Integrations

What's new?

In-Product Prompts

Participant Management

Interview Studies

Prototype Testing

Card Sorting

Tree Testing

Live Website Testing

Automated Reports

Templates Gallery

Choose from our library of pre-built mazes to copy, customize, and share with your own users

Browse all templates

Financial Services

Tech & Software

Product Designers

Product Managers

User Researchers

By use case

Concept & Idea Validation

Wireframe & Usability Test

Content & Copy Testing

Feedback & Satisfaction

Content Hub

Educational resources for product, research and design teams

Explore all resources

Question Bank

Maze Research Success Hub

Guides & Reports

Help Center

Future of User Research Report

The Optimal Path Podcast

Maze Guides | Resources Hub

Product Research: The Building Blocks of a User-Centered Solution

0% complete

Product research is a foundational step in building user-centric products. It allows you to understand customer needs, preferences, and market trends, informing the development of successful solutions to user problems. Read on for the ultimate guide to product research, including methods, processes, and best practices—plus our favorite tips from the industry’s leading experts.

Product research 101: Definition, methods, and best practices

You may only build new products once, but you iterate on them continuously. The ongoing evolution of a product’s user experience (UX), informed by user insights, is pivotal to staying ahead of competitors and giving your users exactly what they need. In chapter one of this guide, we’ll explore what product research is, give an overview of key methods (and when to use them), plus best practices to follow.

What is product research?

Product research is any research you conduct to better inform your product and understand your user and market. Unlike user research , product research goes beyond evaluating the user experience and includes market analysis, pricing, feature prioritization, and assessing business viability.

Product research is a broader term than UX research—you can conduct research on the user, the interaction, the market, or your business strategy.

Matthieu Dixte , Product Researcher at Maze

It helps you understand the world you are bringing your product into, and what your users expect to do with a product like yours—so you can use their insights to influence development and design decisions.

Product research can be conducted in multiple ways, such as talking directly to users in focus groups or user interviews , or through product experimentation, usability tests and competitive analysis.

Other research terms you might come across

Ultimately, all research falls under the 'product research' banner if it influences the final product. For some product teams, ‘user research’ and ‘product research’ may be interchangeable. But there are some subtle differences between various research terms that it can be helpful to know. Here are the distinctions between key terms you might hear, explained by Maze's Product Researcher, Matthieu Dixte:

- Market research: Discover who is leading the market, who your direct and indirect competitors are, and what similar products are available to your users at what price

- User research: Understand the user, including their needs, pain points, likes and dislikes, and characteristics—both as a consumer and user of your product

- User experience (UX) research : Learn how your user perceives and interacts with your product—where they click, which paths they follow, and where they search for information on-page

- Product discovery : Uncover what your users’ needs and problems are, validate ideas for potential solutions before development, and apply user insights to your product strategy

- Continuous product discovery : Adapt the mindset of an ever-evolving product and user; conduct research continuously throughout the product lifecycle and ensure all decisions are informed by user insights

For example, let’s say you’re thinking of developing and launching a note-taking app for teenagers. You’d need to conduct market research to see if there are any similar products in high demand to gauge if your tool is something customers want. In parallel, you should run user research to discover who your user persona would be and what their pain points are.

You also have to do product discovery to identify the best way to build and design your potential product to make it appealing for teens. And, if you want to know how your users will feel about your product compared to other options, you need product research .

Lastly, run UX research tests on your mobile and web app to gather feedback, and improve the experience. You should continue to talk with users regularly after launch by adopting a continuous product discovery mindset (and ensure you’re always updating and offering the right product).

Talk to more users without needing to grow your product team

Recruit and test users from Maze’s high-quality panel to get more eyes on your product, without increasing payroll.

Why is product research important?

Are we making the right assumptions? Is this product what users really need? Can they use it effectively?

Research answers all those questions. But product research goes a step further by placing those answers in the context of your niche and the market. It empowers your team—not only to create unbiased, user-centric products—but also to create best-selling products that are based on a robust business strategy and deep understanding of the market.

Product research will also help you:

Head in the right direction

Conducting types of product research like competitive analysis gives you inside information on what your users value in a similar product—and what they’re missing. It ensures you’re heading in the right direction by only working on aspects of your product you know will succeed. This helps you speed time-to-market, reduce the cost of fixing future mistakes, and achieve higher goals.

Product research allows you to “define the total addressable market and north star metric, based on the customer segments that found your idea and product valuable. We would fail at achieving product-market fit without doing customer research,” explains Prerna Kaul , Product Lead for Alexa AI at Amazon.

Make the right decisions at the right time

User data can inform your decisions and help you prioritize them according to the goals of the business. “Make choices regarding the evolution of your product and find the right balance between what you want to deliver to improve the user experience, and the benefits it’ll bring to your company,” advises Matthieu. Without product research, you’re building products in the dark with no idea whether your target audience will like or buy them—which could mean wasted resources and sinking revenue.

Get stakeholder buy-in

You’ve probably found yourself explaining multiple times to stakeholders why you need to prioritize one feature over another. Conducting product research enables you to “clearly articulate the customer value proposition to leadership, tech, and science counterparts,” says Prerna. Having quantitative and qualitative user insights provides reassurance to stakeholders and speeds up sign-off—while ensuring the wider organization is aligned on your product ideas.

In short, product research provides you evidence you need to start evangelizing research among your organization, and get the whole team on board.

Understand the position your users hold in the market

User research is about getting to know your target audience and building ideal customer profiles, but product research is about discovering where your potential customers are located in the market and which trending products to take note of. If your audience is already using a similar product, this means finding out: Which one? Why? Are they willing to switch to a different product? What would it take for you to get them to switch?

“Analyzing the market lets you determine which areas could be ripe for disruption or creation. By analyzing existing products and doing conceptual thinking you can build a picture of how you can get your product to gain traction in the market and offer something new, nuanced, or better than the current options,” says Nick Simpson , Head of UX at Airteam.

Challenge your assumptions and anticipate problems

When Prerna worked at Walmart Labs, her team introduced a feature for users to scan products in the Scan and Go app. “We initially believed that all of our inventory was available in a common database and accessible through the app. However, during research and user testing, we identified that some rare products were not in the online database,” she explains.

This caused test users to drop off the app, so her team had to take a step back and prioritize fixing inventory issues before launching the product. Without conducting product research, you can be left guessing at the cause of user problems, or wondering why they prefer a particular product. Research offers your team a chance to challenge what you think you know, and pre-empt what you don’t.

Product tip 💡

You can use Maze to conduct multiple tests on your product through development, such as Five-Second Tests or Content and Copy Testing , or get insights on your live product through Live Website Testing .

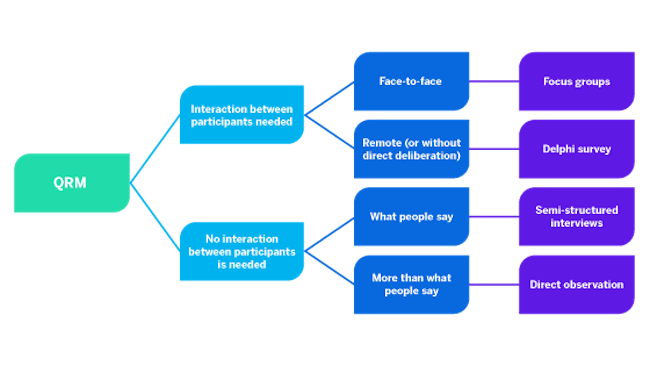

Product research methods

There are many different product research and UX research methods , all of which offer different kinds of data and insight, depending on your objectives. If you’re looking to conduct product research to better understand your users, market, or competitors, here are eight product research methods you should consider to help you build winning products.

1. Customer interviews

Interviews can take place at any take of the product development process and consist of direct conversations with current or potential customers. You may choose to conduct interviews with a market panel during concept testing and idea screening to validate your ideas, or you may want to speak to current users after the product goes live to gather post-launch feedback. Interviews are a varied and flexible product research method.

During customer interviews, you should ask open and unbiased research questions to gather insights about customer needs, preferences, and experiences regarding their pain points, your product, and competitors.

2. Voice of customer (VoC) analysis

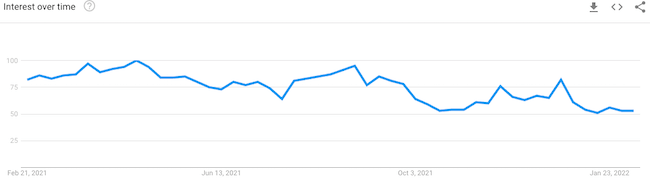

Gauge what current and potential customers are saying about your products or competitor products online. You can do this using VoC tools , by reviewing what people post on social media, looking at Google Trends, or reading reviews on websites like G2.

You should conduct customer voice analysis continuously throughout the lifecycle as it can help you gain a competitive advantage. “Review what’s publicly published, check feature requests, and ask sales, customer success, or support teams for feedback coming from the user,” adds Matthieu.

For example, if a competitor gets acquired by a bigger firm and users start to complain about them removing a feature, you can use the opportunity to develop a similar functionality or improve the one you have. You can also make it more visible on-page and get the sales and marketing teams to use the information to advertise your product.

3. Diary studies

Diary studies involve users self-reporting behaviors, habits, and experiences over a period of time. This is often used during the discovery phase with a competitor product, or later down the line with a prototype. By observing how users feel prior to, during, and after using your (or a competitor) product—and their experience throughout—you can gather valuable, in-the-moment insights within a real life context.

You can conduct diary studies on paper, video, or online on a mobile app or a dedicated platform.

Data from diary research can turn into new product ideas, new features, or inform your current project. For instance, if you have a social media scheduling tool and you identify that users open a time zone calculator when they’re scheduling posts, you instantly have a new feature idea, to add a widget with different time zones.

Learn more about the types of diary study and how to conduct diary research here.

4. Competitive analysis

Analyze competitors' products and strategies to identify what works for them and identify any gaps in the market. The idea behind competitive product analysis is to explore your competitor’s products in-depth, sign up for an account, use them for a while, and take notes of top features, UX, and price points. You can run competitive analysis during the discovery, concept validation , or prototyping stages with direct and indirect competitors, or aspirational businesses.

Matthieu Dixte, Product Researcher at Maze, notes the value of competitive analysis is in understanding your users perspective: “We conduct a lot of competitive analysis at Maze because it's really important for us to understand if the market is mature regarding a particular topic—and to identify the current ground covered. This helps us understand the pros and cons our customers perceive when they choose between our product or another tool.”

Surveys can be a great way to get feedback or gather user sentiment relating to existing products or future concepts. You can also use them to dig deeper into the data gathered during other tests, and understand user issues and preferences in context.

For example, if you ran an A/B test and discovered that certain copy was causing potential users to churn, you could follow-up with a survey with targeted questions around their demographics, preferences, and personal views. This would help add qualitative insights to your quantitative data, and help understand what your users are looking for from your product.

Remember, you can create surveys at any stage of the product development to collect data from users in small or large volumes. You can use different types of surveys and survey principles to validate or debunk hypotheses, prioritize features, and identify your target market. For example, you could ask questions about your product, competitors, and prices or even your customer’s preferences and market trends.

Surveys can have a high drop-out rate, harming the validity of your data. Check out our survey design guide to discover the industry’s top secrets to an engaging survey which keeps users hooked.

6. Usability testing

Since conducting product research is also about understanding how well your customers navigate through your product and if they find it usable, you can run usability or prototype tests . Usability testing evaluates the usability of your product by asking test participants to complete tasks on your tool and seeing how they interact with it.

While typically conducted as a pre-launch check, usability testing is now widely understood as a building block of continuous research. Conducting regular usability tests is crucial to staying familiar with users, taking the pulse of your product, and ensuring every new product decision is informed with real data.

Conduct usability tests on a product research tool like Maze and record your participant’s audio, video, and screen with Clips . This offers you a mix of quantitative and qualitative data to learn why participants take certain actions to complete test tasks.

7. Fake door testing

The fake door testing method, also called the ‘painted door method’, is a way to validate whether your customers would be interested in a particular feature. “It works by faking a feature that is not actually available and implementing a tracker to know how many people click on it,” explains Matthieu.

When people click on the feature, they see a message explaining it’s not available at the moment. If the click-rate is high, you can assume there’s interest in the feature and conduct further research to identify how to design and develop it.

While it’s a quick way to gauge interest, fake door testing runs the risk of frustrating users, so if you’re using this method on a live product, you should be cautious and set a short testing period to avoid creating false expectations in your users.

8. Focus groups

Focus groups are when you gather a group of users to try your product and discuss their thoughts on the design, UX, usability, or price. You’ll offer them prompts or ask a series of user research questions to spark conversation, then observe and take notes.

This can be an expensive or admin-heavy method, as you need to rent a space, find participants who are willing to attend, and compensate them for their time. However, you can also conduct focus groups remotely through video conferencing tools. These groups are a good way of generating new product ideas or gaining deep insight in a short space of time, as you can hear directly from your users and adjust your questioning to follow up on important topics or opinions which participants mention.

When to perform product research

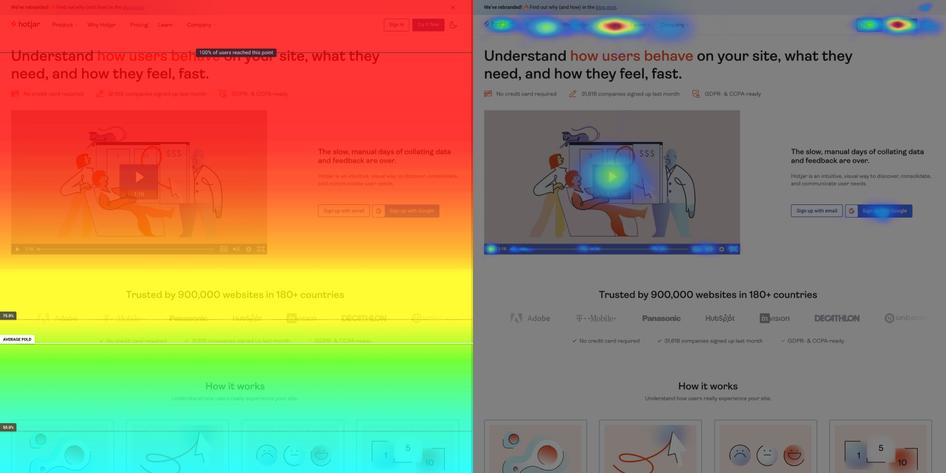

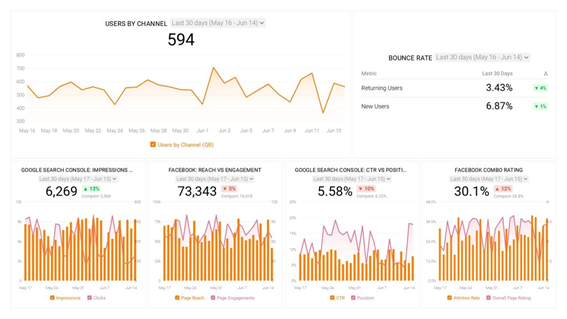

Source: 2023 Continuous Product Discovery Report

According to our 2023 Continuous Product Discovery Report , most teams conduct research at problem discovery (59%) and problem validation (57%), with only 36% researching post-launch.

The consensus is that product teams don’t think that’s enough—78% think they could research more often: which means there’s a big opportunity for you to implement regular research at all stages of the product research process .

Here’s when to conduct research on your product:

- At problem discovery stage to outline a hypothesis based on user insights

- During problem validation to prove your hypothesis

- During solution generation and concept development to see if you’re moving in the right direction

- As you’re screening different ideas for prioritization to identify the ones your users value most

- At solution definition and once you have your initial design to test early wireframes

- After developing a prototype to see assess usability and direction

- During validation and testing to review changes made to previous prototypes

- After development, and post-launch to get feedback and plan your future steps

- Before launching a new feature or doing product optimization to gauge users’ perceptions

Best practices for effective product research

If you only have time to consider one best practice for product research, we’ll keep it short. Just start.

Any research is better than none, and there’s a wealth of knowledge out there waiting to be discovered. If you don’t use it, your competitors will.

Now, here are six other best practices to help you improve your results and get the best insights possible:

1. Conduct research continuously

Your product is never done, at least not while the market, your customers, and technology are evolving. So, for your users to keep choosing you, you need to grow with them, adapt to trends, and keep iterating on your product. The right way to make product iterations is by conducting continuous product research, having frequent communication with your users, and actively listening to the market.

Did you know that user-centric organizations achieve 2.3x better business outcomes? 📊

By putting customers' needs front and center, research-mature organizations are driving better customer satisfaction (1.9x), customer retention (2.4), and increased revenue (4.2x). Learn more in our Research Maturity Report .

2. Focus on the business problem when presenting to stakeholders

It’s easy to get so involved in the product that you forget to mention how it helps the business when presenting research findings. To get stakeholders on board and to build great products that are profitable, always keep the business needs in mind. There’s no product without business success, so always align with your stakeholders and bring it back to team KPIs and business metrics. To convey your story, it’s a good rule of thumb to start each cross-team meeting by presenting the business problem, then sharing how adding a certain feature decision will help you solve it, before getting into the data that backs this up.

3. Embrace your curiosity

One of the biggest mistakes you can make in product research is letting cognitive biases take over the process. Work in teams and ask questions out of curiosity—consider research a way to disprove your hypothesis or challenge your assumptions, rather than a way to prove them right. As Prerna Kaul, Product Lead for Alexa AI at Amazon explains, you often gain more insight from an answer you don’t want to hear. “A huge trust-buster is when researchers sell an idea to customers and reinforce their pre-existing beliefs.” Doing so makes the user tell you what you want to hear but not what you need to know. It’s better to know that you have the wrong assumptions early on and build products that solve the right problem.

It’s non-negotiable to ensure that you are solving the right problem for the customer. Your solution is a painkiller, not a vitamin.

Prerna Kaul , Product Lead for Alexa AI at Amazon

4. Focus on the end goal rather than specific features

When you work closely with a product you’re passionate about, it’s only natural to think of all the possibilities, and minute details and features of the product. However, it’s crucial to understand that, while you might be the one making the internal decisions, the user will have the final call. Getting hung up on specific features will get you frustrated if users disagree, or lead you to make biased choices. To overcome this, you can write a research statement explaining the big problem you’re trying to achieve with the product. Come back to this before and after each decision, to keep your choices grounded in what’s best for the user.

“We always ask: Are we solving the right problem by creating this product? Is it going to have a measurable benefit to people?” says Nick Simpson, Head of UX at Airteam. “Then, we try to answer those questions through research methods to determine whether this investment will be worth it, to both business and users.” By thinking of the overall end goal at all stages, you get to build profitable products and features that really respond to that intention.

5. Take notes of everything

This one might go without saying, but it’s crucial to keep track of everything. Not just to inform future research and remind yourself where decisions came from, but to democratize research and bring the entire organization into your research process .

Set up a centralized research repository that anyone can access, and share it with your wider organization. Within the product team, keep a record of all user insights, even if they sound impossible to achieve at first. “These ‘futuristic’ thoughts or ideas are the ones that can either inform future iterations of the product or that you can creatively turn into something more feasible to design and build,” explains Nick. Keeping an organized information bank enables everyone on the team to get to know the user, the market, and why you’ve made certain decisions in the past.

6. Combine user feedback with data

While your users should be at the center of your business, don’t rely solely on their comments without checking other data. In reality, not everything people say is exactly what they do . Research participants can be influenced by any number of factors, mostly unconscious, so it’s important to use qualitative and quantitative data to reinforce each other.

For example, the users you interviewed might tell you they love a certain feature, but when you contrast those comments with heatmap data and time on page, you see that only a small percentage of your customers actually use it. Consider what research can be conducted to ascertain why this is, how you can improve those metrics, or whether it’s more helpful to refocus efforts on a different feature with a higher profit margin.

Keep learning about product research

In this chapter, we’ve covered a lot about product research:

- What product research is (and what it’s not)

- How researching your product is beneficial to your business

- The different methods you can use to conduct product research

- When to conduct product research

- Best practices for your research

Now, it’s time to kickstart your product research process in the next chapter. We’ll also talk about how to conduct product experiments and competitive analysis, so stay tuned.

Product research process

Are you an agency specialized in UX, digital marketing, or growth? Join our Partner Program

Learn / Guides / Product research basics

Back to guides

A step-by-step guide to the product research process

A strong product research process ensures product teams maximize resources, meet key business goals, and make confident decisions that will deliver successful products and features to create customer delight.

But, how do you conduct effective product research?

Just as there’s no single way to develop a product, no single research process fits all product teams. But there are key steps that will help you balance business goals and user needs for actionable product research .

This article takes you through the factors you should consider to tailor product research to your desired outcomes and provides a step-by-by-step guide to doing research right.

Use Hotjar to streamline your product research process

Hotjar offers product teams a rich stream of quantitative and qualitative data that keeps you connected to user needs at every stage of research.

What to consider before starting product research

Before jumping into the research process , product managers prepare their team. Take time to consider the why and determine how you can design the process to meet your unique product requirements.

Reflect on:

Why you’re doing the research

Get connected with the deep purpose of your research: what you need to understand to create a profitable and effective product .

Determine specific outcomes of the research process.

During the early product discovery stages, generating new product ideas for innovation and getting to know your users better will serve as a solid foundation throughout the research process. At later stages, look for concrete feedback on a new product, or possible upgrades and feature updates for an existing product. The why behind the research should guide your process.

Categorizing your users

Determining customer needs and segmenting users are crucial steps that impact the success of any product research strategy.

You might use a random sample of potential or existing customers; or segment users according to region, industry, or other criteria to spot patterns across different demographics.

Trial users can give immediate product feedback, which is usually incredibly easy to implement (a new theme, for example) or incredibly difficult, like an entirely new functionality or platform for your product. Your long-time users can give nuanced feedback, but they overlook what doesn't work due to their expertise.

Finding that middle ground of users who like what you offer but aren't stuck to your brand is essential. These users appreciate being treated like their insights matter most—because they do.

Finding impartial user insights can be tricky since many tools track users who’ve been paid or incentivized to click through to your website or product. Product experience insights software like Hotjar can help by providing organic, unbiased user data that gives you a clear picture of your customer experience (CX) .

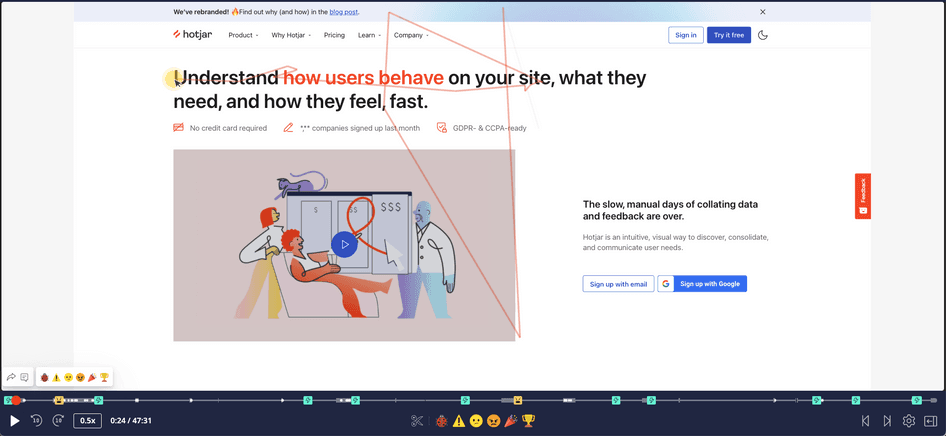

Pro tip: Hotjar Highlights lets you sort and curate user insights and attributes, and share them with your product team. You can also watch Session Recordings of users from specific countries or industries—or filter recordings to see only satisfied or dissatisfied user experiences, which can provide valuable information on what’s working (and what’s not).

A Hotjar Session Recording

Your core business goals

The best product research processes overlap with the overall organizational vision, so update your research goals in line with company goals to ensure alignment.

Designing your research process with cross-functional collaboration in mind is a great way to eliminate any communication issues, ensure all departments collect data that tests product profitability, business goals, and user satisfaction.

Your team’s methodology

Different product methodologies emphasize different aspects of product research throughout its lifecycle, so it’s important to consider techniques that will fit your team’s working stages.

Teams who use waterfall methodologies usually rely on bursts of intense research before development and again during pre-launch. They also make a clear distinction between the product’s research and development phases.

Teams who use agile, lean, or DevOps methods usually integrate research with the broader product development process, engaging in continuous discovery methods.

Whatever your methodology, infuse research into every stage of the product lifecycle to achieve business goals like increased revenue, acquisitions, and user adoption.

Choosing which research tools to use

When you’re deciding how to do product research, you’ll need to consider your budget and company size to pick out your tool stack.

Manual research techniques like user interviews can be time-consuming and cost-intensive, but useful to forge a personal connection with users and ask improvised questions based on their responses.

Automated research tools (like Hotjar 👋) increase speed, efficiency, and cost-effectiveness, and reduce human error. They allow you to reach a larger target audience and ensure you’re getting clean, unbiased product feedback —in person, users are more likely to feel pressure to compliment your product or underplay their concerns, but with tools like Hotjar, you’ll get genuine, in-the-moment feedback from users as they engage with your product.

Which team members will contribute

Involve different team members at each stage of the product workflow. For example, when you’re validating product ideas, you may want to include marketing and technical departments; and when you’re testing product usability , you may want to rely on the expertise of your engineers.

It’s also important to consider what research other departments have done before launching your own process, so you don’t waste resources duplicating generic market research.

8 steps for amazing product research

Amazing product research is all about doing smart research to unearth effective insights without getting lost in an information overload that derails your product workflow .

Follow these eight steps to guide your product research strategies to achieve valuable, actionable product insights that will inform your product’s entire lifecycle, from ideation to execution.

1. Define your research goals

First, set your high-level goals, which should test business objectives as well as customer-centric product discovery. These are often drawn directly from the product vision and strategy.

Then, create attainable, specific goals or questions for your team to focus on during each stage of their research. This might include:

Conducting market research for the product’s adoption before its launch

Identifying areas where key features can be improved after the product launch

Evaluating the product’s performance throughout the product lifecycle

2. Understand your users

User needs are at the center of effective product research processes.

Engage in user discovery—identify and understand your customer—as early as possible , even before you have definite product or feature ideas. Open-ended user research is a key source of product inspiration and innovation, and an essential step in determining product-market fit .

Then, when you have product proposals, prototypes, or a minimum viable product ( MVP) , you can start seeking more specific feedback.

User research is all about interacting with your current or potential users and learning what they want and need . Developing a user-centric culture of ongoing research will help you gauge the market demand, position your product against the competition, and generate customer delight .

To create a user-centric research culture, conduct user interviews and create user personas. You can also connect more passively with your user demographic by looking at forums, Facebook groups, or sites like Reddit that are used by your customer niche.

The more organic the research process, the better. It’s ideal to catch users in situations where they answer by instinct instead of having carefully crafted answers. It's what they say instinctively that leads to better product solutions.

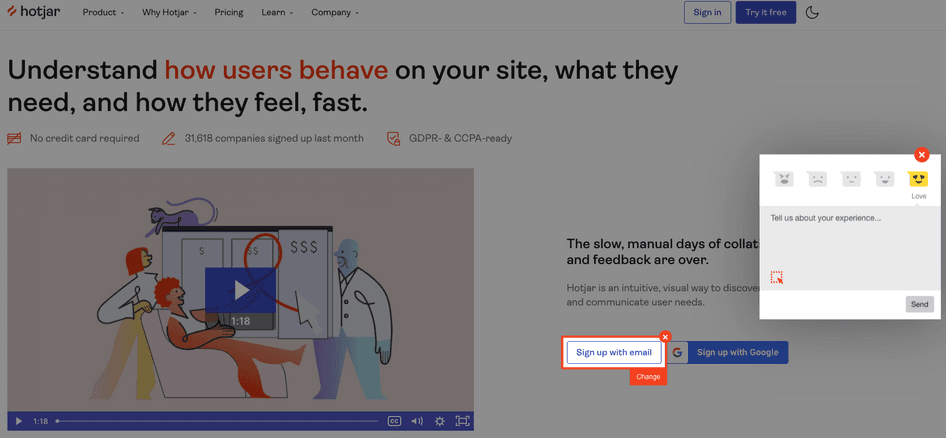

Pro tip: use Feedback widgets to gather user feedback in a non-invasive way.

Hotjar’s Feedback widgets are integrated into the product interface , so users can give quick feedback and then carry on with their tasks. This means you can survey your users and gain valuable insights by learning what they’re thinking and feeling as they interact with the product.

A Hotjar feedback widget

3. Do market research for your product

Run thorough competitive and comparative analyses to test the business potential of your product against other solutions on the market , and engage in opportunity mapping to get stakeholder buy-in.

You can also use historical market data and trade reports to predict potential profitability and run keyword research to understand users and what potential customers are searching for to generate product ideas.

Once you’ve validated whether there’s a viable market for your product and determined how saturated that target market is, focus on your product’s unique selling points.

Pro tip: even if you already have a product established in a specific market, make sure to assess the market periodically. Markets and competitors change, and making assumptions because of your initial research processes can be a costly mistake. Work with your marketing team here to validate your ideas and avoid guesswork.

Evaluate your product regularly against the industry by creating a value curve. The value curve plots the product offerings currently available in the market on one axis, and the factors the industry is competing on and investing in heavily on the other. This can help you spot market opportunities, ensure product relevance, and get ideas for features you could add to increase user demand and open up new user bases.

Check out how Gavin increased conversions for his lead generation agency by 42% with Hotjar.

4. Get to know industry trends

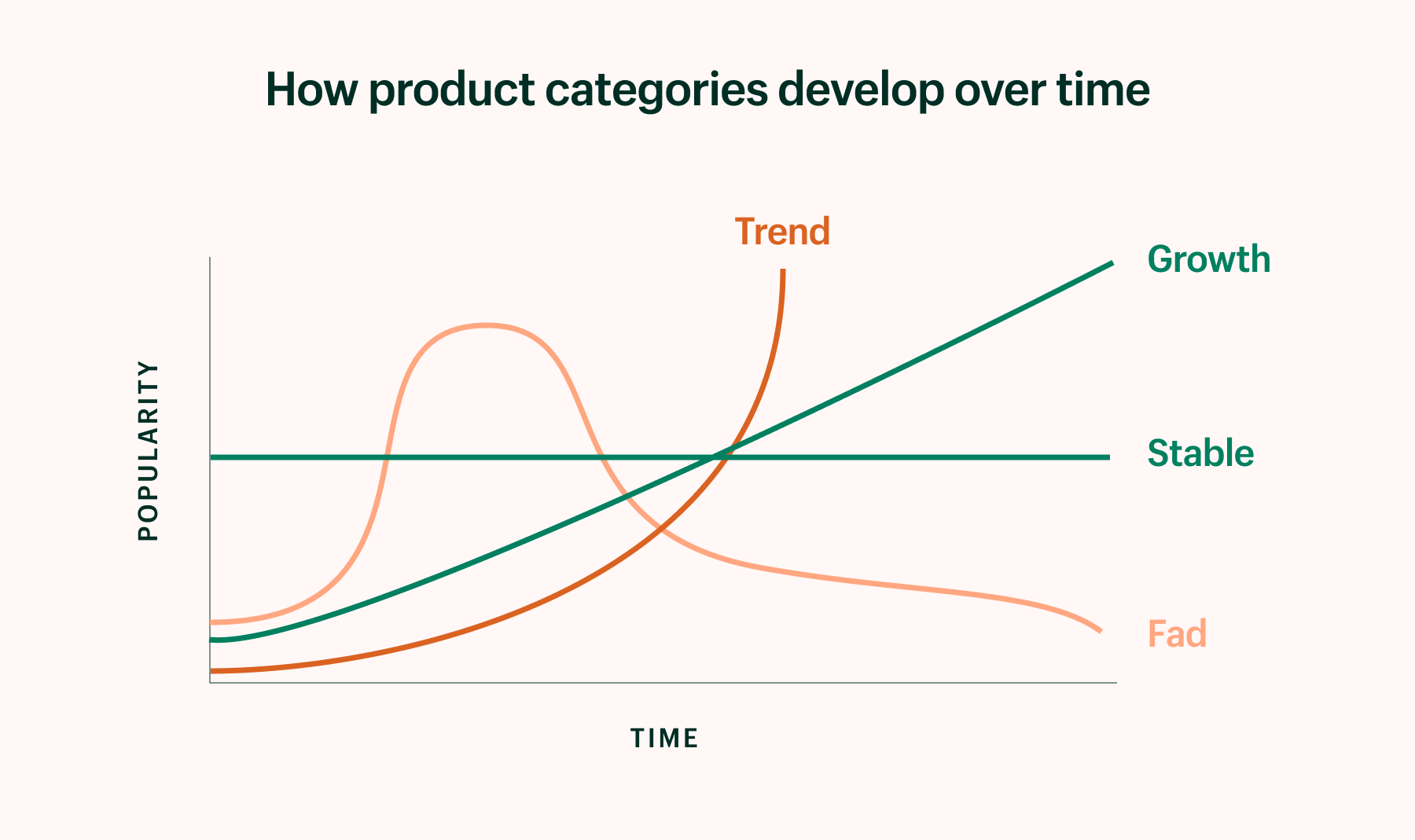

Next, combine your understanding of your users and market with research on technology trends that may affect user expectations of your product or its long-term viability.

Stay on top of trends by regularly engaging with tech cultures —read trade magazines and news sites, listen to tech news podcasts, and follow key trendspotters on social media and specialist forums. You can also use tools like Google Trends , Trend Hunter , and PSFK .

Another key source of tech trend information is your engineering team . Chances are, you have plenty of techies on your team who are up to speed on different aspects of technology and what’s forecasted to change.

Pro tip: rigorously analyze trends and put them into context to understand what has staying power, as you avoid jumping on every passing fad. Create a learning culture that embraces experimentation and gives team members the opportunity to share their knowledge.

Analyze the latest trending topics and projects in mainstream open-source communities across the Internet such as GitHub. These communities are an incredible resource for identifying tech trends that are sustainable, disruptive, and have immense staying power.

It's also important to subscribe to prominent tech publications and leading technology platforms such as Azure and AWS to get the latest tech news and new feature announcements delivered directly to your inbox. This way, your product team is always in the know about the most important tech trends that are shaping product development and product markets.

5. Validate ideas with current or potential users

Once you’ve developed a strong sense of your users, market, and technology, it’s time to start testing concrete ideas and solutions.

Based on your early research, identify possible products, features, or upgrades that could meet user needs as well as business goals. Then, run concept testing to evaluate the user experience.

First, identify key users or user types to test. Recruit participants for customer interviews or focus groups, or deploy Hotjar Surveys , Incoming Feedback tools, and Session Recordings to test ideas with existing users.

Then, ask questions or set tasks and observe user responses. You may just want to explain concepts to users at this stage—or you can use wireframes or mockups; or, at later stages, prototypes or MVPs.

Make sure you account for confirmation bias and false-positive responses from users when designing the validation process. Include open- and closed-ended questions and use measures like purchase intent to determine customer adoption.

Pro tip: use fake door testing to gauge interest in new features across your existing user base.

In fake door tests, you show users a call-to-action for a product action that doesn’t exist yet. Once they click to perform the action, they’ll be taken to a page that explains this feature isn’t available yet—you may also choose to include a short survey on this page to learn more about their interest. By reviewing answers to survey questions and the click-through rate , product teams can quickly validate ideas for new features or improvements with users.

6. Test your MVP

The next step in your product research process is to develop a Minimum Viable Product based on validated ideas and run tests to improve subsequent iterations.

This is a critical stage in product research that you shouldn’t skip. Waiting for the fully developed product before running tests makes it harder to fix software and prioritize bug issues, causing major delays.

Quality assurance (QA) testing, regression testing, and performance testing check the MVP’s functionality and show developers where they need to make product changes .

User tests are also key at this stage. Different types of product testing , like tree testing and card sorting, can confirm whether users can easily navigate your product to find the functionality they need.

A/B tests and multivariate tests , where you split your user base into groups and give them different versions of a product or feature, can help you decide which iteration to run with. Hotjar Heatmaps allow you to easily compare where users click and scroll on different versions of the product.

7. Continue research after the product launch

Consider doing a soft launch—or even canary deployment—where you release new products or features to a small group of users

Gather data to weed out bugs

Finally, adapt the product based on user responses

Then you can roll it out to all users.

But even once you’ve launched the final product, your research isn’t over. The best product teams stay connected with their users and regularly analyze market trends and tech changes.

After the product is released, either through a soft launch or a regular launch, implementing a data-driven approach to the go-to-market strategy is crucial in parsing consumer reports and validating trends and customer opinions.

Continuous research ensures that your product stays relevant and successfully meets customer needs, which will boost user metrics and business metrics alike.

So how can you continue your research throughout the product lifecycle?

Watch session recordings to spot blockers and bugs where users are rage clicking or dropping off the product journey

Use heatmaps to understand which product elements are most popular—and unpopular—with users

Measure product analytics like click-through rate (CTR) and product conversion rate

Stay up to date on industry and market trends

Incorporate regular opportunities for cross-team discussions to get different research perspectives

Schedule regular user and customer interviews

Use product experience insights tools like Hotjar to give you a steady stream of user feedback through Surveys and Feedback widgets

8. Turn research into action

The final step in any product research process is to organize your research and turn insights into action.

Curate your research into specific, actionable themes to cut through the noise and gather valuable, user-centric insights.

Then, use your research to establish a strong product strategy and roadmap to guide your product development process. Make sure you compare the strategy and roadmap with new research at regular intervals and update where needed, though it’s important to strike a balance: these documents should be dynamic but relatively stable touchpoints.

Your product research should also drive your day-to-day decisions and product backlog management , and form the basis of your product storytelling to help get stakeholder buy-in.

Why creating a user-centric research culture is essential

Remember: at heart, all product research is user research.

Product teams who are endlessly curious about their users—who they are, what they need, how they experience your product—can better meet the demands of an ever-evolving market, inspire customer loyalty, and increase their Net Promoter Score (NPS) . With a learning mindset and a commitment to customer-centric product discovery, you can transform research into innovation and sustainable business growth .

FAQs on the product research process

What is product research.

Product research is the process of gathering data about your product’s purpose, intended users, and market to meet user needs and achieve business goals.

What are the steps in the product research process?

The 8 steps in an effective product research process are:

1) Define your research goals

2) Understand your users

3) Do market research for your product

4) Get to know industry trends

5) Validate ideas with current or potential users

6) Test your MVP

7) Continue research after the product launch

8) Turn research into action

Why is product research important?

Strong product research is critical to product management because:

It ensures the product will meet customer needs and hit business targets

It helps product managers (PMs) develop a data-informed product vision, strategy, and roadmap

It helps PMs make confident decisions on the product backlog and day-to-day tasks

It keeps the product team motivated and connected with the purpose of their work

It helps the product team communicate product value to stakeholders to get buy-in and secure resources

Prioritize product features

Previous chapter

Guide index

.webp)

What is Product Research? Methods, Process, and Benefits

Product research does not just happen in the initial stages of product development. Well-seasoned product managers know that the process is continuous. Businesses that perform best conduct regular product research to stay ahead of customer needs, market trends, and the competition.

This guide will help you to:

✅ Understand what product research is ✅ Learn if your product team should invest time and resources in it (and why) ✅ Get to know different product research methods, and when best to use them ✅ Plan your product research step by step ✅ Master product research with some best real-life tips

Without proper product research, your chances of success, like your product decisions , will be random. Learn from the market and your customers to make data-driven and customer-centric decisions.

We’ll show you how 🙌

What is product research?

Product research is a process in which you gather, analyze, and interpret data to make strategic decisions about a product's or feature’s development, improvement, or market positioning. It is a crucial part of the design and development process, whether for a new product or adding features to an existing one.

Product research helps evaluate market demand, analyze conditions and competition, and identify your target audience's needs, expectations, and pain points. The goal is to create products that meet user needs , reduce risks, and enhance user satisfaction.

Product research is essential before and after a product launch to ensure continuous improvement and alignment with market trends and customer preferences.

Types of product research

Product research has different facets depending on which stage of development you are, and what kind of insights you need. They all have a lot in common, but the focus angle will be different. 🔦

🔬 Market research focuses on evaluating the market size, trends, competitive landscape, and customer demographics (within one market). It will help you assess whether your product has a chance to succeed on the intended market, identify opportunities, and optimize your overall product and marketing strategies.

🔬 Customer research aims to understand customers' needs, preferences, behaviors, and experiences. Only then can you create products that meet their expectations and solve their problems.

🔬 User research studies how users interact with a product to make sure it is user-friendly and meets real user needs . Its main focus is to gather insights on user behaviors , needs, motivations, and pain points to improve user experience and product usability.

🔬With product discovery , you want to identify and validate ideas for new products and features before development begins. The primary purpose is to minimize risks by validating assumptions and ensuring alignment with user needs and business goals.

🔬 Continuous product discovery framework integrates into the daily workflow of product teams. Its main focus is to continuously gather insights from users to validate product assumptions, to ultimately build features that bring value for users but also align with business goals.

🔬 Pricing research helps determine the optimal price for your product or service. It involves analyzing market demand, competition, and customer willingness to pay. The goal is to find a price threshold that maximizes revenue and meets market expectations at the same time.

Why do product teams need product research?

To some degree, all product teams need to have a well-established product research process.

Depending on the scope (is it a completely new product, or are you developing new features?) and stage of development (are you assessing your chances in the market or already prototyping?), teams will perform different research activities.

It’s never one size fits all, but it’s also an indisputable part of developing digital products.

To make informed decisions

The fundamental reason to do product research is to reduce the risks of failure.

And even though you might have heard it countless times, you cannot overrate the power of data-driven decisions. Product research provides concrete data, forming a foundation for making them, from feature prioritization to design choices.

To identify the problem and validate product ideas

Product research will help you uncover what your customers need and desire, as well as the challenges they face.

With a well-defined problem, it’s also easier to test and validate product ideas before you invest significant resources. This again reduces the risk of creating a product that misses the mark.

To gain a competitive edge

One integral element of product research is understanding your competition's offerings. Analyzing competitor products will help you identify opportunities for differentiation, making sure your product stands out in the crowded market.

Continuous market research will help you stay abreast of trends and evolving customer needs, ensuring that your product remains relevant.

Bonus: Customer-centric approach focused on user-centered design will also help you build a positive brand reputation.

To optimize product development

This one works two ways. First, by conducting thorough product research, you identify areas that need to be prioritized. It enables your teams to focus on aspects that resonate the most with users.

Second, you save money. Product research gives you tangible arguments for allocating resources better, thus preventing costly development mistakes.

For continuous improvement

As the development of digital products never ends but continues through iterations, you need a trend baseline to make sure that your product evolves in the right direction.

Bonus: Engaging directly with users during research helps develop empathy and improve retention, both of which are crucial for user-centric product development.

Product research methods

With the countless number of available product research methods, the most important part is choosing the right ones. Depending on when in the product development process you’d like to use them, the overall research goal, and the resources available, you might be using different combinations of primary and secondary research .

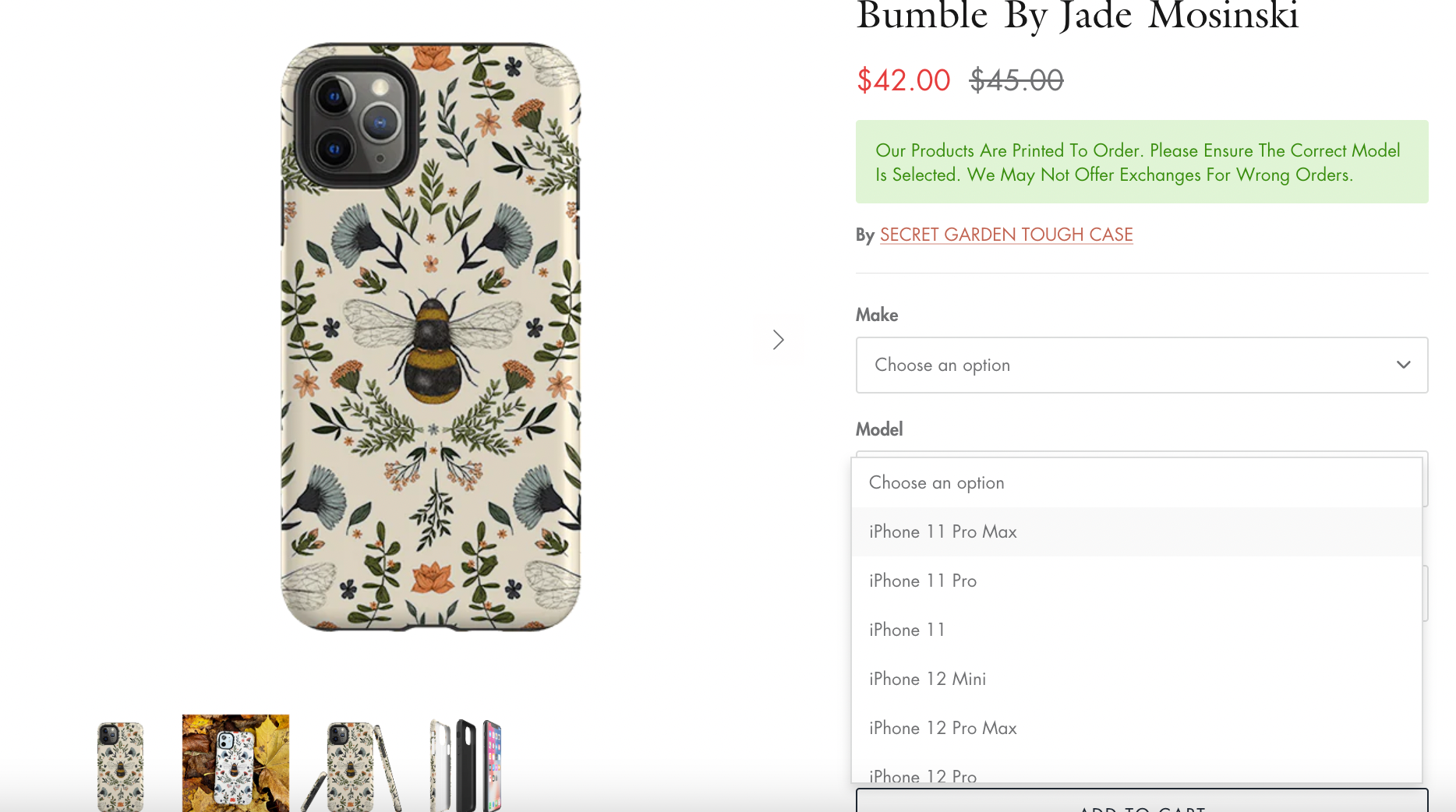

Product surveys are a great way to learn how existing and potential customers feel about your product.

These surveys can include questions about what consumers think of your product, such as:

- What frustrates them the most

- What the most needed improvements include

- What their favorite features are, and more.

You can also gain insights into how these aspects compare to your competitors’ products.

Product surveys can be sent via email or link , in-app , in-product , or displayed on your website . This is probably the most convenient, affordable, and effort-efficient way of gathering information to fuel your product research.

Another kind of survey that can prove useful is a quarterly NPS (Net Promoter Score) survey . The open follow-up question can be a great source of new product and feature ideas.

In-app feedback

In-app feedback and in-product surveys are perfect for gathering real-time user feedback and addressing user issues promptly. They provide immediate user insights that add to your continuous improvement efforts.

With in-product surveys, you can easily stay on top of contextual feedback on existing or new features and recent updates.

Customer reviews

Customer reviews provide unprompted feedback provided by users on various platforms, such as e-commerce sites, social media, and review websites.

They help understand user satisfaction, identify friction points , and gather actionable insights , but they are also an opportunity to build rapport with your audience. Never neglect them, and always be sure to reply.

Voice of Customer (VoC) analysis

You should collect Voice of Customer (VoC) feedback to understand user needs, preferences, and experiences. It is useful for gaining a comprehensive view of customer sentiments and identifying opportunities for improvement.

VoC analysis can be a helpful tool to inform product development and customer service strategies.

Importantly, you need consistency here, hence the systematic collection and analysis of feedback is essential.

Product analytics

Product analysis based on internal analytics is a fundamental element of any digital product. With the user behavioral analytics relevant to your product, you must be on top of the key metrics such as product adoption, user retention , churn , or lifetime value.

Remember, you should adjust the choice of metrics to your goals and needs. Too many of them will just create unnecessary noise. You should also establish one source of truth and democratize access to your tools.

User interviews

User interviews are, by far, the best method to obtain in-depth user insights. They allow the flexibility to ask the best research questions that, in turn, provide rich, detailed data. The downside? User interviews require a lot of resources, including time and money. The key to using them to the fullest is sound interview recruitment.

For example, Medscape runs product research surveys inside the product in which they recruit users for interviews.

We do it at Survicate, too. We also use Intercom conversations with customers to gather additional feedback and input on silent launches. Respondent attributes identify customers who would be good candidates for product testing .

Focus groups

Start with finding focus groups of people who already use a product similar to the one you are thinking of developing. You can enquire about things like an optimal price , the most important features , and the features that are missing in their current solution.

This can Additionally, you’ll learn about the qualities of your product that will make it unique and outbid your competitors.

To eliminate bias , choose third-party interviews or online surveys .

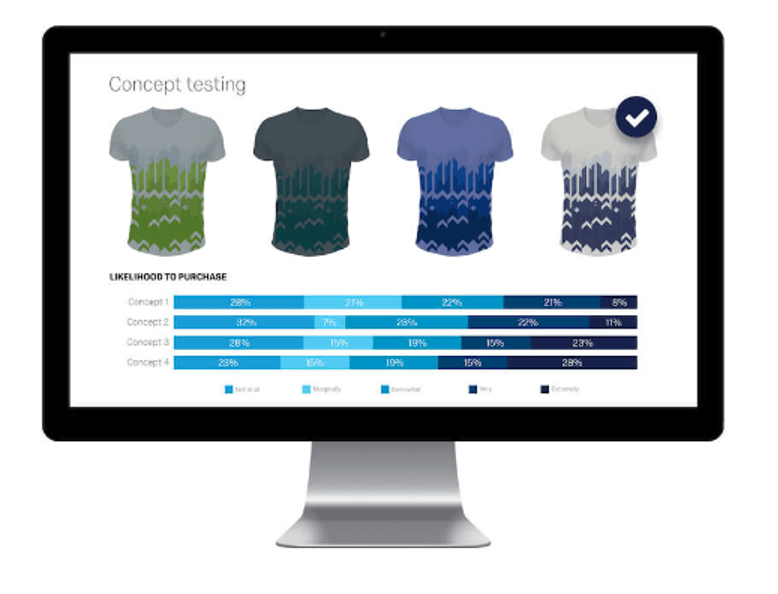

Concept testing

Concept testing is the process of surveying users about a potential product . You can learn how they feel about it and whether they would be willing to purchase it were it available on the market.

This method is very versatile, as it can be conducted online, over the phone, or through real-life interviews. It can be difficult to obtain a sample of potential clients willing to provide you with feedback, so we recommend using a customer feedback tool to facilitate the process.

A/B testing

With A/B testing , you compare two versions of a product or feature to determine which one performs better. It’s useful for optimizing design and functionality based on user preferences and behaviors.

A/B testing is often used during the product development phase to refine features and improve user experience .

Usability testing

After building an MVP , you need to show it to potential customers to get their feedback.

Usability testing involves observing users as they interact with a product to identify any usability issues. This method is useful for understanding how intuitive and user-friendly a product is. Usability testing is often conducted during the design and development stages to ensure the product meets user expectations and is easy to use.

This method is usually used in the later stages of product development to get the final product validation .

When to perform product research

Product research takes place throughout the whole development process. From the initial idea to post-launch, each stage requires its own set of research activities.

Before development

Discovery is probably the most important phase of product development when it comes to research. At this stage, you need to establish the fundamentals of the product. There are many questions you must answer to reduce risks before even thinking about the delivery phase:

🏮Who is it for? 🏮What problems will it solve? 🏮How is it different from the competition, and how does it position itself among similar products? 🏮Can you develop it? 🏮Will people buy it?

This is the time to research the market, define user personas , and get to know their problems, needs, and desires. When you find your niche and your target audience, you’ll have to decide how to position your product against the competition .

🔬Useful research methods : surveys, user interviews, product analytics, market research, product discovery, continuous product discovery

🔧Toolset : Check our list of popular product research tools .

💡How Medscape uses surveys to complement continuous discovery ⤵️

By using surveys within a Continuous Discovery framework, Medscape's product teams have improved their product development through direct user feedback. Contextual surveys have been crucial in recruiting users for interviews and validating hypotheses, resulting in actionable insights.

READ THE WHOLE STORY

Prototyping

Once you have validated your product idea, you’ll move on to prototyping initial versions to capture any usability and UX issues early on.

At this point, you’ll probably already be conducting research to see how your target audience perceives the early iterations of the product (or feature). Gathering product feedback at this stage will help you design a roadmap .

🔬Useful research methods: UX surveys, user interviews, product analytics, concept testing, focus groups, usability testing, A/B testing

🔧Toolset: Check our list of popular UX research tools .

Beta testing

After finding the sweet spot in accommodating user needs, functionality, usability, and your business goals, you’ll end up with a beta version of your product, something really ready to be tested in and out with a wider group of users.

This will help you understand how customers perceive your product or its new iterations, what they like and don’t like, and how you can still improve on it.

💡How Intergiro speeds up feature validation ⤵️

Intergiro's product team employed in-app surveys to validate new features and gather user insights during the product validation process. They periodically deployed surveys in various parts of their product to obtain precise feedback on specific elements.

🔬Useful research methods: in-product and in-app surveys, user interviews, product analytics, focus groups, usability testing, A/B testing

Post-launch

So you’ve launched the product , but the research journey doesn’t end here—it is a continuous commitment. Make sure you collect relevant customer engagement metrics .

After launch, product research should focus on checking if the entire digital journey provides an engaging product experience . This is the time to evaluate if you have nailed your product’s positioning , product-market fit, and pricing.

💡How Landing measures its product-market fit (and more) ⤵️

Landing utilized Survicate's product-market fit survey to consistently assess how well their platform meets user needs and expectations. This survey serves as a health check for Landing's value proposition, offering qualitative feedback that is analyzed and converted into new roadmap items.

💡How hitta.se improves on its customer journey ⤵️

With NPS and CSAT surveys, Hitta.se identified areas for improvement in their customer journey. By leveraging the customer feedback they collected, they were able to make data-driven decisions and implement tangible changes, resulting in a 35% improvement in NPS.

🔬Useful research methods : user reviews, product analytics, user interviews, surveys: NPS , CSAT , CES , product-market-fit

🔧Toolset: Check our list of popular product feedback tools , user feedback tools , conversion optimization tools .

How to conduct product research?

It’s time to look more closely at the very product research process. You already know it’s essential for developing a successful product. But where should you start? Let’s go through the best practices step by step.

Step 1: Define research objectives

Clearly outline what you aim to achieve with your research. This could include identifying market gaps, understanding user needs, validating product ideas, or improving an existing product.

Step 2: Identify your target audience

Knowing your audience is crucial. Define who’s your target while creating the product by understanding their demographics, needs, and behaviors.

Don’t forget to create detailed user persona profiles including their usage patterns, preferences, and decision-making processes.

It could look like this template ⤵️

You can collect this information upon signup, but you can also gather this data with a user persona survey distributing it, for example, directly in-product or via email.

Step 3: Choose research methods

Select the appropriate mix of quantitative and qualitative methods , and make use of existing data through secondary research.

📈Quantitative methods : surveys, data analysis, metrics

📝 Qualitative methods : surveys, interviews, focus groups, user observations, online reviews

📚 Secondary research : existing reports, competitor data, trend analysis

Step 4: Conduct the product research

Now it’s time to put it all into action and implement your chosen methods. Collect data accurately, ensuring objectivity throughout the process.

Step 5: Analyze data and draw insights

Analyzing the collected data to identify key patterns and trends is, traditionally, the most laborious part of the process. While drawing conclusions from quantitative data may be quite fast with the right tools and a wise metric choice, analyzing qualitative feedback is a different story.

To use your qualitative data to the fullest, use a customer feedback analytics tool, such as Insights Hub . It will dramatically cut down the time from raw feedback to contextual insights based on what your users are saying about the product in any feedback source you connect to this tool.

🔦 Identify patterns and trends with quantitative data : Look for recurring themes and statistical trends.

Categorize qualitative feedback and draw actionable conclusions : Link findings directly to product improvements, prioritize changes based on user needs and develop product strategies to address identified challenges.

Step 6: Validate ideas with users

Test your ideas and solutions with existing customers and potential users. Remember to identify key user types before recruiting test participants.

⚖️ Test ideas : Use interviews, focus groups, surveys, and usability tests to gather feedback.

🙊 Account for bias : One way to combat confirmation bias and false-posititve responses is to alway focus on asking about a behavior in a certain context . As Teresa Torres puts it:

“Instead of asking, What criteria do you use when purchasing a pair of jeans? —a direct question that encourages our participant to speculate about their behavior—we want to ask, Tell me about the last time you purchased a pair of jeans. ” [...] It will reflect their actual behavior, not their perceived behavior.

Step 7: Develop and test your MVP

Developing a Minimum Viable Product (MVP) is a result of creating multiple prototypes based on validated ideas and tests to improve subsequent iterations.

⚗️User tests : Use tree testing, card sorting, A/B tests, and heatmaps to confirm usability and functionality

🙌Quality assurance : Conduct QA testing, regression testing, and performance testing.

Step 8: Continue research post-launch

Even after the product launch, continue to gather data and user feedback to weed out bugs and refine the product.

- Gather data : Use user responses to adapt the product before a full rollout.

- Ongoing research : Stay connected with users and regularly analyze market trends and tech changes.

💡How GetResponse uses online surveys for ongoing product research ⤵️

GetResponse runs over 320 ongoing surveys across their free, paying, and enterprise business units, gathering an average of more than 3,000 responses per month. Its Product teams use surveys to validate features, research personas, as automated in-product surveys to gauge satisfaction along the customer journey, as well as ad-hoc product research activities.

We’re also there

The Ultimate Guide to Product Research: Everything You Need to Know

.jpg)

If you're looking to start a business, you must do your research first. Product research is key to determining whether a product will succeed.

In this guide, we'll teach you everything you need to know about product research, including the different methods you can use and the factors you need to consider. We'll also provide some tips on how to get started. So whether you're just getting started or looking for ways to improve your process, this guide is for you!

What Is Product Research?

Product research is gathering data about a potential product or service. This data can include information about the target market, the competition, and the product itself. It's crucial to do product research before launching a new product or service, as it can help you determine whether or not there is a demand for your offering.

Why Is Product Research Important?

Product research is essential because it can help you make informed decisions about your product or service. If you don't research, you could launch a product that no one wants or isn't profitable.

Product research can also help you understand your target market and what they're looking for in a product. How to do product research?

There are a few different ways to do product research. You can use online tools like Google Trends and Amazon Best Sellers to get an idea of what people are searching for and what products are selling well.

You can also reach out to your target market and ask them about their needs and wants. Additionally, you can look at your competition to see what they're doing well and where they could improve.

What Are The Different Types of Product Research?

There are a few different types of product research, including primary research, secondary research, and desk research.

Primary research is data that you collect through surveys or interviews, for example. Secondary research is data that someone else has already collected, like data from a market research report. Desk research is data you can find online, through Google or social media.

Factors To Consider When Doing Product Research

There are a few different factors to consider when doing product research, including your target market, the competition, and the product itself.

You'll want to ensure you understand your target market and what they're looking for. Additionally, it's important to understand your competition and what they're doing well.

Finally, you'll want to make sure you have a clear understanding of the product itself.

Product research is an integral part of developing any new product or service. By understanding your target market, the competition, and the Product, you can make informed decisions about your product design and user experience.

How To Conduct Product Research

1. Evaluate Market Size

You'll want to start by evaluating the market size when conducting product research. This will give you an idea of the potential demand for your product or service. Additionally, it will help you understand the competition. To do this, you can use desk research to find the market size and competition data.

Google search: "market size [your industry]"

"Global [your industry] market size"

"Competition in [your industry]"

Secondary market research:

- For products: Look at Amazon Best Sellers Rank or Google Shopping results.

- For services: Use Google Keyword Planner to look at average monthly searches.

If you're unsure where to start, try looking at secondary market research. This can include Amazon Best Sellers Rank or Google Shopping results for products or using the Google Keyword Planner to look at average monthly searches for services.

Once you understand the market size and competition, you can start to conduct your primary research.

2. Analyze The Competitive Landscape

After you've evaluated the market size, you'll want to analyze the competitive landscape. This will help you understand your competitors and what they're doing well. To do this, you can use desk research to find data about the competition.

Google search: "[your industry] competitors"

"[Your product or service] reviews"

"SWOT analysis [your industry]"

- Look at competitor websites.

- Read competitor reviews.

- Conduct a SWOT analysis.

A SWOT analysis is a great way to evaluate your competition and understand its strengths and weaknesses. To do a SWOT analysis, you'll want to look at your competitor's website, read their reviews, and understand their strengths and weaknesses. This will help you identify areas where you can improve upon.

Once you understand the competition well, you can develop your unique selling proposition. This will help you differentiate yourself from the competition and make your product or service more appealing to potential customers.

3. Determine Product Category Outlook

After you've evaluated the market size and analyzed the competitive landscape, you'll want to determine the product category outlook. This will help you understand the future potential of your product or service. To do this, you can use desk research to find data about the future of your industry.

Google search: "[Your industry] forecast"

"Future of [your industry]"

- Look at industry reports.

- Read articles from thought leaders in your industry.

Industry reports are a great way to get an understanding of the future potential of your product or service. You can also read articles from thought leaders in your industry to get their insights on the future.

Once you have a good understanding of the future potential, you can start to develop your product or service roadmap. This will help you map out the steps you need to take to achieve your desired future state.

4. Is Your Product Available Locally?

If you're looking to launch a new product or service, it's essential to understand the availability of your product. IYou'llwant to research the local market. If your product is available locally, you can use desk research to find data about the local market.

Google search: "[Your product] [your city]"

"[Your product] [your state]"

- Look at local demographic data

- Read local news articles

- Conduct market analysis

Local demographic data can give you insights into the potential market for your product or service. You can also read local news articles to understand the local market better.

Additionally, you can conduct a market analysis to understand the potential demand for your product or service.

Once you have a good understanding of the local market, you can start to develop your marketing strategy. This will help you reach your target market and generate sales.

5. Determine Your Target Customer

Before starting marketing your product or service, you need to determine your target customer.

To do this, you'll want to think about the needs of your target market and the demographics of your potential customers.

This information will help you develop a buyer persona, a fictional representation of your ideal customer.

Once you have a buyer persona, you can develop your marketing strategy. This will help you reach your target market and generate sales.

Additionally, you can use your buyer persona to develop your product or service offering. Understanding your target customer's needs ensures that your product or service meets their needs.

6. Determine Markup

After you've chosen your target customer and developed your marketing strategy, you'll need to determine your markup. Markup is the difference between the cost of your product or service and the selling price. To determine markup, you'll want to consider the following:

- The cost of goods sold (COGS): This includes the cost of materials, labor, and overhead.

- The selling price: This is the price you'll charge your customers.

- The desired profit margin: This is the percentage of profit you want to make on each sale.

Once you've considered these factors, you can calculate your markup. To do this, you'll need to divide your desired profit margin by your COGS. Once you have your markup, you can start to develop your pricing strategy.

7. Figure Out The Selling Price

By understanding markup's components, you can ensure that your product or service is priced correctly. Additionally, you can use markup to help you reach your desired profit margin.

After you've determined your markup, you can start to develop your pricing strategy. To do this, you'll need to multiply your markup by your COGS.

8. Determine Product Weight And Size

After you've decided on your selling price, you'll need to determine your product’s weight and size. To do this, you'll need to consider the following:

- The weight of the product: This will affect shipping costs.

- The dimensions of the product: This will affect packaging costs.

Once you've considered these factors, you can start to develop your packaging strategy.

This will help you keep costs down and ensure your product arrives safely to your customers.

By understanding your product's weight and size, you can ensure that your packaging is sized correctly.

9. Is Your Product Durable?

After you've determined the weight and size of your product, you'll need to consider its durability. To do this, you'll need to think about how your product will be used and how it will stand up to wear and tear. Additionally, you will want to consider the following:

- The materials used in the product: This will affect the durability of the product.

- The product's expected lifespan: This will affect how often your customers need to replace your product.

By understanding your product's durability, you can ensure that it meets your customers' needs. Additionally, you can use this information to help you determine your warranty or return policy.

10. Is Your Product Seasonal?

After considering your product's durability, you'll need to consider its seasonal nature. To do this, you'll need to consider when your customers will use your product and how that will affect demand.

By understanding the seasonal nature of your product, you can ensure that it meets your customers' needs.

11. Does Your Product Serve A Passion, Relieve Pain, Or Solve A Problem?

After considering the seasonal nature of your product, you'll need to consider its purpose. You'll need to consider what your product does and how it can help your customers. Additionally, you'll want to think about the following:

- The product's benefits: This will help you determine what your product does for your customers.

- The product features: This will help you determine how your product can help your customers.

By understanding your product's purpose, you can ensure that it meets your customers' needs.

12. What Will Your Product Turnover Be?

After you've considered the purpose of your product, you'll need to consider its turnover. To do this, you'll need to consider how often your customers will use your product and how that will affect demand.

13. Is Your Product Consumable Or Disposable?

After considering your product's turnover, you'll need to consider its consumable or disposable nature. To do this, you'll need to consider how often your customers will use your product and how that will affect demand.

14. Is Perishability A Factor?

After considering your product's consumable or disposable nature, you'll need to consider its perishability. To do this, you'll need to consider how long your product will last and how that will affect demand.

15. Are There Any Restrictions Or Regulations?

After you've considered the perishability of your product, you'll need to consider any restrictions or regulations. To do this, you'll need to consider what your product is made of and how that will affect its ability to be sold. Additionally, you'll want to think about the following:

- The country of origin: This will affect where you can sell your product

- The product type: This will affect what your product can be used for.

Understanding your product's restrictions or regulations can ensure that it meets your customers' needs. Additionally, you can use this information to help you determine your marketing strategy.

16. Is Your Product Scalable?

After considering your product's restrictions or regulations, you'll need to consider its scalability. To do this, you'll need to consider how easy it is to produce more of your product and how that will affect demand. Additionally, you'll want to think about the following:

- The cost of production: This will affect how much you can charge for your product.

- The time it takes to produce more of your product: This will affect how quickly you can meet customer demand.

By understanding your product's scalability, you can ensure that it meets your customers' needs.

Areas Of Product Research

As you can see, there are a lot of factors to consider when it comes to product research. To make things easier, we've broken down the most critical areas of research into 8 main categories:

- Conduct market research

- Conduct customer research

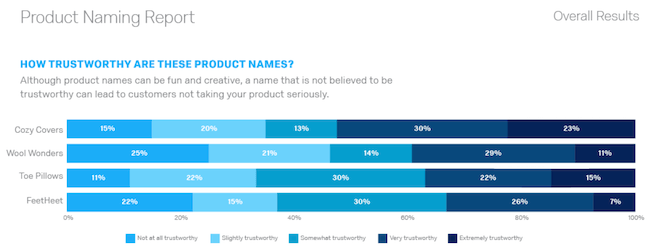

- Conduct segmentation research

- Conduct concept testing

- Conduct usability testing

- Conduct naming research

- Conduct feature research

- Conduct pricing research

Market Research

Market research is a vital part of product research. By understanding your target market, you can ensure that your product meets their needs.

There are a few different methods that you can use to conduct market research. Some common ways include surveys, focus groups, and interviews.

If you're unsure where to start, we recommend checking out our guide on conducting market research.

Customer Research

Customer research is another vital part of product research. By understanding your customers, you can ensure they're happy with your product.

Additionally, you can use this information to help you improve your product.

There are a few different methods that you can use to conduct customer research, with the most common methods include surveys, focus groups, and interviews.

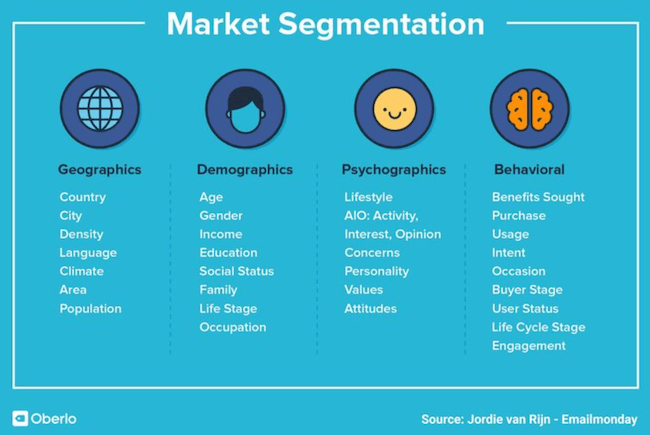

Segmentation Research

Segmentation research is the process of dividing your market into different groups. You can do this based on age, gender, location, and interests.