- Sources of Business Finance

- Small Business Loans

- Small Business Grants

- Crowdfunding Sites

- How to Get a Business Loan

- Small Business Insurance Providers

- Best Factoring Companies

- Types of Bank Accounts

- Best Banks for Small Business

- Best Business Bank Accounts

- Open a Business Bank Account

- Bank Accounts for Small Businesses

- Free Business Checking Accounts

- Best Business Credit Cards

- Get a Business Credit Card

- Business Credit Cards for Bad Credit

- Build Business Credit Fast

- Business Loan Eligibility Criteria

- Small-Business Bookkeeping Basics

- How to Set Financial Goals

- Business Loan Calculators

- How to Calculate ROI

- Calculate Net Income

- Calculate Working Capital

- Calculate Operating Income

- Calculate Net Present Value (NPV)

- Calculate Payroll Tax

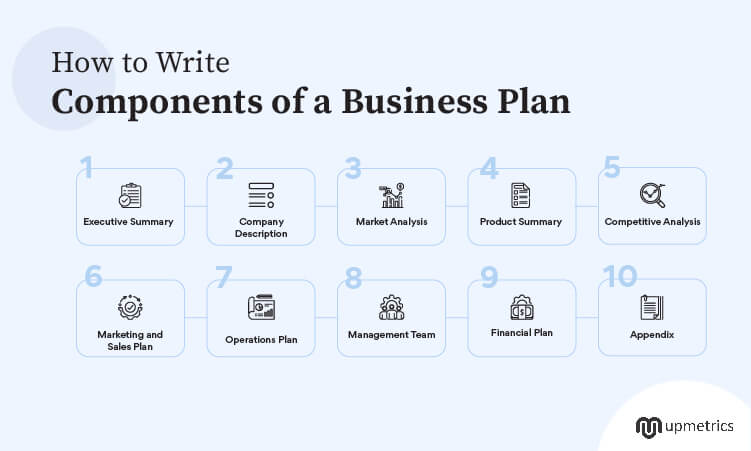

12 Key Elements of a Business Plan (Top Components Explained)

Starting and running a successful business requires proper planning and execution of effective business tactics and strategies .

You need to prepare many essential business documents when starting a business for maximum success; the business plan is one such document.

When creating a business, you want to achieve business objectives and financial goals like productivity, profitability, and business growth. You need an effective business plan to help you get to your desired business destination.

Even if you are already running a business, the proper understanding and review of the key elements of a business plan help you navigate potential crises and obstacles.

This article will teach you why the business document is at the core of any successful business and its key elements you can not avoid.

Let’s get started.

Why Are Business Plans Important?

Business plans are practical steps or guidelines that usually outline what companies need to do to reach their goals. They are essential documents for any business wanting to grow and thrive in a highly-competitive business environment .

1. Proves Your Business Viability

A business plan gives companies an idea of how viable they are and what actions they need to take to grow and reach their financial targets. With a well-written and clearly defined business plan, your business is better positioned to meet its goals.

2. Guides You Throughout the Business Cycle

A business plan is not just important at the start of a business. As a business owner, you must draw up a business plan to remain relevant throughout the business cycle .

During the starting phase of your business, a business plan helps bring your ideas into reality. A solid business plan can secure funding from lenders and investors.

After successfully setting up your business, the next phase is management. Your business plan still has a role to play in this phase, as it assists in communicating your business vision to employees and external partners.

Essentially, your business plan needs to be flexible enough to adapt to changes in the needs of your business.

3. Helps You Make Better Business Decisions

As a business owner, you are involved in an endless decision-making cycle. Your business plan helps you find answers to your most crucial business decisions.

A robust business plan helps you settle your major business components before you launch your product, such as your marketing and sales strategy and competitive advantage.

4. Eliminates Big Mistakes

Many small businesses fail within their first five years for several reasons: lack of financing, stiff competition, low market need, inadequate teams, and inefficient pricing strategy.

Creating an effective plan helps you eliminate these big mistakes that lead to businesses' decline. Every business plan element is crucial for helping you avoid potential mistakes before they happen.

5. Secures Financing and Attracts Top Talents

Having an effective plan increases your chances of securing business loans. One of the essential requirements many lenders ask for to grant your loan request is your business plan.

A business plan helps investors feel confident that your business can attract a significant return on investments ( ROI ).

You can attract and retain top-quality talents with a clear business plan. It inspires your employees and keeps them aligned to achieve your strategic business goals.

Key Elements of Business Plan

Starting and running a successful business requires well-laid actions and supporting documents that better position a company to achieve its business goals and maximize success.

A business plan is a written document with relevant information detailing business objectives and how it intends to achieve its goals.

With an effective business plan, investors, lenders, and potential partners understand your organizational structure and goals, usually around profitability, productivity, and growth.

Every successful business plan is made up of key components that help solidify the efficacy of the business plan in delivering on what it was created to do.

Here are some of the components of an effective business plan.

1. Executive Summary

One of the key elements of a business plan is the executive summary. Write the executive summary as part of the concluding topics in the business plan. Creating an executive summary with all the facts and information available is easier.

In the overall business plan document, the executive summary should be at the forefront of the business plan. It helps set the tone for readers on what to expect from the business plan.

A well-written executive summary includes all vital information about the organization's operations, making it easy for a reader to understand.

The key points that need to be acted upon are highlighted in the executive summary. They should be well spelled out to make decisions easy for the management team.

A good and compelling executive summary points out a company's mission statement and a brief description of its products and services.

An executive summary summarizes a business's expected value proposition to distinct customer segments. It highlights the other key elements to be discussed during the rest of the business plan.

Including your prior experiences as an entrepreneur is a good idea in drawing up an executive summary for your business. A brief but detailed explanation of why you decided to start the business in the first place is essential.

Adding your company's mission statement in your executive summary cannot be overemphasized. It creates a culture that defines how employees and all individuals associated with your company abide when carrying out its related processes and operations.

Your executive summary should be brief and detailed to catch readers' attention and encourage them to learn more about your company.

Components of an Executive Summary

Here are some of the information that makes up an executive summary:

- The name and location of your company

- Products and services offered by your company

- Mission and vision statements

- Success factors of your business plan

2. Business Description

Your business description needs to be exciting and captivating as it is the formal introduction a reader gets about your company.

What your company aims to provide, its products and services, goals and objectives, target audience , and potential customers it plans to serve need to be highlighted in your business description.

A company description helps point out notable qualities that make your company stand out from other businesses in the industry. It details its unique strengths and the competitive advantages that give it an edge to succeed over its direct and indirect competitors.

Spell out how your business aims to deliver on the particular needs and wants of identified customers in your company description, as well as the particular industry and target market of the particular focus of the company.

Include trends and significant competitors within your particular industry in your company description. Your business description should contain what sets your company apart from other businesses and provides it with the needed competitive advantage.

In essence, if there is any area in your business plan where you need to brag about your business, your company description provides that unique opportunity as readers look to get a high-level overview.

Components of a Business Description

Your business description needs to contain these categories of information.

- Business location

- The legal structure of your business

- Summary of your business’s short and long-term goals

3. Market Analysis

The market analysis section should be solely based on analytical research as it details trends particular to the market you want to penetrate.

Graphs, spreadsheets, and histograms are handy data and statistical tools you need to utilize in your market analysis. They make it easy to understand the relationship between your current ideas and the future goals you have for the business.

All details about the target customers you plan to sell products or services should be in the market analysis section. It helps readers with a helpful overview of the market.

In your market analysis, you provide the needed data and statistics about industry and market share, the identified strengths in your company description, and compare them against other businesses in the same industry.

The market analysis section aims to define your target audience and estimate how your product or service would fare with these identified audiences.

Market analysis helps visualize a target market by researching and identifying the primary target audience of your company and detailing steps and plans based on your audience location.

Obtaining this information through market research is essential as it helps shape how your business achieves its short-term and long-term goals.

Market Analysis Factors

Here are some of the factors to be included in your market analysis.

- The geographical location of your target market

- Needs of your target market and how your products and services can meet those needs

- Demographics of your target audience

Components of the Market Analysis Section

Here is some of the information to be included in your market analysis.

- Industry description and statistics

- Demographics and profile of target customers

- Marketing data for your products and services

- Detailed evaluation of your competitors

4. Marketing Plan

A marketing plan defines how your business aims to reach its target customers, generate sales leads, and, ultimately, make sales.

Promotion is at the center of any successful marketing plan. It is a series of steps to pitch a product or service to a larger audience to generate engagement. Note that the marketing strategy for a business should not be stagnant and must evolve depending on its outcome.

Include the budgetary requirement for successfully implementing your marketing plan in this section to make it easy for readers to measure your marketing plan's impact in terms of numbers.

The information to include in your marketing plan includes marketing and promotion strategies, pricing plans and strategies , and sales proposals. You need to include how you intend to get customers to return and make repeat purchases in your business plan.

5. Sales Strategy

Sales strategy defines how you intend to get your product or service to your target customers and works hand in hand with your business marketing strategy.

Your sales strategy approach should not be complex. Break it down into simple and understandable steps to promote your product or service to target customers.

Apart from the steps to promote your product or service, define the budget you need to implement your sales strategies and the number of sales reps needed to help the business assist in direct sales.

Your sales strategy should be specific on what you need and how you intend to deliver on your sales targets, where numbers are reflected to make it easier for readers to understand and relate better.

6. Competitive Analysis

Providing transparent and honest information, even with direct and indirect competitors, defines a good business plan. Provide the reader with a clear picture of your rank against major competitors.

Identifying your competitors' weaknesses and strengths is useful in drawing up a market analysis. It is one information investors look out for when assessing business plans.

The competitive analysis section clearly defines the notable differences between your company and your competitors as measured against their strengths and weaknesses.

This section should define the following:

- Your competitors' identified advantages in the market

- How do you plan to set up your company to challenge your competitors’ advantage and gain grounds from them?

- The standout qualities that distinguish you from other companies

- Potential bottlenecks you have identified that have plagued competitors in the same industry and how you intend to overcome these bottlenecks

In your business plan, you need to prove your industry knowledge to anyone who reads your business plan. The competitive analysis section is designed for that purpose.

7. Management and Organization

Management and organization are key components of a business plan. They define its structure and how it is positioned to run.

Whether you intend to run a sole proprietorship, general or limited partnership, or corporation, the legal structure of your business needs to be clearly defined in your business plan.

Use an organizational chart that illustrates the hierarchy of operations of your company and spells out separate departments and their roles and functions in this business plan section.

The management and organization section includes profiles of advisors, board of directors, and executive team members and their roles and responsibilities in guaranteeing the company's success.

Apparent factors that influence your company's corporate culture, such as human resources requirements and legal structure, should be well defined in the management and organization section.

Defining the business's chain of command if you are not a sole proprietor is necessary. It leaves room for little or no confusion about who is in charge or responsible during business operations.

This section provides relevant information on how the management team intends to help employees maximize their strengths and address their identified weaknesses to help all quarters improve for the business's success.

8. Products and Services

This business plan section describes what a company has to offer regarding products and services to the maximum benefit and satisfaction of its target market.

Boldly spell out pending patents or copyright products and intellectual property in this section alongside costs, expected sales revenue, research and development, and competitors' advantage as an overview.

At this stage of your business plan, the reader needs to know what your business plans to produce and sell and the benefits these products offer in meeting customers' needs.

The supply network of your business product, production costs, and how you intend to sell the products are crucial components of the products and services section.

Investors are always keen on this information to help them reach a balanced assessment of if investing in your business is risky or offer benefits to them.

You need to create a link in this section on how your products or services are designed to meet the market's needs and how you intend to keep those customers and carve out a market share for your company.

Repeat purchases are the backing that a successful business relies on and measure how much customers are into what your company is offering.

This section is more like an expansion of the executive summary section. You need to analyze each product or service under the business.

9. Operating Plan

An operations plan describes how you plan to carry out your business operations and processes.

The operating plan for your business should include:

- Information about how your company plans to carry out its operations.

- The base location from which your company intends to operate.

- The number of employees to be utilized and other information about your company's operations.

- Key business processes.

This section should highlight how your organization is set up to run. You can also introduce your company's management team in this section, alongside their skills, roles, and responsibilities in the company.

The best way to introduce the company team is by drawing up an organizational chart that effectively maps out an organization's rank and chain of command.

What should be spelled out to readers when they come across this business plan section is how the business plans to operate day-in and day-out successfully.

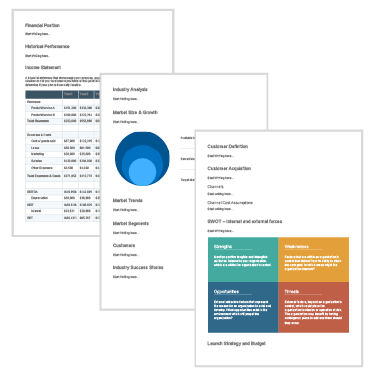

10. Financial Projections and Assumptions

Bringing your great business ideas into reality is why business plans are important. They help create a sustainable and viable business.

The financial section of your business plan offers significant value. A business uses a financial plan to solve all its financial concerns, which usually involves startup costs, labor expenses, financial projections, and funding and investor pitches.

All key assumptions about the business finances need to be listed alongside the business financial projection, and changes to be made on the assumptions side until it balances with the projection for the business.

The financial plan should also include how the business plans to generate income and the capital expenditure budgets that tend to eat into the budget to arrive at an accurate cash flow projection for the business.

Base your financial goals and expectations on extensive market research backed with relevant financial statements for the relevant period.

Examples of financial statements you can include in the financial projections and assumptions section of your business plan include:

- Projected income statements

- Cash flow statements

- Balance sheets

- Income statements

Revealing the financial goals and potentials of the business is what the financial projection and assumption section of your business plan is all about. It needs to be purely based on facts that can be measurable and attainable.

11. Request For Funding

The request for funding section focuses on the amount of money needed to set up your business and underlying plans for raising the money required. This section includes plans for utilizing the funds for your business's operational and manufacturing processes.

When seeking funding, a reasonable timeline is required alongside it. If the need arises for additional funding to complete other business-related projects, you are not left scampering and desperate for funds.

If you do not have the funds to start up your business, then you should devote a whole section of your business plan to explaining the amount of money you need and how you plan to utilize every penny of the funds. You need to explain it in detail for a future funding request.

When an investor picks up your business plan to analyze it, with all your plans for the funds well spelled out, they are motivated to invest as they have gotten a backing guarantee from your funding request section.

Include timelines and plans for how you intend to repay the loans received in your funding request section. This addition keeps investors assured that they could recoup their investment in the business.

12. Exhibits and Appendices

Exhibits and appendices comprise the final section of your business plan and contain all supporting documents for other sections of the business plan.

Some of the documents that comprise the exhibits and appendices section includes:

- Legal documents

- Licenses and permits

- Credit histories

- Customer lists

The choice of what additional document to include in your business plan to support your statements depends mainly on the intended audience of your business plan. Hence, it is better to play it safe and not leave anything out when drawing up the appendix and exhibit section.

Supporting documentation is particularly helpful when you need funding or support for your business. This section provides investors with a clearer understanding of the research that backs the claims made in your business plan.

There are key points to include in the appendix and exhibits section of your business plan.

- The management team and other stakeholders resume

- Marketing research

- Permits and relevant legal documents

- Financial documents

Was This Article Helpful?

Martin luenendonk.

Martin loves entrepreneurship and has helped dozens of entrepreneurs by validating the business idea, finding scalable customer acquisition channels, and building a data-driven organization. During his time working in investment banking, tech startups, and industry-leading companies he gained extensive knowledge in using different software tools to optimize business processes.

This insights and his love for researching SaaS products enables him to provide in-depth, fact-based software reviews to enable software buyers make better decisions.

We earn commissions if you shop through the links below. Read more

8 Components of a Business Plan

Back to Business Plans

Written by: Carolyn Young

Carolyn Young is a business writer who focuses on entrepreneurial concepts and the business formation. She has over 25 years of experience in business roles, and has authored several entrepreneurship textbooks.

Edited by: David Lepeska

David has been writing and learning about business, finance and globalization for a quarter-century, starting with a small New York consulting firm in the 1990s.

Published on February 19, 2023

A key part of the business startup process is putting together a business plan , particularly if you’d like to raise capital. It’s not going to be easy, but it’s absolutely essential, and an invaluable learning tool.

Creating a business plan early helps you think through every aspect of your business, from operations and financing to growth and vision. In the end, the knowledge you’ll gain could be the difference between success and failure.

But what exactly does a business plan consist of? There are eight essential components, all of which are detailed in this handy guide.

1. Executive Summary

The executive summary opens your business plan , but it’s the section you’ll write last. It summarizes the key points and highlights the most important aspects of your plan. Often investors and lenders will only read the executive summary; if it doesn’t capture their interest they’ll stop reading, so it’s important to make it as compelling as possible.

The components touched upon should include:

- The business opportunity – what problem are you solving in the market?

- Your idea, meaning the product or service you’re planning to offer, and why it solves the problem in the market better than other solutions.

- The history of the business so far – what have you done to this point? When you’re just getting started, this may be nothing more than coming up with the idea, choosing a business name , and forming a business entity.

- A summary of the industry, market size, your target customers, and the competition.

- A strong statement about how your company is going to stand out in the market – what will be your competitive advantage?

- A list of specific goals that you plan to achieve in the short term, such as developing your product, launching a marketing campaign, or hiring a key person.

- A summary of your financial plan including cost and sales projections and a break-even analysis.

- A summary of your management team, their roles, and the relevant experience that they have to serve in those roles.

- Your “ask”, if applicable, meaning what you’re requesting from the investor or lender. You’ll include the amount you’d like and how it will be spent, such as “We are seeking $50,000 in seed funding to develop our beta product”.

Remember that if you’re seeking capital, the executive summary could make or break your venture. Take your time and make sure it illustrates how your business is unique in the market and why you’ll succeed.

The executive summary should be no more than two pages long, so it’s important to capture the reader’s interest from the start.

- 2. Company Description/Overview

In this section, you’ll detail your full company history, such as how you came up with the idea for your business and any milestones or achievements.

You’ll also include your mission and vision statements. A mission statement explains what you’d like your business to achieve, its driving force, while a vision statement lays out your long-term plan in terms of growth.

A mission statement might be “Our company aims to make life easier for business owners with intuitive payroll software”, while a vision statement could be “Our objective is to become the go-to comprehensive HR software provider for companies around the globe.”

In this section, you’ll want to list your objectives – specific short-term goals. Examples might include “complete initial product development by ‘date’” or “hire two qualified sales people” or “launch the first version of the product”.

It’s best to divide this section into subsections – company history, mission and vision, and objectives.

3. Products/Services Offered

Here you’ll go into detail about what you’re offering, how it solves a problem in the market, and how it’s unique. Don’t be afraid to share information that is proprietary – investors and lenders are not out to steal your ideas.

Also specify how your product is developed or sourced. Are you manufacturing it or does it require technical development? Are you purchasing a product from a manufacturer or wholesaler?

You’ll also want to specify how you’ll sell your product or service. Will it be a subscription service or a one time purchase? What is your target pricing? On what channels do you plan to sell your product or service, such as online or by direct sales in a store?

Basically, you’re describing what you’re going to sell and how you’ll make money.

- 4. Market Analysis

The market analysis is where you’re going to spend most of your time because it involves a lot of research. You should divide it into four sections.

Industry analysis

You’ll want to find out exactly what’s happening in your industry, such as its growth rate, market size, and any specific trends that are occurring. Where is the industry predicted to be in 10 years? Cite your sources where you can by providing links.

Then describe your company’s place in the market. Is your product going to fit a certain niche? Is there a sub-industry your company will fit within? How will you keep up with industry changes?

Competitor analysis

Now you’ll dig into your competition. Detail your main competitors and how they differentiate themselves in the market. For example, one competitor may advertise convenience while another may tout superior quality. Also highlight your competitors’ weaknesses.

Next, describe how you’ll stand out. Detail your competitive advantages and how you’ll sustain them. This section is extremely important and will be a focus for investors and lenders.

Target market analysis

Here you’ll describe your target market and whether it’s different from your competitors’. For example, maybe you have a younger demographic in mind?

You’ll need to know more about your target market than demographics, though. You’ll want to explain the needs and wants of your ideal customers, how your offering solves their problem, and why they will choose your company.

You should also lay out where you’ll find them, where to place your marketing and where to sell your products. Learning this kind of detail requires going to the source – your potential customers. You can do online surveys or even in-person focus groups.

Your goal will be to uncover as much about these people as possible. When you start selling, you’ll want to keep learning about your customers. You may end up selling to a different target market than you originally thought, which could lead to a marketing shift.

SWOT analysis

SWOT stands for strengths, weaknesses, opportunities, and threats, and it’s one of the more common and helpful business planning tools.

First describe all the specific strengths of your company, such as the quality of your product or some unique feature, such as the experience of your management team. Talk about the elements that will make your company successful.

Next, acknowledge and explore possible weaknesses. You can’t say “none”, because no company is perfect, especially at the start. Maybe you lack funds or face a massive competitor. Whatever it is, detail how you will surmount this hurdle.

Next, talk about the opportunities your company has in the market. Perhaps you’re going to target an underserved segment, or have a technology plan that will help you surge past the competition.

Finally, examine potential threats. It could be a competitor that might try to replicate your product or rapidly advancing technology in your industry. Again, discuss your plans to handle such threats if they come to pass.

5. Marketing and Sales Strategies

Now it’s time to explain how you’re going to find potential customers and convert them into paying customers.

Marketing and advertising plan

When you did your target market analysis, you should have learned a lot about your potential customers, including where to find them. This should help you determine where to advertise.

Maybe you found that your target customers favor TikTok over Instagram and decided to spend more marketing dollars on TikTok. Detail all the marketing channels you plan to use and why.

Your target market analysis should also have given you information about what kind of message will resonate with your target customers. You should understand their needs and wants and how your product solves their problem, then convey that in your marketing.

Start by creating a value proposition, which should be no more than two sentences long and answer the following questions:

- What are you offering

- Whose problem does it solve

- What problem does it solve

- What benefits does it provide

- How is it better than competitor products

An example might be “Payroll software that will handle all the payroll needs of small business owners, making life easier for less.”

Whatever your value proposition, it should be at the heart of all of your marketing.

Sales strategy and tactics

Your sales strategy is a vision to persuade customers to buy, including where you’ll sell and how. For example, you may plan to sell only on your own website, or you may sell from both a physical location and online. On the other hand, you may have a sales team that will make direct sales calls to potential customers, which is more common in business-to-business sales.

Sales tactics are more about how you’re going to get them to buy after they reach your sales channel. Even when selling online, you need something on your site that’s going to get them to go from a site visitor to a paying customer.

By the same token, if you’re going to have a sales team making direct sales, what message are they going to deliver that will entice a sale? It’s best for sales tactics to focus on the customer’s pain point and what value you’re bringing to the table, rather than being aggressively promotional about the greatness of your product and your business.

Pricing strategy

Pricing is not an exact science and should depend on several factors. First, consider how you want your product or service to be perceived in the market. If your differentiator is to be the lowest price, position your company as the “discount” option. Think Walmart, and price your products lower than the competition.

If, on the other hand, you want to be the Mercedes of the market, then you’ll position your product as the luxury option. Of course you’ll have to back this up with superior quality, but being the luxury option allows you to command higher prices.

You can, of course, fall somewhere in the middle, but the point is that pricing is a matter of perception. How you position your product in the market compared to the competition is a big factor in determining your price.

Of course, you’ll have to consider your costs, as well as competitor prices. Obviously, your prices must cover your costs and allow you to make a good profit margin.

Whatever pricing strategy you choose, you’ll justify it in this section of your plan.

- 6. Operations and Management

This section is the real nuts and bolts of your business – how it operates on a day-to-day basis and who is operating it. Again, this section should be divided into subsections.

Operational plan

Your plan of operations should be specific , detailed and mainly logistical. Who will be doing what on a daily, weekly, and monthly basis? How will the business be managed and how will quality be assured? Be sure to detail your suppliers and how and when you’ll order raw materials.

This should also include the roles that will be filled and the various processes that will be part of everyday business operations . Just consider all the critical functions that must be handled for your business to be able to operate on an ongoing basis.

Technology plan

If your product involves technical development, you’ll describe your tech development plan with specific goals and milestones. The plan will also include how many people will be working on this development, and what needs to be done for goals to be met.

If your company is not a technology company, you’ll describe what technologies you plan to use to run your business or make your business more efficient. It could be process automation software, payroll software, or just laptops and tablets for your staff.

Management and organizational structure

Now you’ll describe who’s running the show. It may be just you when you’re starting out, so you’ll detail what your role will be and summarize your background. You’ll also go into detail about any managers that you plan to hire and when that will occur.

Essentially, you’re explaining your management structure and detailing why your strategy will enable smooth and efficient operations.

Ideally, at some point, you’ll have an organizational structure that is a hierarchy of your staff. Describe what you envision your organizational structure to be.

Personnel plan

Detail who you’ve hired or plan to hire and for which roles. For example, you might have a developer, two sales people, and one customer service representative.

Describe each role and what qualifications are needed to perform those roles.

- 7. Financial Plan

Now, you’ll enter the dreaded world of finance. Many entrepreneurs struggle with this part, so you might want to engage a financial professional to help you. A financial plan has five key elements.

Startup Costs

Detail in a spreadsheet every cost you’ll incur before you open your doors. This should determine how much capital you’ll need to launch your business.

Financial projections

Creating financial projections, like many facets of business, is not an exact science. If your company has no history, financial projections can only be an educated guess.

First, come up with realistic sales projections. How much do you expect to sell each month? Lay out at least three years of sales projections, detailing monthly sales growth for the first year, then annually thereafter.

Calculate your monthly costs, keeping in mind that some costs will grow along with sales.

Once you have your numbers projected and calculated, use them to create these three key financial statements:

- Profit and Loss Statement , also known as an income statement. This shows projected revenue and lists all costs, which are then deducted to show net profit or loss.

- Cash Flow Statement. This shows how much cash you have on hand at any given time. It will have a starting balance, projections of cash coming in, and cash going out, which will be used to calculate cash on hand at the end of the reporting period.

- Balance Sheet. This shows the net worth of the business, which is the assets of the business minus debts. Assets include equipment, cash, accounts receivables, inventory, and more. Debts include outstanding loan balances and accounts payable.

You’ll need monthly projected versions of each statement for the first year, then annual projections for the following two years.

Break-even analysis

The break-even point for your business is when costs and revenue are equal. Most startups operate at a loss for a period of time before they break even and start to make a profit. Your break-even analysis will project when your break-even point will occur, and will be informed by your profit and loss statement.

Funding requirements and sources

Lay out the funding you’ll need, when, and where you’ll get it. You’ll also explain what those funds will be used for at various points. If you’re in a high growth industry that can attract investors, you’ll likely need various rounds of funding to launch and grow.

Key performance indicators (KPIs)

KPIs measure your company’s performance and can determine success. Many entrepreneurs only focus on the bottom line, but measuring specific KPIs helps find areas of improvement. Every business has certain crucial metrics.

If you sell only online, one of your key metrics might be your visitor conversion rate. You might do an analysis to learn why just one out of ten site visitors makes a purchase.

Perhaps the purchase process is too complicated or your product descriptions are vague. The point is, learning why your conversion rate is low gives you a chance to improve it and boost sales.

8. Appendices

In the appendices, you can attach documents such as manager resumes or any other documents that support your business plan.

As you can see, a business plan has many components, so it’s not an afternoon project. It will likely take you several weeks and a great deal of work to complete. Unless you’re a finance guru, you may also want some help from a financial professional.

Keep in mind that for a small business owner, there may be no better learning experience than writing a detailed and compelling business plan. It shouldn’t be viewed as a hassle, but as an opportunity!

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- Executive Summary

- Products/Services Offered

- Marketing and Sales Strategies

Subscribe to Our Newsletter

Featured resources.

Crafting the Perfect Business Plan: A Deep Dive with Upmetrics’ Vinay Kevadiya

Carolyn Young

Published on October 13, 2023

In the first segment of our conversation with Vinay Kevadiya, the visionary behind Upmetrics, we explored the platform’s origins and itsunique ...

LivePlan Software Review: Features, Cost, Pros & Cons

Published on September 15, 2023

When you’re starting a business, a business plan is essential whether you’re going to obtain financing or not. Creating a business plan helpsyou ...

What to Include in Your Business Plan Appendix?

Published on September 13, 2023

Launching a business involves countless tasks, and one of the crucial early hurdles is writing a business plan. Many entrepreneurs who aren’tlooki ...

No thanks, I don't want to stay up to date on industry trends and news.

- Customer Reviews

- Net 30 Account

- Wise Services

- Steps & Timeline

- Work at a Glance

- Market Research at a Glance

- Business Plan Writing Services

- Bank Business Plan

- Investor Business Plan

- Franchise Business Plan

- Cannabis Business Plan

- Strategic Business Plan

- Corporate Business Plan

- Merge and Acquisition Business Plan (M&A)

- Private Placement Memorandums (PPM)

- Sample Business Plans

- Professional Feasibility Study

- PowerPoint Presentations

- Pitch Deck Presentation Services

- Business Plan Printing

- Market Research

- L-1 Business Plan

- E-2 Business Plan

- EB-5 Business Plan

- EB-5 Regional Centers

- Immigration Attorneys

- Nonprofit Business Plan

- Exit Business Planning

- Business Planning

- Business Formation

- Business License

- Business Website

- Business Branding

- Business Bank Account

- Digital Marketing

- Business Funding Resources

- Small Business Loans

- Venture Capital

- Net 30 Apply

8 Things You Need in a Business Plan

The Harvard Business Review says a good business plan is super important for entrepreneurs. It’s like a guide for them in the tricky world of business. The plan has different parts, and each part is like a piece of the puzzle for success.

For example, there’s the short and powerful Executive Summary that tells the most important things about the business. Then, there’s the smart Market Analysis that helps you understand what customers want.

All of these parts work together to make a strong plan. So, let’s take a closer look at these important pieces that help turn business dreams into successful reality.

What is a business plan?

A business plan is a detailed document that explains how a business works and what it aims to achieve. It outlines the business’s goals, strategies , and resources. It’s like a roadmap for the business, helping it stay on course and navigate challenges.

The plan typically includes sections about the business’s description , market research , marketing and sales strategies, operations, management, and financial projections .

Entrepreneurs use it to clarify their vision, secure funding, and measure progress. It’s a crucial tool for anyone starting or running a business, helping them make informed decisions and work toward success.

Need assistance in writing a business plan?

Contact our award-winning business plan writers now!

Eight Key Components of Business Plans

Crafting a business plan is akin to laying the foundation for a grand architectural masterpiece. It’s your roadmap to success, a strategic blueprint that breathes life into your entrepreneurial dreams. Allow me to take you on a journey through the essential components of this vital document.

- Executive Summary

- Business Description

- Market Analysis

- Marketing and Sales Strategy

- Operations Plan

- Management and Organization

- Financial Plan

1. Executive Summary

Picture this as the dazzling opening act of your business plan, where you showcase your vision, mission, and why your venture is destined for greatness. It’s a compelling glimpse into the heart and soul of your business.

It’s like a short summary of your business, including what it does and what makes it special.

- Advice: Keep it concise and engaging. Think of it as a teaser that makes people want to read more. Highlight what makes your business unique.

2. Business Description

Here, we dive deep into the DNA of your business. You’ll spill the beans on what you do, your industry, your history, and your grand plans for the future. It’s a snapshot that captures the essence of your business.

This part explains your business in detail, like what it sells, the industry it’s in, and its history.

- Advice: Be clear about what your business does and why it matters. Describe your industry and explain how your business fits into it.

Free Example Business Plans

Explore our free business plan samples now!

3. Market Analysis

This section is where we turn detective. We unearth market trends, study customer behaviors, and dissect your competitors. It’s a treasure trove of insights that helps you navigate the marketplace.

Here, you look at the market your business is in. You study things like customer behavior and what other businesses are doing.

- Advice: Research thoroughly. Understand your customers’ needs and your competition. Show that you know your market inside and out.

4. Marketing and Sales Strategy

Imagine this as the stage where you reveal your magic tricks. Here, you outline how you’ll entice and retain your customers. It’s where the art of attracting and selling meets strategy.

This section talks about how you’ll get customers and sell your products or services.

- Advice: Outline your plan for attracting customers and selling your products or services. Focus on how you’ll reach your target audience and convince them to buy from you.

5. Operations Plan

Ever wondered how the show runs backstage? This is where you spill the beans. From location to logistics, it’s the nitty-gritty of daily operations. It’s the backbone that keeps your business standing tall.

It’s about how your business will work day-to-day, like where you’ll be located and how you’ll make your products.

Advice: Detail how your business will operate day-to-day. Discuss your location, equipment, suppliers, and how you’ll ensure quality.

6. Management and Organization

Introducing the cast and crew of your business. Who’s in charge? What’s their expertise? It’s where you showcase your dream team and the hierarchy that keeps everything in check.

This part introduces the people running the business and how it’s organized.

- Advice: Introduce your team and their qualifications. Explain who’s in charge and how your business is structured.

7. Financial Plan

This section is your crystal ball into the future. It predicts your financial performance, balances your books, and forecasts cash flows. Investors love it, and you will too.

It’s like a prediction of how much money your business will make and spend in the future.

Advice: Be realistic with your financial projections. Include income, expenses, and cash flow predictions. Show how you’ll make a profit.

8. Appendix

This is your secret stash. All those extra documents, licenses, contracts, and accolades find their home here. It’s the vault of credibility that adds weight to your plan.

This is where you put extra documents like licenses, contracts, and other important stuff.

- Advice: Use this section for supporting documents. Include licenses, contracts, and anything that adds credibility to your plan.

Hire our professional business plan writing consultants now!

Remember, your business plan isn’t set in stone. It’s a living, breathing document that evolves with your journey. It’s your guiding star, your go-to reference, and your pitch to investors, all rolled into one.

With a well-crafted business plan, you’re equipped to clarify your vision, rally support from investors, and steer your venture to success. So, let’s get started on your masterpiece!

Quick Links

- Investor Business Plans

- M&A Business Plan

- Private Placement

- Feasibility Study

- Hire a Business Plan Writer

- Business Valuation Calculator

- Business Plan Examples

- Real Estate Business Plan

- Business Plan Template

- Business Plan Pricing Guide

- Business Plan Makeover

- SBA Loans, Bank Funding & Business Credit

- Finding & Qualifying for Business Grants

- Leadership for the New Manager

- Content Marketing for Beginners

- All About Crowdfunding

- EB-5 Regional Centers, A Step-By-Step Guide

- Logo Designer

- Landing Page

- PPC Advertising

- Business Entity

- Business Licensing

- Virtual Assistant

- Business Phone

- Business Address

- E-1 Visa Business Plan

- EB1-A Visa Business Plan

- EB1-C Visa Business Plan

- EB2-NIW Business Plan

- H1B Visa Business Plan

- O1 Visa Business Plan

- Business Brokers

- Merger & Acquisition Advisors

- Franchisors

Proud Sponsor of

- 1-800-496-1056

- (613) 800-0227

- +44 (1549) 409190

- +61 (2) 72510077

- Search Search Please fill out this field.

What Is a Business Plan?

Understanding business plans, how to write a business plan, common elements of a business plan, the bottom line, business plan: what it is, what's included, and how to write one.

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

- How to Start a Business: A Comprehensive Guide and Essential Steps

- How to Do Market Research, Types, and Example

- Marketing Strategy: What It Is, How It Works, How To Create One

- Marketing in Business: Strategies and Types Explained

- What Is a Marketing Plan? Types and How to Write One

- Business Development: Definition, Strategies, Steps & Skills

- Business Plan: What It Is, What's Included, and How to Write One CURRENT ARTICLE

- Small Business Development Center (SBDC): Meaning, Types, Impact

- How to Write a Business Plan for a Loan

- Business Startup Costs: It’s in the Details

- Startup Capital Definition, Types, and Risks

- Bootstrapping Definition, Strategies, and Pros/Cons

- Crowdfunding: What It Is, How It Works, and Popular Websites

- Starting a Business with No Money: How to Begin

- A Comprehensive Guide to Establishing Business Credit

- Equity Financing: What It Is, How It Works, Pros and Cons

- Best Startup Business Loans

- Sole Proprietorship: What It Is, Pros & Cons, and Differences From an LLC

- Partnership: Definition, How It Works, Taxation, and Types

- What is an LLC? Limited Liability Company Structure and Benefits Defined

- Corporation: What It Is and How to Form One

- Starting a Small Business: Your Complete How-to Guide

- Starting an Online Business: A Step-by-Step Guide

- How to Start Your Own Bookkeeping Business: Essential Tips

- How to Start a Successful Dropshipping Business: A Comprehensive Guide

A business plan is a document that outlines a company's goals and the strategies to achieve them. It's valuable for both startups and established companies. For startups, a well-crafted business plan is crucial for attracting potential lenders and investors. Established businesses use business plans to stay on track and aligned with their growth objectives. This article will explain the key components of an effective business plan and guidance on how to write one.

Key Takeaways

- A business plan is a document detailing a company's business activities and strategies for achieving its goals.

- Startup companies use business plans to launch their venture and to attract outside investors.

- For established companies, a business plan helps keep the executive team focused on short- and long-term objectives.

- There's no single required format for a business plan, but certain key elements are essential for most companies.

Investopedia / Ryan Oakley

Any new business should have a business plan in place before beginning operations. Banks and venture capital firms often want to see a business plan before considering making a loan or providing capital to new businesses.

Even if a company doesn't need additional funding, having a business plan helps it stay focused on its goals. Research from the University of Oregon shows that businesses with a plan are significantly more likely to secure funding than those without one. Moreover, companies with a business plan grow 30% faster than those that don't plan. According to a Harvard Business Review article, entrepreneurs who write formal plans are 16% more likely to achieve viability than those who don't.

A business plan should ideally be reviewed and updated periodically to reflect achieved goals or changes in direction. An established business moving in a new direction might even create an entirely new plan.

There are numerous benefits to creating (and sticking to) a well-conceived business plan. It allows for careful consideration of ideas before significant investment, highlights potential obstacles to success, and provides a tool for seeking objective feedback from trusted outsiders. A business plan may also help ensure that a company’s executive team remains aligned on strategic action items and priorities.

While business plans vary widely, even among competitors in the same industry, they often share basic elements detailed below.

A well-crafted business plan is essential for attracting investors and guiding a company's strategic growth. It should address market needs and investor requirements and provide clear financial projections.

While there are any number of templates that you can use to write a business plan, it's best to try to avoid producing a generic-looking one. Let your plan reflect the unique personality of your business.

Many business plans use some combination of the sections below, with varying levels of detail, depending on the company.

The length of a business plan can vary greatly from business to business. Regardless, gathering the basic information into a 15- to 25-page document is best. Any additional crucial elements, such as patent applications, can be referenced in the main document and included as appendices.

Common elements in many business plans include:

- Executive summary : This section introduces the company and includes its mission statement along with relevant information about the company's leadership, employees, operations, and locations.

- Products and services : Describe the products and services the company offers or plans to introduce. Include details on pricing, product lifespan, and unique consumer benefits. Mention production and manufacturing processes, relevant patents , proprietary technology , and research and development (R&D) information.

- Market analysis : Explain the current state of the industry and the competition. Detail where the company fits in, the types of customers it plans to target, and how it plans to capture market share from competitors.

- Marketing strategy : Outline the company's plans to attract and retain customers, including anticipated advertising and marketing campaigns. Describe the distribution channels that will be used to deliver products or services to consumers.

- Financial plans and projections : Established businesses should include financial statements, balance sheets, and other relevant financial information. New businesses should provide financial targets and estimates for the first few years. This section may also include any funding requests.

Investors want to see a clear exit strategy, expected returns, and a timeline for cashing out. It's likely a good idea to provide five-year profitability forecasts and realistic financial estimates.

2 Types of Business Plans

Business plans can vary in format, often categorized into traditional and lean startup plans. According to the U.S. Small Business Administration (SBA) , the traditional business plan is the more common of the two.

- Traditional business plans : These are detailed and lengthy, requiring more effort to create but offering comprehensive information that can be persuasive to potential investors.

- Lean startup business plans : These are concise, sometimes just one page, and focus on key elements. While they save time, companies should be ready to provide additional details if requested by investors or lenders.

Why Do Business Plans Fail?

A business plan isn't a surefire recipe for success. The plan may have been unrealistic in its assumptions and projections. Markets and the economy might change in ways that couldn't have been foreseen. A competitor might introduce a revolutionary new product or service. All this calls for building flexibility into your plan, so you can pivot to a new course if needed.

How Often Should a Business Plan Be Updated?

How frequently a business plan needs to be revised will depend on its nature. Updating your business plan is crucial due to changes in external factors (market trends, competition, and regulations) and internal developments (like employee growth and new products). While a well-established business might want to review its plan once a year and make changes if necessary, a new or fast-growing business in a fiercely competitive market might want to revise it more often, such as quarterly.

What Does a Lean Startup Business Plan Include?

The lean startup business plan is ideal for quickly explaining a business, especially for new companies that don't have much information yet. Key sections may include a value proposition , major activities and advantages, resources (staff, intellectual property, and capital), partnerships, customer segments, and revenue sources.

A well-crafted business plan is crucial for any company, whether it's a startup looking for investment or an established business wanting to stay on course. It outlines goals and strategies, boosting a company's chances of securing funding and achieving growth.

As your business and the market change, update your business plan regularly. This keeps it relevant and aligned with your current goals and conditions. Think of your business plan as a living document that evolves with your company, not something carved in stone.

University of Oregon Department of Economics. " Evaluation of the Effectiveness of Business Planning Using Palo Alto's Business Plan Pro ." Eason Ding & Tim Hursey.

Bplans. " Do You Need a Business Plan? Scientific Research Says Yes ."

Harvard Business Review. " Research: Writing a Business Plan Makes Your Startup More Likely to Succeed ."

Harvard Business Review. " How to Write a Winning Business Plan ."

U.S. Small Business Administration. " Write Your Business Plan ."

SCORE. " When and Why Should You Review Your Business Plan? "

:max_bytes(150000):strip_icc():format(webp)/GettyImages-904536858-c089bc26f4fd4025b23f536345ba73ae.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

What is a Business Plan? Definition and Resources

9 min. read

Updated July 29, 2024

If you’ve ever jotted down a business idea on a napkin with a few tasks you need to accomplish, you’ve written a business plan — or at least the very basic components of one.

The origin of formal business plans is murky. But they certainly go back centuries. And when you consider that 20% of new businesses fail in year 1 , and half fail within 5 years, the importance of thorough planning and research should be clear.

But just what is a business plan? And what’s required to move from a series of ideas to a formal plan? Here we’ll answer that question and explain why you need one to be a successful business owner.

- What is a business plan?

A business plan lays out a strategic roadmap for any new or growing business.

Any entrepreneur with a great idea for a business needs to conduct market research , analyze their competitors , validate their idea by talking to potential customers, and define their unique value proposition .

The business plan captures that opportunity you see for your company: it describes your product or service and business model , and the target market you’ll serve.

It also includes details on how you’ll execute your plan: how you’ll price and market your solution and your financial projections .

Reasons for writing a business plan

If you’re asking yourself, ‘Do I really need to write a business plan?’ consider this fact:

Companies that commit to planning grow 30% faster than those that don’t.

Creating a business plan is crucial for businesses of any size or stage. It helps you develop a working business and avoid consequences that could stop you before you ever start.

If you plan to raise funds for your business through a traditional bank loan or SBA loan , none of them will want to move forward without seeing your business plan. Venture capital firms may or may not ask for one, but you’ll still need to do thorough planning to create a pitch that makes them want to invest.

But it’s more than just a means of getting your business funded . The plan is also your roadmap to identify and address potential risks.

It’s not a one-time document. Your business plan is a living guide to ensure your business stays on course.

Related: 14 of the top reasons why you need a business plan

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

What research shows about business plans

Numerous studies have established that planning improves business performance:

- 71% of fast-growing companies have business plans that include budgets, sales goals, and marketing and sales strategies.

- Companies that clearly define their value proposition are more successful than those that can’t.

- Companies or startups with a business plan are more likely to get funding than those without one.

- Starting the business planning process before investing in marketing reduces the likelihood of business failure.

The planning process significantly impacts business growth for existing companies and startups alike.

Read More: Research-backed reasons why writing a business plan matters

When should you write a business plan?

No two business plans are alike.

Yet there are similar questions for anyone considering writing a plan to answer. One basic but important question is when to start writing it.

A Harvard Business Review study found that the ideal time to write a business plan is between 6 and 12 months after deciding to start a business.

But the reality can be more nuanced – it depends on the stage a business is in, or the type of business plan being written.

Ideal times to write a business plan include:

- When you have an idea for a business

- When you’re starting a business

- When you’re preparing to buy (or sell)

- When you’re trying to get funding

- When business conditions change

- When you’re growing or scaling your business

Read More: The best times to write or update your business plan

How often should you update your business plan?

As is often the case, how often a business plan should be updated depends on your circumstances.

A business plan isn’t a homework assignment to complete and forget about. At the same time, no one wants to get so bogged down in the details that they lose sight of day-to-day goals.

But it should cover new opportunities and threats that a business owner surfaces, and incorporate feedback they get from customers. So it can’t be a static document.

Related Reading: 5 fundamental principles of business planning

For an entrepreneur at the ideation stage, writing and checking back on their business plan will help them determine if they can turn that idea into a profitable business .

And for owners of up-and-running businesses, updating the plan (or rewriting it) will help them respond to market shifts they wouldn’t be prepared for otherwise.

It also lets them compare their forecasts and budgets to actual financial results. This invaluable process surfaces where a business might be out-performing expectations and where weak performance may require a prompt strategy change.

The planning process is what uncovers those insights.

Related Reading: 10 prompts to help you write a business plan with AI

- How long should your business plan be?

Thinking about a business plan strictly in terms of page length can risk overlooking more important factors, like the level of detail or clarity in the plan.

Not all of the plan consists of writing – there are also financial tables, graphs, and product illustrations to include.

But there are a few general rules to consider about a plan’s length:

- Your business plan shouldn’t take more than 15 minutes to skim.

- Business plans for internal use (not for a bank loan or outside investment) can be as short as 5 to 10 pages.

A good practice is to write your business plan to match the expectations of your audience.

If you’re walking into a bank looking for a loan, your plan should match the formal, professional style that a loan officer would expect . But if you’re writing it for stakeholders on your own team—shorter and less formal (even just a few pages) could be the better way to go.

The length of your plan may also depend on the stage your business is in.

For instance, a startup plan won’t have nearly as much financial information to include as a plan written for an established company will.

Read More: How long should your business plan be?

What information is included in a business plan?

The contents of a plan business plan will vary depending on the industry the business is in.

After all, someone opening a new restaurant will have different customers, inventory needs, and marketing tactics to consider than someone bringing a new medical device to the market.

But there are some common elements that most business plans include:

- Executive summary: An overview of the business operation, strategy, and goals. The executive summary should be written last, despite being the first thing anyone will read.

- Products and services: A description of the solution that a business is bringing to the market, emphasizing how it solves the problem customers are facing.

- Market analysis: An examination of the demographic and psychographic attributes of likely customers, resulting in the profile of an ideal customer for the business.

- Competitive analysis: Documenting the competitors a business will face in the market, and their strengths and weaknesses relative to those competitors.

- Marketing and sales plan: Summarizing a business’s tactics to position their product or service favorably in the market, attract customers, and generate revenue.

- Operational plan: Detailing the requirements to run the business day-to-day, including staffing, equipment, inventory, and facility needs.

- Organization and management structure: A listing of the departments and position breakdown of the business, as well as descriptions of the backgrounds and qualifications of the leadership team.

- Key milestones: Laying out the key dates that a business is projected to reach certain milestones , such as revenue, break-even, or customer acquisition goals.

- Financial plan: Balance sheets, cash flow forecast , and sales and expense forecasts with forward-looking financial projections, listing assumptions and potential risks that could affect the accuracy of the plan.

- Appendix: All of the supporting information that doesn’t fit into specific sections of the business plan, such as data and charts.

Read More: Use this business plan outline to organize your plan

- Different types of business plans

A business plan isn’t a one-size-fits-all document. There are numerous ways to create an effective business plan that fits entrepreneurs’ or established business owners’ needs.

Here are a few of the most common types of business plans for small businesses:

- One-page plan : Outlining all of the most important information about a business into an adaptable one-page plan.

- Growth plan : An ongoing business management plan that ensures business tactics and strategies are aligned as a business scales up.

- Internal plan : A shorter version of a full business plan to be shared with internal stakeholders – ideal for established companies considering strategic shifts.

Business plan vs. operational plan vs. strategic plan

- What questions are you trying to answer?

- Are you trying to lay out a plan for the actual running of your business?

- Is your focus on how you will meet short or long-term goals?

Since your objective will ultimately inform your plan, you need to know what you’re trying to accomplish before you start writing.

While a business plan provides the foundation for a business, other types of plans support this guiding document.

An operational plan sets short-term goals for the business by laying out where it plans to focus energy and investments and when it plans to hit key milestones.

Then there is the strategic plan , which examines longer-range opportunities for the business, and how to meet those larger goals over time.

Read More: How to use a business plan for strategic development and operations

- Business plan vs. business model

If a business plan describes the tactics an entrepreneur will use to succeed in the market, then the business model represents how they will make money.

The difference may seem subtle, but it’s important.

Think of a business plan as the roadmap for how to exploit market opportunities and reach a state of sustainable growth. By contrast, the business model lays out how a business will operate and what it will look like once it has reached that growth phase.

Learn More: The differences between a business model and business plan

- Moving from idea to business plan

Now that you understand what a business plan is, the next step is to start writing your business plan .

The best way to start is by reviewing examples and downloading a business plan template . These resources will provide you with guidance and inspiration to help you write a plan.

We recommend starting with a simple one-page plan ; it streamlines the planning process and helps you organize your ideas. However, if one page doesn’t fit your needs, there are plenty of other great templates available that will put you well on your way to writing a useful business plan.

Tim Berry is the founder and chairman of Palo Alto Software , a co-founder of Borland International, and a recognized expert in business planning. He has an MBA from Stanford and degrees with honors from the University of Oregon and the University of Notre Dame. Today, Tim dedicates most of his time to blogging, teaching and evangelizing for business planning.

Table of Contents

- Reasons to write a business plan

- Business planning research

- When to write a business plan

- When to update a business plan

- Information to include

- Business vs. operational vs. strategic plans

Related Articles

7 Min. Read

7 Financial Terms Small Business Owners Need to Know

9 Min. Read

Free Etsy Business Plan Template [2024 PDF + Sample Plan]

6 Min. Read

How to Write a Nail Salon Business Plan + Free Sample Plan PDF

3 Min. Read

How to Use TAM, SAM, SOM to Determine Market Size

The LivePlan Newsletter

Become a smarter, more strategic entrepreneur.

Your first monthly newsetter will be delivered soon..

Unsubscribe anytime. Privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

What is a Business Plan? Definition, Tips, and Templates

Published: June 28, 2024

Years ago, I had an idea to launch a line of region-specific board games. I knew there was a market for games that celebrated local culture and heritage. I was so excited about the concept and couldn't wait to get started.

But my idea never took off. Why? Because I didn‘t have a plan. I lacked direction, missed opportunities, and ultimately, the venture never got off the ground.

And that’s exactly why a business plan is important. It cements your vision, gives you clarity, and outlines your next step.

In this post, I‘ll explain what a business plan is, the reasons why you’d need one, identify different types of business plans, and what you should include in yours.

Table of Contents

What is a business plan?

What is a business plan used for.

- Business Plan Template [Download Now]

Purposes of a Business Plan

What does a business plan need to include, types of business plans.

.webp)

Free Business Plan Template

The essential document for starting a business -- custom built for your needs.

- Outline your idea.

- Pitch to investors.

- Secure funding.

- Get to work!

Download Free

All fields are required.

You're all set!

Click this link to access this resource at any time.

A business plan is a comprehensive document that outlines a company's goals, strategies, and financial projections. It provides a detailed description of the business, including its products or services, target market, competitive landscape, and marketing and sales strategies. The plan also includes a financial section that forecasts revenue, expenses, and cash flow, as well as a funding request if the business is seeking investment.

The business plan is an undeniably critical component to getting any company off the ground. It's key to securing financing, documenting your business model, outlining your financial projections, and turning that nugget of a business idea into a reality.

The purpose of a business plan is three-fold: It summarizes the organization’s strategy in order to execute it long term, secures financing from investors, and helps forecast future business demands.

Business Plan Template [ Download Now ]

Don't forget to share this post!

Related articles.

The Best AI Tools for Ecommerce & How They'll Boost Your Business

18 of My Favorite Sample Business Plans & Examples For Your Inspiration

23 of My Favorite Free Marketing Newsletters

![what are components of a business plan The 8 Best Free Flowchart Templates [+ Examples]](https://www.hubspot.com/hubfs/free-flowchart-template-1-20240716-6679104-1.webp)

The 8 Best Free Flowchart Templates [+ Examples]

![what are components of a business plan 7 Gantt Chart Examples You'll Want to Copy [+ 5 Steps to Make One]](https://www.hubspot.com/hubfs/gantt-chart-1-20240625-3861486-1.webp)

7 Gantt Chart Examples You'll Want to Copy [+ 5 Steps to Make One]

![what are components of a business plan How to Write an Executive Summary Execs Can't Ignore [+ 5 Top Examples]](https://www.hubspot.com/hubfs/executive-summary-example_5.webp)

How to Write an Executive Summary Execs Can't Ignore [+ 5 Top Examples]

20 Free & Paid Small Business Tools for Any Budget

Maximizing Your Social Media Strategy: The Top Aggregator Tools to Use

The Content Aggregator Guide for 2024

2 Essential Templates For Starting Your Business

Marketing software that helps you drive revenue, save time and resources, and measure and optimize your investments — all on one easy-to-use platform

Finding Investors

How Funding Works

Idea Validation Bootcamp

Pitch Deck Bootcamp

Pitching Investors

Product MVP

Product/MVP

Idea Validation

Customer Acquisition

Emotional Support

13 Key Business Plan Components

The Startups Team

As is the case with most big projects, crafting a business plan is one of those things that takes an incredible amount of diligence and no shortage of courage. After all, your business idea is probably more than just some passionless money-making ploy — it’s your dream that you’re getting ready to lay bare for the world to scrutinize!

Never fear!

We have 4 sample business plans here to make it all less scary.

If you approach this with a firm understanding of what key information to include in each section of your business plan and know how each section works together to form a cohesive, compelling, and — above all — persuasive whole, it will make the writing process a whole lot less daunting.

We’re about to help you do exactly that by deconstructing each of the core components of your business plan one at a time and showing you exactly what information you should present to your readers so when all is said you done, you can walk away confidently knowing you’ve penned the most effective business plan possible.

As we learned in the “ What is a Business Plan? ” article, a business plan generally consists of the following sections:

Executive Summary

Company Synopsis

Market Analysis / Overview

Product (How it Works)

Revenue Model

Operating Model

Competitive Analysis

Customer Definition

Management Team

Financial Statements

Let’s dive in, shall we?

1. Executive Summary

In the same way that a great movie trailer gives you a basic understanding of what the film is about while also enticing you to go check out the full-length feature, your Executive Summary serves as an overview of the main aspects of your company and business plan that you will discuss in greater length in the rest of your plan.

In other words, your Executive Summary is the highlight reel of your business plan.