Asian Financial Crisis

July 1997–december 1998.

On July 2, 1997, Thailand devalued its currency relative to the U.S. dollar. This development, which followed months of speculative pressures that had substantially depleted Thailand’s official foreign exchange reserves, marked the beginning of a deep financial crisis across much of East Asia. In subsequent months, Thailand’s currency, equity, and property markets weakened further as its difficulties evolved into a twin balance-of-payments and banking crisis. Malaysia, the Philippines, and Indonesia also allowed their currencies to weaken substantially in the face of market pressures, with Indonesia gradually falling into a multifaceted financial and political crisis. Hong Kong faced several large but unsuccessful speculative attacks on its currency peg to the dollar, the first of which triggered short-term stock market sell-offs across the globe. And severe balance-of-payments pressures in South Korea brought the country to the brink of default.

Across East Asia, capital inflows slowed or reversed direction, and growth slowed sharply. Banks came under significant pressures, investment rates plunged, and some Asian countries entered deep recessions, producing important spillovers to trading partners across the globe.

The events that came to be known as the Asian Financial Crisis generally caught market participants and policymakers by surprise. While some vulnerabilities were well recognized before the crisis erupted, especially in Thailand, these countries’ economies were also viewed as having many strengths. Indeed, the most affected economies were among the world’s most successful in the decade heading into the crisis. Business-friendly policies and cautious fiscal and monetary management had translated into high rates of savings and investment, supporting GDP growth rates exceeding 5 percent and often approaching 10 percent.

However, as the crisis unfolded, it became clear that the strong growth record of these economies had masked important vulnerabilities. In particular, years of rapid domestic credit growth and inadequate supervisory oversight had resulted in a significant build-up of financial leverage and doubtful loans. Overheating domestic economies and real estate markets added to the risks and led to increased reliance on foreign savings, reflected in mounting current account deficits and a build-up in external debt. Heavy foreign borrowing, often at short maturities, also exposed corporations and banks to significant exchange rate and funding risks—risks that had been masked by longstanding currency pegs. When the pegs proved unsustainable, firms saw sharp increases in the local currency value of their external debts, leading many into distress and even insolvency.

The unfolding crisis in Thailand illustrated how problems in the banking sector could lead to a pullback by foreign investors, setting off a spiral of depreciation, recession, and amplified banking sector weakness. The result was contagion, with foreign creditors pulling back from other countries in the region seen as having similar vulnerabilities. Japan’s deteriorating economic and financial situation also played a role, with Japanese banks—formerly an important source of credit—pulling back from lending activity in the region. In the face of these pressures, foreign exchange intervention often proved counterproductive, with some countries depleting the bulk of their official reserves and suffering even larger subsequent depreciations.

In response to the spreading crisis, the international community mobilized large loans totaling $118 billion for Thailand, Indonesia, and South Korea, and took other actions to stabilize the most affected countries. Financial support came from the International Monetary Fund, the World Bank, the Asian Development Bank, and governments in the Asia-Pacific region, Europe, and the United States. The basic strategy was to help the crisis countries rebuild official reserve cushions, and buy time for policy adjustments to restore confidence and stabilize economies, while also minimizing lasting disruption to countries’ relations with their external creditors.

To address the structural weaknesses exposed by the crisis, aid was contingent on substantial domestic policy reforms. The mix of policies varied by country, but generally included measures to deleverage, clean up and strengthen weak financial systems, and to improve the competitiveness and flexibility of their economies. On the macro side, countries hiked interest rates to help stabilize currencies and tightened fiscal policy to speed external adjustment and cover the cost of bank clean-ups. However, over time, as markets began to stabilize, the macro policy mix evolved to include some loosening of fiscal and interest rate policy to support growth.

The Federal Reserve played an active role in informing and supporting the U.S. and global policy responses. Behind the scenes, the Federal Reserve provided timely analysis of the underlying adjustment challenges and closely monitored the risks the crisis posed to U.S. banks, and the condition and funding profiles of Asian bank offices in the United States, coordinating policy with other bank supervisors in the United States and internationally. The Fed also acted as an agent for the U.S. Treasury, including by helping arrange a bridge loan for Thailand in the early stages of the crisis.

Perhaps most visibly, the Federal Reserve played a catalytic role in an official sector effort to encourage banks to act in their collective self interest in helping South Korea avoid a disorderly default. Following a meeting on December 24, 1997, hosted by the Federal Reserve Bank of New York, U.S. banks with the largest exposures to South Korean banks voluntarily committed to roll over their short-term loans, and to work with South Korean authorities to restructure them into medium-term loans. Similar meetings and other forms of outreach took place in other G-10 countries. In the ensuing months, the Federal Reserve and other central banks oversaw banks’ cooperation with their rollover commitments, pending completion of the restructuring in April 1998.

The combination of strong policy measures by the affected countries and external support from the international community ultimately contained the crisis and set the stage for a subsequent strong recovery.

For the United States, the adverse direct trade impact resulting from the Asian crisis proved manageable, and was partly offset by some other more positive spillovers, including reduced inflation pressures (from cheaper Asian imports and weaker global commodity prices) and lower bond yields (from a flight to dollar assets). The adverse fallout for some other countries was more substantial. In particular, a number of emerging market economies in Latin America and Eastern Europe, including Brazil and Russia, faced significant balance-of-payments pressures in 1998, reflecting spillovers from the Asia crisis as well as home grown vulnerabilities, some of which were quite different from those at the heart of Asia’s crisis.

Bibliography

Board of Governors of the Federal Reserve System. “FOMC: Transcripts and Other Historical Materials, 1997.” Last updated August 2, 2013, http://www.federalreserve.gov/monetarypolicy/fomchistorical1997.htm .

Board of Governors of the Federal Reserve System. “FOMC: Transcripts and Other Historical Materials, 1998.” Last updated August 2, 2013, http://www.federalreserve.gov/monetarypolicy/fomchistorical1998.htm .

Boughton, James. Tearing Down Walls: The International Monetary Fund, 1990 – 1999 . Washington, DC: International Monetary Fund, 2012.

Blustein, Paul. The Chastening: Inside the Crisis that Rocked the Global Financial System and Humbled the IMF . New York: PublicAffairs, 2001.

Corsetti, Giancarlo, Paolo Pesenti, and Nouriel Roubini, “What Caused the Asian Currency and Financial Crisis? Part I: A Macroeconomic Overview,” NBER Working Paper 6833, National Bureau of Economic Research, Cambridge, MA, 1998.

Corsetti, Giancarlo, Paolo Pesenti, and Nouriel Roubini, “What Caused the Asian Currency and Financial Crisis? Part II: The Policy Debate,” NBER Working Paper 6834, National Bureau of Economic Research, Cambridge, MA, 1998.

Fischer, Stanley. IMF Essays from a Time of Crisis: The International Financial System, Stabilization, and Development . Cambridge: MIT Press, 2004.

Rhodes, William. Banker to the World: Leadership Lessons from the Front Lines of Global Finance . New York: McGraw–Hill, 2011.

Rubin, Robert, and Jacob Weisberg. In An Uncertain World: Tough Choices from Wall Street to Washington . New York: Random House, 2003.

Written as of November 22, 2013. See disclaimer .

Related Essays

- The Great Moderation

- Latin American Debt Crisis of the 1980s

Federal Reserve History

Could We Have Learned from the Asian Financial Crisis of 1997-98?

Galina Hale

Download PDF (61 KB)

FRBSF Economic Letter 2011-06 | February 28, 2011

Economists drew a number of lessons from the Asian financial crisis of 1997-98 for preventing such episodes or mitigating their effects. Some of those are similar to lessons drawn from the global financial crisis of 2007-09. But differences in economic development and sophistication of the financial systems of East Asian countries compared with those of the United States and Western Europe made it difficult to apply the lessons of the earlier crisis.

The recent global financial crisis caught many by surprise and prompted economists to look again at past crises going back to the Great Depression and even further. In their 2009 book, Carmen Reinhart and Kenneth Rogoff demonstrated that the U.S. subprime financial crisis was not unique, but rather fit well with historical patterns of financial market booms and busts around the world. In this and other work, they also showed that lessons from past crises could have helped soften the impact of the recent crisis. However, these lessons were formulated after the onset of the 2007–09 crisis, with the benefit of hindsight based on the most recent experience.

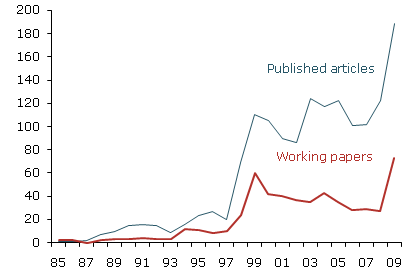

Figure 1 Academic research on international crises

Source: Econlit. Numbers represent the number of items found when searching for “(crisis (or) crash) and (international).”

Not surprisingly, each major economic crisis reenergizes academic literature on the subject of crises. Figure 1 shows the number of academic publications and working papers on international crises from 1985 to 2009. The literature during this period focused on crisis prevention and management, and aimed at drawing lessons that would help avoid or soften the effects of similar crises in the future. The goals of such research were, first, to improve the models designed to predict imminent crises, and, second, to develop policies to minimize losses, speed up recovery, and minimize the susceptibility of a country to crisis, whether it originates internally or spreads through financial and goods markets. Rose and Spiegel (2009), however, show that the recent global financial crisis was hard to predict using early warning models based on the experiences of past crises.

This Economic Letter takes a step back in time and looks at the lessons drawn in the literature written in the aftermath of the Asian financial crisis of 1997–98, the most serious predecessor in recent decades of the current crisis. The Letter examines why those lessons might not be applicable to developed economies. It focuses on policies that, following the Asian financial crises, were thought to prevent similar crises, or at least mitigate their economic effects and speed up recovery. The Letter argues that, despite many similarities between the Asian financial crisis and the recent global financial crisis, there were also important differences. Those largely had to do with differences in the economies and financial systems of the emerging market countries of East Asia prior to 1997 and those of the United States and developed nations of Western Europe before 2007. Those differences explain why recommendations made to Asian countries following the 1997–98 crisis did not lead to major banking and financial regulatory reform in the developed world.

Asian financial crisis of 1997–98

The following is a brief overview of the Asian financial crisis of 1997–98. A summary of other emerging market crises and comparisons with the Asian crisis can be found in Dornbusch (2001).

Prior to the Asian financial crisis, most East Asian countries fixed their exchange rates to the U.S. dollar and ran current account deficits, which subjected their currencies to downward pressure. At the same time, private banks and large nonfinancial companies in these countries were borrowing large amounts, predominantly in dollars, from foreign banks. As became apparent when the crisis unfolded, East Asian governments implicitly guaranteed these loans. Meanwhile, domestic banks were lending to domestic companies in local currencies. Some corporations in those countries borrowed predominantly in dollars directly from abroad, but collected large shares of their revenue in domestic currency from domestic sales. As a result, borrowers accumulated large currency mismatches on their balance sheets. Their liabilities were mostly denominated in dollars, while their assets were, to a large extent, denominated in domestic currency.

East Asian financial systems were subject to two additional risk factors: maturity mismatches due to liabilities that were predominantly short-term and assets that were much longer term or illiquid, and excessive risk taking. Credit was available from abroad cheaply and in large quantities because of the implicit government guarantees. Banks were running out of low-risk projects to lend to and increasingly were financing riskier projects, thanks to an international lending boom and easy access to credit from abroad.

The date of the onset of the Asian financial crisis can be fixed precisely. On July 2, 1997, speculators attacked the Thai baht by selling off baht-denominated assets. Simultaneously, foreign investors withdrew dollar-denominated loans to Thai institutions. The Thai government was forced to let go of its currency peg. The baht plunged 16% on the day of the attack and lost over 50% of its value by January 1998. In the months that followed, other East Asian countries experienced similar debacles. Financial contagion spread through the region so fast that it was nicknamed the “Asian flu.” Only Hong Kong and China were able to maintain their currency pegs. The Hong Kong Monetary Authority intervened directly in the stock market, while China imposed capital controls.

Because of currency mismatches, bank and corporate balance sheets were under tremendous pressure as asset values declined dramatically relative to liabilities. To make matters worse, amid the speculative attacks, bank access to overseas credit dried up as foreign investors executed a flight to quality. Many overseas bank loans had relatively short maturities and banks were unable to roll them over as they had previously. In short, East Asian countries experienced severe banking crises. Nonperforming loan ratios skyrocketed because of prior excessive risk taking, and most banks had to be recapitalized by their governments. Before the crisis, most governments in the region had balanced or nearly balanced budgets. But the fiscal costs of bank recapitalization led to big deficits, forcing governments to seek funds from the International Monetary Fund (IMF).

Lessons for crisis prevention

The Asian financial crisis came as a surprise to policymakers, investors, and academics alike. Yet, in hindsight, many agreed not only that the crisis could have been expected, but also that, to a great extent, it might have been avoided.

Investors and policymakers missed some warning signs of unsustainable lending booms, such as high corporate debt-to-equity ratios. In 1996, those ratios were respectively 310% in Indonesia and 518% in Korea. High ratios of short-term debt to central bank reserves, an important measure of a country’s overall external foreign currency liquidity, were another red flag. In 1996, this ratio was 177% in Indonesia and 193% in Korea. However, some symptoms common in previous crises, such as excessive current account and budget deficits, were missing. Importantly, prior to the Asian financial crisis, early warning systems focused on government external finances and ignored private debt stocks that could become public liabilities because of implicit guarantees. For these reasons, the early warning systems did not sound alarms.

Economists formulated a number of policy recommendations aimed at preventing a repetition of Asian-flu-type crises (see Eichengreen 1999, Mishkin 1999, Rogoff 1999, and Roubini 2000). Bank regulators were encouraged to require greater transparency and supervise lending activity more strictly, paying particular attention to currency and maturity mismatches. Some scholars urged that highly leveraged institutions be required to improve risk assessment and reduce leverage ratios. Some argued for capital controls to lengthen the maturity and alter the composition of foreign capital inflows so that more investment came in as equity and less as debt. An international lender of last resort was needed to resolve crises, economists said, questioning whether the IMF could fulfill this role given its limited funds. Economists also called for private-sector contingent credit lines to manage liquidity problems. Private-sector involvement in crisis resolution was held to be vital, given the enormous volume of international capital flows.

Have we learned the lessons?

An informed reader may notice parallels between the lessons drawn from the Asian crisis and the current discussion of policies aimed at preventing a repetition of the global financial crisis of 2007–09. Does that mean that the lessons of the Asian crisis were ignored? Was it believed that those lessons didn’t apply to developed countries? Despite many similarities between the Asian financial crisis and the recent global crisis, there were many important differences between the economies and financial systems of the emerging markets of East Asia prior to 1997 and those of the United States and Western Europe before 2007. These differences may have led policymakers to conclude that an Asian-flu-type crisis was unlikely in the developed world.

First and foremost, financial markets in the developed world were much more mature and regulation stricter than in Asian countries. Regulatory changes proposed for Asian economies were designed to make financial and banking regulation more like that in the developed world. Specifically, the proposals were intended to align regulation with the core principles of banking supervision as practiced in the G-10 countries. For example, economists recommended that East Asian banks bring their capital ratios in line with the Basel Accord levels adopted in the developed world. In short, developed world financial markets were in much better shape in 2007 than financial markets in East Asia prior to the Asian crises.

A second set of differences stems from the fact that mature financial markets that had been through the Great Depression and the collapse of the Bretton Woods global monetary system were much more resilient to shocks, due to their depth and sophistication, and their supervisory and insurance systems. Developed world financial systems were thought to be able to function safely with less oversight and more leverage. However, as we have learned, reduced oversight and high leverage tend to reduce transparency.

Third, developed world financial systems had proved to be capable of rebounding from external one-time shocks. The Russia/Long-Term Capital Management crisis of the fall of 1998 and the September 11, 2001, terrorist attacks are two cases in point. These events precipitated large temporary declines in asset prices, especially in the United States. But they did not grow into widespread financial market freezes like the one that occurred in the fall of 2008 after the collapse of the investment bank Lehman Brothers.

The differences between the economies and financial systems of East Asia in 1997 and the United States and Western Europe in 2007 were genuine and important. Developed world financial markets were more mature, more sophisticated, and better supervised than markets in East Asia. Yet, despite these differences, the developed world also turned out to be vulnerable to financial crisis. Global financial integration increased dramatically in the decade preceding the 2007–09 crisis (Lane and Milesi-Ferretti 2008), creating channels for the rapid spread of financial contagion throughout the developed world.

Lessons learned from the Asian financial crisis of 1997–98, such as the dangers of high leverage ratios and credit growth, appear to be similar to the ones that emerged in the post-2007–09 policy debate. However, differences in economic development and sophistication of the financial systems of East Asian countries compared with those of the United States and Western Europe led policymakers in the advanced economies to believe that the lessons of the earlier crisis did not apply to them. Moreover, it turned out that mature financial markets were not as resilient to shocks as we thought they were prior to 2007.

Galina Hale is a senior economist at the Federal Reserve Bank of San Francisco.

Dornbusch, Rudiger. 2001. “A Primer on Emerging Market Crises.” NBER Working Paper 8326.

Eichengreen, Barry. 1999. Toward a New International Financial Architecture: A Practical Post-Asia Agenda . Washington, DC: Institute for International Economics.

Lane, Philip R., and Gian Maria Milesi-Ferretti. 2008. “The Drivers of Financial Globalization.” American Economic Review 98(2, May), pp. 327–332.

Mishkin, Frederic. 1999. “Lessons from the Asian Crisis.” Journal of International Money and Finance 18, pp. 709–723.

Reinhart, Carmen M., and Kenneth S. Rogoff. 2009. This Time Is Different: Eight Centuries of Financial Folly . Princeton, NJ: Princeton University Press.

Rogoff, Kenneth. 1999. “International Institutions for Reducing Global Financial Instability.” Journal of Economic Perspectives 13(4), pp. 21–42.

Rose, Andrew K., and Mark M. Spiegel. 2009. “Predicting Crises, Part II: Did Anything Matter (to Everybody)?” FRBSF Economic Letter 2009-30 (September 28).

Roubini N. 2000. “Bail-in, Burden Sharing, and Private Sector Involvement in Crisis Resolution.” Unpublished manuscript (September).

Opinions expressed in FRBSF Economic Letter do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System. This publication is edited by Anita Todd and Karen Barnes. Permission to reprint portions of articles or whole articles must be obtained in writing. Please send editorial comments and requests for reprint permission to [email protected]

Three Major Financial Crises: What Have We Learned

Forthcoming in S. Schwarcz, E. Avgouleas, D. Busch & D. Arner (eds), Systemic Risk in the Financial Sector: Ten Years After the Great Crash (Centre for International Governance Innovation 2019 forthcoming).

AIIFL Working Paper No. 31

UNSW Law Research Paper No. 18-61

University of Hong Kong Faculty of Law Research Paper No. 2019/041

37 Pages Posted: 11 Sep 2018 Last revised: 17 Sep 2019

Ross P. Buckley

University of New South Wales (UNSW) - UNSW Law & Justice

Emilios Avgouleas

University of Edinburgh - School of Law

Douglas W. Arner

The University of Hong Kong; The University of Hong Kong - Faculty of Law

Date Written: January 1, 2018

Few experts predicted the Asian Financial Crisis of 1997-1998, or the Global Financial Crisis of 2008 and its close companion the Eurozone Debt Crisis of 2010, and we certainly do not pretend to be able to predict the next one. Yet history teaches there will be another crisis and probably sooner rather than later, and, of course, in the decade since the start of the Global Financial Crisis, the Eurozone crisis has been ongoing in many of its dimensions. Fragility that periodically erupts into a full blown financial crisis appears to be an integral feature of market-based financial systems in spite of the advent of sophisticated risk management tools and regulatory systems. If anything the increased frequency of modern crises since the collapse of the Bretton Woods international monetary system and the period of financial internationalization and globalization which has followed, underscores how difficult it is to prevent and deal with systemic risk. We thus seek to compare and contrast these three major crises both to distill the lessons to be learned, and to identify what more can be done to strengthen our financial systems. The following sections will provide an overview of each crisis in turn, considering in particular (i) its causes; (ii) the effectiveness of policy responses; and (iii) the lessons. In the conclusion we seek to draw some common themes from these experiences going forward.

Keywords: Asian Financial Crisis, Global Financial Crisis, GFC, Eurozone Debt Crisis, Bretton Woods, financial internationalization, globalization, risk management tools, regulatory systems

Suggested Citation: Suggested Citation

Ross P. Buckley (Contact Author)

University of new south wales (unsw) - unsw law & justice ( email ).

Sydney, New South Wales 2052 Australia

University of Edinburgh - School of Law ( email )

Old College South Bridge Edinburgh, EH8 9YL United Kingdom

The University of Hong Kong ( email )

Pokfulam Road Hong Kong, Pokfulam HK China

The University of Hong Kong - Faculty of Law ( email )

Pokfulam Road Hong Kong, Hong Kong China

HOME PAGE: http://hub.hku.hk/rp/rp01237

Do you have a job opening that you would like to promote on SSRN?

Paper statistics, related ejournals, university of hong kong faculty of law legal studies research paper series.

Subscribe to this free journal for more curated articles on this topic

UNSW Law & Justice Legal Studies Research Paper Series

Behavioral & experimental finance (editor's choice) ejournal, financial crises ejournal.

Subscribe to this journal for more curated articles on this topic

Bankruptcy, Reorganization & Creditors eJournal

Subscribe to this fee journal for more curated articles on this topic

Regulation of Financial Institutions eJournal

European economics: political economy & public economics ejournal, international finance ejournal, history of finance ejournal, monetary economics: international financial flows, financial crises, regulation & supervision ejournal, risk, regulation, & policy ejournal, compliance & risk management ejournal, international political economy: investment & finance ejournal, international political economy: monetary relations ejournal.

The Onset of the East Asian Financial Crisis

MARC RIS BibTeΧ

Download Citation Data

- Comment on "The Onset of the East Asian Financial Crisis"

Published From Paper

More from nber.

In addition to working papers , the NBER disseminates affiliates’ latest findings through a range of free periodicals — the NBER Reporter , the NBER Digest , the Bulletin on Retirement and Disability , the Bulletin on Health , and the Bulletin on Entrepreneurship — as well as online conference reports , video lectures , and interviews .

Academia.edu no longer supports Internet Explorer.

To browse Academia.edu and the wider internet faster and more securely, please take a few seconds to upgrade your browser .

- We're Hiring!

- Help Center

Asian Financial Crisis

- Most Cited Papers

- Most Downloaded Papers

- Newest Papers

- Last »

- East Asia Study Group Follow Following

- ASEAN Plus Three Follow Following

- East Asia Vision Group Follow Following

- Level 3 Follow Following

- Occupational Psychology Follow Following

- Service Quality Follow Following

- Services Marketing and Management Follow Following

- ASEAN Follow Following

- Monitoring System Follow Following

- Volatility Follow Following

Enter the email address you signed up with and we'll email you a reset link.

- Academia.edu Journals

- We're Hiring!

- Help Center

- Find new research papers in:

- Health Sciences

- Earth Sciences

- Cognitive Science

- Mathematics

- Computer Science

- Academia ©2024

COMMENTS

PDF | This paper takes a thorough look at the 1997-1998 Asian financial crisis, examining its major causes, the way the affected countries recovered,... | Find, read and cite all the research you ...

This paper tells the story of the Asian financial crisis by addressing four questions: What were the causes of the crisis, how did the crisis unfold, what were the policy responses, and what have been the outcomes? The paper takes the view that none of these questions can be understood without appreciating the fundamental vulnerabilities that left authorities without effective tools to counter ...

the Asian financial crisis of 1997. Although the crisis first began in Thailand, it quickly spread to ... Finally, the paper spells out some policy implications arising out of this research. The paper is organized as follows. Section II critically examines the prevailing view of the Asian currency crisis. Section III presents an alternative ...

DOI 10.3386/w6833. Issue Date December 1998. The paper explores the view that the Asian currency and financial crises in 1997 and 1998 reflected structural and policy distortions in the countries of the region, even if market overreaction and herding caused the plunge of exchange rates, asset prices, and economic activity to be more severe than ...

Steven Radelet & Jeffrey Sachs. Working Paper 6680. DOI 10.3386/w6680. Issue Date August 1998. This paper provides an early diagnosis of the financial crisis in Asia, focusing on the empirical record in the lead-up to the crisis. The main goal is to emphasize the role of financial panic as an essential element of the Asian crisis.

The events that came to be known as the Asian Financial Crisis generally caught market participants and policymakers by surprise. ... Part II: The Policy Debate," NBER Working Paper 6834, National Bureau of Economic Research, Cambridge, MA, 1998. Fischer, Stanley. IMF Essays from a Time of Crisis: The International Financial System ...

This paper takes a thorough look at the 1997-1998 Asian financial crisis, examining its major causes, the way the affected countries recovered, and their paths going forward. View Show abstract

This book provides answers to all the above questions and more, and gives a comprehensive account of how the international economic order operates, examines its strengths and weaknesses, and what needs to be done to fix it. 978-1-84779-057-6. Business. The Asian financial crisis of 1997-98 shook the foundations of the global economy and what ...

The Asian financial crisis underscored the need for new overlapping arrangements capable of better defending the region against future financial instability. The less severe crisis affecting East Asia in 2008, in contrast, has led to a more dispersed and nationally driven institutional response.

This paper offers an explanation of the causes of the crises and, in doing so, provides a critique of the international policy response. It begins with an examination of the way that the crisis exemplifies the terminal collapse of Southeast Asia's fast‐track development model through case studies of Thailand and the Philippines.

The Asian financial crisis of 1997 revealed the region's vulnerability to cross-border capital flows. Banks and corporations had borrowed massively and cheaply in US dollars, often on very short terms. A sudden outflow of foreign capital pushed the region's currencies into a downward spiral, leaving many borrowers insolvent. Governments spent billions in vain attempts to support their ...

DOI 10.3386/w6834. Issue Date December 1998. The paper explores the view that the Asian currency and financial crises in 1997 and 1998 reflected structural and policy distortions in the countries of the region, even if market overreaction and herding caused the plunge of exchange rates, asset prices, and economic activity to be more severe than ...

Academia.edu is a platform for academics to share research papers. The Asian Financial Crisis What Happened and What We Can Learn from It ... The Asian Financial Crisis What Happened and What We Can Learn from It. barry bosworth. 1998, The Brookings Review. See Full PDF Download PDF.

The date of the onset of the Asian financial crisis can be fixed precisely. On July 2, 1997, speculators attacked the Thai baht by selling off baht-denominated assets. Simultaneously, foreign investors withdrew dollar-denominated loans to Thai institutions. The Thai government was forced to let go of its currency peg.

Abstract. This paper provides an early diagnosis of the financial crisis in Asia, focusing on the empirical record in the lead-up to the crisis. The main goal is to emphasize the role of financial panic as an essential element of the Asian crisis. At the core of the crisis were large-scale foreign capital inflows into financial systems that ...

The magnitude and suddenness of the financial reversal are made clear in table 1, which records net capital flows to the five East Asian crisis economies: Indonesia, Korea, Malaysia, the ...

crisis by Asian governments, and poorly designed international rescue programs have led to a much deeper fall in (otherwise viable) output than was either necessary or inevitable. This paper, originally written in early 1998, provides an early diagnosis of the financial crisis in Asia. It builds on existing theories and focuses on

In line with the population and affluence, energy structure also increases the total CO 2 during the study period, except in 1999, 2001, 2006 and 2009. The financial crises of 1990 in Asia possess ...

Devwudfw Wkh sdshu h{soruhv wkh ylhz wkdw wkh Dvldq fxuuhqf| dqg ?qdqfldo fulvhv lq4<<:dqg4<<;uh hfwhgvwuxfwxudodqgsrolf|glvwruwlrqvlqwkhfrxqwulhv

Few experts predicted the Asian Financial Crisis of 1997-1998, or the Global Financial Crisis of 2008 and its close companion the Eurozone Debt Crisis of 2010, and we certainly do not pretend to be able to predict the next one. ... UNSW Law Research Paper No. 18-61, University of Hong Kong Faculty of Law Research Paper No. 2019/041, Available ...

Abstract and Figures. The turmoil that has rocked Asian foreign exchange and equity markets over the past eight months is the third major currency crisis of the 1990s. Its predecessors were the ...

ISBN -226-45462-2. Book: Currency Crises. Book editor: Paul Krugman. PUBLISHER: University of Chicago Press. Download Purchase Book. Download Citation. Comments and Discussions. Published From Paper. The Onset of the East Asian Financial Crisis.

This paper examines why Indonesia had to suffer for ten years when other East Asian countries recover relatively more quick. It will start with describing pre-crisis condition, the Indonesia financial crisis 1997-1998 itself and causes of the crisis which is more likely Indonesia's vulnerability financial system.