- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

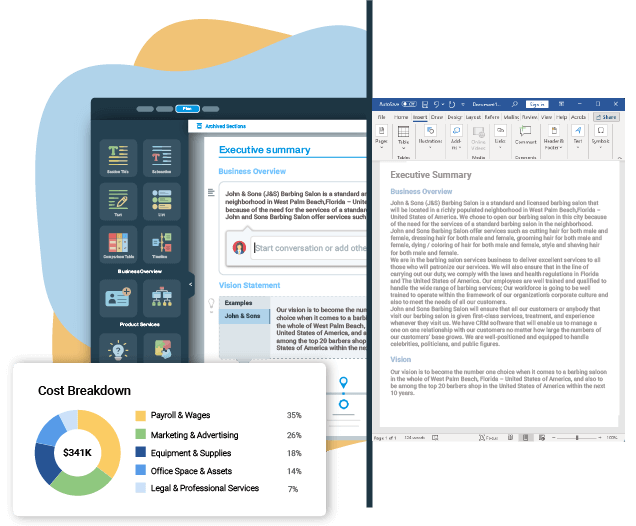

How to Write an Executive Summary in 6 Steps

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

When you’re starting a business, one of the first things you need to do is write a business plan. Your business plan is like a roadmap for your business, so you can lay out your goals and a concrete plan for how you’ll reach them.

Not only is a business plan essential for any business owner, but it’s also a requirement if you decide to apply for small business funding or find investors. After all, before a bank or individual hands over any money, they’ll want to be sure your company is on solid ground (so they can get their money back).

A business plan consists of several pieces, from an executive summary and market analysis to a financial plan and projections. The executive summary will be the first part of your business plan.

If wondering how to write an executive summary has kept you from completing your business plan, we’re here to help. In this guide, we’ll explain what an executive summary is and provide tips for writing your own so your business plan can start strong.

What is an executive summary?

An executive summary is a short, informative, and easy-to-read opening statement to your business plan. Even though it’s just one to two pages, the executive summary is incredibly important.

An executive summary tells the story of what your business does, why an investor might be interested in giving funds to your business, why their investment will be well-spent, and why you do what you do. An executive summary should be informative, but it should also capture a busy reader’s attention.

How much do you need?

with Fundera by NerdWallet

We’ll start with a brief questionnaire to better understand the unique needs of your business.

Once we uncover your personalized matches, our team will consult you on the process moving forward.

Why write an executive summary?

Anyone you’re sending your executive summary and business plan to is likely busy—very busy. An entire business plan is long, involved, and deals with a lot of numbers.

Someone busy wants to get an understanding of your business, and they want to do it quickly, which is to say not by diving into a complicated, 80-page business plan. That’s where your executive summary comes in.

An executive summary provides just the opportunity to hook someone’s interest, tell them about your business, and offer a clear selling point as to why they should consider investing in your business.

Your executive summary is your chance to sell your business to potential investors and show them your business is worth not only their money but also their time.

What to include in an executive summary

By its nature, an executive summary is short. You must be able to clearly communicate the idea of your business, what sets you apart, and how you plan to grow into a successful enterprise.

The subsequent sections of your business plan will go into more detail, but your executive summary should include the most critical pieces of your business plan—enough to stand on its own, as it’s often the only thing a prospective investor will read. Here’s what your executive summary should include—consider it an executive summary template from which you can model your own.

1. The hook

The first sentence and paragraph of your executive summary determine whether or not the entire executive summary gets read. That’s why the hook or introduction is so important.

In general, a hook is considered anything that will get a reader’s attention. While an executive summary is a formal business document, you do want your hook to make you stand out from the crowd—without wasting time.

Your hook can be sharing something creative about your company, an interesting fact, or just a very well-crafted description of your business. It’s crucial to craft your hook with the personality of your reader in mind. Give them something that will make your company stand out and be memorable among a sea of other business plans.

Grab their attention in the first paragraph, and you’re much more likely to get your executive summary read, which could lead to an investment.

2. Company description summary

Now that you’ve hooked your reader, it’s time to get into some general information about your business. If an investor is going to give you money, after all, they first need to understand what your company does or what product you sell and who is managing the company.

Your company description should include information about your business, such as when it was formed and where you’re located; your products or services; the founders or executive team, including names and specific roles; and any additional details about the management team or style.

3. Market analysis

Your market analysis in the executive summary is a brief description of what the market for your business looks like. You want to show that you have done your research and proven that there is a need for your specific product or services. Some questions you should answer:

Who are your competitors?

Is there a demand for your products or services?

What advantages do you have that make your business unique in comparison to others?

To reiterate, stick to the highlights of your market analysis in your executive summary. You’ll provide a complete analysis in a separate section of your business plan, but you should be able to communicate enough in the executive summary that a potential investor can gauge whether your business has potential.

4. Products and services

Now that you’ve established a need in the market, it’s time to show just how your business will fill it. This section of your executive summary is all about highlighting the product or service that your company offers. Talk about your current sales, the growth you’ve seen so far, and any other highlights that are a selling point for your company.

This is also a good time to identify what sets your business apart and gives you a competitive advantage. After all, it’s unlikely that your business is the first of its kind. Highlight what you do better than the competition and why potential customers will choose your product or service over the other options on the market.

5. Financial information and projections

In this section of your executive summary, you want to give the reader an overview of your current business financials. Again, you’ll go more in-depth into this section later in your business plan, so just provide some highlights. Include your current sales and profits (if you have any), as well as what funding you’re hoping to acquire and how this will affect your financials in the next few years.

This is also where you can explain what funding, if any, you’ve received in the past. If you paid back your loan on time, this is an especially bright selling point for potential lenders.

6. Future plans

While asking for what funding you need is essential, you’ve also got to make clear what you’re going to use that funding for. If you’re asking for money, you want the person to know you have a plan to put those funds to good use.

Are you hoping to open another location, expand your product line, invest in your marketing efforts? This final section of your executive summary should detail where you want your business to go in the future, as well as drive home how funding can help you get there.

Tips for writing an executive summary

Even if you include each part of a good executive summary, you might not get noticed. What is written can be just as important as how it’s written. An executive summary has to strike a delicate balance between formal, personable, confident, and humble.

1. Be concise

An executive summary should include everything that’s in your business plan, just in a much shorter format. Writing a concise executive summary is no easy task and will require many revisions to get to the final draft. And while this is the first section of your executive summary, you’ll want to write it last, after you’ve put together all the other elements.

To choose your most important points and what should be included in the executive summary, go through your business plan, and pull out single-line bullet points. Go back through those bullet points and eliminate everything unnecessary to understanding your business.

Once you have your list of bullet points narrowed down, you can start writing your executive summary. Once it’s written, go back in and remove any unnecessary information. Remember, you should only be including the highlights—you have the rest of your business plan to go into more detail. The shorter and clearer your executive summary is, the more likely someone is to read it.

2. Use bullet points

One simple way to make your executive summary more readable is to use bullet points. If someone is reading quickly or skimming your executive summary, extra whitespace can make the content faster and easier to read.

Short paragraphs, short sentences, and bullet points all make an executive summary easier to skim—which is likely what the reader is doing. If important numbers and convincing stats jump out at the reader, they’re more likely to keep reading.

3. Speak to your audience

When writing your executive summary, be sure to think about who will be reading it; that’s who you’re speaking to. If you can personalize your executive summary to the personality and interests of the person who will read it, you’re more likely to capture their attention.

Personalizing might come in the form of a name in the salutation, sharing details in a specific way you know that person likes and the tone of your writing. An executive summary deals with business, so it will generally have a formal tone. But, different industries may be comfortable with some creativity of language or using shorthand to refer to certain ideas.

Know who you’re speaking to and use the right tone to speak to them. That might be formal and deferential, expert and clipped, informal and personable, or any other appropriate tone. This may also involve writing different versions of your executive summary for different audiences.

4. Play to your strengths

One of the best ways to catch the attention of your reader is to share why your business is unique. What makes your business unique is also what makes your business strong, which can capture a reader’s interest and show them why your business is worth investing in. Be sure to highlight these strengths from the start of your executive summary.

5. Get a test reader

Once you’ve written and edited your executive summary, you need a test reader. While someone in your industry or another business owner can be a great resource, you should also consider finding a test reader with limited knowledge of your business and industry. Your executive summary should be so clear that anyone can understand it, so having a variety of test readers can help identify any confusing language.

If you don’t have access to a test reader, consider using tools such as Hemingway App and Grammarly to ensure you’ve written something that’s easy to read and uses proper grammar.

How long should an executive summary be?

There’s no firm rule on how long an executive summary should be, as it depends on the length of your business plan and the depth of understanding needed by the reader to fully grasp your ask.

That being said, it should be as short and concise as you can get it. In general, an executive summary should be one to two pages in length.

You can fudge the length slightly by adjusting the margin and font size, but don’t forget readability is just as important as length. You want to leave plenty of white space and have a large enough font that the reader is comfortable while reading your executive summary. If your executive summary is hard to read, it’s less likely your reader will take the time to read your business plan.

What to avoid in an executive summary

While the rules for writing a stellar executive summary can be fuzzy, there are a few clear rules for what to avoid in your executive summary.

Your executive summary should avoid:

Focusing on investment. Instead, focus on getting the reader to be interested enough to continue and read your business plan or at least schedule a meeting with you.

Clichés, superlatives, and claims that aren’t backed up by fact. Your executive summary isn’t marketing material. It should be straightforward and clear.

Avoiding the executive summary no-nos is just as important as striking the right tone and getting in the necessary information for your reader.

The bottom line

While an executive summary is short, it’s challenging to write. Your executive summary condenses your entire introduction, business description, business plan, market analysis, financial projections, and ask into one to two pages. Condensing information down to its most essential form takes time and many drafts. When you’re putting together your business plan’s executive summary, be sure to give yourself plenty of time to write it and to seek the help of friends or colleagues for editing it to perfection.

However, some tools make crafting a business plan, including your executive summary, a simpler process. A business plan template is a great place to start, and business plan software can especially help with the design of your business plan. After all, a well-written executive summary can make all the difference in obtaining funding for your business, so you’ll want all the help you can get.

This article originally appeared on JustBusiness, a subsidiary of NerdWallet.

On a similar note...

How to Write an Executive Summary (+ Examples)

- March 21, 2024

- Business Plan , How to Write

The executive summary is the cornerstone of any business plan, serving as a gateway for readers to understand the essence of your proposal.

It summarizes the plan’s key points into a digestible format, making it crucial for capturing the interest of investors, partners, and stakeholders.

In this comprehensive guide, we’ll explore what the executive summary is, why we use it, and also how you can create one for your business plan. Let’s dive in!

What is an Executive Summary?

An executive summary is a concise and compelling overview of a business plan (or simply a report), designed to provide readers, such as investors, partners, or upper management, with a quick and clear understanding of the document’s most critical aspects.

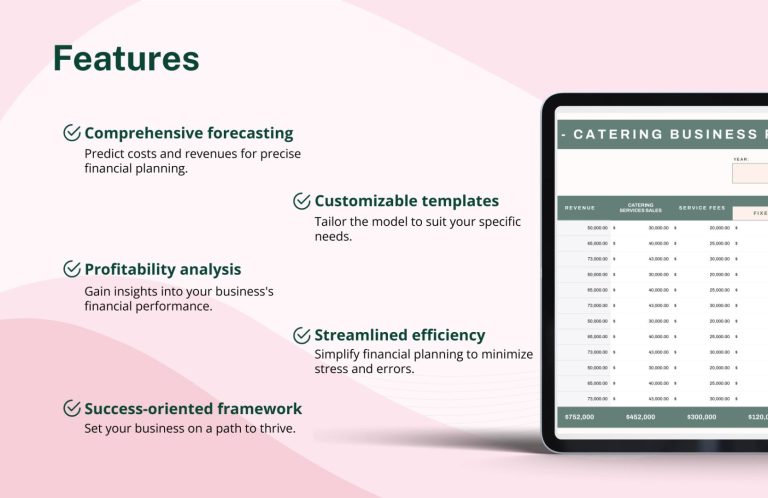

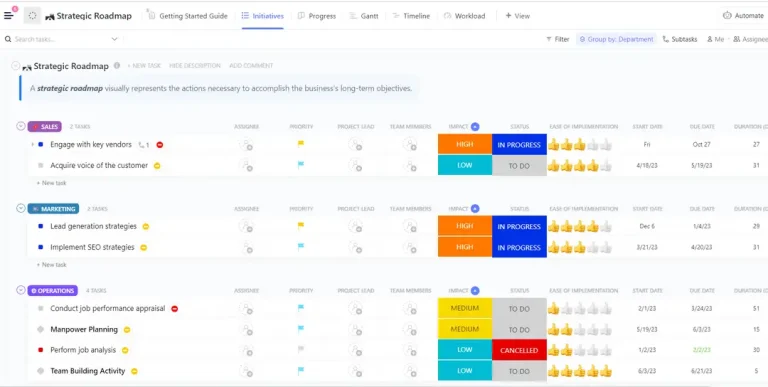

For a business plan, it summarizes the key points including the business overview , market analysis , strategy plan timeline and financial projections.

Typically, the executive summary is the first section of a business plan, but it should be written last to ensure it accurately reflects the content of the entire document.

The primary goal of an executive summary is to engage the reader’s interest and encourage them to read the full document.

It should be succinct, typically no more than one to two pages, and articulate enough to stand on its own, presenting the essence of the business proposal or report without requiring the reader to go through the entire document for basic understanding.

Why Do We Use It?

The executive summary plays a crucial role in whether a business plan opens doors to funding, partnerships, or other opportunities . It’s often the first (and sometimes the only) part of the plan that stakeholders read, making it essential for making a strong, positive first impression. As such, we use it in order to:

- Capture Attention: Given the volume of business plans investors, partners, and lenders might receive, an executive summary’s primary function is to grab the reader’s attention quickly. It highlights the most compelling aspects of the business to encourage further reading.

- Save Time: It provides a succinct overview of the business plan, allowing readers to understand the key points without going through the entire document. This is particularly beneficial for busy stakeholders who need to make informed decisions efficiently.

- Facilitate Understanding: An executive summary distills complex business concepts and strategies into a concise format. Therefore, it makes it easier for readers to grasp the business’s core mission, strategic direction, and potential for success.

- Driving Action: By summarizing the financial projections and funding requirements, an executive summary can effectively communicate the investment opportunity. Indeed the investment opportunity, whether to raise money from investors or a loan from a bank, is the most common reason why we prepare business plans.

- Setting the Tone: The executive summary sets the tone for the entire business plan. A well-written summary indicates a well-thought-out business plan, reflecting the professionalism and competence of the management team.

How to Write an Executive Summary in 4 Simple Steps

Here’s a streamlined approach to crafting an impactful executive summary:

1. Start with Your Business Overview

- Company Name: Begin with the name of your business.

- Location: Provide the location of your business operations.

- Business model: Briefly describe how you make money, the producfs and/or services your business offers.

2. Highlight the Market Opportunity

- Target Market : Identify your target market and its size.

- Market Trends : Highlight the key market trends that justify the need for your product or service.

- Competitive Landscape : Describe how your business is positioned to meet this need effectively.

3. Present Your Management Team

- Team Overview: Introduce the key members of your management team and their roles.

- Experience: Highlight relevant experience and skills that contribute to the business’s success.

4. Include Financial Projections

- Financial Summary: Provide a snapshot of key financial projections, including revenue, profits, and cash flow over the next three to five years.

- Funding Requirements: If seeking investment, specify the amount needed and how it will be used.

2 Executive Summary Examples

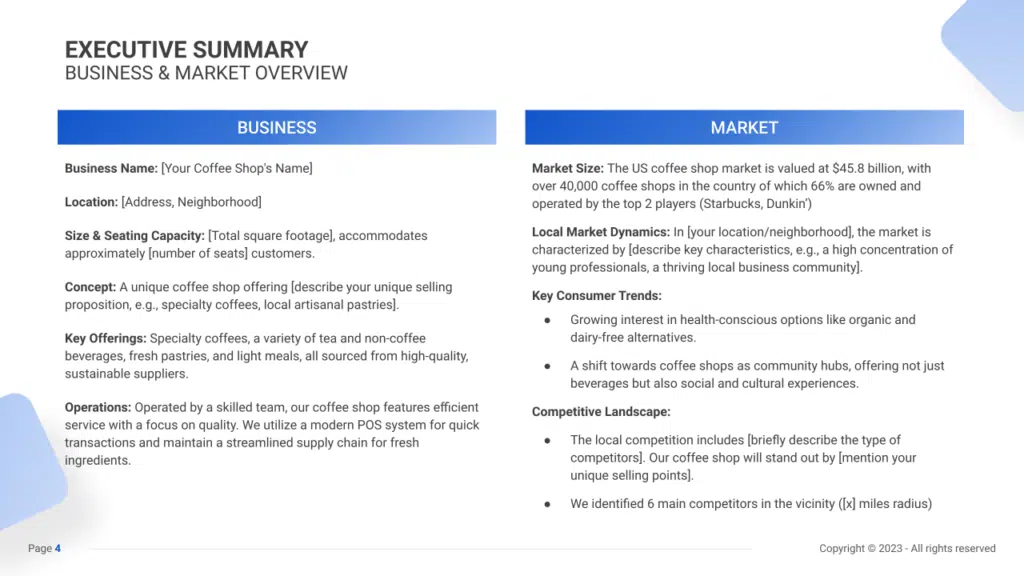

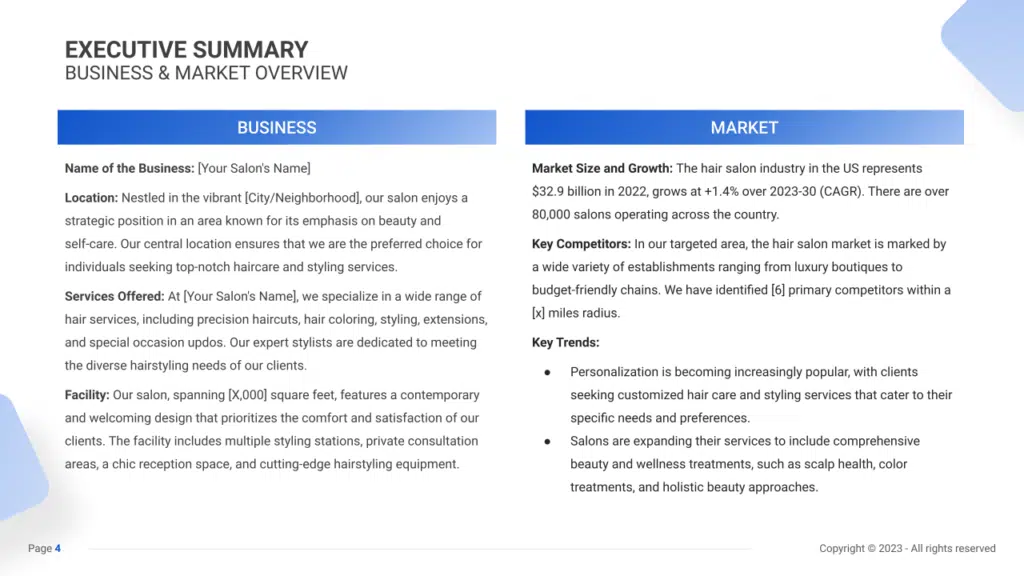

Here are 2 examples you can use as an inspiration to create yours. These are taken from our coffee shop and hair salon business plan templates.

Coffee Shop Executive Summary

Hair Salon Executive Summary

Related Posts

Outdoor Sports Gear Store Business Plan PDF Example

- May 29, 2024

- Business Plan

Shoe Store Business Plan PDF Example

Auto Parts Store Business Plan PDF Example

Privacy overview.

How to Write an Executive Summary

9 min. read

Updated December 13, 2023

An executive summary isn’t just the beginning of your business plan – it’s your opening act, your first chance to impress potential investors, banks, clients and other stakeholders.

An effective executive summary gives decision-makers critical information about your business instantly.

Creating an executive summary is more than just a writing exercise. It requires careful crafting and strategic thinking, as well as an ability to balance the needs to be both succinct and comprehensive.

- What is an executive summary?

The executive summary is a brief introduction and summary of your business plan. It introduces your business, the problem you solve, and what you’re asking from your readers. Anyone should be able to understand your business by simply reading this section of your plan.

While structurally it is the first chapter of your plan—you should write it last. Once you know the details of your business inside and out, you will be better prepared to write this section.

- Why write an executive summary?

The business plan executive summary provides quick access to critical information from your more detailed business plan.

It is essential for informing anyone outside of your business. Many people—including investors and bankers—will only read your summary. Others will use it to decide if they should read the rest. For you, it is a snapshot of your business to reference when planning or revising your strategy.

Now if you’re writing a business plan solely for internal use you may not need an executive summary. However, some internal plans may necessitate writing an executive summary for assignment—such as for an annual operations plan or a strategic plan .

It takes some effort to do a good summary, so if you don’t have a business use in mind, don’t do it.

- How long should it be?

Business plan executive summaries should be as short as possible. Your audience has limited time and attention and they want to quickly get the details of your business plan.

Try to keep your executive summary under two pages if possible, although it can be longer if absolutely necessary. If you have a one-page business plan, you can even use that as your executive summary.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

- Executive summary outline

Two pages isn’t a ton of space to capture the full scope of your vision for the business. That means every sentence of your executive summary counts.

You will want to immediately capture the reader’s attention with a compelling introduction. Without getting too lengthy, present who you are as an organization, the problem you are seeking to solve, your skills, and why you are the best entity to solve the problem you’ve outlined.

It’s crucial to establish the need or problem your business is solving in a clear manner, in order to convince your audience that it must be addressed. Following that, recommend the solution and show its value. Be clear and firm in your recommendation, making sure to justify your cause and highlighting key reasons why your organization is the perfect fit for the solution you’re proposing. Finally, a strong conclusion is needed to reiterate the main points and wrap up the executive summary.

What to include in your executive summary

1. business overview.

A one-sentence description that explains what you do, why you do it, and how you do it.

Summarize the problem you’re solving in the market and reference any data that solidifies that there is a need.

3. Solution

Describe your product or service and how it addresses the problem you identified.

4. Target market

Who is your ideal customer? Describe who they are, how they’ll benefit, and why they’re an attainable customer base.

5. Competition

Who are your competitors? List out any primary competition as well as alternatives that your customers may consider. Include key details about their current offerings, promotions, and business strategy.

6. Your team

In your executive summary, outline your organizational structure and current team. List out brief explanations of who you and your team are, your qualifications, and what your function will be within the business. It may be valuable to also highlight any gaps in your team and how you intend to fill them. If you have potential partners or candidates in mind, briefly mention them and expand on their qualifications within your full business plan.

7. Financial summary

Highlight key aspects of your financial plan that address sales, expenses, and profitability. Try to keep these in chart or graph form to ensure the information is easy to consume and resonates visually.

8. Funding requirements

This section is only necessary if you’re seeking out funding or pitching to investors. Be sure to throw out your financing number and reasoning upfront, rather than hiding it later on in your plan. It helps investors understand your position, what you’re asking for, and how you’ll use it.

9. Milestones and traction

Add initial sales, pre-sales, newsletter sign-ups, or anything else that showcases customer interest. Outline what steps you’ve already taken to launch your business, the milestones you’ve hit, and your goals and milestones for the next month, six months, year, etc.

Executive summary vs introduction

A common mistake some people make when starting an executive summary outline is thinking it performs the same function as the introduction to their business plan. In fact, the two serve different purposes and contain different types of information, even though they are both essential.

As we’ve discussed, the executive summary is a high-level overview of the entire business plan. The introduction, by contrast, dives deeper into your business, providing information about the nature of your business, the history of your company, your mission statement, products or services, and the specific problem that your business solves.

The introduction is more detailed, and usually comes right after the executive summary.

On the other hand, the introduction gives investors or lenders – anyone reading your business plan – a sense of why they should continue reading. Think of it more as the space to tell stakeholders why you are speaking to them. An executive summary can also serve this purpose, but the introduction is meant to speak more directly to your target audience, while an executive summary could give a larger audience a general overview of your business.

Tips for writing an effective executive summary

Here are a few best practices to make writing your executive summary easier, and ultimately more effective.

1. Think of an executive summary as your pitch

The executive summary is like an elevator pitch. You’re selling someone on reading your full plan while quickly summarizing the key points. Readers will expect it to cover certain areas of your business—such as the product, market, and financial highlights, at the very least.

While you need to include what’s necessary, you should also highlight areas that you believe will spark the reader’s interest. Remember, you’re telling the brief but convincing story of your business with this summary. Just be sure that you’re able to back it up with the right details with the rest of your business plan.

2. Write it last

Even though the executive summary is at the beginning of a finished business plan, many experienced entrepreneurs choose to write it after everything else. In theory, this makes it easier to write since all of the information is already written out and just needs to be condensed into a shorter format.

Now, if you’ve started with a one-page plan, this process is even easier. Just use your one-page plan as a starting point and add additional details to any sections that need it. You may even find that no changes are necessary.

3. Keep it short

Ideally, the executive summary is short—usually just a page or two, five at the outside—and highlights the points you’ve made elsewhere in your business plan. Whatever length you land on, just focus on being brief and concise. Keep it as short as you can without missing the essentials.

4. Keep it simple

Form follows function, so don’t overcomplicate or over-explain things. The best executive summaries are a mixture of short text, broken up with bullets and subheadings, and illustrations, such as a bar chart showing financial highlights.

Run through a legibility test after writing your summary. Is it easy to skim through? Are the right pieces of information jumping out? If the answer to either of those questions is no, then work back through and try breaking up information or adjusting the formatting.

5. Create an executive summary outline based on importance and strengths

Organize your executive summary outline so that the most important information appears first. While there are specific components to include, there is no set order of appearance. So, use the order to show emphasis.

Lead with what you want to get the most attention, and add the rest by order of importance. For example, you may start with the problem because that can add drama and urgency that tees up the solution you provide.

Additional resources to write a great executive summary

Need more information and guidance to craft a convincing executive summary? Check out these in-depth resources and templates.

Key mistakes to avoid when writing an executive summary

Here are the critical mistakes you should avoid when writing your executive summary.

How to write your executive summary for specific audiences

The executive summary should tell your audience exactly what your business is, what it does, and why it’s worth their time. Here’s how you can take it a step further and fine-tune it for specific people.

How to develop a mission statement

Learn to put a heart behind the business and create an easy-to-understand narrative by writing a mission statement.

Executive Summary FAQ

What is in an executive summary?

The executive summary of a business plan is a brief introduction and summary of your business strategy, operations, and goals.

What is the purpose of an executive summary?

An executive summary is typically written to convince someone to read your more detailed plan. For investors, it may be the only thing they look at when deciding if they’d like to hear your pitch. Loan officers may review it to determine if your business seems financially sound. And partners, mentors, or anyone else may use it to determine if they want to be involved with your business.

How do you start an executive summary?

While there is no required order for an executive summary, it’s often recommended that you lead with the problem you’re solving or the purpose of your business. This will help frame your intent for the reader, and ideally make them more interested in learning more.

How do you write a good executive summary?

A good executive summary is brief, convincing, and easy to read. Focus on keeping things short and concise, only including necessary information. Be sure to lead and highlight anything that is especially interesting or important about your business. And after writing, spend some time reviewing and reformatting to make your summary as attractive to read as possible.

Tim Berry is the founder and chairman of Palo Alto Software , a co-founder of Borland International, and a recognized expert in business planning. He has an MBA from Stanford and degrees with honors from the University of Oregon and the University of Notre Dame. Today, Tim dedicates most of his time to blogging, teaching and evangelizing for business planning.

Table of Contents

- What to include

- Writing tips

- Additional resources

Related Articles

3 Min. Read

What to Include in Your Business Plan Appendix

24 Min. Read

The 10 AI Prompts You Need to Write a Business Plan

10 Min. Read

How to Set and Use Milestones in Your Business Plan

6 Min. Read

How to Write Your Business Plan Cover Page + Template

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

Our Recommendations

- Best Small Business Loans for 2024

- Businessloans.com Review

- Biz2Credit Review

- SBG Funding Review

- Rapid Finance Review

- 26 Great Business Ideas for Entrepreneurs

- Startup Costs: How Much Cash Will You Need?

- How to Get a Bank Loan for Your Small Business

- Articles of Incorporation: What New Business Owners Should Know

- How to Choose the Best Legal Structure for Your Business

Small Business Resources

- Business Ideas

- Business Plans

- Startup Basics

- Startup Funding

- Franchising

- Success Stories

- Entrepreneurs

- The Best Credit Card Processors of 2024

- Clover Credit Card Processing Review

- Merchant One Review

- Stax Review

- How to Conduct a Market Analysis for Your Business

- Local Marketing Strategies for Success

- Tips for Hiring a Marketing Company

- Benefits of CRM Systems

- 10 Employee Recruitment Strategies for Success

- Sales & Marketing

- Social Media

- Best Business Phone Systems of 2024

- The Best PEOs of 2024

- RingCentral Review

- Nextiva Review

- Ooma Review

- Guide to Developing a Training Program for New Employees

- How Does 401(k) Matching Work for Employers?

- Why You Need to Create a Fantastic Workplace Culture

- 16 Cool Job Perks That Keep Employees Happy

- 7 Project Management Styles

- Women in Business

- Personal Growth

- Best Accounting Software and Invoice Generators of 2024

- Best Payroll Services for 2024

- Best POS Systems for 2024

- Best CRM Software of 2024

- Best Call Centers and Answering Services for Busineses for 2024

- Salesforce vs. HubSpot: Which CRM Is Right for Your Business?

- Rippling vs Gusto: An In-Depth Comparison

- RingCentral vs. Ooma Comparison

- Choosing a Business Phone System: A Buyer’s Guide

- Equipment Leasing: A Guide for Business Owners

- HR Solutions

- Financial Solutions

- Marketing Solutions

- Security Solutions

- Retail Solutions

- SMB Solutions

5 Steps for Writing an Executive Summary

Learn what to include in your executive summary and how to go about writing one.

Table of Contents

Anyone starting a new business must create a business plan that clearly outlines the organization’s details and goals. The executive summary is a crucial element of that business plan.

We’ll explore five steps to writing your business plan’s executive summary, including what to include and avoid. We’ll also point you toward executive summary templates to help you get started.

What is an executive summary?

New entrepreneurs or business owners typically use a business plan to present their great business idea to potential stakeholders like angel investors . The purpose of the business plan is to attract financing from investors or convince banking executives to get a bank loan for their business . An executive summary is a business plan overview that succinctly highlights its most essential elements.

It’s not just a general outline; the executive summary might be the only part of your business plan that busy executives and potential investors read.

“The executive summary of a business plan is designed to capture the reader’s attention and briefly explain your business, the problem you are solving, the target audience, and key financial information,” Ross Kimbarovsky, CEO and founder of Crowdspring, told Business News Daily. “If the executive summary lacks specific information or does not capture the attention of the reader, the rest of the plan might not be read.”

While your executive summary should be engaging and comprehensive, it must also be quick and easy to read. These documents average one to four pages – ideally, under two pages – and should comprise less than 10% of your entire business plan.

How do you write an executive summary?

Your executive summary will be unique to your organization and business plan. However, most entrepreneurs and business owners take the following five steps when creating their executive summary.

- Write your business plan first. The executive summary will briefly cover the most essential topics your business plan covers. For this reason, you should write the entire business plan first, and then create your executive summary. The executive summary should only cover facts and details included in the business plan.

- Write an engaging introduction. What constitutes “engaging” depends on your audience. For example, if you’re in the tech industry, your introduction may include a surprising tech trend or brief story. The introduction must be relevant to your business and capture your audience’s attention. It is also crucial to identify your business plan’s objective and what the reader can expect to find in the document.

- Write the executive summary. Go through your business plan and identify critical points to include in your executive summary. Touch on each business plan key point concisely but comprehensively. You may mention your marketing plan , target audience, company description, management team, and more. Readers should be able to understand your business plan without reading the rest of the document. Ideally, the summary will be engaging enough to convince them to finish the document, but they should be able to understand your basic plan from your summary. (We’ll detail what to include in the executive summary in the next section.)

- Edit and organize your document. Organize your executive summary to flow with your business plan’s contents, placing the most critical components at the beginning. A bulleted list is helpful for drawing attention to your main points. Double-check the document for accuracy and clarity. Remove buzzwords, repetitive information, qualifying words, jargon, passive language and unsupported claims. Verify that your executive summary can act as a standalone document if needed.

- Seek outside assistance. Since most entrepreneurs aren’t writing experts, have a professional writer or editor look over your document to ensure it flows smoothly and covers the points you’re trying to convey.

What should you include in an executive summary?

Your executive summary is based on your business plan and should include details relevant to your reader. For example, if your business plan’s goal is pitching a business idea to potential investors , you should emphasize your financial requirements and how you will use the funding.

The type of language you use depends on whether your audience consists of generalists or industry experts.

While executive summary specifics will vary by company, Marius Thauland, business strategist at OMD EMEA, says all executive summaries should include a few critical elements:

- Target audience

- Products and services

- Marketing and sales strategies

- Competitive analysis

- Funding and budget allocation for the processes and operations

- Number of employees to be hired and involved

- How you’ll implement the business plan

When synthesizing each section, highlight the details most relevant to your reader. Include any facts and statistics they must know. In your introduction, present pertinent company information and clearly state the business plan’s objective. To pinpoint key messages for your executive summary, ask yourself the following questions:

- What do you want the reader to take away from the document?

- What do you want to happen after they read it?

“Put yourself in the business plan reader’s shoes, and think about what you would like to know in the report,” Thauland advised. “Get their attention by making it simple and brief yet still professional. It should also attract them to read the entire document to understand even the minute details.”

What should you avoid in an executive summary?

When writing your executive summary, be aware of the following common mistakes:

- Making your executive summary too long. An executive summary longer than two pages will deter some readers. You’re likely dealing with busy executives, and an overlong stretch of text can overwhelm them.

- Copying and pasting from other executive summary sections. Reusing phrases from other sections and stringing them together without context can seem confusing and sloppy. It’s also off-putting to read the same exact phrase twice within the same document. Instead, summarize your business plan’s central points in new, descriptive language.

- Too many lists and subheadings in your executive summary. After one – and only one – introductory set of bullets, recap your business plan’s main points in paragraph form without subheadings. Concision and clarity are more important for an executive summary than formatting tricks.

- Passive or unclear language in your executive summary. You’re taking the reins of your business, and your executive summary should show that. Use active voice in your writing so everyone knows you’re running the show. Be as clear as possible in your language, leaving no questions about what your business will do and how it will get there.

- Avoid general descriptions in your executive summary. Kimbarovsky said it’s best to avoid generalities in your executive summary. For example, there’s no need to include a line about “your team’s passion for hard work.” This information is a given and will take attention away from your executive summary’s critical details.

- Don’t use comparisons in your executive summary. Kimbarovsky also advises staying away from comparisons to other businesses in your executive summary. “Don’t say you will be the next Facebook, Uber or Amazon,” said Kimbarovsky. “Amateurs make this comparison to try and show how valuable their company could be. Instead, focus on providing the actual facts that you believe prove you have a strong company. It’s better if the investor gives you this accolade because they see the opportunity.”

Executive summary templates and resources

If you’re writing an executive summary for the first time, online templates can help you outline your document. However, your business is unique, and your executive summary should reflect that. An online template probably won’t cover every detail you’ll need in your executive summary. Experts recommend using templates as general guidelines and tailoring them to fit your business plan and executive summary.

To get you started, here are some popular executive summary template resources:

- FormSwift. The FormSwift website lets you create and edit documents and gives you access to over 500 templates. It details what an effective executive summary includes and provides a form builder to help you create your executive summary. Fill out a step-by-step questionnaire and export your finished document via PDF or Word.

- Smartsheet. The Smartsheet cloud-based platform makes planning, managing and reporting on projects easier for teams and organizations. It offers several free downloadable executive summary templates for business plans, startups, proposals, research reports and construction projects.

- Template.net. The Template.net website provides several free business templates, including nine free executive summary templates that vary by project (e.g., business plan, startup, housing program development, proposal or marketing plan). Print out the templates and fill in your relevant details.

- TemplateLab. The TemplateLab website is a one-stop shop for new business owners seeking various downloadable templates for analytics, finance, HR, marketing, operations, project management, and time management. You’ll find over 30 free executive summary templates and examples.

- Vertex42. The Vertex42 website offers Excel templates for executive summaries on budgets, invoices, project management and timesheets, as well as Word templates for legal forms, resumes and letters. This site also provides extensive information on executive summaries and a free executive summary template you can download into Word or Google Docs.

Summing it all up

Your executive summary should preview your business plan in, at most, two pages. Wait until your business plan is complete to write your executive summary, and seek outside help as necessary. A thorough, engaging business plan and executive summary are well worth the time and money you put into them.

Max Freedman contributed to the reporting and writing in this article. Some source interviews were conducted for a previous version of this article.

Building Better Businesses

Insights on business strategy and culture, right to your inbox. Part of the business.com network.

- Link to facebook

- Link to linkedin

- Link to twitter

- Link to youtube

- Writing Tips

How to Write an Executive Summary for a Business Plan

3-minute read

- 19th November 2023

An executive summary is the part of a business plan that gives an outline of the main plan. So to write an executive summary, we first need to read the business plan carefully and understand its key points. These key points are what we will condense to form the executive summary. It’s important to ensure that the executive summary can stand alone because plenty of users will read only that and not the main business plan. We could say that the business plan is the original TL;DR (too long; didn’t read)!

But first, let’s take a quick look at what goes into a business plan so we can focus on the sections we need for our executive summary.

What Is a Business Plan?

A business plan is a document that sets out a business’s strategy and the means of achieving it. The business plan usually contains the following sections:

How to Write an Executive Summary

The executive summary covers the same headings as the main business plan but not in so much detail. This is where our editing skills come to the fore!

The following six steps explain how to approach writing the executive summary.

Consider the Audience

Who will be using the summary? The business plan might be issued only to a very specific group of people, in which case, their needs are paramount and specialized. If the business plan is going out on wider release, we need to think about what a general reader will want to know.

Check That It Makes Sense on Its Own

Make sure the summary can be read as a stand-alone document for users who won’t read the whole plan.

Use Formatting Effectively

Make good use of formatting, headings, numbering, and bullets to increase clarity and readability.

Keep It Brief

One page (or around ten percent of the total word count for a large document) is great.

Avoid Jargon

Try to avoid jargon and use straightforward language. Readers of the executive summary might not have business backgrounds (for instance, if they are friend and family investors in a small start-up business).

Find this useful?

Subscribe to our newsletter and get writing tips from our editors straight to your inbox.

Proofread the Executive Summary

The executive summary will very likely be the first – and perhaps the only – part of the business plan some people will read, and it must be error-free to make a professional impression.

● Consider the audience .

● Ensure that the executive summary can stand alone.

● Use formatting tools to good advantage.

● Keep it brief.

● Keep it simple.

● Proofread it.

If you’d like an expert to proofread your business plan – or any of your writing – get in touch!

Share this article:

Post A New Comment

Got content that needs a quick turnaround? Let us polish your work. Explore our editorial business services.

9-minute read

How to Use Infographics to Boost Your Presentation

Is your content getting noticed? Capturing and maintaining an audience’s attention is a challenge when...

8-minute read

Why Interactive PDFs Are Better for Engagement

Are you looking to enhance engagement and captivate your audience through your professional documents? Interactive...

7-minute read

Seven Key Strategies for Voice Search Optimization

Voice search optimization is rapidly shaping the digital landscape, requiring content professionals to adapt their...

4-minute read

Five Creative Ways to Showcase Your Digital Portfolio

Are you a creative freelancer looking to make a lasting impression on potential clients or...

How to Ace Slack Messaging for Contractors and Freelancers

Effective professional communication is an important skill for contractors and freelancers navigating remote work environments....

How to Insert a Text Box in a Google Doc

Google Docs is a powerful collaborative tool, and mastering its features can significantly enhance your...

Make sure your writing is the best it can be with our expert English proofreading and editing.

How to Write an Executive Summary Execs Can't Ignore [+ 5 Top Examples]

Published: May 30, 2024

Early in my career, I was intimidated by executive summaries. They sounded so corporate and formal. But, proper name aside, they’re really just the elevator pitch or the TL;DR (too long, didn’t read) of a document.

Writing an executive summary is an important leadership skill, whether you're an entrepreneur creating a business plan or a CEO delivering a quarterly report.

So, let’s sharpen that skill.

What is an Executive Summary?

An executive summary is a brief overview of a longer professional document, like a business plan, proposal, or report. It's commonly at the beginning of a document and aims to grab a reader’s attention while summarizing critical information such as the problem or opportunity being addressed, objectives, key findings, goals, and recommendations.

Ultimately, an executive summary gives readers a concise overview of the most important information in a document, so they don't have to read the entire thing.

Think of it like the SparkNotes of the business world.

Documents that frequently have an executive summary include:

- Business plans

- Research reports

- Project proposals

- Annual reports

How does it differ from other business statements? Let’s compare.

.png)

Free Executive Summary Template

Use this executive summary template to provide a summary of your report, business plan, or memo.

- Company & Opportunity

- Industry & Market Analysis

- Management & Operations

- Financial Plan

You're all set!

Click this link to access this resource at any time.

Executive Summary vs. Business Plan

All business plans have an executive summary, but not all executive summaries belong to business plans.

A business plan includes a company overview, short-term and long-term goals, information on your product or service, sales targets, expense budgets, your marketing plan, and even team information

Business plans are very detailed and comprehensive. They can be as short as a dozen pages or as long as 100 pages. The executive summary is the first section of the business plan.

An in-demand CEO or investor might not have the bandwidth to read your full business plan without first understanding your company or goals. That’s where an executive summary comes in handy.

Note: Need help putting together your business plan? We’ve got a template for you.

Executive Summary vs. Mission Statement

Mission statements and executive summaries are typically found in business plans, but they serve different purposes.

A mission statement defines your organization’s purpose, values, and vision. It’s your company’s North Star and communicates your core identity and reason for existence. On the other hand, an executive summary provides a high-level overview of the document.

I also love how we define key terms to help readers understand the rest of the report. This is an excellent example of setting the tone for the rest of your document in an executive summary and making it easier to navigate.

3. ClickUp: Product Update Release Notes

Now, I know this article is about writing an executive summary, but I love ClickUp’s unique approach with its product release notes videos.

This digital report from research firm McKinsey Global Institute features an executive summary titled “At a Glance.”

Here, the organization recaps the key findings from its 56-page research report in six easy-to-skim bullet points.

It’s compelling, easy to digest, and makes it easy to jump into the full report with download links.

5. UN: World Economic Situation and Prospects 2024

Finally, we have a fairly traditional approach to an executive summary from the United Nations (UN) , clocking in at 16 pages.

Now, I know. Sixteen pages seems lengthy, but the full report is just shy of 200 pages.

The executive summary highlights the report’s largest conclusions with headers. Then, it expands on those headers with relevant statistics. It also uses bold font to draw attention to the countries or regions affected (something the reader will likely be most interested in).

The tone and visual design are both formal, which matches the esteem of the United Nations. Overall, this executive summary does an admirable job of making the report's information more approachable.

Make your executive summary memorable.

Make sure your executive summary is strong. Tell your story. Include compelling data and facts. Use easy-to-understand and digest language. If you can, get visual.

An executive summary should be concise, but also memorable. After all, this may be the only part of your proposal, report, or analysis that actually gets read.

Use the guidance above to ensure your executive summary resonates with your audience and opens the door to the opportunities you crave.

Editor's note: This post was originally published in December 2018 and has been updated for comprehensiveness.

Don't forget to share this post!

Related articles.

20 Free & Paid Small Business Tools for Any Budget

24 of My Favorite Sample Business Plans & Examples For Your Inspiration

What is a Business Plan? Definition, Tips, and Templates

Maximizing Your Social Media Strategy: The Top Aggregator Tools to Use

The Content Aggregator Guide for 2024

![what is the executive summary of business plan 7 Gantt Chart Examples You'll Want to Copy [+ 5 Steps to Make One]](https://blog.hubspot.com/hubfs/gantt-chart-example.jpg)

7 Gantt Chart Examples You'll Want to Copy [+ 5 Steps to Make One]

![what is the executive summary of business plan The 8 Best Free Flowchart Templates [+ Examples]](https://blog.hubspot.com/hubfs/flowchart%20templates.jpg)

The 8 Best Free Flowchart Templates [+ Examples]

16 Best Screen Recorders to Use for Collaboration

The 25 Best Google Chrome Extensions for SEO

Professional Invoice Design: 28 Samples & Templates to Inspire You

Marketing software that helps you drive revenue, save time and resources, and measure and optimize your investments — all on one easy-to-use platform

What is an executive summary in a business plan?

Including an executive summary in your business plan can grab attention and help communicate key information quickly.

September 2023 | Published by Xero

What is a business plan?

A business plan is the blueprint for how your business will run. It describes your product or service, identifies your customer and the problem they face, and explains how you’ll succeed in fixing that for them.

Your business plan also helps other people understand what you do and how you do it. Groups like banks and investors will want to see your business plan before deciding to put money into your business, for example. Your accountant should also be able to easily understand what your business idea is and how you’ll make money from it.

It’s a living document that can help you clarify your ideas and maintain a clear direction as you grow. It shouldn’t be just a one-off document – you can return to it at any time and add to it or change it as your business changes.

Looking for help to build your business plan? Download our free business plan templates to get started.

The executive summary is the elevator pitch for the rest of your business plan. Use it to highlight what you do, why you do it and how you’ll succeed.

It’s often the first section that a person will read in your business plan, so this is your opportunity to "sell" your idea and its potential for success.

It should explain enough that a reader could understand the key information about your business without having to read the whole document – this is especially helpful for readers who are pushed for time. However, a compelling executive summary will also grab someone’s attention enough to make them want to keep reading.

While it’s a helpful section for rushed readers, you may feel an executive summary isn’t absolutely necessary just yet. Think about your audience and the complexity of your business plan when weighing up the benefit of having an executive summary.

How does an executive summary differ from a mission statement or business objective?

A mission statement outlines the overall purpose and vision of your business, and a business objective is a specific goal or target you’ll aim for to help you achieve that vision.

The executive summary could include both your mission statement and business objectives. However, it should ultimately be a high-level overview of your whole business plan.

What to include in an executive summary

Treat your executive summary as the one and only section someone may read in your business plan. What must they know in order to understand your business?

Pull the key high-level information from other parts of your business plan, including:

- what your business does and why you do it

- your mission statement, if you have one

- your target customers, the problem they face and how you solve it for them

- the product or service you’re selling

- any key information from competitor or market research that helps tell your story

- a schedule to launch, or steps to implement your business plan

If you’re approaching lenders or investors for financing, include key financial information and your plans for growth in your executive summary too.

How to write an executive summary

It’s a good idea to fill in the other sections of your business plan first, before deciding what goes in an executive summary. This way, you have complete information for you to draw from.

Aim to summarize the key sections of your business plan in a few sentences using plain language that’s easy to understand. Include any important data or information that backs up your ideas, and leave out personal opinions.

Beware of copying and pasting information from other parts of your plan; the executive summary should be as specific and concise as possible. An executive summary that’s too general, or padded with unnecessary detail might lose the reader’s interest.

Think about who will read your business plan, and what they’ll be interested in. For example, if you want to connect with lenders or investors, promote the size of the opportunity for your business, and how much money you’ll need to make it a success.

There’s no strict rule about length, but it should remain clear and engaging the whole way through. Keeping to one page is a good general guide to maintain your reader’s attention without overwhelming them.

Ultimately, an executive summary should benefit your business plan by laying out critical information clearly and simply upfront. An engaging, informative summary will help key people understand your plan and your needs, so they can offer guidance and support your success.

You can find tips on business planning and more in How to start a business

Xero does not provide accounting, tax, business or legal advice. This guide has been provided for information purposes only. You should consult your own professional advisors for advice directly relating to your business or before taking action in relation to any of the content provided.

Start using Xero for free

Access Xero features for 30 days, then decide which plan best suits your business.

- Included Safe and secure

- Included Cancel any time

- Included 24/7 online support

Or compare all plans

Business Plan Executive Summary with Example

Written by Dave Lavinsky

Executive Summary of a Business Plan

The Executive Summary is the most important part of your business plan. This is because it’s the first section in your plan, and if it doesn’t excite readers, they won’t continue reviewing it. Importantly, there is a way to ensure your executive summary is compelling and includes the key information readers expect. In this article, you’ll learn how to craft the perfect executive summary for your business plan.

Download our Ultimate Business Plan Template here >

Table of Contents:

What is an executive summary, why do i need an executive summary, how long should an executive summary be for a business plan, how to write an executive summary for a business plan + template, sample executive summary, other helpful resources for writing your business plan.

An executive summary of a business plan gives readers an overview of your business plan and highlights its key points.

The executive summary should start with a brief overview of your business concept. Then it should briefly summarize each section of your business plan: your industry analysis, customer analysis, competitive analysis, marketing plan, operations plan, management team, financial plan and funding needs.

If presented for funding, the executive summary provides the lender or investor a quick snapshot which helps them determine their interest level and if they should continue reading the rest of the business plan.

An effective executive summary is a quick version of your complete business plan. You need to keep it simple and succinct in order to grab the reader’s attention and convince them it’s in their best interest to keep reading.

As mentioned above, your business plan is a detailed document that requires time to read. Capturing the reader’s attention with a concise format that provides an interesting overview of your plan saves them time and indicates which parts of the business plan may be most important to read in detail. This increases the odds that your business plan will be read and your business idea understood. This is why you need a well-written executive summary.

When structuring your executive summary, the first thing to keep in mind is that it should be short and comprehensive. The length of your executive summary should never exceed 3 pages; the ideal length is one or two pages.

Finish Your Business Plan Today!

To write a compelling executive summary, follow the steps below and use our executive summary template as a guide:

State the Problem and/or Business Opportunity

Briefly describe your business idea, provide key information about your company history, conduct market research about your industry, identify the target market or ideal customer, explain your competitive advantage, establish relevant milestones for your business to achieve, develop a financial plan, describe the qualifications of your management team.

To help you get started, you can download our executive summary example business plan pdf here.

Whether you’re a large or small business, your executive summary is the first thing someone reads that forms an opinion of your business. Whether they decide to read your detailed business plan or push it aside depends on how good your executive summary is. We hope your executive summary guide helps you craft an effective and impactful executive summary. That way, readers will be more likely to read your full plan, request an in-person meeting, and give you funding to pursue your business plans.

Looking to get started on your business plan’s executive summary? Take a look at the business plan executive summary example below!

Finish Your Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Shoutmouth.com Executive Summary

Business Overview Launched late last year, Shoutmouth.com is the most comprehensive music news website on the Internet.

Music is one of the most searched and accessed interests on the Internet. Top music artists like Taylor Swift receive over 5 million searches each month. In addition, over 500 music artists each receive over 25,000 searches a month.

However, music fans are largely unsatisfied when it comes to the news and information they seek on the artists they love. This is because most music websites (e.g., RollingStone.com, MTV.com, Billboard.com, etc.) cover only the top eight to ten music stories each day – the stories with mass appeal. This type of generic coverage does not satisfy the needs of serious music fans. Music fans generally listen to many different artists and genres of music. By publishing over 100 music stories each day, Shoutmouth enables these fans to read news on all their favorite artists.

In addition to publishing comprehensive music news on over 1200 music artists, Shoutmouth is a social network that allows fans to meet and communicate with other fans about music, and allows them to:

- Create personal profiles

- Interact with other members

- Provide comments on news stories and music videos

- Submit news stories and videos

- Recommend new music artists to add to the community

- Receive customized news and email alerts on their favorite artists

Success Factors

Shoutmouth is uniquely qualified to succeed due to the following reasons:

- Entrepreneurial track record : Shoutmouth’s CEO and team have helped launch numerous successful ventures.

- Monetization track record : Over the past two years, Shoutmouth’s founders have run one of the most successful online affiliate marketing programs, having sold products to over 500,000 music customers online.

- Key milestones completed : Shoutmouth’s founders have invested $500,000 to-date to staff the company (we currently have an 11-person full-time team), build the core technology, and launch the site. We have succeeded in gaining initial customer traction with 50,000 unique visitors in March, 100,000 unique visitors in April, and 200,000 unique visitors in May.

Unique Investment Metrics

The Shoutmouth investment opportunity is very exciting due to the metrics of the business.

To begin, over the past five years, over twenty social networks have been acquired. The value in these networks is their relationships with large numbers of customers, which allow acquirers to effectively sell to this target audience.

The sales price of these social networks has ranged from $25 to $137 per member. Shoutmouth has the ability to enroll members at less than $1 each, thus providing an extraordinary return on marketing expenditures. In fact, during a recent test, we were able to sign-up 2,000 members to artist-specific Shoutmouth newsletters at a cost of only 43 cents per member.

While we are building Shoutmouth to last, potential acquirers include many types of companies that seek relationships with music fans such as music media/publishing (e.g., MTV, Rolling Stone), ticketing (e.g., Ticketmaster, LiveNation) and digital music sales firms (e.g., iTunes).

Financial Strategy, Needs and Exit Strategy

While Shoutmouth’s technological, marketing and operational infrastructure has been developed, we currently require $3 million to execute on our marketing and technology plan over the next 24 months until we hit profitability.

Shoutmouth will primarily generate revenues from selling advertising space. As technologies evolve that allow us to seamlessly integrate music sampling and purchasing on our site, sales of downloadable music are also expected to become a significant revenue source. To a lesser extent, we may sell other music-related items such as ringtones, concert tickets, and apparel.

Topline projections over the next three years are as follows:

- Search Search Please fill out this field.

- Building Your Business

- Becoming an Owner

- Business Plans

Executive Summary of the Business Plan

How to Write an Executive Summary That Gets Your Business Plan Read

Susan Ward wrote about small businesses for The Balance for 18 years. She has run an IT consulting firm and designed and presented courses on how to promote small businesses.

:max_bytes(150000):strip_icc():format(webp)/SusanWardLaptop2crop1-57aa62eb5f9b58974a12bac9.jpg)

CP Cheah / Getty Images

An executive summary of a business plan is an overview. Its purpose is to summarize the key points of a document for its readers, saving them time and preparing them for the upcoming content.

Think of the executive summary as an advance organizer for the reader. Above all else, it must be clear and concise. But it also has to entice the reader to read the rest of the business plan .

This is why the executive summary is often called the most important part of the business plan. If it doesn’t capture the reader's attention, the plan will be set aside unread—a disaster if you've written your business plan as part of an attempt to get money to start your new business . (Getting startup money is not the only reason to write a business plan; there are other just-as-important reasons .)

Because it is an overview of the entire plan, it is common to write the executive summary last (and writing it last can make it much easier).

What Information Goes in an Executive Summary?

The information you need to include varies somewhat depending on whether your business is a startup or an established business.

For a startup business typically one of the main goals of the business plan is to convince banks, angel investors , or venture capitalists to invest in your business by providing startup capital in the form of debt or equity financing .

In order to do so you will have to provide a solid case for your business idea which makes your executive summary all the more important. A typical executive summary for a startup company includes the following sections:

- The business opportunity. Describe the need or the opportunity.

- Taking advantage of the opportunity. Explain how will your business will serve the market.

- The target market . Describe the customer base you will be targeting.

- Business model . Describe your products or services and and what will make them appealing to the target market.

- Marketing and sales strategy . Briefly outline your plans for marketing your products and services.

- The competition. Describe your competition and your strategy for getting market share. What is your competitive advantage, e.g. what will you offer to customers that your competitors cannot?

- Financial analysis. Summarize the financial plan including projections for at least the next three years.

- Owners/Staff. Describe the owners and the key staff members and the expertise they bring to the venture.

- Implementation plan. Outline the schedule for taking your business from the planning stage to opening your doors.

For established businesses the executive summary typically includes information about achievements, growth plans , etc. A typical executive summary outline for an established business includes:

- Mission Statement . Articulates the purpose of your business. In a few sentences describe what your company does and your core values and business philosophy.

- Company Information. Give a brief history of your company —d escribe your products or services, when and where it was formed, who the owners and key employees are, statistics such as the number of employees, business locations, etc.

- Business Highlights. Describe the evolution of the businesshow it has grown, including year-over-year revenue increases, profitability, increases in market share, number of customers, etc.

- Financial Summary. If the purpose of updating the business plan is to seek additional financing for expansion, then give a brief financial summary.

- Future goals. Describe your goals for the business . If you are seeking financing explain how additional funding will be used to expand the business or otherwise increase profits.

How Do I Write an Executive Summary of a Business Plan?

Start by following the list above and writing one to two sentences about each topic (depending on whether your business is a startup or an established business). No more!

The Easy Way of Writing One

Having trouble getting started? The easiest way of writing the executive summary is to review your business plan and take a summary sentence or two from each of the business plan sections you’ve already written.

If you compare the list above to the sections outlined in the Business Plan Outline , you’ll see that this could work very well.

Then finish your business plan’s executive summary with a clinching closing sentence or two that answers the reader’s question, “Why is this a winning business?”

For example, an executive summary for a pet-sitting business might conclude: “The loving on-site professional care that Pet Grandma will provide is sure to appeal to both cat and dog owners throughout the West Vancouver area.”

(You may find it useful to read the entire Pet Grandma executive summary example before you write your own.)

Tips for Writing the Business Plan’s Executive Summary

- Focus on providing a summary. The business plan itself will provide the details and whether bank managers or investors, the readers of your plan don’t want to have their time wasted.

- Keep your language strong and positive. Don’t weaken your executive summary with weak language. Instead of writing, “Dogstar Industries might be in an excellent position to win government contracts,” write “Dogstar Industries will be in an excellent position.”

- Keep it short–no more than two pages long . Resist the temptation to pad your business plan’s executive summary with details (or pleas). The job of the executive summary is to present the facts and entice your reader to read the rest of the business plan, not tell him everything.

- Polish your executive summary. Read it aloud. Does it flow or does it sound choppy? Is it clear and succinct? Once it sounds good to you, have someone else who knows nothing about your business read it and make suggestions for improvement.

- Tailor it to your audience. If the purpose of your business plan is to entice investors , for instance, your executive summary should focus on the opportunity your business provides investors and why the opportunity is special. If the purpose of your business plan is to get a small business loan , focus on highlighting what traditional lenders want to see, such as management's experience in the industry and the fact that you have both collateral and strategies in place to minimize the lender's risk.

- Put yourself in your readers’ place. And read your executive summary again. Does it generate interest or excitement in the reader? If not, why? Also try giving it to a friend or relative to read, who is not engaged in the business. If you've done a good job on the executive summary, an impartial third party should be able to understand it.

Remember, the executive summary will be the first thing your readers read. If it's poorly written, it will also be the last thing they read, as they set the rest of your business plan aside unread.

Office of the Comptroller of the Currency. " Business Plan Guidelines ," Page 2.

Corporate Finance Institute. " Executive Summary ."

United Nations Conference on Trade and Development. " How to Prepare Your Business Plan ," Page 167.

Iowa State University. " Types and Sources of Financing for Start-up Businesses ."

U.S. Small Business Administration. " Write Your Business Plan ."

Clute Institute. " Using Business Plans for Teaching Entrepreneurship ," Page 733.

Example of Executive Summary for a Business Plan

Starting a business can be intimidating due to the complex web of decisions, uncertainties, and risks that entrepreneurs must navigate through, while ensuring the path to success for their businesses. Business plans serve as a business’s compass to direct a business and drive its growth to achieve its goals and objectives.

Consequently, a concise but striking executive summary is an essential part and arguably, one of the most critical components of a business plan.

However, people spend only an approximate 48 minutes a day reading about business, according to a study by The Economist Intelligence Unit and Peppercomm. In a week, about 69% of young executives and 43% of veteran professionals read for business for less than four hours.

Similarly, an article from Time Magazine mentioned that 55% of people only actively read content for less than 15 seconds. This implies that a robust executive summary of a business plan should capture a reader’s interest and show that a business plan is worthy of a reader’s attention in a very narrow timeframe.