SUCCESS STORY: YETI

Investment Year: June 2012

Industry: Consumer Products

Ownership Profile: Founder-Owned

Exit Year: IPO in October 2018 (1)

(1) Cortec exited its investment in YETI through the company’s IPO in October 2018 and subsequent stock sales completed from May 2019 – February 2021.

Situation Overview

YETI is a leading global, branded outdoor products company that designs, markets, and sells premium coolers, drinkware, bags, and other innovative products and accessories. The company sells to a broad base of consumers in the U.S. and internationally through an omni-channel sales strategy, including direct-to- consumer eCommerce, a diverse range of retail partners, and a network of company-owned stores.

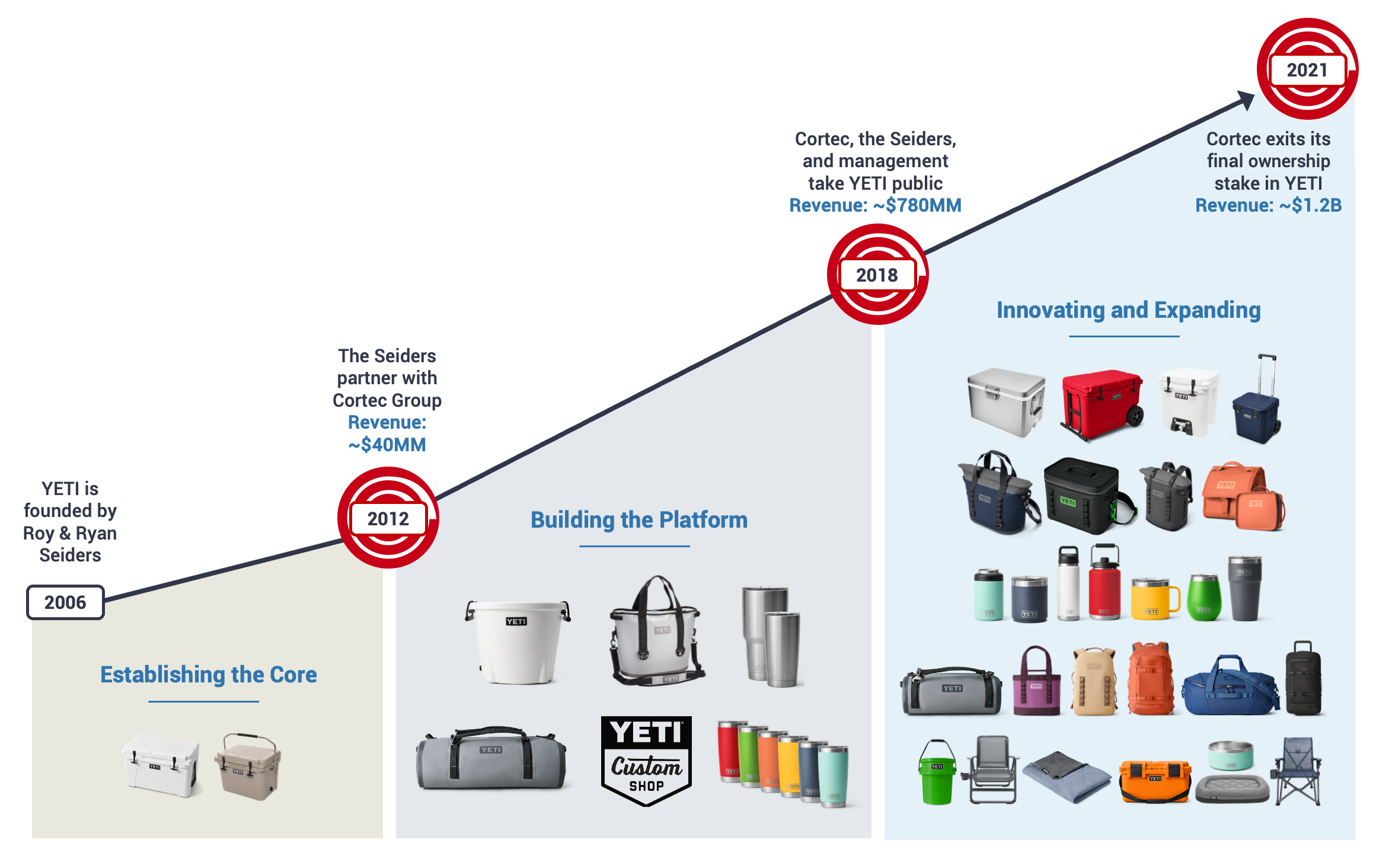

Roy and Ryan Seiders (CEO and President, respectively, at the time of our investment) founded YETI in 2006 with the simple goal of creating a durable, multi-functional, hard shell cooler that would outperform all other alternatives in the market. Prior to Cortec’s ownership, “YETI Coolers” (as it was known at the time) was a single-product business with a relatively small, but fiercely loyal and growing customer base and a strong brand reputation that resonated in the market, but remained largely untapped.

By 2011, the Seiders had grown YETI to ~$40 million in revenue, but recognized the need for a partner to help them realize the full potential of the company. Roy and Ryan chose Cortec over numerous private equity suitors following a competitive sale process and remained significant owners in the company while staying active in the business.

Investment Thesis

YETI offered a rare and compelling opportunity to partner with two successful founders to continue to build an influential and growing lifestyle brand. Despite the company’s early success, the Seiders had reached a point where they required an experienced teammate to help them navigate the next stage of YETI’s evolution. Cortec’s successful track record working with entrepreneur-led, high-growth businesses aligned extremely well with what the company needed.

In addition to YETI’s leading products, brand strength, and market position, the company had an impressive growth trajectory and strong momentum among a fast-growing and passionate customer base. We saw an opportunity to help YETI facilitate continued growth by developing a multi-pronged strategy that included: building the team, introducing a broad line of new products, penetrating consumers in new geographies, expanding distribution channels (including via a direct-to-consumer presence), refining and marketing the YETI brand, and strengthening the operating infrastructure to support these initiatives.

Evolution From Entry to Exit

(1) Includes sales through eCommerce channels (including YETI.com) and company-owned retail stores. Note: Unless otherwise stated, all statistics are as of YETI’s IPO in October 2018.

Key Cortec Value-Add Initiatives

Expanded and professionalized the leadership team.

- In partnership with YETI’s founders, hired new CEO, CFO, COO, and CMO, along with VPs of Sales, Product Development, IT, and HR

- Grew overall employee base from ~20 at acquisition to ~630, meaningfully scaling the organization

Developed Marketing and Sales Organizations

- Formed and built a 60+ person marketing department, including a sizable digital team

- Built and launched YETI.com, significantly enhancing the direct-to-consumer experience and revenue stream

- Established 70+ person company-employed direct salesforce

- Expanded internationally into Canada, Australia, New Zealand, and Japan

Broadened Product Line

- Created multi-year road map to expand the product suite beyond hard coolers, including via the successful launches of Hopper ® soft coolers, Rambler ® insulated drinkware, and other travel, storage, and outdoor products

- Hired 60+ person new product development team, built a cutting-edge Innovation Center, and developed a new product “stage / gate” process (from ideation through launch)

- Introduced colorways to drinkware and core product lines, as well as customizable products on YETI.com

Improved Systems, Operations, and Processes

- Implemented new ERP, CRM, and eCommerce platforms to improve information access and ability to manage a larger, more complex business

- Qualified multiple new supplier partners and added production capacity, enhancing quality and reducing lead times

- Transitioned to global third-party logistics partners, significantly improving inventory management and customer service

Unless otherwise stated, all statistics are as of YETI’s IPO in October 2018.

Product and Category Expansion

Given the strong performance of the business, Cortec, the Seiders, and management completed an IPO (NYSE:YETI) in 2018. Cortec exited its ownership through the IPO and a series of subsequent share sales completed through February 2021.

Past performance is not necessarily indicative of future returns. Case studies are for illustrative purposes only and do not represent a complete list of investments. There can be no assurance future investments will be comparable in quality or performance.

Business Focused. Results Oriented.

Before you proceed.

Just a quick note to tell you that you are about to leave our website.

Terms of Use | Privacy Policy | Learn About Our Privacy Standards | Sitemap © 2024 Cortec Group Management Services, LLC

Brand Strategy Case Study: YETI Grows by Expanding Reach

It’s Not a Cooler. It’s the Promise of Adventure

Recently, I was inspired to dive into a brand strategy case study for premium cooler brand YETI. With 19% growth in 2020, the brand must be doing something worth studying.

I asked my husband what he wanted for his birthday, and he requested a cooler to take on outdoor outings – specifically, a YETI cooler, which has a reputation for being incredibly durable. I thought, “No big deal. How expensive can a YETI cooler possibly be?” To my utter amazement, they start at $250 and can go up to $1,300.

Now, my husband and I have always loved the outdoors, but nowadays our trips require taking two toddlers. So, it’s questionable how durable our cooler needs to be. It’s not like we’ll be backpacking into bear country anytime soon. I did end up getting him the cooler, because I know he had been researching it for awhile but would not make the purchase himself. (And, what are birthdays for?)

YETI is a great brand strategy case study of a niche brand that has transformed the cooler category and driven growth by expanding its reach and product offerings.

Brand Strategy Case Study: Building a Strong Product…and Community

YETI launched in 2006 , founded by two brothers with a simple mission of building a durable cooler they could use every day. At the time, the alternatives were $30 coolers sold at Target and Walmart. They broke easily and didn’t meet the brothers’ outdoor adventure needs. As a result, they focused on developing a premium, high-quality cooler that would be put through rigorous field testing. Although priced significantly higher, it would be worth the price for the true outdoor enthusiast.

At the start, YETI used grassroots efforts to market their coolers. They turned early adopters into YETI ambassadors, providing branded hats and t-shirts to help drive interest and tell their story. YETI ambassadors included influential guides and fishermen, who provided an extra layer of credibility and organic community engagement with YETI’s core consumer target.

According to founder Roy Seiders :

“It was a huge help to have high-profile hunters and fishers reinforce that image with testimonials. At the time, no other cooler company was advertising to outdoor enthusiasts or taking advantage of the professionals in the sport. Ryan and I couldn’t quite believe it; it was wide open.”

Today, YETI boasts an incredibly loyal online community fanbase, with 1.6 million followers on Instagram . Like many lifestyle brands, YETI fans are considered almost “cult-like,” continually sharing their experience with others online through the hashtag #BuiltForTheWild.

YETI clearly built a strong product, but they also built a successful lifestyle brand that is associated with outdoor adventure, being indestructible and the best in class – not according to them- but rather everyone that uses the product, including professionals.

Brand Strategy Case Study: Expanding Reach

While YETI started out targeting hardcore outdoor enthusiasts, by 2014 they realized the need to expand the brand’s reach and started developing a strategy to attract other segments that work or play outdoors. This included farmers, ranchers, snowboarders, mountain bikers and even tailgaters.

Part of the strategy including increasing distribution in channels these new segments shopped at. They also evolved the brand positioning to be inclusive of expansion targets, making it the:

“cooler of choice for outdoor enthusiasts, pros, tailgaters, and backyard barbecue kings.”

Brand Strategy Case Study: Entering Adjacent Categories

Over the last five years, YETI has also expanded its product offerings beyond coolers, allowing it to reach new audiences and solidify its place as an aspirational outdoor lifestyle brand. It has strategically launched backpacks, drinkware, pet gear, apparel, and other outdoor living gear.

Drinkware (bottles, mugs, jugs, etc.) accounts for the majority of their sales, at $628 million . Coolers and equipment, while still strong, drive only $446 million in sales.

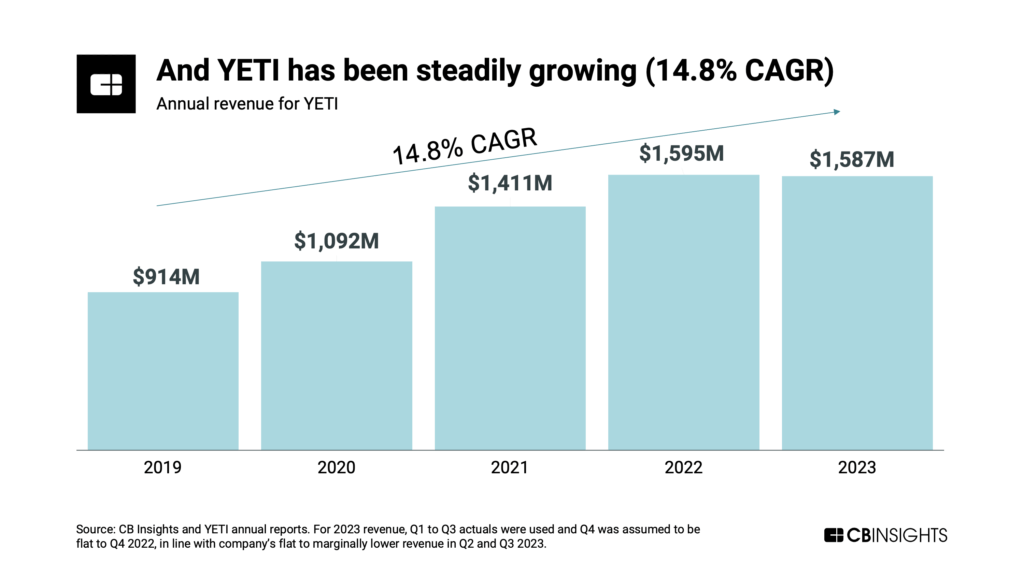

Today, YETI sales show no signs of slowing down. In 2020, YETI reached $1 billion dollars in sales and had a healthy 19% growth versus 2019. YETI is the perfect example of a niche brand that has evolved into an outdoor lifestyle brand by successfully expanding its core offerings and audience.

For more brand strategy examples, visit our resources page or contact us to start a conversation.

Yeti SWOT Analysis

Before we dive deep into the SWOT analysis, let’s get the business overview of Yeti. Yeti Inc. is a leading manufacturer and retailer of high-quality outdoor lifestyle products, which include coolers, drinkware, bags, and other outdoor accessories.

Founded in 2006 by brothers Roy and Ryan Seiders, the company was built to create durable, high-performance gear to cater to the needs of outdoor enthusiasts, hunters, fishermen, and adventurers.

Product Lines :

- Coolers: Yeti’s flagship products are their premium coolers, which include hard coolers (Tundra Series), soft coolers (Hopper Series), and backpack coolers. Known for their exceptional insulation, rugged design, and long-lasting performance, these coolers are popular among customers seeking high-quality outdoor cooling solutions.

- Drinkware: Yeti offers a wide range of insulated drinkware, including tumblers, bottles, mugs, and jugs. These products are made from stainless steel with vacuum insulation, which helps maintain the temperature of beverages for extended periods.

- Bags: Yeti provides a variety of durable, waterproof bags and backpacks suitable for outdoor adventures, such as duffel bags, waterproof backpacks, and insulated lunch bags.

- Outdoor Gear: The company also offers an assortment of outdoor gear and accessories, like chairs, blankets, dog bowls, and more. These products cater to the diverse needs of outdoor enthusiasts and help enhance their experiences in the wild.

Business Model : Yeti operates through a multi-channel distribution model, which includes direct-to-consumer sales through its e-commerce platform and a network of authorized retailers. By focusing on premium materials, innovative designs, and exceptional customer service, Yeti has carved out a niche in the outdoor products market.

Market Positioning: Yeti has established itself as a premium brand in the outdoor products market, attracting customers who value quality, durability, and performance. With an emphasis on innovation and continuous improvement, Yeti has maintained a loyal customer base and differentiated itself from competitors.

Key Growth Strategies :

- Product Innovation: Yeti continuously invests in research and development to improve existing and launch new products, ensuring it stays ahead of the curve in the rapidly evolving outdoor products market.

- Geographic Expansion: By entering new markets and expanding its distribution network, Yeti aims to capitalize on the growing demand for premium outdoor products worldwide.

- Marketing and Brand Awareness: Yeti continues to build brand awareness through targeted marketing campaigns, collaborations, and partnerships with outdoor enthusiasts, influencers, and ambassadors.

Financial Performance 2023 : Sales increased 4% to $1,658.7 million, compared to $1,595.2 million in the prior year. Gross profit increased 24% to $943.2 million, or 56.9% of sales, compared to $763.4 million, or 47.9% of sales in the prior year.

Here is the SWOT analysis for Yeti

A SWOT analysis is a strategic planning tool used to evaluate the Strengths, Weaknesses, Opportunities, and Threats of a business, project, or individual. It involves identifying the internal and external factors that can affect a venture’s success or failure and analyzing them to develop a strategic plan. In this article, we do a SWOT Analysis of Yeti.

SWOT Analysis: Meaning, Importance, and Examples

- Strong Brand Reputation : Yeti has established itself as a premium brand in the outdoor products market, synonymous with quality, durability, and performance. This strong brand reputation attracts loyal customers who pay a premium for high-quality products.

- High-Quality Products : Yeti’s commitment to using premium materials and innovative designs results in high-quality products with superior performance and longevity. This sets Yeti apart from competitors and ensures customer satisfaction.

- Product Innovation : Yeti’s focus on research and development enables the company to introduce new and improved products regularly, catering to the evolving needs of outdoor enthusiasts. This commitment to innovation helps maintain customer interest and brand loyalty.

- Diversified Product Portfolio : Yeti offers a wide range of outdoor products, including coolers, drinkware, bags, and other accessories. This diversified portfolio caters to different customer needs and helps mitigate risks depending on a single product category.

- Multi-Channel Distribution : Yeti’s multi-channel distribution strategy, which includes direct-to-consumer sales through its e-commerce platform and a network of authorized retailers, ensures broad market reach and helps the company reach more customers.

- Loyal Customer Base : Yeti’s focus on customer satisfaction, exceptional product quality, and after-sales service has helped build a loyal customer base that contributes to repeat purchases and word-of-mouth marketing.

- Strategic Partnerships and Collaborations : Yeti’s partnerships with outdoor enthusiasts, influencers, and ambassadors help increase brand visibility and strengthen its market positioning as a premium outdoor lifestyle brand.

- Scalable Business Model : Yeti’s business model allows for scalability, enabling the company to expand its product offerings, enter new markets, and grow its distribution network without significant challenges.

- Premium Pricing : Yeti’s high-quality products come with premium price tags, which may deter price-sensitive customers and limit the brand’s appeal to a specific market segment. This could result in limited market share compared to more affordably priced competitors.

- Competition : The outdoor products market is highly competitive, with numerous brands offering similar products. Yeti faces competition from both established players and new entrants, which may affect market share and profitability.

- Dependence on Third-Party Manufacturers : Yeti relies on third-party manufacturers for the production of its products. This dependence can pose risks such as supply chain disruptions, quality control issues, or increased production costs that may impact the business.

- Limited International Presence : Although Yeti has started to expand internationally, its presence in global markets is still limited compared to other major outdoor product brands. This may restrict growth opportunities and make the company more vulnerable to regional market fluctuations.

- Counterfeit Products : The popularity of Yeti’s products has led to the proliferation of counterfeit and imitation products in the market. This erodes brand value and can lead to customer dissatisfaction and potential legal issues.

- Potential Environmental Concerns : Manufacturing outdoor products, especially those made of plastic and metal materials, can have environmental implications. Increased scrutiny of environmental practices and potential regulatory changes could impact Yeti’s production costs or require changes in its manufacturing processes.

- Slow Adoption of New Products : Yeti’s premium pricing and the durability of its products may result in customers taking longer to adopt new offerings. This slow adoption rate can limit the company’s ability to capitalize quickly on new product launches and innovations.

- Economic Sensitivity : As a premium brand, Yeti’s sales may be more susceptible to economic downturns when customers may cut back on discretionary spending. This sensitivity to economic conditions can lead to fluctuations in revenue and profitability.

Opportunities

- Geographic Expansion : Yeti can capitalize on the growing demand for premium outdoor products by expanding its presence in emerging markets and untapped regions. This would increase its customer base, diversify revenue streams, and reduce dependence on existing markets.

- Product Line Expansion : By introducing new products and expanding into adjacent categories, such as camping equipment, outdoor apparel, or footwear, Yeti can cater to a broader range of customer needs and tap into new revenue streams.

- Collaboration and Partnerships : Yeti can explore strategic partnerships with other outdoor brands, retailers, or organizations to enhance its product offerings, increase brand visibility, and access new distribution channels.

- Sustainability Initiatives : By focusing on sustainable materials and production processes, Yeti can appeal to environmentally conscious consumers and strengthen its brand image. This includes implementing eco-friendly packaging, utilizing recycled materials, and promoting responsible disposal practices.

- Targeting New Customer Segments : Yeti can explore opportunities to target new customer segments, such as younger consumers, urban dwellers, and casual outdoor enthusiasts, with tailored marketing campaigns and product offerings.

- Enhancing Digital Presence: Investing in digital marketing, e-commerce capabilities, and leveraging social media platforms can help Yeti strengthen its online presence and improve customer engagement, increasing sales and brand awareness.

- Technological Innovations: Yeti can invest in cutting-edge technology to develop advanced, energy-efficient cooling systems, insulation materials, or smart features in its products, giving it a competitive advantage and reinforcing its position as an innovative brand in the outdoor products market.

- Acquisition and Mergers : Yeti can explore opportunities to acquire or merge with complementary businesses, which can help expand its product portfolio, improve distribution networks, and enhance its market presence.

- Intense Competition : The outdoor products market is highly competitive, with numerous brands offering similar products at varying prices. Yeti faces competition from both established players and new entrants, which could lead to pricing pressures, loss of market share, and reduced profitability.

- Economic Fluctuations : As a premium brand, Yeti’s sales may be susceptible to economic downturns when customers may cut back on discretionary spending. Economic fluctuations can reduce consumer demand and impact the company’s revenue and profitability.

- Supply Chain Disruptions : Yeti relies on third-party manufacturers to produce its products, making it vulnerable to supply chain disruptions caused by natural disasters, geopolitical tensions, or other unforeseen events. Such disturbances can lead to delays in product delivery, increased costs, and potential damage to the brand’s reputation.

- Counterfeit Products : The popularity of Yeti’s products has led to the proliferation of counterfeit and imitation products in the market. These counterfeit products erode brand value and result in customer dissatisfaction and potential legal issues.

- Changing Consumer Preferences : The outdoor products market constantly evolves, and consumer preferences can shift rapidly. Failure to anticipate and adapt to these changes in consumer preferences can lead to decreased demand for Yeti’s products and impact its market position.

- Regulatory Changes : Changes in environmental, labor, or trade regulations in the countries where Yeti operates or sources its products can lead to increased compliance costs, production challenges, or disruptions in its supply chain.

- Currency Fluctuations : As Yeti expands its international presence, it becomes more exposed to fluctuations in foreign currency exchange rates. Volatile currency movements can impact the company’s financial performance and profitability.

- Technological Disruptions : Rapid technological advancements and innovations in the outdoor products market may result in the developing of new materials or products that can outperform Yeti’s offerings. Failure to stay ahead of technological changes can make the company’s products obsolete or less competitive.

Check out the SWOT Analysis of Global Businesses

Related posts.

Mattel SWOT Analysis

Lockheed Martin SWOT Analysis

SWOT Analysis of Customer Service

SWOT Analysis of a recruitment process

SWOT Analysis of a New Product Development

SWOT Analysis of Digital Marketing

SWOT Analysis of an insurance company

SWOT Analysis of a Supply Chain

Type above and press Enter to search. Press Esc to cancel.

Investor Relations

Corporate overview.

YETI is a rapidly growing designer, marketer, retailer, and distributor of a variety of innovative, branded, premium products to a wide-ranging customer base. Our brand promise is to ensure each YETI product delivers exceptional performance and durability in any environment, whether in the remote wilderness, at the beach, or anywhere else life takes you. By consistently delivering high-performing products, we have built a following of engaged brand loyalists throughout the United States, Canada, Australia, and elsewhere, ranging from serious outdoor enthusiasts to individuals who simply value products of uncompromising quality and design. Our relationship with customers continues to thrive and deepen as a result of our innovative new product introductions, expansion and enhancement of existing product families, and multifaceted branding activities.

YETI is a global designer, retailer, and distributor of innovative outdoor products. From coolers and drinkware to backpacks and bags, YETI products are built to meet the unique and varying needs of diverse outdoor pursuits, whether in the remote wilderness, at the beach, or anywhere life takes our customers. By consistently delivering high-performing, exceptional products, we have built a strong following of brand loyalists throughout the world, ranging from serious outdoor enthusiasts to individuals who simply value products of uncompromising quality and design. We have an unwavering commitment to outdoor and recreation communities, and we are relentless in our pursuit of building superior products for people to confidently enjoy life outdoors and beyond.

Latest News

Latest events, latest presentation, latest quarterly reports, yeti investor relations.

512-271-6332 Send Email

Quick Links

- SEC Filings

- Investor FAQs

- Information Request Form

Investor Email Alerts

To opt-in for investor email alerts, please enter your email address in the field below and select at least one alert option. After submitting your request, you will receive an activation email to the requested email address. You must click the activation link in order to complete your subscription. You can sign up for additional alert options at any time.

At YETI Holdings, Inc., we promise to treat your data with respect and will not share your information with any third party. You can unsubscribe to any of the investor alerts you are subscribed to by visiting the ‘unsubscribe’ section below. If you experience any issues with this process, please contact us for further assistance.

By providing your email address below, you are providing consent to YETI Holdings, Inc. to send you the requested Investor Email Alert updates.

| * |

:max_bytes(150000):strip_icc():format(webp)/wk_headshot_aug_2018_02__william_kenton-5bfc261446e0fb005118afc9.jpg)

:max_bytes(150000):strip_icc():format(webp)/CharleneRhinehartHeadshot-CharleneRhinehart-ca4b769506e94a92bc29e4acc6f0f9a5.jpg)

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1353798240-61bbcf6f183b4c42b709624686f44046.jpg)

IMAGES

VIDEO

COMMENTS

Investment Thesis. YETI offered a rare and compelling opportunity to partner with two successful founders to continue to build an influential and growing lifestyle brand. Despite the company's early success, the Seiders had reached a point where they required an experienced teammate to help them navigate the next stage of YETI's evolution. ...

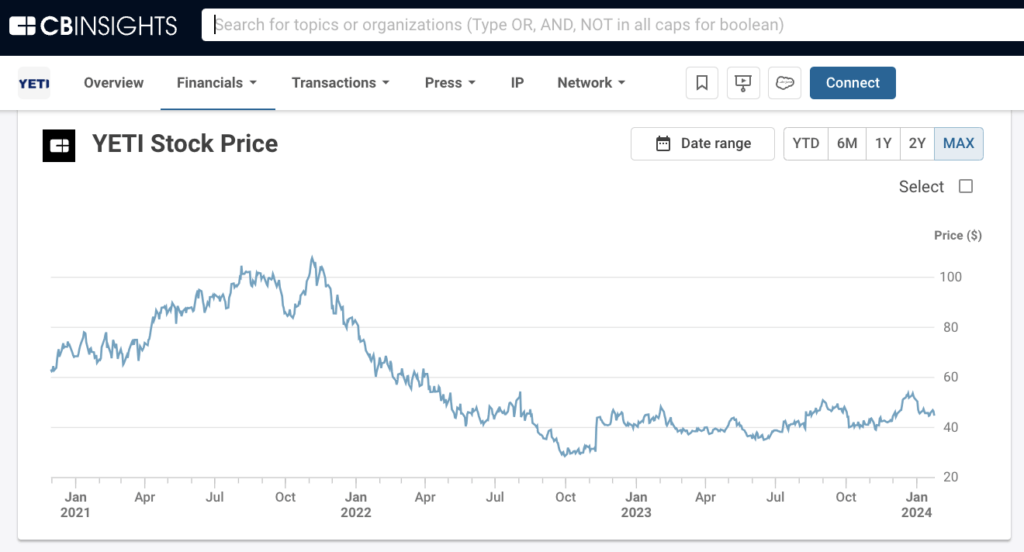

bgton/iStock via Getty Images. Investment Thesis. Over the past three months, YETI (NYSE:YETI) shares have declined by almost 40% from their historic highs.The general loss of appetite for growth ...

Investment Thesis. Since our previous publication, YETI (NYSE:YETI) shares have lost more than 40% of their market capitalization. Slowing sales growth, declining margins, supply chain problems ...

Investment Thesis. YETI Holdings, Inc. (NYSE: YETI), the iconic brand name of drinkware and coolers, is down 58% from its high in early November 2021. YETI sold off during the broader market ...

A small private-equity firm is about to get a big payoff from a bet on $400 coolers. If all goes as hoped, Cortec Group, with just 20 employees in Midtown Manhattan, could make a profit on paper ...

With shares currently priced at $40.91, YETI Holdings Inc has witnessed a daily loss of 7.59%, marked against a three-month change of 7.14%. A thorough analysis, underlined by the GF Score ...

Coolers and equipment, while still strong, drive only $446 million in sales. Today, YETI sales show no signs of slowing down. In 2020, YETI reached $1 billion dollars in sales and had a healthy 19% growth versus 2019. YETI is the perfect example of a niche brand that has evolved into an outdoor lifestyle brand by successfully expanding its core ...

Present Value of Terminal Value (PVTV) = TV / (1 + r) 10 = US$11b÷ ( 1 + 7.1%) 10 = US$5.7b. The total value, or equity value, is then the sum of the present value of the future cash flows, which ...

Analysts say that when Yeti went public in 2018, investors were initially skeptical consumers would shell out $200 to $1,300 on a cooler. But for the right cooler, it turns out many people would.

TREX Trex Company, Inc. 66.41. -4.87%. Find the latest YETI Holdings, Inc. (YETI) stock quote, history, news and other vital information to help you with your stock trading and investing.

Here is the SWOT analysis for Yeti. A SWOT analysis is a strategic planning tool used to evaluate the Strengths, Weaknesses, Opportunities, and Threats of a business, project, or individual. It involves identifying the internal and external factors that can affect a venture's success or failure and analyzing them to develop a strategic plan.

Announces Two Category Expansion Acquisitions a $300 Million Share Repurchase Program Provides Fiscal Year 2024 Outlook YETI Holdings, Inc. ("YETI") (NYSE: YETI) today announced its financial results for the fourth quarter and fiscal year ended December 30, 2023. The results below should be read in conjunction with the "Product Recall Updates" section of this press release.

Your issue with Yeti's growing online channel dependence is interesting, because that is often a positive investment thesis in the retail industry. Yeti's Youtube and Instagram followers tower ...

Corporate Overview. YETI is a global designer, retailer, and distributor of innovative outdoor products. From coolers and drinkware to backpacks and bags, YETI products are built to meet the unique and varying needs of diverse outdoor pursuits, whether in the remote wilderness, at the beach, or anywhere life takes our customers.

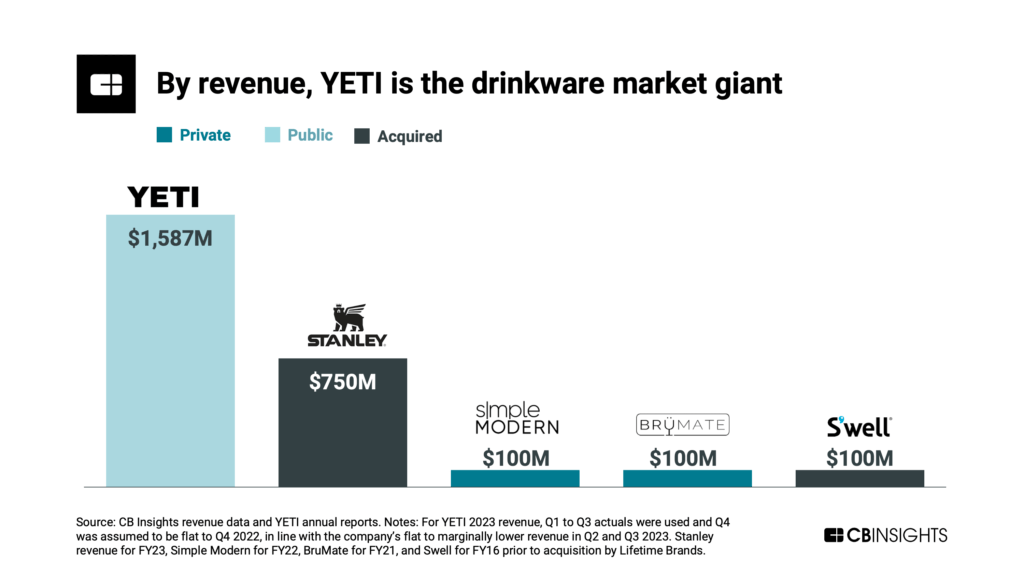

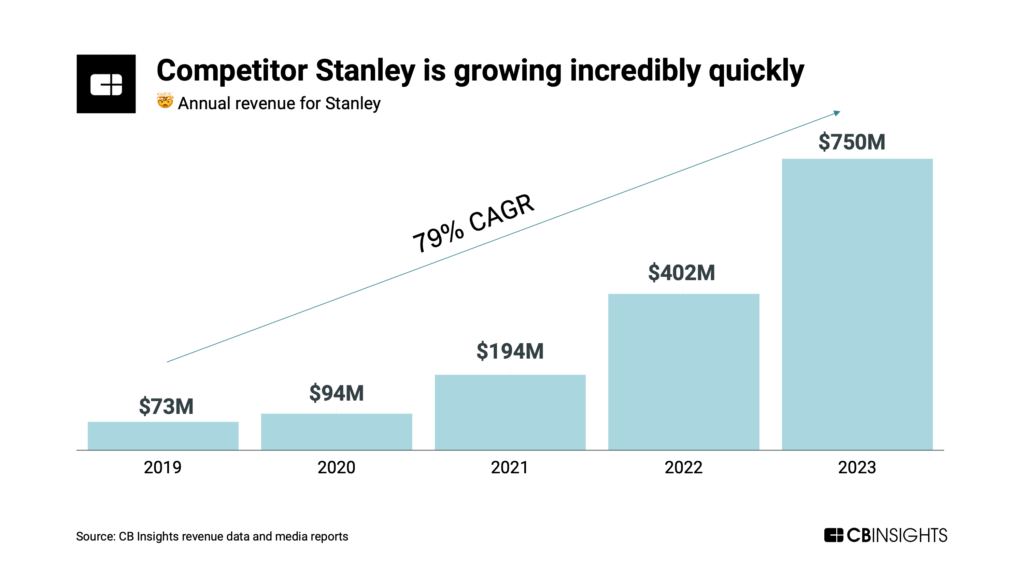

Drinkware is hot right now. Demand for the Stanley tumbler is particularly high — so high that the release of limited-edition versions has stirred up mayhem at Target locations across the US.. Within drinkware (e.g., coolers, tumblers, etc.), however, YETI is the market leader doing 2x the revenue of Stanley. But Stanley is growing at a 79% CAGR.. YETI, on the other hand, is growing at a 14. ...

YETI Holdings, Inc. engages in the design, marketing, and distribution of products for the outdoor and recreation market. Its products include coolers, drinkware, travel bags, backpacks ...

The direct connection to its core customer base has been highly successful. Direct-to-consumer (DTC) sales were up 14% for the third quarter results. In less than ten years, Yeti has progressed ...

• 100% of YETI's sourcing will come from tier 1 and 2 suppliers who meet our responsible sourcing expectations by 2025 • 100% of tier 1 and 2 suppliers will have worker well-being or fair wage programs in place by 2030 FOSTER HUMAN CONNECTION YETI aims to create positive social impact for the people in our workforce,

YETI has aggressively grown revenue over the last few years, going from $469 million in revenue in 2015 to $779 million in 2018, a compounded annual growth rate of 18%. In Q3, revenue was up 17% ...

Developing an investment thesis requires careful consideration of the factors driving an asset's potential performance.

YETI is adding a line of cookware for direct to consumer in Summer 2024, keeping margins high by avoiding wholesale to begin. These two acquisitions combined only cost $48.5 million and should be ...

An investment thesis is a written document that recommends a new investment, based on research and analysis of its potential for profit. Individual investors can use this technique to investigate ...

My thesis remains unchanged — I'm bullish on NVDA shares as an investment due to its clear AI supremacy and exponential growth potential. NVDA's Long-Term AI-Driven Growth Trajectory Remains ...

In the FY2022 Q4 earning call (YETI Holdings, Inc. Q4 2022 Earnings Call Transcript), Yeti reported it absorbed $129 million in write-offs related to the recall and will have a stop-sale in 2023 ...