Your 10 Step Guide to Building a Real Estate Investing Business Plan

Real estate empires grow from a blueprint, not last-minute hunches. This guide outlines how to create a real estate investing business plan to help you navigate market dynamics, seek funding, and add to your team so that you can successfully grow your business.

Let’s be honest, the idea of drafting a formal real estate investing business plan probably doesn’t excite you. After all, you got into real estate investing to scout deals and transform properties, not write novels full of financial projections.

But experienced investors know a solid plan spells the difference between profitability and major headaches. It forces clarity on direction and feasibility before you sink hundreds of thousands into property purchases and rehabs.

Think of your business plan as a blueprint for success tailored to your unique investment goals and market conditions. Whether you currently own a few rentals or are launching a full-fledged development firm, a plan guides decisions, aligns partners, and demonstrates viability to secure financing.

So how do you build one effectively without needless complexity? What key strategy areas require your focus? Let’s explore components that set you up for growth while avoiding common first-timer pitfalls. With realistic planning as your foundation, your investing journey can start smooth and stay the course.

What is a real estate investing business plan?

At its core, a real estate investment business plan is simply a strategic guide outlining your intended real estate approach. It defines target markets, preferred project types based on expertise, capital sources, growth strategy, key operational procedures, and other investment specifics tailored to your situation.

View your plan as an evolving document rather than a rigid static rulebook collecting dust. It should provide goalposts and guardrails as markets shift over time and new opportunities appear. You'll be able to refer back to the plan to confirm that these new opportunities align with proven tactics that yield predictable returns.

Detailed upfront planning provides a sound foundation for confident direction. It protects stakeholders by identifying potential pitfalls and mitigation strategies before costly surprises trip up the stability of your real estate business.

So, it's worth it to take the time and develop a customized plan aligned to your niche, resources, and risk tolerance. While initially tedious, the practice of putting together your strategic real estate business plan ultimately provides clarity and confidence moving forward.

Importance of having a business plan

Now that we’ve defined what a business plan is, let’s explore why having one matters — especially if you want to grow a successful real estate investment company.

Have you considered what originally attracted you to investing in properties? Whether it was rehabbing flips, acquiring rentals, or simply a lucrative hobby, your motivations and ideal path can get lost in the daily distractions of life. That’s where an intentional business plan provides clarity and conviction moving forward.

Reasons every real estate investor should prioritize planning are:

- Goals and vision : You might be wanting to quit your day job and focus on real estate full time, or you might simply want to generate some extra income on the side. Either way, a business plan forces you to define what success looks like for you.

- Due diligence : Creating a plan forces you to research the real estate markets you want to invest in — analyzing sales, rents, permits, zoning, demographics, and growth projections. This helps you objectively identify high-potential neighborhoods and properties rather than relying on hearsay or intuition.

- Funding and financing : Lenders and potential investors will want to review your business plan to evaluate the viability and profitability of your real estate investment business before offering any financing . A complete plan builds credibility and confidence with stakeholders.

- Guide decision-making : It's easy to get distracted by the latest real estate seminar or shiny new construction techniques. But sticking to the parameters and strategies laid out in your plan prevents you from making hasty changes or going down rabbit holes.

- Identify potential risks : There are always things that can unexpectedly go wrong: what if interest rates spike and make your loans unaffordable, or your best tenants move out and unreliable folks move in? Brainstorming these scenarios in advance allows you to minimize risks and have contingency plans.

- Systemize operations : As you grow, how will you scale operations? A business plan helps you identify areas that will require attention as your business evolves, like creating maintenance checklists for rentals, standardizing lease agreements , or automating accounting procedures.

- Build the right team : Your business plan provides guidance on the team you'll need for your business. Know if you require a real estate agent to help you find deals or a property manager to handle tenant complaints at 2 AM.

- Track progress : Your plan helps you compare things like actual rehab costs, rental occupancy rates, cash flow, etc. to your initial projections and determine whether you're on track. You can then make adjustments as needed.

- Maintain strategy : As you scale your operations with new hires or partnerships, you'll want to maintain direction in alignment with your original business plan. For example, if you are considering new verticals like commercial real estate, does evaluation criteria match your proven risk metrics and return hurdles? A real estate business plan keeps everyone focused on the same goals as your business grows.

What to include in a real estate investment business plan

A good real estate investing business plan covers everything from business goals to financing strategy. Here are the ten key elements you should include:

1. Executive summary

The executive summary provides a high-level overview of your real estate investment business plan. It briefly describes your company mission, objectives, competitive advantages, growth strategies, team strengths, and financial outlook.

Think of it as the elevator pitch for your business plan, and write it last after you have completed the full plan. Limit it to 1-2 pages at most.

Make your executive summary compelling and motivate investors or lenders to learn more. Be sure to also summarize your past successes and experiences to build credibility.

2. Company description

The company description section provides background details on your real estate investment company. Keep this section brief, but use it to legitimize your business and team.

- Business model : Explain your core business model and investment strategies. Will you primarily flip properties, buy and hold rentals, conduct wholesale deals, or use another approach?

- Company history and achievements : Provide a brief timeline of your company's history, including its formation, past projects, key milestones, and achievements.

- Legal business structure : Identify your corporate structure, such as LLC , S-Corp , C-Corp, or sole proprietorship.

- Office location : Provide your company's office address, which lends you credibility. If you are initially working from home, consider establishing a local PO Box or virtual address.

- Founders and key team members : Introduce your founders and key team members. Highlight relevant real estate, finance, management expertise, and credentials.

- Past projects : Provide an overview of any successful prior real estate projects your company or founders have executed.

- Competitive advantages : Explain unique resources, systems, or other strengths that give your company an edge over competitors. These could be proprietary analytic models, contractor relationships, deal access, or specialized expertise.

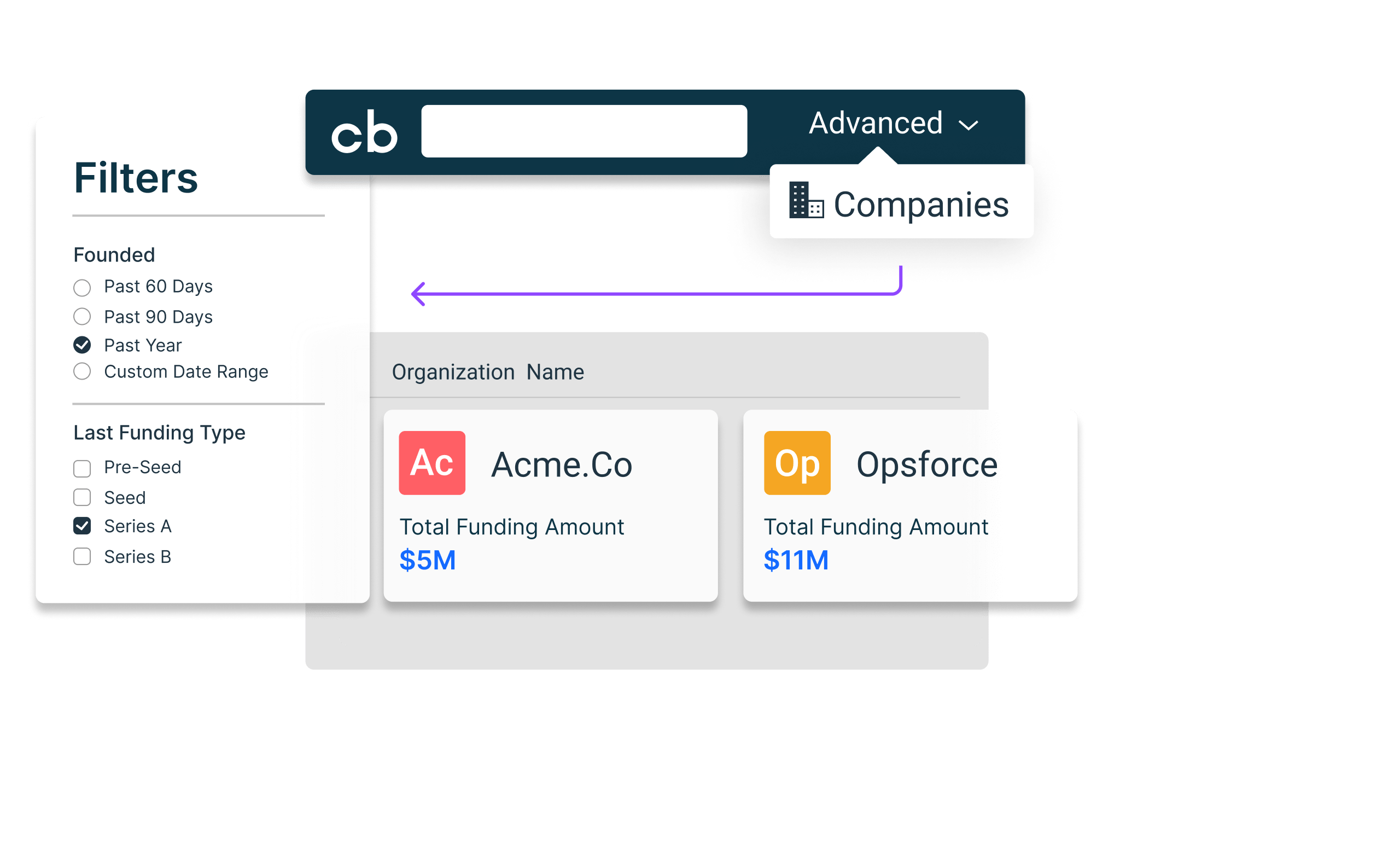

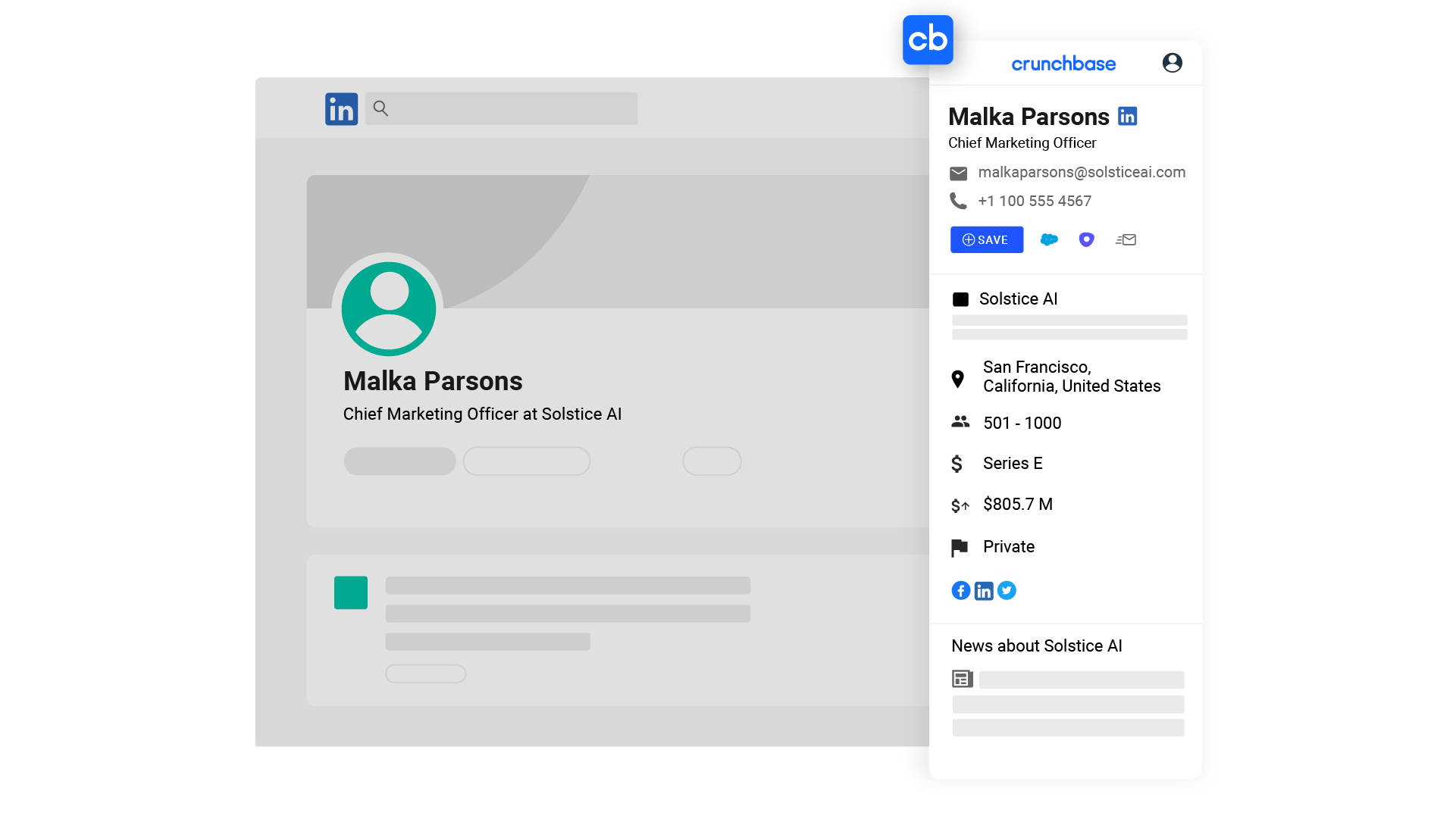

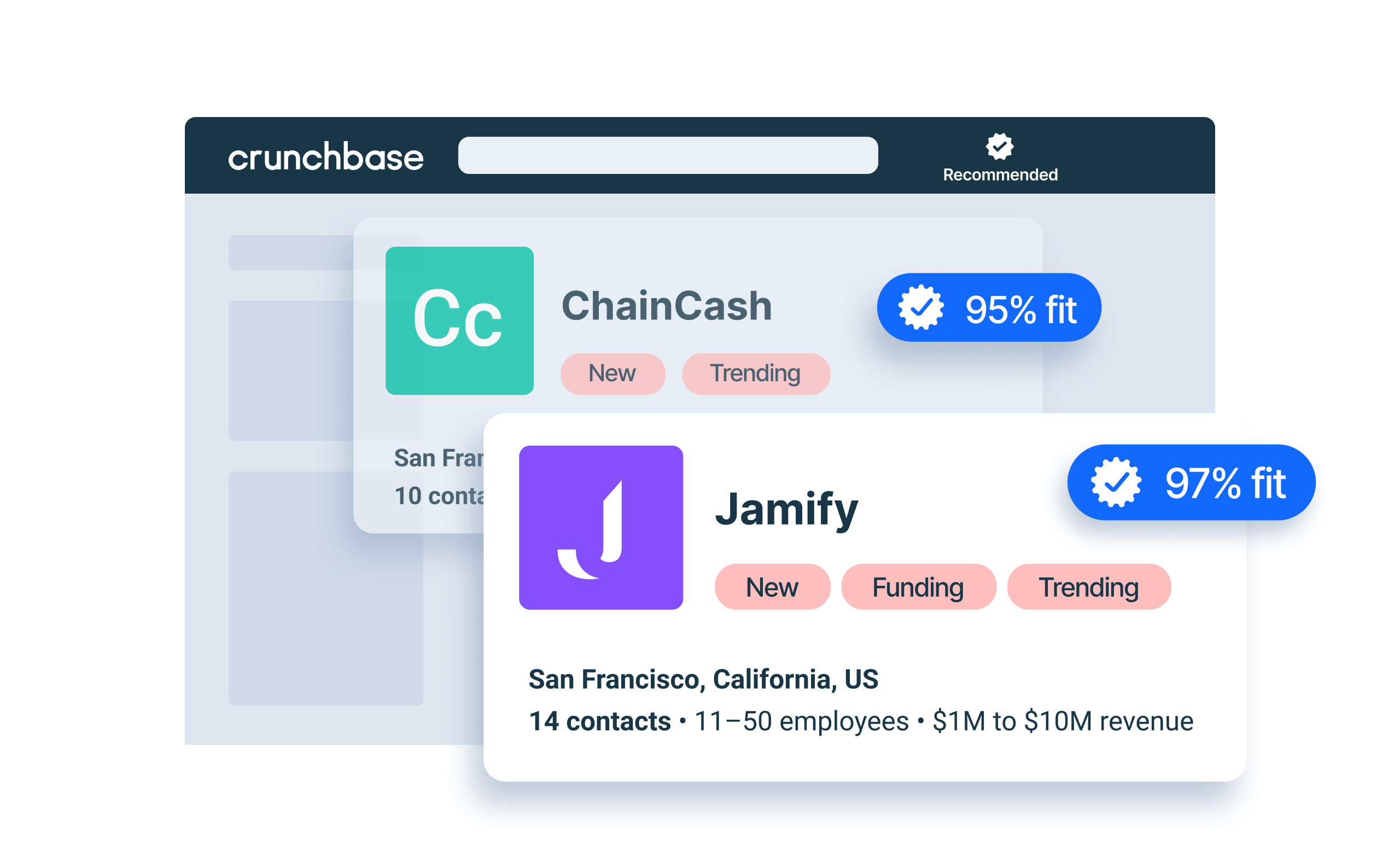

- Technologies and tools : Discuss technologies, software programs, or tools your company uses to streamline processes and optimize operations.

3. Market analysis

The market analysis section validates whether your real estate investment strategy makes sense in a given area.

Conduct detailed research from multiple sources to create realistic real estate investment market projections and identify potentially profitable opportunities.

Outline why certain neighborhoods, property types, or price points pique your interest more than others.

Your market analysis should dig deep into factors like:

- Local sales and rental price trends : Analyze pricing history and current trends for both sales and rents. Look at different property types, sizes, and neighborhoods.

- Housing inventory and demand analysis : Research the balance of supply and demand and how that impacts prices. Is the market undersupplied or oversupplied?

- Market growth projections : Review forecasts from real estate analysts on expected market growth or decline in coming years. Incorporate these projections into your analysis.

- Competitor analysis : Identify other real estate investors actively acquiring or managing properties in your target areas. Look at their business models and strategies.

- Target neighborhood and property analysis : Provide an in-depth analysis of your chosen neighborhoods and target property types. Outline positive attributes, risks, and opportunities.

- Demographic analysis : Analyze the demographics of potential tenants or homebuyers for your target properties. Factors like income, age, and family size impact demand.

- Local construction and renovation costs : Research materials and labor costs for accurate budgets and understand the permitting process and timelines.

- Regional economic outlook : Factor in projections for job growth, new employers, infrastructure projects, and how they may impact the real estate market.

4. SWOT analysis

SWOT stands for strengths, weaknesses, opportunities and threats. Conducting a SWOT analysis means stepping back from day-to-day business to assess your broader position and path from a strategic lens.

Internal strengths for your real estate investment business may include an experienced team skilled in major rehab projects, strong contractor relationships, or access to private lending capital. Weaknesses might be limited staff for handling tenant maintenance issues across a growing rental portfolio or only having a small number of referral partners for deal flow.

External opportunities can come from accelerating population growth and development in your target market, new zoning favorable to multifamily housing, or record-low mortgage interest rates. Threats could be rising material prices that hurt your flip margins, laws imposing restrictions on non-primary residence owners, or an oversupply of new luxury rentals, allowing tenants to be choosy.

The SWOT analysis highlights strengths to double down on and risks to mitigate in the real estate market.

5. Financial projections

The financial plan helps for both internal preparation and attracting investors. For real estate companies, the financial plan section should cover:

- Startup costs : Include the expected startup costs involved to start your investment project, such as getting licenses and permits or paying for legal fees.

- Profit and loss forecasts : Create projected profit and loss statements that outline what you think your revenues and expenses will be over the next 3-5 years.

- Cash flow projections : Put together projected cash flow statements that show expected cash flow for each month.

- Return on investment projections : Project your company's expected ROI over time under the different investment scenarios.

- Funding requirements : Based on your forecasts, detail exactly how much capital you will need to start and operate your business until it is profitable. Specify whether you plan to use debt or equity financing.

6. Investment strategy

The investment strategy outlines your niche — will you focus on flipping, buying rentals, commercial properties, or a blend? Define any geographic targets like certain cities or zip codes backed by your research on growth potential.

Specify your criteria for ideal investment properties based on your goals. Decide which factors — age, size, layout, condition, or price point — matter most to you.

You can also use this section to explain how you plan to find deals, whether that's by scouting listed properties, attending foreclosure auctions, or networking to create off-market opportunities.

Clearly conveying your approach allows lenders and potential private investors to grasp your niche, planned pursuits, and process for finding deals. Having a strong strategy that summarizes how you locate, evaluate and capture deals matching your investing thesis can increase lender and private investor confidence in your ability to execute.

7. Marketing plan

Real estate marketing can’t just be an afterthought; it helps attract profitable deals, financing, and tenants to your business, making it a necessary component of your business plan to prioritize.

Components of your marketing plan can include:

- Networking: Actively networking at local real estate meetups puts you directly in front of promising off-market opportunities and partnerships with motivated sellers, lenders and contractors in your community.

- Social media: Consistently nurturing your social media presence can also pay off to help you find opportunities or potential investors.

- Direct marketing: Never underestimate old school direct marketing — sending postcards to addresses with outdated “We Buy Houses” signs or calling the For Sale by Owners numbers from public listings can help you reach motivated sellers.

- Listings management: Note that marketing does not end once you own property. To keep rental vacancies filled, leverage listing sites that can publish your units to a wide audience of prospective tenants.

8. Operations plan

Without systems, real estate investors struggle through renovations plagued by cost overruns, shoddy contractors who never call back, and frustrating tenants who always pay late . The operations component of your plan should consider aspects like:

- Renovations: Ever lined up a contractor who juggles too many clients and leaves your projects languishing? Create standardized processes for accurate scoping, vetting subs, enforcing deadlines contractually, and maintaining contingency funds.

- Business technologies: As your portfolio grows, tasks like tracking income, expenses , assets, and communicating with tenants can quickly overwhelm. Identify technologies early on that help centralize details to avoid getting swamped. Look into property management platforms that automate listings, tenant screening , digitized lease agreements, maintenance work order flows, and communications.

- Insurance: Tenants or contractors can sometimes damage assets. Discuss landlord insurance policies to protect you against lawsuits, natural disasters, and major property repairs as you scale up.

9. Team structure

If you plan to grow your team beyond just yourself or a few partners, your business plan should outline your organization's key roles and responsibilities. This helps you consider what positions you may need to fill as your company scales.

- Partners or co-founders: These are the main decision-makers and equity holders. Outline their background, skills, and the value they bring.

- Property manager: This person handles day-to-day management of properties, tenants and maintenance issues.

- Bookkeeper: You may need daily help managing bank accounts, invoices, taxes, and financial reporting.

- Contractors and project managers : You'll need trusted renovations, repairs, and landscaping contractors. Dedicated project managers help oversee large jobs.

- Leasing agents : As you grow and add more properties, leasing agents handle showings, applications, and signing new tenants.

- Real estate attorneys : Real estate investing requires proper legal filings and compliance. Attorneys can help you manage this risk.

10. Exit strategies

Every wise investor plans their exit strategy upfront before acquiring a property. Will you aim to flip the asset quickly or retain it as a rental long-term? What factors determine ideal timing and the right profit margin for you to walk away?

Build flexibility into your strategy, as markets move in unpredictable ways. Especially with flips, have contingency plans if your listing gets lowballs or no offers. Be willing to rent short-term, refinance and hold if possible, convert to condos, or just patiently wait until the market changes. Having reserves and backup options allows you to avoid a distress sale.

Also include plans for strategies after a property sale, like a 1031 exchange to defer capital gains taxes and reinvest in another property. You may want to use sale proceeds to reduce or clear outstanding debts, enhancing cash flow and financial standing.

Tips for your real estate business plan

Now that you know what to include, consider the following four tips to help your real estate investment business plan stand out.

1. Be detailed and specific

Resist the urge to gloss over details as you put together your plan. Drill down on the specifics for parameters like:

- Target purchase and rehab costs.

- Timelines for completing projects.

- Minimum profit margins.

- Maximum allowable vacancy rates .

- Minimum cash reserves.

2. Refine and update regularly

Markets change, so don't create your business plan and file it away. Review your plan regularly to see how market conditions and your actual results compare to projections.

Make adjustments as needed. Tweak your approach if your rehabs are going over budget or your properties aren't selling as quickly as expected.

Aim to update your full plan annually at a minimum. Even if your overall strategy remains consistent, refresh the details around market factors, financials, tactics, risks, and projections.

3. Seek expert feedback

Before implementing your new real estate investment business plan, seek feedback from advisors who can identify potential issues or weaknesses.

Ask experienced real estate investors in your area to review your plan and provide constructive input. It's also a good idea to share your plan and numbers with your CPA and legal counsel as well.

4. Keep it simple

While specificity is good, don't over complicate your business plan to the point where it becomes difficult to follow. You want to inform readers without confusing them.

The goal is for stakeholders, such as co-investors, lenders, and partners, to easily digest your plan and understand it after a quick skim. Make it easy for readers to grasp your reasons behind focusing on a given area or project type based on market conditions and opportunity.

A property investment business plan fit to your goals

After finally finishing your business plan, you’re probably eager to dive into tangible investments rather than tweaking spreadsheets. But in the real estate industry, even experienced investors periodically step back and update strategies.

Approach your business plan as a living document that evolves as the market shifts, as you create new partnerships, or when you need to make changes in strategy. Set reminders to revisit quarterly and confirm your activities of today still align with the vision from day one.

Solid planning is proven to improve outcomes in dynamic industries like real estate investing. Though preparation isn’t glamorous, it pays dividends. Thoughtfully constructing your playbook puts the odds of executing successfully in your favor.

With a solid blueprint backed by your research, you’re now ready to capture the best real estate investment opportunities.

Business plan real estate investor FAQs

How do i stay flexible and adapt my business plan to changes in the market.

To stay flexible, review your real estate investing business plan regularly and update it based on changes in market conditions, trends, and opportunities. If things change in the market, find ways to adapt your strategy. This can include your goals, target market, financing, and even your exit plans.

How do I know if my real estate investing business plan is effective?

You'll know your business plan is effective if you're meeting the key objectives and metrics you outlined. Let's say your plan called for you to purchase a certain number of properties and achieve a specific cash flow or rate of return. If you're falling short, you can use the plan to course-correct.

Are there any specific software or tools for creating a real estate investing business plan?

Azibo is a helpful software tool for creating real estate investing business plans. This comprehensive platform has templates and tools to build out key sections of your plan. Its robust accounting and financial capabilities help construct accurate statements and projections.

Incorporating Azibo's online rent collection allows you to model cash flows. By centralizing lease documents , accounting, and portfolio management, Azibo streamlines the process of putting together a strategically sound real estate business plan.

Important Note: This post is for informational and educational purposes only. It should not be taken as legal, accounting, or tax advice, nor should it be used as a substitute for such services. Always consult your own legal, accounting, or tax counsel before taking any action based on this information.

Nichole co-founded Gateway Private Equity Group, with a history of investments in single-family and multi-family properties, and now a specialization in hotel real estate investments. She is also the creator of NicsGuide.com, a blog dedicated to real estate investing.

Other related articles

Whether you’re a property owner, renter, property manager, or real estate agent, gain valuable insights, advice, and updates by joining our newsletter.

Latest posts

The landlord lien: key insights for renters and owners.

Understanding landlord liens is important for property owners to secure unpaid rent through the tenant's personal property. This guide explores the legal framework, benefits, and best practices, ensuring landlords and tenants navigate liens effectively.

Fair Credit Reporting Act: Details for Landlords and Tenants

Running credit checks on prospective tenants? As a landlord or renter, you should understand the Fair Credit Reporting Act and how it impacts the rental process. This article covers the key elements of this law and how it governs the use of credit information during the rental process. Both property owners and prospective tenants will discover how this regulation supports a fair rental experience for all parties involved.

Implied Warranty of Habitability: The Landlord and Tenant Handbook

Rental properties are meant to provide safe, livable housing, and the implied warranty of habitability helps ensure that that's the case. However, not every repair issue falls under this rule. Discover the key areas landlords must address, what lies outside the warranty's scope, and steps tenants can take if landlords fail to make necessary repairs to maintain rental habitability.

How to Start an Investment Company

Importantly, a critical step in starting your own investment firm is to complete your business plan. To help you out, you should download Growthink’s Ultimate Business Plan Template here .

Download our Ultimate Business Plan Template here

14 Steps To Start an Investment Company :

- Choose the Name for Your Investment Company

- Develop Your Investment Company Business Plan

- Choose the Legal Structure for Your Investment Company

- Secure Startup Funding for Your Investment Company (If Needed)

- Secure a Location for Your Business

- Register Your Investment Company with the IRS

- Open a Business Bank Account

- Get a Business Credit Card

- Get the Required Business Licenses and Permits

- Get Business Insurance for Your Investment Company

- Buy or Lease the Right Investment Company Equipment

- Develop Your Investment Company Marketing Materials

- Purchase and Setup the Software Needed to Run Your Investment Company

- Open for Business

1. Choose the Name for Your Investment Company

The first step to starting your own investment company is to choose your business name.

This is a very important choice since your company name is your brand and will last for the lifetime of your business. Ideally, you choose a name that is meaningful and memorable. Here are some tips for choosing a name for your own investment firm:

- Make sure the name is available . Check your desired name against trademark databases and your state’s list of registered business names to see if it’s available. Also check to see if a suitable domain name is available.

- Keep it simple . The best names are usually ones that are easy to remember, pronounce and spell.

- Think about marketing . Come up with a name that reflects the desired brand and/or focus of your reputable firm.

2. Develop Your Investment Company Business Plan

One of the most important steps in starting an investment firm is to develop your own investment company business plan . The process of creating your plan ensures that you fully understand your market and your business strategy. The plan also provides you with a roadmap to follow and if needed, to present to funding sources to raise capital for your business. Your business plan should include the following sections:

- Executive Summary – this section should summarize your entire business plan so readers can quickly understand the key details of your investment firm.

- Company Overview – this section tells the reader about the history of your investment firm and what type of investment company you operate. For example, are you a mutual fund, hedge fund, closed-end fund, or exchange-traded fund (ETF) investment company?

- Industry Analysis – here you will document key information about the investment industry. Conduct market research and document how big the industry is and what trends are affecting it.

- Customer Analysis – in this section, you will document who your ideal or target customers are and their demographics. For example, how old are they? Where do they live? What do they find important when purchasing products or services like the ones you will offer?

- Competitive Analysis – here you will document the key direct and indirect competitors you will face and how you will build competitive advantage.

- Marketing Plan – your marketing plan should address the 4Ps: Product, Price, Promotions and Place.

- Product : Determine and document what products/services you will offer

- Prices : Document the prices of your products/services

- Place : Where will your business be located and how will that location help you increase sales?

- Promotions : What promotional methods will you use to attract customers to your investment firm? For example, you might decide to use pay-per-click advertising, public relations, search engine optimization and/or social media marketing.

- Operations Plan – here you will determine the key processes you will need to run your day-to-day operations. You will also determine your staffing needs. Finally, in this section of your plan, you will create a projected growth timeline showing the milestones you hope to achieve in the coming years.

- Management Team – this section details the background of your company’s management members and their qualifications.

- Financial Plan – finally, the financial plan answers questions including the following:

- What startup costs will you incur?

- How will your investment firm make money?

- What are your projected sales and expenses for the next five years?

- Do you need to raise funding to launch your business?

Finish Your Business Plan Today!

3. choose the legal structure for your investment company.

Next you need to choose a business structure for your investment company and register it and your business name with the Secretary of State in each state where you operate your business. Below are the five most common business structures:

1) Sole proprietorship

A sole proprietorship is a legal entity in which the owner of the investment company and the business are the same legal person. The owner of a sole proprietorship is responsible for all debts and obligations of the business. There are no formalities required to establish a sole proprietorship, and it is easy to set up and operate. The main advantage of a sole proprietorship is that it is simple and inexpensive to establish. The main disadvantage is that the owner is liable for all debts and obligations of the business.

2) Partnerships

A partnership is a business structure that is popular among small businesses. It is an agreement between two or more people who want to start an investment company together. The partners share in the profits and losses of the business. The advantages of a partnership are that it is easy to set up, and the partners share in the profits and losses of the business. The disadvantages of a partnership are that the partners are jointly liable for the debts of the business, and disagreements between partners can be difficult to resolve.

3) Limited Liability Company (LLC)

A limited liability company, or LLC, is a type of business entity that provides limited liability to its owners. This means that the owners of an LLC are not personally responsible for the debts and liabilities of the business. The advantages of an LLC for an investment firm include flexibility in management, pass-through taxation (avoids double taxation as explained below), and limited personal liability. The disadvantages of an LLC include lack of availability in some states and self-employment taxes.

4) C Corporation

A C Corporation is a business entity that is separate from its owners. It has its own tax ID and can have shareholders. The main advantage of a C Corporation for an investment company is that it offers limited liability to its owners. This means that the owners are not personally responsible for the debts and liabilities of the business. The disadvantage is that C Corporations are subject to double taxation. This means that the corporation pays taxes on its profits, and the shareholders also pay taxes on their dividends.

5) S Corporation

An S Corporation is a type of corporation that provides its owners with limited liability protection and allows them to pass their business income through to their personal income tax returns, thus avoiding double taxation. There are several limitations on S Corporations including the number of shareholders they can have among others.

Once you register your investment company, your state will send you your official “Articles of Incorporation.” You will need this among other documentation when establishing your banking account (see below). We recommend that you consult an attorney in determining which legal structure is best suited for your company.

Incorporate Your Business at the Guaranteed Lowest Price

We are proud to have partnered with Business Rocket to help you incorporate your business at the lowest price, guaranteed.

Not only does BusinessRocket have a 4.9 out of 5 rating on TrustPilot (with over 1,000 reviews) because of their amazing quality…but they also guarantee the most affordable incorporation packages and the fastest processing time in the industry.

4. Secure Startup Funding for Your Investment Company (If Needed)

In developing your investment company business plan , you might have determined that you need to raise funding to launch your business. If so, the main sources of funding for an investment company to consider are personal savings, family and friends, credit card financing, bank loans, crowdfunding and angel investors. Angel investors are individuals who provide capital to early-stage businesses. Angel investors typically will invest in an investment company that they believe has high potential for growth.

5. Secure a Location for Your Business

When looking for a location for your own investment firm, it’s important to find an area that will be beneficial for your business. You’ll want to look for a city with a strong economy that is welcoming to businesses.

Another essential factor to consider is the tax environment. You’ll ideally want to find a state that has low taxes so you can keep more of your profits.

6. Register Your Investment Company with the IRS

Next, you need to register your business with the Internal Revenue Service (IRS) which will result in the IRS issuing you an Employer Identification Number (EIN).

Most banks will require you to have an EIN in order to open up an account. In addition, in order to hire employees, you will need an EIN since that is how the IRS tracks your payroll tax payments.

Note that if you are a sole proprietor without employees, you generally do not need to get an EIN. Rather, you would use your social security number (instead of your EIN) as your taxpayer identification number.

7. Open a Business Bank Account

It is important to establish a bank account in your own investment firm’s name. This process is fairly simple and involves the following steps:

- Identify and contact the bank you want to use

- Gather and present the required documents (generally include your company’s Articles of Incorporation, driver’s license or passport, and proof of address)

- Complete the bank’s application form and provide all relevant information

- Meet with a banker to discuss your business needs and establish a relationship with them

8. Get a Business Credit Card

You should get a business credit card for your investment firm to help you separate personal and business expenses. You can either apply for a business credit card through your bank or apply for one through a credit card company.

When you’re applying for a business credit card, you’ll need to provide some information about your business. This includes the name of your business, the address of your business, and the type of business you’re running. You’ll also need to provide some information about yourself, including your name, Social Security number, and date of birth.

Once you’ve been approved for a business credit card, you’ll be able to use it to make purchases for your business. You can also use it to build your credit history which could be very important in securing loans and getting credit lines for your business in the future.

9. Get the Required Business Licenses and Permits

To start an investment company, you’ll need to register with the Securities and Exchange Commission. You also must obtain a securities license from the state where you plan to do business.

You may also need a broker-dealer license, depending on the products you plan to offer. You’ll need an investment company registration and any applicable permits or licenses from the local municipality in which your company is based.

Some states have basic requirements for the minimum amount of capital you must have to start a securities company, but most do not. Additionally, you may need to file with your state’s department of corporations or secretary of state.

10. Get Business Insurance for Your Investment Company

The type of insurance you need to operate your own investment firm depends on the type of company you operate.

If you are a limited liability company (LLC), you need errors and omissions insurance. This type of insurance protects you from lawsuits if someone believes that you made a mistake while advising them on their investments.

If you are a corporation, you need directors and officers insurance. This type of insurance protects you from lawsuits if someone believes that you did something wrong while running the company. Other business insurance policies that you should consider for your investment company include:

- General liability insurance : This covers accidents and injuries that occur on your property. It also covers damages caused by your employees or products.

- Workers’ compensation insurance : If you have employees, this type of policy works with your general liability policy to protect against workplace injuries and accidents. It also covers medical expenses and lost wages.

- Commercial property insurance : This covers damage to your property caused by fire, theft, or vandalism.

- Business interruption insurance : This covers lost income and expenses if your business is forced to close due to a covered event.

- Professional liability insurance : This protects your business against claims of professional negligence.

Find an insurance agent, tell them about your business and its needs, and they will recommend policies that fit those needs.

11. Buy or Lease the Right Investment Company Equipment

There are a few pieces of equipment you will need in order to start your own investment company. You’ll need a computer, phone, and internet connection. Additionally, you’ll need promotional materials such as business cards and letterheads.

12. Develop Your Investment Company Marketing Materials

Marketing materials will be required to attract and retain customers to your investment company. The key marketing materials you will need are as follows:

- Logo : Spend some time developing a good logo for your investment company. Your logo will be printed on company stationery, business cards, marketing materials and so forth. The right logo can increase customer trust and awareness of your brand.

- Website : Likewise, a professional investment company website provides potential clients with information about the products and/or services you offer, your company’s history, and contact information. Importantly, remember that the look and feel of your website will affect how potential clients perceive you.

- Social Media Accounts : establish social media accounts in your company’s name. Accounts on Facebook, Twitter, LinkedIn and/or other social media networks will help customers and others find and interact with your investment company.

13. Purchase and Setup the Software Needed to Run Your Investment Company

There are a few software programs that are essential for investment companies. You’ll need a financial analysis program to help you make informed decisions about what stock markets to invest in. You’ll also need a customer relationship management (CRM) program to keep track of your clients and their portfolios. Finally, you’ll need an accounting program to manage money.

14. Open for Business

You are now ready to open your investment firm. If you followed the steps above, you should be in a great position to build a successful business. Below are answers to frequently asked questions that might further help you.

Additional Resources

Investment Company Mavericks

How to Finish Your Ultimate Business Plan in 1 Day!

How to start an investment company faqs, is it hard to start an investment company.

There are many steps involved in starting an investment company, but it's not hard. The most important part is making sure you have a clear vision and plan for your company and have the resources to make it happen. You'll need to find investors, set up your corporate structure, and develop a marketing strategy. There are also a lot of regulations governing investment companies, so make sure you're familiar with them before launching your business.

How can I start an investment company with no experience?

There are a few different options for starting an investment company with no experience. You could outsource the management of your investment company to a professional firm, or you could find a mentor who can help guide you through the process. Additionally, there are a number of online resources that can help you get started in the investment industry.

Whatever route you choose, make sure you do your research and take the time to learn as much as you can about the investment process.

Is an investment company a good idea and/or a good investment?

There is no one-size-fits-all answer to this question, as the best investment company for you will depend on your individual needs and goals. That said, investment companies can be a good idea for those who want to invest in a broad range of assets or are looking for professional help in making wise investment choices. Offering a variety of investments gives you exposure to a wide range of markets.

What type of investment company is most profitable?

Venture capital firms, which provide financing for startup companies, are some of the most profitable types of investment companies. They invest in high-growth-potential firms that may not have access to traditional funding sources. Venture capital firms typically receive a significant equity stake in return for their investment.

How much does it cost to start an investment company?

The cost of starting an investment company will vary depending on the size and scope of the business, as well as the state or country in which it is based. However, there are a few expenses that are typical for most investment companies:

- Licensing and regulatory fees

- Office space and equipment

- Staffing costs

- Marketing and advertising expenses

Depending on the specific nature of your investment company, you may also incur additional costs such as legal fees, accounting fees, and software licensing fees. Typically, starting an investment company costs $50,000 to $100,000.

What are the ongoing expenses for an investment company?

An investment company has a variety of ongoing expenses, including management and advisory fees, marketing and advertising costs, and custodial and other operational costs. Management and advisory fees are paid to the investment company's management team for their services in managing the portfolio and providing advice to investors. Marketing and advertising costs are incurred to attract new investors and keep current investors informed about the company's offerings. Custodial and other operational expenses include the cost of maintaining the investment company's infrastructure, such as its computer systems and office space.

How does an investment company make money?

To make money, investment companies charge investors management fees for taking care of their money. The most common way to charge these fees is by charging a percentage of total assets under management. This percentage ranges from 0.5% to 2.5% annually.

Is owning an investment company profitable?

Yes, owning an investment company can be profitable. One reason for this is that you can make a lot of money if you invest in the right companies. Another reason is that you can charge your clients a management fee, which can be quite lucrative. Additionally, you can earn commissions by referring your clients to other investment companies. Finally, you can make money by investing in real estate or other types of assets.

Why do investment companies fail?

There are a number of reasons why investment companies fail. One of the most common is that the company invested in a failed project. This can happen when the company is not able to properly assess the risk associated with a potential investment. Other reasons for failure include mismanagement of funds, fraud, and poor investment decisions.

Other Helpful Business Plan Articles & Templates

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Start Investing in 2024: A 5-Step Guide for Beginners

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

The investing information provided on this page is for educational purposes only. NerdWallet, Inc. does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

Investing is one of the best ways to see solid returns on your money.

How much you should invest depends on your financial situation, investment goal and when you need to reach it.

Open either a taxable brokerage account or a tax-advantaged account like an IRA, depending on your goal.

Pick an investment strategy that makes sense for your saving goals, how much you're investing and your time horizon.

Understand your investment choices — such as stocks, bonds and funds — to build a portfolio for your goals.

Rent, utility bills, debt payments and groceries might seem like all you can afford when you're just starting out, much less during inflationary times when your paycheck buys less bread, gas or home than it used to. But once you've wrangled budgeting for those monthly expenses (and set aside at least a little cash in an emergency fund ), it's time to start investing. The tricky part is figuring out what to invest in — and how much.

As a newbie to the world of investing, you'll have a lot of questions, not the least of which is: How much money do I need, how do I get started and what are the best investment strategies for beginners? Our guide will answer those questions and more.

Here are five steps to start investing this year:

1. Start investing as early as possible

Investing when you’re young is one of the best ways to see solid returns on your money. That's thanks to compound earnings, which means your investment returns start earning their own return. Compounding allows your account balance to snowball over time.

At the same time, people often wonder if it's possible to get started with a little money. In short: Yes.

Investing with smaller dollar amounts is possible now more than ever, thanks to low or no investment minimums, zero commissions and fractional shares. There are plenty of investments available for relatively small amounts, such as index funds, exchange-traded funds and mutual funds.

If you’re stressed about whether your contribution is enough, focus instead on what amount feels manageable given your financial situation and goals. “It doesn't matter if it's $5,000 a month or $50 a month, have a regular contribution to your investments,” says Brent Weiss, a certified financial planner in St. Petersburg, Florida and the co-founder of financial planning firm Facet.

How that works, in practice: Let's say you invest $200 every month for 10 years and earn a 6% average annual return. At the end of the 10-year period, you'll have $33,300. Of that amount, $24,200 is money you've contributed — those $200 monthly contributions — and $9,100 is interest you've earned on your investment.

» Learn more about micro-investing

There will be ups and downs in the stock market, of course, but investing young means you have decades to ride them out — and decades for your money to grow. Start now, even if you have to start small.

If you're still unconvinced by the power of investing, use our inflation calculator to see how inflation can cut into your savings if you don't invest.

In this episode of NerdWallet's Smart Money podcast, Sean and Alana Benson talk about how to get started investing, including digging into your attitudes around investing and different types of investing accounts.

2. Decide how much to invest

One common investment goal is retirement. As a general rule of thumb, you want to aim to invest a total of 10% to 15% of your income each year for retirement. That probably sounds unrealistic now, but you can start small and work your way up to it over time. (Calculate a more specific retirement goal with our retirement calculator .)

If you have a retirement account at work, like a 401(k) , and it offers matching dollars, your first investing milestone is easy: Contribute at least enough to that account to earn the full match. That's free money, and you don't want to miss out on it, especially since your employer match counts toward that goal.

For other investing goals, such as purchasing a home, travel or education, consider your time horizon and the amount you need, then work backwards to break that amount down into monthly or weekly investments.

» Learn more: IRA vs. 401K retirement accounts

3. Open an investment account

If you’re one of the many investing for retirement without access to an employer-sponsored retirement account like a 401(k), you can invest for retirement in an individual retirement account (IRA), like a traditional or Roth IRA .

» Looking to start saving for retirement? See our roundup of the best IRAs.

If you're investing for another goal, you likely want to avoid retirement accounts — which are designed to be used for retirement, and have restrictions about when and how you can take your money back out.

Instead, consider a taxable brokerage account you can withdraw from at any time without paying additional taxes or penalties. Brokerage accounts are also a good option for people who have maxed out their IRA retirement contributions and want to continue investing (as the contribution limits are often significantly lower for IRAs than employer-sponsored retirement accounts).

» Get the details: How to open a brokerage account

4. Pick an investment strategy

Your investment strategy depends on your saving goals, how much money you need to reach them and your time horizon.

If your savings goal is more than 20 years away (like retirement), almost all of your money can be in stocks. But picking specific stocks can be complicated and time consuming, so for most people, the best way to invest in stocks is through low-cost stock mutual funds, index funds or ETFs.

If you’re saving for a short-term goal and you need the money within five years, the risk associated with stocks means you're better off keeping your money safe, in an online savings account, cash management account or low-risk investment portfolio. We outline the best options for short-term savings here .

If you can't or don't want to decide, you can open an investment account (including an IRA) through a robo-advisor, an investment management service that uses computer algorithms to build and look after your investment portfolio.

Robo-advisors largely build their portfolios out of low-cost ETFs and index funds. Because they offer low costs and low or no minimums, robos let you get started quickly. They charge a small fee for portfolio management, generally around 0.25% of your account balance.

» Get the details: How to invest $500

5. Understand your investment options

Once you decide how to invest, you’ll need to choose what to invest in. Every investment carries risk, and it’s important to understand each instrument, how much risk it carries and whether that risk is aligned with your goals. The most popular investments for those just starting out include:

A stock is a share of ownership in a single company. Stocks are also known as equities.

Stocks are purchased for a share price, which can range from the single digits to a couple thousand dollars, depending on the company. We recommend purchasing stocks through mutual funds, which we'll detail below.

» Learn more: How to invest in stocks

A bond is essentially a loan to a company or government entity, which agrees to pay you back in a certain number of years. In the meantime, you get interest.

Bonds generally are less risky than stocks because you know exactly when you’ll be paid back and how much you’ll earn. But bonds earn lower long-term returns, so they should make up only a small part of a long-term investment portfolio.

» Learn more: How to buy bonds

Mutual funds

A mutual fund is a mix of investments packaged together. Mutual funds allow investors to skip the work of picking individual stocks and bonds, and instead purchase a diverse collection in one transaction. The inherent diversification of mutual funds makes them generally less risky than individual stocks.

Some mutual funds are managed by a professional, but index funds — a type of mutual fund — follow the performance of a specific stock market index, like the S&P 500. By eliminating the professional management, index funds are able to charge lower fees than actively managed mutual funds.

Most 401(k)s offer a curated selection of mutual or index funds with no minimum investment, but outside of those plans, these funds may require a minimum of $1,000 or more.

» Learn more: How to invest in mutual funds

Exchange-traded funds

Like a mutual fund, an ETF holds many individual investments bundled together. The difference is that ETFs trade throughout the day like a stock, and are purchased for a share price.

An ETF's share price is often lower than the minimum investment requirement of a mutual fund, which makes ETFs a good option for new investors or small budgets. Index funds can also be ETFs.

» Learn more: How to buy ETFs

On a similar note...

Find a better broker

View NerdWallet's picks for the best brokers.

on Robinhood's website

Get a custom financial plan and unlimited access to a Certified Financial Planner™ for just $49/month.

NerdWallet Advisory LLC

Don't bother with copy and paste.

Get this complete sample business plan as a free text document.

Investment Company Business Plan

Start your own investment company business plan

Investment Company

Executive summary executive summary is a brief introduction to your business plan. it describes your business, the problem that it solves, your target market, and financial highlights.">.

This sample plan was created for a hypothetical investment company that buys other companies as investments. In this sample, the hypothetical Venture Capital firm starts with $20 million as an initial investment fund. In its early months of existence, it invests $5 million each in four companies. It receives a management fee of two percent (2%) of the fund value, paid quarterly. It pays salaries to its partners and other employees, and office expenses, from the management fee.

The investments show up in the Cash Flow table as the purchase of long-term assets, which also puts them into the balance sheet as long-term assets. You can see them in this sample plan, in the first few months.

In the third year, one of the target companies fails, so $5 million is written off as failure. You’ll see how that looks as a $5 million sale of long-term assets in the cash flow, and a balancing entry of $5 million in costs of sales in the profit and loss, making for a loss and write-off that year. The result is a tax loss, and the balance of investments goes to $15 million.

In the fifth year, one of the target companies is transacted at $50 million. You’ll see in the sample how that shows up as a $45 million equity appreciation in the sales forecast, plus a $5 million sale of long-term assets in the cash flow. At that point there’s been a $45 million profit, and the balance of long-term assets goes down to $10 million.

This is a simplified example. The business model holds long-term assets and waits for them to appreciate. It doesn’t show appreciation of assets until they are finally sold, and it doesn’t show write-down of assets until they fail. Sales and cost of sales are the appreciation and write-down of assets, plus the management fees.

The explanation above has been broken down and copied into key topics in the outline that are linked to corresponding tables. These topics are:

- 2.2 Start-up Summary

- 5.5.1 Sales Forecast

- 6.4 Personnel

- 7.4 Projected Profit and Loss

- 7.5 Projected Cash Flow

- 7.6 Projected Balance Sheet

Company Summary company overview ) is an overview of the most important points about your company—your history, management team, location, mission statement and legal structure.">

Content has been omitted from this sample plan topic, and following sub-topics. This sample plan has an abbreviated plan outline. With the exception of the Executive Summary, only those topics linked to key tables have been used.

The focus of this sample plan is to show the financials for this type of company. Brief descriptions can be found in the topics associated with key tables.

2.1 Start-up Summary

This hypothetical Venture Capital firm starts with $20 million as an initial investment fund. The venture capital partners invest $100,000 as working capital needed to balance the cash flow from quarter to quarter.

Market Analysis Summary how to do a market analysis for your business plan.">

Strategy and implementation summary, sales forecast forecast sales .">.

Management Summary management summary will include information about who's on your team and why they're the right people for the job, as well as your future hiring plans.">

7.1 personnel plan.

This hypothetical company pays salaries to its partners and other employees, and office expenses, from the management fee of two percent (2%).

Financial Plan investor-ready personnel plan .">

8.1 projected profit and loss.

Please note that in the third year one investment is written off as a failure, producing a $5 million cost which ends up showing a loss for the year of nearly $5 million. The sale of equity at the end of the period enters the sales forecast and the profit and loss statement as a $45 million gain.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

8.2 Projected Cash Flow

The Cash Flow shows four $5 million investments made in the first few months of the plan.

In the third year, one of the target companies fails, so $5 million is written off as failure. You’ll see that shows as a $5 million sale of long-term assets in the cash flow, and a balancing entry of $5 million in costs of sales in the profit and loss, making for a loss and write-off that year. The result is a tax loss, and the balance of investments goes to $15 Million.

In the fifth year, another investment is transacted at $50 million. This shows up as a $5 million equity appreciation in the Sales Forecast, plus a $5 million sale of long-term assets in the Cash Flow. At that point there’s been a $45 million profit and the balance of long-term assets goes down to $10 million.

The partners invest an additional $100,000 in the fourth year as additional working capital to balance the cash flow of the company.

8.3 Projected Balance Sheet

You can see in the balance sheet how the ending balances for long-term assets were not re-valued. They remain at the original purchase price until they are sold, or written off as a complete loss. There is a $5 million write-off in the third year, and a sale of $5 million worth of assets in the last year. That sale of $5 million in assets produces the $5 million sale at book value plus the $45 million gain in the sales forecast and profit and loss table.

8.4 Business Ratios

The Standard Industry Code (SIC) for this type of business is 7389, Business Services. The Industry Data is provided in the final column of the Ratios table.

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

- Sample Business Plans

Investment Company Business Plan

The possibility for substantial financial gains is one of the main advantages of an investment company. As the company expands and gains customers, it has the potential to generate large fees and commissions based on investment portfolios.

Are you looking for the same rewards? Then go on with planning everything first.

Need help writing a business plan for your investment company? You’re at the right place. Our investment company business plan template will help you get started.

Free Business Plan Template

Download our free business plan template now and pave the way to success. Let’s turn your vision into an actionable strategy!

- Fill in the blanks – Outline

- Financial Tables

How to Write An Investment Company Business Plan?

Writing an investment company business plan is a crucial step toward the success of your business. Here are the key steps to consider when writing a business plan:

1. Executive Summary

An executive summary is the first section planned to offer an overview of the entire business plan. However, it is written after the entire business plan is ready and summarizes each section of your plan.

Here are a few key components to include in your executive summary:

Introduce your Business:

Start your executive summary by briefly introducing your business to your readers.

Market Opportunity:

Products and services:.

Highlight the investment company services you offer your clients. The USPs and differentiators you offer are always a plus.

Marketing & Sales Strategies:

Financial highlights:, call to action:.

Ensure your executive summary is clear, concise, easy to understand, and jargon-free.

Say goodbye to boring templates

Build your business plan faster and easier with AI

Plans starting from $7/month

2. Business Overview

The business overview section of your business plan offers detailed information about your company. The details you add will depend on how important they are to your business. Yet, business name, location, business history, and future goals are some of the foundational elements you must consider adding to this section:

Business Description:

Describe your business in this section by providing all the basic information:

Describe what kind of investment company you run and the name of it. You may specialize in one of the following investment businesses:

- Mutual fund companies

- Venture capital funds

- Private equity funds

- Asset management companies

- Pension fund managers

- Describe the legal structure of your investment company, whether it is a sole proprietorship, LLC, partnership, or others.

- Explain where your business is located and why you selected the place.

Mission Statement:

Business history:.

If you’re an established investment company, briefly describe your business history, like—when it was founded, how it evolved over time, etc.

Future Goals:

This section should provide a thorough understanding of your business, its history, and its future plans. Keep this section engaging, precise, and to the point.

3. Market Analysis

The market analysis section of your business plan should offer a thorough understanding of the industry with the target market, competitors, and growth opportunities. You should include the following components in this section.

Target market:

Start this section by describing your target market. Define your ideal customer and explain what types of services they prefer. Creating a buyer persona will help you easily define your target market to your readers.

Market size and growth potential:

Describe your market size and growth potential and whether you will target a niche or a much broader market.

Competitive Analysis:

Market trends:.

Analyze emerging trends in the industry, such as technology disruptions, changes in customer behavior or preferences, etc. Explain how your business will cope with all the trends.

Regulatory Environment:

Here are a few tips for writing the market analysis section of your investment company business plan:

- Conduct market research, industry reports, and surveys to gather data.

- Provide specific and detailed information whenever possible.

- Illustrate your points with charts and graphs.

- Write your business plan keeping your target audience in mind.

4. Products And Services

The product and services section should describe the specific services and products that will be offered to customers. To write this section should include the following:

Describe your services:

Mention the investment company services your business will offer. This list may include services like,

- Portfolio management

- Financial planning

- Investment research and analysis

- Wealth management

- Mutual funds and exchange-traded funds

Investment advisory services:

Additional services:.

In short, this section of your investment business plan must be informative, precise, and client-focused. By providing a clear and compelling description of your offerings, you can help potential investors and readers understand the value of your business.

5. Sales And Marketing Strategies

Writing the sales and marketing strategies section means a list of strategies you will use to attract and retain your clients. Here are some key elements to include in your sales & marketing plan:

Unique Selling Proposition (USP):

Define your business’s USPs depending on the market you serve, the equipment you use, and the unique services you provide. Identifying USPs will help you plan your marketing strategies.

Pricing Strategy:

Marketing strategies:, sales strategies:, customer retention:.

Overall, this section of your investment company business plan should focus on customer acquisition and retention.

Have a specific, realistic, and data-driven approach while planning sales and marketing strategies for your investment business, and be prepared to adapt or make strategic changes in your strategies based on feedback and results.

6. Operations Plan

The operations plan section of your business plan should outline the processes and procedures involved in your business operations, such as staffing requirements and operational processes. Here are a few components to add to your operations plan:

Staffing & Training:

Operational process:, equipment & software:.

Include the list of equipment and software required for investment business, such as servers & data storage, network equipment, trading platforms, customer relationship management software, portfolio management software, etc.

Adding these components to your operations plan will help you lay out your business operations, which will eventually help you manage your business effectively.

7. Management Team

The management team section provides an overview of your investment business’s management team. This section should provide a detailed description of each manager’s experience and qualifications, as well as their responsibilities and roles.

Founders/CEO:

Key managers:.

Introduce your management and key members of your team, and explain their roles and responsibilities.

Organizational structure:

Compensation plan:, advisors/consultants:.

Mentioning advisors or consultants in your business plans adds credibility to your business idea.

This section should describe the key personnel for your investment company, highlighting how you have the perfect team to succeed.

8. Financial Plan

Your financial plan section should provide a summary of your business’s financial projections for the first few years. Here are some key elements to include in your financial plan:

Profit & loss statement:

Cash flow statement:, balance sheet:, break-even point:.

Determine and mention your business’s break-even point—the point at which your business costs and revenue will be equal.

Financing Needs:

Be realistic with your financial projections, and make sure you offer relevant information and evidence to support your estimates.

9. Appendix

The appendix section of your plan should include any additional information supporting your business plan’s main content, such as market research, legal documentation, financial statements, and other relevant information.

- Add a table of contents for the appendix section to help readers easily find specific information or sections.

- In addition to your financial statements, provide additional financial documents like tax returns, a list of assets within the business, credit history, and more. These statements must be the latest and offer financial projections for at least the first three or five years of business operations

- Provide data derived from market research, including stats about the industry, user demographics, and industry trends.

- Include any legal documents such as permits, licenses, and contracts.

- Include any additional documentation related to your business plan, such as product brochures, marketing materials, operational procedures, etc.

Use clear headings and labels for each section of the appendix so that readers can easily find the necessary information.

Remember, the appendix section of your investment firm business plan should only include relevant and important information supporting your plan’s main content.

The Quickest Way to turn a Business Idea into a Business Plan

Fill-in-the-blanks and automatic financials make it easy.

This sample investment company business plan will provide an idea for writing a successful investment company plan, including all the essential components of your business.

After this, if you still need clarification about writing an investment-ready business plan to impress your audience, download our investment company business plan pdf .

Related Posts

Bookkeeping Business Plan

Concierge Services Business Plan

How to make Perfect Business Outline

Simple Business Plan Template Example

What are Business Plan Components

How to Write Business Plan Appendix

Frequently asked questions, why do you need an investment company business plan.

A business plan is an essential tool for anyone looking to start or run a successful investment business. It helps to get clarity in your business, secures funding, and identifies potential challenges while starting and growing your business.

Overall, a well-written plan can help you make informed decisions, which can contribute to the long-term success of your investment company.

How to get funding for your investment company?

There are several ways to get funding for your investment company, but self-funding is one of the most efficient and speedy funding options. Other options for funding are:

Small Business Administration (SBA) loan

Crowdfunding, angel investors.

Apart from all these options, there are small business grants available, check for the same in your location and you can apply for it.

Where to find business plan writers for your investment company?

There are many business plan writers available, but no one knows your business and ideas better than you, so we recommend you write your investment company business plan and outline your vision as you have in your mind.

What is the easiest way to write your investment company business plan?

A lot of research is necessary for writing a business plan, but you can write your plan most efficiently with the help of any investment company business plan example and edit it as per your need. You can also quickly finish your plan in just a few hours or less with the help of our business plan software .

About the Author

Upmetrics Team

Upmetrics is the #1 business planning software that helps entrepreneurs and business owners create investment-ready business plans using AI. We regularly share business planning insights on our blog. Check out the Upmetrics blog for such interesting reads. Read more

Plan your business in the shortest time possible

No Risk – Cancel at Any Time – 15 Day Money Back Guarantee

Create a great Business Plan with great price.

- 400+ Business plan templates & examples

- AI Assistance & step by step guidance

- 4.8 Star rating on Trustpilot

Streamline your business planning process with Upmetrics .

- Small Business

- How to Start a Business

How to Start a Business: A Comprehensive Guide and Essential Steps

Building an effective business launch plan

- Search Search Please fill out this field.

Conducting Market Research

Crafting a business plan, reviewing funding options, understanding legal requirements, implementing marketing strategies, the bottom line.

:max_bytes(150000):strip_icc():format(webp)/Headshot-4c571aa3d8044192bcbd7647dd137cf1.jpg)

- How to Start a Business: A Comprehensive Guide and Essential Steps CURRENT ARTICLE

- How to Do Market Research, Types, and Example

- Marketing Strategy: What It Is, How It Works, How To Create One

- Marketing in Business: Strategies and Types Explained

- What Is a Marketing Plan? Types and How to Write One

- Business Development: Definition, Strategies, Steps & Skills

- Business Plan: What It Is, What's Included, and How to Write One

- Small Business Development Center (SBDC): Meaning, Types, Impact

- How to Write a Business Plan for a Loan

- Business Startup Costs: It’s in the Details

- Startup Capital Definition, Types, and Risks

- Bootstrapping Definition, Strategies, and Pros/Cons

- Crowdfunding: What It Is, How It Works, and Popular Websites

- Starting a Business with No Money: How to Begin

- A Comprehensive Guide to Establishing Business Credit

- Equity Financing: What It Is, How It Works, Pros and Cons

- Best Startup Business Loans

- Sole Proprietorship: What It Is, Pros & Cons, and Differences From an LLC

- Partnership: Definition, How It Works, Taxation, and Types

- What is an LLC? Limited Liability Company Structure and Benefits Defined

- Corporation: What It Is and How to Form One

- Starting a Small Business: Your Complete How-to Guide

- Starting an Online Business: A Step-by-Step Guide

- How to Start Your Own Bookkeeping Business: Essential Tips

- How to Start a Successful Dropshipping Business: A Comprehensive Guide

Starting a business in the United States involves a number of different steps spanning legal considerations, market research, creating a business plan, securing funding, and developing a marketing strategy. It also requires decisions about a business’ location, structure, name, taxation, and registration. Here are the key steps involved in starting a business, as well as important aspects of the process for entrepreneurs to consider.

Key Takeaways

- Entrepreneurs should start by conducting market research to understand their industry space, competition, and target customers.

- The next step is to write a comprehensive business plan, outlining the company’s structure, vision, and strategy.

- Securing funding in the form of grants, loans, venture capital, and/or crowdfunded money is crucial if you’re not self-funding.

- When choosing a venue, be aware of local regulations and requirements.

- Design your business structure with an eye to legal aspects, such as taxation and registration.

- Make a strategic marketing plan that addresses the specifics of the business, industry, and target market.

Before starting a business, entrepreneurs should conduct market research to determine their target audience, competition, and market trends. The U.S. Small Business Administration (SBA) breaks down common market considerations as follows:

- Demand : Is there a need for this product or service?

- Market size : How many people might be interested?

- Economic indicators : What are the income, employment rate, and spending habits of potential customers?

- Location : Are the target market and business well situated for each other?

- Competition : What is the market saturation ? Who and how many are you going up against?

- Pricing : What might a customer be willing to pay?

Market research should also include an analysis of market opportunities, barriers to market entry, and industry trends, as well as the competition’s strengths, weaknesses, and market share .