- Share full article

Advertisement

The Morning

What’s going on with the u.s. economy.

The economic picture is simpler than the swirl of economic indicators sometimes suggests.

By David Leonhardt

The economy is probably headed toward a recession. No, it’s actually booming again.

Inflation is plummeting. No, it has started rising again.

If you find the cacophony of economic indicators to be confusing, don’t feel bad. It is confusing. Some numbers point in one direction, while others point in the opposite. Partisans from both political parties have an interest in promoting one type of news and downplaying the other.

Yesterday’s inflation report added to the muddle. Inflation — a major concern for many families and already a 2024 campaign issue — has been falling for the past year and half. Americans’ economic mood has improved slightly as a result . But the numbers released yesterday showed inflation to be higher than forecasters had expected. In response, the S&P 500 index fell 1.4 percent , its second-biggest daily decline this year.

In today’s newsletter, I’ll give you a framework for thinking about the state of the U.S. economy by describing the four main phases of the past several years. I can’t tell you what will happen next, but I do think the picture is simpler than the swirl of economic indicators sometimes suggests.

1. The pre-Covid boom

The American economy has been disappointing for much of the past half-century. Income and wealth growth has been slow for most families, and inequality has soared. Perhaps the starkest sign of the problems: Life expectancy in the U.S. is now lower than in any other high-income country, and it isn’t especially close .

Still, there have been a few brief periods when the economy has boomed. One of them began late in Barack Obama’s presidency and continued during Donald Trump’s term. The country finally emerged from its hangover after the housing crash, as businesses expanded and consumers spent more.

The unemployment rate fell below 5 percent in 2016 and below 4 percent in 2018. The tight labor market — combined with increases in the minimum wage in many states — raised income for all income groups.

Change in median weekly income

Compared with two years earlier, adjusted for inflation

By early 2020, the U.S. economy’s short-term performance was as healthy as it had been since the dot-com boom two decades earlier.

2. The Covid crash

Then the pandemic arrived.

People stayed home and cut back on spending. Businesses laid off workers, and the unemployment rate exceeded 10 percent. Experts understandably worried that the economy could fall into a vicious cycle, in which companies went out of business, families couldn’t make loan payments and banks went under.

Many economists believed that the federal government had been too timid with stimulus after the early-2000s housing crash. During the pandemic, members of Congress vowed not to repeat the mistake and passed huge stimulus bills, which both Trump and President Biden signed.

3. The too-hot recovery

Those stimulus programs worked — a bit too well.

For all the misery that Covid caused, it ended up being less economically destructive than the housing crash. The unemployment surge was temporary. And thanks to the stimulus, the typical American family’s finances improved during the pandemic — a very different situation than the aftermath of the housing crash.

In effect, Washington overlearned the lesson of the previous crisis. It pumped so much money into the economy during the pandemic that families were able to go on a spending spree. Businesses, in response, raised prices.

The pandemic’s supply-chain disruptions played a big role, too. This combination — high demand and low supply — led to sharp price increases.

Year-over-year change in Consumer Price Index

excluding food

in Jan. 2024

4. The healthier recovery

Once inflation rises, it can remain high for years (as it did from the late 1960s to the early 1980s). Workers demand bigger raises, and businesses, facing higher costs, raise prices even more. The dynamic is reinforcing.

When inflation soared in 2021, some economists thought the pattern was repeating. They predicted that only a deep recession would bring a return to normalcy. These dark predictions turned out to be wrong , though. Instead, inflation started falling rapidly in 2022. The end of the stimulus programs, combined with the end of most supply-chain problems, was enough to reduce price increases.

For the past several months, the economy has again looked healthy, with both employment and wages growing nicely. Yesterday’s report doesn’t change that: Annual inflation fell to 3.1 percent in January, from 3.4 percent in December. It’s just that forecasters had expected it to fall more than it did.

Why didn’t it? Maybe last month’s number was just a statistical blip. But maybe it is a sign that the economy has again become too strong for inflation to keep falling.

“Hiring picked up in January, wage growth was solid, and consumers continue to spend,” as my colleague Jeanna Smialek explains. “Some analysts have suggested that in an economy this hot, wrestling inflation the rest of the way to normal will prove more difficult than the progress so far.” Economists generally consider the ideal inflation rate to be around 2 percent.

By almost any measure, the economy is in better shape today than most forecasters predicted even a year ago. Still, it hasn’t fully recovered from the pandemic.

Related: The American economy has seen a burst of productivity recently. Read more about economists’ views on whether it will continue.

THE LATEST NEWS

Alejandro mayorkas.

House Republicans impeached Alejandro Mayorkas , Biden’s homeland security secretary, despite no evidence that he had committed impeachable offenses.

He is the first sitting cabinet member to be impeached. Read what could happen next .

The number of migrants illegally crossing into the U.S. from Mexico has dropped by half in the past month.

More on Politics

Tom Suozzi, a Democratic former congressman, won a special House election to replace George Santos in a Queens and Long Island district. Suozzi’s strategy offers a playbook for other Democrats .

Biden criticized Trump for suggesting that he would let Russia attack NATO countries that don’t spend enough on defense. “It’s dumb, it’s shameful, it’s dangerous, it’s un-American,” Biden said.

Biden urged Speaker Mike Johnson to let the House vote on a bill to aid Ukraine and Israel. If Johnson refuses, House members may use a procedural trick — a discharge petition — to go around him.

Defense Secretary Lloyd Austin has been released from hospital after his admission for a bladder issue.

A diamond ring and a “James Bond” phone: Court filings revealed new details in Senator Robert Menendez’s bribery case .

Top Senate Republicans endorsed Kari Lake for Senate in Arizona. Lake refused to admit her loss in the state’s 2022 governor’s race.

Israel-Hamas War

Arab governments are privately discussing a new vision for governing Gaza, according to a senior adviser . Their idea includes an independent Palestinian leader and an Arab peacekeeping force.

Negotiations in Cairo over a pause in fighting in Gaza have been extended by three days, according to Egyptian officials.

Hezbollah fired missiles into northern Israel , injuring at least two people.

Two Michigan students have opposing views on the war. Read about their civil, if awkward, conversation on campus .

After a crackdown on drunken driving, motorbikes are filling impound lots in Vietnam.

A South Korean court found three former police officers guilty of destroying evidence tied to a Halloween crowd crush that killed nearly 160 people in Seoul in 2022.

Two major parties in Pakistan agreed to form a coalition government. They withheld power from candidates aligned with former Prime Minister Imran Khan, even though his allies recently won the most seats.

Myanmar’s junta said it would impose a military draft to replenish forces that have been depleted fighting pro-democracy rebels.

China, faced with declining foreign investment, is trying to soften its image abroad. One Communist Party official has played a prominent role.

Other Big Stories

The East Coast is sinking , research has found. A major culprit: overpumping of groundwater.

Better memory: OpenAI is releasing a new version of ChatGPT . It will store what users write and apply the information to future chats.

A vehicle crashed into a hospital emergency room in Austin, Texas, killing at least one person and injuring five others.

As artificial intelligence takes over technical tasks, the human side of work — collaboration, empathy, communication — will become more valuable , Aneesh Raman and Maria Flynn argue.

Don’t buy flowers for your valentine . There are more environmentally friendly ways to show love, Margaret Renkl says.

Here are columns by Ross Douthat on inflation and Thomas Edsall on isolationism .

MORNING READS

Anti-Valentine’s Day: Single, anti-consumerist or just not a romantic? There’s a market for you, too .

Small acts: Times readers shared the little things they do to show affection all year long.

Your brain on love: Roses are red, violets are blue. This is how romance can mess with you .

Modern Love podcast: Hear how a couple navigated getting “un-married” while staying together .

New gig: Grover, the furry blue Muppet from “Sesame Street,” is becoming a reporter. Journalists aren’t optimistic .

Lives Lived: Bob Moore leveraged his grandfatherly image to turn the artisanal grain company Bob’s Red Mill into a $100 million-a-year business. He died at 94 .

N.F.L. draft: Read about the top 100 prospects in this year’s class.

N.B.A.: The Knicks are said to be filing a protest to dispute their 105-103 loss to the Rockets .

No. 32: The Orlando Magic retired Shaquille O’Neal’s jersey , making him the second player in N.B.A. history to have a jersey retired by three different franchises.

ARTS AND IDEAS

The closer: When the comedian Taylor Tomlinson began her tour, she was happy with everything in her set except for her closing joke. So, over months of live shows, she refined it, adding punchlines and tweaking details. A new story by the Times comedy critic Jason Zinoman follows her through the process, showing how small changes led to big laughs .

More on culture

Meghan Markle has found a new podcast partner . Markle and Prince Harry’s deal with Spotify ended after they delivered just one show, Variety reports.

The creators of “Six,” about the six wives of Henry VIII, announced that their second musical , “Why Am I So Single?,” will premiere in London in August.

Paramount, which owns Nickelodeon and MTV, is laying off hundreds of employees as it moves away from traditional television.

Late-night hosts discussed Trump recommending Lara Trump for co-chair of the R.N.C.

THE MORNING RECOMMENDS …

Combine just a few ingredients to make a simple, romantic spaghetti carbonara .

Listen to love songs about crushes .

Shop more sustainably .

Clean your blankets .

Here is today’s Spelling Bee . Yesterday’s pangrams were applicable and clippable .

Celebrate Valentine’s Day with this month’s bonus crossword puzzle , which has a rom-com theme.

And here are today’s Mini Crossword , Wordle , Sudoku and Connections .

Thanks for spending part of your morning with The Times. See you tomorrow. — David

Sign up here to get this newsletter in your inbox . Reach our team at [email protected] .

David Leonhardt runs The Morning , The Times’s flagship daily newsletter. Since joining The Times in 1999, he has been an economics columnist, opinion columnist, head of the Washington bureau and founding editor of the Upshot section, among other roles. More about David Leonhardt

Sorry, we did not find any matching results.

We frequently add data and we're interested in what would be useful to people. If you have a specific recommendation, you can reach us at [email protected] .

We are in the process of adding data at the state and local level. Sign up on our mailing list here to be the first to know when it is available.

Search tips:

• Check your spelling

• Try other search terms

• Use fewer words

How is the US economy doing?

Us gross domestic product (gdp) increased 1.9% in 2022 and another 2.5% in 2023..

GDP reached $27.4 trillion in 2023. The increase in real GDP (or GDP adjusted for inflation) was primarily due to increased consumer spending, nonresidential fixed investment, government spending, and exports.

Year-over-year inflation — the rate at which consumer prices increase — was 3.1% in January 2023.

That’s down from June 2022’s rate of 9.1%, the largest 12-month increase in 40 years. Shelter was the largest contributor to monthly inflation growth for most of 2023. Gasoline was the largest contributor in August.

The Federal Reserve raised interest rates seven times in 2022 and four times in 2023. It raised the target rate to between 5.25% to 5.50% in late July 2023 and has left rates unchanged since then.

Rate increases make it more expensive for banks to borrow from each other. Banks pass these costs on to consumers through higher interest rates. (Read more about how the Federal Reserve tries to control inflation here .)

Workers’ average hourly earnings were up 4% in December 2023 compared to a year prior. However, when accounting for inflation, it was less than 1%.

Inflation-adjusted average hourly earnings rose in all private industries (which excludes government employees) except in education and health services, where earnings decreased by 1 cent.

The ratio of unemployed people to job openings hit a record low in 2022 but trended upward in 2023. The 2023 average of 0.64 unemployed people per opening was 0.11 higher than in 2022.

However, there was fewer than one unemployed worker for every open job throughout 2023. The ratio was lower than any other year prior to the pandemic for which there is data.

The unemployment rate was 3.4% at the beginning of 2023 and 3.7% by the end.

It increased 0.3 percentage points for white and Hispanic people, decreased by 0.1 for Black people, and remained unchanged for Asian people. Black and Hispanic people continue to have unemployment rates higher than the national average.

The labor force participation rate was 62.5% in January 2024, up 0.1 percentage points over January 2023.

Although participation increased last year, the Bureau of Labor Statistics projects it will decline over the next decade due to the aging population .

Get facts first

Unbiased, data-driven insights in your inbox each week

You are signed up for the facts!

Last year, the US continued to import more than it exported; however, the trade deficit fell 22% from $990.3 billion in 2022 to $773.4 billion.

According to preliminary data , the US imported more goods and services from Mexico than China for the first time in 20 years.

Continue exploring the State of the Union

How much does the government spend and where does the money go how does this affect the national debt.

Standard of Living

How is the American middle class doing? What support does the government provide people?

Explore more of usafacts, related articles, how much money do banks in the us control, which countries does the us trade with, what is labor productivity, and how has it changed in the us over time, what role do small businesses play in the economy, related data, gross domestic product.

$27.36 trillion

Federal minimum wage

Stock index: s&p 500, 30-year average interest on fixed-rate mortgages, data delivered to your inbox.

Keep up with the latest data and most popular content.

SIGN UP FOR THE NEWSLETTER

What to know about the report on America’s COVID-hit GDP

Some of the deepest contractions on record. Image: REUTERS/Keith Bedford

.chakra .wef-1c7l3mo{-webkit-transition:all 0.15s ease-out;transition:all 0.15s ease-out;cursor:pointer;-webkit-text-decoration:none;text-decoration:none;outline:none;color:inherit;}.chakra .wef-1c7l3mo:hover,.chakra .wef-1c7l3mo[data-hover]{-webkit-text-decoration:underline;text-decoration:underline;}.chakra .wef-1c7l3mo:focus,.chakra .wef-1c7l3mo[data-focus]{box-shadow:0 0 0 3px rgba(168,203,251,0.5);} Lucia Mutikani

.chakra .wef-9dduvl{margin-top:16px;margin-bottom:16px;line-height:1.388;font-size:1.25rem;}@media screen and (min-width:56.5rem){.chakra .wef-9dduvl{font-size:1.125rem;}} Explore and monitor how .chakra .wef-15eoq1r{margin-top:16px;margin-bottom:16px;line-height:1.388;font-size:1.25rem;color:#F7DB5E;}@media screen and (min-width:56.5rem){.chakra .wef-15eoq1r{font-size:1.125rem;}} United States is affecting economies, industries and global issues

.chakra .wef-1nk5u5d{margin-top:16px;margin-bottom:16px;line-height:1.388;color:#2846F8;font-size:1.25rem;}@media screen and (min-width:56.5rem){.chakra .wef-1nk5u5d{font-size:1.125rem;}} Get involved with our crowdsourced digital platform to deliver impact at scale

Stay up to date:, united states.

- The COVID-19 pandemic has caused the biggest blow to the US economy since the Great Depression.

- GDP fell at a 32.9% annualized rate, the deepest decline since records began back in 1947.

- 30.2 million Americans were receiving unemployment checks in the week ending July 11.

The U.S. economy suffered its biggest blow since the Great Depression in the second quarter as the COVID-19 pandemic shattered consumer and business spending, and a nascent recovery is under threat from a resurgence in new cases of coronavirus.

The bulk of the deepest contraction in at least 73 years reported by the Commerce Department on 30th July occurred in April when activity almost ground to an abrupt halt after restaurants, bars and factories among others were shuttered in mid-March to slow the spread of coronavirus.

Have you read?

Record number of black women set to run for u.s. congress, 5 facts about how covid-19 is affecting unemployment in the u.s..

More than five years of growth have been wiped out. With the recovery faltering, pressure is mounting for the White House and Congress to agree on a second stimulus package. President Donald Trump, who is trailing Democratic challenger and former Vice President Joe Biden in opinion polls, said on Wednesday he was in no hurry. Trump on 30th of July raised the possibility of delaying the Nov. 3 presidential election.

“This is hard to swallow,” said Jason Reed, finance professor at the University of Notre Dame’s Mendoza College of Business. “Right now, the American economy is speeding toward a fiscal cliff. Not only do we need Americans to take serious action preventing the spread of the disease, but we also need Congress to agree on another stimulus package and quickly.”

Gross domestic product collapsed at a 32.9% annualized rate last quarter, the deepest decline in output since the government started keeping records in 1947. The drop in GDP was more than triple the previous all-time decline of 10% in the second quarter of 1958. The economy contracted at a 5.0% pace in the first quarter. It fell into recession in February.

Economists polled by Reuters had forecast GDP slumping at a 34.1% rate in the April-June quarter.

On a year-on-year basis GDP fell a record 9.5% last quarter. Output shrank 10.6% in the first half. The level of GDP has dropped to levels last seen in the last quarter of 2014.

Though activity picked up starting in May, momentum has slowed amid the explosion of COVID-19 infections, especially in the densely populated South and West regions where authorities in hard-hit areas are closing businesses again and pausing reopenings. That has tempered hopes of a sharp rebound in growth in the third quarter.

Federal Reserve Chair Jerome Powell on Wednesday acknowledged the slowdown in activity. The U.S. central bank kept interest rates near zero and pledged to continue pumping money into the economy.

Trump’s campaign shrugged off the GDP slump, saying the economy was “rebounding.” Biden blamed a leadership “failure,” and urged “a massive public health response to save lives and get our economy back up to speed.” Stocks on Wall Street fell. The dollar dipped against a basket of currencies. U.S. Treasury prices rose.

Broad historic declines

Economists say without the historic fiscal package of nearly $3 trillion, the economic contraction would have been deeper. The package offered companies help paying wages and gave millions of unemployed Americans a weekly $600 supplement, which expires on Friday. Many companies have exhausted their loans.

This, together with the sky-rocketing coronavirus infections is keeping layoffs elevated. In a separate report on Thursday, the Labor Department said initial claims for unemployment benefits increased 12,000 to a seasonally adjusted 1.434 million in the week ending July 25. A staggering 30.2 million Americans were receiving unemployment checks in the week ending July 11.

“Tens of millions of workers have lost their jobs over the past few months and remain unemployed, and the pace of improvement in the labor market has slowed,” said Gus Faucher, chief economist at PNC Financial in Pittsburgh.

“These $600 payments are adding about $75 billion per month to household income, at a time when income from work has plummeted. The loss of huge amounts of unemployment income in the near term would be a significant drag on consumer spending.”

There have been claims, mostly from Republicans, that the generous jobless benefits are discouraging some of the unemployed from looking for work. The GDP report showed income at the disposal of households surged $1.53 trillion in the second quarter compared to an increase of $157.8 billion in the January-March period.

A significant portion of the income was stashed away, boosting savings to $4.69 trillion from $1.59 trillion in the first quarter. Consumer spending, which accounts for more than two-thirds of the U.S. economy, plunged at a 34.6% pace last quarter.

Business investment tumbled at a 27% rate. It was pulled down by spending on equipment, which collapsed at a 37.7% rate. Investment is equipment has now contracted for five straight quarters. Boeing reported a bigger-than-expected quarterly loss on Wednesday and slashed production on its widebody programs.

The pandemic has also crushed oil prices, leading to deep cuts in shale oil production and layoffs. Spending on nonresidential structures such as mining exploration, shafts and wells plunged at a record 34.9% rate.

Investment in homebuilding tumbled at a 38.7% rate. Government spending rose, though state and local government outlays fell. Trade added to GDP, but inventories were a drag.

Don't miss any update on this topic

Create a free account and access your personalized content collection with our latest publications and analyses.

License and Republishing

World Economic Forum articles may be republished in accordance with the Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International Public License, and in accordance with our Terms of Use.

The views expressed in this article are those of the author alone and not the World Economic Forum.

Related topics:

The agenda .chakra .wef-n7bacu{margin-top:16px;margin-bottom:16px;line-height:1.388;font-weight:400;} weekly.

A weekly update of the most important issues driving the global agenda

.chakra .wef-1dtnjt5{display:-webkit-box;display:-webkit-flex;display:-ms-flexbox;display:flex;-webkit-align-items:center;-webkit-box-align:center;-ms-flex-align:center;align-items:center;-webkit-flex-wrap:wrap;-ms-flex-wrap:wrap;flex-wrap:wrap;} More on Health and Healthcare Systems .chakra .wef-17xejub{-webkit-flex:1;-ms-flex:1;flex:1;justify-self:stretch;-webkit-align-self:stretch;-ms-flex-item-align:stretch;align-self:stretch;} .chakra .wef-nr1rr4{display:-webkit-inline-box;display:-webkit-inline-flex;display:-ms-inline-flexbox;display:inline-flex;white-space:normal;vertical-align:middle;text-transform:uppercase;font-size:0.75rem;border-radius:0.25rem;font-weight:700;-webkit-align-items:center;-webkit-box-align:center;-ms-flex-align:center;align-items:center;line-height:1.2;-webkit-letter-spacing:1.25px;-moz-letter-spacing:1.25px;-ms-letter-spacing:1.25px;letter-spacing:1.25px;background:none;padding:0px;color:#B3B3B3;-webkit-box-decoration-break:clone;box-decoration-break:clone;-webkit-box-decoration-break:clone;}@media screen and (min-width:37.5rem){.chakra .wef-nr1rr4{font-size:0.875rem;}}@media screen and (min-width:56.5rem){.chakra .wef-nr1rr4{font-size:1rem;}} See all

How midwife mentors are making it safer for women to give birth in remote, fragile areas

Anna Cecilia Frellsen

May 9, 2024

From Athens to Dhaka: how chief heat officers are battling the heat

Angeli Mehta

May 8, 2024

How a pair of reading glasses could increase your income

Emma Charlton

Nigeria is rolling out Men5CV, a ‘revolutionary’ meningitis vaccine

5 conditions that highlight the women’s health gap

Kate Whiting

May 3, 2024

How philanthropy is empowering India's mental health sector

Kiran Mazumdar-Shaw

May 2, 2024

The U.S. Economy Essay

The U.S. economy faces many challenges given the fact that it is recovering from a financial crisis. Virtually every sector of the economy was affected by the 2009 financial crisis. Economic growth slowed down while unemployment rates increased. It is important to note that these conditions have not changed much.

High rates of unemployment are still being reported in the U.S. During the financial crisis, the American economy shrunk and approximately 9 million jobs were lost. The unemployment rates have been alarming especially from 2009. The unemployment rate was 5% in 2008 but rose during the financial crisis to 10%. Though they have declined to around 7.8% as of 2012, much has to be done because the number of people unemployed is still high (Lewis, 2013).

It is paramount to note that despite the recovery that is being recorded in various sectors of the American economy, the figures are still very low compared to the drop that took place. On the same note, there are still the unpaid, and almost certainly impossible to pay, house mortgages which caused the 2009 financial crisis.

Similarly, the euro crisis is likely to spill over to other parts of the world and America’s financial system is at risk. On the same note, there is reduction in spending due to the cut in government expenditure which is slowing down economic growth. All these factors are raising eye brows among economists because they form a perfect recipe for another economic crisis (Krugman, 2012).

In conditions like the one America is in right now, choice of policy is quite vital to boost the economy. It has been stated that the economy is recovering but not as expected. In order to strengthen economic growth and job creation, private spending should be improved through increasing disposable income. To achieve this, expansionary monetary policy is essential.

The FOMC had reduced interest rates during the financial crisis to improve the public’s access to money. Maintaining the interest rates low will go a long way in ensuring ease access of credit and thus boost spending. On the same note, the FOMC can also buy more treasury bills to increase the amount of money in circulation (Lewis, 2013).

On the other hand, public spending will also be crucial in increasing aggregate consumption. Though the federal government has proposed tax cuts to increase disposable income as well as private spending, government expenditure is still low.

The policy that was implemented to reduce federal, state and local government spending is still in force (Lewis, 2013). To help the situation, the government needs to implement an expansionary fiscal policy that will not only encourage tax cuts, but also increased government spending at all levels.

Krugman, P. (2012). The Conscience of a Liberal. The New York Times . Web.

Lewis, P. (2013). Family and Business Tax Cut Certainty Act of 2012 . Munchen: GRIN Verlag.

- Chicago (A-D)

- Chicago (N-B)

IvyPanda. (2023, December 21). The U.S. Economy. https://ivypanda.com/essays/the-u-s-economy/

"The U.S. Economy." IvyPanda , 21 Dec. 2023, ivypanda.com/essays/the-u-s-economy/.

IvyPanda . (2023) 'The U.S. Economy'. 21 December.

IvyPanda . 2023. "The U.S. Economy." December 21, 2023. https://ivypanda.com/essays/the-u-s-economy/.

1. IvyPanda . "The U.S. Economy." December 21, 2023. https://ivypanda.com/essays/the-u-s-economy/.

Bibliography

IvyPanda . "The U.S. Economy." December 21, 2023. https://ivypanda.com/essays/the-u-s-economy/.

- Mortgage Rates and Expansionary Economy Balance

- Japanese expansionary fiscal policy

- Unpaid Internships: Pros and Cons

- Scholars on the Effects of Capitalism

- Essay on the American Dream: Positive and Negative Aspects

- Effects of China’s Economic Growth on Sub-Saharan Africa

- Competing Theories of Economic Development

- Economic Analysis of Germany

Numbers, Facts and Trends Shaping Your World

Read our research on:

Full Topic List

Regions & Countries

- Publications

- Our Methods

- Short Reads

- Tools & Resources

Read Our Research On:

Americans More Upbeat on the Economy; Biden’s Job Rating Remains Very Low

1. views of the nation’s economy, table of contents.

- The economy, past and future; top concerns

- Biden’s job performance, personal traits

- Other findings on partisan compromise and the House GOP impeachment inquiry

- Why do Americans rate the nation’s economy as they do?

- Cost of goods, housing remain top economic concerns

- Partisans’ views of Biden’s personal characteristics

- Perceptions of Biden over time

- Biden’s job approval ratings

- Biden’s presidency in the long run

- Acknowledgments

- The American Trends Panel survey methodology

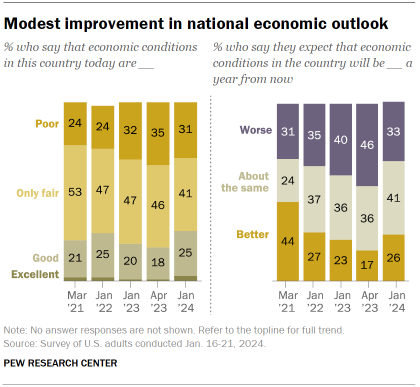

About three-in-ten Americans (28%) currently rate national economic conditions as excellent or good, while a similar share (31%) say they are poor and about four-in-ten (41%) view them as “only fair.”

While ratings remain substantially lower than they were prior to the start of the COVID-19 pandemic , they are more positive than they were last spring – when just 19% viewed the economy in positive terms.

Expectations for future economic conditions are also more positive than they were last spring: Today, roughly a quarter say that they expect economic conditions will be better a year from now (26%) – up from 17% in April 2023.

At the same time, the share who says conditions will be worse has declined by 13 percentage points. About four-in-ten say they expect conditions will be about the same.

As has long been the case , partisans who share the party of the president have more positive views of economic conditions than those who support the opposing party. Today, 44% of Democrats and Democratic leaners say the nation’s economy is excellent or good. This compares with 13% of Republicans and GOP leaners.

Similarly, Democrats are more likely than Republicans to say they expect economic conditions a year from now will be better than they are today: 34% of Democrats say this, compared with 20% of Republicans.

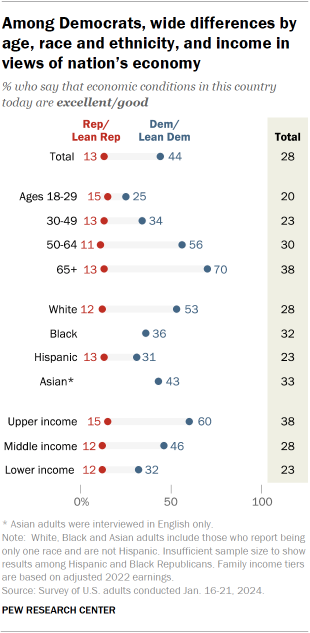

There are substantial differences among Democrats in views of the nation’s economy – particularly by age and income.

Younger Democrats are much less likely than older Democrats to view current economic conditions in positive terms. Among Democrats under 30, a quarter view the economy positively. This share rises to 34% among those ages 30 to 49, 56% among those 50 to 64, and 70% among those 65 and older.

There are also significant differences by race and ethnicity. White Democrats are more likely than Black, Hispanic and Asian Democrats to say the economy is excellent or good.

Democrats in different income groups also diverge in their evaluations of the nation’s economy. Democrats with higher household incomes are more positive about economic conditions than Democrats with lower incomes. A clear majority of upper-income Democrats (60%) say the economy is doing excellent or good. By comparison, 32% of those with lower incomes view the economy positively, while a majority say it is only fair (40%) or poor (28%).

Across Republican groups, economic assessments vary less drastically. Republicans overwhelmingly rate the economy negatively: Just 15% or less across demographic groups say national economic conditions are good or excellent.

However, there are some differences in how negative GOP assessments are. For instance, upper-income Republicans are more likely to say the economy is doing only fair (48%) rather than poorly (36%), while lower-income Republicans are more likely to say poor (49%) rather than only fair (38%).

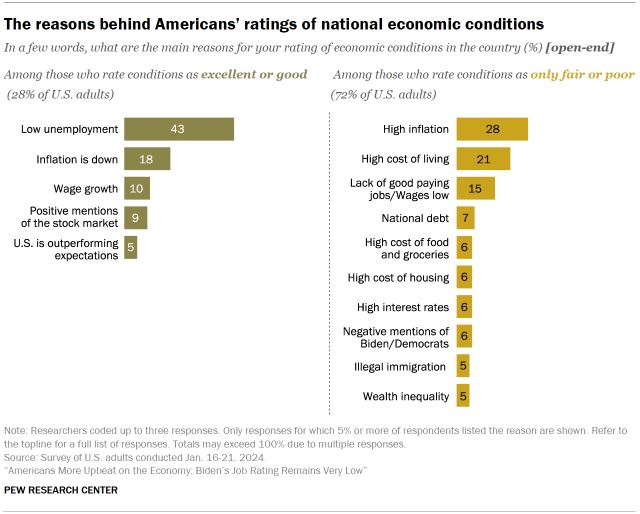

In an open-ended question which asked Americans to explain the reasons for their overall evaluation of the nation’s economy (as excellent, good, only fair, or poor), people provide wide-ranging answers.

Among the 28% of Americans who say the nation’s economy is doing excellent or good, many offer overwhelmingly positive reasons for why they rate the economy this way. A large share (43%) note the country’s low unemployment, while 18% say that inflation is coming down or is lower than it has been in recent months. Roughly one-in-ten mention wage growth, while a similar share (9%) say strong stock market performance contributes to their rating. And 5% say the reason for their rating is that the U.S. is outperforming expectations or otherwise doing better than other countries in terms of economic growth.

Among the 72% of adults who say the economy is doing only fair or poor, most offer negative reasons for why they rate the economy the way they do. Those who say the economy is only fair are slightly more likely to offer a mix of positive and negative responses than those who say the economy is poor . However, respondents in both groups offer similar reasons for their ratings.

Among those who say the nation’s economy is only fair or poor, high inflation or high costs of various goods are frequently mentioned: 28% say high inflation is a main reason they evaluate the economy as only fair or poor, while roughly two-in-ten cite the high cost of living. Along this same theme, 6% point to the high cost of food and groceries while identical shares say the high cost of housing and high interest rates are a main reason they view the economy as doing only fair or poor.

Other issues are also mentioned: 15% say the lack of good paying jobs or low wages is a major reason for their rating while 7% point to the national debt and government spending. Another 5% give a negative response about Biden’s or Democrats’ economic policies more broadly.

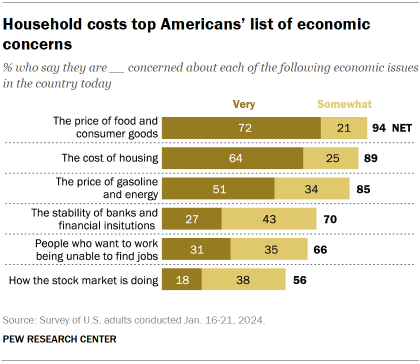

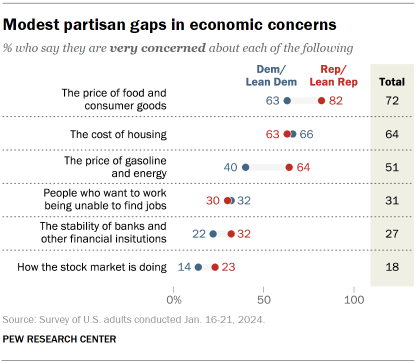

Majorities of Americans continue to express a high level of concern about the price of food and consumer goods (72% say they are very concerned about this) and the cost of housing (64%). About half (51%) say they are very concerned about the price of gasoline and energy. More than eight-in-ten say they are at least somewhat concerned about each of these economic issues.

Other economic issues rank lower on the public’s list of concerns. Smaller shares of Americans say they are very concerned about the stability of banks and financial institutions (27%), people who want to work being unable to find jobs (31%) or the performance of the stock market (18%).

Majorities in both parties are very concerned about the cost of goods and housing

Republicans and Democrats are fairly aligned in their economic concerns. Majorities in both groups say they are very concerned about the cost of food, consumer goods and housing. And substantially smaller shares express concern about the stability of banks or the performance of the stock market.

However, Republican concern about the price of food and consumer goods is more widespread than Democratic concern (82% vs. 63%). And the partisan gap on concerns about the price of gasoline and energy is even wider: A 64% majority of Republicans say they are very concerned about the cost of gas, compared with 40% of Democrats.

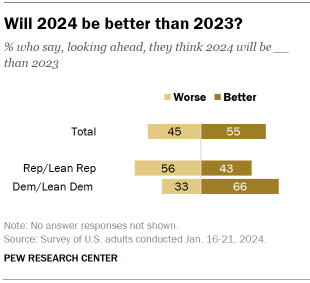

Partisans’ expectations for the year ahead

As has been the case for the last three years , Democrats are more likely than Republicans to say the upcoming year will be better than the last. Two-thirds of Democrats say 2024 will be better than 2023, while 43% of Republicans say the same.

This dynamic in feelings about the new year – with Democrats expressing more optimism than Republicans – has held true since 2021. Then, 83% of Democrats said 2021 would be better than 2020 while 48% of Republicans agreed. In 2020, the pattern was the reverse. Republicans were more likely to say 2020 would be better than 2019 compared with Democrats (78% vs. 36%, respectively).

In Pew Research Center surveys dating back to 2006 (when the question was first asked), Americans who identify with or lean toward the president’s party have tended to be more optimistic about the coming year than those who associate with the opposing party.

Sign up for our weekly newsletter

Fresh data delivery Saturday mornings

Sign up for The Briefing

Weekly updates on the world of news & information

- Economic Conditions

- Election 2024

- Presidential Approval

A look at small businesses in the U.S.

State of the union 2024: where americans stand on the economy, immigration and other key issues, americans’ top policy priority for 2024: strengthening the economy, online shopping has grown rapidly in u.s., but most sales are still in stores, congress has long struggled to pass spending bills on time, most popular, report materials.

- January 2024 Biden Job Approval Detailed Tables

1615 L St. NW, Suite 800 Washington, DC 20036 USA (+1) 202-419-4300 | Main (+1) 202-857-8562 | Fax (+1) 202-419-4372 | Media Inquiries

Research Topics

- Age & Generations

- Coronavirus (COVID-19)

- Economy & Work

- Family & Relationships

- Gender & LGBTQ

- Immigration & Migration

- International Affairs

- Internet & Technology

- Methodological Research

- News Habits & Media

- Non-U.S. Governments

- Other Topics

- Politics & Policy

- Race & Ethnicity

- Email Newsletters

ABOUT PEW RESEARCH CENTER Pew Research Center is a nonpartisan fact tank that informs the public about the issues, attitudes and trends shaping the world. It conducts public opinion polling, demographic research, media content analysis and other empirical social science research. Pew Research Center does not take policy positions. It is a subsidiary of The Pew Charitable Trusts .

Copyright 2024 Pew Research Center

Terms & Conditions

Privacy Policy

Cookie Settings

Reprints, Permissions & Use Policy

An official website of the United States government

U.S. Economy at a Glance

Perspective from the bea accounts.

BEA produces some of the most closely watched economic statistics that influence decisions of government officials, business people, and individuals. These statistics provide a comprehensive, up-to-date picture of the U.S. economy. The data on this page are drawn from featured BEA economic accounts.

National Economic Accounts

Gross domestic product, first quarter 2024 (advance estimate).

Real gross domestic product (GDP) increased at an annual rate of 1.6 percent in the first quarter of 2024, according to the “advance” estimate. In the fourth quarter of 2023, real GDP increased 3.4 percent. The increase in the first quarter primarily reflected increases in consumer spending and housing investment that were partly offset by a decrease in inventory investment. Imports, which are a subtraction in the calculation of GDP, increased.

- Current release: April 25, 2024

- Next release: May 30, 2024

Gross Domestic Product, First Quarter 2024 (Advance Estimate) CHART - HP

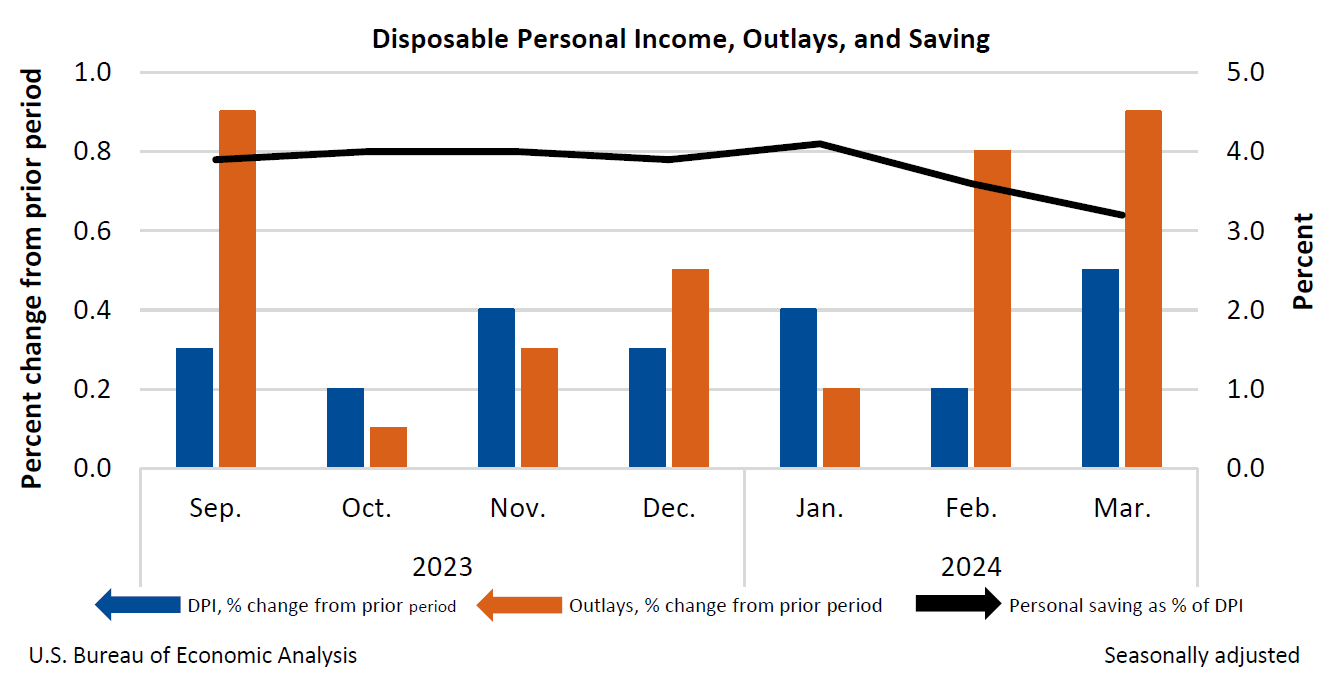

Personal Income and Outlays, March 2024

Personal income increased $122.0 billion (0.5 percent at a monthly rate) in March. Disposable personal income (DPI)—personal income less personal current taxes—increased $104.0 billion (0.5 percent). Personal outlays—the sum of personal consumption expenditures (PCE), personal interest payments, and personal current transfer payments—increased $172.1 billion (0.9 percent) and consumer spending increased $160.9 billion (0.8 percent). Personal saving was $671.0 billion and the personal saving rate—personal saving as a percentage of disposable personal income—was 3.2 percent in March.

- Current release: April 26, 2024

- Next release: May 31, 2024

Personal Income and Outlays, March 2024 CHART

Industry Economic Accounts

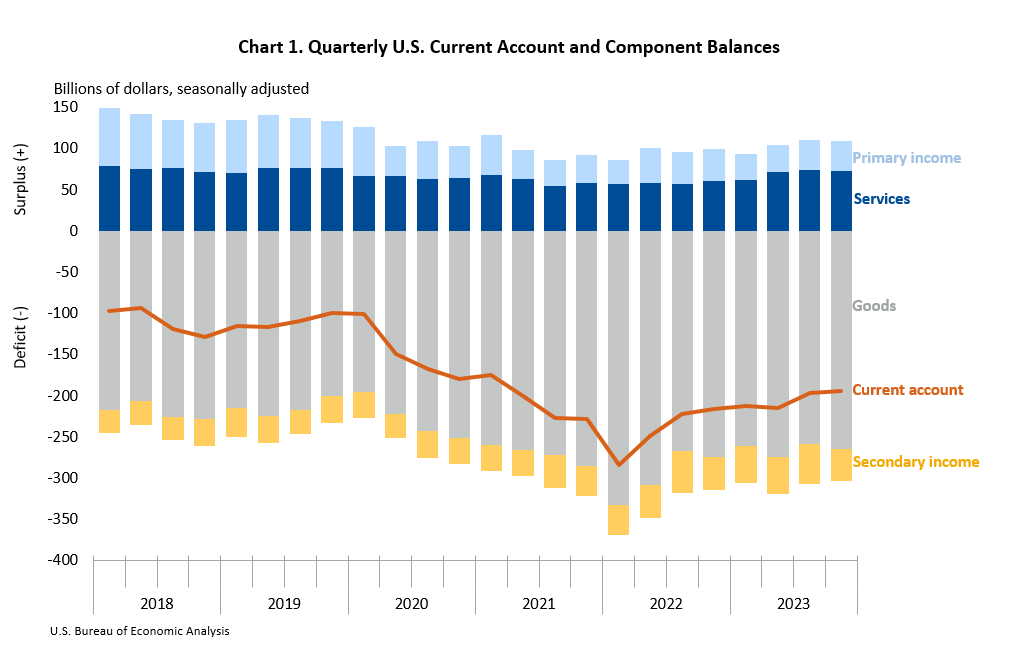

International economic accounts, u.s. international transactions, 4th quarter and year 2023.

The U.S. current-account deficit narrowed by $1.6 billion, or 0.8 percent, to $194.8 billion in the fourth quarter of 2023, according to statistics released today by the U.S. Bureau of Economic Analysis. The revised third-quarter deficit was $196.4 billion. The fourth-quarter deficit was 2.8 percent of current-dollar gross domestic product, down less than 0.1 percent from the third quarter.

- Current Release: March 21, 2024

- Next Release: June 20, 2024

U.S. International Transactions 4th Quarter, '23 Chart 1

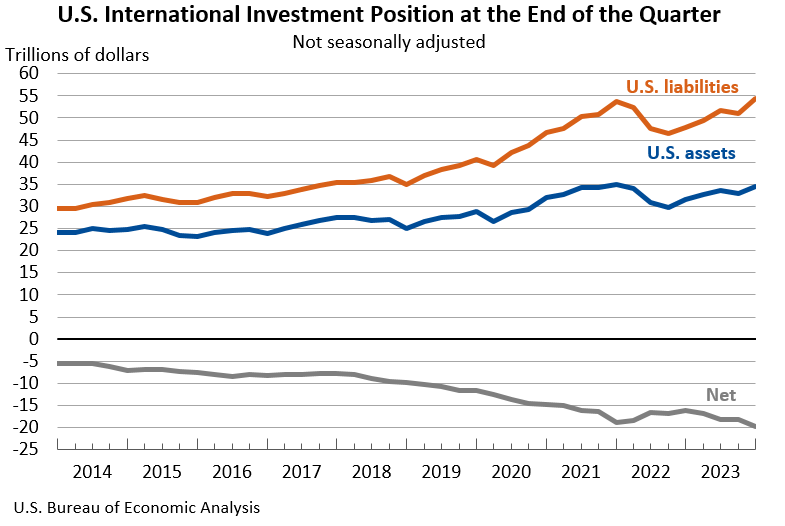

U.S. International Investment Position, 4th Quarter and Year 2023

The U.S. net international investment position, the difference between U.S. residents’ foreign financial assets and liabilities, was -$19.77 trillion at the end of the fourth quarter of 2023, according to statistics released today by the U.S. Bureau of Economic Analysis (BEA). Assets totaled $34.54 trillion, and liabilities were $54.31 trillion. At the end of the third quarter, the net investment position was -$18.11 trillion (revised).

- Current Release: March 27, 2024

- Next Release: June 26, 2024

U.S. International Investment Position, 4th Quarter and year '23 CHART

U.S. International Trade in Goods and Services, March 2024

The U.S. goods and services trade deficit decreased in March 2024 according to the U.S. Bureau of Economic Analysis and the U.S. Census Bureau. The deficit decreased from $69.5 billion in February (revised) to $69.4 billion in March, as imports decreased more than exports. The goods deficit increased $0.8 billion in March to $92.5 billion. The services surplus increased $0.9 billion in March to $23.1 billion.

- Current Release: May 2, 2024

- Next release: June 6, 2024

U.S. International Trade in Goods and Services, March 2024 CHART

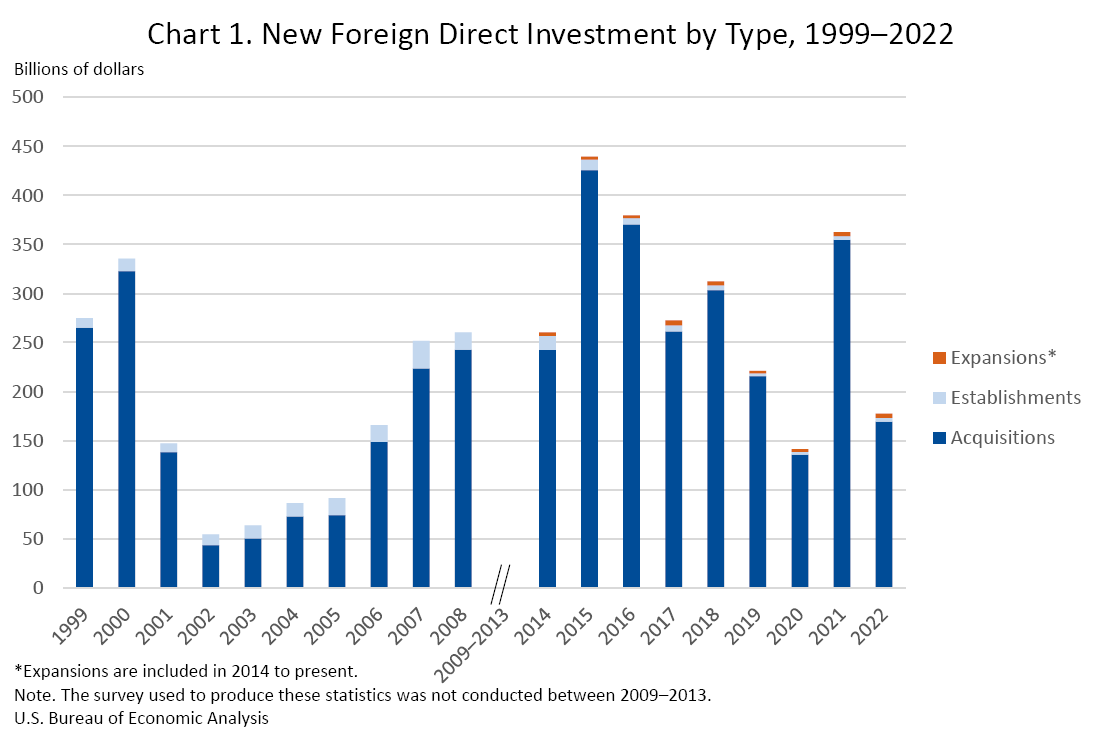

New Foreign Direct Investment in the United States, 2022

Expenditures by foreign direct investors to acquire, establish, or expand U.S. businesses totaled $177.5 billion in 2022, down $185.1 billion from $362.6 billion in 2021.

- Current release: July 10, 2023

- Next release: July 2024

New Foreign Direct Investment Expenditures by Type, '99-'22 Chart

Regional Economic Accounts

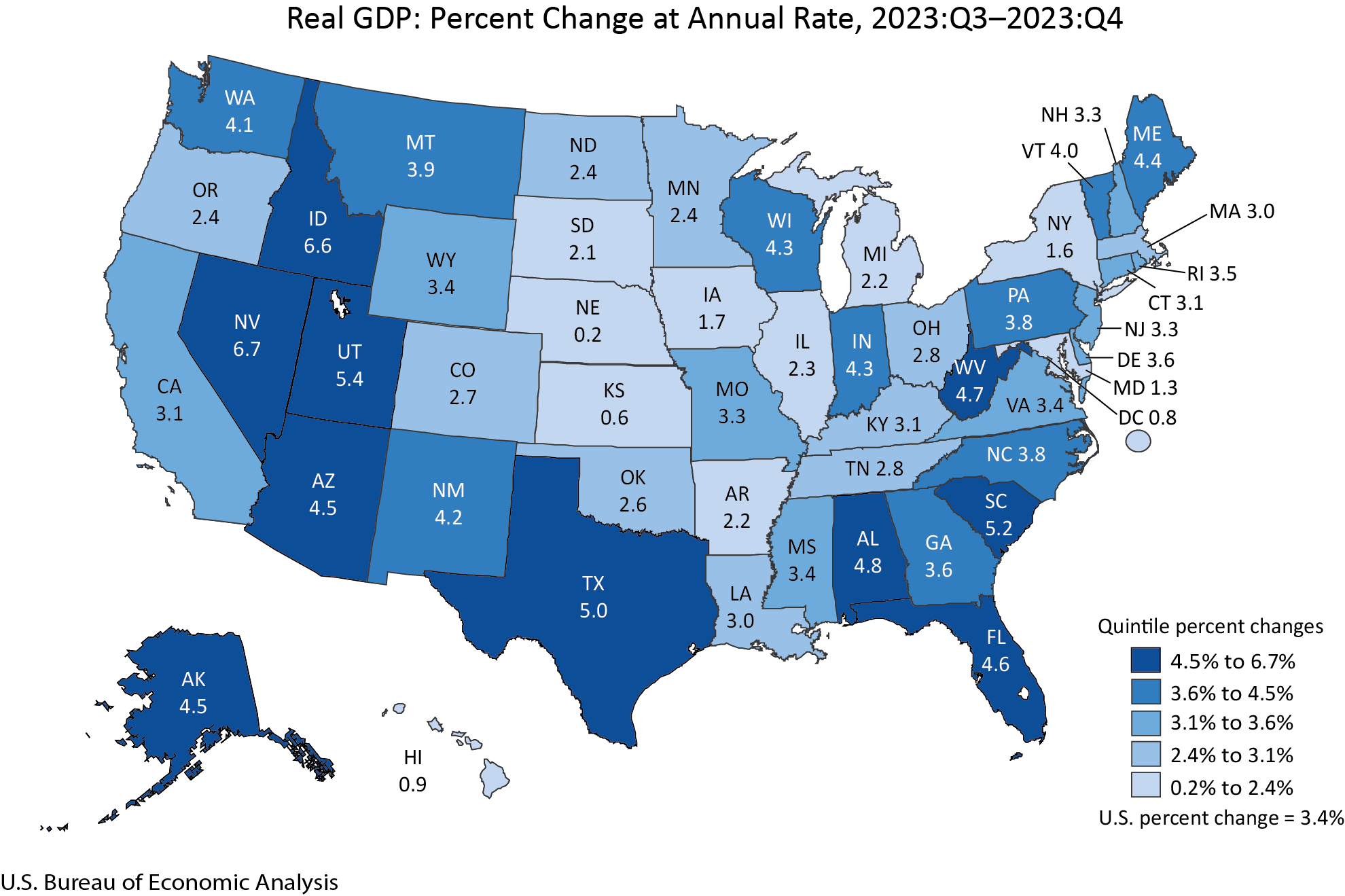

Gross domestic product by state and personal income by state, 4th quarter 2023 and preliminary 2023.

Real gross domestic product (GDP) increased in all 50 states and the District of Columbia in the fourth quarter of 2023, with the percent change ranging from 6.7 percent in Nevada to 0.2 percent in Nebraska

- Current Release: March 29, 2024

- Next Release: June 28, 2024

Gross Domestic Product by State and Personal Income by State, 4th Quarter '23 and Preliminary '23 - CHART

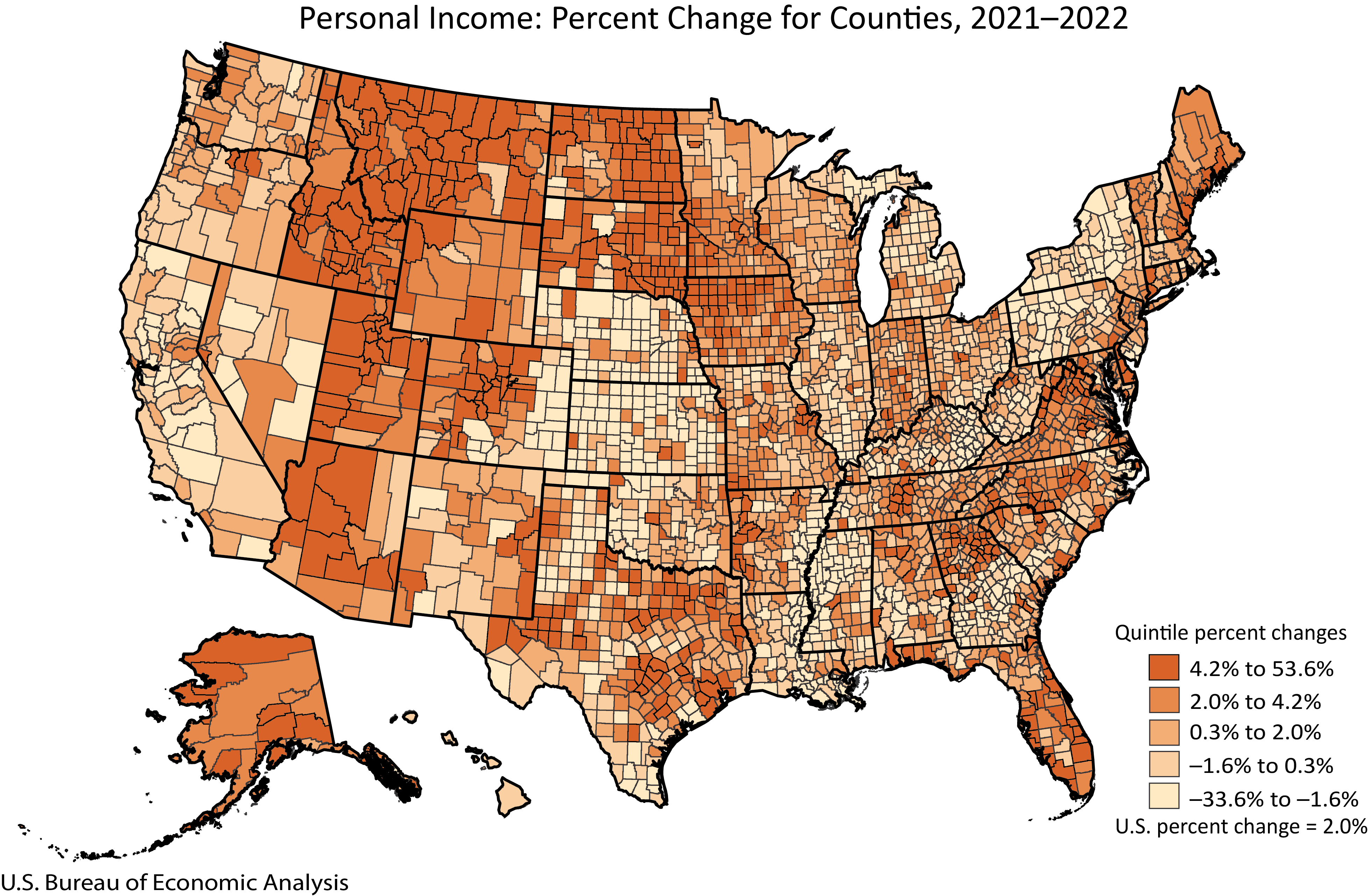

Personal Income by County and Metropolitan Area, 2022

In 2022, personal income, in current dollars, increased in 1,964 counties, decreased in 1,107, and was unchanged in 43. Personal income increased 2.1 percent in the metropolitan portion of the United States and 1.3 percent in the nonmetropolitan portion.

- Current Release: November 16, 2023

- Next Release: November 14, 2024

Personal Income by County and Metropolitan Area, 2022 CHART

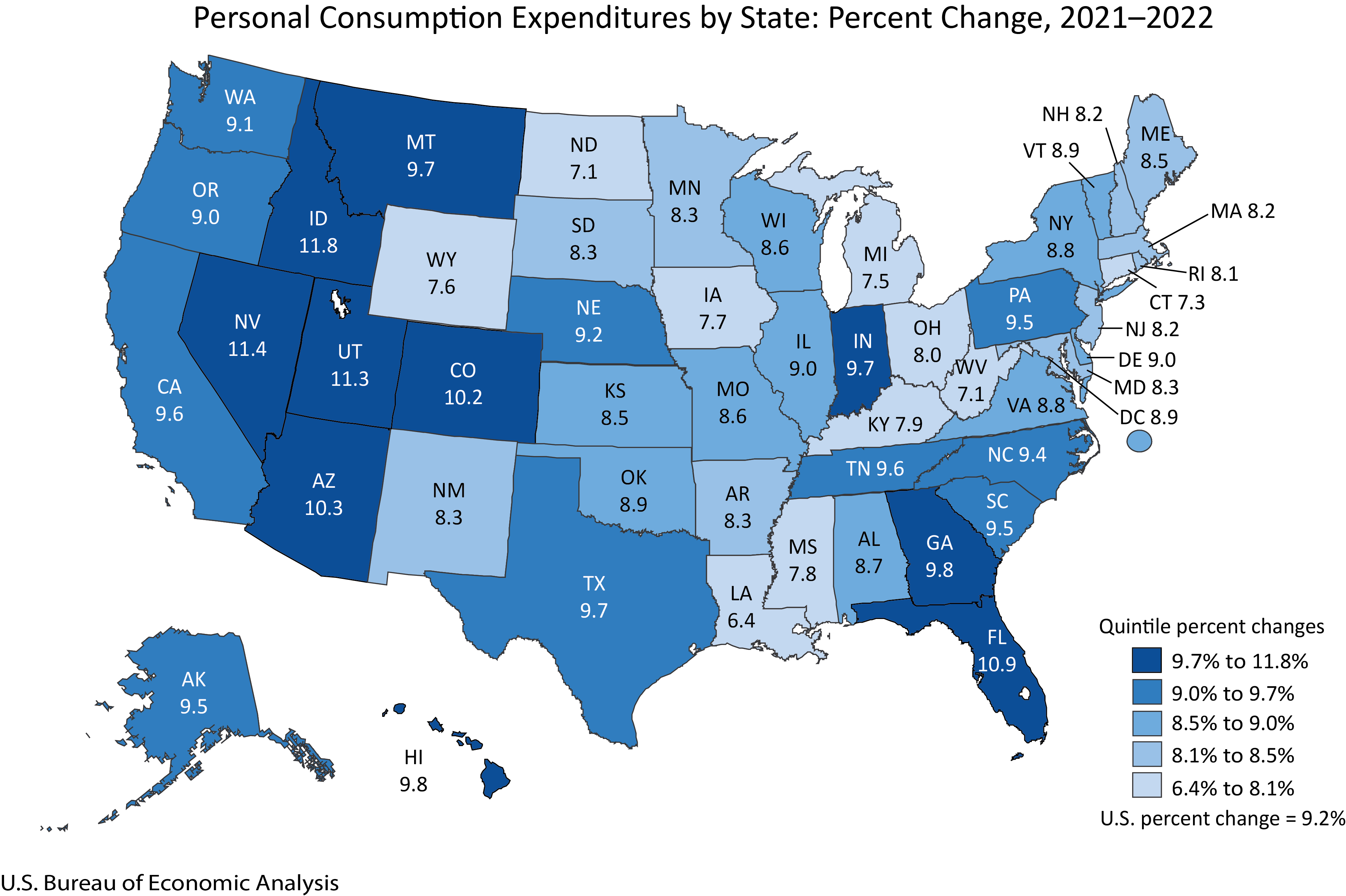

Personal Consumption Expenditures by State, 2022

Nationally, personal consumption expenditures (PCE), in current dollars, increased 9.2 percent in 2022 after increasing 12.9 percent in 2021. PCE increased in all 50 states and the District of Columbia, with the percent change ranging from 11.8 percent in Idaho to 6.4 percent in Louisiana.

- Current Release: October 4, 2023

- Next release: October 3, 2024

Personal Consumption Expenditures by State: Percent Change, '21-'22

U.S. Department of the Treasury

The u.s. economy in global context.

Eric Van Nostrand , Assistant Secretary for Economic Policy (P.D.O.)

Tara Sinclair , Deputy Assistant Secretary for Macroeconomics

The U.S. economy in 2023 outperformed expectations along three key dimensions: growing economic output, labor market resilience, and slowing inflation. This month, the IMF released its latest World Economic Outlook (WEO), which provides an important occasion to consider U.S. economic performance in the context of the global outlook. The progress we have made on growth, labor markets, and inflation stands out across the globe, and remains an important source of strength for the global economy.

The resilience of the entire global economy is a testament to the international cooperation and policy coordination that continues to help us recover from the pandemic. In particular, the U.S. policy environment is a clear contributor to U.S. economic performance. The Biden Administration’s focus on supply-side measures via the Bipartisan Infrastructure Law, the CHIPS and Science Act, and the Inflation Reduction Act is working to expand our productive capacity to create space for faster growth without stoking inflation. Indeed, the October 2023 WEO attributes the improved global outlook partly to the strength of the United States economy. Our supply-side investments are not just bolstering the U.S. economy but supporting the global economic outlook as well.

We offer three key conclusions:

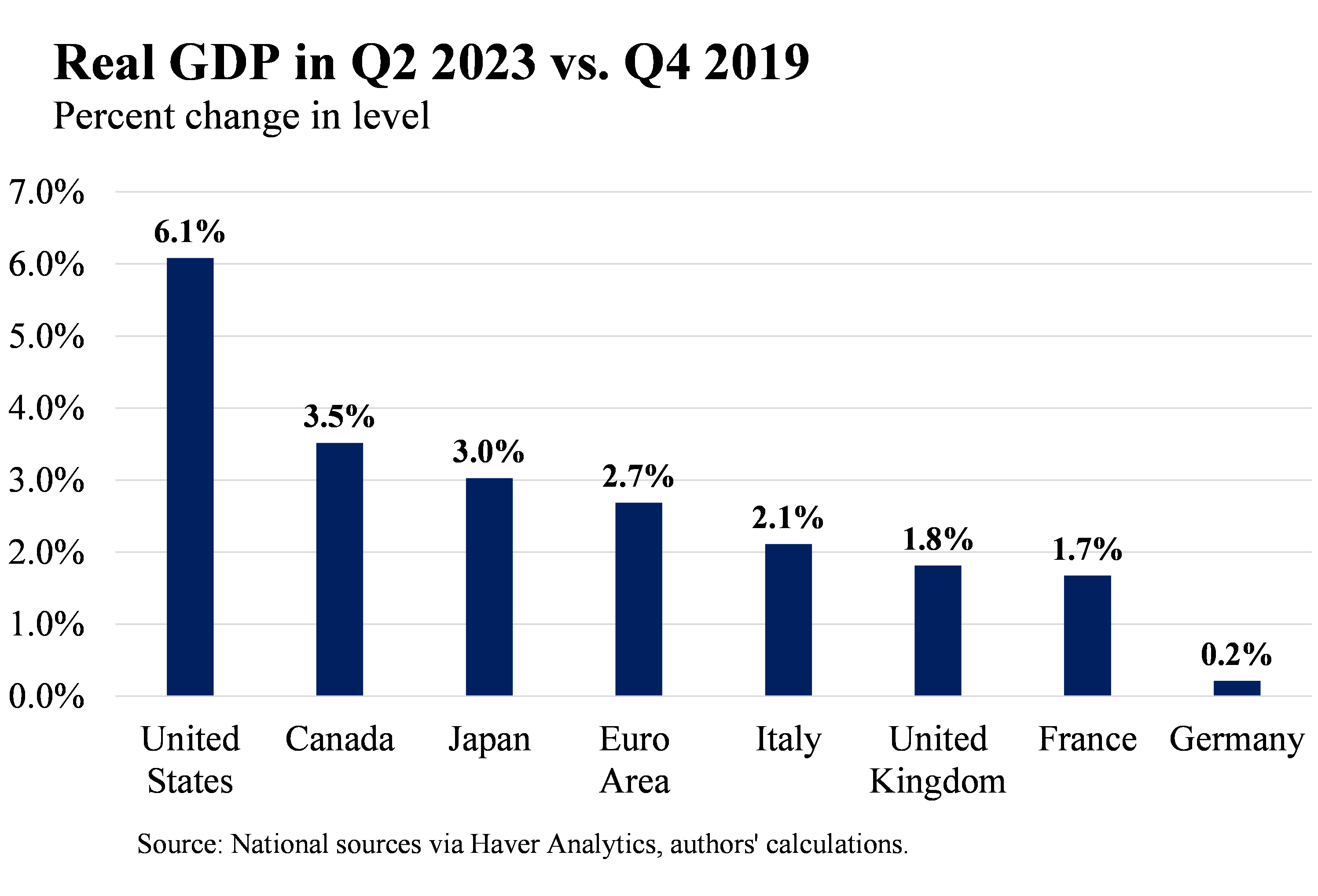

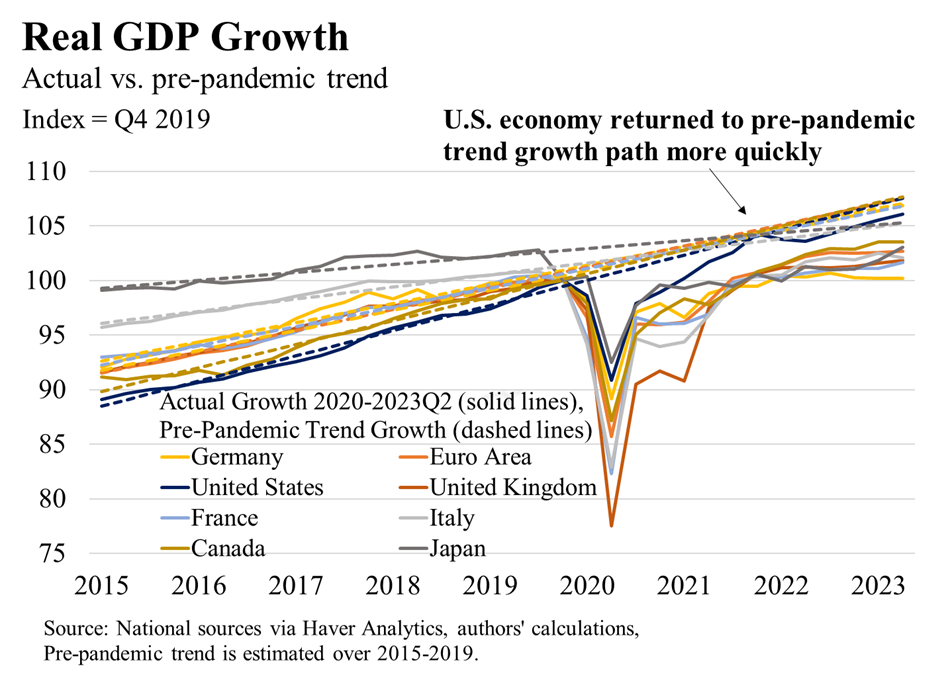

- The United States has seen a particularly strong GDP recovery and is on track this year to reach the level that would have been predicted by the pre-pandemic trend.

- Global labor markets continue to strengthen, and the United States has been especially resilient.

- U.S. inflation has cooled sooner and more quickly than in other advanced economies.

Advanced economies faced different shocks and challenges than the United States. Economies heavily dependent on Russian energy imports were hit hardest by the war in Ukraine with steeper increases in energy prices and a sharper slowdown. As the WEO notes, the euro area suffered an adverse terms-of-trade shock in part due to the energy shock. The WEO also cites analysis showing that the pass-through effects from energy shocks associated with external factors have been a larger driver of core inflation in Europe than in the U.S. Consequently, comparisons across diverse economies must be done carefully. Indeed, many foreign advanced economies have similarly surprised forecasters to the upside. And many risks to the U.S. outlook remain, including tighter credit, persistent uncertainty over government funding, and ongoing autoworker strikes. But across growth, labor, and inflation, the United States’ resilience remains an important source of global economic strength.

Strong U.S. GDP Recovery

The global recovery has been slow and uneven with considerable divergence across countries. In most advanced economies, real GDP has risen above pre-pandemic levels. U.S. real GDP surpassed its pre-pandemic level in the first quarter of 2021 and is now 6.1 percent higher than in Q4 2019.

Partly due to the divergent shocks noted above, real GDP recovery has been quicker in energy- exporting countries (U.S. and Canada) than in energy-importing countries (remaining countries in the figure).

Even today, most advanced economies are below the trend growth path that they were on before the pandemic – except the United States, which is on track this year to return to reach the level that would have been predicted by the pre-pandemic trend. None of the large advanced economies in our sample have reached the level of GDP they would have today if pre-pandemic trends persisted. But given its quicker return to trend growth, the United States is the closest, real output is only 1.4% lower than if pre-pandemic trends persisted.

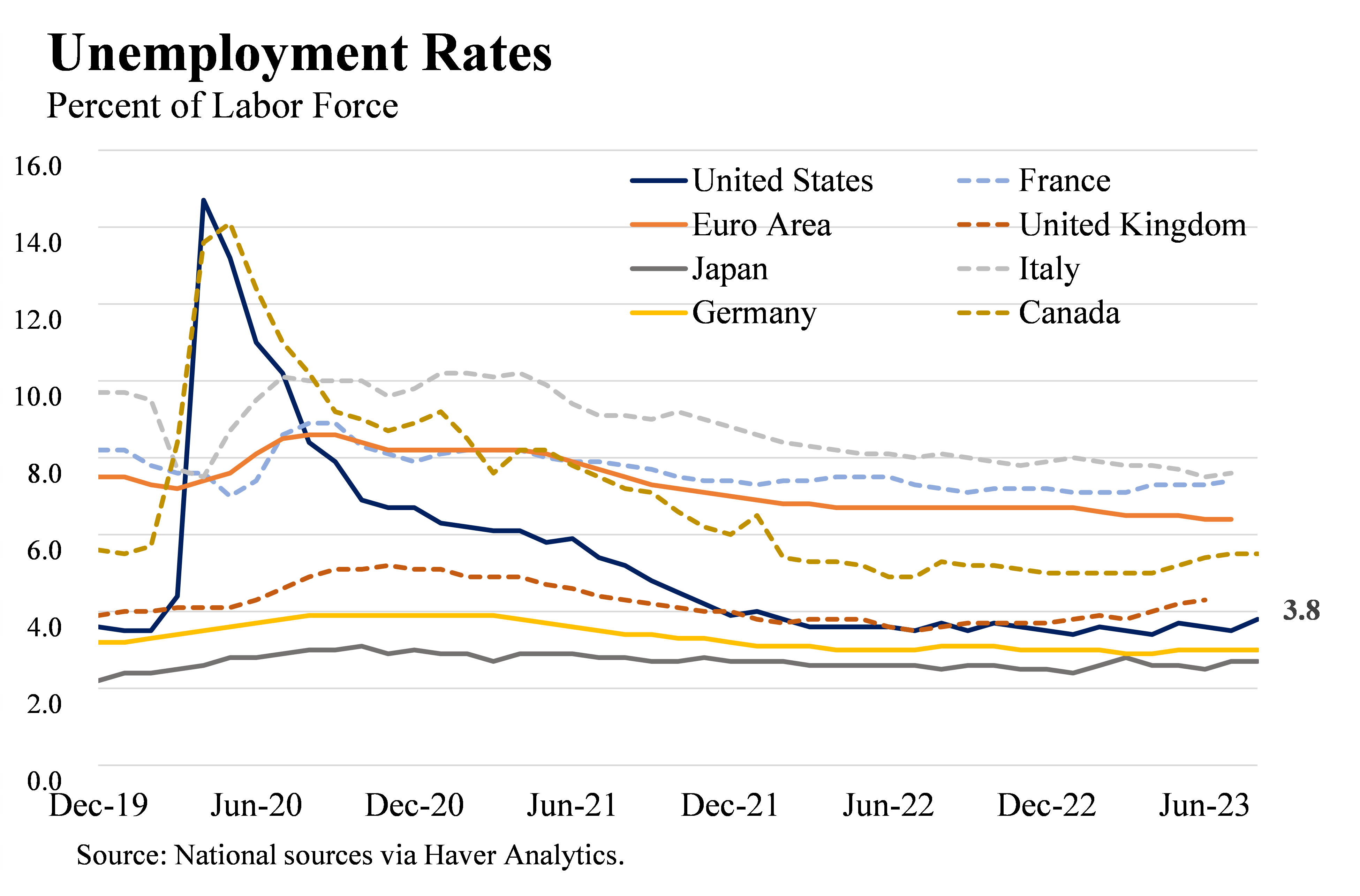

Labor Markets Remain Resilient

Differences in national labor policies can make unemployment rate comparisons across economics especially difficult. But even so, COVID-era unemployment statistics show significant divergence across the G7. The United States and Canada experienced high spikes in their unemployment rates in April and May of 2020 and supported workers through supplemental unemployment insurance, while several European economies with workshare schemes saw declines in their unemployment rates.

However, after the COVID shock the U.S. unemployment rate rapidly improved and has been consistently below 4 percent since January 2022. Amid the most rapid monetary tightening cycle since the 1980s and an increasing labor force participation rate, the jobs market in the United States remains strong with a current unemployment rate of 3.8 percent.

Although many other advanced economies have higher unemployment rates than the United States, they are also showing resilience. In August, the euro area unemployment rate returned to its record low of 6.4%.

Inflation is Gradually Nearing Target

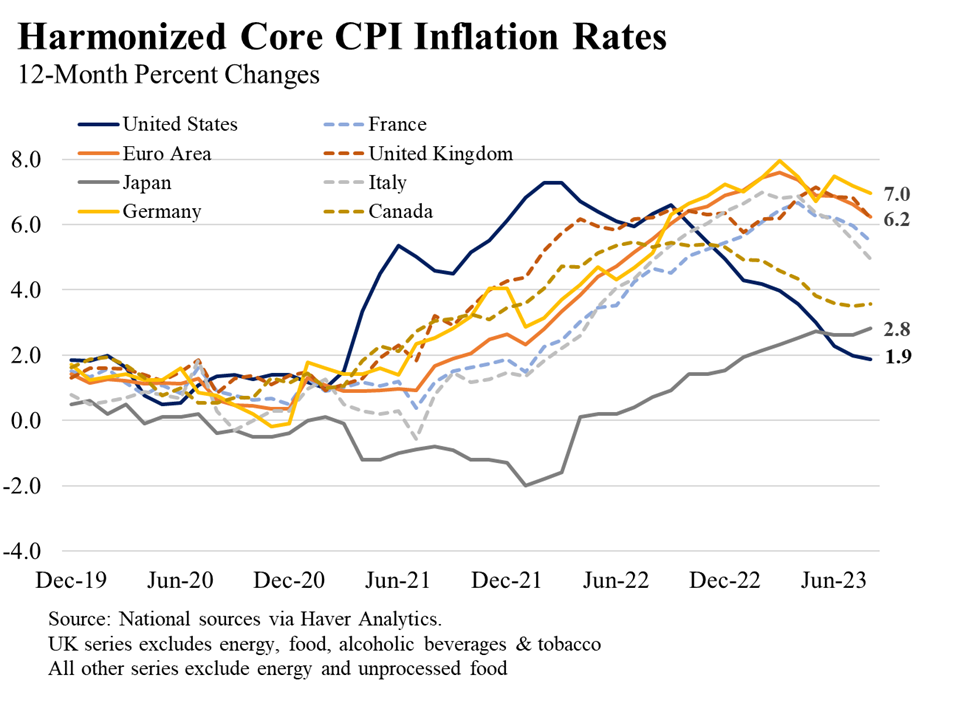

U.S. core CPI inflation (excluding food and energy) has declined significantly over the last 12 months. Cross-country comparisons, however, are not simple because countries have different standards as to what is included in their inflation consumption baskets—most notably regarding owners’ equivalent rent (OER, or the rental value of housing services received by homeowners). Whereas the United States includes OER in its CPI measure, European inflation statistics do not. Using the core measure of the Harmonized Index of Consumer Prices—excluding food, energy, and OER—enables cross-country comparisons.

Elevated inflation has been a phenomenon among most industrialized nations. Although inflation in the United States rose earlier than in other G7 economies—reflecting the brisk recovery from the pandemic—it also fell sooner and quicker. Indeed, once we exclude owners’ equivalent rent to make U.S. core inflation comparable to other countries, the U.S. harmonized core inflation is now about 2 percent—well below many other large advanced economies. [1] Some of the differential relative to European economies is due to Russia’s invasion of Ukraine, which raised food and energy prices substantially with some passing through to core inflation. Even despite this challenge, these economies have shown some signs of disinflation recently—welcome trends for their near- and medium-run outlooks.

Conclusion: Improving Near-Term Outlook

Stronger-than-expected U.S. growth continues to drive surprises to the upside in global growth in 2023, and the IMF notes that the likelihood of a hard landing has receded and the downside risks from last spring have moderated. While important risks for the U.S. economy remain, the progress we have made underscores the value of a swift and growth-oriented policy response while making important investments in our economy’s long-run productive capacity.

[1] Including OER raises the U.S. core inflation rate to 4.1 percent in September 2023, but the broad international comparison conclusions hold when we use individual country-preferred measures.

We serve the public by pursuing a growing economy and stable financial system that work for all of us.

- Center for Indian Country Development

- Opportunity & Inclusive Growth Institute

- Monetary Policy

- Banking Supervision

- Financial Services

- Community Development & Outreach

- Board of Directors

- Advisory Councils

Work With Us

- Internships

- Job Profiles

- Speakers Bureau

- Doing Business with the Minneapolis Fed

Overview & Mission

The ninth district, our history, diversity & inclusion, region & community.

We examine economic issues that deeply affect our communities.

- Request a Speaker

- Publications Archive

- Agriculture & Farming

- Community & Economic Development

- Early Childhood Development

- Employment & Labor Markets

- Indian Country

- K-12 Education

- Manufacturing

- Small Business

- Regional Economic Indicators

Community Development & Engagement

The bakken oil patch.

We conduct world-class research to inform and inspire policymakers and the public.

Research Groups

Economic research.

- Immigration

- Macroeconomics

- Minimum Wage

- Technology & Innovation

- Too Big To Fail

- Trade & Globalization

- Wages, Income, Wealth

Data & Reporting

- Income Distributions and Dynamics in America

- Minnesota Public Education Dashboard

- Inflation Calculator

- Recessions in Perspective

- Market-based Probabilities

We provide the banking community with timely information and useful guidance.

- Become a Member Bank

- Discount Window & Payments System Risk

- Appeals Procedures

- Mergers & Acquisitions (Regulatory Applications)

- Business Continuity

- Paycheck Protection Program Liquidity Facility

- Financial Studies & Community Banking

- Market-Based Probabilities

- Statistical & Structure Reports

Banking Topics

- Credit & Financial Markets

- Borrowing & Lending

- Too Big to Fail

For Consumers

Large bank stress test tool, banking in the ninth archive.

We explore policy topics that are important for advancing prosperity across our region.

Policy Topics

- Labor Market Policies

- Public Policy

Racism & the Economy

Policy has tightened a lot. how tight is it (an update).

May 7, 2024

Over the past few years, I have published a series of essays assessing where we are in our inflation fight and highlighting some important questions policymakers are facing. My most recent essay was in February of this year, where I questioned how much monetary policy was actually restraining demand. This essay is an update to that commentary, and I now examine the current stance of monetary policy in more detail. 1

I will argue that the Federal Open Market Committee (FOMC) has tightened policy significantly, compared with prior cycles, both in absolute terms and relative to the market’s understanding of neutral. But I will also observe that the housing market is proving more resilient to that tight policy than it generally has in the past. Given that housing is a key channel through which monetary policy affects the economy, its resilience raises questions about whether policymakers and the market are misperceiving neutral, at least in the near term. It is possible that once the reopening dynamics of the post-COVID economy have concluded, the macro forces that drove the low-rate environment that existed before the pandemic will reemerge, pulling neutral back down. But the FOMC must set policy based on where neutral is in the short run to achieve our dual mandate goals in a reasonable period of time. The uncertainty about where neutral is today creates a challenge for policymakers.

Economic Update

Since my last update in February, two significant economic developments have occurred simultaneously: Inflation appears to have stopped falling and economic activity has proven resilient, continuing the robust activity we saw in the latter half of 2023.

The FOMC targets 12-month headline inflation of 2 percent. While we saw rapid disinflation in the second half of 2023, that progress appears to have stalled in the most recent quarter (see Figure 1). The question we now face is whether the disinflationary process is in fact still underway, merely taking longer than expected, or if inflation is instead settling to around a 3 percent level, suggesting that the FOMC has more work to do to achieve our dual mandate goals.

During this time, economic activity has continued to show remarkable strength, as shown in Figure 2. While the most recent headline GDP appears somewhat weaker than prior quarters, that slowdown was driven largely by inventories and net exports. Underlying domestic demand remained strong.

The labor market, the other half of our dual mandate, has also remained strong with the unemployment rate at a historically low 3.9 percent.

Policy Is Much Tighter than the Pre-pandemic Period

In prior essays I wrote that the single best proxy for the overall stance of monetary policy is the long-term real rate, specifically the 10-year Treasury inflation-protected securities (TIPS) yield. Focusing on a long-term rate incorporates the expected path of both the federal funds rate and balance sheet, not just the current level of the federal funds rate. Moreover, it adjusts the expected path of policy by expected future inflation—the relevant comparison—rather than by recently realized inflation.

As I noted in earlier essays, prior to the pandemic the 10-year real yield was about zero, which I estimate was roughly a neutral policy stance at that time. In response to the pandemic, the FOMC acted aggressively to support the economy by driving the federal funds rate to the effective lower bound and massively expanding our balance sheet. Those combined effects drove the 10-year real yield to roughly -1 percent, as shown in Figure 3. Since we began our tightening cycle two years ago, 10-year real yields have more than fully retraced their pandemic decline and are now around 2.2 percent. Thus, we are clearly in a tighter stance now than immediately before the pandemic.

This Tightening Cycle Appears to Be as Aggressive as the 1994 Cycle

Data from the TIPS market only go back 20 years or so; thus, to evaluate earlier tightening cycles one must make a number of assumptions about the neutral rate and about inflation expectations.

I do not think comparisons to the 1970s and early 1980s are particularly relevant to us today because in those decades, the FOMC had to establish its inflation-fighting credibility, so the required monetary tightening was very large.

The tightening cycle in 1994 might be a better benchmark because at that time, as is true now, the FOMC had a lot of credibility with the public. Inflation was not as high in 1994, however, as it was in this episode. So it is not a perfect comparison either.

Minneapolis Fed staff’s best estimate is that when the FOMC raised the policy rate by 300 basis points in the 1994 tightening cycle, this translated into an increase of about 200 basis points in the 10-year real rate (Figure 4), which was coincidentally also about 200 basis points above the then-neutral 10-year real rate. So that is the key: It seems as though policy drove the 10-year real rate about 200 basis points above neutral.

How does that compare to our current tightening cycle? (See Figure 3.) If my estimate of neutral being zero before the pandemic still holds, then we have accomplished similar or a bit more tightening in this cycle than was achieved in the 1994 tightening cycle.

Yield Curve Suggests Policy Is Tight

As I stated earlier, the underlying inflationary dynamics are quite different today than in 1994, so simply repeating the 1994 tightening might not be enough. And perhaps the unique dynamics of the post-COVID reopening economy have caused neutral to increase.

Another indicator I look at to assess the stance of monetary policy is the shape of the yield curve. Specifically, if the yield curve is inverted, it might indicate that monetary policy is in a contractionary stance. A lot of public attention is given to the yield curve, and there is a robust debate about whether an inverted yield curve is a reliable recession indicator. I wrote about this in 2018. Setting aside its usefulness as a predictor of recessions, the yield curve does seem to give some indication of the stance of monetary policy. The long end of the yield curve should offer some signal of where market participants believe interest rates will settle once current economic and policy shocks have run their course; if markets understand that neutral has moved, it should be reflected in the long end of the curve. If current short rates are higher than long rates, then that might signal an overall tight stance of policy today. Figure 5 shows the history of the (nominal) yield curve with a number of inversions over the past 50 years, including the current inversion. 2

Depending on the specific measures chosen, the yield curve has now been inverted for more than 20 months, which is a relatively long and somewhat deeper inversion than most prior cycles, the Volcker disinflation period being the exception. The current inverted yield curve suggests that policy is in fact tight relative to the market’s understanding of neutral.

The Resilience in the Housing Market Nonetheless Raises Questions

Housing is traditionally the most interest-rate-sensitive sector of the economy. Prior yield curve inversions also coincided with a marked slowdown or even contraction in residential investment, as shown in Figure 6. Curiously, while residential investment fell in the first part of our tightening cycle, it has since reversed and has grown 5 percent over the past year.

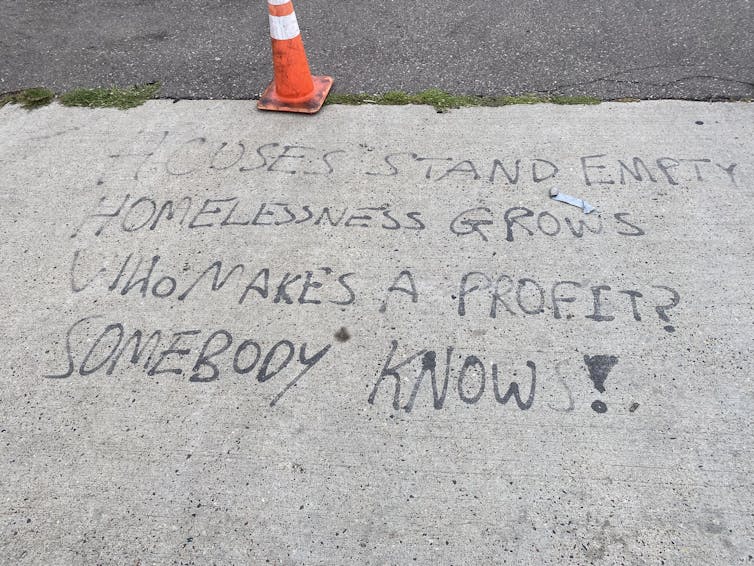

What could explain this apparent resilience in residential real estate given monetary policy that has led to an inverted yield curve? We know that following the Global Financial Crisis, the country built far fewer housing units than were needed to keep up with population growth and household formation. Thus, there appears to be a significant shortage of housing that will take a long time to close. In addition, responses to COVID have led to an increase in people working from home, and that has led to increased demand for housing. In recent years there has also been a significant increase in immigration. While the long-run effect of increased immigration on inflation is unclear, immigrants nonetheless need a place to live, and their arrival in the U.S. has likely also increased demand for housing. Policy actions by the FOMC have driven 30-year mortgage rates from around 4.0 percent prior to the pandemic to around 7.5 percent today. Perhaps that level of mortgage rates is not as contractionary for residential investment as it would have been absent these unique factors which are driving housing demand higher. In other words, perhaps a neutral rate for the housing market is higher than before the pandemic.

Other Signals from the Real Economy Are Mixed

Monetary policy is a blunt instrument that eventually affects virtually the entire economy, not only housing. While high interest rates may not be slowing housing as much as in prior tightening cycles, it is nonetheless having an impact on other sectors of the economy. For example, auto loan and credit card delinquencies have increased from very low levels and are now at rates higher than existed before the pandemic, indicating that some consumers are feeling stress from increased borrowing costs. Overall, however, economic activity, consumer spending and the labor market have proven surprisingly resilient.

The FOMC has undeniably tightened policy meaningfully, both relative to the pre-pandemic period and to some prior tightening cycles. Nonetheless, it is hard for me to explain the robust economic activity that has persisted during this cycle. My colleagues and I are of course very happy that the labor market has proven resilient, but, with inflation in the most recent quarter moving sideways, it raises questions about how restrictive policy really is. If policymakers and market participants are misperceiving the neutral policy rate, that could explain the constellation of data we are observing. This is also a communication challenge for policymakers. In my own Summary of Economic Projections (SEP) submission, I have only modestly increased my longer-run nominal neutral funds rate level from 2 percent to 2.5 percent. The SEP does not provide a simple way to communicate the possibility that the neutral rate might be at least temporarily elevated.

1 These comments reflect my own views and may not necessarily represent the views of others in the Federal Reserve System or of the Federal Open Market Committee.

2 Conceptually, the real yield curve is a better measure of the stance of monetary policy than the nominal yield curve. That said, because nominal and real spreads have been quite similar over the past 18 months, the nominal spread in Figure 5 currently provides an equivalent measure of the stance of monetary policy. I plot nominal yields in Figure 5 simply because they are available for a longer time period than TIPS yields.

Related Content

Policy Has Tightened a Lot. How Tight Is It?

Policy Has Tightened a Lot. Is It Enough? (A Second Update)

The Interaction between Inflation and Financial Stability

Sign up for news and events.

- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

The U.S. Economy’s Soft Landing Is Still on Track

- Philipp Carlsson-Szlezak,

- Paul Swartz,

- Martin Reeves

A close look at consumer trends, monetary policy, and other trends gives reason for optimism — not pessimism.

While there’s been a recent string of disappointing macroeconomic data, in reality, these developments are signs of the U.S. economy’s strengths, not weaknesses. The economic pessimism of the last few years has often been rooted in a misreading of the U.S. consumer. Too often, they are cast as financially squeezed, burning through their pandemic-era savings, and reeling from the real income cut that inflation has inflicted on them. In this telling, demand is artificially high, and its collapse has been delayed, not averted. Consumption is also still distorted by post-pandemic gyrations, but aggregate consumption sits more than $1.5 trillion above 2019 levels in real terms. This strength, however, is not an unalloyed good for all firms — while high interest rates have been absorbed successfully in aggregate, they still create existential struggle for some firms and households. Executives need to resist the temptation to respond to every wrinkle in the volatile data and adjust their mental models to lead in an era of tightness.

Less than a year ago, many pessimists rejected the possibility of a soft landing for the U.S. economy. They argued that U.S. resilience was a confluence of lucky factors, such as pandemic-era savings that would eventually run out. As inflation moderated and growth remained remarkably strong, they grudgingly had to accept that the economy is far more resilient than they had thought.

- Philipp Carlsson-Szlezak is a managing director and partner in BCG’s New York office and the firm’s global chief economist. He is a coauthor of Shocks, Crises, and False Alarms: How to Assess True Macroeconomic Risk (Harvard Business Review Press, 2024).

- Paul Swartz is an executive director and senior economist in the BCG Henderson Institute, based in BCG’s New York office. He is a coauthor of Shocks, Crises, and False Alarms: How to Assess True Macroeconomic Risk (Harvard Business Review Press, 2024).

- Martin Reeves is the chairman of Boston Consulting Group’s BCG Henderson Institute in San Francisco and a coauthor of The Imagination Machine (Harvard Business Review Press, 2021).

Partner Center

Economics Essay Examples

Ace Your Essay With Our Economics Essay Examples

Published on: Jun 6, 2023

Last updated on: Jan 31, 2024

Share this article

Are you struggling to understand economics essays and how to write your own?

It can be challenging to grasp the complexities of economic concepts without practical examples.

But don’t worry!

We’ve got the solution you've been looking for. Explore quality examples that bridge the gap between theory and real-world applications. In addition, get insightful tips for writing economics essays.

So, if you're a student aiming for academic success, this blog is your go-to resource for mastering economics essays.

Let’s dive in and get started!

On This Page On This Page -->

What is an Economics Essay?

An economics essay is a written piece that explores economic theories, concepts, and their real-world applications. It involves analyzing economic issues, presenting arguments, and providing evidence to support ideas.

The goal of an economics essay is to demonstrate an understanding of economic principles and the ability to critically evaluate economic topics.

Why Write an Economics Essay?

Writing an economics essay serves multiple purposes:

- Demonstrate Understanding: Showcasing your comprehension of economic concepts and their practical applications.

- Develop Critical Thinking: Cultivating analytical skills to evaluate economic issues from different perspectives.

- Apply Theory to Real-World Contexts: Bridging the gap between economic theory and real-life scenarios.

- Enhance Research and Analysis Skills: Improving abilities to gather and interpret economic data.

- Prepare for Academic and Professional Pursuits: Building a foundation for success in future economics-related endeavors.

Paper Due? Why Suffer? That's our Job!

If youâre wondering, âhow do I write an economics essay?â, consulting an example essay might be a good option for you. Here are some economics essay examples:

Short Essay About Economics

A Level Economics Essay Examples

Here is an essay on economics a level structure:

Band 6 Economics Essay Examples

Here are some downloadable economics essays:

Economics essay pdf

Economics essay introduction

Economics Extended Essay Examples

In an economics extended essay, students have the opportunity to delve into a specific economic topic of interest. They are required to conduct an in-depth analysis of this topic and compile a lengthy essay.

Here are some potential economics extended essay question examples:

- How does foreign direct investment impact economic growth in developing countries?

- What are the factors influencing consumer behavior and their effects on market demand for sustainable products?

- To what extent does government intervention in the form of minimum wage policies affect employment levels and income inequality?

- What are the economic consequences of implementing a carbon tax to combat climate change?

- How does globalization influence income distribution and the wage gap in developed economies?

IB Economics Extended Essay Examples

IB Economics Extended Essay Examples

Economics Extended Essay Topic Examples

Extended Essay Research Question Examples Economics

Tips for Writing an Economics Essay

Writing an economics essay requires specific expertise and skills. So, it's important to have some tips up your sleeve to make sure your essay is of high quality:

- Start with a Clear Thesis Statement: It defines your essay's focus and argument. This statement should be concise, to the point, and present the crux of your essay.

- Conduct Research and Gather Data: Collect facts and figures from reliable sources such as academic journals, government reports, and reputable news outlets. Use this data to support your arguments and analysis and compile a literature review.

- Use Economic Theories and Models: These help you to support your arguments and provide a framework for your analysis. Make sure to clearly explain these theories and models so that the reader can follow your reasoning.

- Analyze the Micro and Macro Aspects: Consider all angles of the topic. This means examining how the issue affects individuals, businesses, and the economy as a whole.

- Use Real-World Examples: Practical examples and case studies help to illustrate your points. This can make your arguments more relatable and understandable.

- Consider the Policy Implications: Take into account the impacts of your analysis. What are the potential solutions to the problem you're examining? How might different policies affect the outcomes you're discussing?

- Use Graphs and Charts: These help to illustrate your data and analysis. These visual aids can help make your arguments more compelling and easier to understand.

- Proofread and Edit: Make sure to proofread your essay carefully for grammar and spelling errors. In economics, precision and accuracy are essential, so errors can undermine the credibility of your analysis.

These tips can help make your essay writing journey a breeze. Tailor them to your topic to make sure you end with a well-researched and accurate economics essay.

To wrap it up , writing an economics essay requires a combination of solid research, analytical thinking, and effective communication.

You can craft a compelling piece of work by taking our examples as a guide and following the tips.

However, if you are still questioning "how do I write an economics essay?", it's time to get professional help from the best essay writing service - CollegeEssay.org.

Our economics essay writing service is always ready to help students like you. Our experienced economics essay writers are dedicated to delivering high-quality, custom-written essays that are 100% plagiarism free.

Also try out our AI essay writer and get your quality economics essay now!

Barbara P (Literature)

Barbara is a highly educated and qualified author with a Ph.D. in public health from an Ivy League university. She has spent a significant amount of time working in the medical field, conducting a thorough study on a variety of health issues. Her work has been published in several major publications.

Paper Due? Why Suffer? That’s our Job!

Legal & Policies

- Privacy Policy

- Cookies Policy

- Terms of Use

- Refunds & Cancellations

- Our Writers

- Success Stories

- Our Guarantees

- Affiliate Program

- Referral Program

- AI Essay Writer

Disclaimer: All client orders are completed by our team of highly qualified human writers. The essays and papers provided by us are not to be used for submission but rather as learning models only.

Some experts say the US economy is on the up, but here’s why voters don’t think so

PhD Candidate, University of Warwick

Disclosure statement

Jessica Eastland-Underwood received funding from the University of Warwick's Department of Politics and International Studies to conduct their PhD research.

University of Warwick provides funding as a founding partner of The Conversation UK.

View all partners

Many Americans are gloomy about the economy , despite some data saying it is improving.

The Economist even took this discussion to TikTok. When its US editor John Prideaux examined inflation, wage and employment numbers, he concluded that the US has “an objectively pretty good economy”.

Is Prideaux wrong or the American electorate ? And if the US economy is bouncing back, why is President Joe Biden not seeing an economic bounce in the polls?

Political commentator Robert Reich recently explained : “The economy is getting better overall – but overall has become a less useful gauge of wellbeing.” Reich suggested that the usual way the economy is measured can obscure more diverging or individualised economic trends, such as wealth inequality . That is, the macroeconomic indicators are right, but that only tells us part of the story.

Pundits frequently turn to the same narrow measures to define the very large, complex concept of the economy. Widely quoted measurements such as GDP are often treated as synonymous with the economy itself. Importantly though, when polling firms asks Americans about the issues important to their vote , it is the economy and not GDP that is given as an option.

Voters think of the economy in very different ways. Researchers observe that the public often perceives the economy through the lens of their personal experience.

As part of my research, I carried out 17 in-depth interviews and reviewed social media comments, to find out what Americans mean when they say “the economy”. Answers included topics as varied as religion, marriage and nature.

This might seem incorrect, but economics researchers already know that these are all elements of the economy. Religion can shape economic behaviour . Marriage partners combine savings to make larger purchases . Finally, nature provides physical resources necessary for production and consumption.

Just one interviewee mentioned GDP, but only to say that GDP is not the economy. He recommended looking at “measures of wellbeing”.

Read more: Biden v Trump: winning suburbia is key to clinching the presidency in 2024

This is consistent with research seeking to better represent these other aspects of the economy important to people. It is from these more inclusive studies that we might understand American voters’ pessimism.

The Academy of Arts and Sciences’ Commission on Reimagining Our Economy released a report in November 2023, recommending additional measures to evaluate the economy around “wellbeing”: security, opportunity, mobility and democracy.