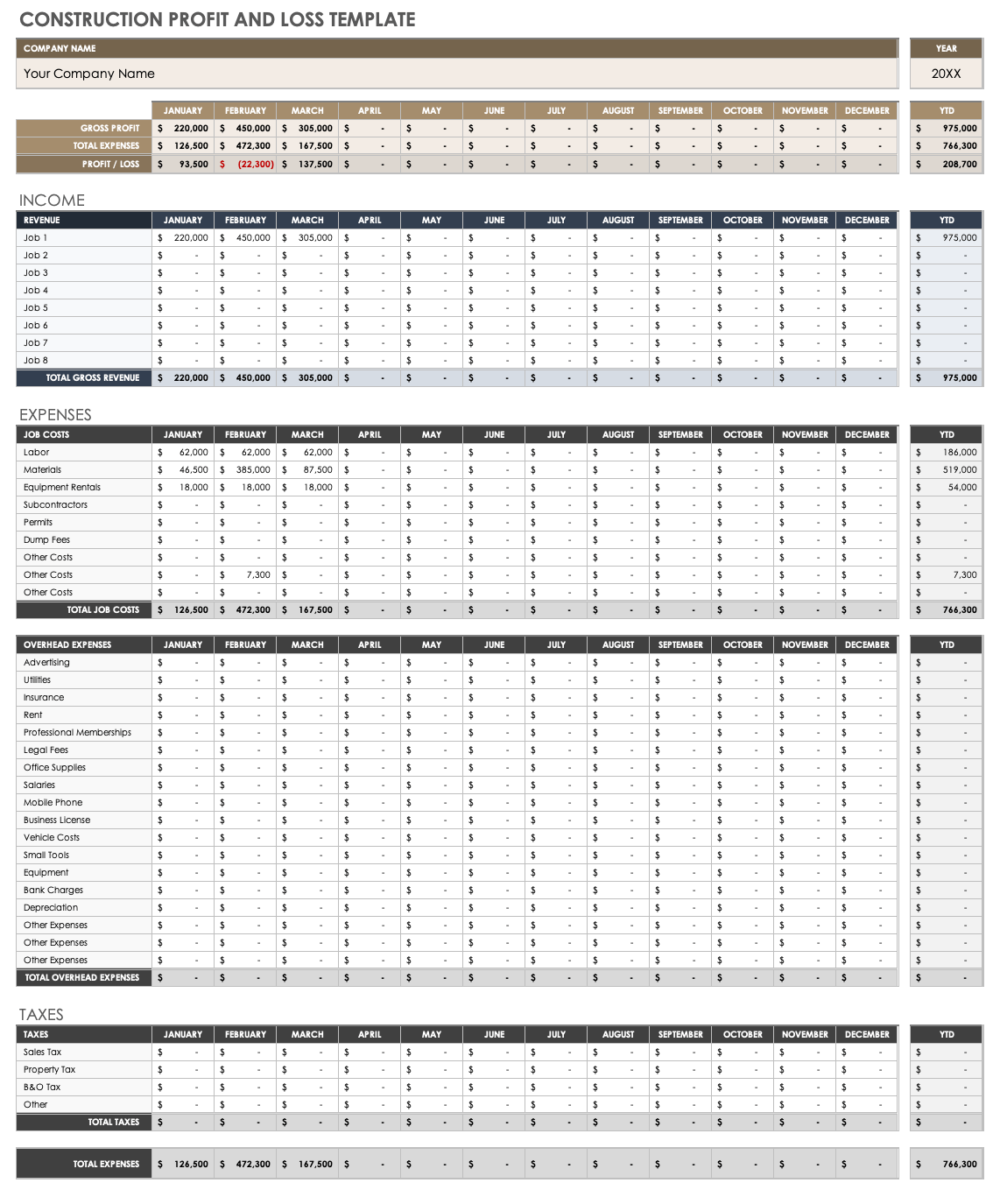

Profit and loss template #2: Multi-step P&L statement

The multi-step P&L statement is a more detailed type of profit and loss statement that includes multiple subtotals. For example, it separates the operating expenses and operating income from non-operating expenses and non-operating income. In turn, this helps a company find out which areas are performing as expected or poorly.

Suppose a budget item from your non-operating income — like insurance proceeds — is through the roof. In this case, the multi-step P&L statement provides you with details about this item. In contrast, the single-step P&L statement typically attaches this non-operating income to other budget items, which doesn’t give a proper explanation for the rise in insurance proceeds.

Filing out this template is time-consuming, but it helps you get more in-depth into your financial situation and is meant for mid-sized and large businesses.

Pros of the Multi-step P&L statement template:

- Calculates gross profit and operating income easily, and

- Offers deeper insight into operating trends and financial performance.

Cons of the Multi-step P&L statement template:

- Lacks simplicity, making it hard for non-finance persons to interpret, and

- Takes plenty of time and effort to create one.

How best to use the Multi-step P&L statement template?

If you click on the Google Sheets link below, a new screen will appear with the prompt: Would you like to make a copy of the Multi-step P&L statement template?

Click on Make a copy, and you’ll get an editable copy of the Multi-step P&L statement template.

After you’ve inserted your company’s details and the period you want to cover, start by filling in details such as:

- Sales or revenue, and

- Cost of goods sold.

Next, you need to populate data in the Operating expenses column, including:

- Selling expenses, and

- Administrative expenses.

This brings you to the Operating income , which you get when you subtract Total operating expenses from your Gross profit . The line item Operating income is critical, as it lets you see if your operating activities are generating profit or not. Depending on the industry, an operating activity can fall into many categories, like manufacturing, sales, marketing, and others.

Next, you need to fill in data for:

- Non-operating income, and

- Non-operating expenses.

To get the net income, you’ll need to add Operating income to the Total non-operating expenses . For simplicity’s sake, net income is the bottom line of a company. In other words, it represents the amount your business has made after deducting expenses, taxes, allowances, and other costs.

⬇️ Download the Multi-step P&L statement template (Google Sheets)

⬇️ Download the Multi-step P&L statement template (Excel)

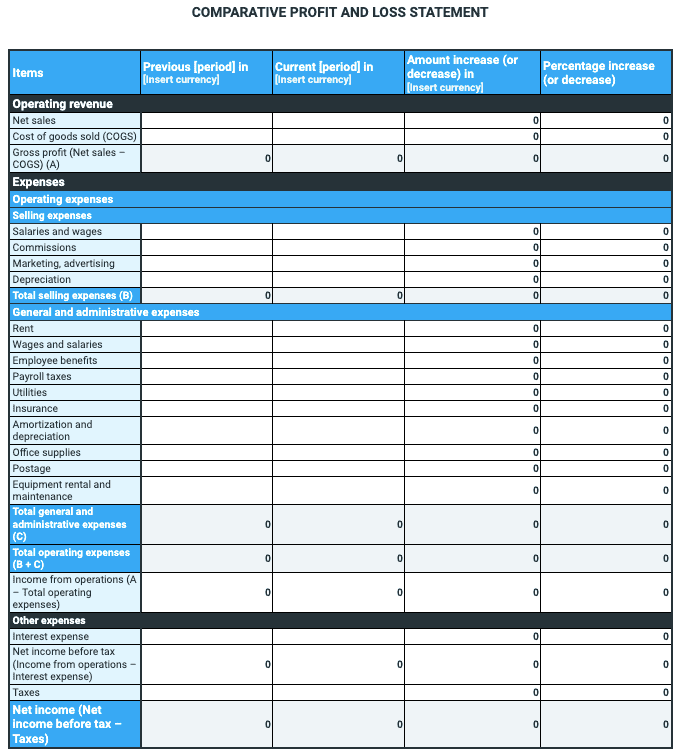

Profit and loss template #3: Comparative P&L statement

The comparative P&L statement is a complex type of a profit and loss statement that compares different accounting periods for one company — or multiple different-sized companies. Experts praise it as one of the most useful P&L statements, as it presents investors and managers with changes in percentage and numbers from one period to the next.

The Comparative P&L statement template presents figures of expenses and income on a single page without having to go back to previous P&L statements and compare them to current ones.

This template allows you to spot problems and trends over different accounting periods. In fact, since it’s digital, you can easily correct numbers and do necessary calculations online without having to print them out.

Pros of the Comparative P&L statement template:

- Provides a clear comparison between multiple accounting periods, and

- Simplifies analysis of sales and net income line items.

Cons of the Comparative P&L statement template:

- Benefits the company only if it uses identical accounting principles consistently to produce such P&L statements (like the accrual or cash method), and

- Fails to be practical when the company branches out into new lines of business.

How best to use the Comparative P&L statement template?

If you click on the Google Sheets link below, a new screen will appear with the prompt: Would you like to make a copy of the Comparative P&L statement template?

Click on Make a copy, and you’ll get an editable copy of the Comparative P&L statement template.

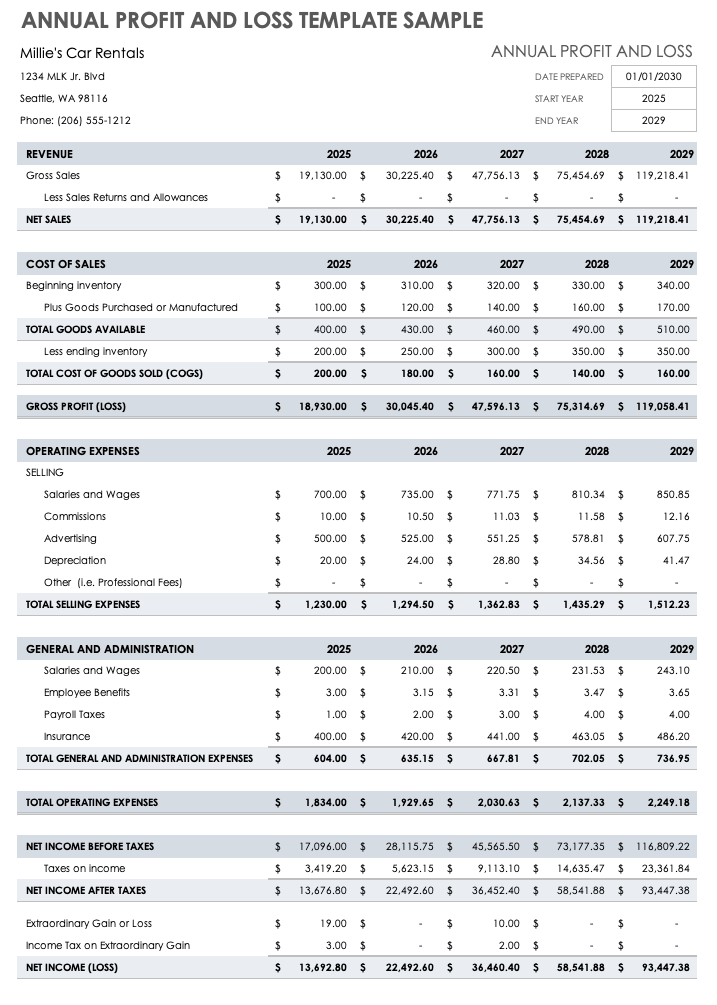

After you’ve inserted your company’s details and the period you want to cover, start by filling in details for the Operating revenue column, such as:

- Net sales, and

Next, you need to populate data in the Operating expenses and General and administrative expenses columns, including:

- Salaries and wages,

- Depreciation,

- Payroll taxes,

- Insurance, and others.

This brings you to the Total operating expenses column, which you get when you add Total selling expenses to the Total general and administrative expenses .

- Income from operations,

- Interest expenses,

- Taxes, and others.

To get the net income, you’ll need to subtract Net income before tax from Taxes .

⬇️ Download the Comparative P&L statement template (Google Sheets)

⬇️ Download the Comparative P&L statement template (Excel)

Note: Even though our P&L statement templates are pretty straightforward, it’s always best to consult with an accountant before making a profit and loss statement official. Clockify is not responsible for any losses or risks incurred should this example be used without further guidance from professionals.

FAQ about profit and loss statements

In this segment, we’ll take a look at a few frequently asked questions people face when they start working on a profit and loss statement.

What is the difference between a cash flow statement, balance sheet, and P&L?

Companies typically make 3 types of financial statements on their financial performance annually, quarterly, and monthly, including:

- Cash flow statement — a financial document that lists the sources of cash deriving from investment, operating, and financing activities,

- Balance sheet — a financial statement that looks into equity, liabilities, and assets that the company has in its possession, and

- Profit and loss statement or income statement — a financial document that details revenues, sales, expenses, and costs in one form or another, depending on the company’s reporting standards.

But when it comes to disclosing this information, not all companies have the same responsibilities toward authorities.

Which companies have to give away financial statements?

Public companies are required by law to file regular reports with the U.S. Securities and Exchange Commission. Yet, most private companies don’t have to disclose this information — at least the ones with less than $10,000,000 in assets and with more than 500 owners who hold securities (a financial instrument that provides individuals with a form of company ownership).

Private companies that aren’t subject to these criteria often still provide these financial statements to the authorities. The reason? Well, this information gives financial experts deeper insight into how they do business. As a result, investors can make informed decisions about investing, and buyers can decide whether they want to buy or sell a company.

Paired together, the cash flow statement, balance sheet , and profit and loss statement comprise 3 critical components that help managers and investors explore a company’s financial performance over a given accounting period.

Is a P&L the same as an income statement?

Yes, profit and loss statement and income statement are synonyms for the financial document that gives you insight into your company’s financial performance. They include expenses, revenue, and net profit for a given accounting period (a week, month, quarter, or year).

Is P&L the same as a balance sheet?

A profit and loss statement differs from a balance sheet by focusing on expenses and revenue. On the other hand, the balance sheet looks into:

- Liabilities,

- Assets, and

- Equity.

Yet, the balance sheet is a critical companion of the P&L statement in assessing the overall health of a business.

Does P&L include revenue?

Yes, a profit and loss statement always includes revenue and expenses. Line items on revenue, sales, expenses, and costs are the identifying marks of P&L statements.

Is a P&L a cash flow statement?

No, a profit and loss statement isn’t the same as a cash flow statement. Unlike the P&L statement, the cash flow statement lists the cash sources stemming from investment activities, operating activities, and financing activities. In other words, the cash flow statement doesn’t include information on expenses and revenue — as is the case with the P&L statement.

Wrap-up: Prepare regular P&L statements to learn if your business operations are profitable

To make your profits shine, you surely have to go through a strenuous process. And it’s so much more than mere cost management!

In fact, you need to be aware of what exactly happens with your company’s money — and this is where a profit and loss statement comes into play.

In a nutshell, P&L statements allow accountants and managers to make more informed decisions by giving them insight into which activities are a waste of money and which generate profit.

For this and a wealth of other reasons, we geared you up with everything that can help you make the best profit and loss statements, paired with examples and templates.

In summary, here are the main takeaways:

- Choose a simple or complex type of a P&L statement, depending on your needs,

- Harness the power of expense-tracking software to make the process effortless,

- Use templates to speed up the creation of a P&L statement,

- Implement a P&L statement regularly to keep tabs on sales and revenues, and

- Track and manage your time by using time and billing software.

If you follow just a few of these pieces of advice, you’ll be on your way to creating profit and loss statements that will amaze investors and managers alike.

Sources for the table:

- Khatabook, Comparative Income Statement: Examples, Analysis and Format

- Library of Congress, Research Guide on U.S. Private Companies

- Millie Atkinson, 2017, Income Statements Essentials

- Risks and benefits of handling digital receipts, Eurocard, 2021

- Sandy Baruffi, 2021, The Basics Of Understanding Financial Statements: A Guide To Understanding Financial Reports

- U.S. Securities and Exchange Commission, The Laws that Govern the Securities Industry

- U.S. Securities and Exchange Commission, What does it mean to be a public company?

- WallStreetMojo, Single-step Income Statement

Explore further

Business Regulations

Freelancers & Contractors

Free time tracker

Time tracking software used by millions. Clockify is a time tracker and timesheet app that lets you track work hours across projects.

Profit and Loss Statements 101 (with Template)

Bryce Warnes

Reviewed by

Janet Berry-Johnson, CPA

April 26, 2024

This article is Tax Professional approved

Want to know how profitable your business is? The best way to find out is to create a profit and loss statement.

Here’s how you put one together, how to read it, and why profit and loss statements are important for running your business.

I am the text that will be copied.

What is a profit and loss statement?

A P&L statement (sometimes called a statement of operations) is a type of financial report that tells you how profitable your business was over a given period. It shows your revenue, minus expenses and losses. The result is either your final profit (if things went well) or loss .

The P&L statement is one of the three most important financial statements for business owners, along with the balance sheet and the cash flow statement (or statement of cash flows).

One of the most common reasons small businesses start producing profit and loss statements is to show banks and investors how profitable their business is.

When profit and loss statements are meant to be shared outside a business, they’re called income statements. A P&L statement is for internal use only. Other than that, the two statements are essentially the same.

Profit and loss statement example

We’ve created a profit and loss statement for an imaginary small business—Terracotta Warriors, a supplies store for potted plant enthusiasts.

Terracotta Warriors Inc.

Income Statement

For Year Ended Dec. 31, 2021

| Category | Amount |

|---|---|

| Sales Revenue | $57,050.68 |

| Cost of Goods Sold (COGS) | $24,984.79 |

| Gross Profit | $32,065.89 |

| General Expenses | $11,049.55 |

| *Rent | $9,000.00 |

| *Bank & ATM Fee Expenses | $9.43 |

| *Equipment Expenses | $742.40 |

| *Marketing Expenses | $503.53 |

| *Merchant Fees Expenses | $794.19 |

| Operating Earnings | $21,016.34 |

| Interest Expense | $5,000.00 |

| Earnings Before Income Tax | $16,016.34 |

| Income Tax Expense | $10,000.00 |

| Net Profit | $6,016.34 |

Profit and loss statements should be read top to bottom—so we’ll go through this one line by line, starting at the first.

Further reading: How to Read (and Understand) an Income Statement

Sales revenue

Every profit and loss statement starts off by showing your company’s revenues.

How you calculate your revenue depends on whether you do cash or accrual accounting and how your company recognizes revenue —particularly if you’re tracking income for a single month (rather than a year, as part of an annual report.)

The sales revenue line simply represents your total revenue for the time period you’re reporting. (In this case, it’s the year ending on December 31, 2021.)

Cost of goods sold

Abbreviated as “ COGS ,” this is the cost of producing the goods or services you sold to your customers during the reporting period.

COGS involves only direct expenses: Raw materials, labor, and shipping costs. In the case of Terracotta Warriors, that might include planting pots (purchased wholesale), wages for employees, and the cost of shipping online orders.

Indirect expenses—for instance, utilities, bank fees, and rent—aren’t included in COGS. Those go into a separate category.

Gross profit