Pro Forma Business Plan Template & Financial Statements

Written by Dave Lavinsky

What are Pro Forma Financial statements?

A pro forma business plan is simply another name for a business plan. The term “pro forma” specifically means “based on financial assumptions or projections” which all business plans are. That is, all business plans present a vision of the company’s future using assumptions and projections. “Pro forma” most specifically refers to the financial projections included in your plan, as these are entirely based on future assumptions.

Pro forma financial statements are a type of statement that provides estimates or financial projections for a company. They are often used by businesses to plan for upcoming periods or quarters, assess new opportunities, or track progress against goals.

Why include a Pro Forma Statement in your Business Plan

A pro forma statement is important for your business plan because it gives investors and lenders an idea of your company’s potential financial health. They use your pro forma statements in determining whether to invest in your company or not. Among other things, they consider the likelihood your company will achieve the financial results you forecast, and their expected return on investment (ROI). Your pro forma financial statements also help you to identify and track key financial indicators and metrics over time.

Writing a Pro Forma Business Plan

When writing a pro forma business plan, you will need to include information such as your company’s sales forecasts, expenses, capital expenditure plans, and funding requirements. You should also include a pro forma income statement, balance sheet, and cash flow statement.

Importance of a Pro Forma Income Statement in Business Plans

The pro forma income statement is a crucial financial tool that can be used to assess the viability of your business. It shows a company’s expected revenue and expenses over a period of time and can help you to identify potential problems early on.

Finish Your Business Plan Today!

Types of pro forma statements in business plans.

There are several types of pro forma statements, including the income statement, balance sheet, and cash flow statement.

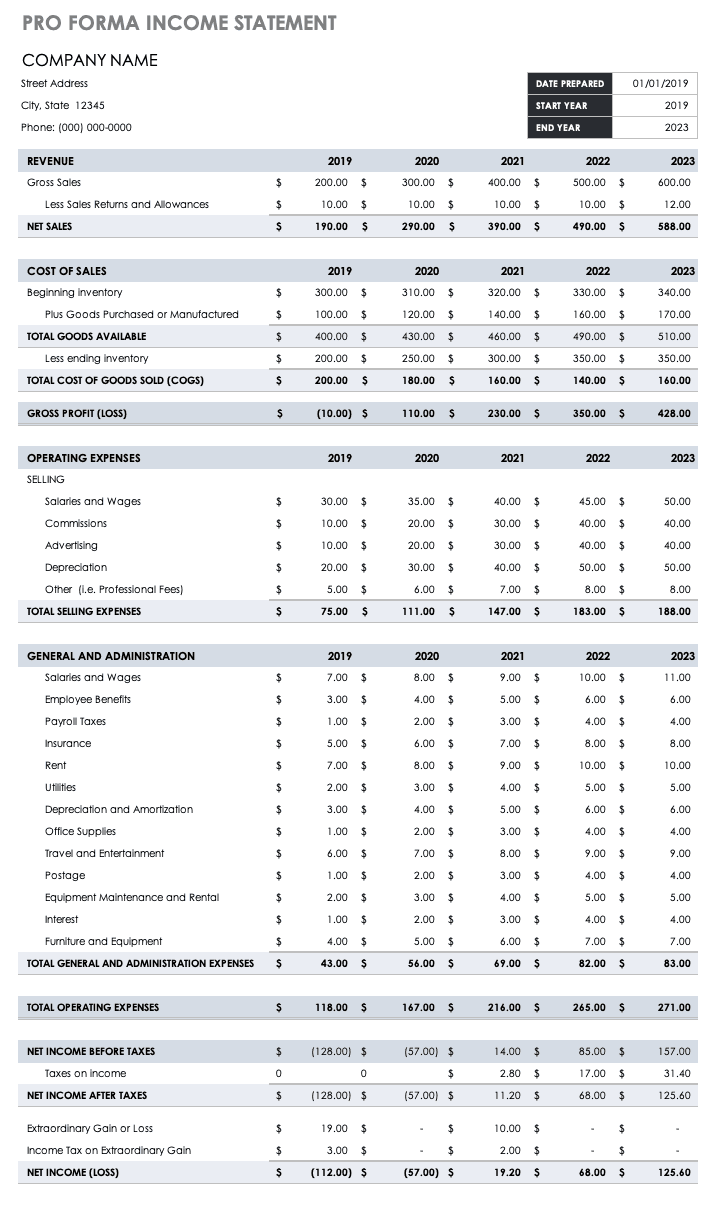

Pro Forma Income Statement

A pro forma income statement is an estimate of your company’s financial performance over a period of time. It shows your expected revenue and expenses and can be used to assess the viability of your business.

Example 5 Year Annual Income Statement

| FY 1 | FY 2 | FY 3 | FY 4 | FY 5 | ||

|---|---|---|---|---|---|---|

| Revenues | ||||||

| Revenues | $342,610 | $374,685 | $409,762 | $448,123 | $490,075 | |

| Direct Costs | ||||||

| Direct Costs | $9,744 | $10,140 | $10,552 | $10,980 | $11,426 | |

| Salaries | $58,251 | $60,018 | $61,839 | $63,715 | $65,648 | |

| Marketing Expenses | $0 | $0 | $0 | $0 | $0 | |

| Rent/Utility Expenses | $0 | $0 | $0 | $0 | $0 | |

| Other Expenses | $12,135 | $12,503 | $12,883 | $13,274 | $13,676 | |

| Depreciation | $6,000 | $6,000 | $6,000 | $6,000 | $6,000 | |

| Amortization | $0 | $0 | $0 | $0 | $0 | |

| Interest Expense | $8,000 | $8,000 | $8,000 | $8,000 | $8,000 | |

| Net Operating Loss | $0 | $0 | $0 | $0 | $0 | |

| Use of Net Operating Loss | $0 | $0 | $0 | $0 | $0 | |

| Taxable Income | $248,478 | $278,022 | $310,487 | $346,152 | $385,323 | |

| Income Tax Expense | $86,967 | $97,307 | $108,670 | $121,153 | $134,863 | |

| Net Profit Margin (%) | 47.1% | 48.2% | 49.3% | 50.2% | 51.1% |

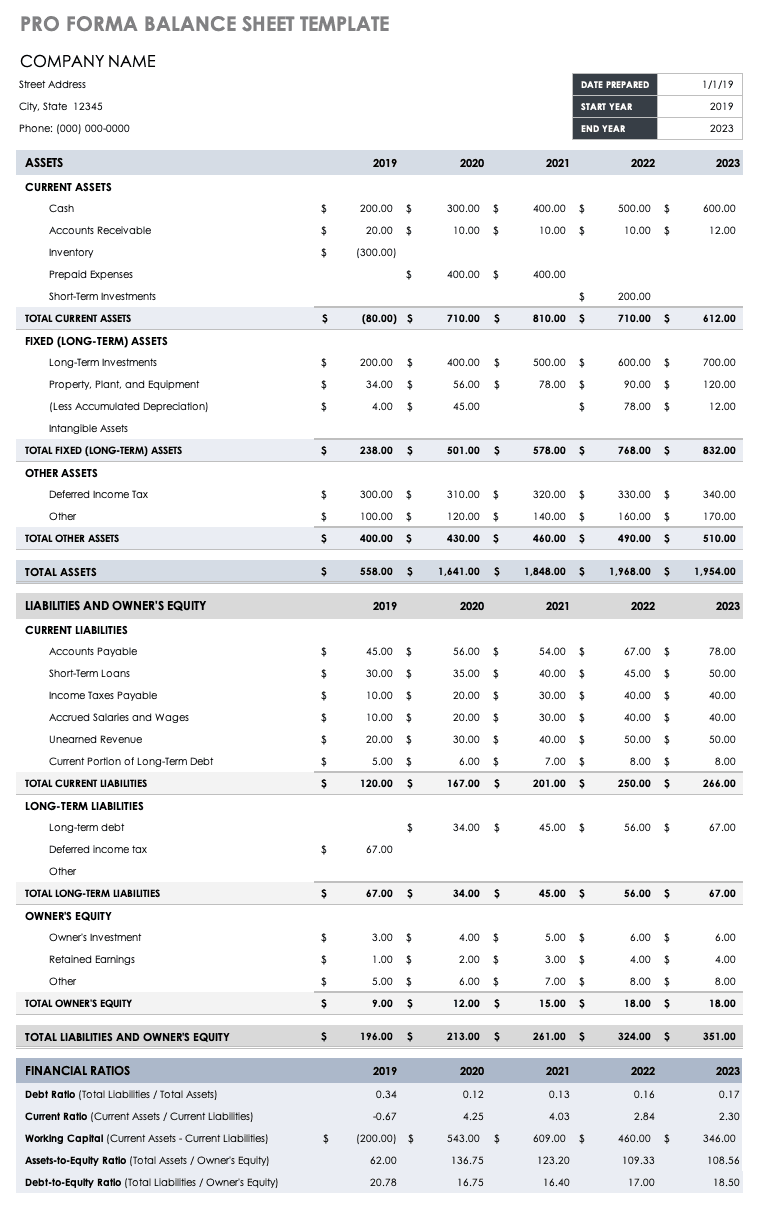

Pro Forma Balance Sheet

A pro forma balance sheet is an estimate of your company’s financial position at a specific point in time. It shows your assets, liabilities, and equity, and can be used to assess your company’s financial health.

Example 5 Year Annual Balance Sheet

| FY 1 | FY 2 | FY 3 | FY 4 | FY 5 | ||

|---|---|---|---|---|---|---|

| Cash | $194,750 | $378,915 | $583,930 | $813,028 | $986,224 | |

| Other Current Assets | $29,516 | $32,279 | $35,301 | $37,343 | $40,839 | |

| Intangible Assets | $0 | $0 | $0 | $0 | $0 | |

| Acc Amortization | $0 | $0 | $0 | $0 | $0 | |

| Fixed Assets | $30,000 | $30,000 | $30,000 | $30,000 | $30,000 | |

| Accum Depreciation | $6,000 | $12,000 | $18,000 | $24,000 | $30,000 | |

| Preliminary Exp | $0 | $0 | $0 | $0 | $0 | |

| Current Liabilities | $6,755 | $6,969 | $7,189 | $7,330 | $7,562 | |

| Debt outstanding | $80,000 | $80,000 | $80,000 | $80,000 | $0 | |

| Share Capital | $0 | $0 | $0 | $0 | $0 | |

| Retained earnings | $161,511 | $342,225 | $544,042 | $769,041 | $1,019,501 | |

Pro Forma Cash Flow Statement

A pro forma cash flow statement is an estimate of how your company’s cash flows over a period of time. It shows your expected cash inflows and outflows and can be used to assess your company’s financial health and ensure you never run out of money.

Example 5 Year Annual Cash Flow Statement

| FY 1 | FY 2 | FY 3 | FY 4 | FY 5 | ||

|---|---|---|---|---|---|---|

| Net Income (Loss) | $161,511 | $180,714 | $201,816 | $224,999 | $250,460 | |

| Change in Working Capital | ($22,760) | ($2,549) | ($2,801) | ($1,900) | ($3,264) | |

| Plus Depreciation | $6,000 | $6,000 | $6,000 | $6,000 | $6,000 | |

| Plus Amortization | $0 | $0 | $0 | $0 | $0 | |

| Fixed Assets | ($30,000) | $0 | $0 | $0 | $0 | |

| Intangible Assets | $0 | $0 | $0 | $0 | $0 | |

| Cash from Equity | $0 | $0 | $0 | $0 | $0 | |

| Cash from Debt financing | $80,000 | $0 | $0 | $0 | ($80,000) | |

| Cash at Beginning of Period | $0 | $194,750 | $378,915 | $583,930 | $813,028 | |

Pro Forma Income Statements for a Business Plan

Pro forma statements for a business plan can take many different forms, but they all typically include information on sales forecasts, expenses, capital expenditure plans, and funding requirements. A pro forma statement that is included in a business plan template should also include financial projections and break-even analysis.

Cash Flow Statements and Pro Forma Income Statements

The main difference between a cash flow statement and a pro forma income statement is that a cash flow statement shows your actual cash inflows and outflows, while a pro forma income statement shows your estimated future financial performance. For example, if you make a sale today, it will be considered revenue in your income statement. But, if you don’t receive payment for that sale for 90 days, that would be reflected in your cash flow statement. A cash flow statement can help you to manage your finances effectively, while a pro forma income statement can help you to assess the viability of your business.

Pro Forma Statements and Budgets

Pro forma statements and budgets are both financial tools that can be used to track the progress of a business. However, there are key differences between them.

A budget is a plan for how you will use your resources to achieve specific goals. It shows your expected income and expenses and can help you to stay on track financially.

A pro forma statement estimates your company’s future financial performance. It shows your expected revenue and expenses and can be used to assess the viability of your business.

Both pro forma statements and budgets can be useful tools for businesses. However, budgets are more focused on short-term planning , while pro forma statements are more concerned with long-term financial planning.

Business Plan Pro Forma Template and Example

The following is an example of a pro forma business plan:

Executive Summary

In this pro forma business plan, we forecasted our company’s sales, expenses, and capital expenditures over the next three years. We also estimated our funding requirements and outlined our plans for growth. Our pro forma income statement shows that we are expected to have positive net income each year of the forecast period. Our pro forma balance sheet shows that we will have a strong financial position, with increasing equity and minimal debt. Lastly, our pro forma statement predicts healthy cash flow throughout the three-year period. We believe that these results demonstrate the viability of our business and its potential for long-term success.

Our company is XYZ, a leading provider of ABC products and services. We have been in business for 10 years, and our products are sold in over 10 countries. We have a strong track record of financial success, and we are now looking to expand our operations into new markets. In order to do this, we need to raise $5 million in funding.

Business Plan Pro Forma

In this section of the business plan, we will provide pro forma statements for our company’s sales, expenses, capital expenditures, funding requirements, and cash flow. These statements will demonstrate the viability of our business and its potential for long-term success.

Sales Forecast

We forecast that our sales will increase by 20% in each year of the forecast period. This growth will be driven by our expansion into new markets, as well as our continued focus on innovation and customer service.

Expense Forecast

We expect our expenses to increase at a slower rate than our sales, due to our economies of scale. We anticipate that our expenses will increase by 15% in Year 1, 10% in Year 2, and 5% in Year 3.

Capital Expenditure Forecast

We forecast that our capital expenditures will increase in line with our sales, at a rate of 20% per year. We plan to invest heavily in research and development, as well as new product launches.

Funding Requirements

We estimate that we will need to raise $5 million in funding in order to expand our operations into new markets. We plan to use this funding to invest in research and development, as well as to cover the costs of marketing and new product launches.

Cash Flow Forecast

Our pro forma cash flow statement predicts healthy cash flow throughout the three-year period. We expect to have positive cash flow in each year of the forecast period.

This pro forma business plan demonstrates the viability of our company and its potential for long-term success. We have a strong track record of financial success, and we are well-positioned to continue growing our business. Our pro forma statements show that we are expected to generate positive net income, and have a strong financial position and healthy cash flow. We believe that this business plan provides a clear roadmap for our company’s future growth.

A pro forma business plan is an important tool for any business owner. By outlining your sales, expenses, and profit, you can get a clear picture of your company’s financial health and make informed decisions about its future. If you’re not sure where to start, we can help. Our team of experts has created a comprehensive business plan template that will guide you through the process of creating your own pro forma business plan. So what are you waiting for? Get started today and ensure your company’s success tomorrow.

How to Finish Your Business Plan Template in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan template?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

- Business Essentials

- Leadership & Management

- Credential of Leadership, Impact, and Management in Business (CLIMB)

- Entrepreneurship & Innovation

- Digital Transformation

- Finance & Accounting

- Business in Society

- For Organizations

- Support Portal

- Media Coverage

- Founding Donors

- Leadership Team

- Harvard Business School →

- HBS Online →

- Business Insights →

Business Insights

Harvard Business School Online's Business Insights Blog provides the career insights you need to achieve your goals and gain confidence in your business skills.

- Career Development

- Communication

- Decision-Making

- Earning Your MBA

- Negotiation

- News & Events

- Productivity

- Staff Spotlight

- Student Profiles

- Work-Life Balance

- AI Essentials for Business

- Alternative Investments

- Business Analytics

- Business Strategy

- Business and Climate Change

- Creating Brand Value

- Design Thinking and Innovation

- Digital Marketing Strategy

- Disruptive Strategy

- Economics for Managers

- Entrepreneurship Essentials

- Financial Accounting

- Global Business

- Launching Tech Ventures

- Leadership Principles

- Leadership, Ethics, and Corporate Accountability

- Leading Change and Organizational Renewal

- Leading with Finance

- Management Essentials

- Negotiation Mastery

- Organizational Leadership

- Power and Influence for Positive Impact

- Strategy Execution

- Sustainable Business Strategy

- Sustainable Investing

- Winning with Digital Platforms

What Are Pro Forma Financial Statements?

- 28 Oct 2021

When it comes to making business decisions, so much relies on numbers. To get sign-off from key stakeholders, win investors, and strategically plan, you need to demonstrate that your ideas make financial sense.

While certain financial statements —such as balance sheets, income statements, cash flow statements, and annual reports—help provide a historical snapshot of a business’s performance, they often lack the ability to provide foresight when planning for the future. For this reason, professionals typically turn to forecasts and financial projections to guide their plans and answer critical “what if” questions. Pro forma financial statements are a common type of forecast that can be useful in these situations.

Here’s a closer look at what pro forma financial statements are, how they’re created, and why they’re a key aspect of financial decision-making.

Access your free e-book today.

What Is a Pro Forma Financial Statement?

A pro forma financial statement leverages hypothetical data or assumptions about future values to project performance over a period that hasn’t yet occurred.

In the online course Financial Accounting , pro forma financial statements are defined as “financial statements forecasted for future periods. They may also be referred to as a financial forecast or financial projection.”

The course notes that these projections can be used “as a depiction of what the financial statements for the business will look like over a certain period of time, if the assumptions made when preparing them hold true.”

Since the term “pro forma” refers to projections or forecasts, it can apply to a variety of financial statements, including:

- Income statements

- Balance sheets

- Cash flow statements

Whether you’re trying to interpret pro forma financial statements or prepare them, these projections can be useful in guiding important business decisions. In fact, business owners, investors, creditors, and other key decision-makers all use pro forma financial statements to measure the potential impact of business decisions.

How Are Pro Forma Financial Statements Used?

Traditionally, financial statement analysis is used to better understand a company’s performance over a specified period. While this provides insight into a company’s historical health, creating pro forma financial statements focuses on its future. For this reason, these reports can be leveraged in several ways, including analyzing risk, projecting investments, and showing expected results before the end of a reporting period.

One of the most important uses of pro forma reports is related to decision-making and strategic planning efforts. For example, you might create pro forma financial statements to reflect the outcomes of three investment scenarios for your business. Doing so can allow you to conduct a side-by-side comparison of possible outcomes to determine which is favorable and guide your planning process.

Creating Pro Forma Financial Statements

Keep in mind that the general process of creating pro forma financial statements isn’t significantly different from that of creating traditional statements. The difference lies in the assumptions and adjustments made about various inputs, while the format and calculations remain the same.

There are, however, specific methods used for these forecasts. The percent of a sales forecasting method, for example, involves determining future expected sales and finding trends across accounts in statements. This is typically used when creating pro formas internally.

Other individual line items can also be easily forecasted, such as the cost of goods sold, since it can be assumed it will proportionally grow with sales. Line items like income tax expense, on the other hand, typically don’t change directly with sales. Stable businesses can generally estimate income tax expense as a percentage of income before taxes.

All in all, the process of preparing a pro forma balance sheet is much the same as preparing a normal balance sheet . The same holds true for the process of preparing income statements and cash flow statements. It differs when you begin forecasting various line items and calculating how those projections impact your bottom line.

Beyond the Numbers

The true value of pro forma statements goes beyond the numbers they show. These reports provide key stakeholders, investors, and creditors the foresight needed to make decisions and strategically plan. Managers and individual contributors can also benefit from creating pro forma statements, enabling them to understand different factors impacting business units.

Remember: There are limitations to pro forma financial statements. Since these documents are based on assumptions, they shouldn’t be taken as fact. Rather, they can inform decisions using hypothetical data based on historical trends.

Taking an online course like Financial Accounting can help you understand how to create and interpret different kinds of financial statements so you can find meaning in them. Learners enrolled in the course learn the language of accounting and how to create financial statements and forecasts to make strategic decisions.

Do you want to learn more about what's behind the numbers on financial statements? Explore Financial Accounting , one of three courses comprising our Credential of Readiness (CORe) program , to discover how you can develop an intuitive knowledge of financial principles and statements to unlock critical insights into performance and potential.

About the Author

- Sample Business Plans

Pro Forma Business Plan

Financial planning is essential for any business to grow, thrive, and succeed.

Whether it’s a new opportunity or an impending threat—planning for different hypothetical situations strategically and financially creates a safety net that safeguards your business from hitting failure.

Well, pro forma statements, with their forward-looking nature, help you evaluate your future finances and strategize for business accordingly.

But what is it really?

In this blog post, we will learn everything about pro forma business plan statements and steps to create.

Ready to dive in? Let’s get started.

What are pro forma financial statements?

Pro forma statements are projected financial statements that predict the future financial position of a business based on current trends and assumptions. These statements offer a snapshot of financials under different scenarios, helping companies plan efficiently.

A pro forma statement serves as a financial blueprint allowing businesses to set realistic goals, anticipate risks, assess outcomes, and track their goals. When included in a business plan, these statements typically include the income statement, balance sheet, and cash flow statement.

Why integrate pro forma statements into your business plan?

Although pro forma isn’t calculated using generally accepted accounting principles, these statements offer significant value while making important strategic decisions.

That said, let’s check out more benefits of adding statements of pro forma projections to your business plan:

- Pro forma statements help secure funding from investors by offering them an insight into your expected profitability, growth rate, ROI, and the overall financial health of your company.

- A pro forma statement aids in strategic decision-making by helping you evaluate the financial impact of different situations. For instance, the impact of launching a new product or expanding into a foreign market.

- Pro forma statements nudge you to make timely adjustments to your business strategies by helping you set and track your financial metrics.

- A pro forma statement helps you prepare for different situations by identifying potential challenges and prompting you to develop efficient strategies.

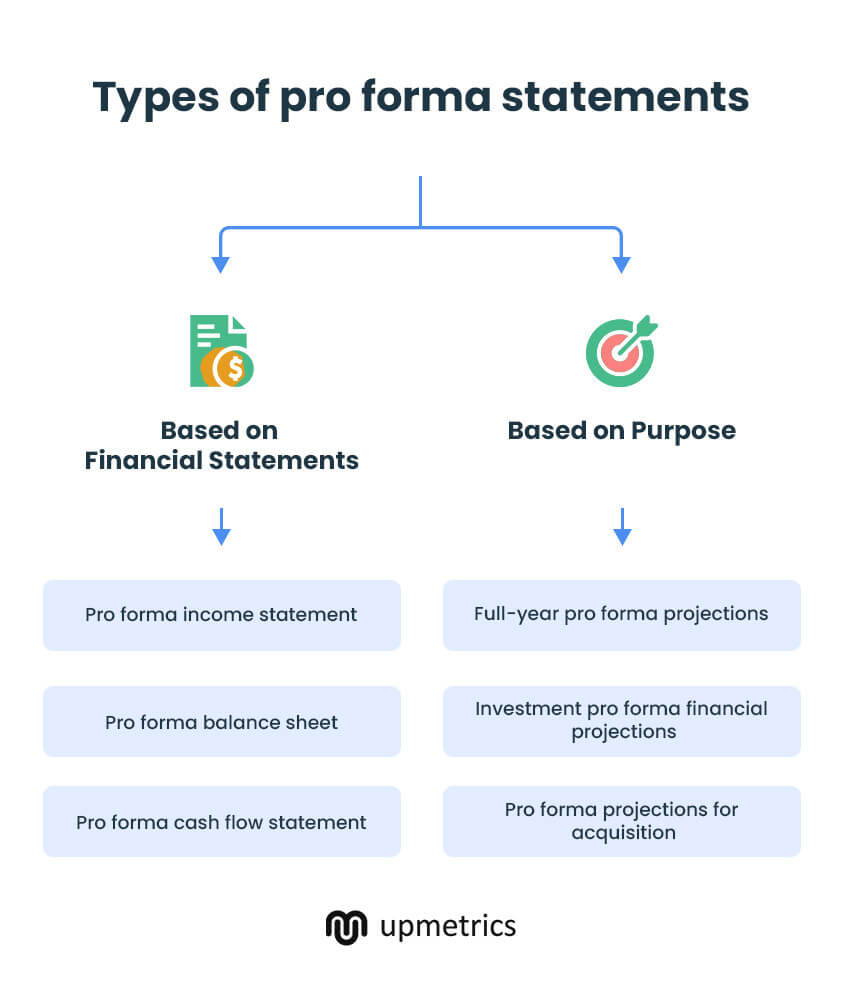

Types of pro forma statements

Let’s now understand the type of pro forma statements to include in your business plan.

1. Pro forma statements based on financial statements

A pro forma includes three financial statements—pro forma income statement, pro forma balance sheet, and pro forma cash flow statement.

Let’s understand these three types in detail.

Pro forma income statement

The most important aspect of financial planning and management is projecting the sales, revenue, costs, and expenses of a business in the future.

Pro Forma income statements do exactly that. They offer insight into expected revenue and expenses and help you assess a business’s profits and retained earnings in a specific financial period.

Pro forma income statements are often used to evaluate the financial viability of launching new products, business expansion, mergers, acquisitions, and other strategic decisions. These statements help you assess what a business income would look like in certain situations.

Pro forma balance sheet

Pro forma balance sheets are similar to actual balance sheets in terms of formatting. However, certain or all the values in such balance sheets are projected based on certain events such as loans, acquisitions, or mergers.

You can use these balance sheets to assess the financial health of your company at a certain stipulated time in the future. It offers an expected value of assets, liabilities, and equity under different situations, thereby, helping you make informed choices.

Moreover, you can use a pro forma balance sheet to evaluate the impact of a specific loan, acquisition, merger, or financing round on a business’s financials by offering you an overall understanding of making such decisions.

Pro forma cash flow statement

Pro forma cash flow statements illustrate the cash inflow and outflow over a period. It is used to assess the financial health of your company and to ensure that the business never runs out of cash.

Pro forma cash flow projections can be for short-term, mid-term, and long-term. It is often used to evaluate if the company will have enough cash to make significant purchases and investments and to maintain day-to-day operations.

2. Pro forma Statements based on purpose

While an income statement, cash flow statement, and a balance sheet remain quintessential parts of pro forma projections, there are different types of pro forma statements based on distinct purposes.

Full-year pro forma projections

Full-year pro forma statements take into account the financials for the fiscal year till the present time and then add projected outcomes for the remaining year. This will help you illustrate the company’s financial position by the end of the year.

Such statements offer investors a comprehensive overview of the business and its expected performance.

Investment pro forma financial projections

An investment pro forma statement shows how securing a loan and making their interest payout will affect the business’s financial position in the future.

Such financial pro formas are required when you want to convince your business partners about the value of potential financing.

Pro forma projections for acquisition

Such pro forma projections merge the past financial statements of your business and the business you want to acquire to show how the financials would have looked in case of a merger. It helps you decide on acquisition and merger opportunities.

Projections for risk analysis

While preparing your startup financial plan , you need to account for various progressive and aggressive situations that may affect your company’s financial health.

These pro forma statements consider various best-case and worst-case scenarios to evaluate the company’s future financial performance in different situations. It helps you plan for risks and equips you to face them strategically.

Now that you’re aware of the different types of pro forma statements, let’s understand the process of creating pro forma statements useful for your business.

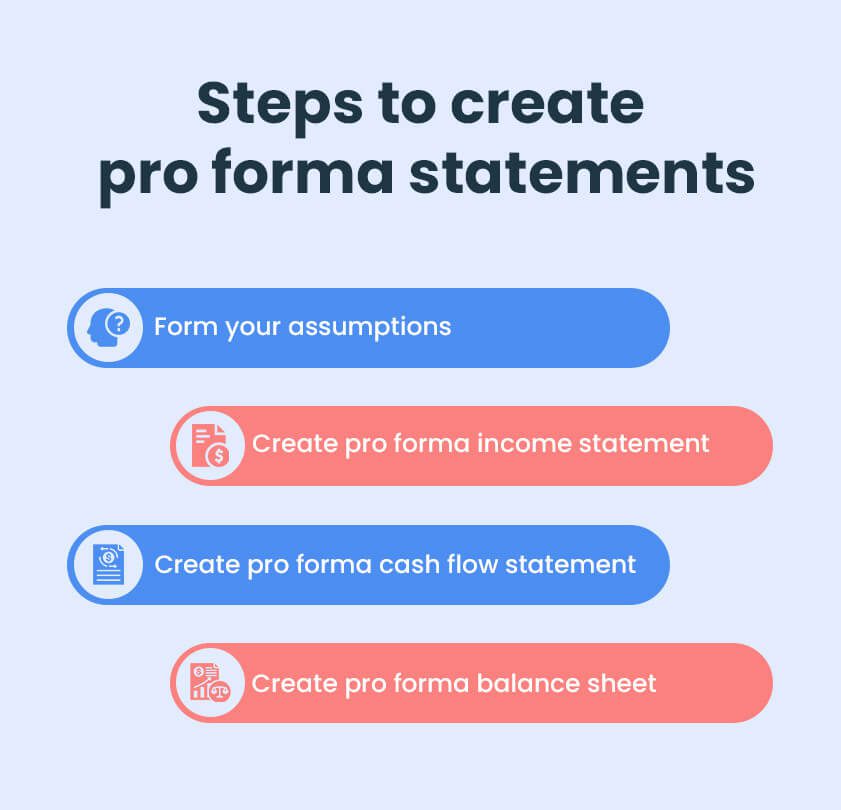

How to create pro forma statements for your business plan

Here’s a quick step-by-step guide to creating your pro forma financial statements.

1. Form your assumptions

To create your comprehensive pro forma statements, you first need to form realistic assumptions for different business components. This includes projecting your sales, expenses, revenue, and capital expenditure for different scenarios.

You should also consider the funding you will require and the investments you would make under different business circumstances.

Ensure that you carry out extensive research and study the historical data to form realistic projections. These projections will form the basis for your income statement, balance sheet, and cash flow forecast.

Say goodbye to boring templates

Build your business plan faster and easier with AI

Plans starting from $7/month

2. Create a pro forma income statement

A pro forma income statement offers an estimate of a company’s financial performance in the future. To get an insight into your expected revenue, expenses, and net profit, create your projected income statement as follows:

- Calculate your COGS (cost of goods sold) and subtract it from your revenue projections to determine your gross profit.

- Estimate your operating expenses. Take everything from rent to salaries into account and then calculate your operating income.

- Also, calculate your other income and expenses and make necessary adjustments to get your net pro forma profit.

Now, place these together in your P&L format and add them to your business plan.

3. Create a pro forma cash flow statement

Next, prepare a pro forma cash flow statement. It’s similar to preparing your actual cash flow forecast. However, here you take the values from your pro forma income statement to plot the cash inflow and outflow.

Be it a new investment, purchase of an asset, repayment of debt, or your operating activities—plot every activity that involves money.

The calculations will either give you a negative or a positive cash flow. To clarify, a negative cash flow indicates a scarcity of money and a positive cash flow indicates extra money at hand to make new purchases or investments.

Now, add your pro forma CFS to the business plan and use it to assess the future cash position of your business.

4. Create a Pro forma balance sheet

A pro forma balance sheet will offer a financial snapshot of your business at a certain point in time in the future. To prepare your pro forma balance sheet:

- List down your current and long-term assets, and calculate your total assets.

- Make note of your liabilities, both short-term and long term to calculate your total liabilities.

- Add your equities, liquidity, and retained earnings from an income statement to your balance sheet.

- Ensure that the liabilities are equal to your assets and add them to your business plan.

Following this, you will have your pro forma statements ready in no time. Ready to jump right in? Let’s take a quick look at a pro forma business plan template to place your statements together.

Pro forma business plan example

Refer to this example of a pro forma business plan and use it as a reference point to build yours.

Executive Summary

In this pro forma business plan, we forecast our company’s sales, expenses, capital expenditures, and funding needs over the next five years. Our projections show positive net income, a strong financial position with increasing equity, and healthy cash flow, underscoring our business’s viability and long-term potential.

Auto Gear, a leader in auto products and services, has been operating for 10 years across 10 countries. With a solid financial track record, we aim to expand into new markets, seeking $8 million in funding to facilitate this growth.

Business Plan Pro Forma

This section provides detailed pro forma statements for sales, expenses, capital expenditures, funding requirements, and cash flow, illustrating the viability and growth potential of Auto Gear.

Sales Forecast

Auto Gear forecasts 20% annual sales growth driven by market expansion, innovation, and enhanced customer service.

- Year 1: $12 million

- Year 2: $14.4 million

- Year 3: $17.28 million

- Year 4: $20.74 million

- Year 5: $24.89 million

Expense Forecast

Auto Gear anticipates slower expense growth due to economies of scale in the long term.

- Year 1: $8 million, 15% increase

- Year 2: $8.8 million, 10% increase

- Year 3: $9.5 million, 8% increase

- Year 4: $10.07 million, 6% increase

- Year 5: $10.58 million, 5% increase

Capital Expenditure Forecast

The capital expenditure at Auto Gear will report a 20% annual growth to accommodate research and new product launch shifts

- Year 1: $2 million

- Year 2: $2.4 million

- Year 3: $2.88 million

- Year 4: $3.46 million

- Year 5: $4.15 million

Funding requirements

Auto Gear needs $8 million in funding for research, new product launches, and marketing to support its expansion in new markets.

Cash flow forecast

Auto Gear’s pro forma cash flow statement predicts positive cash flow throughout the forecast period, ensuring liquidity and operational stability.

- Year 2: $3.2 million

- Year 3: $4.6 million

- Year 4: $5.6 million

- Year 5: $6.8 million

Before we conclude this blog post, here’s one last segment that needs clarity.

Pro forma statements vs. budgets

Pro forma and budgets are important financial statements that offer a future financial overview of your business. However, that’s the only similarity between them.

With this table, you can understand the differences between these two statements better.

| Difference | Pro Forma Statements | Budget |

|---|---|---|

| Meaning | Pro forma statements are financial projections based on hypothetical situations and assumptions. | Budgets are financial plans highlighting the expected expenses and the resource allocation for a specific time in the future. |

| Purpose | To estimate the future financial performance of a company under various scenarios. | To plan and control the financial resources by setting spending limits and monitoring the performance. |

| Uses | Pro forma statements are used to assess a business’s viability and to make strategic decisions. | Budgets are used for cost control and short-term goal achievement. |

Simply put, pro forma projections assist in long-term financial planning while a budget helps in the achievement of short-term goals.

Prepare your Pro Forma Financial Statements with Upmetrics

Accurate and forward-thinking business and financial planning is quintessential to building a successful business.

That being said, pro forma projections offer the numerical perspective of your business’s financial position and performance in the future. It’s much easier to make decisions when you have clearly outlined sales, revenue, expenses, and funding demands in sight.

Don’t worry. It’s quite easy to create your pro forma projections when you have a business planning app like Upmetrics at your disposal.

Its financial forecasting feature allows you to plan for multiple scenarios and create financial statements and projections for up to 7 years. It generates interactive visual reports and offers AI functionality to simplify financial planning.

This easy-to-use tool has everything you need to plan efficiently.

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.

Frequently Asked Questions

Is a pro forma the same as a p&l.

Pro forma income statements are based on projections. They reflect the expected revenue, expenses, and profitability of a business under specific situations in the future. Profit and loss (P&L), on the other hand, unless specified as pro forma, reflects the exact figures of revenue and expenses in the current situation.

What’s usually included in the pro forma of the business plan?

The pro forma statements in a business plan typically include an income statement, a cash flow statement, a balance sheet, and sometimes even a break-even analysis. Now, if you’re publicly publishing the pro forma, it’s essential to comply with Securities and Exchange Commission guidelines .

Can a pro forma business plan help in securing loans or investments?

Yes, pro forma when based on realistic assumptions and projections, offers a realistic overview of the company’s financial health in the future. It offers investors a thorough understanding of how their funding will be utilized and the expected profitability, growth, and financial standing of a business.

Are there tools or software that can help create a pro forma business plan?

Yes, there are many tools and resources available to help you create your pro forma business plans. Upmetrics is one of the easiest and most cost-effective business and financial planning tools that will help you create detailed pro forma statements with its automated financial forecasting features.

About the Author

Upmetrics Team

Upmetrics is the #1 business planning software that helps entrepreneurs and business owners create investment-ready business plans using AI. We regularly share business planning insights on our blog. Check out the Upmetrics blog for such interesting reads. Read more

Turn your business idea into a solid business plan

Explore Plan Builder

Plan your business in the shortest time possible

No Risk – Cancel at Any Time – 15 Day Money Back Guarantee

Create a great Business Plan with great price.

- 400+ Business plan templates & examples

- AI Assistance & step by step guidance

- 4.8 Star rating on Trustpilot

Streamline your business planning process with Upmetrics .

Pro Forma Financial Statements: A Comprehensive Guide for Businesses

- Banking & Finance

- Bookkeeping

- Business Operations

- Starting a Business

Pro forma financial statements play a crucial role in business planning and decision-making processes. These financial reports are based on hypothetical scenarios, enabling business owners and managers to evaluate potential situations that could occur in the future. By utilizing pro forma statements, companies can project the financial impact of various business decisions, such as launching new product lines, expanding to new locations, or restructuring a department.

Understanding pro forma financial statements involves various components, such as income statements, balance sheets, and statements of cash flow. Each of these elements provides a financial snapshot of a company’s hypothetical future performance. By combining these components, it is possible to create a comprehensive financial projection that can help inform strategic decisions and evaluate the potential return on investment.

Key Takeaways

- Pro forma financial statements help businesses make informed decisions by evaluating hypothetical scenarios

- Components of pro forma statements include income statements, balance sheets, and statements of cash flow

- These statements are essential tools for strategic planning and assessing the impact of various business decisions

Understanding Pro Forma Statements

Definition and purpose.

Pro forma financial statements are hypothetical financial reports that project the future financial performance of an entity, based on expected income, expenses, assets, and liabilities. They are created using assumptions about future values and conditions, which serve to forecast financial performance over a period that has not yet occurred. Their primary purpose is to aid in business planning, investment decision making, and to show the potential impact of a proposed transaction on a company’s financial health.

Significance to Investors

Investors find pro forma financial statements valuable in evaluating a business’s potential for growth and profitability. These statements help investors to:

- Identify trends: Comparing the projected numbers with historical trends can reveal areas of opportunity or concern.

- Assess risk: By reviewing pro forma statements, investors can see how the business may be affected under various hypothetical scenarios, such as changes in the economy, market, or industry.

- Make informed decisions: Investors can use pro forma statements to estimate returns on investment or potential value of a company, and to decide whether to buy or sell securities.

Differences Between GAAP and Pro Forma

Financial statements prepared using Generally Accepted Accounting Principles (GAAP) are based on a company’s historical financial performance, whereas pro forma financial statements focus on future projections. The main differences include:

- Basis of calculations : GAAP financials use historical data, while pro forma financials use forward-looking data.

- Accounting standards : GAAP financial statements follow strict accounting standards, whereas pro forma financial statements may deviate from these standards, relying on a company’s assumptions.

- Usage : GAAP statements are used to assess past performance, make comparisons across different periods, and analyze trends; pro forma statements are used for planning, forecasting, and scenario analysis.

It is crucial to note that pro forma financial statements should be used in conjunction with GAAP-compliant financials to gain a comprehensive view of a company’s health and potential growth.

Components of Pro Forma Financial Statements

Pro forma financial statements are essential tools for businesses to plan and project their future financial performance. These statements are based on assumptions and estimates, helping companies understand the impact of various scenarios on their financial position. The three primary components of pro forma financial statements are the Pro Forma Income Statement, Pro Forma Balance Sheet, and Pro Forma Cash Flow Statement.

Pro Forma Income Statement

The Pro Forma Income Statement, also known as the projected income statement, provides an estimate of the company’s future revenues and expenses. This statement helps businesses plan for growth, identify potential risks, and make informed decisions based on expected profitability. The main components of a pro forma income statement include:

- Revenue : The projected sales generated by the company during a specific period.

- Cost of Goods Sold : The estimated cost of producing or purchasing the products sold.

- Gross Profit : The difference between revenue and cost of goods sold.

- Operating Expenses : The anticipated expenses associated with running the business, including salaries, rent, and marketing.

- Net Income : The estimated profit or loss, calculated by subtracting operating expenses from gross profit.

Pro Forma Balance Sheet

The Pro Forma Balance Sheet provides an overview of the company’s projected assets, liabilities, and equity. This statement helps businesses understand their anticipated financial position and evaluate their solvency and liquidity. The main components of a pro forma balance sheet include:

- Assets : The resources a company expects to own or control, such as cash, accounts receivable, inventory, and fixed assets.

- Liabilities : The obligations a company anticipates incurring, such as accounts payable, loans, and taxes payable.

- Equity : The residual interest in the company’s assets, representing the difference between assets and liabilities. This includes retained earnings and contributed capital.

Pro Forma Cash Flow Statement

The Pro Forma Cash Flow Statement offers insight into the company’s anticipated cash inflows and outflows, enabling businesses to plan and manage their liquidity. This statement presents an estimation of cash flows from operating, investing, and financing activities. The main components of a pro forma cash flow statement include:

- Operating Activities : The cash flows generated from a company’s core business operations, such as sales and expenses.

- Investing Activities : The cash flows associated with purchases and sales of assets, such as property, equipment, or investments.

- Financing Activities : The cash flows related to borrowing, repaying loans, issuing stock, or paying dividends.

By understanding and utilizing pro forma financial statements, companies can make more informed decisions, develop strategies, and improve their overall financial planning and management.

Creating Pro Forma Statements

Forecasting and assumptions.

When creating pro forma financial statements, the first step is to forecast future revenues, expenses, and other financial data based on a company’s past performance and experience. It is important to make reasonable and educated assumptions to provide an accurate projection of the company’s future financial performance. Some common assumptions used when creating pro forma statements include:

- Expected growth rates

- Changes in market conditions

- Alterations in the company’s strategy or operations

- Expected changes in costs or pricing

Preparing Hypothetical Scenarios

In addition to using historical data and assumptions, pro forma financial statements can incorporate hypothetical scenarios. These scenarios provide a range of possible financial outcomes based on various “what-if” situations. For example, consider a software company that plans to launch a new product in six months. The company can create multiple pro forma statements based on different launch scenarios:

- Scenario 1 : The software product has a successful launch, generating significant sales and revenue.

- Scenario 2 : The software product has a moderate launch, with sales and revenue matching current market conditions.

- Scenario 3 : The software product experiences a weak launch, with sales and revenue falling below market expectations.

Creating a variety of hypothetical scenarios can help gain insight into the potential financial impacts of different decisions, risks, and opportunities.

Projecting Future Performance

Once you have established a solid foundation of assumptions and hypothetical scenarios, you can begin projecting future performance using the pro forma financial statements. This process involves utilizing the following statements:

- Pro Forma Income Statement : Estimates future revenues, expenses, and net income.

- Pro Forma Balance Sheet : Reflects the company’s projected financial position, including assets, liabilities, and equity.

- Pro Forma Cash Flow Statement : Showcases expected cash inflows and outflows, helping a company plan for liquidity needs.

The information gathered from each of these statements can help a company make business decisions, secure funding, and drive strategic planning. In summary, pro forma financial statements serve as a valuable tool for forecasting, preparing hypothetical scenarios, and projecting future performance to ensure a company’s long-term financial success.

Analyzing Pro Forma Statements

Financial ratios and metrics.

When analyzing pro forma financial statements , it is essential to use various financial ratios and metrics to evaluate a company’s performance adequately. These ratios can provide valuable insights into the company’s financial health. Key ratios include:

- Liquidity ratios , such as the current ratio and quick ratio, help assess the company’s ability to meet short-term obligations.

- Solvency ratios , such as the debt-to-equity ratio, evaluate the company’s long-term financial stability and its ability to meet long-term debts.

- Profitability ratios , including the gross margin and return on equity (ROE), gauge the company’s earnings relative to its investments and equity.

- Efficiency ratios , like inventory turnover and the accounts receivable turnover, reveal the effectiveness of the company’s assets management.

These ratios, derived from balance sheets and income statements, can be compared to industry benchmarks to understand how the business is performing against competitors.

Evaluating Business Potential

To gain a clear understanding of a company’s potential for future growth, pro forma earnings must be examined in conjunction with the anticipated financial impact of various business decisions. This analysis enables investors and management to:

- Assess the potential profitability of new projects or investment opportunities.

- Estimate the effect of price changes for products or services.

- Evaluate the implications of business expansions—that may involve mergers, acquisitions, or entry into new markets.

- Gauge the potential impact of changes in cost structures, such as modifications in labor costs.

Using tools like forecasting and scenario planning, decision-makers can estimate the organization’s future financial position and determine actionable strategies to optimize performance.

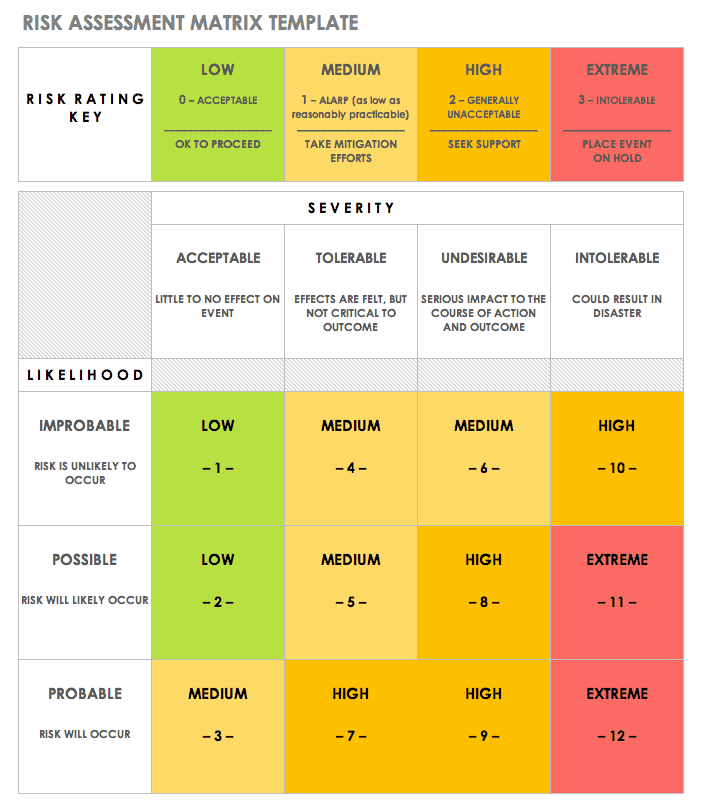

Risk Analysis

An important aspect of analyzing pro forma statements is identifying potential risks that might affect the company’s financial performance. Risk analysis involves evaluating factors that could negatively impact revenue, increase costs, or alter the overall business dynamics. These factors include:

- Market risks: Changes in consumer preferences, increased competition, or market saturation.

- Operational risks: Disruptions in the supply chain, inefficient production processes, or employee turnover.

- Financial risks: Interest rate fluctuations, exchange rate volatility, or changes in credit terms.

A comprehensive risk analysis enables management to make well-informed business decisions and devise contingency plans to minimize the company’s exposure. This, in turn, helps safeguard the organization’s bottom line and ensure a robust financial standing in the long run.

Strategic Use of Pro Forma Projections

Pro forma financial statements are used by business owners and companies for various strategic purposes. These include business planning and budgeting, funding and investment attraction, and mergers and acquisitions.

Business Planning and Budgeting

Companies use pro forma projections to create a detailed budget, forecasting revenues, expenses, and cash flow, which usually span over three to five years. This provides insights into the financial health and growth potential of the business. It helps companies to:

- Make data-driven decisions

- Identify areas for cost savings

- Determine feasible growth strategies

- Allocate resources efficiently

By leveraging pro forma projections, businesses can test hypothetical scenarios and make informed decisions, effectively planning and structuring their financial activities.

Funding and Investment Attraction

Pro forma financial statements are critical in attracting funding and investments for businesses. These projections provide potential investors with a clear understanding of the business’s:

- Future growth potential

- Risk management strategies

- Financial stability

Investment pro forma projections showcase the company’s ability to generate returns on investments, giving investors the confidence to commit their capital. Business owners can tailor these projections to highlight their business’s unique strengths, ultimately appealing to a broad range of potential investors.

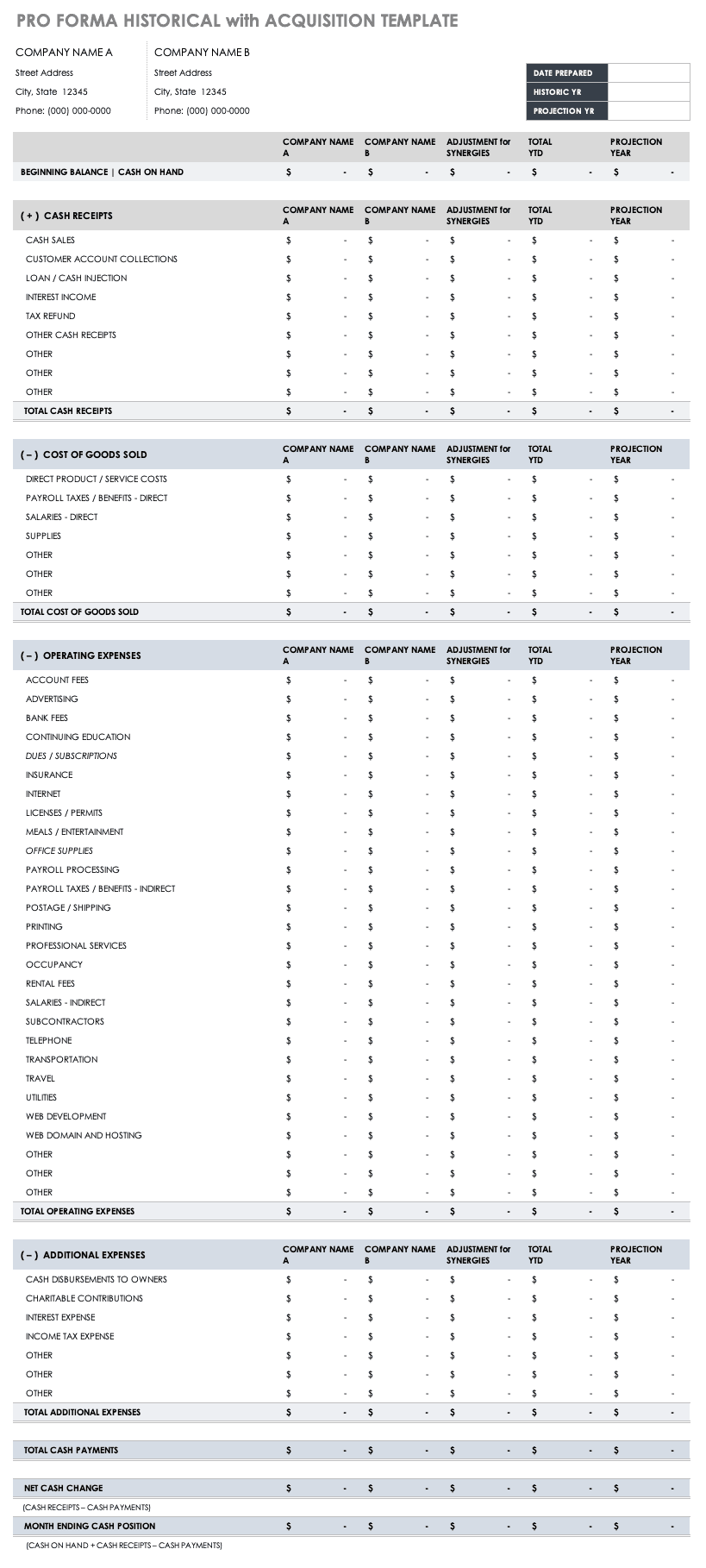

Mergers and Acquisitions

In mergers and acquisitions, pro forma financial statements play an important role in revealing the financial impact of a potential transaction. Companies create historical with acquisition pro forma projections that showcase combined financial position of both organizations. This helps in assessing:

- Expected synergies

- Post-acquisition financial performance

- Integration costs

By identifying these financial outcomes, companies can better evaluate the potential benefits and risks associated with mergers and acquisitions, ensuring that the decision to pursue the transaction is well-informed and in line with their strategic goals.

Real-World Application of Pro Forma

Public reporting and the sec.

Pro forma financial statements often play a significant role in public reporting, especially when dealing with the Securities and Exchange Commission (SEC). Companies may use pro forma statements to present their financial results, adjusted for specific events such as acquisitions or divestitures. This provides stakeholders with a clearer understanding of the company’s financial position and helps them make informed decisions.

Key aspects of pro forma financial statements in public reporting:

- Financial forecast based on hypothetical scenarios

- Used for decision-making by investors, creditors, and other stakeholders

- Adjustments for specified events, such as acquisitions

Case Studies of Successful Use Cases

1. Business Expansion:

A company plans to expand its operations by opening a new manufacturing facility. They prepare pro forma financial statements to estimate the impact on future revenue, expenses, and profitability, considering various factors such as initial investment, operating costs, and expected sales. This helps them align their growth strategy and make informed decisions on whether or not to proceed with the expansion.

2. Mergers and Acquisitions:

A company is considering acquiring a smaller competitor. They create pro forma statements combining their own historical financial information with that of the acquisition target. This enables them to better understand the combined entity’s future financial performance and potential synergetic effects.

3. Restructuring:

A company facing financial challenges decides to restructure its operations to improve efficiency. They use pro forma financial statements to analyze different restructuring scenarios, such as cost reduction initiatives, refinancing options, or divestitures. This assists them in evaluating the long-term viability and profitability of their restructuring plan.

Learning from Pro Forma Mistakes

While pro forma statements can provide valuable insights, they can also be subject to misuse or misinterpretation. Fraudulent activities may involve manipulating pro forma results to present a rosier financial picture than reality, potentially misleading investors and other stakeholders.

To avoid such pitfalls and maintain a neutral and clear stance, companies should:

- Clearly disclose the basis of any adjustments or assumptions made

- Ensure the use of consistent methodologies across multiple scenarios

- Conduct thorough sensitivity analyses, incorporating a range of possible outcomes

- Seek guidance from accounting or financial experts, when necessary

By understanding the real-world application of pro forma financial statements and learning from past mistakes, businesses can use these tools effectively to drive informed decision-making and achieve better outcomes.

Limitations and Criticisms of Pro Forma

Potential for misrepresentation.

Pro forma financial statements may present an optimistic picture of a company’s financial health, intentionally or unintentionally, that differs from the reality per Generally Accepted Accounting Principles (GAAP). The adjusted nature of pro forma statements allows management to exclude certain items that they consider non-recurring or extraordinary. This level of discretion opens the door for worst-case scenarios , where pro forma statements might be utilized to paint an overly favorable picture of the company’s performance, potentially veiling fraudulent activities or significant financial issues.

A relevant example of this issue can be observed in cases when companies release pro forma earnings and provide little or no reconciling information, making comparisons with audited GAAP financial statements difficult. Thus, it is essential for decision-makers, such as investors and analysts, to be aware of the potential for misrepresentation in pro forma disclosures and to remain vigilant in their research and due diligence.

Understanding Limitations in Decision Making

While pro forma statements provide valuable insights for companies’ internal management, their usefulness is limited for external decision-making by investors or other stakeholders. These statements often focus on estimates and projections, rather than actual financial data, which can result in an unclear picture of a company’s performance. Furthermore, pro forma statements might not take into account the full range of worst-case scenarios , increasing the risk inherent in making decisions based on these projections.

In order to navigate the limitations of pro forma statements, it is crucial for decision-makers to:

- Understand the basis : Scrutinize the methods used to create pro forma statements, such as non-recurring items excluded or other adjustments made by management.

- Compare with GAAP : Cross-check the pro forma disclosures with audited financial statements, ensuring a more comprehensive and accurate understanding of the company’s financial health.

- Evaluate risks : Assess the likelihood and potential impact of worst-case scenarios not captured by the pro forma statements, incorporating this knowledge into the decision-making process.

Despite their limitations, pro forma financial statements have a place in financial planning and forecasting. However, recognizing their limitations and staying cautious in the decision-making process is key to fully leverage their value while avoiding potential pitfalls.

Legal and Ethical Considerations

Gaap compliance.

Pro forma financial statements should adhere to Generally Accepted Accounting Principles (GAAP) in order to provide accurate and reliable information to investors and other stakeholders. While pro forma statements are used to illustrate the potential impact of a significant transaction on historical financial data, they must still adhere to GAAP requirements, which are designed to ensure consistency and comparability across different financial reports.

For example, when preparing pro forma financial statements, the following GAAP principles should be considered:

- Revenue Recognition : Ensure that revenue is recognized in accordance with GAAP standards, which typically means recognizing revenue when it is earned and realizable.

- Consistency : Apply accounting policies and methods consistently across all financial reports, including pro forma statements, to ensure comparability between different periods and scenarios.

- Conservatism : Exercise caution in making assumptions and estimates when preparing pro forma statements, to avoid overstating potential revenues or understating potential costs.

It is also important to keep in mind that the SEC (Securities and Exchange Commission) requires companies to provide a thorough and compliant pro forma financial information when significant business combinations or real estate transactions occur.

Addressing Fraudulent Pro Forma Practices

As with all financial reports, there is a risk that pro forma financial information could be used for fraudulent purposes. To mitigate this risk, companies should implement certain policies and procedures to ensure the accuracy and integrity of their pro forma statements:

- Internal Controls : Implement robust internal controls over the financial reporting process, including controls related to the preparation of pro forma statements. This may involve segregating duties between those who generate the data for the pro forma statements and those responsible for reviewing them.

- Documentation : Maintain detailed records supporting the assumptions and estimates used in the preparation of pro forma statements. This documentation should be readily available for review by auditors or regulatory authorities when necessary.

- Transparency : Clearly disclose the basis for any adjustments made in pro forma statements, such as one-time charges or non-recurring items. This includes providing a detailed reconciliation between historical financial statements and the pro forma information.

- Oversight : Establish a process for independent review and approval of pro forma financial information by individuals with appropriate expertise, such as an audit committee or external auditor.

In summary, ensuring legal and ethical compliance in pro forma financial statements is crucial to maintain investor confidence and uphold the integrity of financial reports. By adhering to GAAP requirements and implementing safeguards against potential fraudulent practices, companies can produce accurate and reliable pro forma information that effectively illustrates the potential impact of significant transactions on their financial position and results of operations.

Frequently Asked Questions

What is the purpose of pro forma financial statements in assessing a company’s financial health.

Pro forma financial statements provide a hypothetical look at how a company would perform based on a set of credible assumptions about one or more transactions it is contemplating. This enables businesses to evaluate the potential impact of new product launches, expansions, or other strategic decisions, making them essential tools for planning and decision-making.

How do pro forma and traditional profit and loss statements differ?

Traditional profit and loss statements are based on actual financial results, providing an accurate representation of a company’s past performance. Pro forma statements, on the other hand, are based on hypothetical scenarios, such as the impact of a specific business decision or a future event. In essence, pro forma statements are projections, while traditional statements are historical records.

What distinguishes pro forma financial statements from prospective financial statements?

Pro forma financial statements are projections that consider hypothetical situations, such as a proposed transaction or a new product launch. Prospective financial statements, on the other hand, provide a forecast of a company’s future financial position based on current business conditions and expected trends. While both types of statements involve predictions, pro forma statements focus on specific scenarios, whereas prospective statements provide a broader outlook on the company’s potential performance.

Are there specific instances where pro forma financial statements should not be utilized?

Pro forma financial statements are most useful when analyzing potential business decisions or anticipating the impact of future events. However, they should not be used as a substitute for traditional financial statements when assessing a company’s overall financial health or stability. Additionally, pro forma statements can be misleading if based on unrealistic or overly optimistic assumptions, and users need to scrutinize their underlying premises carefully.

Is adherence to GAAP required for pro forma financial statements?

While pro forma financial statements are not subject to the same strict adherence to Generally Accepted Accounting Principles (GAAP) as traditional financial statements, it is essential to maintain transparency and consistency in the presentation and preparation of these projections. Misleading or inaccurate pro forma statements can result in a loss of credibility and trust with stakeholders, making it crucial to approach them with integrity and objectivity.

How do pro forma financials assist in cash flow forecasting and management?

Pro forma financial statements, including cash flow statements, provide insights into a company’s anticipated cash inflows and outflows based on specific business scenarios. This allows management to anticipate potential liquidity issues, evaluate financing options, and make informed decisions regarding cash flow management. In essence, pro forma cash flow statements contribute to strategic planning and help minimize financial risks.

- 1-800-711-3307

- Expense management

- Corporate card

- Tax returns & preparation

- Payment processing

- Tax compliance

- Vision & clarity

- Accounting mobile app

- Reduce your accounting expenses

- What does a bookkeeper do

- Why outsource

- Cash vs. Accrual Accounting

- Guides & ebooks

- How Finally works

- Privacy policy

- Terms of service

*Finally is not a CPA firm © 2024 Finally, Backoffice.co , Inc. All rights reserved.

This device is too small

If you're on a Galaxy Fold, consider unfolding your phone or viewing it in full screen to best optimize your experience.

- Small Business

- The Top 10 Accounting Software for Small Businesses

What Are Pro Forma Financial Statements?

See Full Bio

Our Small Business Expert

In accounting, pro forma refers to financial reports based on assumptions and hypothetical situations, not reality. Businesses use pro forma financial documents internally to aid in decision-making and externally to showcase the effect of business decisions.

Before acquiring another business, investing in new equipment, or taking on new debt, businesses draft forward-looking pro forma financial statements to understand the effect. Unlike traditional financial statements that explain the past, pro forma documents usually look forward and rely on financial modeling and speculation.

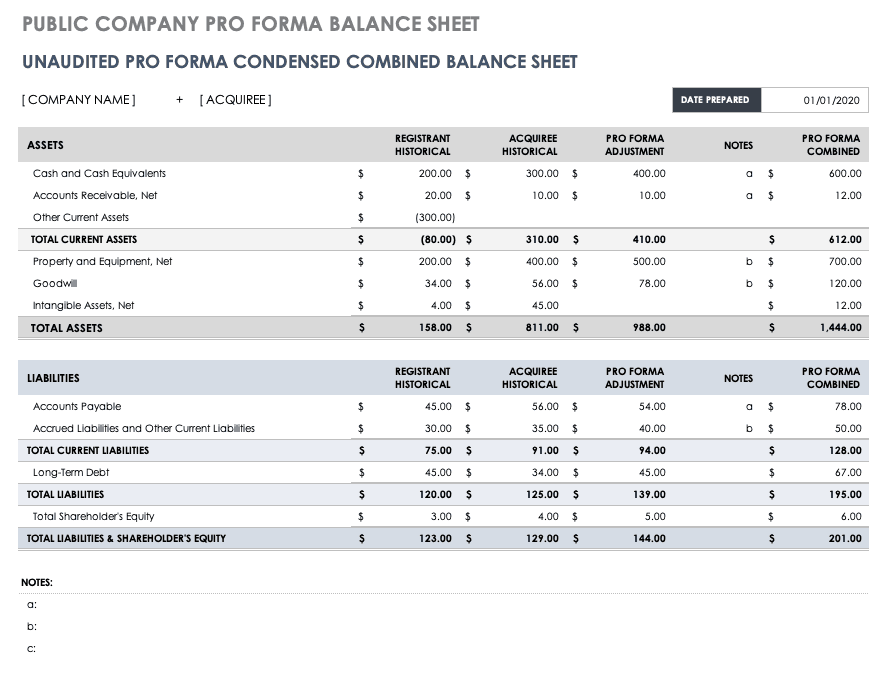

Pro forma statements take on a slightly new meaning with public companies. After a major acquisition, a public company must prepare a secondary balance sheet and income statement as if the purchase occurred at the beginning of the year. We put the “pro forma” label on these financial documents because there’s a lot of “what if” involved in their making.

“What if” doesn’t jibe with Generally Accepted Accounting Principles (GAAP). Straying even further from GAAP, pro forma financials exclude unusual one-time expenses, such as restructuring costs. Critics say pro forma financial statements are ploys to excite investors about the benefits of a business combination, what finance nerds call “synergies.”

The Securities and Exchange Commission (SEC) consistently updates its stringent rules on preparing pro forma statements for the public. Still, pro forma financials are not regulated to the same extent as historical financial statements.

3 types of pro forma statements

Small business owners can use pro forma statements to draft forecasted financial statements, budgets, and quotes.

1. Forecasted financial statements

Small business owners draft pro forma financial statements to quantify the impact of potential business decisions, such as taking out a loan to grow your business. Pro forma financial statements give you and your team something to consider before signing on the dotted line.

The most common pro forma financial statements are projected balance sheets, income statements, and cash flow statements. Together, the documents help you assess whether your business’s financial health improves, declines, or remains the same following the decision.

Say you’re a business owner contemplating a loan to invest in more efficient equipment. Your current equipment still works, but the cutting edge technology in newer machines can speed up production by 20%. You’re not sure what to do.

Guide your decision-making by creating two sets of forecasted financial statements: the first to project next year’s net income if you take out the loan, the second if you don’t.

If you take out the loan, you might share the pro forma financial statements with the lender to demonstrate your ability to repay the loan. Businesses also use pro forma financial statements to prod investors to provide capital.

Since we can’t predict the future, don’t rely solely on pro forma financial statements. Your assumptions could wind up wrong, throwing off your financial projections.

Businesses create annual budgets that fall in line with a company’s profitability and production goals.

Budgets and projected financials are similar in that they both factor in assumptions and scenarios that remain to be seen. Where they differ: Budgets are managerial accounting documents, meaning they’re meant to guide business decisions and aren’t to be shared publicly. Budgets provide more detail than you’d care to share with a lender, and they’re more nearsighted, usually focusing one year ahead.

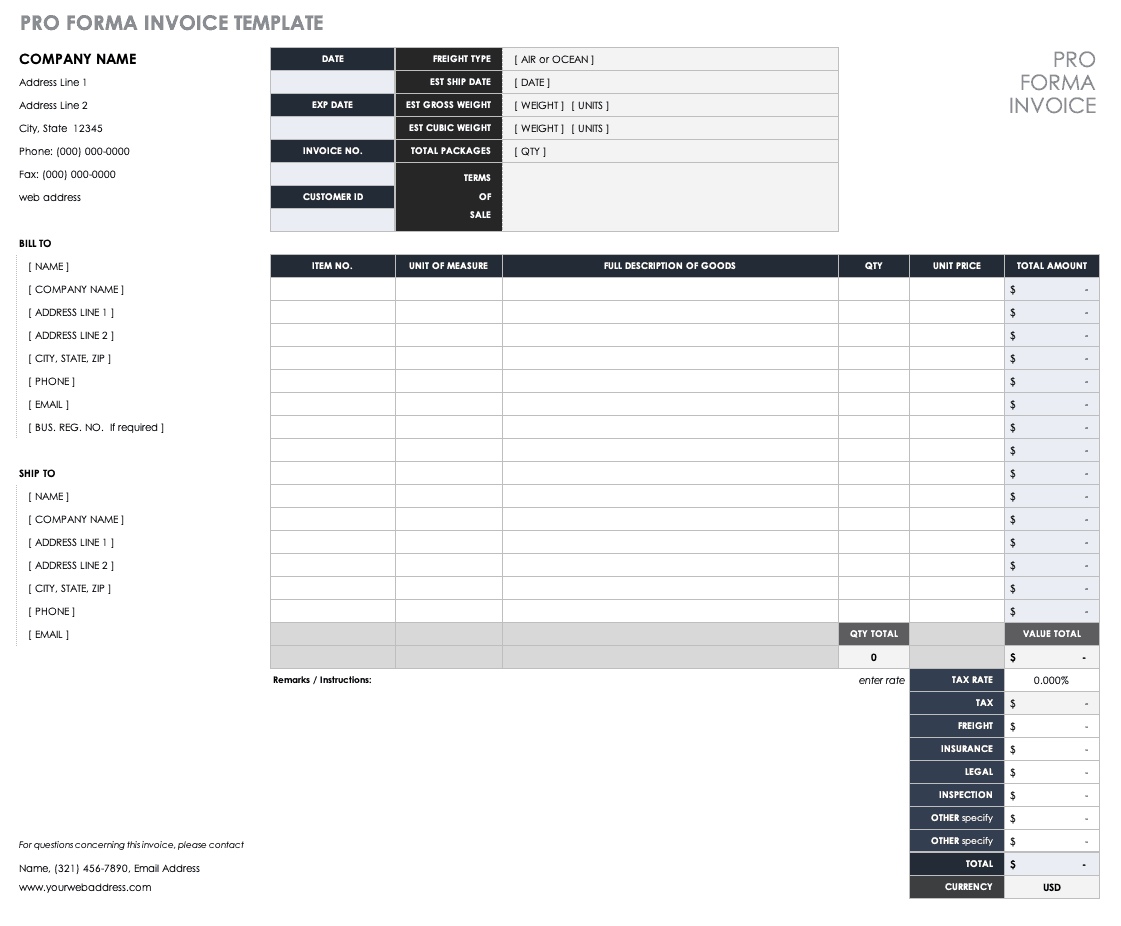

3. Pro forma invoices

The best way to package a quote for your goods and services is by using a pro forma invoice, also called a draft invoice.

Before delivering an actual invoice, send a client a pro forma invoice that lists the cost of the goods and services you’re planning to provide. A pro forma invoice isn’t binding; it’s a way to make sure you and the client are on the same page before agreeing to the transaction. The transparency could score you points for customer satisfaction.

Your accounting software can make pro forma invoices.

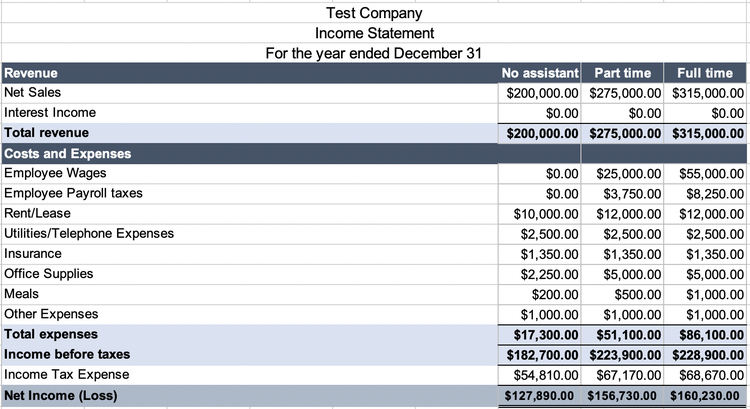

An example of pro forma

Russell operates a life coaching business. Word has gotten around that Russell is the absolute best, and he has more prospective clients lined up than he has time to take on. Russell is considering hiring an assistant to lighten his administrative workload, but he’s unsure whether he can afford to pay someone full time. His options are:

- Not hiring an assistant

- Hiring a part-time assistant

- Hiring a full-time assistant

Russell creates a pro forma income statement for next year to inform his decision. He dedicates a column for each scenario he’s considering. Russell follows The Ascent’s guide to forecasted financial statements to generate the document.

Create multiple pro forma documents to play out different scenarios. Image source: Author

According to Russell’s projections, he reaches the highest earnings when he hires a full-time administrative assistant. More significantly, the pro forma income statement reveals that hiring a part-time assistant is nearly as lucrative as bringing someone on full-time.

I’d advise Russel to hire a part-time assistant to reduce the risk of sinking nearly $60,000 into a new position when he’s not sure he’ll see the increased revenue he’s expecting. He can always offer the person a full-time job after his projection actualizes.

Not all pro forma documents are made equal. Pro forma financials have their place, but some public companies have taken advantage of loose rules to mislead potential investors.

For small, private companies, pro forma financials can help you see the long-term impact of decisions you’re considering today. Nobody is dissing the use of pro forma reports here.

The dot-com bubble, where tech companies enjoyed bloated market valuations before losing it all, proved the harm of pro forma financials. In the early 2000s, Yahoo caught heat after years of releasing pro forma financial statements that downplayed hefty one-time costs from business acquisitions.

Public companies release pro forma financials under the guise of clarifying their financial position after a business acquisition. They take out one-time or unusual costs to offer a fuller picture of the business’s operating profit. To some, pro forma financials feel like companies are creating their own financial accounting rules to engineer appealing financial results.

Since the dot-com bubble burst, the SEC has cracked down on using pro forma financials to protect the public from being misled.

Before extending capital or credit, investors and lenders might ask for pro forma statements to understand your outlook on company performance. For new businesses with no historical financial statements , lenders look at pro forma statements for a realistic vision of your company’s future.

After you create pro forma financial statements to inform a business decision, run a pro forma analysis to assess your company’s profitability.

Say you own a small restaurant, and you’re considering extending your business hours and hiring a new waiter. You drafted a balance sheet, income statement, and cash flow statement for next year, assuming increased utility, wages, and food expenses.

Analyze the results using profitability metrics. If the measures point to increased profitability, you might have hit on a winning opportunity for your restaurant.

It’s not called “amateur forma” for a reason

Building accurate pro forma financials requires an in-depth financial analysis of your present business. When creating pro forma financial statements, ask an accountant to provide additional guidance.

We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent, a Motley Fool service, does not cover all offers on the market. The Ascent has a dedicated team of editors and analysts focused on personal finance, and they follow the same set of publishing standards and editorial integrity while maintaining professional separation from the analysts and editors on other Motley Fool brands.

The Ascent is a Motley Fool service that rates and reviews essential products for your everyday money matters.

Copyright © 2018 - 2024 The Ascent. All rights reserved.

Mastering Pro Forma Financial Statements: The Three You Need

By Andy Marker | November 26, 2018

- Share on Facebook

- Share on LinkedIn

Link copied

Using pro forma templates can save you valuable time when creating your own pro forma income statements. However, like any template, you need to adjust it to suit your needs.

In this guide, you will learn everything you need to know about pro forma financial statements: what they are, how they’re regulated, how they work with financial modeling, how to create them, and the problems with pro forma projections, statements, and sheets. We’ll show you what variables link the three sheets, along with equations, examples, and a sampling of free, downloadable pro forma templates.

What Are Pro Forma Financial Statements?

Pro forma financial statements present the complete future economic projection of a company or person. Often used to back up a lending or investment proposal, they are issued in a standardized format that includes balance sheets , income statements, and statements of cash flow. “Pro forma” literally means “as a matter of form.” In finance, this matter of form forecasts the future based on the present, using hypothetical budgeting. Pro forma data estimates are built in to show the company’s profits if certain, one-time items are taken out. Anything the company sees as a one-time only expense — or that does not show the company’s representative value — is removed. Instead of tracking the past exactly, such as would be reported in historical income statements, pro forma statements are used to guide big financial decisions, such as the following:

Debt Refinancing : How the short term is affected by refinance options.

One-Time Large Purchases : Purchases such as land or services, and how they affect the budget.

Company Mergers or Acquisitions : Complete as a part of due diligence to assess future business operating prospects and valuation. In startups, this is often a way to find venture capital.

Leases : How big leases, such as buildings or vehicles, will affect the budget with new accounting standards.

You can also use pro forma statements to do the following:

Develop various sales and budget projections.

Assemble results in profit/loss projections.

Translate data into cash flow projections.

Identify the company assumptions about their financial and operating characteristics.

Compare balance sheets.

Perform financial ratio analysis.

Make decisions about marketing, production, research, development, and projects.

Show the financial picture of a company sans a specific program or department may be floundering.

Show a more accurate picture of the company’s finance, as compared to GAAP or IFRS accounting frameworks.

Act as a benchmark.

Motivate your staff.

Used to show company results to investors, pro forma financial statements are often combined with generally accepted accounting principles (GAAP) adjusted statements. Pro forma financial statements are not computed using GAAP and are often called non-GAAP. GAAP-adjusted statements are uniform financial statements guided by rules of the Financial Accounting Standard Board (FASB). They differ from pro forma statements in that they are not projections, but rather historical reports — therefore, they do not consider things like litigation costs, restructuring charges, and other one-time items.

Pro forma analyses are meant to paint a better picture of what is happening with the company, irrespective of one-time events, but considering the specific industry’s standards. In some respects, this type of analysis is a more accurate depiction of the company’s financial health and outlook. Further, organizations may want to develop their pro forma financial statements while they are doing an annual review of their business plan.

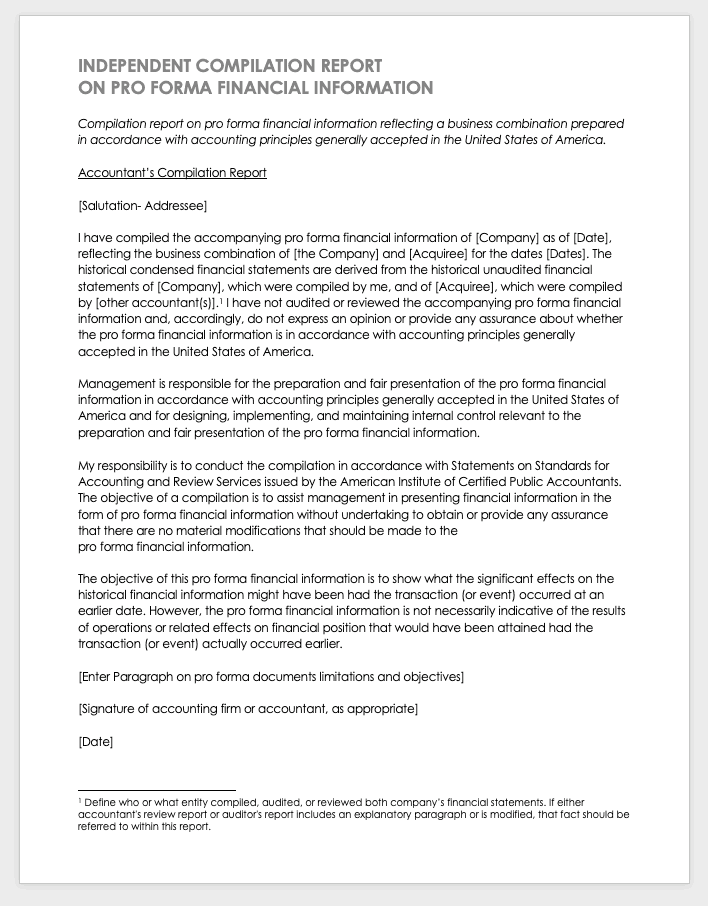

Pro Forma Financial Statements and Regulation

The Securities and Exchange Commission (SEC), the United States’ regulator of its stock market, requires pro forma statements with any filing, registration, or proxy statement. They have articles governing the preparation of pro forma financial statements for public companies. These are Regulation S-X Article 11 , and Regulation S-X 8-05 for smaller companies from 17 CFR 210. According to the SEC, pro forma financial statements will be prepared for public companies when something happens that the investors should know, such as in the case of an acquisition, jettison of a business, real estate transactions, roll-ups, spin-offs, changes in accounting principles, changes in accounting estimates, or corrections of previously made errors. Additionally, the SEC may require that pro forma financial statements be submitted when a company is filing for an initial public offering (IPO). This is also true of companies that change tax status from a private, nontaxable company to a taxable C-corporation to file for an IPO. The pro forma financial statements, including pro forma earnings per share calculated, must be submitted. Finally, if substantial changes to the firm’s capitalization (the sum of their stock, debt, and retained earnings) are assumed to change substantially after the offering’s close date, pro forma documents must reflect that.

A financial forecast may be used in lieu of pro forma financial statements. According to the SEC, this does not take the place of the pro forma balance sheet, but the pro forma income statement may be withheld. The difference is that the financial forecast details the company’s expected results of operations as a single-point estimate or a range. The legal liability of the company may increase upon submitting forecasts instead of pro forma income statements, but the practice may be more relevant for certain businesses.

Not only does the SEC regulate pro forma statements, but the FASB and the AICPA provide directives, especially when there are major changes in the business structure. To evaluate a new or proposed business structure in pro forma documents, these agencies say that the statements must conform with those of the predecessor business. For businesses that are going public and have to transform into a corporation, the predecessor business may not contain items relevant to a corporation, so the following adjustments must be made:

State the owners’ salaries as officers’ salaries.

Recalculate the federal taxes of the predecessor business as though it were a corporation.

Include corporate state franchise taxes.

Add the partner capital balance to the contributed capital instead of to retained earnings through pooling of interests.

Consider making pro forma provision for taxes that would have been paid if the company was a corporation in the past.

For businesses that previously acted as a partnership or sole proprietorship that are being acquired into a corporation, the statements must reflect that of the acquiring business. This includes that business’ net sales, cost of sales, gross profit on sales, expenses, other income and deductions, and income before taxes.

If a business is acquiring a new business or disposing part of its business, the pro forma statements need to adjust the historical figures to reflect this, and to show, in the case of an acquisition, what a corporation would have looked like separately, but added together. If possible, show a five year projection of the businesses together. There’s no need to include overhead costs. For the effects of the business combination, only show the current and immediately preceding periods.

Financial Modeling Based on Pro Forma Projections