- Search Search Please fill out this field.

What Is a Business Plan?

Understanding business plans, how to write a business plan, common elements of a business plan, the bottom line, business plan: what it is, what's included, and how to write one.

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

- How to Start a Business: A Comprehensive Guide and Essential Steps

- How to Do Market Research, Types, and Example

- Marketing Strategy: What It Is, How It Works, How To Create One

- Marketing in Business: Strategies and Types Explained

- What Is a Marketing Plan? Types and How to Write One

- Business Development: Definition, Strategies, Steps & Skills

- Business Plan: What It Is, What's Included, and How to Write One CURRENT ARTICLE

- Small Business Development Center (SBDC): Meaning, Types, Impact

- How to Write a Business Plan for a Loan

- Business Startup Costs: It’s in the Details

- Startup Capital Definition, Types, and Risks

- Bootstrapping Definition, Strategies, and Pros/Cons

- Crowdfunding: What It Is, How It Works, and Popular Websites

- Starting a Business with No Money: How to Begin

- A Comprehensive Guide to Establishing Business Credit

- Equity Financing: What It Is, How It Works, Pros and Cons

- Best Startup Business Loans

- Sole Proprietorship: What It Is, Pros & Cons, and Differences From an LLC

- Partnership: Definition, How It Works, Taxation, and Types

- What is an LLC? Limited Liability Company Structure and Benefits Defined

- Corporation: What It Is and How to Form One

- Starting a Small Business: Your Complete How-to Guide

- Starting an Online Business: A Step-by-Step Guide

- How to Start Your Own Bookkeeping Business: Essential Tips

- How to Start a Successful Dropshipping Business: A Comprehensive Guide

A business plan is a document that outlines a company's goals and the strategies to achieve them. It's valuable for both startups and established companies. For startups, a well-crafted business plan is crucial for attracting potential lenders and investors. Established businesses use business plans to stay on track and aligned with their growth objectives. This article will explain the key components of an effective business plan and guidance on how to write one.

Key Takeaways

- A business plan is a document detailing a company's business activities and strategies for achieving its goals.

- Startup companies use business plans to launch their venture and to attract outside investors.

- For established companies, a business plan helps keep the executive team focused on short- and long-term objectives.

- There's no single required format for a business plan, but certain key elements are essential for most companies.

Investopedia / Ryan Oakley

Any new business should have a business plan in place before beginning operations. Banks and venture capital firms often want to see a business plan before considering making a loan or providing capital to new businesses.

Even if a company doesn't need additional funding, having a business plan helps it stay focused on its goals. Research from the University of Oregon shows that businesses with a plan are significantly more likely to secure funding than those without one. Moreover, companies with a business plan grow 30% faster than those that don't plan. According to a Harvard Business Review article, entrepreneurs who write formal plans are 16% more likely to achieve viability than those who don't.

A business plan should ideally be reviewed and updated periodically to reflect achieved goals or changes in direction. An established business moving in a new direction might even create an entirely new plan.

There are numerous benefits to creating (and sticking to) a well-conceived business plan. It allows for careful consideration of ideas before significant investment, highlights potential obstacles to success, and provides a tool for seeking objective feedback from trusted outsiders. A business plan may also help ensure that a company’s executive team remains aligned on strategic action items and priorities.

While business plans vary widely, even among competitors in the same industry, they often share basic elements detailed below.

A well-crafted business plan is essential for attracting investors and guiding a company's strategic growth. It should address market needs and investor requirements and provide clear financial projections.

While there are any number of templates that you can use to write a business plan, it's best to try to avoid producing a generic-looking one. Let your plan reflect the unique personality of your business.

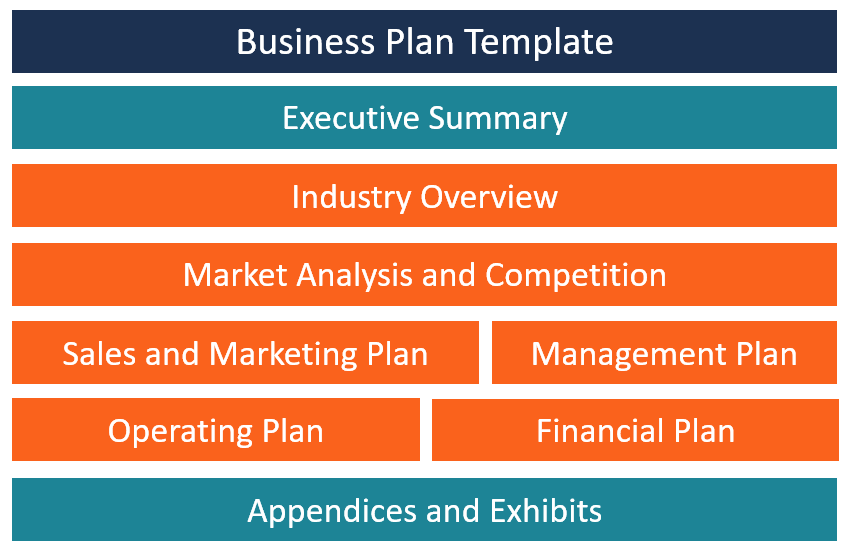

Many business plans use some combination of the sections below, with varying levels of detail, depending on the company.

The length of a business plan can vary greatly from business to business. Regardless, gathering the basic information into a 15- to 25-page document is best. Any additional crucial elements, such as patent applications, can be referenced in the main document and included as appendices.

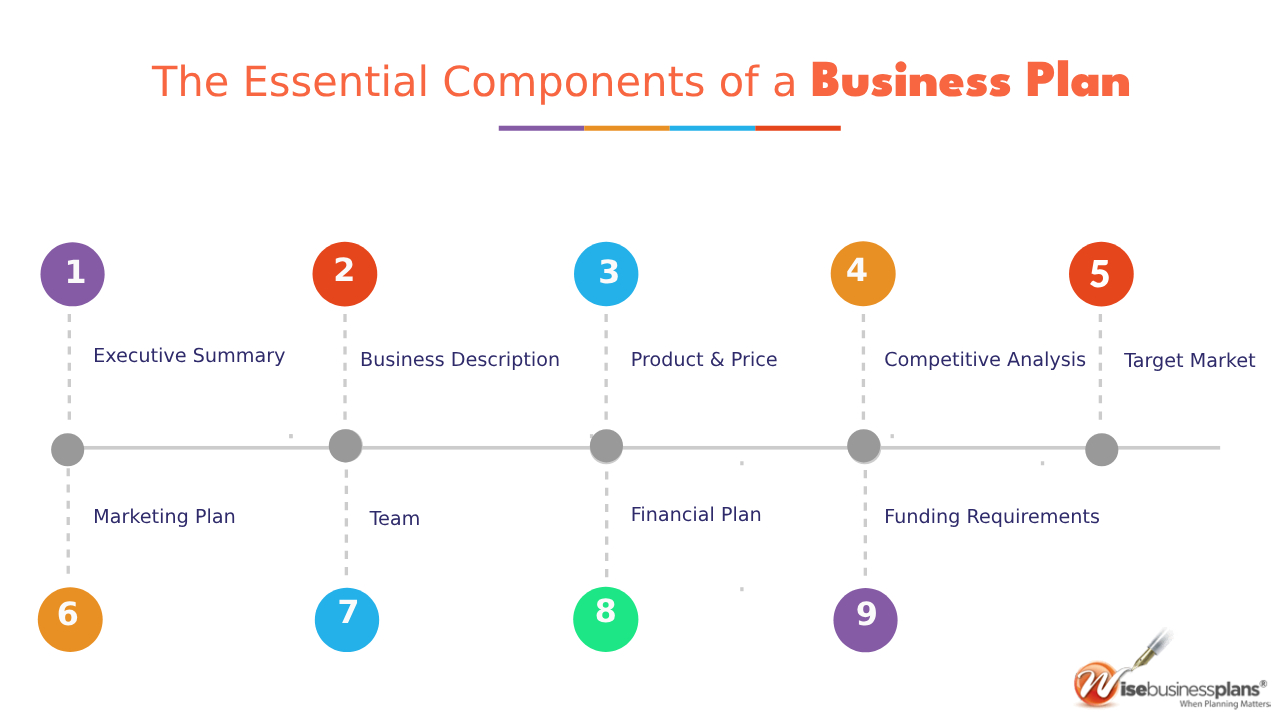

Common elements in many business plans include:

- Executive summary : This section introduces the company and includes its mission statement along with relevant information about the company's leadership, employees, operations, and locations.

- Products and services : Describe the products and services the company offers or plans to introduce. Include details on pricing, product lifespan, and unique consumer benefits. Mention production and manufacturing processes, relevant patents , proprietary technology , and research and development (R&D) information.

- Market analysis : Explain the current state of the industry and the competition. Detail where the company fits in, the types of customers it plans to target, and how it plans to capture market share from competitors.

- Marketing strategy : Outline the company's plans to attract and retain customers, including anticipated advertising and marketing campaigns. Describe the distribution channels that will be used to deliver products or services to consumers.

- Financial plans and projections : Established businesses should include financial statements, balance sheets, and other relevant financial information. New businesses should provide financial targets and estimates for the first few years. This section may also include any funding requests.

Investors want to see a clear exit strategy, expected returns, and a timeline for cashing out. It's likely a good idea to provide five-year profitability forecasts and realistic financial estimates.

2 Types of Business Plans

Business plans can vary in format, often categorized into traditional and lean startup plans. According to the U.S. Small Business Administration (SBA) , the traditional business plan is the more common of the two.

- Traditional business plans : These are detailed and lengthy, requiring more effort to create but offering comprehensive information that can be persuasive to potential investors.

- Lean startup business plans : These are concise, sometimes just one page, and focus on key elements. While they save time, companies should be ready to provide additional details if requested by investors or lenders.

Why Do Business Plans Fail?

A business plan isn't a surefire recipe for success. The plan may have been unrealistic in its assumptions and projections. Markets and the economy might change in ways that couldn't have been foreseen. A competitor might introduce a revolutionary new product or service. All this calls for building flexibility into your plan, so you can pivot to a new course if needed.

How Often Should a Business Plan Be Updated?

How frequently a business plan needs to be revised will depend on its nature. Updating your business plan is crucial due to changes in external factors (market trends, competition, and regulations) and internal developments (like employee growth and new products). While a well-established business might want to review its plan once a year and make changes if necessary, a new or fast-growing business in a fiercely competitive market might want to revise it more often, such as quarterly.

What Does a Lean Startup Business Plan Include?

The lean startup business plan is ideal for quickly explaining a business, especially for new companies that don't have much information yet. Key sections may include a value proposition , major activities and advantages, resources (staff, intellectual property, and capital), partnerships, customer segments, and revenue sources.

A well-crafted business plan is crucial for any company, whether it's a startup looking for investment or an established business wanting to stay on course. It outlines goals and strategies, boosting a company's chances of securing funding and achieving growth.

As your business and the market change, update your business plan regularly. This keeps it relevant and aligned with your current goals and conditions. Think of your business plan as a living document that evolves with your company, not something carved in stone.

University of Oregon Department of Economics. " Evaluation of the Effectiveness of Business Planning Using Palo Alto's Business Plan Pro ." Eason Ding & Tim Hursey.

Bplans. " Do You Need a Business Plan? Scientific Research Says Yes ."

Harvard Business Review. " Research: Writing a Business Plan Makes Your Startup More Likely to Succeed ."

Harvard Business Review. " How to Write a Winning Business Plan ."

U.S. Small Business Administration. " Write Your Business Plan ."

SCORE. " When and Why Should You Review Your Business Plan? "

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1456193345-2cc8ef3d583f42d8a80c8e631c0b0556.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

What is a Business Plan? Definition, Tips, and Templates

Published: June 28, 2024

Years ago, I had an idea to launch a line of region-specific board games. I knew there was a market for games that celebrated local culture and heritage. I was so excited about the concept and couldn't wait to get started.

But my idea never took off. Why? Because I didn‘t have a plan. I lacked direction, missed opportunities, and ultimately, the venture never got off the ground.

And that’s exactly why a business plan is important. It cements your vision, gives you clarity, and outlines your next step.

In this post, I‘ll explain what a business plan is, the reasons why you’d need one, identify different types of business plans, and what you should include in yours.

Table of Contents

What is a business plan?

What is a business plan used for.

- Business Plan Template [Download Now]

Purposes of a Business Plan

What does a business plan need to include, types of business plans.

.webp)

Free Business Plan Template

The essential document for starting a business -- custom built for your needs.

- Outline your idea.

- Pitch to investors.

- Secure funding.

- Get to work!

Download Free

All fields are required.

You're all set!

Click this link to access this resource at any time.

A business plan is a comprehensive document that outlines a company's goals, strategies, and financial projections. It provides a detailed description of the business, including its products or services, target market, competitive landscape, and marketing and sales strategies. The plan also includes a financial section that forecasts revenue, expenses, and cash flow, as well as a funding request if the business is seeking investment.

The business plan is an undeniably critical component to getting any company off the ground. It's key to securing financing, documenting your business model, outlining your financial projections, and turning that nugget of a business idea into a reality.

The purpose of a business plan is three-fold: It summarizes the organization’s strategy in order to execute it long term, secures financing from investors, and helps forecast future business demands.

Business Plan Template [ Download Now ]

Don't forget to share this post!

Related articles.

![the meaning of the business plan 7 Gantt Chart Examples You'll Want to Copy [+ 5 Steps to Make One]](https://www.hubspot.com/hubfs/gantt-chart-1-20240625-3861486-1.webp)

7 Gantt Chart Examples You'll Want to Copy [+ 5 Steps to Make One]

![the meaning of the business plan How to Write an Executive Summary Execs Can't Ignore [+ 5 Top Examples]](https://www.hubspot.com/hubfs/executive-summary-example_5.webp)

How to Write an Executive Summary Execs Can't Ignore [+ 5 Top Examples]

20 Free & Paid Small Business Tools for Any Budget

24 of My Favorite Sample Business Plans & Examples For Your Inspiration

Maximizing Your Social Media Strategy: The Top Aggregator Tools to Use

The Content Aggregator Guide for 2024

![the meaning of the business plan The 8 Best Free Flowchart Templates [+ Examples]](https://newinboundblog.hubspot.com/hubfs/flowchart%20templates.jpg)

The 8 Best Free Flowchart Templates [+ Examples]

16 Best Screen Recorders to Use for Collaboration

The 25 Best Google Chrome Extensions for SEO

Professional Invoice Design: 28 Samples & Templates to Inspire You

2 Essential Templates For Starting Your Business

Marketing software that helps you drive revenue, save time and resources, and measure and optimize your investments — all on one easy-to-use platform

Limited Time Offer:

Save Up to 25% on LivePlan today

0 results have been found for “”

Return to blog home

What Is a Business Plan? Definition and Planning Essentials Explained

Posted february 21, 2022 by kody wirth.

What is a business plan? It’s the roadmap for your business. The outline of your goals, objectives, and the steps you’ll take to get there. It describes the structure of your organization, how it operates, as well as the financial expectations and actual performance.

A business plan can help you explore ideas, successfully start a business, manage operations, and pursue growth. In short, a business plan is a lot of different things. It’s more than just a stack of paper and can be one of your most effective tools as a business owner.

Let’s explore the basics of business planning, the structure of a traditional plan, your planning options, and how you can use your plan to succeed.

What is a business plan?

A business plan is a document that explains how your business operates. It summarizes your business structure, objectives, milestones, and financial performance. Again, it’s a guide that helps you, and anyone else, better understand how your business will succeed.

Why do you need a business plan?

The primary purpose of a business plan is to help you understand the direction of your business and the steps it will take to get there. Having a solid business plan can help you grow up to 30% faster and according to our own 2021 Small Business research working on a business plan increases confidence regarding business health—even in the midst of a crisis.

These benefits are directly connected to how writing a business plan makes you more informed and better prepares you for entrepreneurship. It helps you reduce risk and avoid pursuing potentially poor ideas. You’ll also be able to more easily uncover your business’s potential. By regularly returning to your plan you can understand what parts of your strategy are working and those that are not.

That just scratches the surface for why having a plan is valuable. Check out our full write-up for fifteen more reasons why you need a business plan .

What can you do with your plan?

So what can you do with a business plan once you’ve created it? It can be all too easy to write a plan and just let it be. Here are just a few ways you can leverage your plan to benefit your business.

Test an idea

Writing a plan isn’t just for those that are ready to start a business. It’s just as valuable for those that have an idea and want to determine if it’s actually possible or not. By writing a plan to explore the validity of an idea, you are working through the process of understanding what it would take to be successful.

The market and competitive research alone can tell you a lot about your idea. Is the marketplace too crowded? Is the solution you have in mind not really needed? Add in the exploration of milestones, potential expenses, and the sales needed to attain profitability and you can paint a pretty clear picture of the potential of your business.

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

Document your strategy and goals

For those starting or managing a business understanding where you’re going and how you’re going to get there are vital. Writing your plan helps you do that. It ensures that you are considering all aspects of your business, know what milestones you need to hit, and can effectively make adjustments if that doesn’t happen.

With a plan in place, you’ll have an idea of where you want your business to go as well as how you’ve performed in the past. This alone better prepares you to take on challenges, review what you’ve done before, and make the right adjustments.

Pursue funding

Even if you do not intend to pursue funding right away, having a business plan will prepare you for it. It will ensure that you have all of the information necessary to submit a loan application and pitch to investors. So, rather than scrambling to gather documentation and write a cohesive plan once it’s relevant, you can instead keep your plan up-to-date and attempt to attain funding. Just add a use of funds report to your financial plan and you’ll be ready to go.

The benefits of having a plan don’t stop there. You can then use your business plan to help you manage the funding you receive. You’ll not only be able to easily track and forecast how you’ll use your funds but easily report on how it’s been used.

Better manage your business

A solid business plan isn’t meant to be something you do once and forget about. Instead, it should be a useful tool that you can regularly use to analyze performance, make strategic decisions, and anticipate future scenarios. It’s a document that you should regularly update and adjust as you go to better fit the actual state of your business.

Doing so makes it easier to understand what’s working and what’s not. It helps you understand if you’re truly reaching your goals or if you need to make further adjustments. Having your plan in place makes that process quicker, more informative, and leaves you with far more time to actually spend running your business.

What should your business plan include?

The content and structure of your business plan should include anything that will help you use it effectively. That being said, there are some key elements that you should cover and that investors will expect to see.

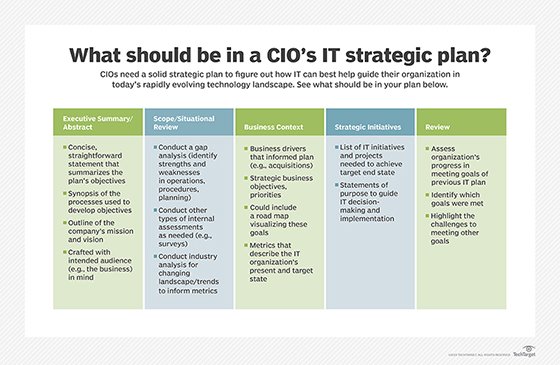

Executive summary

The executive summary is a simple overview of your business and your overall plan. It should serve as a standalone document that provides enough detail for anyone—including yourself, team members, or investors—to fully understand your business strategy. Make sure to cover the problem you’re solving, a description of your product or service, your target market, organizational structure, a financial summary, and any necessary funding requirements.

This will be the first part of your plan but it’s easiest to write it after you’ve created your full plan.

Products & Services

When describing your products or services, you need to start by outlining the problem you’re solving and why what you offer is valuable. This is where you’ll also address current competition in the market and any competitive advantages your products or services bring to the table. Lastly, be sure to outline the steps or milestones that you’ll need to hit to successfully launch your business. If you’ve already hit some initial milestones, like taking pre-orders or early funding, be sure to include it here to further prove the validity of your business.

Market analysis

A market analysis is a qualitative and quantitative assessment of the current market you’re entering or competing in. It helps you understand the overall state and potential of the industry, who your ideal customers are, the positioning of your competition, and how you intend to position your own business. This helps you better explore the long-term trends of the market, what challenges to expect, and how you will need to initially introduce and even price your products or services.

Check out our full guide for how to conduct a market analysis in just four easy steps .

Marketing & sales

Here you detail how you intend to reach your target market. This includes your sales activities, general pricing plan, and the beginnings of your marketing strategy. If you have any branding elements, sample marketing campaigns, or messaging available—this is the place to add it.

Additionally, it may be wise to include a SWOT analysis that demonstrates your business or specific product/service position. This will showcase how you intend to leverage sales and marketing channels to deal with competitive threats and take advantage of any opportunities.

Check out our full write-up to learn how to create a cohesive marketing strategy for your business.

Organization & management

This section addresses the legal structure of your business, your current team, and any gaps that need to be filled. Depending on your business type and longevity, you’ll also need to include your location, ownership information, and business history. Basically, add any information that helps explain your organizational structure and how you operate. This section is particularly important for pitching to investors but should be included even if attempted funding is not in your immediate future.

Financial projections

Possibly the most important piece of your plan, your financials section is vital for showcasing the viability of your business. It also helps you establish a baseline to measure against and makes it easier to make ongoing strategic decisions as your business grows. This may seem complex on the surface, but it can be far easier than you think.

Focus on building solid forecasts, keep your categories simple, and lean on assumptions. You can always return to this section to add more details and refine your financial statements as you operate.

Here are the statements you should include in your financial plan:

- Sales and revenue projections

- Profit and loss statement

- Cash flow statement

- Balance sheet

The appendix is where you add additional detail, documentation, or extended notes that support the other sections of your plan. Don’t worry about adding this section at first and only add documentation that you think will be beneficial for anyone reading your plan.

Types of business plans explained

While all business plans cover similar categories, the style and function fully depend on how you intend to use your plan. So, to get the most out of your plan, it’s best to find a format that suits your needs. Here are a few common business plan types worth considering.

Traditional business plan

The tried-and-true traditional business plan is a formal document meant to be used for external purposes. Typically this is the type of plan you’ll need when applying for funding or pitching to investors. It can also be used when training or hiring employees, working with vendors, or any other situation where the full details of your business must be understood by another individual.

This type of business plan follows the outline above and can be anywhere from 10-50 pages depending on the amount of detail included, the complexity of your business, and what you include in your appendix. We recommend only starting with this business plan format if you plan to immediately pursue funding and already have a solid handle on your business information.

Business model canvas

The business model canvas is a one-page template designed to demystify the business planning process. It removes the need for a traditional, copy-heavy business plan, in favor of a single-page outline that can help you and outside parties better explore your business idea.

The structure ditches a linear structure in favor of a cell-based template. It encourages you to build connections between every element of your business. It’s faster to write out and update, and much easier for you, your team, and anyone else to visualize your business operations. This is really best for those exploring their business idea for the first time, but keep in mind that it can be difficult to actually validate your idea this way as well as adapt it into a full plan.

One-page business plan

The true middle ground between the business model canvas and a traditional business plan is the one-page business plan. This format is a simplified version of the traditional plan that focuses on the core aspects of your business. It basically serves as a beefed-up pitch document and can be finished as quickly as the business model canvas.

By starting with a one-page plan, you give yourself a minimal document to build from. You’ll typically stick with bullet points and single sentences making it much easier to elaborate or expand sections into a longer-form business plan. This plan type is useful for those exploring ideas, needing to validate their business model, or who need an internal plan to help them run and manage their business.

Now, the option that we here at LivePlan recommend is the Lean Plan . This is less of a specific document type and more of a methodology. It takes the simplicity and styling of the one-page business plan and turns it into a process for you to continuously plan, test, review, refine, and take action based on performance.

It holds all of the benefits of the single-page plan, including the potential to complete it in as little as 27-minutes . However, it’s even easier to convert into a full plan thanks to how heavily it’s tied to your financials. The overall goal of Lean Planning isn’t to just produce documents that you use once and shelve. Instead, the Lean Planning process helps you build a healthier company that thrives in times of growth and stable through times of crisis.

It’s faster, keeps your plan concise, and ensures that your plan is always up-to-date.

Try the LivePlan Method for Lean Business Planning

Now that you know the basics of business planning, it’s time to get started. Again we recommend leveraging a Lean Plan for a faster, easier, and far more useful planning process.

To get familiar with the Lean Plan format, you can download our free Lean Plan template . However, if you want to elevate your ability to create and use your lean plan even further, you may want to explore LivePlan.

It features step-by-step guidance that ensures you cover everything necessary while reducing the time spent on formatting and presenting. You’ll also gain access to financial forecasting tools that propel you through the process. Finally, it will transform your plan into a management tool that will help you easily compare your forecasts to your actual results.

Check out how LivePlan streamlines Lean Planning by downloading our Kickstart Your Business ebook .

Like this post? Share with a friend!

Posted in Business Plan Writing

Join over 1 million entrepreneurs who found success with liveplan, like this content sign up to receive more.

Subscribe for tips and guidance to help you grow a better, smarter business.

You're all set!

Exciting business insights and growth strategies will be coming your way each month.

We care about your privacy. See our privacy policy .

- Customer Reviews

- Net 30 Account

- Wise Services

- Steps & Timeline

- Work at a Glance

- Market Research at a Glance

- Business Plan Writing Services

- Bank Business Plan

- Investor Business Plan

- Franchise Business Plan

- Cannabis Business Plan

- Strategic Business Plan

- Corporate Business Plan

- Merge and Acquisition Business Plan (M&A)

- Private Placement Memorandums (PPM)

- Sample Business Plans

- Professional Feasibility Study

- PowerPoint Presentations

- Pitch Deck Presentation Services

- Business Plan Printing

- Market Research

- L-1 Business Plan

- E-2 Business Plan

- EB-5 Business Plan

- EB-5 Regional Centers

- Immigration Attorneys

- Nonprofit Business Plan

- Exit Business Planning

- Business Planning

- Business Formation

- Business License

- Business Website

- Business Branding

- Business Bank Account

- Digital Marketing

- Business Funding Resources

- Small Business Loans

- Venture Capital

- Net 30 Apply

What is a business plan? Definition, Purpose, and Types

In the world of business, a well-thought-out plan is often the key to success. This plan, known as a business plan, is a comprehensive document that outlines a company’s goals, strategies , and financial projections. Whether you’re starting a new business or looking to expand an existing one, a business plan is an essential tool.

As a business plan writer and consultant , I’ve crafted over 15,000 plans for a diverse range of businesses. In this article, I’ll be sharing my wealth of experience about what a business plan is, its purpose, and the step-by-step process of creating one. By the end, you’ll have a thorough understanding of how to develop a robust business plan that can drive your business to success.

What is a business plan?

Purposes of a business plan, what are the essential components of a business plan, executive summary, business description or overview, product and price, competitive analysis, target market, marketing plan, financial plan, funding requirements, types of business plan, lean startup business plans, traditional business plans, how often should a business plan be reviewed and revised, what are the key elements of a lean startup business plan.

- What are some of the reasons why business plans don't succeed?

A business plan is a roadmap for your business. It outlines your goals, strategies, and how you plan to achieve them. It’s a living document that you can update as your business grows and changes.

Looking for someone to write a business plan?

Find professional business plan writers for your business success.

These are the following purpose of business plan:

- Attract investors and lenders: If you’re seeking funding for your business , a business plan is a must-have. Investors and lenders want to see that you have a clear plan for how you’ll use their money to grow your business and generate revenue.

- Get organized and stay on track: Writing a business plan forces you to think through all aspects of your business, from your target market to your marketing strategy. This can help you identify any potential challenges and opportunities early on, so you can develop a plan to address them.

- Make better decisions: A business plan can help you make better decisions about your business by providing you with a framework to evaluate different options. For example, if you’re considering launching a new product, your business plan can help you assess the potential market demand, costs, and profitability.

The executive summary is the most important part of your business plan, even though it’s the last one you’ll write. It’s the first section that potential investors or lenders will read, and it may be the only one they read. The executive summary sets the stage for the rest of the document by introducing your company’s mission or vision statement, value proposition, and long-term goals.

The business description section of your business plan should introduce your business to the reader in a compelling and concise way. It should include your business name, years in operation, key offerings, positioning statement, and core values (if applicable). You may also want to include a short history of your company.

In this section, the company should describe its products or services , including pricing, product lifespan, and unique benefits to the consumer. Other relevant information could include production and manufacturing processes, patents, and proprietary technology.

Every industry has competitors, even if your business is the first of its kind or has the majority of the market share. In the competitive analysis section of your business plan, you’ll objectively assess the industry landscape to understand your business’s competitive position. A SWOT analysis is a structured way to organize this section.

Your target market section explains the core customers of your business and why they are your ideal customers. It should include demographic, psychographic, behavioral, and geographic information about your target market.

Marketing plan describes how the company will attract and retain customers, including any planned advertising and marketing campaigns . It also describes how the company will distribute its products or services to consumers.

After outlining your goals, validating your business opportunity, and assessing the industry landscape, the team section of your business plan identifies who will be responsible for achieving your goals. Even if you don’t have your full team in place yet, investors will be impressed by your clear understanding of the roles that need to be filled.

In the financial plan section,established businesses should provide financial statements , balance sheets , and other financial data. New businesses should provide financial targets and estimates for the first few years, and may also request funding.

Since one goal of a business plan is to secure funding from investors , you should include the amount of funding you need, why you need it, and how long you need it for.

- Tip: Use bullet points and numbered lists to make your plan easy to read and scannable.

Access specialized business plan writing service now!

Business plans can come in many different formats, but they are often divided into two main types: traditional and lean startup. The U.S. Small Business Administration (SBA) says that the traditional business plan is the more common of the two.

Lean startup business plans are short (as short as one page) and focus on the most important elements. They are easy to create, but companies may need to provide more information if requested by investors or lenders.

Traditional business plans are longer and more detailed than lean startup business plans, which makes them more time-consuming to create but more persuasive to potential investors. Lean startup business plans are shorter and less detailed, but companies should be prepared to provide more information if requested.

Need Guidance with Your Business Plan?

Access 14 free business plan samples!

A business plan should be reviewed and revised at least annually, or more often if the business is experiencing significant changes. This is because the business landscape is constantly changing, and your business plan needs to reflect those changes in order to remain relevant and effective.

Here are some specific situations in which you should review and revise your business plan:

- You have launched a new product or service line.

- You have entered a new market.

- You have experienced significant changes in your customer base or competitive landscape.

- You have made changes to your management team or organizational structure.

- You have raised new funding.

A lean startup business plan is a short and simple way for a company to explain its business, especially if it is new and does not have a lot of information yet. It can include sections on the company’s value proposition, major activities and advantages, resources, partnerships, customer segments, and revenue sources.

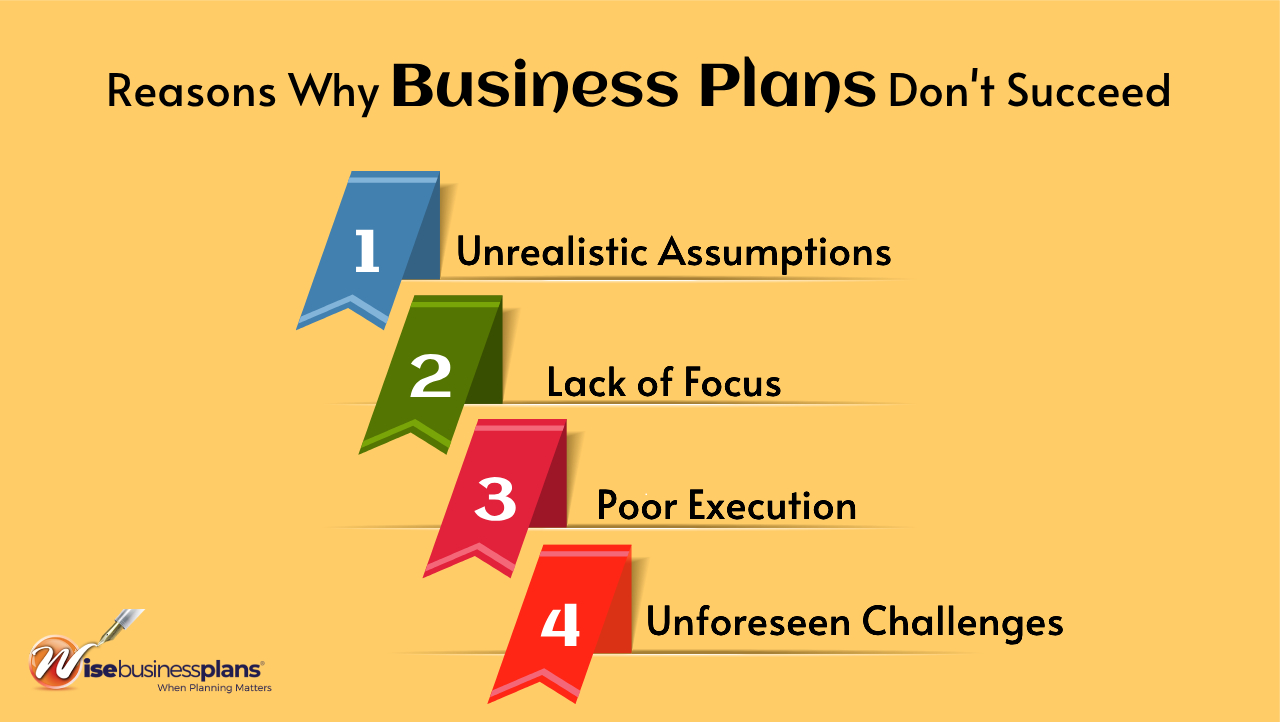

What are some of the reasons why business plans don't succeed?

- Unrealistic assumptions: Business plans are often based on assumptions about the market, the competition, and the company’s own capabilities. If these assumptions are unrealistic, the plan is doomed to fail.

- Lack of focus: A good business plan should be focused on a specific goal and how the company will achieve it. If the plan is too broad or tries to do too much, it is unlikely to be successful.

- Poor execution: Even the best business plan is useless if it is not executed properly. This means having the right team in place, the necessary resources, and the ability to adapt to changing circumstances.

- Unforeseen challenges: Every business faces challenges that could not be predicted or planned for. These challenges can be anything from a natural disaster to a new competitor to a change in government regulations.

What are the benefits of having a business plan?

- It helps you to clarify your business goals and strategies.

- It can help you to attract investors and lenders.

- It can serve as a roadmap for your business as it grows and changes.

- It can help you to make better business decisions.

How to write a business plan?

There are many different ways to write a business plan, but most follow the same basic structure. Here is a step-by-step guide:

- Executive summary.

- Company description.

- Management and organization description.

- Financial projections.

How to write a business plan step by step?

Start with an executive summary, then describe your business, analyze the market, outline your products or services, detail your marketing and sales strategies, introduce your team, and provide financial projections.

Why do I need a business plan for my startup?

A business plan helps define your startup’s direction, attract investors, secure funding, and make informed decisions crucial for success.

What are the key components of a business plan?

Key components include an executive summary, business description, market analysis, products or services, marketing and sales strategy, management and team, financial projections, and funding requirements.

Can a business plan help secure funding for my business?

Yes, a well-crafted business plan demonstrates your business’s viability, the use of investment, and potential returns, making it a valuable tool for attracting investors and lenders.

Quick Links

- Investor Business Plans

- M&A Business Plan

- Private Placement

- Feasibility Study

- Hire a Business Plan Writer

- Business Valuation Calculator

- Business Plan Examples

- Real Estate Business Plan

- Business Plan Template

- Business Plan Pricing Guide

- Business Plan Makeover

- SBA Loans, Bank Funding & Business Credit

- Finding & Qualifying for Business Grants

- Leadership for the New Manager

- Content Marketing for Beginners

- All About Crowdfunding

- EB-5 Regional Centers, A Step-By-Step Guide

- Logo Designer

- Landing Page

- PPC Advertising

- Business Entity

- Business Licensing

- Virtual Assistant

- Business Phone

- Business Address

- E-1 Visa Business Plan

- EB1-A Visa Business Plan

- EB1-C Visa Business Plan

- EB2-NIW Business Plan

- H1B Visa Business Plan

- O1 Visa Business Plan

- Business Brokers

- Merger & Acquisition Advisors

- Franchisors

Proud Sponsor of

- 1-800-496-1056

- (613) 800-0227

- +44 (1549) 409190

- +61 (2) 72510077

| You might be using an unsupported or outdated browser. To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website. |

How To Write A Business Plan (2024 Guide)

Updated: Apr 17, 2024, 11:59am

Table of Contents

Brainstorm an executive summary, create a company description, brainstorm your business goals, describe your services or products, conduct market research, create financial plans, bottom line, frequently asked questions.

Every business starts with a vision, which is distilled and communicated through a business plan. In addition to your high-level hopes and dreams, a strong business plan outlines short-term and long-term goals, budget and whatever else you might need to get started. In this guide, we’ll walk you through how to write a business plan that you can stick to and help guide your operations as you get started.

Featured Partners

ZenBusiness

$0 + State Fees

Varies By State & Package

On ZenBusiness' Website

On LegalZoom's Website

Northwest Registered Agent

$39 + State Fees

On Northwest Registered Agent's Website

$0 + State Fee

On Formations' Website

Drafting the Summary

An executive summary is an extremely important first step in your business. You have to be able to put the basic facts of your business in an elevator pitch-style sentence to grab investors’ attention and keep their interest. This should communicate your business’s name, what the products or services you’re selling are and what marketplace you’re entering.

Ask for Help

When drafting the executive summary, you should have a few different options. Enlist a few thought partners to review your executive summary possibilities to determine which one is best.

After you have the executive summary in place, you can work on the company description, which contains more specific information. In the description, you’ll need to include your business’s registered name , your business address and any key employees involved in the business.

The business description should also include the structure of your business, such as sole proprietorship , limited liability company (LLC) , partnership or corporation. This is the time to specify how much of an ownership stake everyone has in the company. Finally, include a section that outlines the history of the company and how it has evolved over time.

Wherever you are on the business journey, you return to your goals and assess where you are in meeting your in-progress targets and setting new goals to work toward.

Numbers-based Goals

Goals can cover a variety of sections of your business. Financial and profit goals are a given for when you’re establishing your business, but there are other goals to take into account as well with regard to brand awareness and growth. For example, you might want to hit a certain number of followers across social channels or raise your engagement rates.

Another goal could be to attract new investors or find grants if you’re a nonprofit business. If you’re looking to grow, you’ll want to set revenue targets to make that happen as well.

Intangible Goals

Goals unrelated to traceable numbers are important as well. These can include seeing your business’s advertisement reach the general public or receiving a terrific client review. These goals are important for the direction you take your business and the direction you want it to go in the future.

The business plan should have a section that explains the services or products that you’re offering. This is the part where you can also describe how they fit in the current market or are providing something necessary or entirely new. If you have any patents or trademarks, this is where you can include those too.

If you have any visual aids, they should be included here as well. This would also be a good place to include pricing strategy and explain your materials.

This is the part of the business plan where you can explain your expertise and different approach in greater depth. Show how what you’re offering is vital to the market and fills an important gap.

You can also situate your business in your industry and compare it to other ones and how you have a competitive advantage in the marketplace.

Other than financial goals, you want to have a budget and set your planned weekly, monthly and annual spending. There are several different costs to consider, such as operational costs.

Business Operations Costs

Rent for your business is the first big cost to factor into your budget. If your business is remote, the cost that replaces rent will be the software that maintains your virtual operations.

Marketing and sales costs should be next on your list. Devoting money to making sure people know about your business is as important as making sure it functions.

Other Costs

Although you can’t anticipate disasters, there are likely to be unanticipated costs that come up at some point in your business’s existence. It’s important to factor these possible costs into your financial plans so you’re not caught totally unaware.

Business plans are important for businesses of all sizes so that you can define where your business is and where you want it to go. Growing your business requires a vision, and giving yourself a roadmap in the form of a business plan will set you up for success.

How do I write a simple business plan?

When you’re working on a business plan, make sure you have as much information as possible so that you can simplify it to the most relevant information. A simple business plan still needs all of the parts included in this article, but you can be very clear and direct.

What are some common mistakes in a business plan?

The most common mistakes in a business plan are common writing issues like grammar errors or misspellings. It’s important to be clear in your sentence structure and proofread your business plan before sending it to any investors or partners.

What basic items should be included in a business plan?

When writing out a business plan, you want to make sure that you cover everything related to your concept for the business, an analysis of the industry―including potential customers and an overview of the market for your goods or services―how you plan to execute your vision for the business, how you plan to grow the business if it becomes successful and all financial data around the business, including current cash on hand, potential investors and budget plans for the next few years.

- Best VPN Services

- Best Project Management Software

- Best Web Hosting Services

- Best Antivirus Software

- Best LLC Services

- Best POS Systems

- Best Business VOIP Services

- Best Credit Card Processing Companies

- Best CRM Software for Small Business

- Best Fleet Management Software

- Best Business Credit Cards

- Best Business Loans

- Best Business Software

- Best Business Apps

- Best Free Software For Business

- How to Start a Business

- How To Make A Small Business Website

- How To Trademark A Name

- What Is An LLC?

- How To Set Up An LLC In 7 Steps

- What is Project Management?

Best West Virginia Registered Agent Services Of 2024

Best Vermont Registered Agent Services Of 2024

Best Rhode Island Registered Agent Services Of 2024

Best Wisconsin Registered Agent Services Of 2024

Best South Dakota Registered Agent Services Of 2024

B2B Marketing In 2024: The Ultimate Guide

Julia is a writer in New York and started covering tech and business during the pandemic. She also covers books and the publishing industry.

Plan Your Business

A well-written business plan is your path to a successful business. Learn to write, use, and improve your business plan with exclusive guides, templates, and examples.

What is a business plan?

- Types of plans

- How to write

Industry business plans

Explore Topics

How to Write a Business Plan

Noah Parsons

May. 7, 2024

Learn to write a detailed business plan that will impress investors and lenders—and provide a foundation to start, run, and grow a successful business.

Jun. 14, 2024

Jun. 9, 2024

May. 11, 2024

Free Download

Business Plan Template

A lender-approved fill-in-the-blanks resource crafted by business planning experts to help you write a great business plan.

Simple Business Plan Outline

Follow this detailed outline for a business plan to understand what the structure, details, and depth of a complete plan looks like.

550+ Sample Business Plans

Explore our industry-specific business plan examples to understand what details should be in your own plan.

How to Write a Nonprofit Business Plan

Angelique O'Rourke

May. 10, 2024

While a nonprofit business plan isn’t all that different from a traditional plan—there are unique considerations around fundraising, partnerships, and promotions that must be made.

How to Write a One-Page Business Plan

Jan. 30, 2024

How to Write a Franchise Business Plan + Template

Elon Glucklich

Feb. 7, 2024

New to business planning? Start here

What should i include in my business plan.

You must have an executive summary, product/service description, market and competitive analysis, marketing and sales plan, operations overview, milestones, company overview, financial plan, and appendix.

Why should I write a business plan?

Businesses that write a business plan typically grow 30% faster because it helps them minimize risk, establish important milestones, track progress, and make more confident decisions.

What are the qualities of a good business plan?

A good business plan uses clear language, shows realistic goals, fits the needs of your business, and highlights any assumptions you’re making.

How long should my business plan be?

There is no target length for a business plan. It should be as long as you need it to be. A good rule of thumb is to go as short as possible, without missing any crucial information. You can always expand your business plan later.

How do I write a simple business plan?

Use a one-page business plan format to create a simple business plan. It includes all of the critical sections of a traditional business plan but can be completed in as little as 30 minutes.

What should I do before writing a business plan?

If you do anything before writing—figure out why you’re writing a business plan. You’ll save time and create a far more useful plan.

What is the first step in writing a business plan?

The first thing you’ll do when writing a business plan is describe the problem you’re solving and what your solution is.

What is the biggest mistake I can make when writing a business plan?

The worst thing you can do is not plan at all. You’ll miss potential issues and opportunities and struggle to make strategic decisions.

Business planning guides

Learn what a business plan is, why you need one, when to write it, and the fundamental elements that make it a unique tool for business success.

Types of business plans

Explore different business plan formats and determine which type best suits your needs.

How to write a business plan

A step-by-step guide to quickly create a working business plan.

Tips to write your business plan

A curated selection of business plan writing tips and best practices from our experienced in-house planning experts.

Explore industry-specific guides to learn what to focus on when writing your business plan.

Business planning FAQ

What is business planning?

Business planning is the act of sitting down to establish goals, strategies, and actions you intend to take to successfully start, manage, and grow a business.

What are the 7 steps of a business plan?

The seven steps to write a business plan include:

- Craft a brief executive summary

- Describe your products and services

- Conduct market research and compile data into a market analysis

- Describe your marketing and sales strategy

- Outline your organizational structure and management team

- Develop financial projections for sales, revenue, and cash flow

- Add additional documents to your appendix

What should a business plan include?

A traditional business plan should include:

- An executive summary

- Description of your products and services

- Market analysis

- Competitive analysis

- Marketing and sales plan

- Overview of business operations

- Milestones and metrics

- Description of your organization and management team

- Financial plan and forecasts

Do you really need a business plan?

You are more likely to start and grow into a successful business if you write a business plan.

A business plan helps you understand where you want to go with your business and what it will take to get there. It reduces your overall risk, helps you uncover your business’s potential, attracts investors, and identifies areas for growth.

Having a business plan ultimately makes you more confident as a business owner and more likely to succeed for a longer period of time.

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

- Starting a Business

- Growing a Business

- Small Business Guide

- Business News

- Science & Technology

- Money & Finance

- For Subscribers

- Write for Entrepreneur

- Tips White Papers

- Entrepreneur Store

- United States

- Asia Pacific

- Middle East

- South Africa

Copyright © 2024 Entrepreneur Media, LLC All rights reserved. Entrepreneur® and its related marks are registered trademarks of Entrepreneur Media LLC

Business Plan

By Entrepreneur Staff

Business Plan Definition:

A written document describing the nature of the business, the sales and marketing strategy, and the financial background, and containing a projected profit and loss statement

A business plan is also a road map that provides directions so a business can plan its future and helps it avoid bumps in the road. The time you spend making your business plan thorough and accurate, and keeping it up-to-date, is an investment that pays big dividends in the long term.

Your business plan should conform to generally accepted guidelines regarding form and content. Each section should include specific elements and address relevant questions that the people who read your plan will most likely ask. Generally, a business plan has the following components:

Title Page and Contents A business plan should be presented in a binder with a cover listing the name of the business, the name(s) of the principal(s), address, phone number, e-mail and website addresses, and the date. You don't have to spend a lot of money on a fancy binder or cover. Your readers want a plan that looks professional, is easy to read and is well-put-together.

Include the same information on the title page. If you have a logo, you can use it, too. A table of contents follows the executive summary or statement of purpose, so that readers can quickly find the information or financial data they need.

Executive Summary The executive summary, or statement of purpose, succinctly encapsulates your reason for writing the business plan. It tells the reader what you want and why, right up front. Are you looking for a $10,000 loan to remodel and refurbish your factory? A loan of $25,000 to expand your product line or buy new equipment? How will you repay your loan, and over what term? Would you like to find a partner to whom you'd sell 25 percent of the business? What's in it for him or her? The questions that pertain to your situation should be addressed here clearly and succinctly.

The summary or statement should be no more than half a page in length and should touch on the following key elements:

- Business concept describes the business, its product, the market it serves and the business' competitive advantage.

- Financial features include financial highlights, such as sales and profits.

- Financial requirements state how much capital is needed for startup or expansion, how it will be used and what collateral is available.

- Current business position furnishes relevant information about the company, its legal form of operation, when it was founded, the principal owners and key personnel.

- Major achievements points out anything noteworthy, such as patents, prototypes, important contracts regarding product development, or results from test marketing that have been conducted.

Description of the Business The business description usually begins with a short explanation of the industry. When describing the industry, discuss what's going on now as well as the outlook for the future. Do the necessary research so you can provide information on all the various markets within the industry, including references to new products or developments that could benefit or hinder your business. Base your observations on reliable data and be sure to footnote and cite your sources of information when necessary. Remember that bankers and investors want to know hard facts--they won't risk money on assumptions or conjecture.

When describing your business, say which sector it falls into (wholesale, retail, food service, manufacturing, hospitality and so on), and whether the business is new or established. Then say whether the business is a sole proprietorship, partnership, C or Sub chapter S corporation. Next, list the business' principals and state what they bring to the business. Continue with information on who the business' customers are, how big the market is, and how the product or service is distributed and marketed.

Description of the Product or Service The business description can be a few paragraphs to a few pages in length, depending on the complexity of your plan. If your plan isn't too complicated, keep your business description short, describing the industry in one paragraph, the product in another, and the business and its success factors in two or three more paragraphs.

When you describe your product or service, make sure your reader has a clear idea of what you're talking about. Explain how people use your product or service and talk about what makes your product or service different from others available in the market. Be specific about what sets your business apart from those of your competitors.

Then explain how your business will gain a competitive edge and why your business will be profitable. Describe the factors you think will make it successful. If your business plan will be used as a financing proposal, explain why the additional equity or debt will make your business more profitable. Give hard facts, such as "new equipment will create an income stream of $10,000 per year" and briefly describe how.

Other information to address here is a description of the experience of the other key people in the business. Whoever reads your business plan will want to know what suppliers or experts you've spoken to about your business and their response to your idea. They may even ask you to clarify your choice of location or reasons for selling this particular product.

Market Analysis A thorough market analysis will help you define your prospects as well as help you establish pricing, distribution, and promotional strategies that will allow your company to be successful vis-à-vis your competition, both in the short and long term.

Begin your market analysis by defining the market in terms of size, demographics, structure, growth prospects, trends, and sales potential. Next, determine how often your product or service will be purchased by your target market. Then figure out the potential annual purchase. Then figure out what percentage of this annual sum you either have or can attain. Keep in mind that no one gets 100 percent market share, and that a something as small as 25 percent is considered a dominant share. Your market share will be a benchmark that tells you how well you're doing in light of your market-planning projections.

You'll also have to describe your positioning strategy. How you differentiate your product or service from that of your competitors and then determine which market niche to fill is called "positioning." Positioning helps establish your product or service's identity within the eyes of the purchaser. A positioning statement for a business plan doesn't have to be long or elaborate, but it does need to point out who your target market is, how you'll reach them, what they're really buying from you, who your competitors are, and what your USP (unique selling proposition) is.

How you price your product or service is perhaps your most important marketing decision. It's also one of the most difficult to make for most small business owners, because there are no instant formulas. Many methods of establishing prices are available to you, but these are among the most common.

- Cost-plus pricing is used mainly by manufacturers to assure that all costs, both fixed and variable, are covered and the desired profit percentage is attained.

- Demand pricing is used by companies that sell their products through a variety of sources at differing prices based on demand.

- Competitive pricing is used by companies that are entering a market where there's already an established price and it's difficult to differentiate one product from another.

- Markup pricing is used mainly by retailers and is calculated by adding your desired profit to the cost of the product.

You'll also have to determine distribution, which includes the entire process of moving the product from the factory to the end user. Make sure to analyze your competitors' distribution channels before deciding whether to use the same type of channel or an alternative that may provide you with a strategic advantage.

Finally, your promotion strategy should include all the ways you communicate with your markets to make them aware of your products or services. To be successful, your promotion strategy should address advertising, packaging, public relations, sales promotions and personal sales.

Competitive Analysis The purpose of the competitive analysis is to determine:

- the strengths and weaknesses of the competitors within your market.

- strategies that will provide you with a distinct advantage.

- barriers that can be developed to prevent competition from entering your market.

- any weaknesses that can be exploited in the product development cycle.

The first step in a competitor analysis is to identify both direct and indirect competition for your business, both now and in the future. Once you've grouped your competitors, start analyzing their marketing strategies and identifying their vulnerable areas by examining their strengths and weaknesses. This will help you determine your distinct competitive advantage.

Whoever reads your business plan should be very clear on who your target market is, what your market niche is, exactly how you'll stand apart from your competitors, and why you'll be successful doing so.

Operations and Management The operations and management component of your plan is designed to describe how the business functions on a continuing basis. The operations plan highlights the logistics of the organization, such as the responsibilities of the management team, the tasks assigned to each division within the company, and capital and expense requirements related to the operations of the business.

Financial Components of Your Business Plan After defining the product, market and operations, the next area to turn your attention to are the three financial statements that form the backbone of your business plan: the income statement, cash flow statement, and balance sheet.

The income statement is a simple and straightforward report on the business' cash-generating ability. It is a scorecard on the financial performance of your business that reflects when sales are made and when expenses are incurred. It draws information from the various financial models developed earlier such as revenue, expenses, capital (in the form of depreciation), and cost of goods. By combining these elements, the income statement illustrates just how much your company makes or loses during the year by subtracting cost of goods and expenses from revenue to arrive at a net result, which is either a profit or loss. In addition to the income statements, include a note analyzing the results. The analysis should be very short, emphasizing the key points of the income statement. Your CPA can help you craft this.

The cash flow statement is one of the most critical information tools for your business, since it shows how much cash you'll need to meet obligations, when you'll require it and where it will come from. The result is the profit or loss at the end of each month and year. The cash flow statement carries both profits and losses over to the next month to also show the cumulative amount. Running a loss on your cash flow statement is a major red flag that indicates not having enough cash to meet expenses-something that demands immediate attention and action.

The cash flow statement should be prepared on a monthly basis during the first year, on a quarterly basis for the second year, and annually for the third year. The following 17 items are listed in the order they need to appear on your cash flow statement. As with the income statement, you'll need to analyze the cash flow statement in a short summary in the business plan. Once again, the analysis doesn't have to be long and should cover highlights only. Ask your CPA for help.

The last financial statement you'll need is a balance sheet. Unlike the previous financial statements, the balance sheet is generated annually for the business plan and is, more or less, a summary of all the preceding financial information broken down into three areas: assets, liabilities and equity.

Balance sheets are used to calculate the net worth of a business or individual by measuring assets against liabilities. If your business plan is for an existing business, the balance sheet from your last reporting period should be included. If the business plan is for a new business, try to project what your assets and liabilities will be over the course of the business plan to determine what equity you may accumulate in the business. To obtain financing for a new business, you'll need to include a personal financial statement or balance sheet.

In the business plan, you'll need to create an analysis for the balance sheet just as you need to do for the income and cash flow statements. The analysis of the balance sheet should be kept short and cover key points.

Supporting Documents In this section, include any other documents that are of interest to your reader, such as your resume; contracts with suppliers, customers, or clients, letters of reference, letters of intent, copy of your lease and any other legal documents, tax returns for the previous three years, and anything else relevant to your business plan.

Some people think you don't need a business plan unless you're trying to borrow money. Of course, it's true that you do need a good plan if you intend to approach a lender--whether a banker, a venture capitalist or any number of other sources--for startup capital. But a business plan is more than a pitch for financing; it's a guide to help you define and meet your business goals.

Just as you wouldn't start off on a cross-country drive without a road map, you should not embark on your new business without a business plan to guide you. A business plan won't automatically make you a success, but it will help you avoid some common causes of business failure, such as under-capitalization or lack of an adequate market.

As you research and prepare your business plan, you'll find weak spots in your business idea that you'll be able to repair. You'll also discover areas with potential you may not have thought about before--and ways to profit from them. Only by putting together a business plan can you decide whether your great idea is really worth your time and investment.

More from Business Plans

Financial projections.

Estimates of the future financial performance of a business

Financial Statement

A written report of the financial condition of a firm. Financial statements include the balance sheet, income statement, statement of changes in net worth and statement of cash flow.

Executive Summary

A nontechnical summary statement at the beginning of a business plan that's designed to encapsulate your reason for writing the plan

Latest Articles

Wells fargo analysts tested 75 bowls at chipotle — and the portion sizes were wildly inconsistent.

Zachary Fadem and a team of analysts ordered the same bowl 75 times at eight different NYC restaurants.

Swae Lee: From McDonald's to McMillions in Entrepreneurship and Records Sold

This podcast is a fun, entertaining and informative show that will teach you how to succeed and achieve your goals with practical advice and actionable steps given through compelling stories and conversations with Clinton and his guests.

Warren Buffett Just Changed Up His Will and Locked Out the Bill & Melinda Gates Foundation

Buffett still donated over nine million Berkshire Hathaway shares to the foundation, but the contributions will only continue during his lifetime.

Home > Business > Business Startup

How To Write a Business Plan

We are committed to sharing unbiased reviews. Some of the links on our site are from our partners who compensate us. Read our editorial guidelines and advertising disclosure .

Starting a business is a wild ride, and a solid business plan can be the key to keeping you on track. A business plan is essentially a roadmap for your business — outlining your goals, strategies, market analysis and financial projections. Not only will it guide your decision-making, a business plan can help you secure funding with a loan or from investors .

Writing a business plan can seem like a huge task, but taking it one step at a time can break the plan down into manageable milestones. Here is our step-by-step guide on how to write a business plan.

Table of contents

- Write your executive summary

- Do your market research homework

- Set your business goals and objectives

- Plan your business strategy

- Describe your product or service

- Crunch the numbers

- Finalize your business plan

By signing up I agree to the Terms of Use and Privacy Policy .

Step 1: Write your executive summary

Though this will be the first page of your business plan , we recommend you actually write the executive summary last. That’s because an executive summary highlights what’s to come in the business plan but in a more condensed fashion.

An executive summary gives stakeholders who are reading your business plan the key points quickly without having to comb through pages and pages. Be sure to cover each successive point in a concise manner, and include as much data as necessary to support your claims.

You’ll cover other things too, but answer these basic questions in your executive summary:

- Idea: What’s your business concept? What problem does your business solve? What are your business goals?

- Product: What’s your product/service and how is it different?

- Market: Who’s your audience? How will you reach customers?

- Finance: How much will your idea cost? And if you’re seeking funding, how much money do you need? How much do you expect to earn? If you’ve already started, where is your revenue at now?

Step 2: Do your market research homework

The next step in writing a business plan is to conduct market research . This involves gathering information about your target market (or customer persona), your competition, and the industry as a whole. You can use a variety of research methods such as surveys, focus groups, and online research to gather this information. Your method may be formal or more casual, just make sure that you’re getting good data back.

This research will help you to understand the needs of your target market and the potential demand for your product or service—essential aspects of starting and growing a successful business.

Step 3: Set your business goals and objectives

Once you’ve completed your market research, you can begin to define your business goals and objectives. What is the problem you want to solve? What’s your vision for the future? Where do you want to be in a year from now?

Use this step to decide what you want to achieve with your business, both in the short and long term. Try to set SMART goals—specific, measurable, achievable, relevant, and time-bound benchmarks—that will help you to stay focused and motivated as you build your business.

Step 4: Plan your business strategy

Your business strategy is how you plan to reach your goals and objectives. This includes details on positioning your product or service, marketing and sales strategies, operational plans, and the organizational structure of your small business.

Make sure to include key roles and responsibilities for each team member if you’re in a business entity with multiple people.

Step 5: Describe your product or service

In this section, get into the nitty-gritty of your product or service. Go into depth regarding the features, benefits, target market, and any patents or proprietary tech you have. Make sure to paint a clear picture of what sets your product apart from the competition—and don’t forget to highlight any customer benefits.

Step 6: Crunch the numbers

Financial analysis is an essential part of your business plan. If you’re already in business that includes your profit and loss statement , cash flow statement and balance sheet .

These financial projections will give investors and lenders an understanding of the financial health of your business and the potential return on investment.

You may want to work with a financial professional to ensure your financial projections are realistic and accurate.

Step 7: Finalize your business plan

Once you’ve completed everything, it's time to finalize your business plan. This involves reviewing and editing your plan to ensure that it is clear, concise, and easy to understand.

You should also have someone else review your plan to get a fresh perspective and identify any areas that may need improvement. You could even work with a free SCORE mentor on your business plan or use a SCORE business plan template for more detailed guidance.

Compare the Top Small-Business Banks

$0.00 | ||||||

$0.00 | ||||||

$0.00 | ||||||

$10.00 (waivable) | ||||||

$0.00 |

Data effective 1/10/23. At publishing time, rates, fees, and requirements are current but are subject to change. Offers may not be available in all areas.

The takeaway

Writing a business plan is an essential process for any forward-thinking entrepreneur or business owner. A business plan requires a lot of up-front research, planning, and attention to detail, but it’s worthwhile. Creating a comprehensive business plan can help you achieve your business goals and secure the funding you need.

Related content

- 5 Best Business Plan Software and Tools in 2023 for Your Small Business

- How to Get a Business License: What You Need to Know

- What Is a Cash Flow Statement?

Best Small Business Loans

5202 W Douglas Corrigan Way Salt Lake City, UT 84116

Accounting & Payroll

Point of Sale

Payment Processing

Inventory Management

Human Resources

Other Services

Best Inventory Management Software

Best Small Business Accounting Software

Best Payroll Software

Best Mobile Credit Card Readers

Best POS Systems

Best Tax Software

Stay updated on the latest products and services anytime anywhere.

By signing up, you agree to our Terms of Use and Privacy Policy .

Disclaimer: The information featured in this article is based on our best estimates of pricing, package details, contract stipulations, and service available at the time of writing. All information is subject to change. Pricing will vary based on various factors, including, but not limited to, the customer’s location, package chosen, added features and equipment, the purchaser’s credit score, etc. For the most accurate information, please ask your customer service representative. Clarify all fees and contract details before signing a contract or finalizing your purchase.

Our mission is to help consumers make informed purchase decisions. While we strive to keep our reviews as unbiased as possible, we do receive affiliate compensation through some of our links. This can affect which services appear on our site and where we rank them. Our affiliate compensation allows us to maintain an ad-free website and provide a free service to our readers. For more information, please see our Privacy Policy Page . |

© Business.org 2024 All Rights Reserved.

Business Plan Example and Template

Learn how to create a business plan

What is a Business Plan?