- Online Invoice Generator

- All Features call_made

- Estimates and Invoices

- Invoice Management

- Saved Invoices

- Secure Access

- Mobile Invoices

- Business Expense Tracker

- Industry Templates

- Word Invoice

- Excel Invoice

- Invoice PDF

- Google Sheets & Google Docs Invoice

- Printable Invoice

- Pro Forma Invoice

- Itemized Bill

- Online Invoice Generator call_made

- Rent Receipt

- Cash Receipt

- Donation Receipt

- Receipt Maker call_made

- Quote Template

- Estimate Maker call_made

- Profit Margin Calculator

- TRY IT FREE NOW call_made

- Support call_made

- Login call_made

What Is a Pricing Strategy? Tips & Examples

Starting a business without a pricing strategy is like taking a sailboat out to sea without a sail. The boat would float around aimlessly, at the mercy of the wind and waves. But instead of weather, you’ll be tossed around by changing markets, fluctuating revenue streams, and stiff competition.

Many business owners know setting prices is important but lack a clear plan or process. In this guide, we’ll explain why a pricing strategy is essential for business success. And once you learn about the best types of pricing methods, your business operations will thrive.

What Is Pricing?

Pricing is how much you charge for your products or services. The price you set can tell your customers essential things about your business, like:

Quality and Value. Higher prices might show better quality, while lower prices can make your products seem more affordable.

- Market Position. Your price helps show where you fit among competitors. Are you a budget option or more upscale?

- Comparison. How do your prices compare with similar products or services out there? Do you charge more but offer more features?

- Business Philosophy. Your pricing reflects what you believe in. Do you want to make your products affordable to everyone or feel they offer a premium value?

RELATED ARTICLE — How To Calculate Wholesale Price: Methods and Examples

What Is a Pricing Strategy?

A pricing strategy is the plan a business uses to decide how much to charge for its products or services. Choosing the right pricing strategy is like finding the “Goldilocks zone”—where your price is not too low, not too high, but just right. The ideal price covers your costs and aligns with what customers are willing to pay. A good pricing strategy involves:

- Knowing the costs to provide your product or service, and how much more to charge to be profitable

- Understanding what customers think your product is worth

- Setting prices to meet your business goals

RELATED ARTICLE — What Is an Expense Report and How Do You Create One?

11 Types of Pricing Strategies

There are many pricing strategies, each suited to different business needs. Below, we explore 11 types of pricing strategies so you can find the best approach for your specific circumstances.

1. Psychological Pricing Strategy

Psychological pricing uses tricks like setting prices at $9.99 instead of $10 to appear less expensive and encourage more sales. And promotions like BOGO (buy one, get one free) can make deals seem too good to miss, encouraging customers to buy more than they initially planned. Even the way prices are displayed—changes in font, size, and color—can affect how attractive a price appears and can boost your sales.

2. Hourly Pricing Strategy

Hourly pricing charges clients based on the time spent on a service. This method is used by professionals like lawyers and consultants. One of the benefits of this type of pricing model is the transparency it offers customers. It also takes into account the amount of time it takes to complete a service, making sure you’re paid fairly for the work you do.

3. Project-Based Pricing Strategy

Project-based pricing means charging one flat fee for a whole project. This approach is often used by freelancers and contractors. In this pricing model, the fee can be set based on the total value of the project’s deliverables.

You can also set a flat rate based on how long you think the project will take. This method shows the costs from the start, which makes budgeting easier for both you and your customers.

4. Geographic Pricing Strategy

Geographic pricing sets prices based on customer location. It uses tools like social media ads for targeted pricing by zip code or region. This way, you can match your prices to how much people in different places are willing to pay.

The best part about using social media in this case is that you can be very precise about who sees your ads. Your marketing pricing strategy doesn’t need to change, keeping your advertising budget the same.

5. Competition-Based Pricing

A competition-based pricing strategy bases pricing on what others in the market are charging. This pricing model doesn’t focus on costs or customer demand. By taking this approach, a business uses rival prices as a guide to set its own prices. It’s popular in crowded markets where even small price differences can change customers’ choices.

6. Freemium Pricing Strategy

Freemium comes from blending the two words: “free” and “premium.” It describes a business model where companies offer a basic version of their product for free. The idea is that by giving away a free sample of a product or service, customers will like it enough to pay for more.

After customers enjoy the initial features and benefits, they can choose to upgrade to a paid version that offers extra features.

7. Penetration Pricing Strategy

Penetration pricing is a strategy used by companies to attract customers to a new product or service by first offering a lower price. The goal is to gain quick entry into a competitive market, attract new customers, and build a customer base.

As more customers buy the product and the business has a solid market presence, the price can be raised. The main goal of the penetration pricing strategy is to introduce a new product and create a customer base that will stay loyal even when the price rises.

8. Dynamic Pricing Strategy

Dynamic pricing is a strategy where businesses set flexible prices based on current market demands. It’s used a lot in industries like travel, hospitality, and entertainment. In these industries, demand can yo-yo due to factors like holidays or special events.

Dynamic pricing works by adjusting prices in real-time based on changes in supply and demand, as well as competitor pricing. Customer purchasing patterns, economic conditions, local events, and even time of day can be factors. By adjusting prices based on demand, businesses can capitalize on high-volume purchasing periods by charging more.

9. Skimming Pricing Strategy

The skimming strategy is inspired by the concept of getting the most excited customers first. The “skimming” happens as a company sets a high initial price to deter customers who aren’t willing to pay more at the early stages of the product launch.

The product is priced at a premium, targeting those wanting to own the latest and greatest items. As the market’s initial demand is met, competition increases. Then, prices get lowered to reach more price-sensitive customers.

10. Cost-Plus Pricing Strategy

Cost-plus pricing is a method where the selling price is set by adding a specific markup to the base cost of a product or service. For instance, consider an accounting service where the total cost—including time, labor, and overhead expenses—is $500.

By adding a 50% markup to cover overhead and ensure profitability, the final selling price would be $750. This approach guarantees that you cover all costs and make a profit. This method is ideal for businesses with clear cost structures.

11. Value-Based Pricing Strategy

Value-based pricing means you set your prices based on what your customers believe your service is worth—not what it costs you to provide it. For example, if you’re a writer, consider the quality and convenience you provide rather than only charging for the labor and time. If customers value the high-quality and hassle-free experience, they may pay more.

FROM ONE OF OUR PARTNERS — The Good, Better, Best Approach – does it work?

Why Getting Your Pricing Strategy Right Matters

Setting the right price for your products or services means covering costs and showing customers the value of what they’re buying. When you set the right price, you communicate how much your product is worth and why it’s worth buying. Here’s how an effective pricing strategy differs from an ineffective one.

Elements of an Effective Pricing Strategy

- Proves value by showing customers the real worth of your product or service

- Persuades customers to buy what you’re selling because the price makes buying a no-brainer

- Instills confidence in your business because the price matches the value

Elements of an Ineffective Pricing Strategy:

- Fails to reflect product value because the price is too high or too low

- Creates worry in your potential buyers, making them feel unsure about the quality or the usefulness of the product

- Targets the wrong customer base by attracting customers who aren’t the right fit for your product

RELATED ARTICLE — How to Use Profitability Ratios to Improve Financial Performance

Tips for Choosing Your Pricing Strategy

Finding the right pricing strategy involves knowing the value of what you’re selling, who your customers are, and how much they’re willing to pay.

Understanding these pricing best practices helps you choose the best strategy for your business:

- Identify the value your product or service offers. Understand what sets your offering apart from the competition and how it benefits your customers.

- Assess the potential pricing options. Consider different pricing models and strategies that could fit your product and market.

- Analyze your target customer base. Know who your customers are, what they need, and how much they can afford to pay.

- Establish a price range. Based on your costs, customer value perception, and market research, define a realistic price range.

- Research your competitors’ pricing. Compare the pricing of similar offerings and how your product or service compares in features and quality.

- Factor in industry standards and trends. To remain competitive, stay informed about the pricing trends and standards in your industry.

- Align pricing with your brand image. Ensure your pricing reflects the positioning and image of your brand in the marketplace.

- Collect customer feedback on pricing. Get insights from your customers about how they view your pricing.

- Test and refine your pricing strategy . Experiment with different prices and see what works best, then adjust based on sales data and customer feedback.

Create Estimates and Invoices Instantly

With Invoice Simple , align your pricing strategy with streamlined financial document management. The software lets you make quick estimates and invoices to send to clients. Then, it stores client information and invoice records— in one place.

Sign up with Invoice Simple now and enhance your operational workflow.

Related Stories

How to create a small business budget in 4 easy steps.

Making a small business budget involves analyzing revenue as well as fixed and variable costs. Learn more about creating your budget here....

How to Create an Invoice in Word (With Free Template)

Learn how to create an invoice in Word quickly and easily. Explore templates and custom options, plus get expert tips to enhance your billing process....

How to Write a Strong Invoice Email – 3 Examples/Templates

In this article, we’ll outline what you need to include to write a strong invoice email. Check out these helpful tips and examples to get started today.

Navigating PTO Payouts: What Employers Should Know

Learn how PTO payouts work and when they’re required. Plus, get a state-by-state legal breakdown and tips for managing PTO payout in your business....

What Is a Good Profit Margin For a Small Business?

Find out what a good profit margin is for your small business. Plus, compare industry benchmarks and get practical tips for boosting your bottom line....

Accrual Basis Accounting: Definition and How It Works

What is accrual basis accounting? Discover the difference between cash and accrual basis accounting and learn the accrual method in this easy guide....

What Is a Statement of Accounts? A Helpful Guide

What’s the purpose of a statement of accounts? It's a tool that helps you and your customers keep track of what is bought, paid for, and still owed....

What Is a P.O. Number on an Invoice?

Learn what a P.O. number is and how to effectively use it in your business to keep orders running smoothly and prevent future issues from occurring.

Start Your First Invoice Today

Create customized and professional invoices and connect with clients

Happy Hour: Growing your consumer subscription business

The pricing strategy guide: Choosing pricing strategies that grow (not sink) your business

Choosing the pricing strategy for your business requires research, calculation, and a good amount of thought. Simply guessing may put you out of business. Here's what you need to know.

Definition of pricing

What are pricing strategies.

- Importance of pricing strategy

Top 7 pricing strategies

- 3 real-world examples

- How to create your strategy

- Determine value metric

- Customer profiles & segments

- User research & experiments

- Bonus: 10 data-driven tips

- Industry differences

- Final takeaway

Pricing strategies FAQs

Join our newsletter for the latest in SaaS

By subscribing you agree to receive the Paddle newsletter. Unsubscribe at any time.

Too many businesses set their pricing without putting much thought into it. This is a mistake causing them to leave money on the table from the beginning. The good news is that taking the time to get your product pricing right can act as a powerful growth lever. If you optimize your pricing strategy so that more people are paying a higher amount, you'll end up with significantly more revenue than a business who treats pricing more passively. This sounds obvious, but it's rare for businesses to put much effort into finding the best pricing strategy.

This guide will cover everything you need to know about setting a pricing strategy that works for your business.

Check out this introduction video made by the Paddle Studios team.

Pricing is defined as the amount of money that you charge for your products, but understanding it requires much more than that simple definition. Baked into your pricing are indicators to your potential customers about how much you value your brand, product, and customers. It's one of the first things that can push a customer towards, or away from, buying your product. As such, it should be calculated with certainty.

Pricing strategies refer to the processes and methodologies businesses use to set prices for their products and services. If pricing is how much you charge for your products, then product pricing strategy is how you determine what that amount should be. There are different pricing strategies to choose from but some of the more common ones include:

- Value-based pricing

- Competitive pricing

- Price skimming

- Cost-plus pricing

- Penetration pricing

- Economy pricing

- Dynamic pricing

Pricing is an underutilized growth lever

Many companies focus on acquisition to grow their business, but studies have shown that small variations in pricing can raise or lower revenue by 20-50%. Despite that, even among Fortune 500 companies, fewer than 5% have functions dedicated to setting the best price possible. There's a missed opportunity in the business world to see immediate growth for relatively little effort.

Navigating PLG billing and pricing? Read our latest guide on product-led SaaS

Because most businesses spend less than 10 hours per year thinking about pricing, there's a lot of untapped growth potential in optimizing what you charge. In fact, choosing the best pricing method is a more powerful growth lever than customer acquisition. In some cases, it can be up to 7.5 times more powerful than acquisition.

The importance of nailing your pricing strategy

Having an effective pricing strategy helps solidify your position by building trust with your customers, as well as meeting your business goals. Let's compare and contrast the messaging that a strong pricing strategy sends in relation to a weaker one.

A winning pricing strategy:

- Portrays value

The word cheap has two meanings. It can mean a lower price, but it can also mean poorly made. There's a reason people associate cheaply priced products with cheaply made ones. Built into the higher price of a product is the assumption that it's of higher value.

- Convinces customers to buy

A high price may convey value, but if that price is more than a potential customer is willing to pay, it won't matter. A low price will seem cheap and get your product passed over. The ideal price is one that convinces people to purchase your offering over the similar products that your competitors have to offer.

- Gives your customers confidence in your product

If higher-priced products portray value and exclusivity, then the opposite follows as well. Prices that are too low will make it seem as though your product isn't well made.

A weak pricing strategy:

- Doesn't accurately portray the value of your product

If you believe you have a winning product, and you should if you are selling it, then you need to convince customers of that. Setting prices too low sends the opposite message.

- Makes customers feel uncertain about buying

Just as the right price is one that customers will pull the trigger on quickly, a price that's too high or too low will cause hesitation.

- Targets the wrong customers

Some customers prefer value, and some prefer luxury. You have to price your product to match the type of customer it is targeted towards.

Let's now take a closer look at the seven most common pricing strategies that were outlined above with more from Paddle Studios .

Click on any of the links below for a more in-depth guide to that particular pricing strategy.

1. Value-based pricing

With value-based pricing, you set your prices according to what consumers think your product is worth. We're big fans of this pricing strategy for SaaS businesses.

2. Competitive pricing

When you use a competitive pricing strategy, you're setting your prices based on what the competition is charging. This can be a good strategy in the right circumstances, such as a business just starting out , but it doesn't leave a lot of room for growth.

3. Price skimming

If you set your prices as high as the market will possibly tolerate and then lower them over time, you'll be using the price skimming strategy. The goal is to skim the top off the market and the lower prices to reach everyone else. With the right product it can work, but you should be very cautious using it.

4. Cost-plus pricing

This is one of the simplest pricing strategies. You just take the product production cost and add a certain percentage to it. While simple, it is less than ideal for anything but physical products.

5. Penetration pricing

In highly competitive markets, it can be hard for new companies to get a foothold. One way some companies attempt to push new products is by offering prices that are much lower than the competition. This is penetration pricing. While it may get you customers and decent sales volume, you'll need a lot of them and you'll need them to be very loyal to stick around when the price increases in the future.

6. Economy pricing

This strategy is popular in the commodity goods sector. The goal is to price a product cheaper than the competition and make the money back with increased volume. While it's a good method to get people to buy your generic soda, it's not a great fit for SaaS and subscription businesses.

7. Dynamic pricing

In some industries, you can get away with constantly changing your prices to match the current demand for the item. This doesn't work well for subscription and SaaS business, because customers expect consistent monthly or yearly expenses.

Three real-world pricing strategy examples

Real-world pricing strategy examples are the best way for a business to better understand the above-listed pricing strategies. Evaluating other businesses' approaches can be a good starting point but keep in mind that the right pricing strategy is based on math, market research, and consumer insights. For now, let’s look at the pricing strategy examples of some of the biggest brands of today:

1. Streaming services

Have you noticed that you pay roughly the same amount for Netflix, Amazon Prime Video, Disney+, Hulu, and other streaming services? That's because these companies have adopted competitive pricing , or at least a form of it, called market-based pricing .

2. Salesforce

When Salesforce first came out, they were the only CRM in the cloud. (It wasn't even called 'the cloud' back then!) Armed with ground-breaking deployment and a target customer of a large enterprise, Salesforce could charge what they wanted. Later, after they'd grown, they were able to lower prices so small businesses could sign up. This is a classic example of price skimming .

3. Dollar Shave Club

At one time, you couldn't turn on your TV without an ad for Dollar Shave Club telling you how much cheaper they were than razors at the store. Although an aggressive marketing strategy and advertising like that is unusual for the pricing model, they were nevertheless employing economy pricing. It worked out well for them. They were acquired by Unilever in 2016 for a reported $1 billion.

How to create a winning pricing strategy

In the beginning, the actual number you're charging isn't that important.

There are some exceptions, but for the most part, you should first be figuring out the range you're in: a $10 product, $100 product, $1k product, etc. Don't waste time debating $500 vs. $505, because this doesn't matter as much until you have a stronger foundation beneath you.

Instead, understanding the following is much more important:

- Finding your value metric

- Setting your ideal customer profiles and segments

- Completing user research + experimentation

This video from Paddle Studios goes deep on mastering a winning pricing strategy.

Step 1: Determine your value metric

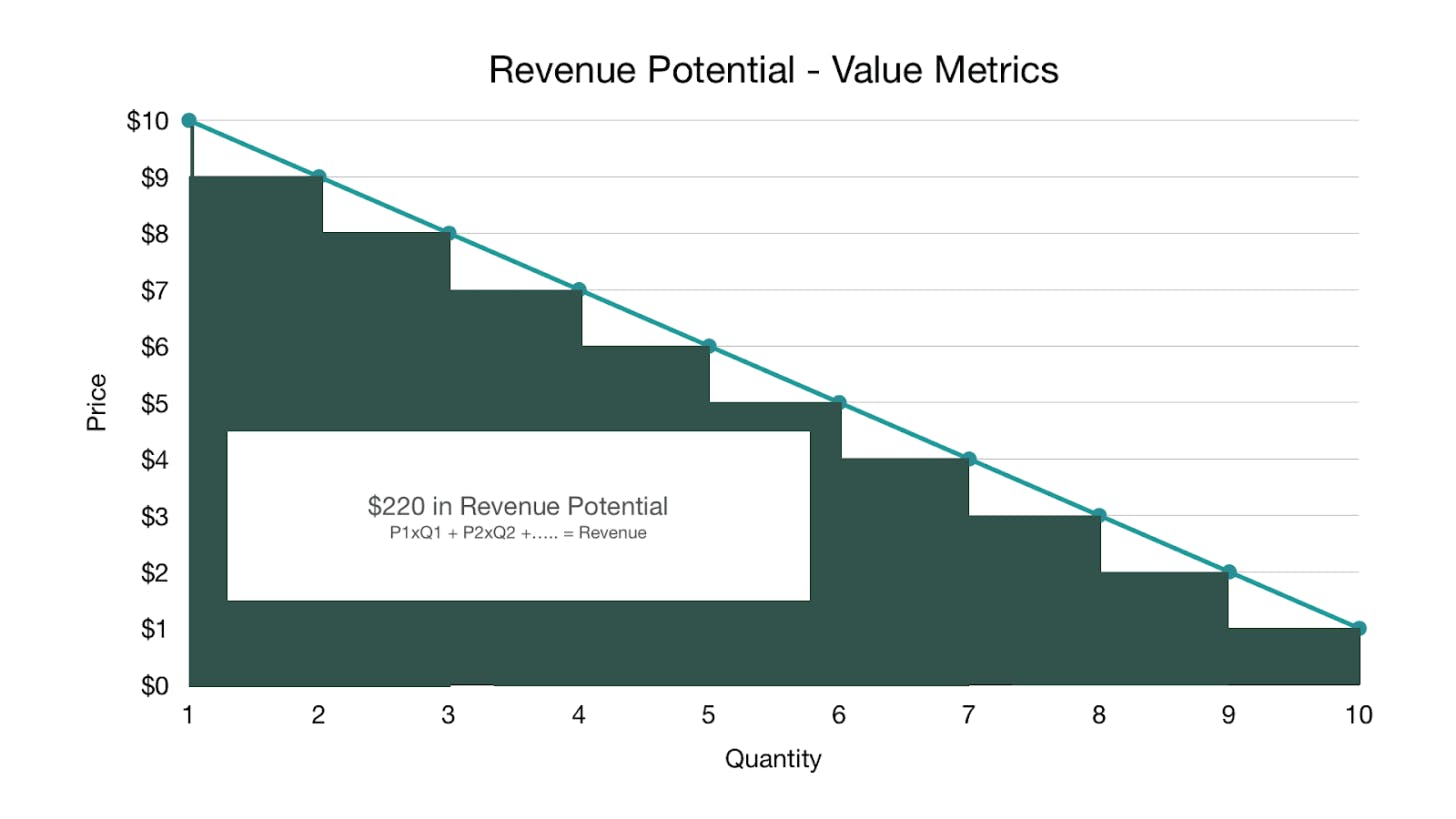

A “ value metric ” is essentially what you charge for. For example: per seat, per 1,000 visits, per CPA, per GB used, per transaction, etc.

If you get everything else wrong in pricing, but you get your value metric right, you'll do ok . It's that important. Partly because it bakes lower churn and higher expansion revenue into your monetization.

A pricing strategy based on a value metric (vs. a tiered monthly fee) is important because it allows you to make sure you're not charging a large customer the same as you'd charge a small customer.

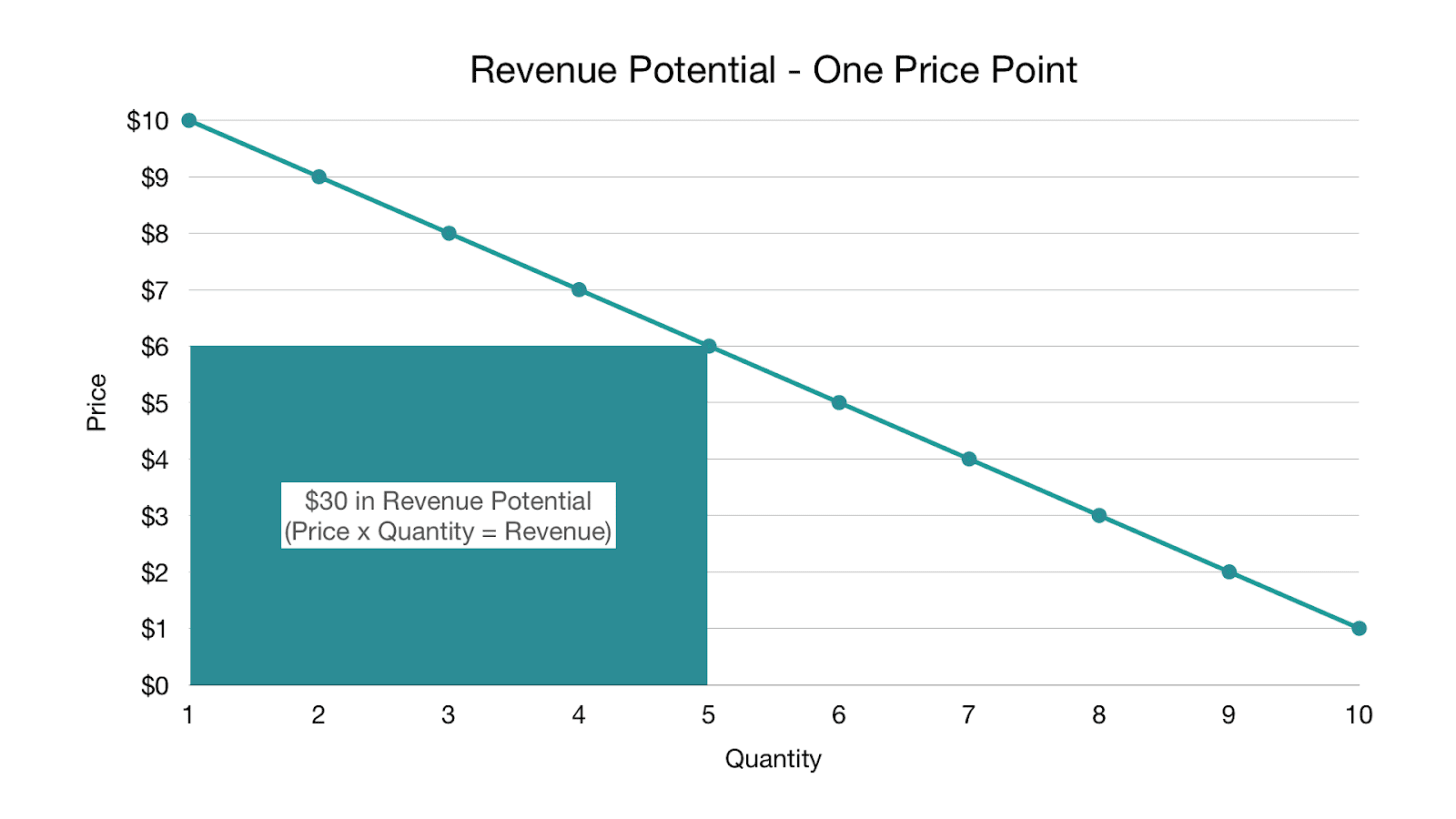

If you remember your high school or college economics class, the professor put a point on a demand curve for the perfect price and said “the revenue a firm gets is the area under that point.” The problem here is: what about all that other area under the curve? You’re missing out on that revenue by charging a flat monthly fee.

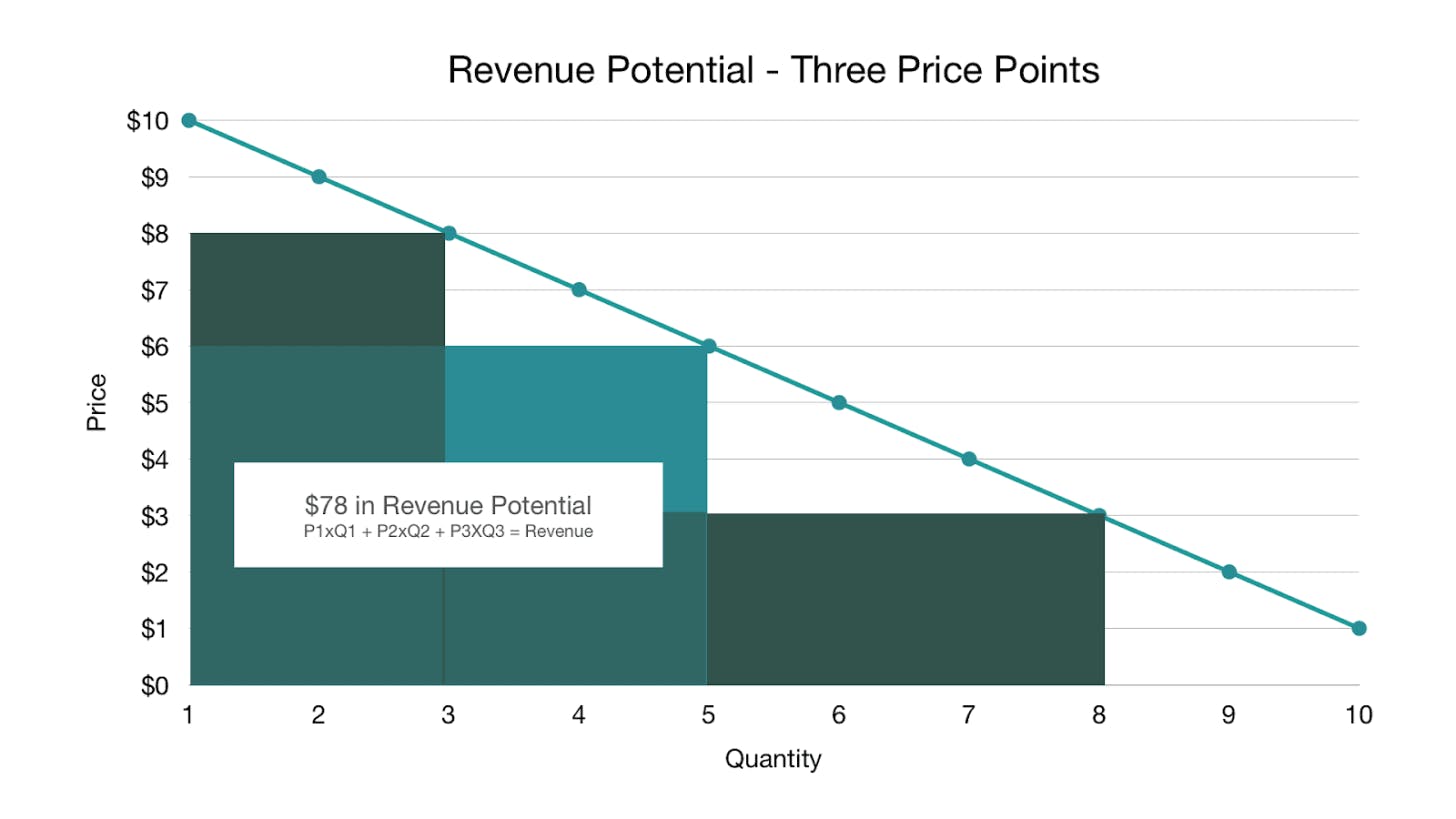

“Good, better, best” pricing strategy is a bit more advantageous, because you end up with three points on our trusty demand curve, and thus more revenue potential. You see this problem among many eCommerce businesses and retailers whose products are constrained by being physical goods—the car with the basic package vs. the car with the stereo and sunroof vs. the car with everything. In software, it’s thankfully dying out, but you’ll still see it with mass-market products: Netflix, Adobe Creative Cloud, etc.

A value metric, however, allows you to have essentially infinite price points—maximizing your revenue potential. In practice, you’ll never show infinite price points on your pricing page , sales deck, or mobile conversion page, but you may have a new customer come in at a certain level and then grow.

Value metrics also bake growth directly into how you charge because as usage or the amount of value received goes up (and those are not the same thing), the customer pays more. If they end up using or consuming less, they pay less (and thus avoid churning). This is why companies using value metrics are typically growing at double the rate with half the churn and 2x the expansion revenue when compared to companies that charge a flat fee or where the only difference between their pricing tiers are features.

To determine your value metric, think about the ideal essence of value for your product—what value are you directly providing your customer?

In B2B, it's likely going to be money saved, revenue gained, time saved, etc. In DTC , it may be the joy you bring them, fitness achieved, increased efficiency, etc. Obviously, we can't measure all of these, but if you can, and your customer trusts your measurement (meaning you say you saved them $100 and they agree you saved them $100), that’s your value metric.

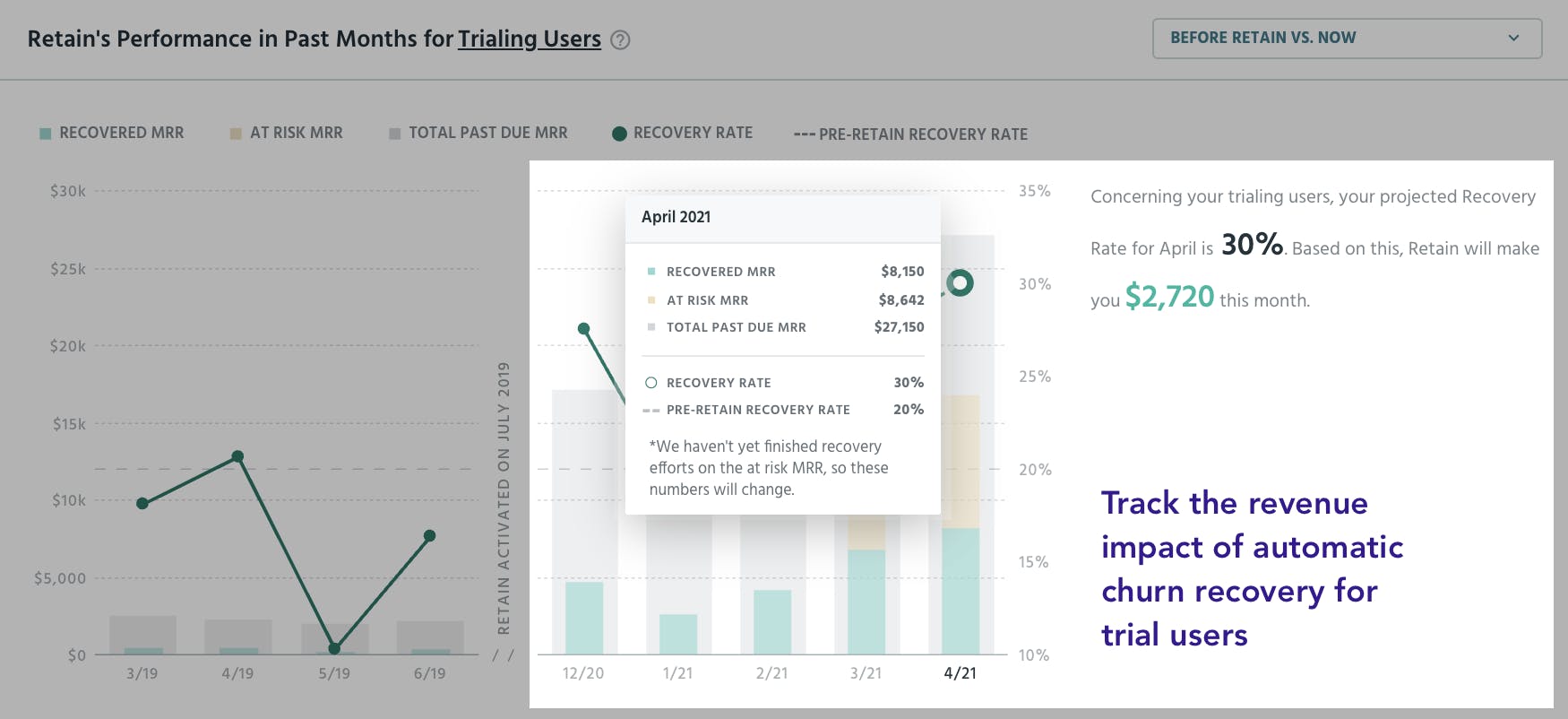

As an example, the perfect value metric for Paddle Retain (our churn recovery product) is how much churn we recover for you. We can measure this, and our customers agree to the measurement, so we can charge on that axis. Other pure value metric products include MainStreet , which handles government paperwork to automatically get you back tax credits—you pay a percentage of the money saved.

Most of you won't have a pure value metric, so the next step is to find a proxy for that metric. Take for example HubSpot ’s marketing product. Their pure value metric is the amount of revenue their tool drives for your business. This is hard to measure and hard for the customer to agree to in terms of what percentage of credit HubSpot deserves for revenue from a blog post. Proxies for HubSpot are things like the number of contacts, number of visits, number of users, etc.

To find the right proxy metric, you want to come up with 5-10 proxies and then talk to your customers and prospects. You’ll typically find 1-2 of these pricing metrics will be most preferred amongst your target customers. You then want to make sure those 1-2 also make sense from a growth perspective. Your larger customers should be using/getting more of the metric, whereas your smaller customers should be using/getting less of the metric. You also want to make sure the metric encourages retention.

When we look at HubSpot, if they were to primarily price on “number of seats”, folks could share a login and HubSpot wouldn’t make much more money on large customers vs. small. Ironically they wouldn’t get as many people invested in HubSpot, because there’d be friction to adding additional seats. Instead, if they give unlimited seats and price based on “number of contacts” there’s minimal friction to getting as many people into HubSpot as possible to do activities (e.g., blog posts, email campaigns , landing pages, etc.) that then produce contacts.

The result: HubSpot’s marketing product’s value metric is “contacts”, which ensures growth is baked directly into how they make money. The usage drives the metric, which therein drives revenue. Most importantly customers small, medium, and large are all paying at the point they see the value and then can grow.

Some other examples:

- Wistia charges by the number of videos or channels you use/have

- Zapier invented the concept of zap (connection of software) and charge based on time to connect

- Theater in Barcelona charged based on the number of laughs

- Husqvarna charges based on time for lawn care products vs. making you buy them

- Rolls Royce charges per mile for airplane engines. They own the engines on the plane you own and do all the maintenance. Cool model.

- Fresh Patch charges based on the amount of grass you want per month for your dog—yes they deliver grass to you monthly

As a side note, you should stop pricing based on seats for products where each seat doesn’t provide a unique experience. For instance, imagine you're an AE using a CRM. If you log into the account of the AE sitting next to you, you can’t really do your work because you are only seeing their leads and accounts. Conversely, if you were a marketing exec and were to log in to another marketing manager’s account in HubSpot, you could do all the work you need to. Thus, for the latter, seats are not the right value metric.

Per-seat pricing is a relic of the perpetual license era when we couldn’t measure usage or value enough within our products. We’re beyond that point, so use the above as a good litmus test.

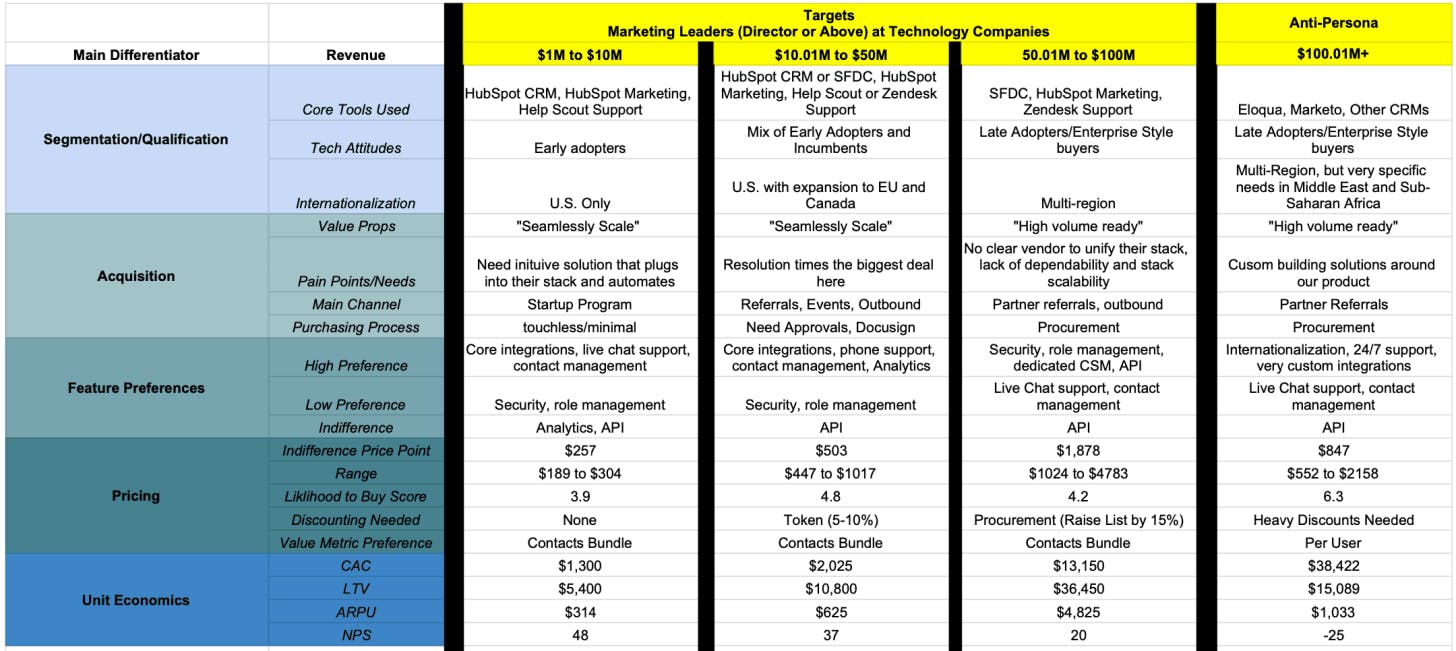

Step 2: Determine your customer profiles and segments

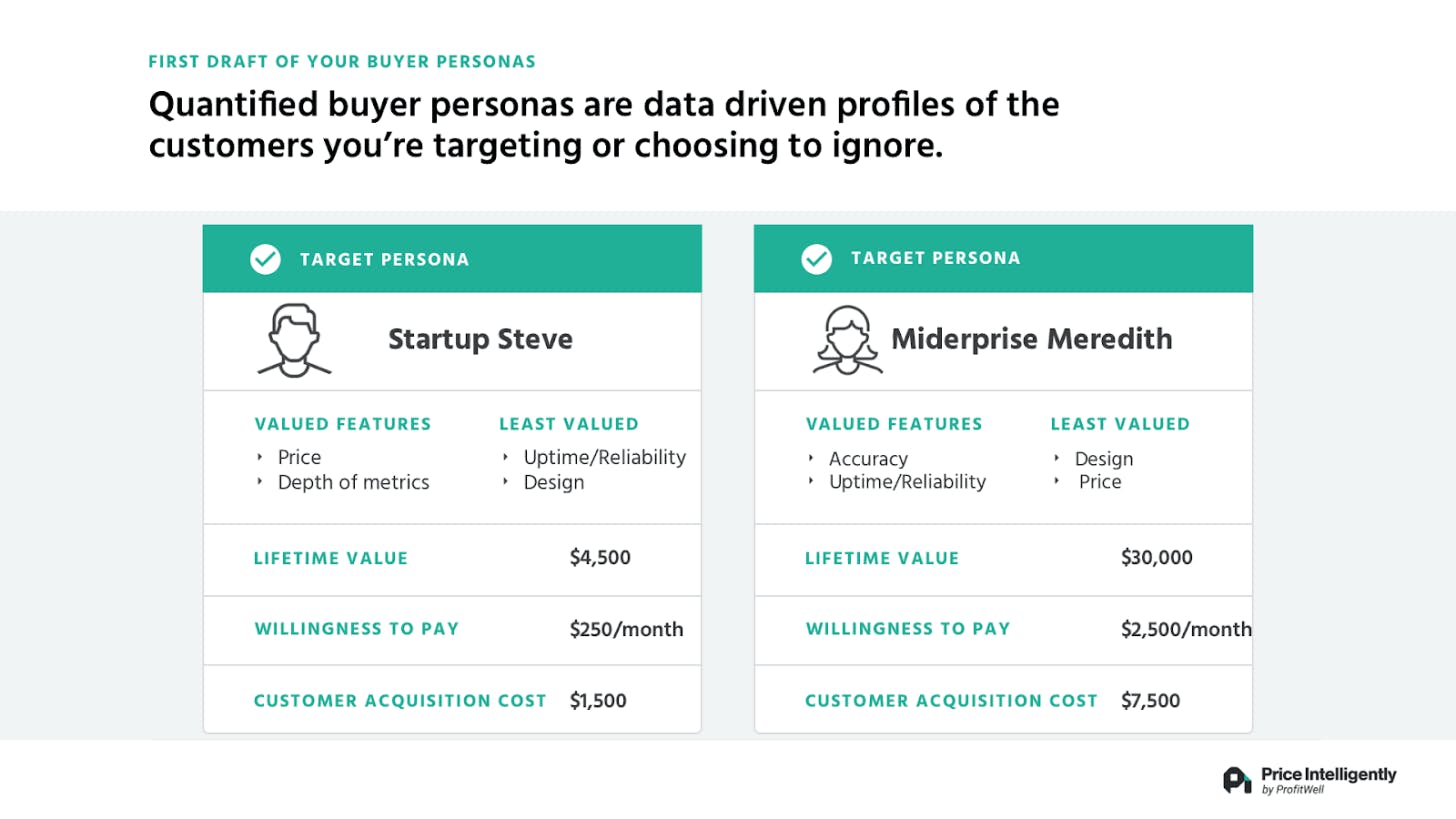

The second key component of your pricing strategy is determining your target segment and ideal customer profile. We've all heard about personas, and you may be rolling your eyes at the concept, but most personas are useless because they aren’t quantitative enough. When used properly, quantified personas and segments are beautiful tools. The information needs to go beyond just cute names like “Startup Steve" with a cute avatar, and cute meetings where people tell you they’re targeting "developers."

To get quantified personas, you need to pull out a spreadsheet. Here’s a template you can use.

1. Columns: Customer profiles you're targeting

These can take many forms, but the ultimate goal is to be as specific as possible so that you not only know who you’re targeting but how to monetize and retain them. Pragmatically, you typically separate these customer profiles based on size or role (or both). For example, a marketing automation product may target the following profiles:

- Marketing leaders (Director and higher) at companies $1M to $10M

- Marketing leaders (Director and higher) at companies $10.01M to $50M

- Marketing leaders (Director and higher) at companies $50.01M to $100M

The point is you can’t be everything to all people and you need to understand who you’re targeting in order to make better decisions.

2. Rows: Characteristics of each profile to help you differentiate between them

- Most valued features

- Least valued features

- Willingness to pay

- Lifetime value (LTV)

- Customer acquisition costs (CAC)

- ... and any other metric or category you think could be useful

If you're just starting out or you don't have some of this data, it’s fine. Still fill it out though with your hypotheses. You know something about your customers.

Next, you then need to validate (or invalidate) the most pressing hypothesis in that spreadsheet based on the decisions you’re going to make. If you're going to validate a new feature for a particular segment, then that's where you should start. Price point the biggest question? Start by researching the price point with each of these roles/segments.

If you don't know who your key roles/segments are, there's no way in hell you’ll set up an efficient growth flywheel, let alone an optimized pricing strategy. Personas act as a constitution within your business to centralize your focus and arguments about direction.

If you don't do segment and persona analysis, you better be able to raise a ton of money. I guarantee you there's some persona or segment on some vision document or in that euphoric part of your entrepreneurial brain that is completely wrong for your business. I see it all the time. Even I—someone who thinks about segments and customer research all the time—fall prey to being an absolute idiot with who we should target.

When we built ProfitWell Metrics (our free subscription metrics tool) I thought we were geniuses who were going to be billionaires. Turns out analytics products are terrible. Willingness to pay for them is terrible; retention for them is terrible; NPS is terrible. Everything is just terrible, mainly because customers don't appreciate graphs or at least aren't willing to pay much for them. When we did our research this became obvious and put us 18 months ahead of our competitors, pushing us to change up the positioning of the product to freemium, which has fueled our business ever since (oh and our NPS is 70, because we massively over-deliver a free product better than the paid competition).

Never underestimate the power of focusing on the customer through research. You should never, ever just do what they ask, but you need to be an anthropologist who knows them better than anyone else.

Step 3: User research + experimentation

Beyond your value metric and core segments, the monetization game becomes extremely tactical and research-based. Figuring out your price point involves researching those segments and then making decisions in the field. Same with discounting, add-on, and packaging strategies. The point: monetization is never finished because it’s the very essence of translating your value into an optimal framework for your target customer segments.

Practically this is why you should be experimenting with your monetization every quarter. Experimentation can get tricky and have a few quirks, but you’ll find it’s similar to most growth frameworks out there (which are all versions of the scientific method).

Here’s a good prioritization list of what business owners should attack in optimizing their monetization strategy once they have the core segments and value metric figured out:

Priority 1: Foundational [see above]

- Core customer segments

- Value metrics

Priority 2: Core

- Order of magnitude price point (are you a $10 product vs. a $500 product)

- Positioning and value props

Priority 3: Optimizations

- Add-on strategy

- Specific price point (are you a $10 product vs. a $11 product)

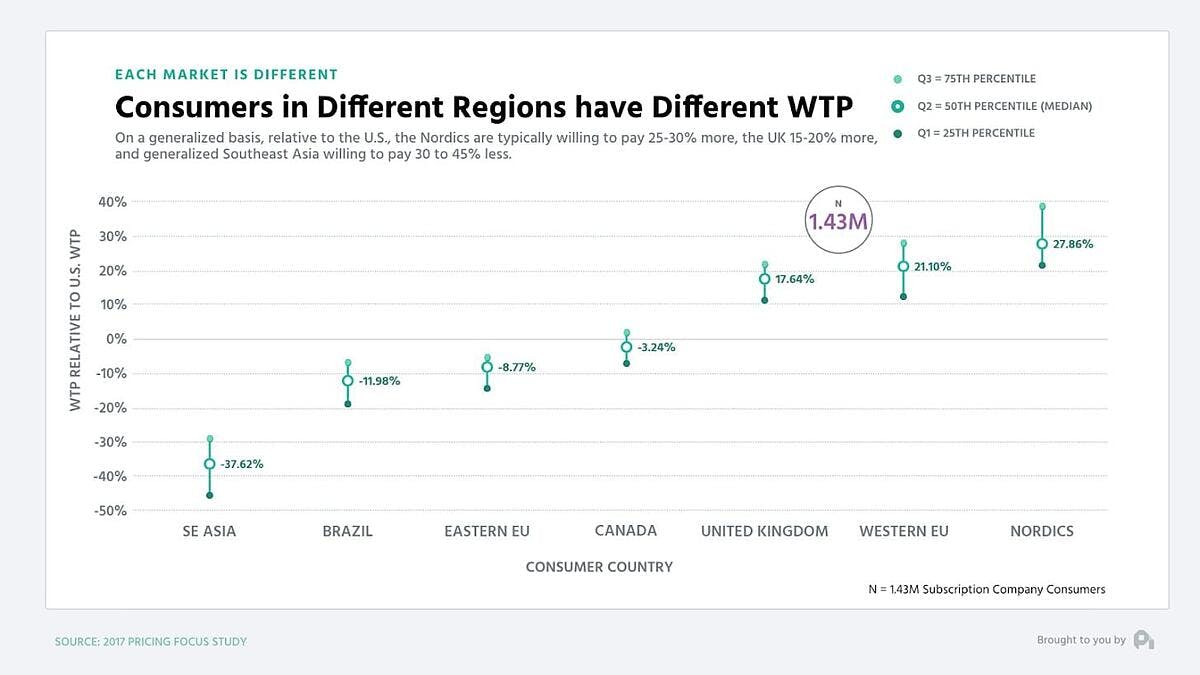

- Price localization/internationalization

- Discounting strategy

- Contract Term optimization

Priority 4: Growth accelerators

- Market expansion (going up or down market)

- Vertical expansion

- Multi-Product

Your true order of operations with monetization will vary, but for the most part, all companies should work through the foundational and core sections before moving to the optimizations and growth accelerators. If you’re larger or there’s a fire, you may start with an optimization. In fact, this is sometimes a good idea. Something more scoped like “price localization” can help get momentum, be a forcing function to clean up tech and experimentation stacks, and mitigate political conversations. Remember, monetization is something that’s important, uncomfortable, and something you likely don’t know much about, so progress is better than nothing. Start small. You can (and should) always do more.

Bonus: 10 rapid-fire pricing strategy tips rooted in data⚡

In case you're still hungry for more tips on nailing your pricing strategy and achieving maximum profitability, look no further. We've got you covered:

1. You should localize your pricing to the currency and willingness to pay of the prospect's region

- Revenue per customer is 30% higher when you just use the proper currency symbol

- Having different price points in different regions increases revenue per customer further, and is justified based on different consumer demands in different regions

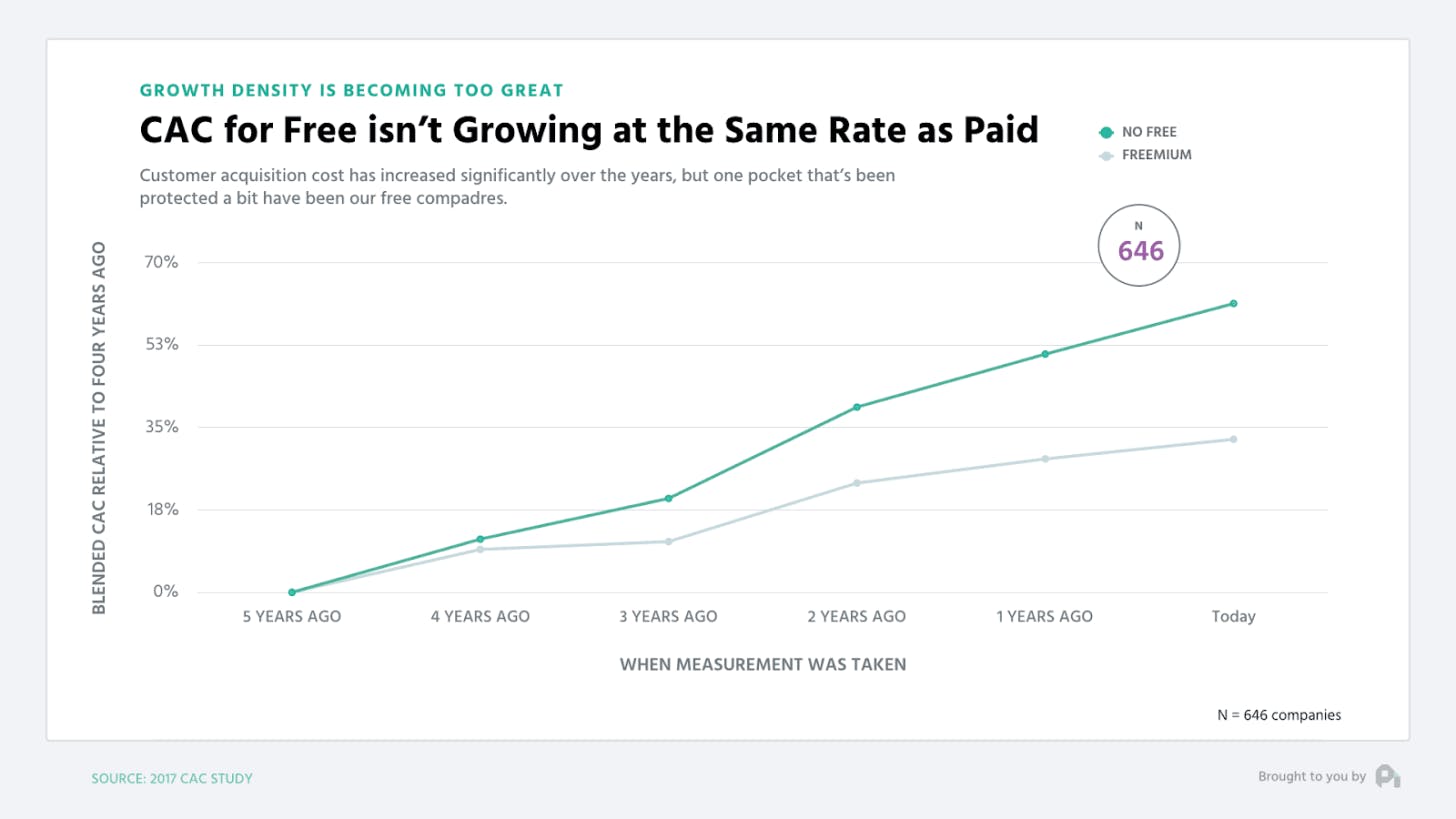

2. Freemium is an acquisition model, not a part of pricing

- Think of freemium as a premium ebook driving leads, not another pricing tier

- Don't do freemium until you truly understand how to convert leads to customers, because you’ll end up increasing noise or false positives when you’re trying to figure out your segment beachheads. The best folks who deploy free typically don’t implement freemium until two to three years into their business. The exceptions to this notion are if you have a very specific need or network effect (eg., marketplaces, social networks, etc.) or if you have a top 50 growth person on your team.

- To be clear, we're not saying DON’T do freemium. we're saying it's a scalpel, not a sledgehammer that requires thought. A lot of people end up reading our articles on freemium and end up going, “Cool, let’s do freemium and we’ll be a unicorn.” I’m being pragmatic in that you need to realize freemium is fantastic, but doing freemium properly takes a lot of effort and nuance.

- Paid users who convert from free tend to have higher NPS, better retention, and much lower CAC .

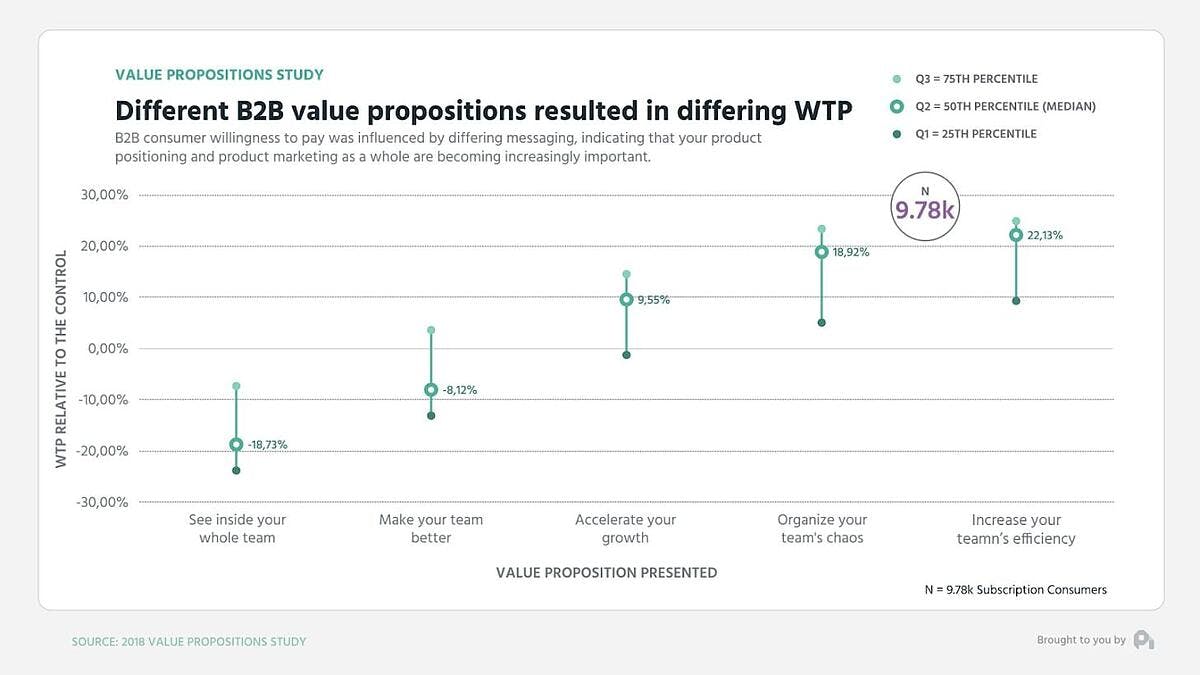

3. Value propositions matter oh so much

In B2B value propositions can swing willingness to pay ±20%, in DTC it's ±15%

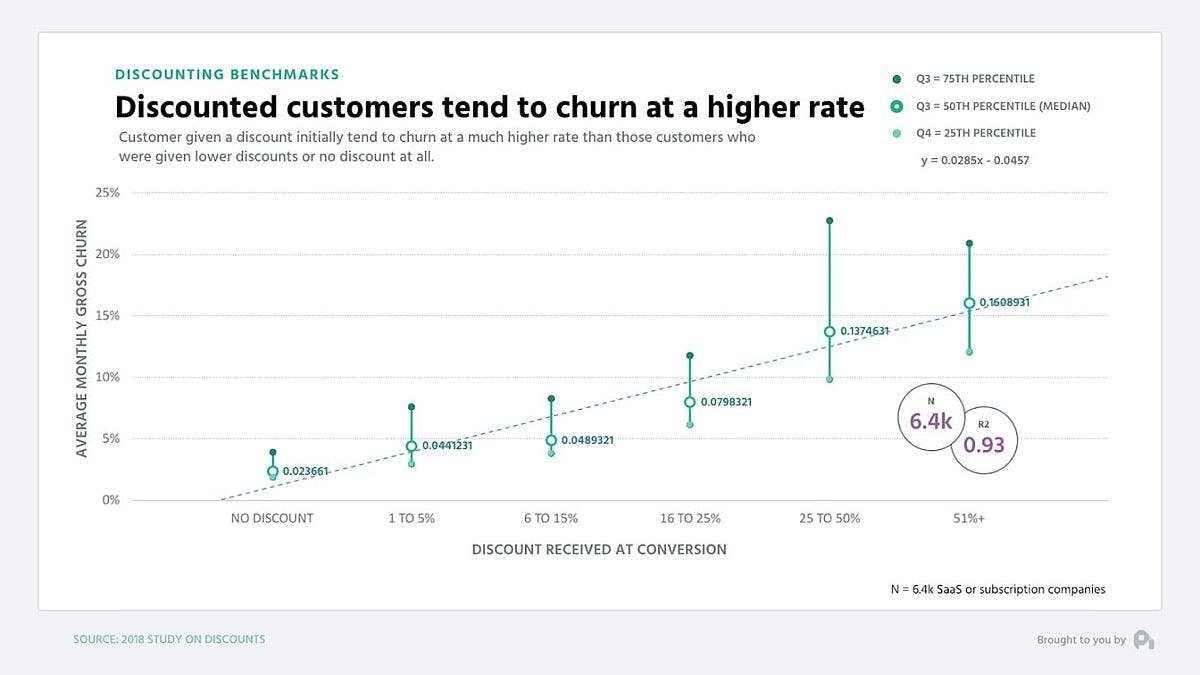

4. Don't discount over 20%

In some verticals discounting over 20% may be fine, but you're likely not in one of them (although you may think you are), but the size of the discount almost perfectly correlates with higher churn. Largely discounts get people to convert, but they don't stick around.

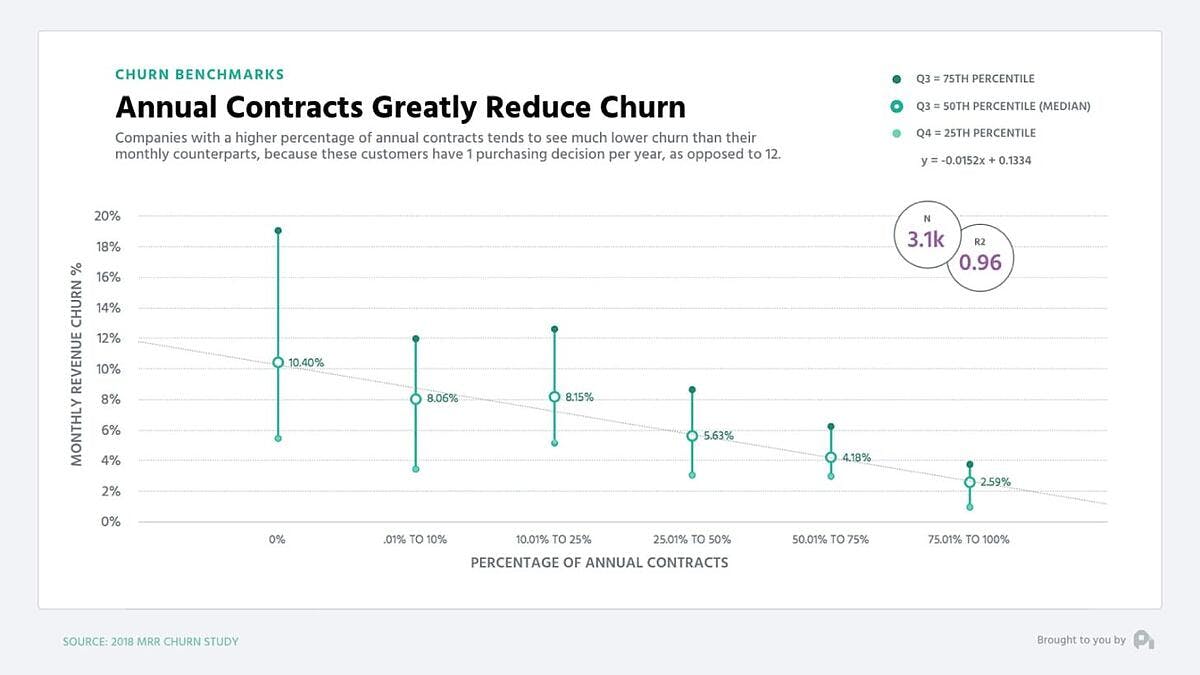

5. For upgrades to annual discounts, don't use percentages and try offers

Percentages don't work as well as whole dollar amounts for discounts (ie., "one month" will work better than "X percent off"). Annuals see much lower churn rates.

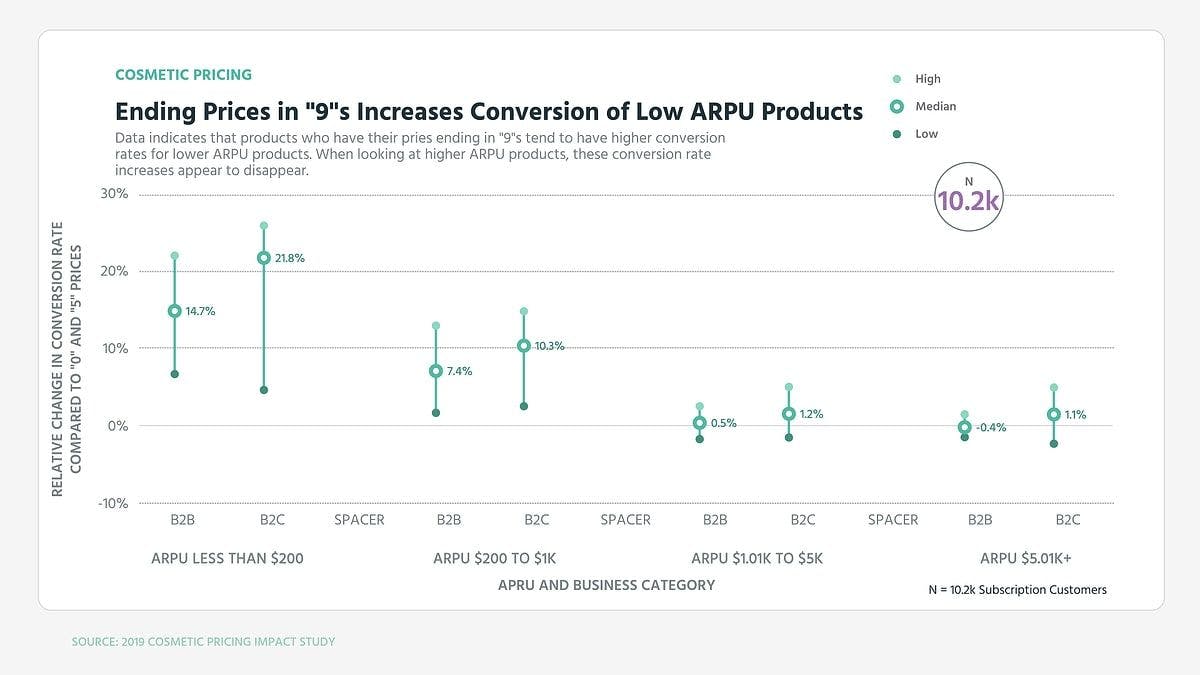

6. Should you end your price in 9s or 0s? Depends on your price point

Ending your prices in 9s evokes a discount brand, making the customer feel like they're getting something. Ending in 0 evokes luxury or premium, making them feel like they're getting a high-end product. Studies on this for technology products are inconclusive. We have seen it increase conversion in lower-cost products, but retention isn't as good with those customers.

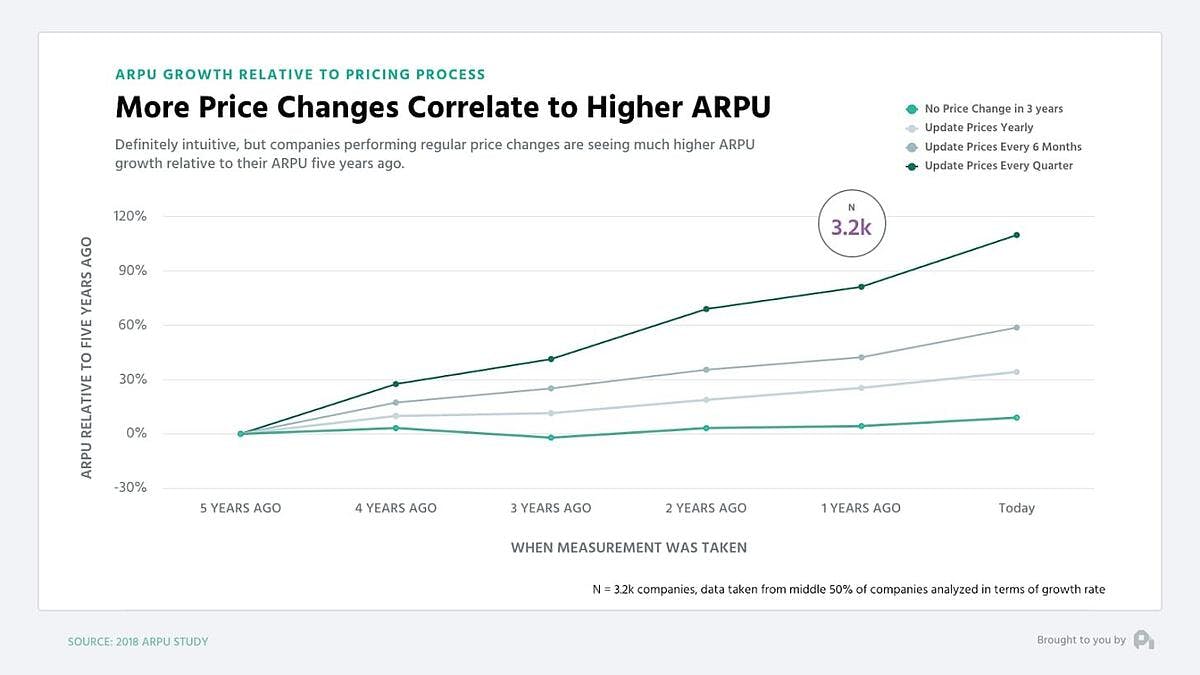

7. You should experiment with your pricing in some manner every quarter

This doesn't mean change you should the price point each quarter, but experiment with variable costs. More changes correlate with increasing revenue per customer. Like all things, focusing on something makes you improve it.

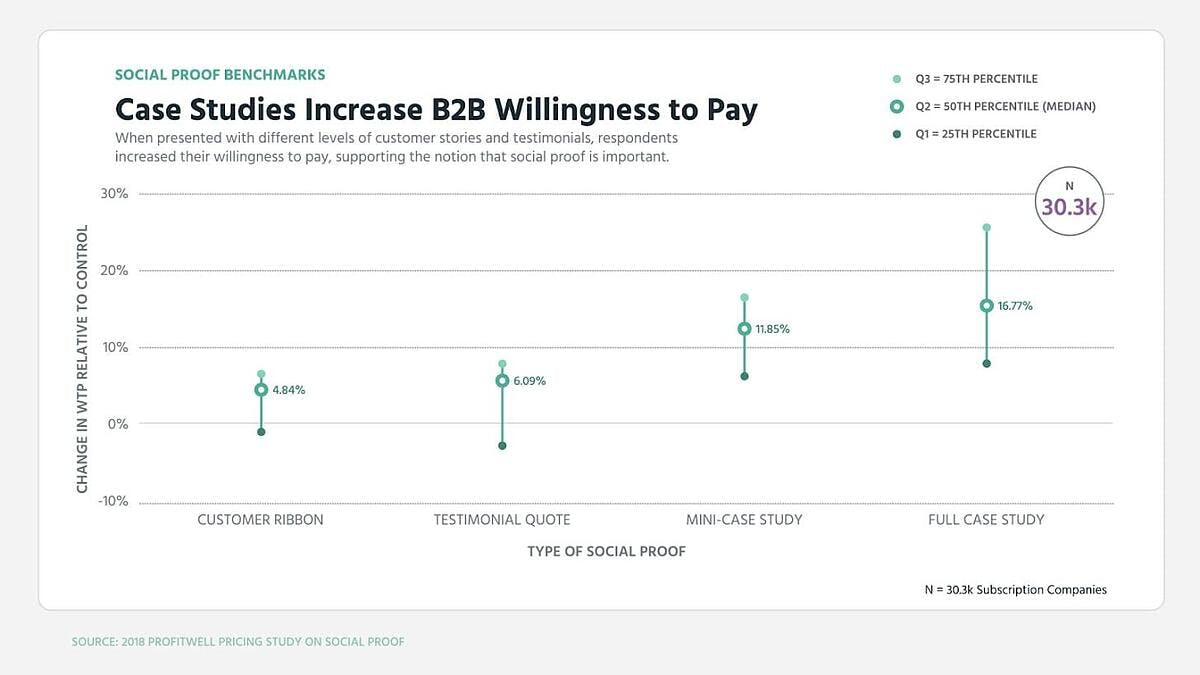

8. Case studies boost willingness to pay quite a bit

Social proof is important. Case studies that offer proof of the high quality of your products can boost willingness to pay by 10-15% in both B2B and in DTC.

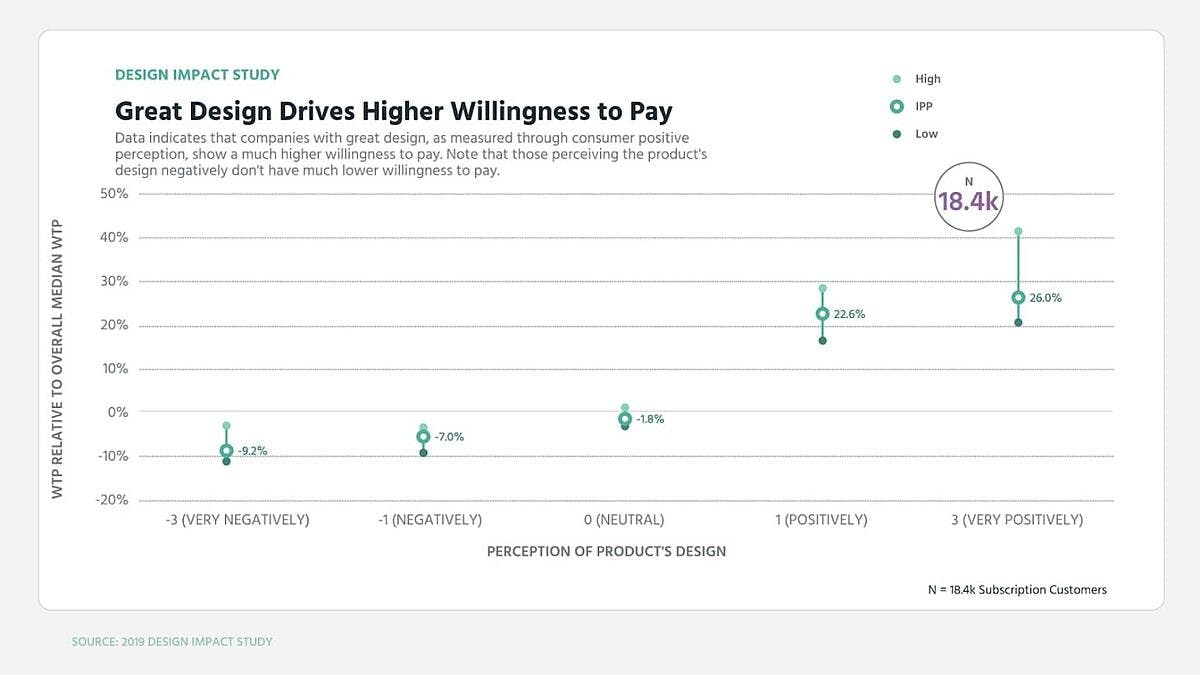

9. Design helps boost willingness to pay by 20%

This graph didn't look this way 10 years ago when design didn't do much for willingness to pay. Today, affinity for a company's design can boost willingness to pay considerably.

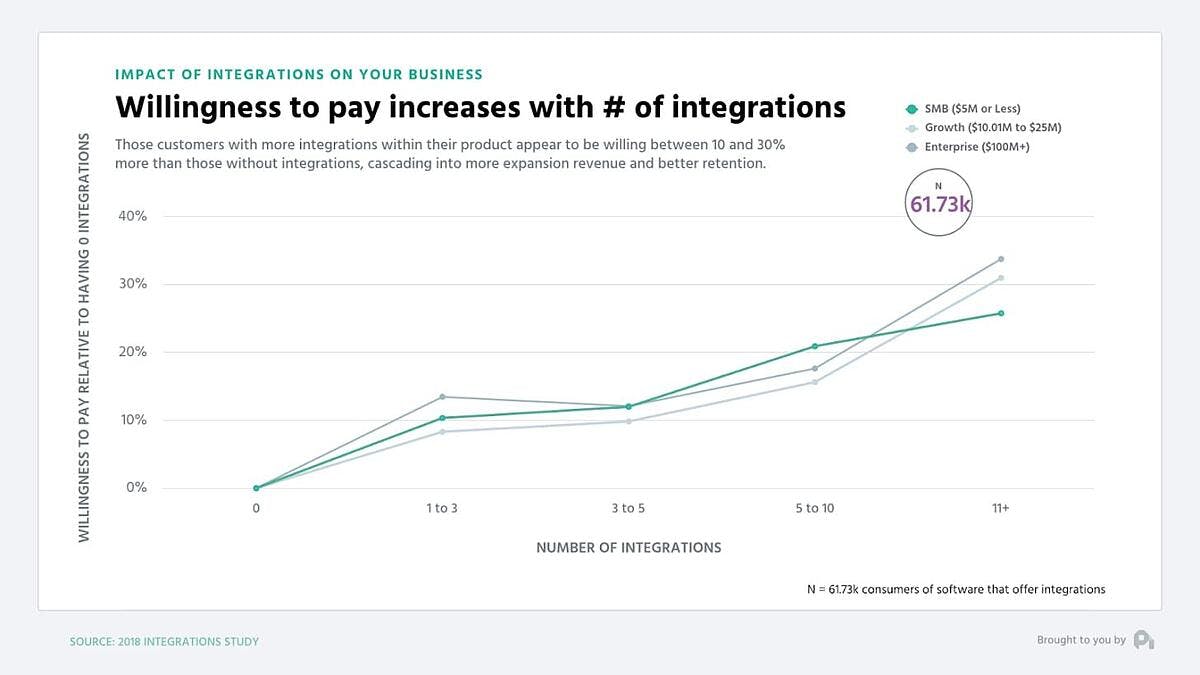

10. Integrations boost retention and willingness to pay

The more integrations a customer is using, typically the higher their willingness to pay and the better their retention. I wouldn't charge for the integrations, but I'd use this as a tool to get people hooked in and paying more or buying different add-ons.

Pricing strategies for different industries

Pricing strategies are not one size fits all. Finding the proper pricing strategy is dependent on your industry, as well as your company's unique objectives. But to give you an idea, we've listed a couple of industries and strategies that are well suited for each other.

SaaS/Subscriptions

For SaaS and subscription-based businesses, value-based pricing is the winner hands down. As long as your customers are willing to pay, you can charge much more than your competitors. Because your price is based on how much customers will spend, it isn't artificially lowered like other methods that fail to account for that.

We also like value-based pricing for B2B companies. Value-based pricing requires you to look outward and understand your customers better. This is good for finding the optimal price, but it's also good for building optimal relationships that will also help grow your company.

Which pricing strategy is best?

This depends on your business model. For SaaS and subscription companies, as well as many others, we recommend value-based pricing.

How do you determine the selling prices of a product?

First, find a pricing strategy that fits well with your business model and product. As you've seen, pricing strategies differ, but they all give clear instructions for how to use them to set prices.

What is the simplest pricing strategy?

Since you only need to add up the cost to make your product and add a percentage to it, cost-plus pricing is the simplest form of pricing to use.

What is a pricing curve?

A pricing curve is a graph that shows you the number of people who are willing to pay a given price for a product.

What are the 4 major pricing strategies?

Value-based, competition-based , cost-plus, and dynamic pricing are all models that are used frequently, depending on the industry and business model in question.

Related reading

Types of Pricing Strategies: Explained with Examples

A pricing strategy is a plan or approach that a company uses to set the price of its products or services. It involves analyzing factors such as the cost of production, competition, demand, target market, and desired profit margins, among others, to determine the optimal price point for a product or service.

There are several types of pricing strategies that businesses can use to price their products or services. Here are some common pricing strategies:

Cost-plus pricing :

Cost-plus pricing is a pricing strategy where the price of a product or service is determined by adding a markup (a percentage of the cost) to the cost of producing or providing the product or service. In other words, the selling price is calculated by adding a predetermined profit margin to the total cost of production or provision.

The cost-plus pricing method is often used in manufacturing industries where production costs are the primary driver of pricing decisions. It is also commonly used in government contracts and construction projects.

The advantages of cost-plus pricing include simplicity, stability, and predictability. It ensures that all costs are covered and that a profit is earned. Additionally, it can be a valuable tool for businesses just starting out or those with difficulty predicting demand or pricing their products or services.

However, the downside of cost-plus pricing is that it does not consider market demand or competition. It assumes that customers will be willing to pay a certain price, which may only sometimes be the case. Furthermore, if the cost of production increases, the price of the product or service will also increase, which could make it less competitive in the marketplace.

Here are some examples of cost-plus pricing:

- Construction Projects: In construction projects, cost-plus pricing is commonly used. The contractor estimates the project’s cost, adds a percentage markup to cover overhead expenses and profit, and bills the client accordingly.

- Government Contracts: When the government needs to procure goods or services, they often use a cost-plus pricing model. This pricing method ensures that the supplier covers all their costs and makes a profit on the sale.

- Custom Manufacturing: Custom manufacturing companies often use cost-plus pricing to price their products. They estimate the cost of raw materials, labor, and overhead and then add a markup to the total cost to determine the final selling price.

- Service Industry: In the service industry, cost-plus pricing is used to price hourly services such as consulting or legal services. The hourly rate includes the cost of labor, overhead, and profit margin.

- Retail Industry: The retail industry may use cost-plus pricing for private-label products. The retailer sets the product’s price based on the production cost and adds a markup for profit.

Penetration pricing:

Penetration pricing is a pricing strategy in which a company initially offers a product or service at a very low price in order to gain market share and attract customers quickly. The goal of penetration pricing is to increase sales volume and establish a foothold in the market, even if it means operating at a loss initially.

Penetration pricing strategy is typically used when a company is entering a new market or introducing a new product and wants to capture market share from existing competitors quickly. By offering a lower price than competitors, a company can attract price-sensitive customers looking for the best deal.

Penetration pricing can be an effective strategy for companies that can quickly scale up production and reduce costs as sales volume increases. However, it can also be risky, as operating at a loss can strain a company’s finances in the short term. Additionally, customers may become accustomed to low prices and may resist price increases in the future.

Here are some examples of penetration pricing:

- Amazon: When Amazon launched its Kindle e-reader in 2007, it priced the device at $399. However, in 2009, it introduced the Kindle 2 at a much lower price of $299 and then dropped it even further to $139 in 2010. This aggressive pricing strategy helped Amazon to dominate the e-reader market quickly.

- Uber: Uber used penetration pricing when it launched in new markets by offering deeply discounted rides to attract new customers and gain market share. This pricing strategy helped Uber rapidly expand its user base and establish itself as the dominant ride-sharing platform.

- Xiaomi: Xiaomi, a Chinese smartphone maker, uses penetration pricing to compete with established players like Apple and Samsung. Xiaomi offers high-quality smartphones at a fraction of the price of its competitors, which has helped it to gain market share in China and other developing countries.

- Gillette: When Gillette launched its Mach3 razor in 1998, it priced the product at a premium to its existing product line. However, it quickly realized that it needed to offer a lower-priced version of the razor to compete with other brands. Gillette introduced the Mach3 Turbo at a lower price point, which helped it to capture a larger share of the market.

- McDonald’s: McDonald’s often uses penetration pricing to promote new products or limited-time offers. For example, it may offer a new menu item at a lower price to entice customers to try it and then gradually increase the price once it has gained popularity.

Market Penetration Pricing Strategy | Explained with Examples

Skimming pricing:

Skimming pricing is a pricing strategy where a company sets a high price for a new product or service during its initial launch. This strategy is often used for products or services that are innovative, unique or have high demand. Skimming pricing aims to maximize profits by charging a premium price to early adopters willing to pay more for the product or service.

As time passes, the company may gradually lower the price as the product or service becomes more widely adopted and competition increases. Skimming pricing can be an effective strategy for companies that have invested heavily in research and development or marketing and need to recoup those costs quickly.

However, there are some potential downsides to skimming pricing. High initial prices can deter some customers from purchasing the product, and if the price is too high, competitors may enter the market and undercut the company’s prices. Additionally, if the company lowers the price too quickly, it may damage the brand’s reputation or anger early adopters who paid the higher price.

Here are some examples of skimming pricing:

- Apple’s iPhone: Apple typically launches new versions of its iPhone at high prices, targeting early adopters willing to pay a premium for the latest technology. Over time, the company gradually lowers the price as the product becomes more widely adopted.

- Tesla’s electric cars: Tesla’s electric cars are priced at a premium compared to others on the market. The company targets early adopters who value the technology and sustainability of the product.

- Sony’s PlayStation: When Sony launches a new version of its PlayStation gaming console, it typically prices it high, targeting hardcore gamers who want the latest technology. As the console becomes more widely adopted, the price is gradually lowered to attract a wider audience.

- GoPro cameras: GoPro cameras are known for their ruggedness and high-quality video capabilities. When the company launches a new camera, it typically prices it high, targeting early adopters willing to pay for the latest technology. Over time, the company lowers prices to appeal to a broader audience.

- Uber’s surge pricing: While not a product launch, Uber’s surge pricing is an example of skimming pricing in the service industry. When demand for rides is high, Uber charges a premium price to riders willing to pay for the convenience of a ride. As demand subsides, the company gradually lowers the price back to normal levels.

Skimming Pricing Strategy: Definition with Examples

Dynamic pricing:

Dynamic pricing is a pricing strategy where the price of a product or service is continuously adjusted based on various factors such as demand, competition, seasonality, and customer behavior. It is a method used by companies to optimize revenue and profitability by setting prices that reflect the current market conditions.

Dynamic pricing is made possible by using algorithms and real-time data analysis. Dynamic pricing has become increasingly popular in recent years, especially in industries such as travel, hospitality, and e-commerce. However, it can be a controversial strategy, as customers may feel that they are being unfairly charged different prices for the same product or service.

Dynamic Pricing Strategy: Meaning | Model | Examples

Here are some examples of dynamic pricing:

- Airline tickets: Airlines frequently adjust their ticket prices based on demand, seasonality, and competition. For example, ticket prices may be higher during peak travel season compared to off-season periods. Similarly, airlines may offer discounts on unsold seats close to the departure date to fill up the plane.

- Ride-sharing services: Ride-sharing services like Uber and Lyft use dynamic pricing to adjust fares based on demand and supply. During peak hours or high demand, the fare may increase, while during low demand, the fare may decrease to attract more customers.

- Hotels and accommodation: Hotels and vacation rentals often use dynamic pricing to adjust room rates based on occupancy rates, seasonal demand, and local events. For example, hotels may offer lower rates during the off-season or weekdays to attract more customers.

- Online retailers: Online retailers like Amazon use dynamic pricing to adjust product prices based on factors such as competitor prices, customer demand, and inventory levels. Prices may frequently change throughout the day, sometimes even hourly.

- Sporting and entertainment events: Ticket prices for sporting and entertainment events may be adjusted based on various factors such as demand, seat location, and time of purchase. For example, ticket prices for a famous sports team may increase as the date of the game approaches and the team performs better in the league.

7 Pricing Mistakes That Are Costing Businesses

Bundle pricing:

Bundle pricing is a marketing strategy that involves offering several products or services together as a package at a discounted price. The idea behind bundle pricing is to encourage customers to purchase multiple items at once, thereby increasing sales and revenue for the seller.

Bundle pricing typically offers a lower overall cost than buying the items separately, making the deal more attractive to customers. For example, a bundle pricing offer may include a laptop, a case, and a mouse for a lower combined price than buying those items separately.

Bundle pricing can benefit both the seller and the customer. For the seller, it can increase sales, move inventory, and reduce marketing costs. For the customer, it offers convenience and cost savings.

The effectiveness of bundle pricing may vary depending on the market, the products or services being bundled, and the discount being offered. However, it can be a valuable tool for businesses to increase sales and improve customer satisfaction.

Here are some examples of bundle pricing:

- Fast-food restaurants often offer a meal deal that includes a sandwich, fries, and a drink at a lower price than buying each item individually.

- Software companies often offer bundles of their products or services at a discounted rate. For example, a company might offer a bundle that includes a word processor, a spreadsheet program, and presentation software for a lower price than buying each item separately.

- Cable or internet service providers may offer a bundle of services, such as cable TV, internet, and phone service, at a lower price than buying each service separately.

- Electronic stores might bundle a TV, a soundbar, and a streaming device as a package deal at a lower price than buying each item individually.

- Online retailers may offer a bundle of related items, such as a camera, a memory card, and a camera bag, at a lower price than buying each item separately.

- Bookstores might offer a bundle of books from the same author or genre at a discounted price.

Bundle pricing can be a successful marketing strategy when the bundled products or services are related and appealing to the customer. The discount offered is attractive enough to motivate them to purchase.

Bundle Product Pricing: Strategy and Examples

Value-based pricing:

Value-based pricing is a pricing strategy in which the price of a product or service is determined by its perceived value to the customer. Instead of setting prices based on the cost of production or competitors’ prices, value-based pricing considers the benefits that the product or service provides to the customer and the value that the customer places on those benefits.

Value-based pricing is often used for products or services that are unique or highly differentiated and offer significant customer value. For example, a luxury car manufacturer might use value-based pricing to set the price of a new model based on factors such as the car’s performance, design, and brand reputation.

Value-based pricing aims to capture the maximum value from the customer while providing the customer with a fair price for the benefits received. This can be a more effective pricing strategy than simply trying to undercut competitors on price, as it allows companies to differentiate their products based on value rather than cost.

However, it can also be more challenging to implement, as it requires a deep understanding of customer needs and preferences and the ability to communicate the value of the product effectively.

Here are some examples of value-based pricing:

- Software as a Service (SaaS) pricing: Many SaaS companies use value-based pricing by charging customers based on the number of users or the features they need. For example, project management software may charge a higher fee for additional users, while CRM software may charge more for advanced features like marketing automation.

- Healthcare pricing: Healthcare providers such as hospitals and clinics often use value-based pricing to price medical procedures based on the perceived value to the patient, their insurance, and the healthcare system. This allows healthcare providers to tailor their prices based on the specific medical needs of each patient.

- Luxury goods pricing: Luxury goods manufacturers often use value-based pricing by setting high prices for their products based on the perceived value to the customer. For example, a luxury watch manufacturer may charge a premium price for a limited edition watch with unique features or materials.

- Personalized services pricing: Service-based businesses such as personal trainers, consultants, and coaches may use value-based pricing to charge clients based on the specific value they receive. For example, a fitness coach may charge a higher fee for personalized workout plans and nutrition advice.

Overall, value-based pricing can be used in various industries to provide customers with fair pricing based on the perceived value of the product or service.

Value-based pricing strategy: Model | Examples

Promotional pricing:

Promotional pricing refers to a marketing strategy where a product or service is temporarily offered at a lower price than its regular price to attract customers and increase sales. Promotional pricing aims to create a sense of urgency and encourage customers to take advantage of the offer while it lasts.

Promotional pricing can take many forms, including discounts, coupons, limited-time offers, and buy-one-get-one-free deals. Businesses commonly use it to introduce new products, increase sales during slow periods, and clear out excess inventory.

While promotional pricing can be an effective tool for driving sales, businesses must carefully consider its potential impact on their profit margins and brand image. It is important to ensure that the promotional pricing is sustainable and that customers only come to expect discounts sometimes. Additionally, businesses must be transparent about the promotion terms and avoid misleading customers with false claims or hidden fees.

Promotional Pricing Strategy: Benefits | Types | Examples

Here are a few examples of promotional pricing:

- Black Friday Sales: Many retailers offer steep discounts on products during the Thanksgiving weekend, commonly called Black Friday. This popular promotion encourages customers to shop for the holiday season.

- Free Gifts with Purchase: Some businesses offer a free gift or product when customers purchase a certain item. This can encourage customers to make a purchase they may not have otherwise.

- Flash Sales: Flash sales are time-limited promotions that offer discounts for a short period of time. This can create a sense of urgency and encourage customers to purchase before the sale ends.

- Seasonal Discounts: Some businesses offer seasonal discounts, such as discounts on winter clothing at the end of the season. This can help clear out inventory and generate sales during slower periods.

- Loyalty Discounts: Businesses may offer discounts to customers who have signed up for loyalty programs or have made multiple purchases. This can encourage repeat business and reward loyal customers.

- Bundling: Bundling involves offering a discount when customers purchase multiple items together. For example, a restaurant may offer a discount on a meal when customers order an entrée, side, and drink together.

Overall, promotional pricing is a common marketing tactic businesses use to generate sales and attract customers.

Related Posts

Effective Essay Writing as a Tool for Strategic Communication

How To Protect Yourself in Business Transactions

How Spiritual Advisors Help Corporate Managers Make Better Business Decisions

Leveraging Essays to Develop a Strategic Mindset

How AI is Changing the Landscape of Car Insurance Customer Service

How Companies are Influencing Consumer Decisions?

How to Enjoy Success in the Amazon Marketplace

How To Write A Comprehensive Business Plan For Your Startup

Type above and press Enter to search. Press Esc to cancel.

IMAGES

VIDEO

COMMENTS

Pricing is a term used to describe the decision-making process before you value a product or service. Your price must communicate how much you care about your brand, product, and customers to you…

Mkt241 document define The Pricing Strategy Assignment. why pricing is key factor to profit margin in every busing. pricing is... View more. Course. Marketing (MKT 241) 155Documents. Students shared 155 documents in this course. …

a pricing strategy for a product of their choice. Students will also develop the . Knowledge@Wharton Article: “Choosing the Wrong Pricing Strategy Can Be a Costly …

A pricing strategy is a model or method used to establish the best price for a product or service. It helps you choose prices to maximize profits and shareholder value while …

Below, we explore 11 types of pricing strategies so you can find the best approach for your specific circumstances. 1. Psychological Pricing Strategy. Psychological pricing uses tricks like setting prices at $9.99 instead of $10 to …

Boost sales. Increase revenue. Improve profit margins. But a bad pricing strategy can target the wrong customers, make them feel uncertain about trusting and buying your product, and inaccurately portray the value of …

The pricing strategy guide: Choosing pricing strategies that grow (not sink) your business. Choosing the pricing strategy for your business requires research, calculation, and a good amount of thought. Simply guessing may put you out …

A pricing strategy is a plan or approach that a company uses to set the price of its products or services. It involves analyzing factors such as the cost of production, competition, demand, target market, and desired profit margins, …