- Search Search Please fill out this field.

- Tesla's First Product

The Next Stage

- Tesla's Models

Other Tesla Products

Is tesla a tech company, the bottom line.

- Company Profiles

- Tech Companies

What Makes Tesla's Business Model Different?

:max_bytes(150000):strip_icc():format(webp)/pic__kristina_a-5bfc262546e0fb005118b2b9.png)

The market for fully electric vehicles is growing. The reasons are many, including new regulations on safety and vehicle emissions, technological advances, and shifting customer expectations. But much of the mainstream acceptance and excitement for electric cars can be attributed to Tesla Motors Inc. (TSLA) and its unique business model .

Tesla founder and CEO Elon Musk launched the company with the mission, “to accelerate the advent of sustainable transport by bringing compelling mass-market electric cars to market as soon as possible.” This mission is the backbone of Tesla’s successful business model.

Key Takeaways

- Tesla's business model is based on direct sales and service, not franchised dealerships.

- Tesla's business model pays particular attention to rolling out charging stations. That may be the biggest obstacle to the mass adoption of electric vehicles.

- Tesla has stretched the business model to encompass energy storage systems for homes and businesses.

Tesla's First Product

Tesla took a unique approach to establish itself in the market. Instead of trying to build a relatively affordable car that it could mass-produce and market, it took the opposite approach, focusing instead on creating a compelling car that would create a demand for electric vehicles.

In a post on Tesla's website, CEO Elon Musk said this about the company's mission, “If we could have [mass marketed] our first product, we would have, but that was simply impossible to achieve for a startup company that had never built a car and that had one technology iteration and no economies of scale . Our first product was going to be expensive no matter what it looked like, so we decided to build a sports car, as that seemed like it had the best chance of being competitive with its gasoline alternatives.”

So, Tesla delivered to the market the first high-performance electric luxury sports car, the Tesla Roadster. The company sold approximately 2,500 Roadsters before ending production in January 2012. Not a number that would fray any nerves at General Motors.

Once Tesla established its brand and had produced and delivered its concept car to the marketplace, it reinforced its business model. Tesla's business model is based on a three-pronged approach to selling, servicing, and charging its electric vehicles.

Direct Sales

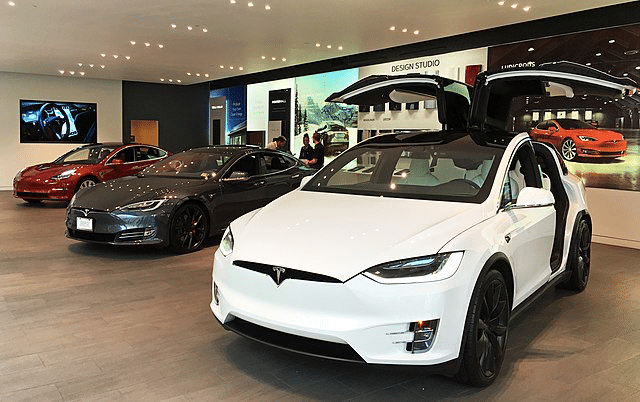

Unlike other car manufacturers who sell through franchised dealerships, Tesla sells directly to consumers. It has created an international network of company-owned showrooms and galleries, mostly in urban centers.

By owning the sales channel, Tesla believes it can gain an advantage in the speed of its product development. More importantly, it creates a better customer buying experience. Unlike car dealerships, Tesla showrooms have no potential conflicts of interest. Customers deal only with Tesla-employed sales and service staff.

Including the showrooms, Service Plus centers (a combination of retail and service center), and service facilities, Tesla has 823 locations around the world as of May 25, 2022. Tesla has also made use of Internet sales—consumers can customize and purchase a Tesla online.

Home Services

In some areas, Tesla employs Mobile Service Support (formerly called Tesla Rangers)—mobile technicians who make house calls. In some cases, the service is delivered remotely. The Model S can wirelessly upload data, so technicians can view and fix some problems without ever physically touching the car.

The Supercharger Network

Tesla has created its own network of 30,000+ Global Superchargers where drivers can charge their Tesla vehicles in about 15 minutes for a quarter of the price of gasoline. The purpose, of course, is to speed up the rate of adoption of electric cars by making it cheaper and easier to keep them running.

Tesla's Models

Tesla entered the market with the sporty Roadster. When it introduced its Model S sedan in June 2012, it stopped producing the Roadster.

Tesla began delivering its first SUV, the Model X, in September 2015.

The first Model 3 deliveries kicked off in July 2017 as Tesla's entry into the category of affordable cars. In 2022, its base model starts at $48,490.

The base price of the 2023 supercharged Tesla Roadster, touted as "the quickest car in the world."

Tesla has combined many of its sales centers with service centers, including charging stations. They believe that opening a service center in a new area corresponds with increased customer demand. Customers can charge or service their vehicles at the service centers or the Service Plus locations.

Tesla also produces a fully electric Semi Truck. The truck boasts an energy consumption of less than 2kWh per mile. The company claims it can go 400 miles on a 30-minute charge now, and it's working on stretching that to more than 600 miles in the future. UPS was among the companies that put in pre-orders for the truck, introduced in 2019.

Tesla's latest model is a supercharged version of the original Roadster, which the company claims is the "quickest car in the world," capable of going 0-60 in 1.9 seconds. Deliveries of the new Roadster are expected in 2023, with a base price of $200,000. Interested individuals can reserve a new Roadster for a $5,000 initial card payment and a $45,000 wire transfer, which is due within 10 days after making the initial payment.

If you recall, part of Tesla’s mission is “to accelerate the advent of sustainable transport.” To that end, Tesla sells powertrain systems and components to other auto manufacturers.

In April 2015, it introduced a line of home batteries, called the Powerwall, that serve as energy storage systems in homes or businesses. They are meant to connect with a solar energy system and can be used as backup power when power is interrupted or peak demand is high. Tesla also sells solar panels and full solar roofing, which is a roof made up of solar panels that still looks like a roof.

Like its rival automakers, Tesla offers financial services including vehicle loans and leases . For some of the loan programs, it used to offer a resale value guarantee provision. This provided some downside protection on a vehicle’s value should the customer want to resell it.

Many financial analysts and investors see Tesla as a technology company rather than a car company. At least, that's how they justified the growth of its stock price starting in 2013, when it shot up by more than 300% within a single year.

Publications scrambled to find similarities between Tesla and companies from the technology sector , which had similar growth rates. Online publication Slate even ran a piece that compared Tesla to Apple Inc. (AAPL) and Alphabet Inc. (GOOGL).

Back then, Morgan Stanley analyst Adam Jonas, who has been a Tesla bull since the company's early days, gave the stock a price target of $103 "at full maturation." By May 25, 2022, TSLA was trading at $661.58.

There are several points of similarity between Tesla and the tech sector. Tesla has embraced the disruption credo of the tech sector. Much like other tech companies, Tesla is intent on changing existing business models within the stodgy automotive industry by selling directly to consumers. Its product pipeline and founder evoke a loyal following similar to those for iconic tech companies such as Apple.

And investors in Tesla, like investors in many technology companies, stayed patient through a long period of quarterly losses. They were finally rewarded: Tesla recorded its first yearly profit in FY 2021.

This is the biggest obstacle to the mass adoption of electric vehicles: It can't happen without the infrastructure to charge on the go. Tesla plans to continue adding to its network of Supercharger stations in the U.S., Europe, and Asia.

Tesla did not invent the electric car or even the luxury electric car. But Tesla did invent a successful business model for bringing compelling electric cars to the market. Part of the strategy was building a network of charging stations to solve one of the greatest obstacles facing the adoption of electric vehicles: refueling on long trips. Tesla’s unique business model , which includes keeping control over sales and service, is one reason its stock has soared since its initial public offering.

Tesla. " The Mission of Tesla ."

Tesla. " Form 10-Q for the Quarterly Period Ended September 30, 2011 ," Page 22.

Tesla. " Find Us ."

Tesla. " Mobile Service Support ."

Tesla. " Model S ."

Tesla. " Supercharger. "

Tesla. " Fourth Quarter & Full Year 2012 Shareholder Letter ," Page 1.

Tesla. " Third Quarter 2015 Shareholder Letter ," Page 1.

Tesla. " Second Quarter 2017 Update ," Page 1.

Kelley Blue Book. " 2022 Tesla Model 3 ."

Car and Driver. " 2023 Tesla Roadster ."

Tesla. " Roadster ."

Autoweek. " Musk Now Says 621 Miles of Range for Tesla Semi ."

Tesla. " Your Roadster ."

Tesla. " First Quarter 2015 Shareholder Letter ," Page 2.

Tesla. " Powerwall ."

Tesla. " Solar Roof ."

The Verge. " Tesla Ends ‘Resale Value Guarantee’ on New Vehicle Purchases ."

CNBC. " Market Insider: Is Tesla Really a Tech Company? "

Yahoo! Finance. " Tesla, Inc. (TSLA) ."

Tesla. " 2020 Form 10-K ," Page 30.

:max_bytes(150000):strip_icc():format(webp)/shutterstock_259393262_tesla_model_3-5bfc476746e0fb0051c410ae.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Innovative Prompts

- Strategies Packs

- Skills Packs

- SOPs Toolkits

- Business Ideas

- Super Guides

- Innovation Report

- Canvas Examples

- Presentations

- Spreadsheets

- Discounted Bundles

- Search for:

No products in the cart.

Return to shop

Tesla Business Model

The Tesla business model operates as a Direct-to-Consumer (D2C) business model as it sells directly, cutting out middlemen such as dealerships and offering its own charging station network. Which of these names do you recognize more easily: Tesla or Elon Musk ? While, in general, we identify the author by the work — that is, it would be normal for you to know Elon Musk as the CEO of Tesla —, in the case of this visionary eccentric, in particular, it is quite common for the opposite to happen: Tesla being Elon Musk’s company.

But, anyway, in addition to its charismatic and incomparable leader, Tesla is also characterized by being a company that is basically divided into three business models: an auto-maker, a hardware supplier, and a tech company. We will know, then, how everything works in this hybrid business model, which has faced great challenges in the market. Follow up!

A brief history of Tesla

Tesla , Inc. is an American company, founded in 2003 by two engineers, Martin Eberhard and Marc Tarpenning, originally as Tesla Motors. Fourteen years later, the company would change its nomenclature, because it started to incorporate supply lifestyle products in its production.

Tesla’s first product was launched in 2008 — the Tesla Roadster, the high-performance electric sports car, whose sales ended four years later, in 2012. Instead of launching a cheaper first car, to gain in quantity, the Roadster was a luxury item. Musk, the company’s CEO, explained that, with all the technology they intended to put in the car, it would be impossible for it to reach the market at a low price. For this very reason, they chose to launch a product, above all, compelling.

In the following years, Tesla invested heavily in marketing, research, and development, prioritizing studies in safe, autopilot, and charging cars. In 2018, Tesla was already the largest seller of electric cars in the world, with more than 250,000 units sold, taking up 12% of that market.

Who Owns Tesla

As mentioned a few times, Tesla is owned by the eccentric billionaire Elon Musk . Although founded by Martin Eberhard and Marc Tarpenning back in July 2003, Elon Musk has been the CEO and chairman of the company since 2008.

Tesla’s Mission Statement

Tesla’s mission is to accelerate the world’s transition to sustainable energy.

Tesla’s Differentials

Currently, Tesla’s business model is based on three foundations: selling model, servicing, and charging network.

First of all, unlike other automakers that have their cars sold by dealerships worldwide, Tesla focuses on direct sales. This means that all Tesla stores are an arm of the company itself and that anyone who is served in that space will, in fact, be received by an employee of the manufacturer itself.

This allows Tesla to improve its product through direct and fast contact with the customer and guarantees them differentiated service facilities, which include the possibility of customizing a vehicle via the internet. In addition, the company has service centers in all places where it sells its cars, with personalized service, including Tesla Rangers, technicians that the company sends to people’s homes for service.

These centers also have a charging service. But, more than that, Tesla also has an extensive network of Supercharges stations, where cars can be fully recharged in up to 30 minutes — at no cost. Of course, in addition to these three factors, there is still a difference between the company’s own products. Tesla has the fastest and longest-range electric cars on the market, with unique design and brand identity.

Finally, there is still the entire research and development process promoted by the company. Tesla invests heavily in hardware and software, focusing on digital technology and even autonomous driving cars. And yet, it increasingly seeks to reduce CO2 emissions, through investment in sustainable energy, which guarantees the support of the government.

How Tesla makes money

Certainly, its most important revenue stream was and remains the sale of electric cars , representing more than 80% of its revenue, which is estimated at more than 20 billion dollars. The other 20% of income includes automotive services and vehicle leasing, but also sales of solar energy systems and storage products (about $1.5 billion).

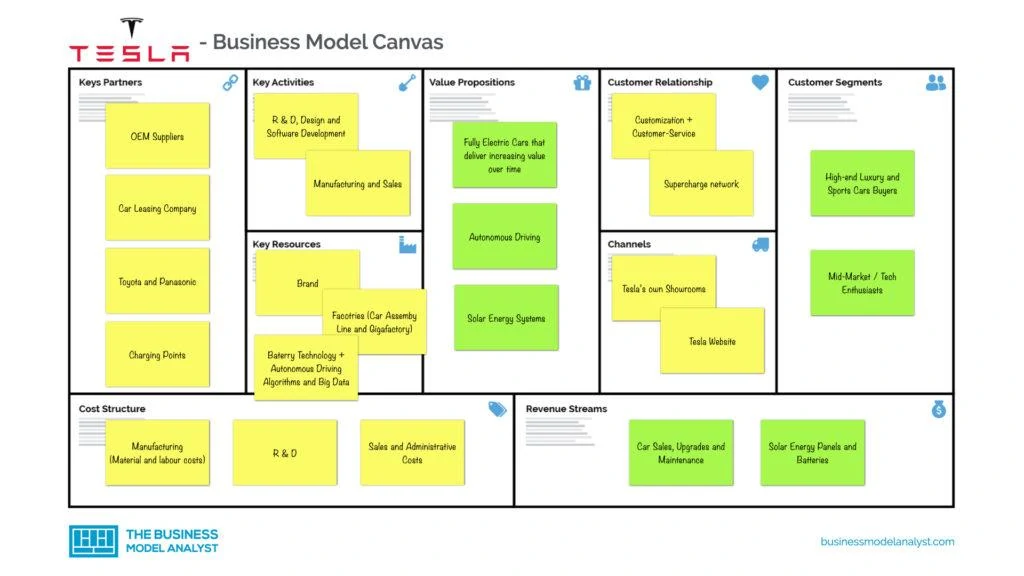

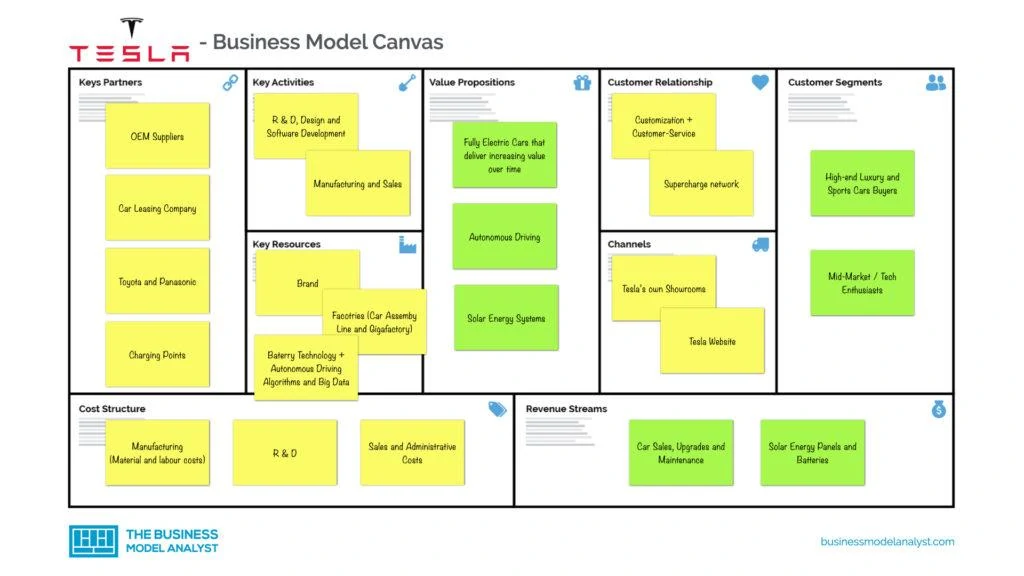

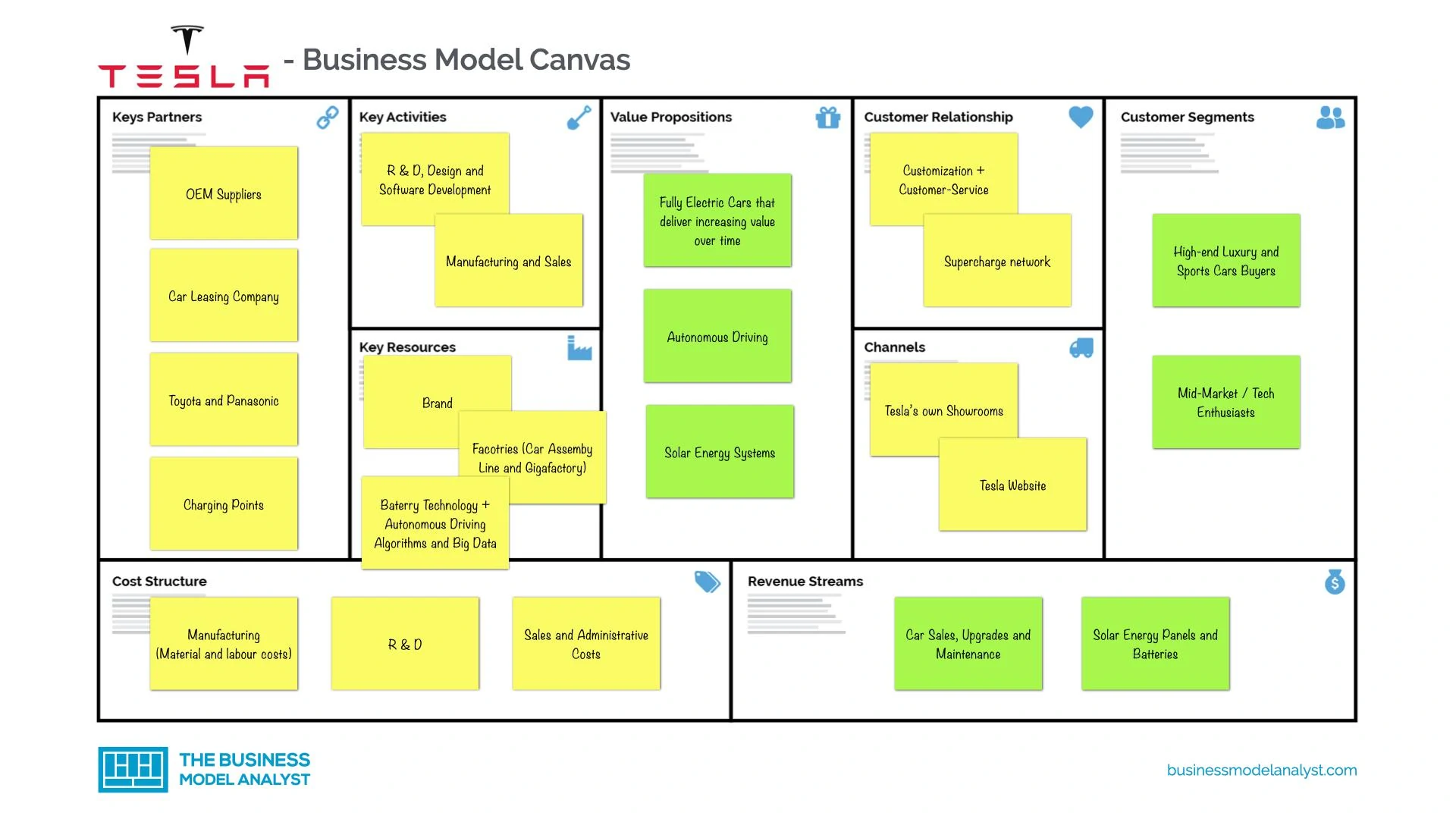

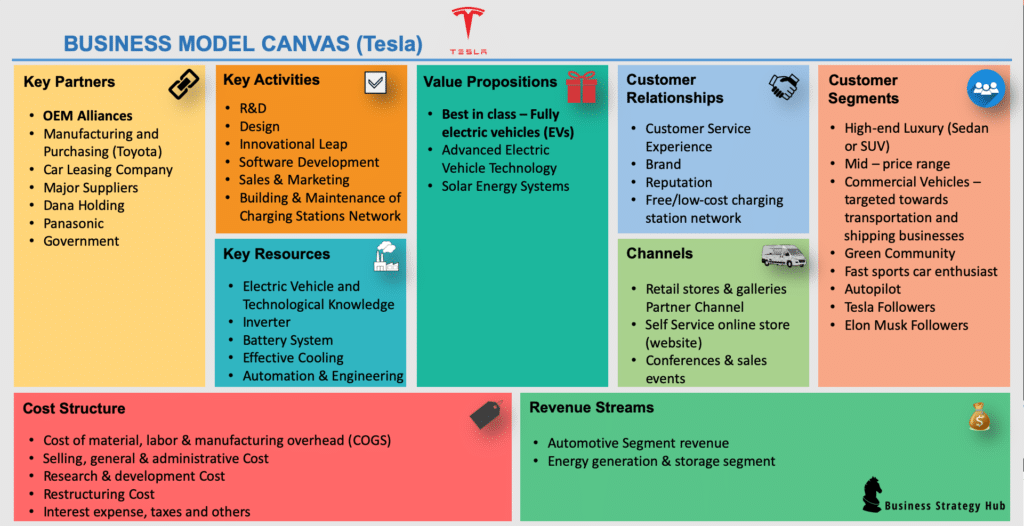

Tesla’s Business Model Canvas

You can look at the Tesla Business Model designed in the Business Model Canvas below:

Download FREE!

To download Tesla Business Model Canvas today just enter your email address!

Tesla’s Customer Segments

Tesla has developed vehicles for every type of customer. From the mid-market range, with affordable pricing, to the high-end luxury and sports cars, competing with Porsche or Ferrari. In addition, Tesla is also covering the commercial vehicle sector, providing a greener option for transportation and shipping. And, of course, it’s worth remembering that Tesla’s customer segments include fast, eco-friendly car enthusiasts, with autopilot — and, surely, Elon Musk followers.

Tesla’s Value Propositions

Regarding automobiles, Tesla’s value proposition includes a greener solution that adds high performance, design, functionality, efficiency, long-range, flexible, and low-cost (or free) recharging. Aside from its own vehicles, it is worth remembering that Tesla sells home batteries and solar panels to residential and commercial customers, providing convenience when it comes to power. In addition, Tesla still sells systems and components to other auto manufacturers, as well as financial services, with loans and leases.

Tesla’s Channels

The channels that Tesla uses to reach its audience, as seen throughout this article, are its own stores, its website (self-service online store), conferences, and sales events. As stated above, the company doesn’t spend a lot on advertising. It believes in the power of its own brand and reputation, in addition to the charm produced by the CEO, Elon Musk.

Tesla’s Customer Relationships

One of Tesla’s foundations is the customer relationship , because, from the beginning, the company has focused its efforts on the customer experience. That is why the company chose, as mentioned above, to implement company-owned stores instead of dealerships, in a direct-to-customer sales model. Besides, customers can choose, order and customize their car directly via the website. In addition, Tesla is also increasingly investing in its charging network, to charge Tesla vehicles more quickly, at low or no cost. Finally, Tesla has built a very positive brand and reputation with the public, always being associated with luxury, technological and innovative vehicles, and taking into account the environmental impact.

Tesla’s Revenue Streams

- Solar energy panels and batteries;

- Car sales, upgrades, and maintenance.

Tesla’s Key Resources

Tesla’s key resources are those that allow it to fulfill its key activities in order to deliver its value proposition. Therefore, we can highlight its cutting-edge technology and engineering, its long-life battery systems, its design, and its software.

Tesla’s Key Activities

Tesla’s key activities include:

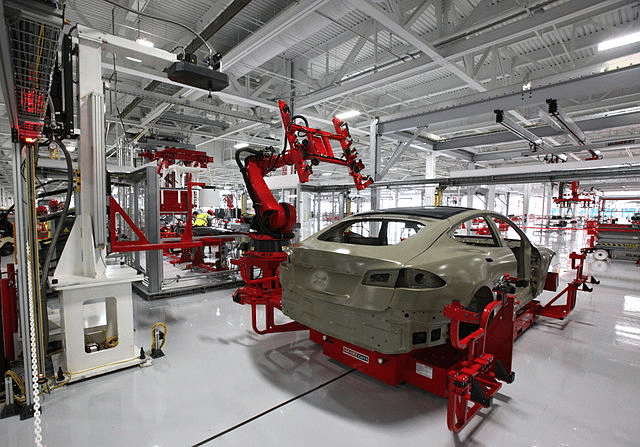

- Manufacturing Cars : Yes, Tesla’s main activity is still delivering the product it promises — electric cars. For this, it also needs to invest in the production of batteries and, still, solar energy panels;

- R&D: The company is always looking for innovative, advanced, and eco-friendly technology;

- Design : One of the differentials of the products — Elon Musk made it clear from the outset that, as its technology would prove to be costly anyway, Tesla would invest in design and not fight for price;

- Building & Maintenance: Tesla is spreading recharge stations around the world so that more people can purchase electric cars;

- Software Development: Tesla applies agile principles to develop and enhance its software;

- Sales & Marketing : The company doesn’t invest much in advertising. On the other hand, its entire operation focuses on the customer experience.

Tesla’s Key Partners

- Suppliers : Tesla manufactures the entire base of its cars, but there are some parts that are purchased from third parties. Therefore, Tesla’s biggest key partners are suppliers that allow the company to deliver its cars, such as windshield and brake manufacturers, just to name a few;

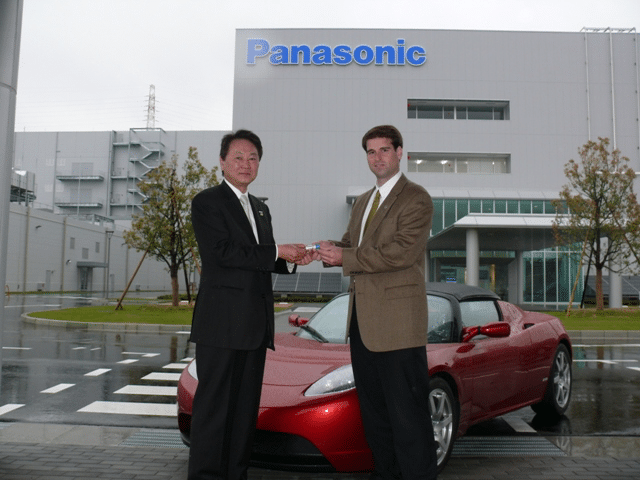

- Alliances : Tesla entered into an alliance with Toyota for both to develop, together, parts and systems for electric vehicles, improving this market share. Tesla and Panasonic are also together in the construction of a manufacturing plant in New York, for the development of large-scale battery and solar cells;

- Government : Due to its focus on the development of eco-friendly vehicles and energies, associated with the number of jobs the company has been creating in the U.S., Tesla receives tax incentives from the U.S. federal government;

- Charging points : Some Tesla partners include hotels, resorts, restaurants, and shopping centers, in which the company establishes its fast car recharging spaces.

Tesla’s Cost Structure

Tesla has a very broad cost structure , like any manufacturer, which includes:

- Manufacturing;

- Administrative costs;

- Research and Development.

Tesla’s Competitors

- Nio : Founded in 2014, the Chinese Nio manufactures premium electric vehicles for the international market. Its sales have been growing more than 100% per year, but it has fewer than 200 battery stations in China, with plenty of room to grow;

- Ford : This traditional auto company has entered the electric-powered market. Its sales of electric cars have been growing by over 70% per year, and most of the buyers are new to Ford. As one of the oldest automakers in the world, the company has a great experience advantage ;

- Volkswagen : The German company launched its first electric vehicles one decade after Tesla. Nevertheless, it predicts that 50% of its sales in the U.S. will be EVs, and it is aiming to manufacture 1.5 million of those by 2025. Just like Ford, it has the strength of an old and traditional brand;

- Li Auto : One of the newest competitors, founded in 2015, this Chinese company has surprised the audience with its technology. It is growing fast and sold over 10k EVs in its first year in China;

- Nikola Corp : The company combines electric battery power with hydrogen fuel cells in its vehicles. But its focus will be on big vehicles, with electric and hydrogen fuel-powered trucks. Founded in 2014 in America, Nikola’s vehicles had zero emissions from 2016 to 2020;

- Workhorse Group : Based in the U.S., this company focuses on electric vans for delivery services. It has already fulfilled a UPS order for 950 vans. The company was founded in 1998, but the offer for EVs only began in 2015;

- Canoo Holdings : It is the latest entrant, with a different business model. Canoo’s vehicles will get on the roads in 2022, with a unique value proposition — drivers will pay a monthly subscription instead of buying or leasing the cars.

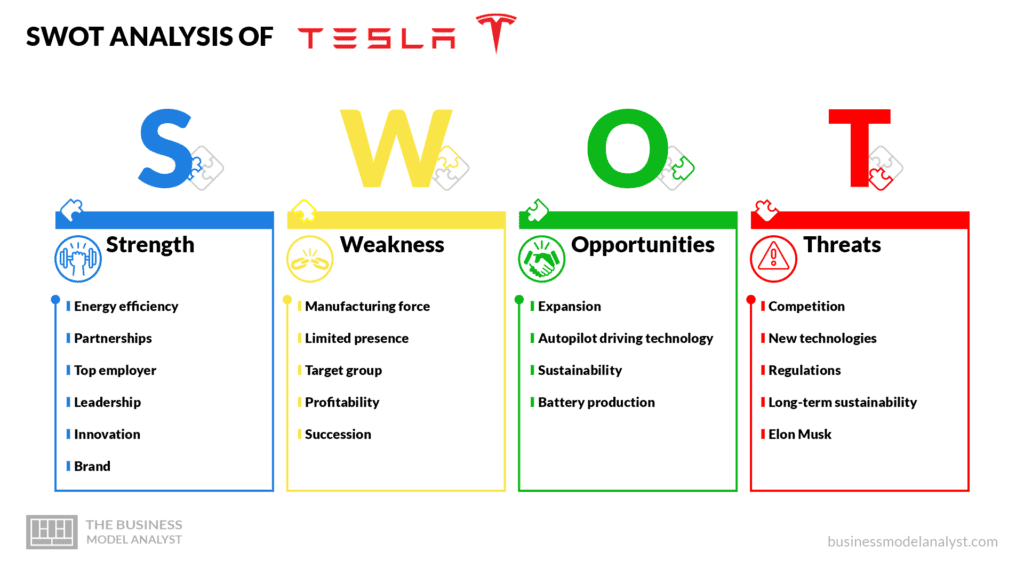

Tesla’s SWOT Analysis

Below, there is a detailed SWOT Analysis of Tesla:

Tesla’s Strengths

- Energy efficiency: Tesla is the market leader not only in numbers of sales, but also in the use of renewable energy sources like solar power;

- Partnerships : Tesla is collaborating with giant energy companies, which help to expand its renewable energy efforts;

- Top employer : The company has been featured in Forbes as one of the best employers in 2019, and it is known as a great place for young employees due to its diversified business culture;

- Leadership : As a result of its extraordinary growth and its leadership in EV sales, Tesla became the most valuable automotive company in 2020;

- Innovation : Tesla invests heavily in research and development in order to build new technologies and deliver top-class design and comfort, thus increasing its popularity among its customers;

- Brand : When Tesla was founded to build electric cars, it did not have any competition, thus becoming the top of mind when it comes to EVs. Besides, the market trusts the company to develop clean energy as well as profitable products.

Tesla’s Weaknesses

- Manufacturing force : When compared to other automobile companies, Tesla has a smaller structure for manufacturing, resulting in limited production and delays in distribution;

- Limited presence : Despite its growth, Tesla’s market core is still the U.S., with over 70% of its revenues, and it struggles on establishing itself around the world;

- Target group : Tesla is a premium clean energy brand, so despite its significant growth, it still has a small target group due to its high prices;

- Profitability : Tesla still burns cash because of its high operational costs, which threatens its profitability and, consequently, the investors’ opinions;

- Succession : Elon Musk is the face of Tesla, and its name has become inseparable from the brand.

Tesla’s Opportunities

- Expansion : The U.S. and China generate most of Tesla’s sales, especially in America, accounting for about 70% of them. The brand has plenty of capacity for expanding globally, mainly in Asian markets like China and India;

- Autopilot driving technology : That is the technology that the whole world has been waiting for, and Tesla’s autonomous driving technology gained fame as safe and convenient, and it keeps evolving;

- Sustainability : As people get more environmentally conscious, the demand for sustainable products has been growing quickly, thus increasing its potential growth;

- Battery production : Tesla is working on manufacturing its battery cell in-house, which will lower the production cost and create many new jobs at the same time.

Tesla’s Threats

- Competition : Tesla’s competitors have been in the market for hundreds of years and are rapidly investing in electric car technology, even being able to offer more affordable products;

- New technologies : Vehicles are using more and more innovative technology and new ways of energy, and that demand can increase operational costs and decrease margins;

- Regulations : There are no adequate regulations for autonomous cars yet, which can jeopardize Tesla’s future;

- Long-term sustainability : Clean energy companies demand long-term sustainability strategies, and Tesla’s limited infrastructure may not support that;

- Elon Musk : Although he may be considered a genius and visionary, Musk has been building a controversial image due to his erratic behavior, which is often not aligned with social expectations.

-> Read more about Tesla’s SWOT Analysis .

Tesla did not invent the electric car, but possibly it was largely responsible for shedding new light on this product on the market, by producing cars with differentiated design, long-lasting batteries, and a whole technological support and servicing network. In addition, it implemented a business model practically unique in its area, by selling directly to the consumer, without middlemen. It can, therefore, be said, without fear of making a mistake, that Tesla is one of the most successful automobile industries today and certainly Elon Musk and his peers continue to seek new and original methods of transportation.

Daniel Pereira

Receive our updates.

Username or email address *

Password *

Remember me Log in

Lost your password?

- Search 56362

- Search 92675

- Search 8109

Tesla Business Model (2023) | Tesla Business Model Canvas

Last updated: Oct 9, 2021

Company: TESLA, Inc. CEO: Elon Reeve Musk Subsidiary: SolarCity, Tesla Grohmann Automation, Maxwell Technologies Founders: Elon Musk, Martin Eberhard, JB Straubel, Marc Tarpenning, Ian Wright Year founded: 2003 Headquarter: Palo Alto, California Type: Public Ticker Symbol: TSLA Annual Revenue (2021): $53.82 Billion Profit |Net income (2021): $5.64 Billion

Products & Services: Tesla Motor Vehicles | Auto service | Financial Services | Energy Storage (Power battery packs) | Solar panels | Lifestyle products | Retail merchandise

Competitors: Kia Soul EV | BMW i3 | Nissan Leaf | Volkswagen e-Golf | Hyundai Ioniq EV | Tesla Model S | Chevrolet Volt EV.

Table of Contents

Introduction to Tesla, Inc.

Tesla, Inc. (formerly known as Tesla Motors, Inc.) is an American automotive, lifestyle and energy company that was originally founded in July of 2003 . The company launched its products specifically in the automotive industry and began to design and supply lifestyle products as well. The company was originally founded by engineers Martin Eberhard and Marc Tarpenning prior to changing its name to just Tesla, Inc. in February of 2017.

During the Series A funding phase, Elon Reeve Musk, J. B. Straubel, and Ian Wright were also accredited with the recognition as the founding fathers of Tesla Motors. Elon Reeve Musk is currently the serving CEO of the company, overlooking all the operations and the structures of the business.

In August of 2015, Tesla, Inc. aimed its focus towards on safety, autopilot, charging networks and motors. Tesla operated a combination of 260 galleries/retails across the United States in 2016. One of the most exciting years for Tesla was 2017.

Tesla was able to focus its markets in the Germany sectors, providing a Dutch RDQ-issued Whole Vehicle type approval (WVTA) which should be accepted as a legal compliance document, without grounds to a national type of approvals in EU member States.

This significantly reduced any compliance check and excelled deliverance exponentially, since the vehicle was already under Germany vehicle standard compliance.

In the same year, Tesla launched additional international locations in Dubai and South Korea, which increased its brand visibility and helped increase revenue streams.

During that year Tesla had a budget of $52 million as a marketing budget and used a referral program and a word of mouth tactic to help attract customers that would be interested in purchasing a Tesla vehicle.

By 2018, Tesla, Inc. was ranked as the bestselling plug-in passenger car manufacturer in the electric car industry. It sold over 245,240 units in total. With over 200k+ units sold, Tesla was responsible for capturing the market shares of 12% in the electric-plug-in vehicle industry. In Q2 of 2020, Tesla delivered 90,650 vehicles to customers and is expected to deliver more than 500,000 cars by the end of 2020. [ 1 ]

The company’s market capitalization increased to nearly $208 billion and surpassed Toyota’s $202 market cap to become the world’s most valuable automaker by market value. [ 2 ]

The following is the complete Tesla Business Model Canvas report and how it is different from the rest of its competition.

Tesla Business Model Canvas

1. Value Propositions of Tesla

Best in class – Fully electric vehicles (EVs)

- Tesla aims to provide some of the best in class EV models that offers high performance, energy efficient, long range (with convenient recharge stations), and sleek designs.

- Model S (Luxury sedan) – June 2012

- Model X (SUV) – September 2015

- Model 3 (Lower priced sedan for the mass market) – July 2017

- Model Y (Compact Crossover) – expected to deliver in 2020

- Semi-Truck (Commercial Heavy-duty truck) – expected to deliver in 2020-21

- Tesla Pickup Truck – expected to deliver in 2020-21

- Tesla Roadster (Sports car) – Original model was in production from 2008-2012. A newer version is expected to deliver in 2020.

- Tesla Cybertruck – Tesla’s angular-designed Cybertruck was unveiled in November 2019 and is expected to hit the market in 2021. [ 3 ]

Advanced Electric Vehicle Technology

- Supercharging and destination recharging station network

- High miles per charge

- All wheel drives

- Free or low-cost electric charging stations or battery swap.

- To support open source movement, Tesla has opened the use of all its patents for other auto-manufacturer to advance EV technology.

- Autopilot option

- Free software updates

- Solar Energy Systems – Tesla is known for its Electric vehicles, also sells solar panels to residential and commercial customers.

2. Customer Segments of Tesla

Tesla’s engineers and designers have designed vehicles appropriate for every customer groups. Vehicle class type is based on the following segments:

- High-end Luxury (Sedan or SUV)

- Mid – price range

- Commercial Vehicles – targeted towards transportation and shipping businesses

- Green Community

- Fast sports car enthusiast

- Autopilot enthusiast

- Tesla Followers

- Elon Musk Followers

3. Key Partners of Tesla

OEM Alliances

- 2009 – Tesla, Inc. aligned a partnership with OEM manufacturer ( Daimler ), which helped to provide Tesla, Inc. with access to superior research and engineering development and a cash infusion that helped Tesla to escape the potential bankruptcy.

- 2010 – Tesla, Inc. signed an alliance with Toyota , which enabled them to buy former NUMMI factory which positioned Tesla professionals to learn the large-scale, high-quality manufacturing from a pioneer of lean manufacturing.

- 2014- Tesla, Inc. joined Osaka (Japan) investments to develop and improve its battery designs.

- 2020 – Tesla, Inc. entered into a partnership with LG Chem Ltd and China’s CATL to develop batteries for its electric cars. [ 4 ]

- 2020 – Tesla, Inc. partnered with Huston-Tillotson University to collaborate in research and provide opportunities for students from disadvantaged communities to engage in the sector. [ 5 ]

Manufacturing and Purchasing (Toyota)

- Toyota and Tesla, Inc. joined forces announcing to the public that they are to build an alliance that would be dedicated to developing electric vehicles , parts and production systems for electric cars and accessories.

- In return, Toyota bought $50 Million of Tesla stocks and Tesla purchased an assembly factory in California to continue its endeavor towards facilitating the process of manufacturing electric vehicles.

- “ Tesla has quite a clear business strategy for developing a better battery ,” said Osamu Nagata , president, and CEO of Toyota Motor Engineering & Manufacturing North America. “

Car Leasing Company

- March 2012 – Athlon Car Lease Company built an alliance with Tesla for Tesla’s premium electric sedan specifically for corporate fleet services throughout the European regions. The model consists of the Model S and the 150 Model S Sedans to ensure early availability of the Model S for its clients.

- Tesla’s strategic alliance helped to pave the way for making the first Model S fleet reservation possible for leasing worldwide.

- Athlon VP Richard Sikkel confirms : “Our collaboration with Tesla has been very well perceived by the market. Almost 50 % of our initial order have already been pre-reserved by several of Athlon’s existing customers – an example that demonstrates the increasing need for electric vehicles in the industry.”

Major Suppliers

Tesla, Inc. is commonly responsible for manufacturing the electric car’s basics, which include the electric motor, the battery pack and the charger. Rest are provided by suppliers from the US, Europe, and Asia.

The following are Tesla’s main designers and suppliers:

- AGC Automotive: windshields

- Brembo: brakes

- Fisher Dynamics: power seats

- Inteva Products: instrument panel

- Modine Manufacturing Co. battery chiller

- Sika: acoustic dampers

- Stabilus: liftgate gas spring

- ZF Lenksysteme: a power steering mechanism

- LG Chem LTD: Batteries [ 6 ]

Other suppliers include:

- Angell-Demmel

- Hitachi Cable America

- Hope Global

- MacLean-Fogg

- Magna International

- Methode Electronics

- PSM International

- T1 Automotive

- Zanini Auto Group

Dana Holding

- Dana Holdings provided Tesla, Inc. with Dana Cooling Technology for further implementation of the Tesla engine and the overall cooling system design .

- Panasonic’s current lithium-ion batteries showed to serve sufficiently; Tesla confirms that it is seeking more batteries for its Model S in which Panasonic is currently supplying.

- In this effort, Panasonic is collaborating to build Tesla’s Gigafactorys – a large scale battery and solar cells manufacturing plant in Nevada and New York.

- Government-funded Tesla with a $465 Million loan for its electric Sedan

- $365 Million of the loan shall be allocated towards the production of it’s Model S Sedan.

- Remaining $100 Million will be allocated towards its electric power train manufacturing plant in California.

- Due to Tesla’s Electric Vehicle development and improvements, the US government provides federal tax incentives of about $3750 to customers depending upon the state .

4. Key Activities of Tesla

- R&D helped Tesla attain its milestones by providing breakthrough technologies and innovational designs that were in association with the engine design of Tesla vehicles.

- Tesla’s innovative design helped to produce reliable electric plug-in cars made affordable for all.

- Modern design that includes lightweight body , durable and long-lasting battery life

- Designs range from small, to classy, to luxurious classes – there is a vehicle type for every customer segment at different price points.

Innovational Leap

- Tesla continues to work around the building blocks of Tesla vehicles to better improve and sufficiently design vehicles that are built with eco-friendly materials, ensure future sustainability and invoke reliability of its line of manufacturers.

Software Development

- One of the most crucial movements for Tesla was its dedication towards the vital software programs that helped shaped the electric vehicle industry to what it is today.

- Tesla does not follow the long development software product lifecycles that many automotive specialists follow; instead, Tesla worked around these hurdles to create diverse software programs that improved the sufficiency of each of their model make series.

- Tesla uses agile principles like “scrums” or also known as regular meetings that are designed to work and improve the structures of its core software.

- Through this breakthrough, it has aided Tesla to minimize errors and bring innovation into progressing leaps.

- Tesla, Inc. regularly evaluates customer experience and feedback that helps to pave the next generation in improving its software spectrum and the sufficiency of its vehicles.

- Technological errors are expected but shall improve in the long run to perfection.

Sales & Marketing

- Tesla invests heavily in executing its sales and marketing efforts, which includes establishing company-owned stores , galleries and service centers known as “Service Plus.”

Building & Maintenance of Charging Stations Network

- Tesla has been building an extensive network of the supercharger and destination recharge stations around the world to expand the widespread adoption of its Electric Vehicles.

- There are 1441 Supercharger stations worldwide with 12,888 superchargers and thousands of Destination charging stations at hotels, restaurants, shopping centers, parking garages, office building, etc.

- MOAT – A Tesla, Inc. project that is geared to provide EV charging stations

- Tesla, Inc. plans on launching a network specifically for other automaker brands for EV charging supply. However, this is still to happen.

- First to launch a portable home charger that costs about $500

5. Customer Relationships of Tesla

Customer Service Experience

- Tesla provides digitally driven Omni-channel experience (stores, website, social media) to its customers.

- Company Owned Stores – Tesla utilizes direct to customer sales model . Tesla sells its cars to customers directly through its stores and galleries, instead of selling through auto dealers. It provides an enhanced level of shopping experience for customers.

- Self Service website – Often times, customer place orders directly on the Tesla website. Customers can build their own car, add features, choose different color combinations, various financing options; which is an again a unique shopping experience.

- Tesla is considered as a luxury brand in the automotive industry. For those that know about Tesla, and what it stands for understands the value and quality that it provides to loyal customers.

- Due to the continuous innovation and the design, Tesla has built a reputation unlike any other technology in the EV automobile industry.

- Customers feel that Tesla is well ahead in its innovation and production electric vehicle ecosystem that is like no other competitors in the industry.

Free/low-cost charging station network

- Extension chargers provided for Model S, Model X and Model 3

- A built-in navigation system that helps to identify and locate the charger stations

- Charging stations are designed to supercharge Tesla vehicles that get charged in just 30 minutes

- Tesla charging stations and app system indicates when the vehicle charging is complete

6. Key Resources of Tesla

Electric Vehicle and Technological Knowledge

A) Superior Engine Design:

- High-Performance Vehicle

- Pollution & Noise free Vehicle

- Super-Fast vehicle

B) Engine components:

- Lithium-ion battery system

- Induction motor. (Rotor Speed < RMF Speed)

- Uniform induction, power, and speed.

- Brushless and requires no magnets, instead the induction creates magnetism through rotational movement

- 3-phase. Ac power input.

- Speed is dependent on the amount of voltages that are fed to the 3-phase AC power Input. Speed can range from 0-18000 RPM.

- No Transmission required a direct mount of the engine to the axel is sufficient.

Comparison Chart of the Tesla Induction Motor VS. Typical IC Engine

| Weight – 31.8 Kg | Weight – 180KG |

| Power – 270 KW | Power – 140 KW |

| Weight / Power – 8.5 KW / KG | Weight / Power – 0.8KW / KG |

Battery System

- Lithium-ion Batteries. (DC Power)

- 7,000 individual battery cells constituted into the design into 16 compartments

- A range of 16 compartments that act as one big cell.

Effective Cooling

- The use of small individual cells is a guarantee of sufficient cooling, instead of using a few big batteries

- This also increases the battery duration and lifeline.

- Glycol is used as the cooling medium that is bypassed through the gaps between the rows of the cells in each of the 16 lithium-ion compartments.

- Battery alignment and frame offers the vehicle side skirt support from a vehicle collision.

Automation & Engineering

- Induction motor. (Rotor Speed < RMF Speed) Uniform induction, power, and speed.

- Brushless and requires no magnets.

- Inverter system = 3 phase. Ac power input.

- Speed is dependent on the amount of voltages that are fed to the 3-phase AC power Input.

- Speed can range from 0-18000 RPM.

- No Transmission required a direct mount of the engine to the axel is sufficient

- Another positive aspect of Tesla that helped progressed its success is the reliability of its big data , which is derived from its in-vehicle software, and strategic partnerships.

- Through channeling new departments, opportunities and the new business operations, Tesla was able to generate potential clients and aim at different business endeavors successfully such as solar energy systems, retail merchandise, etc.

7. Channels of Tesla

The following are the set of channels that Tesla utilizes to channel and market its technology:

- Retail stores & galleries – Tesla, Inc. retail stores and galleries are designed and built to showcase Tesla vehicles and maximize customer experience. In early 2019, there were around 276 Tesla stores worldwide of which around 130 were based in the US but the company has closed most of its stores globally and moved to online sales channels . [ 7 ]

- Self Service online store (website)

- Conferences & sales events

8. Cost Structure of Tesla

In FY 2019, Tesla’s annual revenue was $24.578 Billion with a net expense of about $24.72 Billion, which leaves the company with a net loss of $144 Million. [ 8 ]

The following are Tesla expense and cost structure;

- Cost of Goods and Services (COGS): $20.509 Billion equal to 83% of the revenue

- Selling, General & Administrative Cost: $2.646 Billion equal to 11% of the revenue

- Research & Development Cost: $1.343 Billion equal to 6% of the revenue

- Restructuring Cost: $149 Million equal to less than 1% of the revenue

- Interest Expense, Taxes, and Others: approx. 3% of revenue

9. Revenue Streams of Tesla

Tesla not only sells Electric vehicles but also has created an eco-system of a top of the line green vehicles. Also, it has introduced solar energy systems, and lifestyle products for its loyal customers and the fans of Tesla, Inc;

Here is a high level break down of Tesla’s revenue. In FY2019, the total annual revenue of Tesla was $24.578 Billion .

Automotive Segment revenue – it includes sales of all vehicle models, access to charging network, software updates, after – sales services, sales of EV components, retail merchandise, etc. Here is a further breakdown in the automotive segment.

- Vehicle sales: $19.952 Billion

- Vehicle leasing: $869 Million

Total: $20.821 Billion

Energy generation & storage segment – it includes sales of solar energy systems and storage products such as solar roof panels, etc.

Total Revenue from Energy Generation & Storage: $1.531 Billion

Services – Includes car services, repairs, consultations, and other general services

Total Revenue from Services and other: $2.226 Billion

Tesla, Inc. started its business as offering reliable ways of providing transportation. By reviving the theory of utilizing electric vehicles instead of gasoline combustion chamber engines helped to pave the recognition of sufficient EV system, which also contributed to revolutionize the automobile industry from mechanical drives to all smart computer driven electric vehicles.

Because of the strategic steps taken to design a sound EV engine system, the possibilities of actualizing an electric car that serves sufficiently and safely, Tesla, Inc. is one of the most successful EV company in today’s automobile industries and continues to develop and innovate the methods of transportation.

References & more information

- Wagner, I. (2020, July 15). Tesla’s vehicle deliveries by the quarter – YTD Q2 2020 . Statista

- Korosec, K. (2020, July 1). Tesla Blows Past Toyota to become Most Valuable Automaker in the World . Tech Crunch

- Brown, M. (2020, July 23). Tesla Cybertruck: Elon Musk Reveals where It will be Built . Inverse

- Talia, S. (2020, January 30). Tesla partners with LG Chem, CATL for battery supply . Reuters

- Crider, J. (2020, July 31). Tesla’s Newest Partnership With An HBCU Is A Great Thing . Clean Technica

- Contemporary Amperex Technology Co. Limited (CATL): Batteries

- Williams, M. (2019, March 4). Tesla to close showrooms and move sales online . Automotive Logistics

- Investing Alerts (2020, January). Tesla Inc. Financials . Market Watch

Tell us what you think? Did you find this article interesting? Share your thoughts and experiences in the comments section below.

A management consultant and entrepreneur. S.K. Gupta understands how to create and implement business strategies. He is passionate about analyzing and writing about businesses.

Cancel reply

Loved this!

You may also like

How Does Turnitin Work & Make Money

Last updated: May 30, 2020 Company: Turnitin CEO: Chris Caren Founders: John Barrie Year founded: 1998 Headquarter: Oakland, California, USA Employees: Est. 417 Type: Private Annual...

Swiggy Business Model (2022)| How does Swiggy make money

Last updated: Sept 07, 2020 Company: Swiggy CEO: Sriharsha Majety, Nandan Reddy, and Rahul Jaimini Year founded: 2014 Headquarter: Bangalore, India For all the foodies, what more could you ask for...

Zomato Business Model | How does Zomato make money?

Company: Zomato Founder & CEO: Steve Easterbrook Year founded: 2008 Headquarter: Gurgaon, Haryana, India. Number of Employees (2019): 5000+ Type: Private Monthly Active Users (2019): 70Million+...

Business Model of Ola (2024) | How does Ola make money?

Company: Ola Cabs CEO: Bhavish Aggarwal Year founded: 2010 Headquarter: Bengaluru, India Number of Employees (Dec 2019): 8,000 Type: Private Valuation (Dec 2019): $10 Billion Annual Revenue (FY2019): Rs 2,543.63...

20 Most Unique Business Models

Every company follows a certain business model. The growth and success of a company are based on the business model it follows. Therefore, it is essential for a business model to be diverse and adaptable. However, there...

How Does Popmoney Work ?

Last updated: May 18, 2020 Company: Popmoney (Division of Fiserv) CEO: Jeffery W. Yabuki Founders: Sanjeev Dheer Year founded: 2010 Headquarter: New York, NY Products & Services: Peer...

Twitter Business Model | How Does Twitter Make Money?

Company: Twitter CEO: Jack Dorsey Year founded: 2006 Headquarter: San Francisco, California, USA Number of Employees (2018): 4,100 Public or Private: Public Ticker Symbol: TWTR Market Cap...

How does Fabletics work and make money?

Company: Fabletics Founders: Kate Hudson, Adam Goldenberg, Don Ressler Year founded: 2013 CEO: Don Ressler and Adam Goldenberg Headquarter: El Segundo, CA Employees (2020): Est. 500 Annual Revenue (2020): Est...

How Does Snapchat Make Money?

Company: Snapchat CEO: Evan Spiegel Year founded: 2011 Headquarter: Santa Monica, California, USA Number of Employees (Dec 2018): 2884 Public or Private: Public Ticker Symbol: SNAP Market Cap (April...

How Does HQ Trivia Make Money?

Last updated: Feb 18, 2020 Company: HQ Trivia Founders: Rus Yusupov and Colin Kroll Year founded: 2017 CEO: Rus Yusupov Headquarter: New York, NY Number of Employees (2019): 25 Annual Revenue (2019): $10 million...

Recent Posts

- Who Owns YoungLA

- Who Owns Dave’s Hot Chicken?

- Who Owns 1440 News?

- Who Owns PNC Bank?

- Who Owns The Shade Room?

- Who Owns Professional Fighters League (PFL)?

- Who Owns Ulta Beauty?

- Who Owns History Channel?

- Who Owns Cheesecake Factory?

- Who Owns Westin Hotels & Resorts?

Business Strategy Hub

- A – Z Companies

- Privacy Policy

Subscribe to receive updates from the hub!

- Red Queen Effect

- Blue Ocean Strategy

- Only the paranoid survives

- Co-opetition Strategy

- Mintzberg’s 5 Ps

- Ansoff Matrix

- Target Right Customers

- Product Life Cycle

- Diffusion of Innovation Theory

- Bowman’s Strategic Clock

- Pricing Strategies

- 7S Framework

- Porter’s Five Forces

- Strategy Diamond

- Value Innovation

- PESTLE Analysis

- Gap Analysis

- SWOT Analysis

- Strategy Canvas

- Business Model

- Mission & Vision

- Competitors

Tesla’s master plan is 4 years old: how Elon Musk is doing on EVs and more

Four years ago, Tesla outlined a master plan that covered electric cars, autonomy and clean power. How did it do?

Tesla's most ambitious master plan yet is celebrating its fourth birthday.

On July 20, 2016, CEO Elon Musk published a blog entry that would set the company's course for the coming years. The ambitious document details commitments to transition more of the world onto sustainable energy, reach a broader mass market with electric vehicles and automate the driving process to radically transform transportation. No pressure.

It was a starkly more ambitious proposal to the original master plan that came 10 years prior. That document , published on August 2, 2006, outlined four clear steps: build a sports car (which became the 2008 Roadster), use the money to build an affordable car (2012's Model S), use that money to build an even more affordable car (2017's Model 3) and provide zero-emissions energy sources in the process.

Tesla's second master plan upped the ante, with a bold four-goal strategy:

"Create stunning solar roofs with seamlessly integrated battery storage. Expand the electric vehicle product line to address all major segments. Develop a self-driving capability that is 10X safer than manual via massive fleet learning. Enable your car to make money for you when you aren't using it."

Four years on, nearly halfway through the original document's lifespan, here's how Tesla is getting on.

Integrate Energy Generation and Storage – This first section explains how Tesla will merge with SolarCity, offer a solar roof with battery, then scale it globally. This would offer "one ordering experience, one installation, one service contact, one phone app."

Tesla merged with SolarCity later that year, so that's checked off. The solar roof has been a slightly slower rollout: an early version started reaching Californians in spring 2018, but Musk would later explain in March 2019 that initial rollout was slow due to company-wide constraints.

Tesla Solar Roof.

It wasn't until the third generation launched in October 2019 that Tesla finally started offering it in larger numbers and in more parts of the United States. The roof still has yet to go global, but Musk claimed in February 2020 that the company would expand the product internationally this year .

Master plan progress: 60 percent. The roof may be elusive, and international expansion has yet to happen, but it is a real product that has shipped out to customers in increasing numbers.

Expand to Cover the Major Forms of Terrestrial Transport – This part of the plan outlines several vehicles, aimed at most forms of ground-based transport. There are three consumer vehicles: the Model 3, a compact SUV, and a pickup truck. There's the Tesla Semi electric truck, and an urban transport vehicle with high passenger density. Autonomy could make the bus disappear and transfer the bus driver into a fleet manager. The factory building the Model 3 will improve, as it becomes the machine that builds machines.

That first part is coming together. Tesla launched the Model 3 in July 2017, launched the Model Y compact SUV in March 2020, and is expected to launch the Cybertruck in late 2021. The Tesla Semi is expected to hit roads in increasing numbers soon, as the firm starts building together a pilot production line .

Tesla Cybertruck.

The urban transport vehicle seemed at one stage to get axed from Musk's plan, but in June 2020 new reports claimed the firm is working with Musk's other venture The Boring Company to develop a 12-passenger electric van . The Boring Company's tunnels are designed to support autonomous, electric vehicles.

Musk's initial optimism about automating the factory faded amid Model 3 production issues. In April 2018 Musk described "excessive automation" as "a mistake." An emergent new focus in speeding up production is to build factories around the world , bringing affordable cars closer to the buyers and simplifying production lines. A Shanghai factory has already started building cars, boosting China market share , and a Berlin factory is under construction.

Master plan progress: 60 percent. Of the five vehicles outlined above, two have started hitting roads and two have been repeatedly sighted in prototype form. Tesla is also building vehicles at speed and taking on more market share, thanks to its tweaked factory goals starting to pay off.

Autonomy – Tesla is aiming for full, point-to-point autonomous driving. Once the software has been built and refined, regulatory approval would take some time. Musk suggested this would take somewhere closer to six billion miles of experience to convince regulators.

Tesla Autopilot could one day support point-to-point autonomous driving.

Tesla has released a series of new features, including the likes of Smart Summon that parks the car autonomously and Navigate on Autopilot that exits the highway at the correct location depending on destination. It also detailed the Hardware 3 platform in August 2018 that will support fully autonomous driving, an upgrade that has started appearing in new vehicles. Tesla Autopilot has now completed three billion miles . Musk stated in May 2020 that Tesla is aiming for a feature-complete version of full autonomy by the end of this year, which would drive from A to B with human oversight.

Master plan progress: 20 percent. The autonomous driving software has improved, but it still can't drive from A to B even with human oversight. Regulatory approval for complete hands-off driving seemingly remains distant.

Sharing – Building off the autonomous driving features, Tesla owners would be able to add their vehicle to a shared fleet. This Uber-like fleet would earn money for the owner while they're not using the car, which in turn "lowers the true cost of ownership to the point where almost anyone could own a Tesla." The firm will add vehicles to the fleet for cities where there aren't enough Tesla owners.

As the autonomy project has progressed, Tesla has gradually released more ideas about how the system would work. There would be a smartphone app used to hail rides, initially with a person in the driver's seat, due to launch in 2021. It has also tweaked its leasing terms to take vehicles back at the end of a lease for use in the taxi service.

Master plan progress: 10 percent. While it's provided more details about how a sharing app would work, and it's made steps on autonomy, this vision still seems as distant as ever.

This article was originally published on July 20, 2020

Leadership & Success

What can we learn from tesla’s business strategy.

Andrew Moran

This article is part of our Business Strategies series, an insight and analysis into the makeup and model of some of the world's most successful startups.

In late 2018, Tesla Motors CEO Elon Musk revealed on Twitter that he was thinking about taking the company private. An investment firm, AKR Invest, pleaded with him to reconsider by making the case that selling at $420 a share would undervalue the company significantly.

Fast forward to a little more than a year later and Musk must be pleased that he ditched the idea. With company stock trading in the range of $800 to $900, AKR now anticipates that Tesla shares could spike to $7,000 by 2024. Too good to be true, or a realistic possibility?

Either way, Tesla has made a significant dent into the automotive industry, the energy sector, and even the way automakers sell cars. What started as a perturbed reaction to General Motors recalling its fleet of EV1 electric vehicles has transformed into a juggernaut that is selling cars, energy products and infrastructure across the globe.

So how has the company managed to achieve this? To answer this question, we've compiled an in-depth analysis of the Tesla business strategy – as well as what your company could potentially learn from it.

Vital Information

- Founded : July 2003

- Founders : Martin Eberhard, Marc Tarpenning, Elon Musk, JB Straubel and Ian Wright

- Headquarters : Palo Alto, CA, USA

- Current CEO : Elon Musk

- Global Employees : 48,000 (2019)

- Type : Public (Floated June 2010)

- Initial Funding : $7.5m in venture capital (February 2004)

- Key Products / Services : Electric vehicles

To accelerate the world's transition to sustainable energy.

Tesla Mission Statement

To create the most compelling car company of the 21st century by driving the world's transition to electric vehicles.

Tesla Vision Statement

Officially incorporated in 2003 by two engineers and named in honour of the legendary electrical engineer and inventor of the same name, Tesla underwent several funding rounds between 2004 and 2007. One of the earliest investors was former PayPal CEO Elon Musk, who was keen to develop the company's vision beyond just electric vehicles to renewable energy sources, too.

In January 2020, the company became the most valuable US automaker ever to exist (and the second most valuable in the world, behind Japanese car giant Toyota).

Tesla's Business Model

In general, experts continue to be bullish over electric vehicle (EV) dominance in the global auto market. A 2018 report by the International Energy Agency (IEA) forecasts that electric car ownership will rise from the current four-million mark to more than 120 million by 2030. To put it another way, EV prevalence will jump from 0.3% to approximately 7% of the global car fleet. Estimates vary between conservative and optimistic, but either way, the EV market will be integral to both the auto industry and the global economy in the coming decade.

There are three primary reasons for EV growth, of which Tesla is currently leading the way in terms of development:

- Consumer demands and customer expectations.

- Technological advancements in electric cars.

- Government regulations on safety and vehicle emissions.

However, it was not always thus.

When Tesla first opened its doors, Musk took a unique approach to sell electric automobiles: creating a sports car that could compete with gasoline-powered vehicles rather than a cheap, mass-produced vehicle. Musk explained that it would have been impossible for the startup to mass market its first product because it was never constructed, enduring several technology hiccups and possessing zero economies of scale. As a result, the company's first release was the Tesla Roadster, a high-powered performance vehicle powered entirely by a lithium-ion battery.

The Roadster proved a moderate success, shifting around 3,000 units before curtailing output in January 2012 and, with the infancy stage out of the way, Tesla was able to become an established brand that attracted both customers and capital. The company then evolved its business model to selling, servicing and charging:

Sales : Tesla is unique in that it sells its automobiles directly to customers without relying on dealers. It uses close to 400 company-owned showrooms and galleries in major urban centres around the world to boost product development speeds and improve the buying experience. Tesla has also utilised an online sales platform .

Service : Many of the Tesla-owned and operated sales centres are combined with service centres. Tesla also has a mobile technical service comprised of Tesla "Rangers", who travel to customer homes to assess and repair any issues. In another considerable advancement, Tesla's cars can also wirelessly upload data to the company so that remote technical support teams can view and fix malfunctions.

Charging Network : A common concern for the EV market is the power charging aspect. Tesla has developed a vast network of supercharging stations where owners can charge their cars for free. Tesla believes that these stations can increase the adoption rate for its EVs, which explains the growth in stations across the US, Europe and Asia.

Over the years – and in line with Musk's wider vision – Tesla has branched out from just vehicles. It sells parts and components to other automakers and retailers, including a range of home batteries, solar panels, full solar roofing and energy storage systems.

EVs are nothing new and existed in various shapes and forms well before Tesla's existence; however, Musk was able to take a different approach to create value for the company and establish themselves as the market leader.

Through transformational leadership practices and a focus on engineering and design, Tesla has driven the advancement of a technology which is becoming ever more mainstream, and is tied into the core concerns of both consumers and governments. Tesla vehicles will no longer represent niche vehicles, but the groundwork of an infrastructure that will change unimaginably over the next 30 years.

Elon Musk | Co-Founder and CEO

Although only deemed a cofounder as a result of a 2009 legal settlement, Musk is undoubtedly the face and driving force of Tesla as we know it. His visionary approach to leadership and management has created massive growth and, despite his increasingly bizarre personal behaviour, it is safe to say that Tesla stocks would plummet if he were to step down as CEO.

Jeffrey B. Straubel | CTO

Unfortunately for Tesla, Straubel – who served as its chief technology officer – departed the company in July 2019. He was an essential figure in the company, overseeing the technical and engineering designs of all the company's cars. While he still serves in an advisory capacity, Straubel was responsible for day-to-day technological evaluation, research and development and technical diligence. Put simply, if you drive a Roadster, Straubel's imprint is all over it.

Martin Eberhard and Marc Tarpenning | Co-Founders and Financers

Martin Eberhard and Marc Tarpenning incorporated Tesla Motors in July 2003 and financed the firm until it received Series A venture capital funding . Suffice it to say, these men laid the groundwork for Musk, Straubel and others to make Tesla's business plan of commercialising electric cars a reality. They had active roles within the company for several years before their ousting in 2008.

Tesla's Branding Strategy

What would you say about a company with a market capitalisation of $153bn and an advertising budget of $0? That's right. Tesla successfully sells cars worth $100,000 to $250,000 without any formal marketing plan . Compare this to Ford, who spent $2.3bn on advertising in the US in 2018, or Honda doling out $1.39bn to reach the public. So, how is Tesla able to do it?

The first component of this strategy is that the company plays hard to get. It's the classic exclusivity play: the more difficult it is to get your hands on a Roadster, the more you want one. To illustrate this further:

- Every car is built to order; Tesla does not maintain an inventory of vehicles, negating the need for forecasts .

- As noted, there are no dealerships.

- A deposit of $100 is required (this used to be as high as $5,000).

- Customers are required to book a test drive before buying.

- Most buyers do not get to the see vehicle before they buy it.

- Customers must wait several months before the vehicle is delivered.

Ultimately, Tesla makes it seem like it does not want your money – an effective if somewhat unorthodox brand strategy .

The company also maintains a referral program for its cars and solar products. Anytime owners refer potential customers, they receive awards when they buy a Tesla product (points, cash reward, or a contest to win a car), inspiring further loyalty to the Tesla brand.

Another critical element of Tesla's branding endeavours is the cult of personality around Musk himself. His tweets generate headlines, and his appearances in front of television cameras are usually must-see. Whenever there is a Tesla product launch, it becomes a global event rather than a public relations campaign, which elicits the kind of free publicity that many companies can only dream about.

Competition

As the world starts coming to terms with the impact of carbon emissions and the viability of EVs as a credible long-term alternative, every auto manufacturer is now seemingly delving into the EV market, attempting to take a slice of the pie. It is a wise investment for every company to make, considering the bullish projections for the industry, but will anyone topple Tesla from its throne?

While it can be hard to predict accurately and time the market, some businesses can realistically go toe to toe with Tesla, especially over a long-term trajectory.

Here are some brands to file for future reference:

General Motors : GM and its shareholders have accepted that the company's Bolt and Volt models will not compete with Tesla today, but the brand might rival that of Tesla tomorrow. Not only is it investing in both EVs and autonomous cars, but GM is also preparing to disrupt transportation (as evidenced by investments in Lyft) and manufacturing with its Cruise model. In the next decade, GM will likely be as attractive as Tesla to consumers and traders.

Volkswagen : The Volkswagen Group is going all-in on electric, promising to deliver 70 new EV models in the next decade. The 80-year-old industry giant may not be trying to take on Tesla, but it could rival Musk's company over time by homing in on the mass-market aspect.

Nio : Although unfamiliar to many, this Chinese firm is generating a lot of buzz in venture capital circles for its pioneering technology. The company has experienced a lot of success as of late, including a 35% sales surge, a partnership agreement with Intel, and critical acclaim from industry experts. Despite Tesla's market play in China, Nio may rise to be the chief player in the years to come.

Tesla's Company Culture

Over the years, Tesla has been known to miss quarterly targets, oversell on its promises, and experience numerous technological mishaps. Rather than dwelling on the negatives and apologising profusely, though, the company has turned these hiccups into a positive. As Tesla's corporate strategy states: "We do not cut corners, and we do not settle. No forecast is perfect, but try anyway. We constantly strive to improve the accuracy of our forecasts as well as the reliability and service with which they are delivered. Respect and encourage people."

On the one hand, this emphasises how the company strives to be the best at what it does. On the other, however, it admits that its forecasts need improvement, but that it only misses these estimates because it does not cut corners or settle for anything but premium quality.

Meanwhile, Tesla's corporate culture encourages autonomy among its workforce, fostering an environment of innovation to search for ideal solutions to a whole host of problems related to automobiles, energy generation and industrial storage. Many company reviews by former or current employees typically state that it is a great place to work with competitive pay, plenty of benefits and perks and a positive atmosphere.

Tesla Motors can serve as a corporate role model for any young entrepreneur or large business that is looking to turn things around. A lot of Tesla's success can be attributed to Musk's innovation and outside-the-box thinking, but the company can only go so far as the people it employs, which is a key takeaway.

Indeed, as Musk has stated repeatedly, practical skills and critical thinking supersede any piece of paper. If you are a technology firm or you are solely focused on the development of a single product, then this is wise recruitment advice to follow. There are also numerous leadership lessons to learn from Musk's tenure, including the idea that company management is about fine-tuning, adapting, innovating, creating and, most important of all, listening.

Whether it is a new product or a feeling of exclusivity, Tesla checks off all the boxes of how 21st-century businesses should and could operate, and there is no reason why your enterprise cannot follow suit.

Was this article helpful? What other business lessons can entrepreneurs learn from Tesla's business strategy? Let us know your thoughts in the comments below!

Brand Strategy

Company Culture

Business Strategies

Business Models

Case Studies

- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

How Tesla Sets Itself Apart

- Lou Shipley

It’s ushering in the age of the software car.

Tesla and its flamboyant, and sometimes erratic , innovator Elon Musk have turned the more than a century old industry upside down in a mere 16 years. T raditional automakers are ill prepared to compete in today’s software-centered world. Unlike nimble Tesla, they are big, bureaucratic, slow to respond to customers, dependent on providing customer financing for unit sales growth, and culturally different from a software company. Tesla’s speed in innovation in the market for high-end vehicles is more like a Google or an Amazon than an automaker. And its soaring market valuation is a clear sign to all automakers that they’ll need to develop more innovative, Tesla-like business models in order to survive.

Tesla’s recent breakout market performance is proving some of its skeptics wrong. By mid-January, Tesla’s market capitalization had reached $107 billion, and it surged past the giant German automaker Volkswagen to become the world’s second most valuable auto company behind Toyota. Tesla’s valuation now exceeds that of Ford and GM combined. The Wall Street doubters may be in shock, but I’m not. Full disclosure, I own two Teslas and I own stock in the company. But it’s my experience as a three-time software company CEO that makes it increasingly clear to me that the company’s innovative business model represents an existential threat to the auto industry as a whole.How so?“Software is eating the world,” Marc Andreessen, co-founder and general partner of venture capital firm Andreessen Horowitz, wrote in a memorable 2011 essay. And software is a big part of Tesla’s advantage.

- Lou Shipley is a Senior Lecturer in Entrepreneurial Management at Harvard Business School. He serves on the boards of six early-stage technology companies.

Partner Center

Decoding Tesla's Business Model and Revenue Streams

Uncover the secrets behind Tesla's innovative business model and diverse revenue streams in this captivating article.

Tesla, the pioneering electric vehicle (EV) manufacturer, has disrupted the automotive industry with its unique and innovative business model. This article aims to decode Tesla's business model and explore its various revenue streams, as well as address the challenges and criticisms it has faced. Furthermore, the article will discuss the role of innovation and offer predictions for the future of Tesla and the automotive industry as a whole.

Understanding Tesla's Unique Business Model

Tesla's business model is driven by its vision to accelerate the world's transition to sustainable energy. The company's mission is to create the most compelling car company of the 21st century, while also contributing to the global shift towards renewable energy sources. Tesla achieves this through its integration of sustainable energy generation, storage solutions, and electric vehicles.

The Vision and Mission of Tesla

Tesla's vision encompasses a future where cars run on clean energy, reducing the world's dependence on fossil fuels and combating climate change. The company's mission revolves around producing electric vehicles that are not only environmentally friendly but also superior in terms of performance and design.

In pursuit of this vision and mission, Tesla has set ambitious goals. One of these goals is to produce affordable electric vehicles for the mass market, making sustainable transportation accessible to a wider audience. Another goal is to expand its renewable energy solutions beyond electric vehicles, such as through the development of solar panels and energy storage systems.

Key Components of Tesla's Business Model

Tesla's business model consists of several key components. Firstly, the company focuses on vertical integration, which means controlling its entire supply chain to ensure quality and efficiency. By owning its manufacturing plants and retail stores, Tesla has greater control over its operations.

Secondly, Tesla has invested heavily in research and development (R&D), enabling continuous innovation and improvement of its products. This commitment to R&D has resulted in technological breakthroughs and advancements in battery technology. Through its Gigafactories, Tesla has been able to scale up production and drive down costs, making electric vehicles more affordable and accessible.

Furthermore, Tesla has prioritized building a strong charging infrastructure, including its Supercharger network, to address range anxiety and make electric vehicles more practical and convenient for consumers. This network of fast-charging stations allows Tesla owners to travel long distances with ease, reducing the barriers to electric vehicle adoption.

Additionally, Tesla has embraced a direct-to-consumer sales model, bypassing traditional dealership networks. This approach allows Tesla to have a more personalized and direct relationship with its customers, providing a seamless buying experience. By cutting out the middleman, Tesla can also maintain better control over pricing and distribution.

How Tesla's Business Model Differs from Traditional Automakers

Unlike traditional automakers who primarily rely on internal combustion engines, Tesla exclusively produces electric vehicles. By specializing in EVs, Tesla has a competitive advantage in terms of eco-friendliness and driving experience. Electric vehicles offer lower emissions, quieter operation, and instant torque, providing a unique and exhilarating driving experience.

Furthermore, Tesla's approach to sales and distribution sets it apart from traditional automakers. While traditional automakers rely on franchised dealerships, Tesla sells its vehicles directly to consumers through its own retail stores and online platform. This direct-to-consumer model allows Tesla to have better control over the customer experience and build a stronger brand connection.

Moreover, Tesla's commitment to sustainable energy goes beyond just producing electric vehicles. The company actively promotes the adoption of renewable energy by offering solar panels and energy storage solutions through its subsidiary, SolarCity. This integration of sustainable energy generation, storage, and transportation sets Tesla apart from traditional automakers who have yet to fully embrace the potential of renewable energy.

In conclusion, Tesla's unique business model revolves around its vision to accelerate the world's transition to sustainable energy. Through vertical integration, heavy investment in R&D, a strong charging infrastructure, and a direct-to-consumer sales approach, Tesla has positioned itself as a leader in the electric vehicle industry. By prioritizing sustainability, performance, and innovation, Tesla continues to push the boundaries of what is possible in the automotive industry.

Dissecting Tesla's Multiple Revenue Streams

Tesla generates revenue through various sources, each contributing to its overall success and financial stability.

But let's dive deeper into these revenue streams and explore the fascinating details behind Tesla's multifaceted business model.

Revenue from Electric Vehicles

The primary revenue stream for Tesla comes from the sale of its electric vehicles. With models like the Model S, Model 3, Model X, and Model Y, Tesla has established itself as a leader in the EV market.

But it's not just about selling cars. Tesla's approach to electric vehicles goes beyond the initial purchase. The company's focus on high-performance electric cars has attracted a loyal customer base willing to pay a premium for these cutting-edge vehicles.

Moreover, Tesla benefits from software updates and optional features, providing additional revenue streams. These updates not only enhance user experience but also unlock new functionalities, such as Autopilot capabilities. This continuous improvement model ensures that Tesla owners stay engaged and satisfied with their vehicles, while also generating ongoing revenue for the company.