Build A Profitable EComm Business For Just $1

- Skip to primary navigation

- Skip to main content

A magazine for young entrepreneurs

The best advice in entrepreneurship

Subscribe for exclusive access, the complete guide to market research: what it is, why you need it, and how to do it.

Written by Mary Kate Miller | June 1, 2021

Comments -->

Get real-time frameworks, tools, and inspiration to start and build your business. Subscribe here

Market research is a cornerstone of all successful, strategic businesses. It can also be daunting for entrepreneurs looking to launch a startup or start a side hustle . What is market research, anyway? And how do you…do it?

We’ll walk you through absolutely everything you need to know about the market research process so that by the end of this guide, you’ll be an expert in market research too. And what’s more important: you’ll have actionable steps you can take to start collecting your own market research.

What Is Market Research?

Market research is the organized process of gathering information about your target customers and market. Market research can help you better understand customer behavior and competitor strengths and weaknesses, as well as provide insight for the best strategies in launching new businesses and products. There are different ways to approach market research, including primary and secondary research and qualitative and quantitative research. The strongest approaches will include a combination of all four.

“Virtually every business can benefit from conducting some market research,” says Niles Koenigsberg of Real FiG Advertising + Marketing . “Market research can help you piece together your [business’s] strengths and weaknesses, along with your prospective opportunities, so that you can understand where your unique differentiators may lie.” Well-honed market research will help your brand stand out from the competition and help you see what you need to do to lead the market. It can also do so much more.

The Purposes of Market Research

Why do market research? It can help you…

- Pinpoint your target market, create buyer personas, and develop a more holistic understanding of your customer base and market.

- Understand current market conditions to evaluate risks and anticipate how your product or service will perform.

- Validate a concept prior to launch.

- Identify gaps in the market that your competitors have created or overlooked.

- Solve problems that have been left unresolved by the existing product/brand offerings.

- Identify opportunities and solutions for new products or services.

- Develop killer marketing strategies .

What Are the Benefits of Market Research?

Strong market research can help your business in many ways. It can…

- Strengthen your market position.

- Help you identify your strengths and weaknesses.

- Help you identify your competitors’ strengths and weaknesses.

- Minimize risk.

- Center your customers’ experience from the get-go.

- Help you create a dynamic strategy based on market conditions and customer needs/demands.

What Are the Basic Methods of Market Research?

The basic methods of market research include surveys, personal interviews, customer observation, and the review of secondary research. In addition to these basic methods, a forward-thinking market research approach incorporates data from the digital landscape like social media analysis, SEO research, gathering feedback via forums, and more. Throughout this guide, we will cover each of the methods commonly used in market research to give you a comprehensive overview.

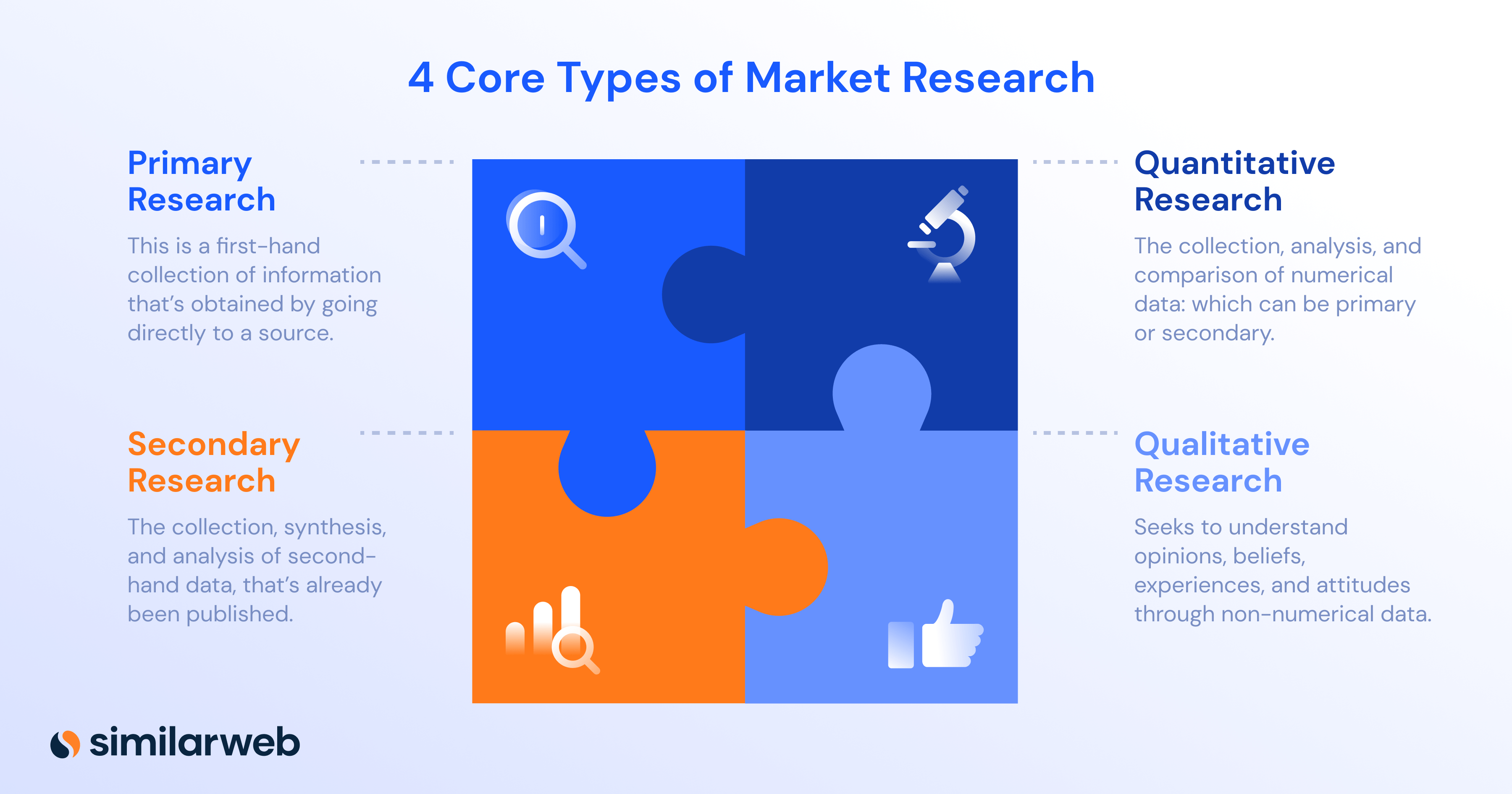

Primary vs. Secondary Market Research

Primary and secondary are the two main types of market research you can do. The latter relies on research conducted by others. Primary research, on the other hand, refers to the fact-finding efforts you conduct on your own.

This approach is limited, however. It’s likely that the research objectives of these secondary data points differ from your own, and it can be difficult to confirm the veracity of their findings.

Primary Market Research

Primary research is more labor intensive, but it generally yields data that is exponentially more actionable. It can be conducted through interviews, surveys, online research, and your own data collection. Every new business should engage in primary market research prior to launch. It will help you validate that your idea has traction, and it will give you the information you need to help minimize financial risk.

You can hire an agency to conduct this research on your behalf. This brings the benefit of expertise, as you’ll likely work with a market research analyst. The downside is that hiring an agency can be expensive—too expensive for many burgeoning entrepreneurs. That brings us to the second approach. You can also do the market research yourself, which substantially reduces the financial burden of starting a new business .

Secondary Market Research

Secondary research includes resources like government databases and industry-specific data and publications. It can be beneficial to start your market research with secondary sources because it’s widely available and often free-to-access. This information will help you gain a broad overview of the market conditions for your new business.

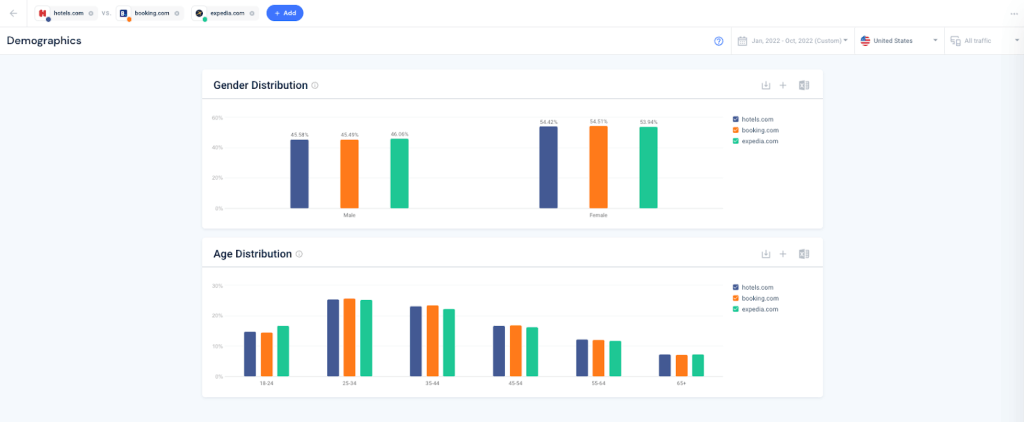

Identify Your Goals and Your Audience

Before you begin conducting interviews or sending out surveys, you need to set your market research goals. At the end of your market research process, you want to have a clear idea of who your target market is—including demographic information like age, gender, and where they live—but you also want to start with a rough idea of who your audience might be and what you’re trying to achieve with market research.

You can pinpoint your objectives by asking yourself a series of guiding questions:

- What are you hoping to discover through your research?

- Who are you hoping to serve better because of your findings?

- What do you think your market is?

- Who are your competitors?

- Are you testing the reception of a new product category or do you want to see if your product or service solves the problem left by a current gap in the market?

- Are you just…testing the waters to get a sense of how people would react to a new brand?

Once you’ve narrowed down the “what” of your market research goals, you’re ready to move onto how you can best achieve them. Think of it like algebra. Many math problems start with “solve for x.” Once you know what you’re looking for, you can get to work trying to find it. It’s a heck of a lot easier to solve a problem when you know you’re looking for “x” than if you were to say “I’m gonna throw some numbers out there and see if I find a variable.”

How to Do Market Research

This guide outlines every component of a comprehensive market research effort. Take into consideration the goals you have established for your market research, as they will influence which of these elements you’ll want to include in your market research strategy.

Secondary Data

Secondary data allows you to utilize pre-existing data to garner a sense of market conditions and opportunities. You can rely on published market studies, white papers, and public competitive information to start your market research journey.

Secondary data, while useful, is limited and cannot substitute your own primary data. It’s best used for quantitative data that can provide background to your more specific inquiries.

Find Your Customers Online

Once you’ve identified your target market, you can use online gathering spaces and forums to gain insights and give yourself a competitive advantage. Rebecca McCusker of The Creative Content Shop recommends internet recon as a vital tool for gaining a sense of customer needs and sentiment. “Read their posts and comments on forums, YouTube video comments, Facebook group [comments], and even Amazon/Goodreads book comments to get in their heads and see what people are saying.”

If you’re interested in engaging with your target demographic online, there are some general rules you should follow. First, secure the consent of any group moderators to ensure that you are acting within the group guidelines. Failure to do so could result in your eviction from the group.

Not all comments have the same research value. “Focus on the comments and posts with the most comments and highest engagement,” says McCusker. These high-engagement posts can give you a sense of what is already connecting and gaining traction within the group.

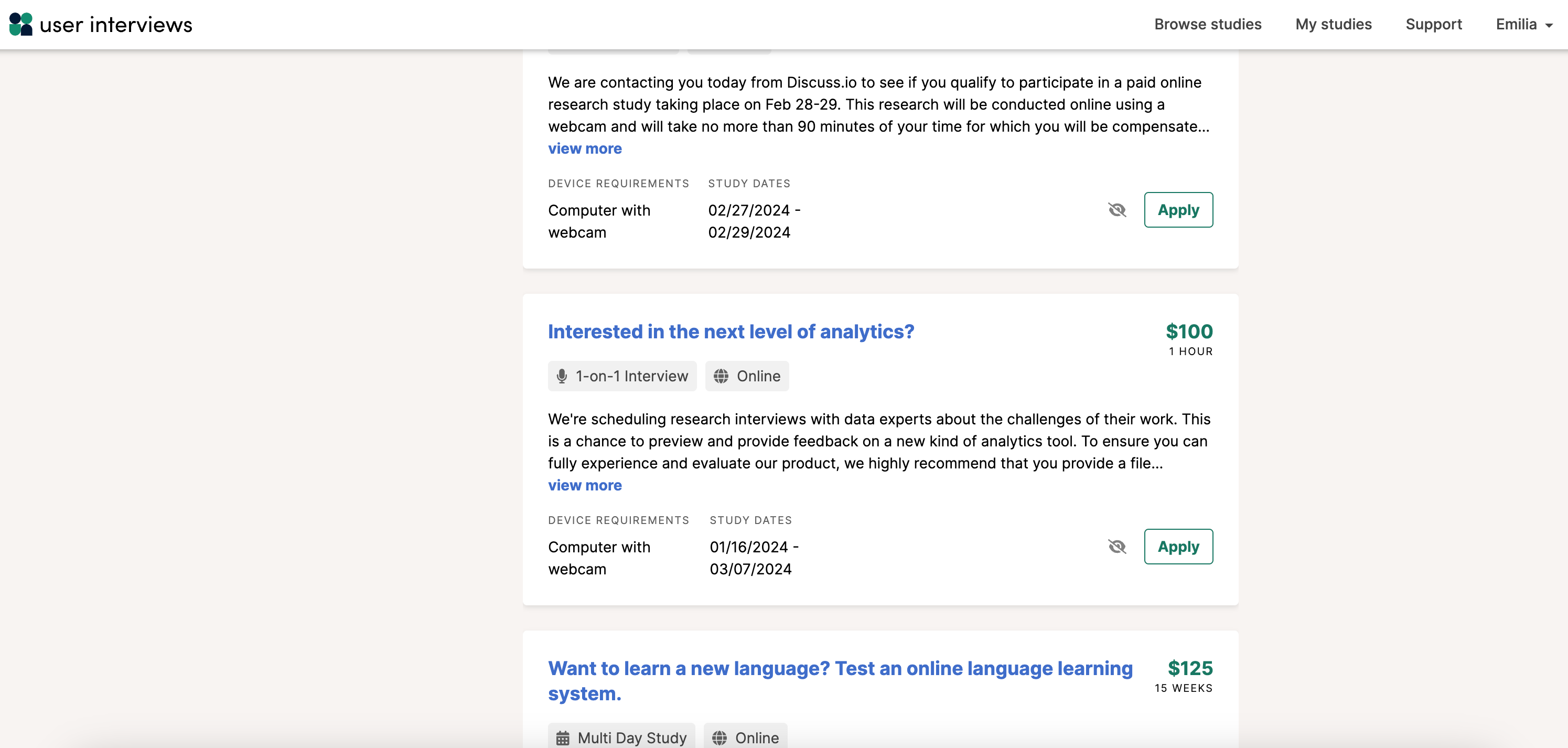

Social media can also be a great avenue for finding interview subjects. “LinkedIn is very useful if your [target customer] has a very specific job or works in a very specific industry or sector. It’s amazing the amount of people that will be willing to help,” explains Miguel González, a marketing executive at Dealers League . “My advice here is BE BRAVE, go to LinkedIn, or even to people you know and ask them, do quick interviews and ask real people that belong to that market and segment and get your buyer persona information first hand.”

Market research interviews can provide direct feedback on your brand, product, or service and give you a better understanding of consumer pain points and interests.

When organizing your market research interviews, you want to pay special attention to the sample group you’re selecting, as it will directly impact the information you receive. According to Tanya Zhang, the co-founder of Nimble Made , you want to first determine whether you want to choose a representative sample—for example, interviewing people who match each of the buyer persona/customer profiles you’ve developed—or a random sample.

“A sampling of your usual persona styles, for example, can validate details that you’ve already established about your product, while a random sampling may [help you] discover a new way people may use your product,” Zhang says.

Market Surveys

Market surveys solicit customer inclinations regarding your potential product or service through a series of open-ended questions. This direct outreach to your target audience can provide information on your customers’ preferences, attitudes, buying potential, and more.

Every expert we asked voiced unanimous support for market surveys as a powerful tool for market research. With the advent of various survey tools with accessible pricing—or free use—it’s never been easier to assemble, disseminate, and gather market surveys. While it should also be noted that surveys shouldn’t replace customer interviews , they can be used to supplement customer interviews to give you feedback from a broader audience.

Who to Include in Market Surveys

- Current customers

- Past customers

- Your existing audience (such as social media/newsletter audiences)

Example Questions to Include in Market Surveys

While the exact questions will vary for each business, here are some common, helpful questions that you may want to consider for your market survey. Demographic Questions: the questions that help you understand, demographically, who your target customers are:

- “What is your age?”

- “Where do you live?”

- “What is your gender identity?”

- “What is your household income?”

- “What is your household size?”

- “What do you do for a living?”

- “What is your highest level of education?”

Product-Based Questions: Whether you’re seeking feedback for an existing brand or an entirely new one, these questions will help you get a sense of how people feel about your business, product, or service:

- “How well does/would our product/service meet your needs?”

- “How does our product/service compare to similar products/services that you use?”

- “How long have you been a customer?” or “What is the likelihood that you would be a customer of our brand?

Personal/Informative Questions: the deeper questions that help you understand how your audience thinks and what they care about.

- “What are your biggest challenges?”

- “What’s most important to you?”

- “What do you do for fun (hobbies, interests, activities)?”

- “Where do you seek new information when researching a new product?”

- “How do you like to make purchases?”

- “What is your preferred method for interacting with a brand?”

Survey Tools

Online survey tools make it easy to distribute surveys and collect responses. The best part is that there are many free tools available. If you’re making your own online survey, you may want to consider SurveyMonkey, Typeform, Google Forms, or Zoho Survey.

Competitive Analysis

A competitive analysis is a breakdown of how your business stacks up against the competition. There are many different ways to conduct this analysis. One of the most popular methods is a SWOT analysis, which stands for “strengths, weaknesses, opportunities, and threats.” This type of analysis is helpful because it gives you a more robust understanding of why a customer might choose a competitor over your business. Seeing how you stack up against the competition can give you the direction you need to carve out your place as a market leader.

Social Media Analysis

Social media has fundamentally changed the market research landscape, making it easier than ever to engage with a wide swath of consumers. Follow your current or potential competitors on social media to see what they’re posting and how their audience is engaging with it. Social media can also give you a lower cost opportunity for testing different messaging and brand positioning.

SEO Analysis and Opportunities

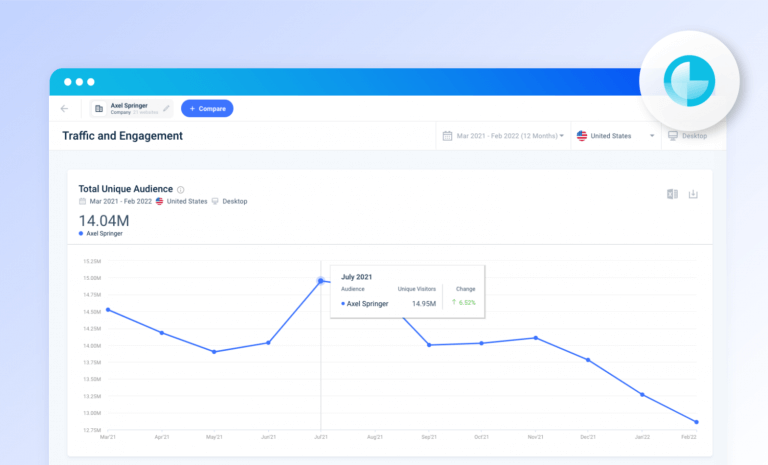

SEO analysis can help you identify the digital competition for getting the word out about your brand, product, or service. You won’t want to overlook this valuable information. Search listening tools offer a novel approach to understanding the market and generating the content strategy that will drive business. Tools like Google Trends and Awario can streamline this process.

Ready to Kick Your Business Into High Gear?

Now that you’ve completed the guide to market research you know you’re ready to put on your researcher hat to give your business the best start. Still not sure how actually… launch the thing? Our free mini-course can run you through the essentials for starting your side hustle .

About Mary Kate Miller

Mary Kate Miller writes about small business, real estate, and finance. In addition to writing for Foundr, her work has been published by The Washington Post, Teen Vogue, Bustle, and more. She lives in Chicago.

Related Posts

5 Ways Personalization in eCommerce Can Enhance Customer Experience

Engaging Your Audience with Social Media Quizzes and Polls

Email Marketing Automation: Tools and Strategies for 2024

How to Find Influencers: 6 Ways to Discover Your Perfect Brand Advocate

How to Create a Marketing Plan In 2024 (Template + Examples)

What Is UGC and Why It’s a Must-Have for Your Brand

Ad Expert Phoenix Ha on How to Make Creative Ads without Breaking Your Budget

14 Punchy TikTok Marketing Strategies to Amplify Your Growth

How to Grow Your YouTube Channel and Gain Subscribers Quickly

How to Get More Views on Snapchat with These 12 Tactics

12 Instagram Growth Hacks For More Engaged Followers (Without Running Ads)

Create Viral Infographics That Boost Your Organic Traffic

How to Create a Video Sales Letter (Tips and Tricks from a 7-Figure Copywriter)

How to Write a Sales Email That Converts in 2024

What Is a Media Kit: How to Make One in 2024 (With Examples)

FREE TRAINING FROM LEGIT FOUNDERS

Actionable Strategies for Starting & Growing Any Business.

- 1000+ lessons.

- Customized learning.

- 30,000+ strong community.

- Skip to main content

- Skip to primary sidebar

- Skip to footer

- QuestionPro

- Solutions Industries Gaming Automotive Sports and events Education Government Travel & Hospitality Financial Services Healthcare Cannabis Technology Use Case AskWhy Communities Audience Contactless surveys Mobile LivePolls Member Experience GDPR Positive People Science 360 Feedback Surveys

- Resources Blog eBooks Survey Templates Case Studies Training Help center

Home Market Research

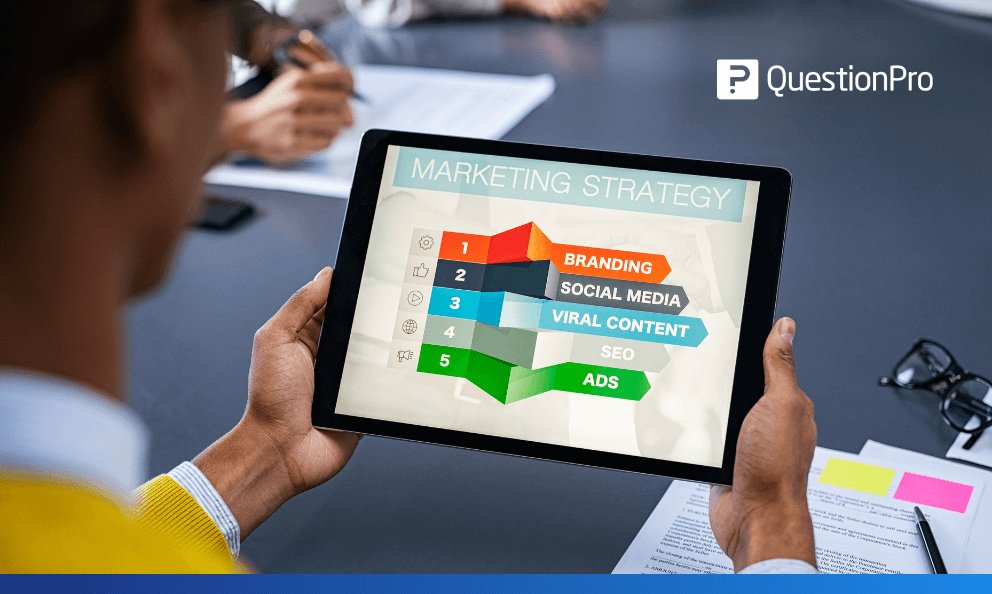

Marketing research: Definition, steps, uses & advantages

What is marketing research?

Marketing research is defined as any technique or a set of practices that companies use to collect information to understand their target market better. Organizations use this data to improve their products, enhance their UX, and offer a better product to their customers. Marketing research is used to determine what the customers want, and how they react to products or features of a product.

Gather research insights

Four standard marketing research methods

The four most common marketing research methods are surveys, interviews, customer observations, and focus groups. You can research various ways without limiting yourself to just one way. Let’s dive deeper into each of these marketing research techniques.

Researchers collect responses by deploying surveys and managing data via online questionnaires or on-screen surveys at the POS. These surveys contain closed-ended and open-ended questions. They are popular and are the most widely used research techniques.

Why are online surveys popular?

Surveys are inexpensive, simple to set-up, deploy, and gather responses. It gets easy to collect multiple answers from a tailored audience group using surveys. Researchers rely on quantitative data, and online surveys provide quick responses compared to the more traditional offline methods. You can collect large amounts of data within minutes from anywhere in the world.

2. Interviews

Face-to-face or personal interviews are a more traditional way of doing marketing research. It is a slow and more expensive way of collecting responses. Researchers doing large scale marketing research do not prefer this method to collect a large number of responses. Interviews are conducted both in-person and on the telephone (CATI).

Why are interviews important?

Personal interviews may not be widely used but play a significant role in understanding precisely what the respondent feels. You can record more than just verbal responses and understand the customer better. Often, when two humans interact with each other, more information is shared because of the dialogue. Personal interviews are useful in small-scale studies, where the researcher wants to interview a specific group of local respondents. CATI’s are helpful when the respondent base is more expansive.

3. Focus groups

Focus groups or online focus groups involve several respondents who participate in discussions about a particular topic. A researcher conducts focus groups to obtain richer information. The main reason for a focus group is to hold a dialogue between various people on a particular topic of interest. Unlike interviews, focus group members are allowed to interact with each other and influence one another.

Why are focus groups impactful?

It is no secret that focus groups are hugely impactful in decision making. Researchers gain a lot of information by organizing focus groups. Often, focus groups bring up issues not foreseen by researchers. Online or video focus groups have a broad reach, and many organizations have now started creating and nurturing research communities for better respondent handling and data gathering. Direct interaction of business groups and customers positively impacts users because they feel that their voices are heard.

4. Observation

Observation, though not popular and widely used, gives intuitive feedback. Research companies organize customer observation sessions to gather information on how they engage with the product or service (or a similar competitor product or service). Feedback from people’s behavioral attitudes is a powerful tool for researchers looking to improve their products and services.

What makes observation so powerful?

Observational market research is an excellent alternative to focus groups. It’s not only an inexpensive research tool, but you will also witness people interacting with and using your product in a natural environment. The downside is that you will have to make inferences about their feelings and reactions.

LEARN ABOUT: market research trends

How to conduct marketing research

Follow these four marketing research steps to help you understand what your users think and feel about your product, service, or business.

LEARN ABOUT: Behavioral Research

1. Create simple user personas

A user persona is nothing more than a fictional character that represents a user or a customer. Understanding user personas will help you gauge how different persons react to other products and services to understand their needs. To create a persona, your questions must answer these types questions about the user or customer:

- Who are they?

- What’s their primary goal?

- What stops them from achieving that goal?

2. Conduct observational research

Use both overt and covert observation methods to observe and take notes while users use your products or a similar one.

Overt vs. covert observation

- Overt observation asks users if they will allow you to watch them use your product.

- Covert observation studies users in a natural environment without them knowing. This type of observation generally works only if you sell a product that consumers buy and use regularly. It brings in the purest observational research data as people act naturally while using the products.

3. Conduct personal interviews

One-on-one conversations with your target population allow you to explore and dig deep into their concerns, revealing answers to many questions. Here are a few tips for conducting personal interviews.

- Be a journalist and not a salesperson. Ask users about their frustrations, needs, and areas where they think they need an improvement in the product.

- Pose the ‘why’ question to dig deeper. Dive into the details to know more about their past behavior.

- Recording the conversation helps you focus on it rather than take notes simultaneously.

4. Analyze the data

The idea of conducting lean marketing research is to receive quick, actionable insight data. Analyze the information you have collected using various techniques to draw patterns into what customers like and dislike, what they want, and what they do not need. Create a simple visual representation of how people will interact with each other and the product to assess their needs in a better way.

LEARN ABOUT: Marketing Insight

Why is research so valuable?

Without research, it is impossible to gauge and understand your customers. Of course, you will have an idea of what they need and who they are and, but you must dive deeper to win their loyalty. Here is why marketing research matters:

- Attract potential customers: The primary aim of marketing research is to find ways to attract potential customers. It also helps to keep current happy and coming back for more. Understanding your customers entirely is the only way to progress. You’ll lose potential customers if you stop caring about improving your user experience.

- Answer the why’s: Marketing research gives you the answer to the ‘why.’ Make use of user analytics, big data, and reporting dashboards in marketing research to tell you what your users are thinking and why they think and act that way. For example, only marketing research can explain why customers leave you.

- Data-backed decisions: Research beats trends, assumptions, and so-called best business practices. Bad decisions are often taken due to emotional reasoning and guesswork. Focusing on customer experience by listening to your customers directs you in the right direction.

- Better planning: Research keeps you from making absurd decisions by planning in a vacuum. You might not fully gauge what your customers experience and feel while using your product. Customers may use products in a way that surprises you, and they may get confused by features that seem obvious to you. Conducting too much planning but not testing your assumptions will waste your money, time, efforts, and resources. Research helps you save up on all these factors.

LEARN ABOUT: 12 Best Tools for Researchers

Advantages of MKT research

Marketing research and user experience (UX) design help you continuously improve your product by acting on your feedback. Here are the advantages of conducting marketing research:

- Improved efficiency: Efficiency draws you closer to your users. You can improve the efficiency of delivering the product to the market and also increase its usability.

- Cost-effective: Marketing research helps you make the right decisions based on consumer demand, thus saving you costs in creating something that customers do not like or want.

LEARN ABOUT: Test Market Demand

- Competitive edge: Quicker, more robust insights can help you place your services and products strategically, gaining a competitive advantage over others.

- Build strategies: You can quickly build, alter, or design new approaches to attract your users and consumers.

- Improved communication: Bridge the communication gap by interacting with consumers and hearing them out. This helps consumers feel wanted and special.

- LEARN ABOUT: Market research vs marketing research

MORE LIKE THIS

Experimental vs Observational Studies: Differences & Examples

Sep 5, 2024

Interactive Forms: Key Features, Benefits, Uses + Design Tips

Sep 4, 2024

Closed-Loop Management: The Key to Customer Centricity

Sep 3, 2024

Net Trust Score: Tool for Measuring Trust in Organization

Sep 2, 2024

Other categories

- Academic Research

- Artificial Intelligence

- Assessments

- Brand Awareness

- Case Studies

- Communities

- Consumer Insights

- Customer effort score

- Customer Engagement

- Customer Experience

- Customer Loyalty

- Customer Research

- Customer Satisfaction

- Employee Benefits

- Employee Engagement

- Employee Retention

- Friday Five

- General Data Protection Regulation

- Insights Hub

- Life@QuestionPro

- Market Research

- Mobile diaries

- Mobile Surveys

- New Features

- Online Communities

- Question Types

- Questionnaire

- QuestionPro Products

- Release Notes

- Research Tools and Apps

- Revenue at Risk

- Survey Templates

- Training Tips

- Tuesday CX Thoughts (TCXT)

- Uncategorized

- What’s Coming Up

- Workforce Intelligence

What is Marketing Research? Examples and Best Practices

12 min read

Marketing research is essentially a method utilized by companies to collect valuable information regarding their target market. Through the common practice of conducting market research, companies gather essential information that enables them to make informed decisions and develop products that resonate with consumers. It encompasses the gathering, analysis, and interpretation of data, which aids in identifying consumer demands, anticipating market trends, and staying ahead of the competition.

Exploratory research is one of the initial steps in the marketing research process. It helps businesses gain broad insights when specific information is unknown. If you are seeking insight into how marketing research can influence the trajectory of your SaaS, then you have come to the right place!

- Market research is a systematic and objective process crucial for understanding target markets, refining business strategies, and informing decisions, which includes collecting, analyzing, and interpreting data on customers, competitors, and the industry.

- Primary market research gathers specific data directly from the target audience using tools like surveys and focus groups, while secondary market research utilizes existing data from various sources to provide broader market insights.

- Effective market research combines both qualitative methods, which explore consumer motivations, and quantitative methods, which provide measurable statistics, to create comprehensive insights that guide business strategy and decision-making.

Try Userpilot and Take Your Product Marketing to the Next Level

- 14 Day Trial

- No Credit Card Required

Defining marketing research

Launching a product without knowing what your target audience wants is like walking in the dark. Market research lights the way, helping you collect, analyze, and understand information about your target market. This allows you to refine your business strategies and make decisions based on solid evidence.

Gone are the days when just intuition or subjective judgment was enough. Objective insights from market research help avoid costly mistakes and meet consumer needs by identifying trends and changes in the market. This is crucial for assessing a product’s potential success, optimizing marketing strategies, and preparing for market shifts.

Market research is a systematic approach that provides essential information, helping businesses navigate the complexities of the commercial world. Partnering with market research companies can offer additional benefits, leveraging their expertise in understanding market demands, trends, market size, economic indicators, location, market saturation, and pricing. Whether starting a new business, developing products, or updating marketing plans, understanding how to conduct effective market research is key to success.

To conduct market research effectively, businesses must determine study goals, identify target consumers, collect and analyze data, and use the findings to make informed decisions. This process is vital for evaluating past performance, measuring changes over time, and addressing specific business needs. It guides businesses in product development, marketing strategies, and overall decision-making, ensuring a better ROI and providing an eye-opening view of the market through various research methods, whether conducted in-house or outsourced.

The purpose of marketing research

Conducting marketing research is more than just gathering data; it’s about turning that data into actionable insights to refine your business strategies. This process helps you understand what motivates your customers, enabling you to tailor your products and services to minimize risks from the start. Importantly, market research plays a pivotal role in measuring and enhancing customer satisfaction and loyalty, which are critical for understanding key demographics, improving user experience, designing better products, and driving customer retention. Customer satisfaction is measured as a key outcome, directly linked to the success of marketing strategies and business activities.

For SaaS product managers, market research, including competitive analysis, is crucial. It evaluates past strategies and gauges the potential success of new offerings. This research provides essential insights into brand strength, consumer behavior, and market position, which are vital for teams focused on sales, marketing, and product development.

A key aspect of market research is analyzing customer attitudes and usage. This analysis offers detailed insights into what customers want, the choices they make, and the challenges they face. It helps identify opportunities in the market and aids in formulating effective strategies for market entry.

Overall, market research equips SaaS entrepreneurs with the knowledge to meet their target audience’s needs effectively, guiding product adjustments and innovations based on informed decisions.

Key components of market research

Conducting market research is analogous to preparing a cake, requiring precise ingredients in specific quantities to achieve the intended outcome. Within this realm, necessary components consist of primary and secondary data gathering, thorough analysis, and insightful interpretation.

Primary research techniques such as exploratory studies, product evolution inquiries, estimations of market dimensions and shares, and consumer behavior examinations play a crucial role in collecting targeted information that can be directly applied. These methods afford a deeper understanding of your target demographic, allowing for customized strategy development.

In contrast, secondary research enriches the specificity of primary findings by adding wider context. It taps into external resources encompassing works from other investigators, sector-specific reports, and demographics data, which provide an expansive yet less particularized landscape view of the marketplace.

The subsequent phase involves meticulous analysis of collated data offering unbiased perspectives critical for identifying deficiencies while recognizing emerging patterns. Technological progress now facilitates examination efforts on both structured and unstructured datasets effectively addressing large-scale analytical complexities.

Ultimately, it’s through expert-led interpretation that value transcends raw figures, yielding strategies grounded in deep comprehension. Akin to decoding recipes using selected ingredients—this interpretative step enables crafting optimal business maneuvers just as one would bake their ideal confectionery creation utilizing proper culinary guidance.

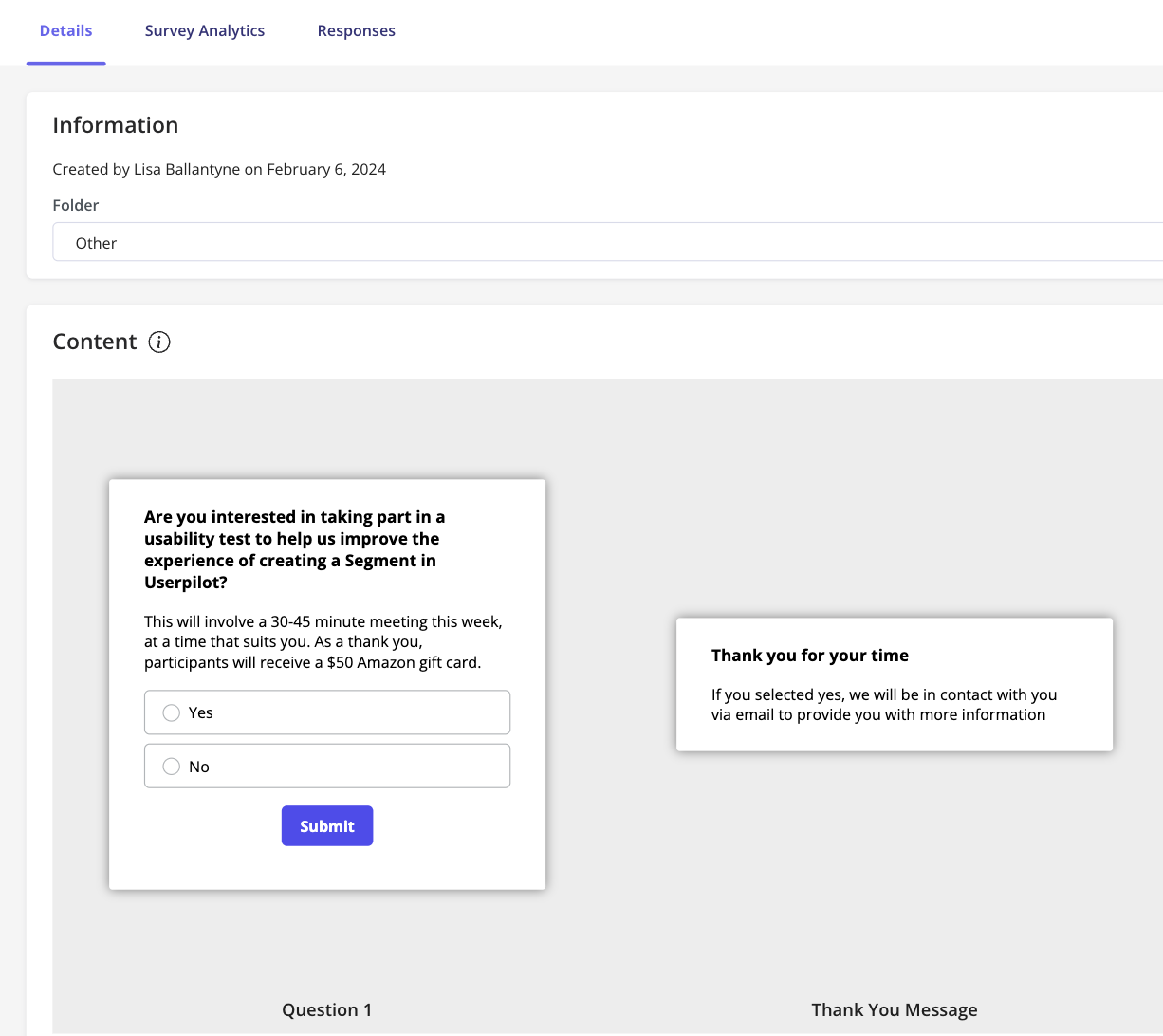

Types of market research: primary and secondary

Now that you know the importance of clear research objectives, let’s explore the different types of market research and the techniques available to achieve these goals. Market research methods can be divided into two main categories: primary research and secondary research . The choice between these depends on factors like your budget, time constraints, and whether you need exploratory data or definitive answers.

Primary research involves collecting new data directly from sources. This process is like mining for precious metals, as it requires using various methods to gather fresh insights.

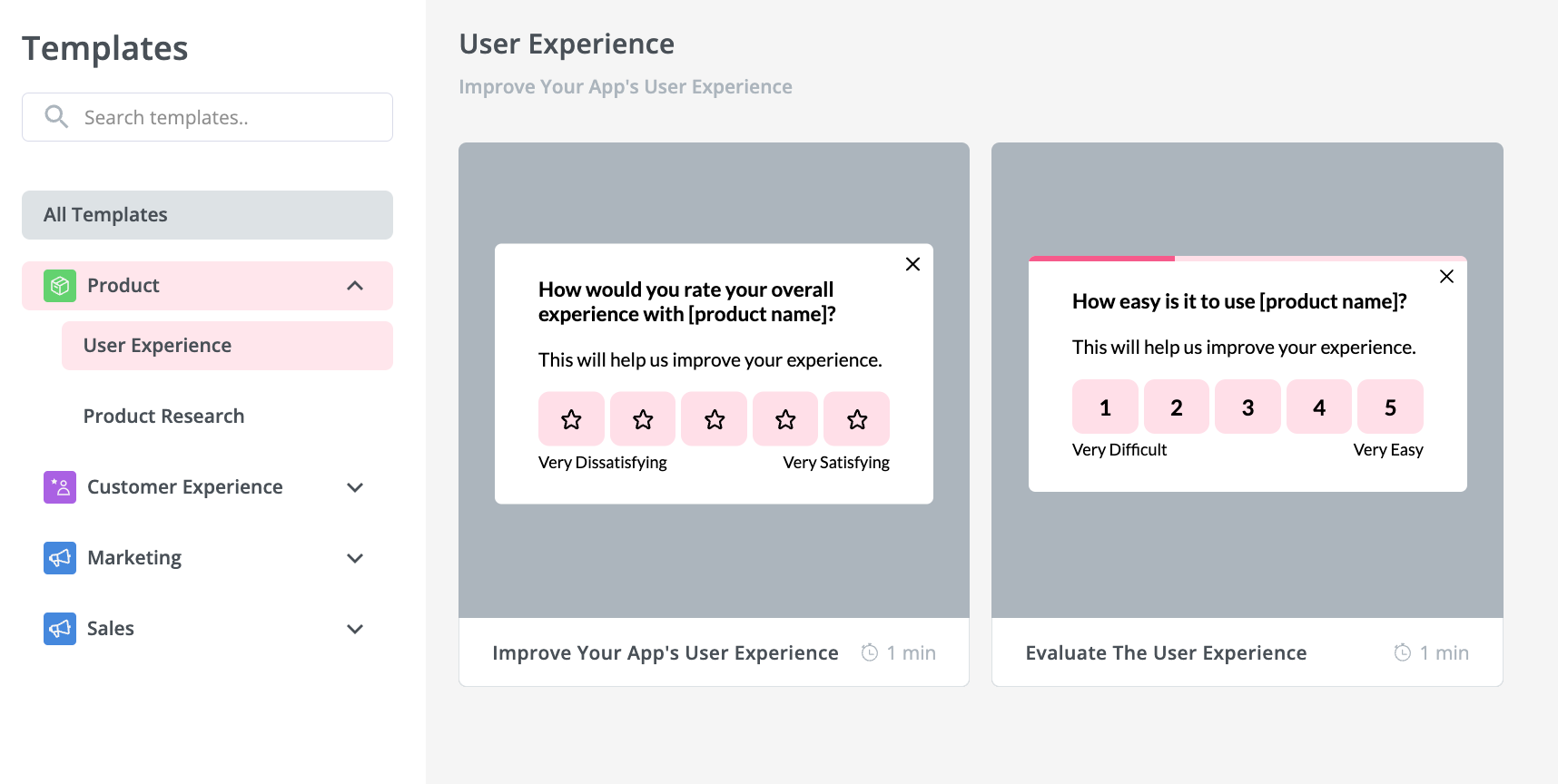

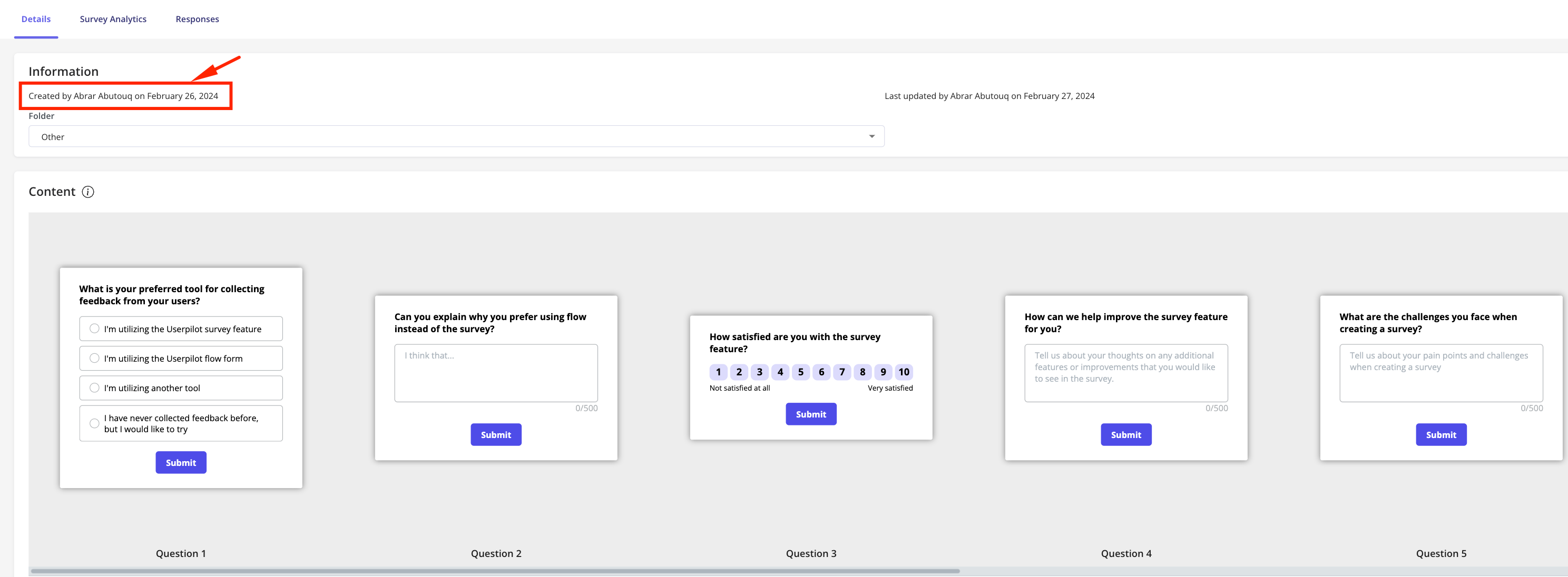

- Surveys (here – in-app survey templates from Userpilot ).

- Interviews.

- Focus groups.

- Product trials.

This approach gives you first-hand insight into your target audience.

Conversely, secondary research uses already established datasets of primary data – which can add depth and reinforcement to your firsthand findings.

Conducting your own market research using primary research tools can be a cost-effective strategy, allowing businesses to gather valuable insights directly and tailor their research to specific needs.

Let’s look a bit deeper into them now.

What is primary market research?

Market research uses primary market research as an essential tool. This involves collecting new data directly from your target audience using various methods, such as surveys , focus groups, and interviews.

Each method has its benefits. For example, observational studies allow you to see how consumers interact with your product.

There are many ways to conduct primary research.

Focus Groups : Hold discussions with small groups of 5 to 10 people from your target audience. These discussions can provide valuable feedback on products, perceptions of your company’s brand name, or opinions on competitors. Additionally, these discussions can help understand the characteristics, challenges, and buying habits of target customers, optimizing brand strategy.

Interviews : Have one-on-one conversations to gather detailed information from individuals in your target audience.

Surveys : These are a common tool in primary market research and can be used instead of focus groups to understand consumer attitudes. Surveys use structured questions and can reach a broad audience efficiently.

Navigating secondary market research

While marketing research using primary methods is like discovering precious metals, secondary market research technique is like using a treasure map. This approach uses data collected by others from various sources, providing a broad industry view. These sources include market analyses from agencies like Statista, historical data such as census records, and academic studies.

Secondary research provides the basic knowledge necessary for conducting primary market research goals but may lack detail on specific business questions and could also be accessible to competitors.

To make the most of secondary market research, it’s important to analyze summarized data to identify trends, rely on reputable sources for accurate data, and remain unbiased in data collection methods.

The effectiveness of secondary research depends significantly on how well the data is interpreted, ensuring that this information complements the insights from primary research.

Qualitative vs quantitative research

Market research employs both qualitative and quantitative methods, offering distinct insights that complement each other. Qualitative research aims to understand consumer behaviors and motivations through detailed analysis, while quantitative research collects measurable data for statistical analysis.

The selection of qualitative or quantitative methods should align with your research goals. If you need to uncover initial insights or explore deep consumer motivations, qualitative techniques like surveys or interviews are ideal.

On the other hand, if you need data that can be measured and analyzed for reliability, quantitative methods are more suitable.

However, these approaches don’t have to be used separately. Combining qualitative and quantitative methods in mixed-method studies allows you to capture both detailed exploratory responses and concrete numerical data. This integration offers a comprehensive view of the market, leveraging the strengths of both approaches to provide a fuller understanding of market conditions.

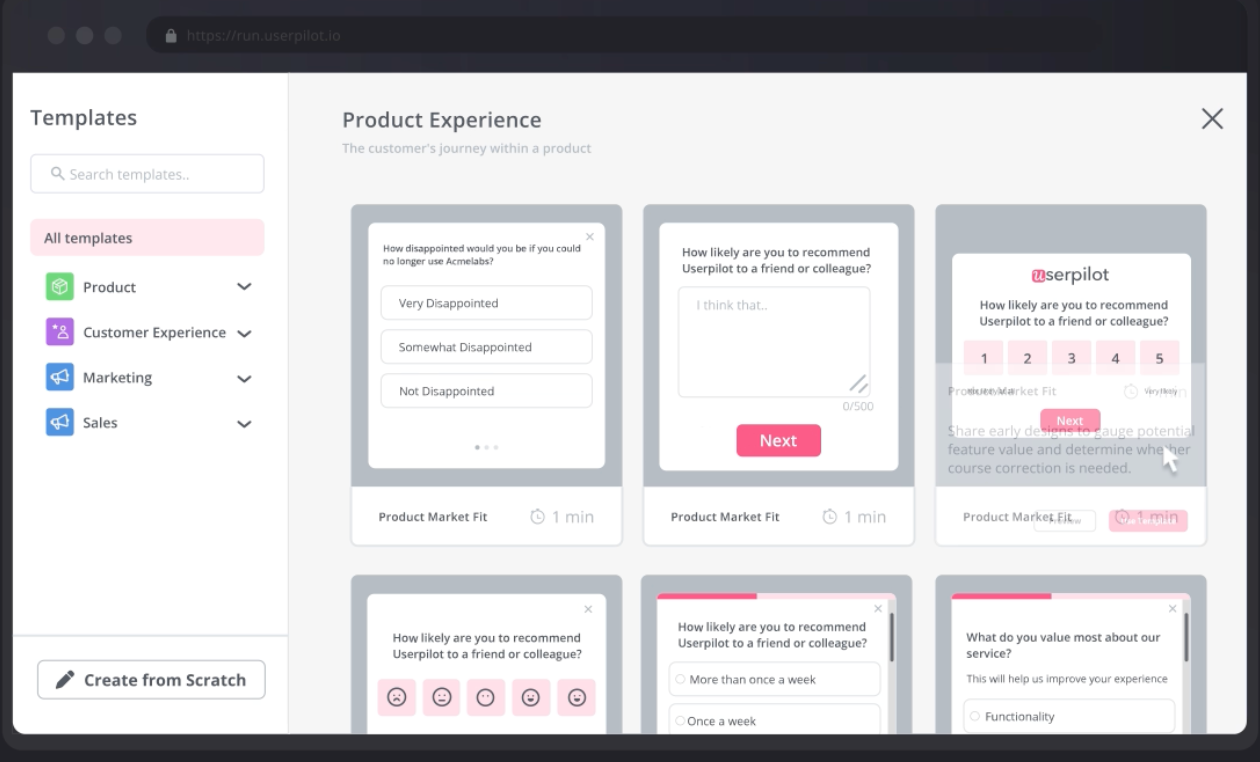

Implementing market research tools: Userpilot’s role

Similar to how a compass is essential for navigation at sea, businesses need appropriate instruments to carry out effective market research. Userpilot’s suite of product analytics and in-app engagement tools are critical components for this purpose.

Acting as a Buyer Persona Research instrument, Userpilot’s product analytics provide key quantitative research capabilities. This helps clearly define and comprehend the attributes and behaviors of potential customers, providing you with insights into your ICP (Ideal Customer Persona), user preferences, and product-market fit.

Beyond product analytics, Userpilot offers robust in-app engagement features such as modals and surveys that support real time collection of market research information. These interactive features work synergistically with the analytical tools to enable companies to gather detailed data and feedback crucial for informed business decision-making.

Marketing research process: Step-by-step guide

Marketing research conists of several critical stages:

- Defining precise goals.

- Delving into the knowledge of your target demographic.

- Collecting and scrutinizing data.

- Revealing insights that can be translated into tangible actions.

Following these steps allows you to gather critical information that guides business decisions.

An effective research strategy is crucial and involves:

- Properly allocating funds.

- Formulating testable hypotheses.

- Choosing appropriate methods for the study.

- Determining the number of study participants.

- Considering external variables.

A well-planned strategy ensures that your market research is focused, efficient, and produces useful outcomes.

After collecting data, the next step is to analyze it. This involves comparing the data to your initial questions to draw conclusions relevant to your business strategies.

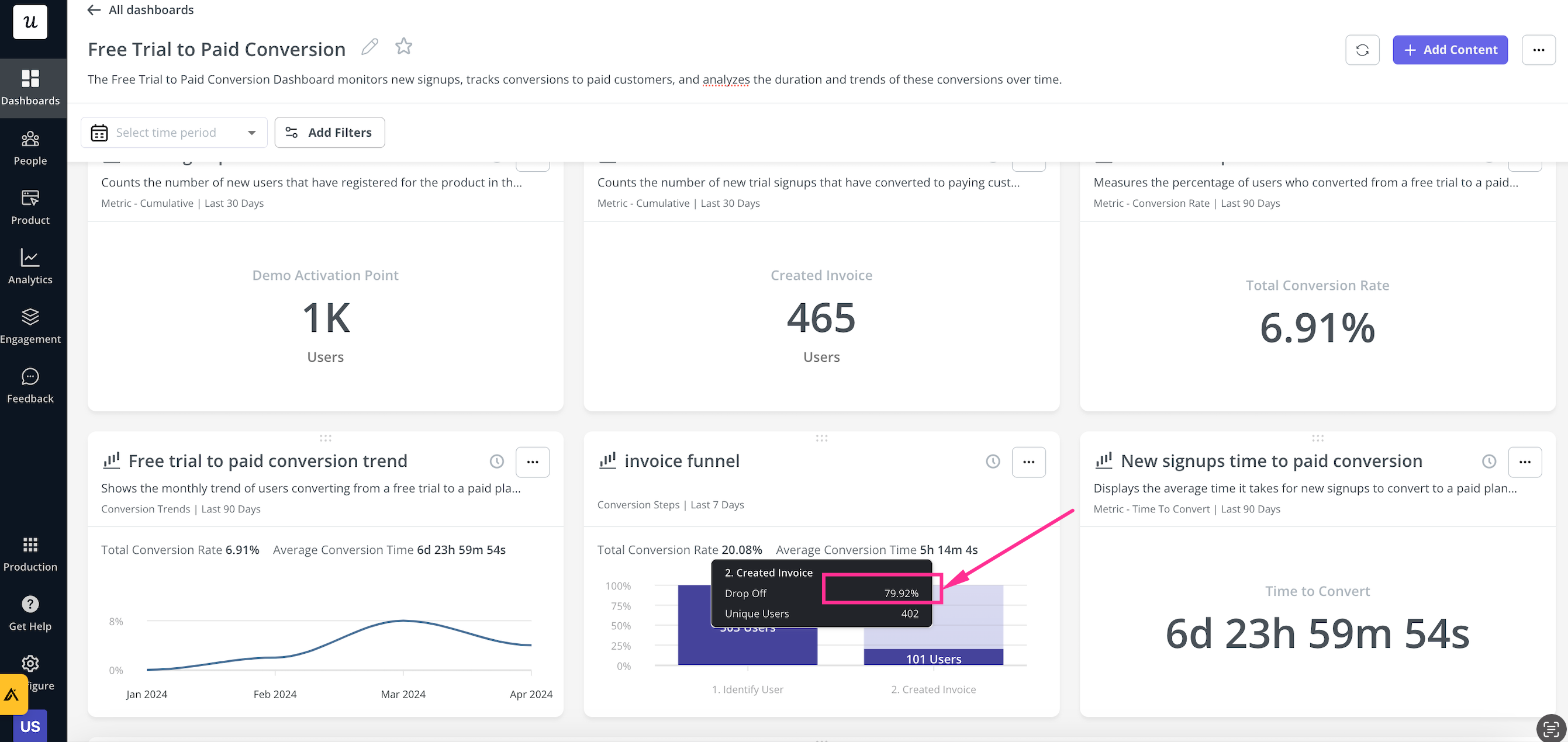

Userpilot makes your data analysis easier by providing handy analytics dashboards for key user metrics such as activation, engagement, core feature adoption, and retention out of the box:

Finally, you report the findings and the process, providing recommendations based on the evidence. This is like solving a puzzle: each piece helps to complete the overall picture.

Challenges and best practices in market research

Delving into market research comes with its own set of hurdles. Those conducting the research must deliver more profound insights within increasingly shorter timespans, and they need to cultivate strategic, continuous research methods to stay abreast of an ever-changing business landscape.

Ensuring high-quality data can be demanding due to issues such as disjointed tools or insufficient analytical expertise. New solutions like Userpilot are surfacing that make these obstacles less daunting by offering accessible and user-friendly options. Maintaining clear lines of communication with your market research team is crucial for achieving both punctuality and quality in outcomes.

The advantages of engaging in marketing research cannot be overstated.

Real-life examples of successful market research

Real-life examples of market research in the SaaS industry often showcase innovative approaches to understanding customer needs and product-market fit.

For instance, Slack, the communication platform, utilized extensive market research to identify gaps in communication tools and understand the workflows of teams. This led to the development of features that seamlessly integrated with other tools and catered to the needs of various team sizes and structures.

Another example is HubSpot, which conducted market research to understand the pain points of small to medium-sized businesses in managing customer relationships. The insights gained helped shape their all-in-one inbound marketing, sales, and service platform, which has become integral to their users’ daily operations. These examples demonstrate how SaaS companies can employ market research to inform product development, improve user experience, and strategically position themselves in a competitive market.

Choosing the right market research tools

For B2B SaaS product managers aiming to do market research, having the right set of tools can make a significant difference. Here’s a list of valuable SaaS tools that can be leveraged for effective market research:

- Userpilot : A comprehensive Product Growth Platform offering in-depth product analytics, a code-free in-app experience builder, bespoke in-app survey capabilities, and robust integration options with platforms like Salesforce and Hubspot. This tool is particularly useful for understanding user behavior, enhancing user engagement, and gathering targeted feedback.

- Qualtrics : Known for its powerful survey tools, Qualtrics helps businesses gather and analyze customer feedback effectively. Its advanced analytics features are ideal for testing market hypotheses and understanding customer sentiments.

- SurveyMonkey : A versatile tool that enables product managers to create, send, and analyze surveys quickly and easily. SurveyMonkey is suitable for gauging customer satisfaction and collecting feedback on potential new features.

- Mixpanel : Specializes in user behavior analytics, offering detailed insights into how users interact with your product. This is essential for identifying patterns and optimizing product features.

- Hotjar : Combines analytics and feedback tools to give teams insights into user behavior and preferences. Hotjar’s heatmaps and session recordings are invaluable for understanding the user experience on a deeper level.

- Tableau : A leading platform for business intelligence and data visualization, Tableau allows product managers to create comprehensive visual reports that can inform strategic decisions based on user data analysis.

Each of these tools provides unique functionalities that can assist SaaS product managers in conducting thorough market research, thereby ensuring that their products are perfectly aligned with user needs and market demands.

Measuring the impact of market research

The pivotal challenge for market research lies in demonstrating its return on investment (ROI) and overall influence on corporate success sufficiently enough to justify regular financial commitment from company leaders. The worth attributed to a market research firm hinges not only on their ability to deliver relevant and high-caliber information, but also on their pricing structures and their contribution towards propelling organizational growth.

To gauge how effectively business choices made based on market research findings succeed, various metrics and key performance indicators (KPIs) are utilized. These numerical tools act as navigational aids directing enterprises toward achieving objectives while simultaneously verifying that efforts invested in conducting market analysis are yielding fruitful guidance.

Throughout our look at market research, we’ve seen its importance and impact. Our discussion covered the basics of market research, its key components, and different types, including both qualitative and quantitative methods, and the role of Userpilot’s tools. We’ve examined the details of the market research process, tackled challenges, identified best practices, and shared success stories. We also provided advice on choosing the right market research partner and how to measure the effectiveness of your market research.

In today’s data-driven world, comprehensive market research is crucial for companies that want to succeed. It acts like a guide, helping businesses navigate the complex market landscape. Start your own detailed research today, supported by insightful analytics to help you succeed.

Frequently asked questions

What is market research and why is it important.

Understanding your target market, honing business strategies, and making informed decisions are all essential components that depend heavily on effective market research. It offers objective insights to help avoid expensive errors and foresees the needs of customers .

What is the difference between primary and secondary market research?

Primary market research is characterized by the direct gathering of data, in contrast to secondary market research which leverages existing information from alternative sources for addressing research inquiries.

Such a distinction can guide you in selecting an approach that aligns with your precise needs for conducting specific research.

What are some examples of successful market research?

Examples of successful market research are evident in the operations of well-known companies such as Starbucks, Apple, and McDonald’s. They have harnessed this tool to fine-tune their business strategies and make decisions based on solid information.

By employing market research, these businesses have managed to gain insight into their customers’ desires and needs, which has contributed significantly to their success.

How can I choose the right market research partner?

Selecting an ideal market research ally involves identifying a firm that resonates with your project requirements, financial plan, and corporate goals while also verifying their track record of dependability and consistency via reviews from previous clients.

Best wishes on your endeavor!

How is the impact of market research measured?

The effectiveness of market research hinges on the precision, representativeness, and pertinence of its data, along with how successful business decisions are when they’re based on the findings from this research. These elements define the impact of the research conducted.

Leave a comment Cancel reply

Save my name, email, and website in this browser for the next time I comment.

Get The Insights!

The fastest way to learn about Product Growth,Management & Trends.

The coolest way to learn about Product Growth, Management & Trends. Delivered fresh to your inbox, weekly.

The fastest way to learn about Product Growth, Management & Trends.

You might also be interested in ...

What are vanity metrics in product marketing definition & examples.

Aazar Ali Shad

What is Customer-led Marketing & Growth? + Best Practices

9 marketing research methods to refine your marketing strategy.

Saffa Faisal

- Search Search Please fill out this field.

What Is Market Research?

- How It Works

- Primary vs. Secondary

- How to Conduct Research

The Bottom Line

- Marketing Essentials

How to Do Market Research, Types, and Example

:max_bytes(150000):strip_icc():format(webp)/dd453b82d4ef4ce8aac2e858ed00a114__alexandra_twin-5bfc262b46e0fb0026006b77.jpeg)

- How to Start a Business: A Comprehensive Guide and Essential Steps

- How to Do Market Research, Types, and Example CURRENT ARTICLE

- Marketing Strategy: What It Is, How It Works, How To Create One

- Marketing in Business: Strategies and Types Explained

- What Is a Marketing Plan? Types and How to Write One

- Business Development: Definition, Strategies, Steps & Skills

- Business Plan: What It Is, What's Included, and How to Write One

- Small Business Development Center (SBDC): Meaning, Types, Impact

- How to Write a Business Plan for a Loan

- Business Startup Costs: It’s in the Details

- Startup Capital Definition, Types, and Risks

- Bootstrapping Definition, Strategies, and Pros/Cons

- Crowdfunding: What It Is, How It Works, and Popular Websites

- Starting a Business with No Money: How to Begin

- A Comprehensive Guide to Establishing Business Credit

- Equity Financing: What It Is, How It Works, Pros and Cons

- Best Startup Business Loans

- Sole Proprietorship: What It Is, Pros & Cons, and Differences From an LLC

- Partnership: Definition, How It Works, Taxation, and Types

- What is an LLC? Limited Liability Company Structure and Benefits Defined

- Corporation: What It Is and How to Form One

- Starting a Small Business: Your Complete How-to Guide

- Starting an Online Business: A Step-by-Step Guide

- How to Start Your Own Bookkeeping Business: Essential Tips

- How to Start a Successful Dropshipping Business: A Comprehensive Guide

Joules Garcia / Investopedia

Market research examines consumer behavior and trends in the economy to help a business develop and fine-tune its business idea and strategy. It helps a business understand its target market by gathering and analyzing data.

Market research is the process of evaluating the viability of a new service or product through research conducted directly with potential customers. It allows a company to define its target market and get opinions and other feedback from consumers about their interest in a product or service.

Research may be conducted in-house or by a third party that specializes in market research. It can be done through surveys and focus groups, among other ways. Test subjects are usually compensated with product samples or a small stipend for their time.

Key Takeaways

- Companies conduct market research before introducing new products to determine their appeal to potential customers.

- Tools include focus groups, telephone interviews, and questionnaires.

- The results of market research inform the final design of the product and determine how it will be positioned in the marketplace.

- Market research usually combines primary information, gathered directly from consumers, and secondary information, which is data available from external sources.

Market Research

How market research works.

Market research is used to determine the viability of a new product or service. The results may be used to revise the product design and fine-tune the strategy for introducing it to the public. This can include information gathered for the purpose of determining market segmentation . It also informs product differentiation , which is used to tailor advertising.

A business engages in various tasks to complete the market research process. It gathers information based on the market sector being targeted by the product. This information is then analyzed and relevant data points are interpreted to draw conclusions about how the product may be optimally designed and marketed to the market segment for which it is intended.

It is a critical component in the research and development (R&D) phase of a new product or service introduction. Market research can be conducted in many different ways, including surveys, product testing, interviews, and focus groups.

Market research is a critical tool that companies use to understand what consumers want, develop products that those consumers will use, and maintain a competitive advantage over other companies in their industry.

Primary Market Research vs. Secondary Market Research

Market research usually consists of a combination of:

- Primary research, gathered by the company or by an outside company that it hires

- Secondary research, which draws on external sources of data

Primary Market Research

Primary research generally falls into two categories: exploratory and specific research.

- Exploratory research is less structured and functions via open-ended questions. The questions may be posed in a focus group setting, telephone interviews, or questionnaires. It results in questions or issues that the company needs to address about a product that it has under development.

- Specific research delves more deeply into the problems or issues identified in exploratory research.

Secondary Market Research

All market research is informed by the findings of other researchers about the needs and wants of consumers. Today, much of this research can be found online.

Secondary research can include population information from government census data , trade association research reports , polling results, and research from other businesses operating in the same market sector.

History of Market Research

Formal market research began in Germany during the 1920s. In the United States, it soon took off with the advent of the Golden Age of Radio.

Companies that created advertisements for this new entertainment medium began to look at the demographics of the audiences who listened to each of the radio plays, music programs, and comedy skits that were presented.

They had once tried to reach the widest possible audience by placing their messages on billboards or in the most popular magazines. With radio programming, they had the chance to target rural or urban consumers, teenagers or families, and judge the results by the sales numbers that followed.

Types of Market Research

Face-to-face interviews.

From their earliest days, market research companies would interview people on the street about the newspapers and magazines that they read regularly and ask whether they recalled any of the ads or brands that were published in them. Data collected from these interviews were compared to the circulation of the publication to determine the effectiveness of those ads.

Market research and surveys were adapted from these early techniques.

To get a strong understanding of your market, it’s essential to understand demand, market size, economic indicators, location, market saturation, and pricing.

Focus Groups

A focus group is a small number of representative consumers chosen to try a product or watch an advertisement.

Afterward, the group is asked for feedback on their perceptions of the product, the company’s brand, or competing products. The company then takes that information and makes decisions about what to do with the product or service, whether that's releasing it, making changes, or abandoning it altogether.

Phone Research

The man-on-the-street interview technique soon gave way to the telephone interview. A telephone interviewer could collect information in a more efficient and cost-effective fashion.

Telephone research was a preferred tactic of market researchers for many years. It has become much more difficult in recent years as landline phone service dwindles and is replaced by less accessible mobile phones.

Survey Research

As an alternative to focus groups, surveys represent a cost-effective way to determine consumer attitudes without having to interview anyone in person. Consumers are sent surveys in the mail, usually with a coupon or voucher to incentivize participation. These surveys help determine how consumers feel about the product, brand, and price point.

Online Market Research

With people spending more time online, market research activities have shifted online as well. Data collection still uses a survey-style form. But instead of companies actively seeking participants by finding them on the street or cold calling them on the phone, people can choose to sign up, take surveys, and offer opinions when they have time.

This makes the process far less intrusive and less rushed, since people can participate on their own time and of their own volition.

How to Conduct Market Research

The first step to effective market research is to determine the goals of the study. Each study should seek to answer a clear, well-defined problem. For example, a company might seek to identify consumer preferences, brand recognition, or the comparative effectiveness of different types of ad campaigns.

After that, the next step is to determine who will be included in the research. Market research is an expensive process, and a company cannot waste resources collecting unnecessary data. The firm should decide in advance which types of consumers will be included in the research, and how the data will be collected. They should also account for the probability of statistical errors or sampling bias .

The next step is to collect the data and analyze the results. If the two previous steps have been completed accurately, this should be straightforward. The researchers will collect the results of their study, keeping track of the ages, gender, and other relevant data of each respondent. This is then analyzed in a marketing report that explains the results of their research.

The last step is for company executives to use their market research to make business decisions. Depending on the results of their research, they may choose to target a different group of consumers, or they may change their price point or some product features.

The results of these changes may eventually be measured in further market research, and the process will begin all over again.

Benefits of Market Research

Market research is essential for developing brand loyalty and customer satisfaction. Since it is unlikely for a product to appeal equally to every consumer, a strong market research program can help identify the key demographics and market segments that are most likely to use a given product.

Market research is also important for developing a company’s advertising efforts. For example, if a company’s market research determines that its consumers are more likely to use Facebook than X (formerly Twitter), it can then target its advertisements to one platform instead of another. Or, if they determine that their target market is value-sensitive rather than price-sensitive, they can work on improving the product rather than reducing their prices.

Market research only works when subjects are honest and open to participating.

Example of Market Research

Many companies use market research to test new products or get information from consumers about what kinds of products or services they need and don’t currently have.

For example, a company that’s considering starting a business might conduct market research to test the viability of its product or service. If the market research confirms consumer interest, the business can proceed confidently with its business plan . If not, the company can use the results of the market research to make adjustments to the product to bring it in line with customer desires.

What Are the Main Types of Market Research?

The main types of market research are primary research and secondary research. Primary research includes focus groups, polls, and surveys. Secondary research includes academic articles, infographics, and white papers.

Qualitative research gives insights into how customers feel and think. Quantitative research uses data and statistics such as website views, social media engagement, and subscriber numbers.

What Is Online Market Research?

Online market research uses the same strategies and techniques as traditional primary and secondary market research, but it is conducted on the Internet. Potential customers may be asked to participate in a survey or give feedback on a product. The responses may help the researchers create a profile of the likely customer for a new product.

What Are Paid Market Research Surveys?

Paid market research involves rewarding individuals who agree to participate in a study. They may be offered a small payment for their time or a discount coupon in return for filling out a questionnaire or participating in a focus group.

What Is a Market Study?

A market study is an analysis of consumer demand for a product or service. It looks at all of the factors that influence demand for a product or service. These include the product’s price, location, competition, and substitutes as well as general economic factors that could influence the new product’s adoption, for better or worse.

Market research is a key component of a company’s research and development (R&D) stage. It helps companies understand in advance the viability of a new product that they have in development and to see how it might perform in the real world.

Britannica Money. “ Market Research .”

U.S. Small Business Administration. “ Market Research and Competitive Analysis .”

:max_bytes(150000):strip_icc():format(webp)/CPM-edit-e635f4dfe70c4749986100b8429533dc.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

Send us an email

How to do market research: The complete guide for your brand

Written by by Jacqueline Zote

Published on April 13, 2023

Reading time 10 minutes

Blindly putting out content or products and hoping for the best is a thing of the past. Not only is it a waste of time and energy, but you’re wasting valuable marketing dollars in the process. Now you have a wealth of tools and data at your disposal, allowing you to develop data-driven marketing strategies . That’s where market research comes in, allowing you to uncover valuable insights to inform your business decisions.

Conducting market research not only helps you better understand how to sell to customers but also stand out from your competition. In this guide, we break down everything you need to know about market research and how doing your homework can help you grow your business.

Table of contents:

What is market research?

Why is market research important, types of market research, where to conduct market research.

- Steps for conducting market research

- Tools to use for market research

Market research is the process of gathering information surrounding your business opportunities. It identifies key information to better understand your audience. This includes insights related to customer personas and even trends shaping your industry.

Taking time out of your schedule to conduct research is crucial for your brand health. Here are some of the key benefits of market research:

Understand your customers’ motivations and pain points

Most marketers are out of touch with what their customers want. Moreover, these marketers are missing key information on what products their audience wants to buy.

Simply put, you can’t run a business if you don’t know what motivates your customers.

And spoiler alert: Your customers’ wants and needs change. Your customers’ behaviors today might be night and day from what they were a few years ago.

Market research holds the key to understanding your customers better. It helps you uncover their key pain points and motivations and understand how they shape their interests and behavior.

Figure out how to position your brand

Positioning is becoming increasingly important as more and more brands enter the marketplace. Market research enables you to spot opportunities to define yourself against your competitors.

Maybe you’re able to emphasize a lower price point. Perhaps your product has a feature that’s one of a kind. Finding those opportunities goes hand in hand with researching your market.

Maintain a strong pulse on your industry at large

Today’s marketing world evolves at a rate that’s difficult to keep up with.

Fresh products. Up-and-coming brands. New marketing tools. Consumers get bombarded with sales messages from all angles. This can be confusing and overwhelming.

By monitoring market trends, you can figure out the best tactics for reaching your target audience.

Not everyone conducts market research for the same reason. While some may want to understand their audience better, others may want to see how their competitors are doing. As such, there are different types of market research you can conduct depending on your goal.

Interview-based market research allows for one-on-one interactions. This helps the conversation to flow naturally, making it easier to add context. Whether this takes place in person or virtually, it enables you to gather more in-depth qualitative data.

Buyer persona research

Buyer persona research lets you take a closer look at the people who make up your target audience. You can discover the needs, challenges and pain points of each buyer persona to understand what they need from your business. This will then allow you to craft products or campaigns to resonate better with each persona.

Pricing research

In this type of research, brands compare similar products or services with a particular focus on pricing. They look at how much those products or services typically sell for so they can get more competitive with their pricing strategy.

Competitive analysis research

Competitor analysis gives you a realistic understanding of where you stand in the market and how your competitors are doing. You can use this analysis to find out what’s working in your industry and which competitors to watch out for. It even gives you an idea of how well those competitors are meeting consumer needs.

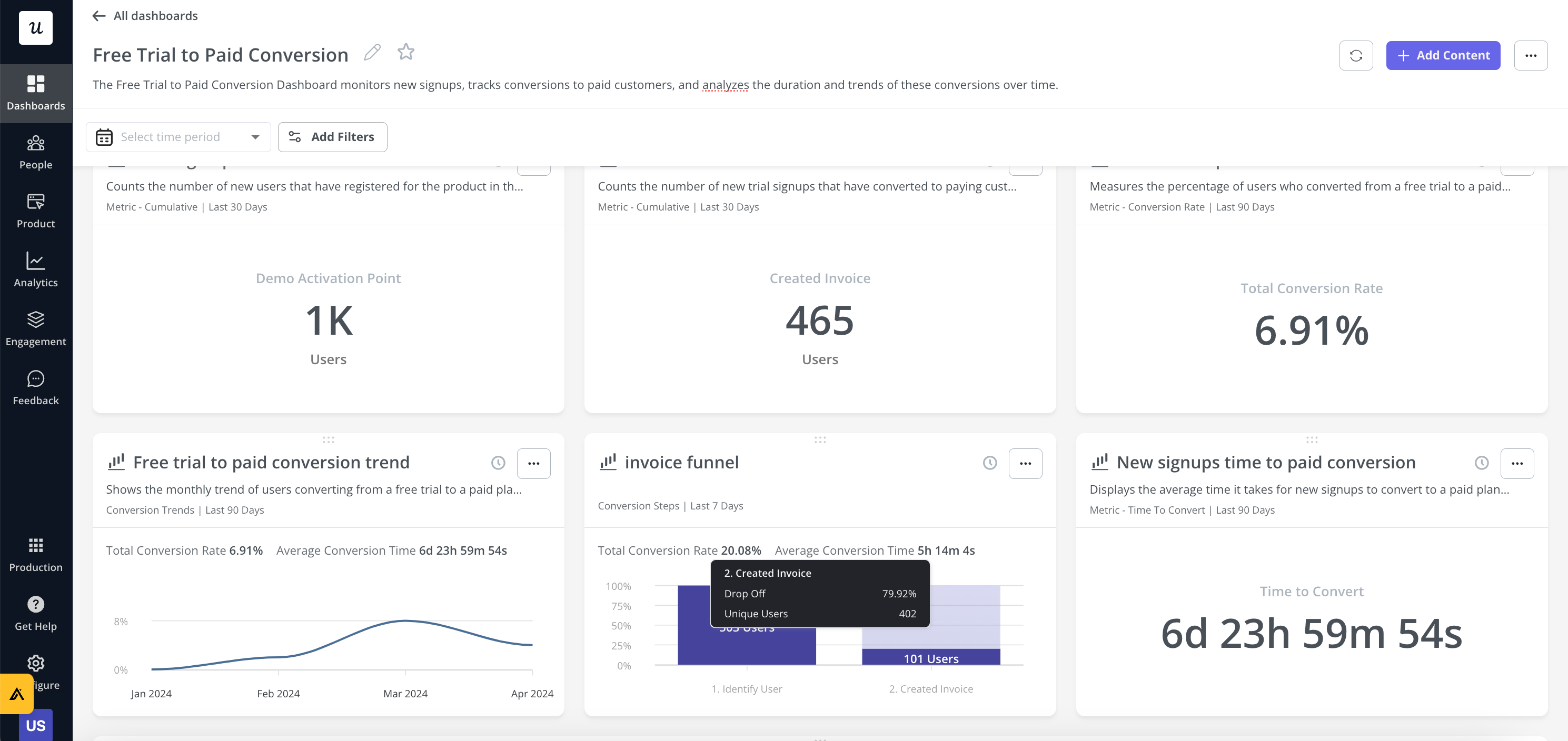

Depending on the competitor analysis tool you use, you can get as granular as you need with your research. For instance, Sprout Social lets you analyze your competitors’ social strategies. You can see what types of content they’re posting and even benchmark your growth against theirs.

Brand awareness research

Conducting brand awareness research allows you to assess your brand’s standing in the market. It tells you how well-known your brand is among your target audience and what they associate with it. This can help you gauge people’s sentiments toward your brand and whether you need to rebrand or reposition.

If you don’t know where to start with your research, you’re in the right place.

There’s no shortage of market research methods out there. In this section, we’ve highlighted research channels for small and big businesses alike.

Considering that Google sees a staggering 8.5 billion searches each day, there’s perhaps no better place to start.

A quick Google search is a potential goldmine for all sorts of questions to kick off your market research. Who’s ranking for keywords related to your industry? Which products and pieces of content are the hottest right now? Who’s running ads related to your business?

For example, Google Product Listing Ads can help highlight all of the above for B2C brands.

The same applies to B2B brands looking to keep tabs on who’s running industry-related ads and ranking for keyword terms too.

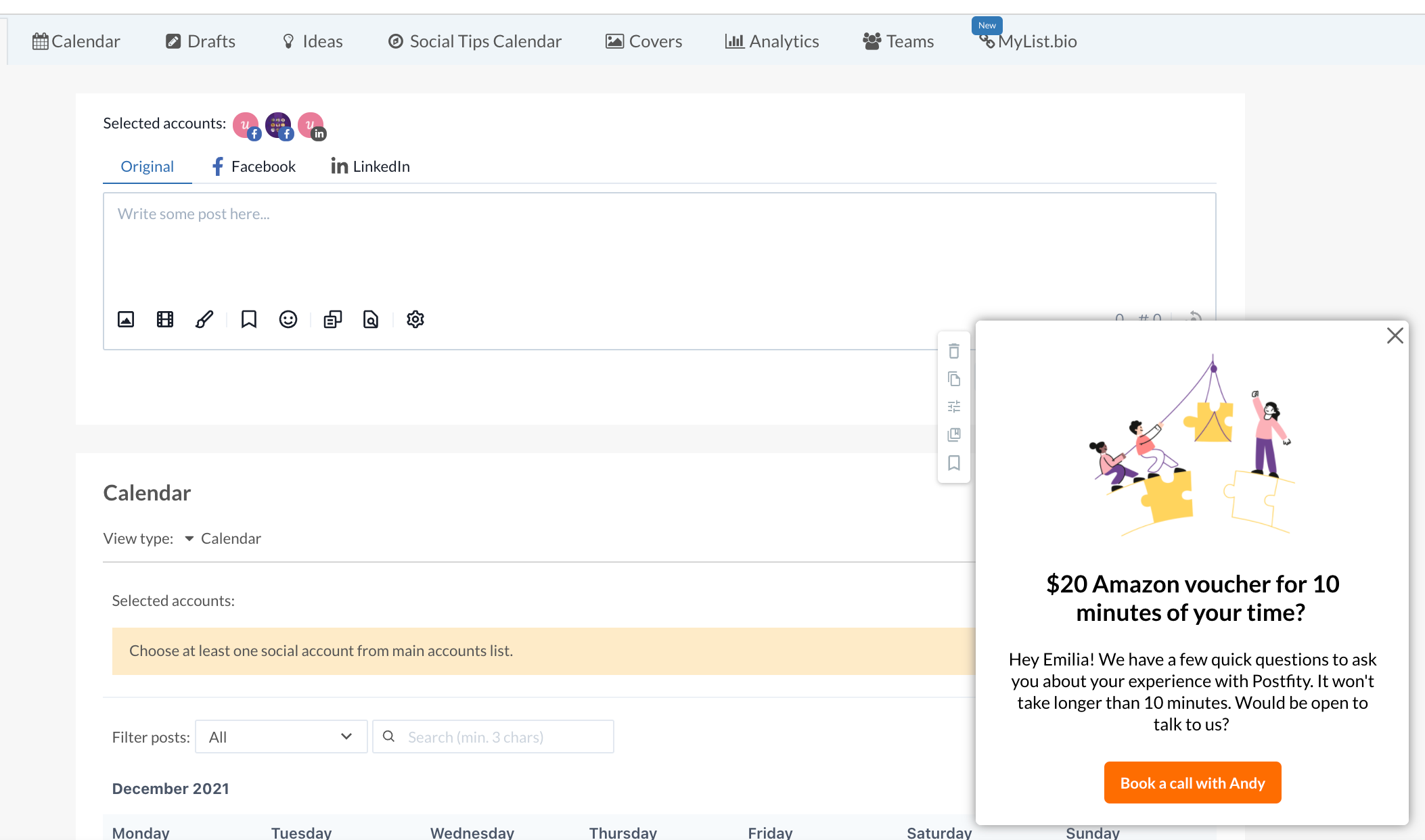

There’s no denying that email represents both an aggressive and effective marketing channel for marketers today. Case in point, 44% of online shoppers consider email as the most influential channel in their buying decisions.

Looking through industry and competitor emails is a brilliant way to learn more about your market. For example, what types of offers and deals are your competitors running? How often are they sending emails?

Email is also invaluable for gathering information directly from your customers. This survey message from Asana is a great example of how to pick your customers’ brains to figure out how you can improve your quality of service.

Industry journals, reports and blogs

Don’t neglect the importance of big-picture market research when it comes to tactics and marketing channels to explore. Look to marketing resources such as reports and blogs as well as industry journals

Keeping your ear to the ground on new trends and technologies is a smart move for any business. Sites such as Statista, Marketing Charts, AdWeek and Emarketer are treasure troves of up-to-date data and news for marketers.

And of course, there’s the Sprout Insights blog . And invaluable resources like The Sprout Social Index™ can keep you updated on the latest social trends.

Social media

If you want to learn more about your target market, look no further than social media. Social offers a place to discover what your customers want to see in future products or which brands are killin’ it. In fact, social media is become more important for businesses than ever with the level of data available.

It represents a massive repository of real-time data and insights that are instantly accessible. Brand monitoring and social listening are effective ways to conduct social media research . You can even be more direct with your approach. Ask questions directly or even poll your audience to understand their needs and preferences.

The 5 steps for how to do market research

Now that we’ve covered the why and where, it’s time to get into the practical aspects of market research. Here are five essential steps on how to do market research effectively.

Step 1: Identify your research topic

First off, what are you researching about? What do you want to find out? Narrow down on a specific research topic so you can start with a clear idea of what to look for.

For example, you may want to learn more about how well your product features are satisfying the needs of existing users. This might potentially lead to feature updates and improvements. Or it might even result in new feature introductions.

Similarly, your research topic may be related to your product or service launch or customer experience. Or you may want to conduct research for an upcoming marketing campaign.

Step 2: Choose a buyer persona to engage

If you’re planning to focus your research on a specific type of audience, decide which buyer persona you want to engage. This persona group will serve as a representative sample of your target audience.

Engaging a specific group of audience lets you streamline your research efforts. As such, it can be a much more effective and organized approach than researching thousands (if not millions) of individuals.

You may be directing your research toward existing users of your product. To get even more granular, you may want to focus on users who have been familiar with the product for at least a year, for example.

Step 3: Start collecting data

The next step is one of the most critical as it involves collecting the data you need for your research. Before you begin, make sure you’ve chosen the right research methods that will uncover the type of data you need. This largely depends on your research topic and goals.

Remember that you don’t necessarily have to stick to one research method. You may use a combination of qualitative and quantitative approaches. So for example, you could use interviews to supplement the data from your surveys. Or you may stick to insights from your social listening efforts.

To keep things consistent, let’s look at this in the context of the example from earlier. Perhaps you can send out a survey to your existing users asking them a bunch of questions. This might include questions like which features they use the most and how often they use them. You can get them to choose an answer from one to five and collect quantitative data.

Plus, for qualitative insights, you could even include a few open-ended questions with the option to write their answers. For instance, you might ask them if there’s any improvement they wish to see in your product.

Step 4: Analyze results

Once you have all the data you need, it’s time to analyze it keeping your research topic in mind. This involves trying to interpret the data to look for a wider meaning, particularly in relation to your research goal.

So let’s say a large percentage of responses were four or five in the satisfaction rating. This means your existing users are mostly satisfied with your current product features. On the other hand, if the responses were mostly ones and twos, you may look for opportunities to improve. The responses to your open-ended questions can give you further context as to why people are disappointed.

Step 5: Make decisions for your business

Now it’s time to take your findings and turn them into actionable insights for your business. In this final step, you need to decide how you want to move forward with your new market insight.

What did you find in your research that would require action? How can you put those findings to good use?

The market research tools you should be using

To wrap things up, let’s talk about the various tools available to conduct speedy, in-depth market research. These tools are essential for conducting market research faster and more efficiently.

Social listening and analytics

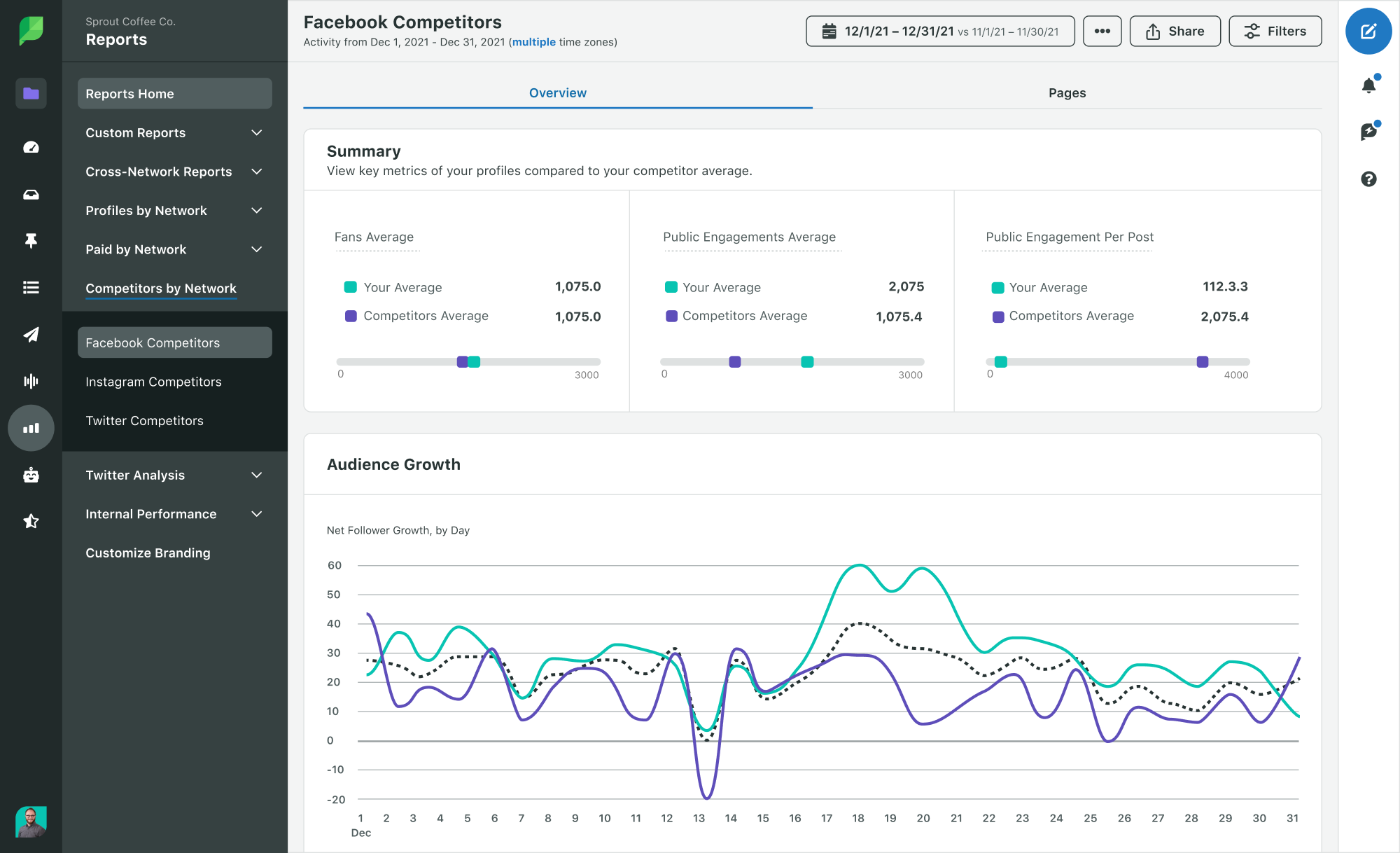

Social analytics tools like Sprout can help you keep track of engagement across social media. This goes beyond your own engagement data but also includes that of your competitors. Considering how quickly social media moves, using a third-party analytics tool is ideal. It allows you to make sense of your social data at a glance and ensure that you’re never missing out on important trends.

Email marketing research tools

Keeping track of brand emails is a good idea for any brand looking to stand out in its audience’s inbox.

Tools such as MailCharts , Really Good Emails and Milled can show you how different brands run their email campaigns.

Meanwhile, tools like Owletter allow you to monitor metrics such as frequency and send-timing. These metrics can help you understand email marketing strategies among competing brands.

Content marketing research

If you’re looking to conduct research on content marketing, tools such as BuzzSumo can be of great help. This tool shows you the top-performing industry content based on keywords. Here you can see relevant industry sites and influencers as well as which brands in your industry are scoring the most buzz. It shows you exactly which pieces of content are ranking well in terms of engagements and shares and on which social networks.

SEO and keyword tracking

Monitoring industry keywords is a great way to uncover competitors. It can also help you discover opportunities to advertise your products via organic search. Tools such as Ahrefs provide a comprehensive keyword report to help you see how your search efforts stack up against the competition.

Competitor comparison template

For the sake of organizing your market research, consider creating a competitive matrix. The idea is to highlight how you stack up side-by-side against others in your market. Use a social media competitive analysis template to track your competitors’ social presence. That way, you can easily compare tactics, messaging and performance. Once you understand your strengths and weaknesses next to your competitors, you’ll find opportunities as well.

Customer persona creator

Finally, customer personas represent a place where all of your market research comes together. You’d need to create a profile of your ideal customer that you can easily refer to. Tools like Xtensio can help in outlining your customer motivations and demographics as you zero in on your target market.

Build a solid market research strategy

Having a deeper understanding of the market gives you leverage in a sea of competitors. Use the steps and market research tools we shared above to build an effective market research strategy.

But keep in mind that the accuracy of your research findings depends on the quality of data collected. Turn to Sprout’s social media analytics tools to uncover heaps of high-quality data across social networks.

- Marketing Disciplines

- Social Media Strategy

Social media RFPs: The best questions to include (plus a template)

Template: Essential Questions to Ask in Your Social Media Management Software RFP

- Team Collaboration

How to build a marketing tech stack that scales your business

- Customer Experience

Brand trust: What it is and why it matters

- Now on slide

Build and grow stronger relationships on social

Sprout Social helps you understand and reach your audience, engage your community and measure performance with the only all-in-one social media management platform built for connection.

How To Do Market Research: Definition, Types, Methods

Jul 25, 2024

11 min. read

Market research isn’t just collecting data. It’s a strategic tool that allows businesses to gain a competitive advantage while making the best use of their resources. Research reveals valuable insights into your target audience about their preferences, buying habits, and emerging demands — all of which help you unlock new opportunities to grow your business.

When done correctly, market research can minimize risks and losses, spur growth, and position you as a leader in your industry.

Let’s explore the basic building blocks of market research and how to collect and use data to move your company forward: