- PRO Courses Guides New Tech Help Pro Expert Videos About wikiHow Pro Upgrade Sign In

- EDIT Edit this Article

- EXPLORE Tech Help Pro About Us Random Article Quizzes Request a New Article Community Dashboard This Or That Game Happiness Hub Popular Categories Arts and Entertainment Artwork Books Movies Computers and Electronics Computers Phone Skills Technology Hacks Health Men's Health Mental Health Women's Health Relationships Dating Love Relationship Issues Hobbies and Crafts Crafts Drawing Games Education & Communication Communication Skills Personal Development Studying Personal Care and Style Fashion Hair Care Personal Hygiene Youth Personal Care School Stuff Dating All Categories Arts and Entertainment Finance and Business Home and Garden Relationship Quizzes Cars & Other Vehicles Food and Entertaining Personal Care and Style Sports and Fitness Computers and Electronics Health Pets and Animals Travel Education & Communication Hobbies and Crafts Philosophy and Religion Work World Family Life Holidays and Traditions Relationships Youth

- Browse Articles

- Learn Something New

- Quizzes Hot

- Happiness Hub

- This Or That Game

- Train Your Brain

- Explore More

- Support wikiHow

- About wikiHow

- Log in / Sign up

- Education and Communications

How to Develop a Questionnaire for Research

Last Updated: July 21, 2024 Fact Checked

This article was co-authored by Alexander Ruiz, M.Ed. . Alexander Ruiz is an Educational Consultant and the Educational Director of Link Educational Institute, a tutoring business based in Claremont, California that provides customizable educational plans, subject and test prep tutoring, and college application consulting. With over a decade and a half of experience in the education industry, Alexander coaches students to increase their self-awareness and emotional intelligence while achieving skills and the goal of achieving skills and higher education. He holds a BA in Psychology from Florida International University and an MA in Education from Georgia Southern University. There are 12 references cited in this article, which can be found at the bottom of the page. This article has been fact-checked, ensuring the accuracy of any cited facts and confirming the authority of its sources. This article has been viewed 593,598 times.

A questionnaire is a technique for collecting data in which a respondent provides answers to a series of questions. [1] X Research source To develop a questionnaire that will collect the data you want takes effort and time. However, by taking a step-by-step approach to questionnaire development, you can come up with an effective means to collect data that will answer your unique research question.

Designing Your Questionnaire

- Come up with a research question. It can be one question or several, but this should be the focal point of your questionnaire.

- Develop one or several hypotheses that you want to test. The questions that you include on your questionnaire should be aimed at systematically testing these hypotheses.

- Dichotomous question: this is a question that will generally be a “yes/no” question, but may also be an “agree/disagree” question. It is the quickest and simplest question to analyze, but is not a highly sensitive measure.

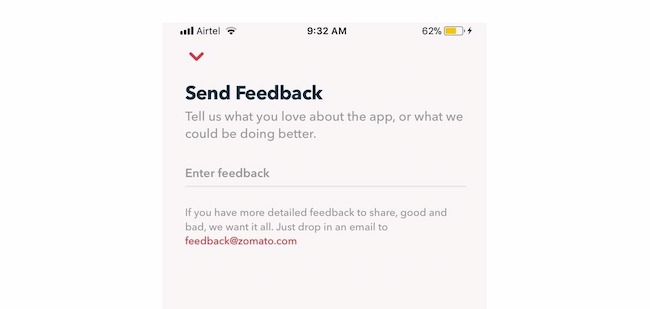

- Open-ended questions: these questions allow the respondent to respond in their own words. They can be useful for gaining insight into the feelings of the respondent, but can be a challenge when it comes to analysis of data. It is recommended to use open-ended questions to address the issue of “why.” [2] X Research source

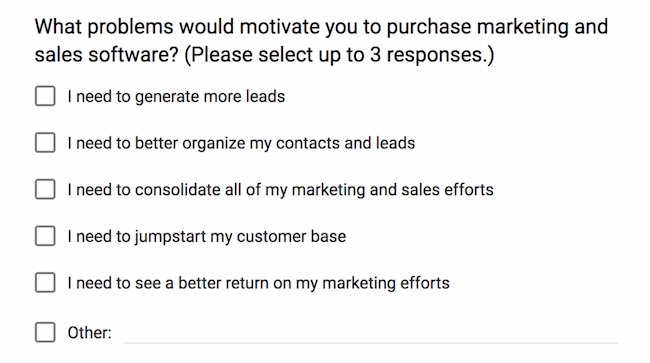

- Multiple choice questions: these questions consist of three or more mutually-exclusive categories and ask for a single answer or several answers. [3] X Research source Multiple choice questions allow for easy analysis of results, but may not give the respondent the answer they want.

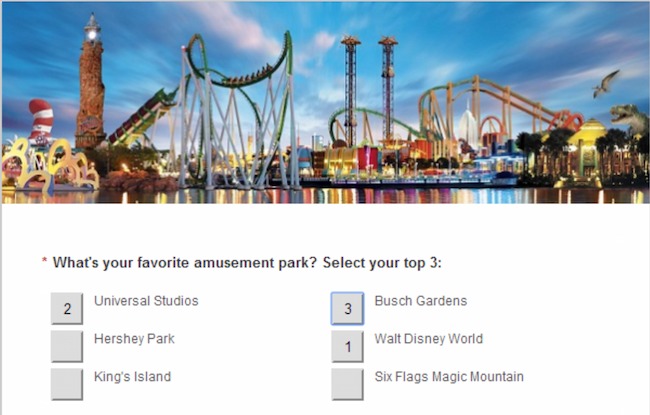

- Rank-order (or ordinal) scale questions: this type of question asks your respondent to rank items or choose items in a particular order from a set. For example, it might ask your respondents to order five things from least to most important. These types of questions forces discrimination among alternatives, but does not address the issue of why the respondent made these discriminations. [4] X Research source

- Rating scale questions: these questions allow the respondent to assess a particular issue based on a given dimension. You can provide a scale that gives an equal number of positive and negative choices, for example, ranging from “strongly agree” to “strongly disagree.” [5] X Research source These questions are very flexible, but also do not answer the question “why.”

- Write questions that are succinct and simple. You should not be writing complex statements or using technical jargon, as it will only confuse your respondents and lead to incorrect responses.

- Ask only one question at a time. This will help avoid confusion

- Asking questions such as these usually require you to anonymize or encrypt the demographic data you collect.

- Determine if you will include an answer such as “I don’t know” or “Not applicable to me.” While these can give your respondents a way of not answering certain questions, providing these options can also lead to missing data, which can be problematic during data analysis.

- Put the most important questions at the beginning of your questionnaire. This can help you gather important data even if you sense that your respondents may be becoming distracted by the end of the questionnaire.

- Only include questions that are directly useful to your research question. [8] X Trustworthy Source Food and Agricultural Organization of the United Nations Specialized agency of the United Nations responsible for leading international efforts to end world hunger and improve nutrition Go to source A questionnaire is not an opportunity to collect all kinds of information about your respondents.

- Avoid asking redundant questions. This will frustrate those who are taking your questionnaire.

- Consider if you want your questionnaire to collect information from both men and women. Some studies will only survey one sex.

- Consider including a range of ages in your target demographic. For example, you can consider young adult to be 18-29 years old, adults to be 30-54 years old, and mature adults to be 55+. Providing the an age range will help you get more respondents than limiting yourself to a specific age.

- Consider what else would make a person a target for your questionnaire. Do they need to drive a car? Do they need to have health insurance? Do they need to have a child under 3? Make sure you are very clear about this before you distribute your questionnaire.

- Consider an anonymous questionnaire. You may not want to ask for names on your questionnaire. This is one step you can take to prevent privacy, however it is often possible to figure out a respondent’s identity using other demographic information (such as age, physical features, or zipcode).

- Consider de-identifying the identity of your respondents. Give each questionnaire (and thus, each respondent) a unique number or word, and only refer to them using that new identifier. Shred any personal information that can be used to determine identity.

- Remember that you do not need to collect much demographic information to be able to identify someone. People may be wary to provide this information, so you may get more respondents by asking less demographic questions (if it is possible for your questionnaire).

- Make sure you destroy all identifying information after your study is complete.

Writing your questionnaire

- My name is Jack Smith and I am one of the creators of this questionnaire. I am part of the Department of Psychology at the University of Michigan, where I am focusing in developing cognition in infants.

- I’m Kelly Smith, a 3rd year undergraduate student at the University of New Mexico. This questionnaire is part of my final exam in statistics.

- My name is Steve Johnson, and I’m a marketing analyst for The Best Company. I’ve been working on questionnaire development to determine attitudes surrounding drug use in Canada for several years.

- I am collecting data regarding the attitudes surrounding gun control. This information is being collected for my Anthropology 101 class at the University of Maryland.

- This questionnaire will ask you 15 questions about your eating and exercise habits. We are attempting to make a correlation between healthy eating, frequency of exercise, and incidence of cancer in mature adults.

- This questionnaire will ask you about your recent experiences with international air travel. There will be three sections of questions that will ask you to recount your recent trips and your feelings surrounding these trips, as well as your travel plans for the future. We are looking to understand how a person’s feelings surrounding air travel impact their future plans.

- Beware that if you are collecting information for a university or for publication, you may need to check in with your institution’s Institutional Review Board (IRB) for permission before beginning. Most research universities have a dedicated IRB staff, and their information can usually be found on the school’s website.

- Remember that transparency is best. It is important to be honest about what will happen with the data you collect.

- Include an informed consent for if necessary. Note that you cannot guarantee confidentiality, but you will make all reasonable attempts to ensure that you protect their information. [11] X Research source

- Time yourself taking the survey. Then consider that it will take some people longer than you, and some people less time than you.

- Provide a time range instead of a specific time. For example, it’s better to say that a survey will take between 15 and 30 minutes than to say it will take 15 minutes and have some respondents quit halfway through.

- Use this as a reason to keep your survey concise! You will feel much better asking people to take a 20 minute survey than you will asking them to take a 3 hour one.

- Incentives can attract the wrong kind of respondent. You don’t want to incorporate responses from people who rush through your questionnaire just to get the reward at the end. This is a danger of offering an incentive. [12] X Research source

- Incentives can encourage people to respond to your survey who might not have responded without a reward. This is a situation in which incentives can help you reach your target number of respondents. [13] X Research source

- Consider the strategy used by SurveyMonkey. Instead of directly paying respondents to take their surveys, they offer 50 cents to the charity of their choice when a respondent fills out a survey. They feel that this lessens the chances that a respondent will fill out a questionnaire out of pure self-interest. [14] X Research source

- Consider entering each respondent in to a drawing for a prize if they complete the questionnaire. You can offer a 25$ gift card to a restaurant, or a new iPod, or a ticket to a movie. This makes it less tempting just to respond to your questionnaire for the incentive alone, but still offers the chance of a pleasant reward.

- Always proof read. Check for spelling, grammar, and punctuation errors.

- Include a title. This is a good way for your respondents to understand the focus of the survey as quickly as possible.

- Thank your respondents. Thank them for taking the time and effort to complete your survey.

Distributing Your Questionnaire

- Was the questionnaire easy to understand? Were there any questions that confused you?

- Was the questionnaire easy to access? (Especially important if your questionnaire is online).

- Do you feel the questionnaire was worth your time?

- Were you comfortable answering the questions asked?

- Are there any improvements you would make to the questionnaire?

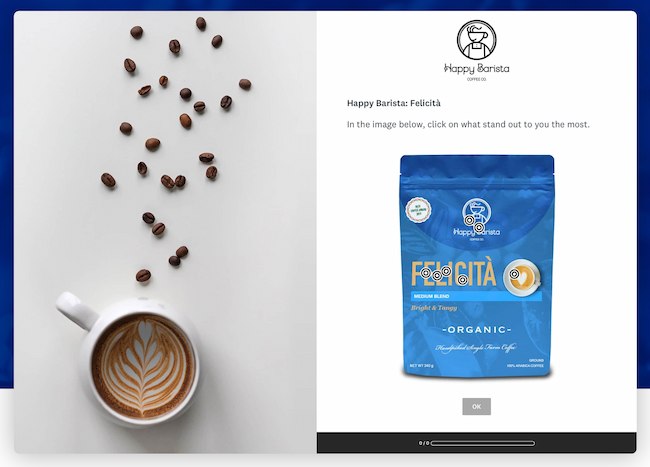

- Use an online site, such as SurveyMonkey.com. This site allows you to write your own questionnaire with their survey builder, and provides additional options such as the option to buy a target audience and use their analytics to analyze your data. [18] X Research source

- Consider using the mail. If you mail your survey, always make sure you include a self-addressed stamped envelope so that the respondent can easily mail their responses back. Make sure that your questionnaire will fit inside a standard business envelope.

- Conduct face-to-face interviews. This can be a good way to ensure that you are reaching your target demographic and can reduce missing information in your questionnaires, as it is more difficult for a respondent to avoid answering a question when you ask it directly.

- Try using the telephone. While this can be a more time-effective way to collect your data, it can be difficult to get people to respond to telephone questionnaires.

- Make your deadline reasonable. Giving respondents up to 2 weeks to answer should be more than sufficient. Anything longer and you risk your respondents forgetting about your questionnaire.

- Consider providing a reminder. A week before the deadline is a good time to provide a gentle reminder about returning the questionnaire. Include a replacement of the questionnaire in case it has been misplaced by your respondent.

Community Q&A

You Might Also Like

- ↑ https://www.questionpro.com/blog/what-is-a-questionnaire/

- ↑ https://www.hotjar.com/blog/open-ended-questions/

- ↑ https://www.questionpro.com/a/showArticle.do?articleID=survey-questions

- ↑ https://surveysparrow.com/blog/ranking-questions-examples/

- ↑ https://www.lumoa.me/blog/rating-scale/

- ↑ http://www.sciencebuddies.org/science-fair-projects/project_ideas/Soc_survey.shtml

- ↑ http://www.fao.org/docrep/W3241E/w3241e05.htm

- ↑ http://managementhelp.org/businessresearch/questionaires.htm

- ↑ https://www.surveymonkey.com/mp/survey-rewards/

- ↑ http://www.ideafit.com/fitness-library/how-to-develop-a-questionnaire

- ↑ https://www.surveymonkey.com/mp/take-a-tour/?ut_source=header

About This Article

To develop a questionnaire for research, identify the main objective of your research to act as the focal point for the questionnaire. Then, choose the type of questions that you want to include, and come up with succinct, straightforward questions to gather the information that you need to answer your questions. Keep your questionnaire as short as possible, and identify a target demographic who you would like to answer the questions. Remember to make the questionnaires as anonymous as possible to protect the integrity of the person answering the questions! For tips on writing out your questions and distributing the questionnaire, keep reading! Did this summary help you? Yes No

- Send fan mail to authors

Reader Success Stories

Abdul Bari Khan

Nov 11, 2020

Did this article help you?

Jul 25, 2023

Iman Ilhusadi

Nov 26, 2016

Jaydeepa Das

Aug 21, 2018

Atefeh Abdollahi

Jan 3, 2017

Featured Articles

Trending Articles

Watch Articles

- Terms of Use

- Privacy Policy

- Do Not Sell or Share My Info

- Not Selling Info

Don’t miss out! Sign up for

wikiHow’s newsletter

- Privacy Policy

Home » Questionnaire – Definition, Types, and Examples

Questionnaire – Definition, Types, and Examples

Table of Contents

Questionnaire

Definition:

A Questionnaire is a research tool or survey instrument that consists of a set of questions or prompts designed to gather information from individuals or groups of people.

It is a standardized way of collecting data from a large number of people by asking them a series of questions related to a specific topic or research objective. The questions may be open-ended or closed-ended, and the responses can be quantitative or qualitative. Questionnaires are widely used in research, marketing, social sciences, healthcare, and many other fields to collect data and insights from a target population.

History of Questionnaire

The history of questionnaires can be traced back to the ancient Greeks, who used questionnaires as a means of assessing public opinion. However, the modern history of questionnaires began in the late 19th century with the rise of social surveys.

The first social survey was conducted in the United States in 1874 by Francis A. Walker, who used a questionnaire to collect data on labor conditions. In the early 20th century, questionnaires became a popular tool for conducting social research, particularly in the fields of sociology and psychology.

One of the most influential figures in the development of the questionnaire was the psychologist Raymond Cattell, who in the 1940s and 1950s developed the personality questionnaire, a standardized instrument for measuring personality traits. Cattell’s work helped establish the questionnaire as a key tool in personality research.

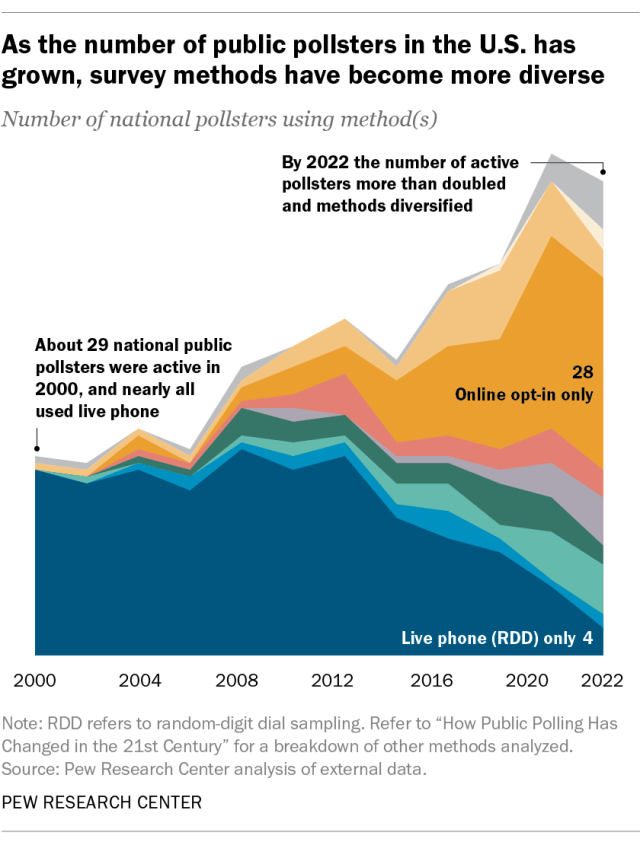

In the 1960s and 1970s, the use of questionnaires expanded into other fields, including market research, public opinion polling, and health surveys. With the rise of computer technology, questionnaires became easier and more cost-effective to administer, leading to their widespread use in research and business settings.

Today, questionnaires are used in a wide range of settings, including academic research, business, healthcare, and government. They continue to evolve as a research tool, with advances in computer technology and data analysis techniques making it easier to collect and analyze data from large numbers of participants.

Types of Questionnaire

Types of Questionnaires are as follows:

Structured Questionnaire

This type of questionnaire has a fixed format with predetermined questions that the respondent must answer. The questions are usually closed-ended, which means that the respondent must select a response from a list of options.

Unstructured Questionnaire

An unstructured questionnaire does not have a fixed format or predetermined questions. Instead, the interviewer or researcher can ask open-ended questions to the respondent and let them provide their own answers.

Open-ended Questionnaire

An open-ended questionnaire allows the respondent to answer the question in their own words, without any pre-determined response options. The questions usually start with phrases like “how,” “why,” or “what,” and encourage the respondent to provide more detailed and personalized answers.

Close-ended Questionnaire

In a closed-ended questionnaire, the respondent is given a set of predetermined response options to choose from. This type of questionnaire is easier to analyze and summarize, but may not provide as much insight into the respondent’s opinions or attitudes.

Mixed Questionnaire

A mixed questionnaire is a combination of open-ended and closed-ended questions. This type of questionnaire allows for more flexibility in terms of the questions that can be asked, and can provide both quantitative and qualitative data.

Pictorial Questionnaire:

In a pictorial questionnaire, instead of using words to ask questions, the questions are presented in the form of pictures, diagrams or images. This can be particularly useful for respondents who have low literacy skills, or for situations where language barriers exist. Pictorial questionnaires can also be useful in cross-cultural research where respondents may come from different language backgrounds.

Types of Questions in Questionnaire

The types of Questions in Questionnaire are as follows:

Multiple Choice Questions

These questions have several options for participants to choose from. They are useful for getting quantitative data and can be used to collect demographic information.

- a. Red b . Blue c. Green d . Yellow

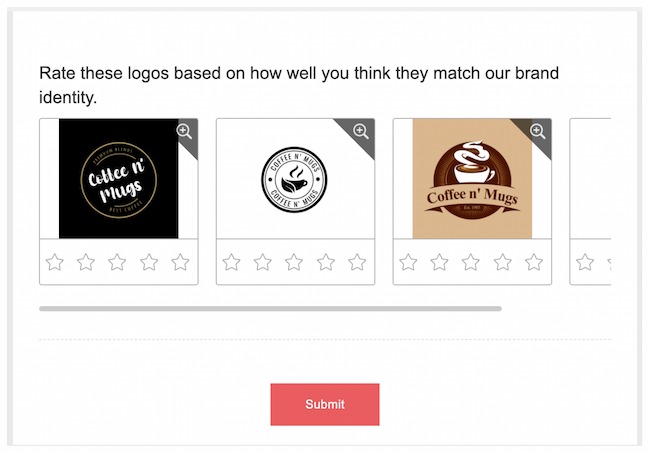

Rating Scale Questions

These questions ask participants to rate something on a scale (e.g. from 1 to 10). They are useful for measuring attitudes and opinions.

- On a scale of 1 to 10, how likely are you to recommend this product to a friend?

Open-Ended Questions

These questions allow participants to answer in their own words and provide more in-depth and detailed responses. They are useful for getting qualitative data.

- What do you think are the biggest challenges facing your community?

Likert Scale Questions

These questions ask participants to rate how much they agree or disagree with a statement. They are useful for measuring attitudes and opinions.

How strongly do you agree or disagree with the following statement:

“I enjoy exercising regularly.”

- a . Strongly Agree

- c . Neither Agree nor Disagree

- d . Disagree

- e . Strongly Disagree

Demographic Questions

These questions ask about the participant’s personal information such as age, gender, ethnicity, education level, etc. They are useful for segmenting the data and analyzing results by demographic groups.

- What is your age?

Yes/No Questions

These questions only have two options: Yes or No. They are useful for getting simple, straightforward answers to a specific question.

Have you ever traveled outside of your home country?

Ranking Questions

These questions ask participants to rank several items in order of preference or importance. They are useful for measuring priorities or preferences.

Please rank the following factors in order of importance when choosing a restaurant:

- a. Quality of Food

- c. Ambiance

- d. Location

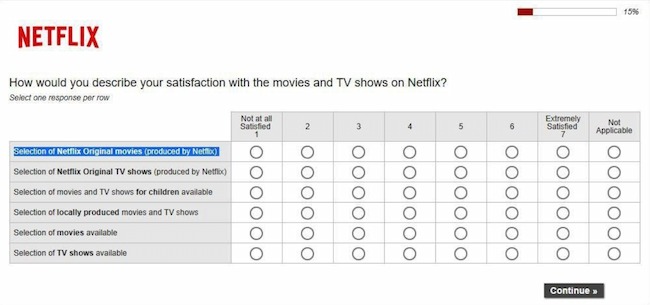

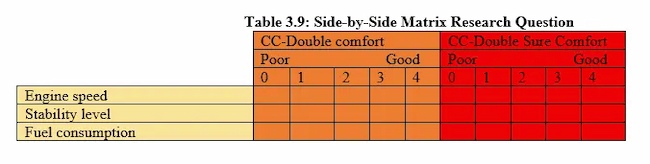

Matrix Questions

These questions present a matrix or grid of options that participants can choose from. They are useful for getting data on multiple variables at once.

| The product is easy to use | ||||

| The product meets my needs | ||||

| The product is affordable |

Dichotomous Questions

These questions present two options that are opposite or contradictory. They are useful for measuring binary or polarized attitudes.

Do you support the death penalty?

How to Make a Questionnaire

Step-by-Step Guide for Making a Questionnaire:

- Define your research objectives: Before you start creating questions, you need to define the purpose of your questionnaire and what you hope to achieve from the data you collect.

- Choose the appropriate question types: Based on your research objectives, choose the appropriate question types to collect the data you need. Refer to the types of questions mentioned earlier for guidance.

- Develop questions: Develop clear and concise questions that are easy for participants to understand. Avoid leading or biased questions that might influence the responses.

- Organize questions: Organize questions in a logical and coherent order, starting with demographic questions followed by general questions, and ending with specific or sensitive questions.

- Pilot the questionnaire : Test your questionnaire on a small group of participants to identify any flaws or issues with the questions or the format.

- Refine the questionnaire : Based on feedback from the pilot, refine and revise the questionnaire as necessary to ensure that it is valid and reliable.

- Distribute the questionnaire: Distribute the questionnaire to your target audience using a method that is appropriate for your research objectives, such as online surveys, email, or paper surveys.

- Collect and analyze data: Collect the completed questionnaires and analyze the data using appropriate statistical methods. Draw conclusions from the data and use them to inform decision-making or further research.

- Report findings: Present your findings in a clear and concise report, including a summary of the research objectives, methodology, key findings, and recommendations.

Questionnaire Administration Modes

There are several modes of questionnaire administration. The choice of mode depends on the research objectives, sample size, and available resources. Some common modes of administration include:

- Self-administered paper questionnaires: Participants complete the questionnaire on paper, either in person or by mail. This mode is relatively low cost and easy to administer, but it may result in lower response rates and greater potential for errors in data entry.

- Online questionnaires: Participants complete the questionnaire on a website or through email. This mode is convenient for both researchers and participants, as it allows for fast and easy data collection. However, it may be subject to issues such as low response rates, lack of internet access, and potential for fraudulent responses.

- Telephone surveys: Trained interviewers administer the questionnaire over the phone. This mode allows for a large sample size and can result in higher response rates, but it is also more expensive and time-consuming than other modes.

- Face-to-face interviews : Trained interviewers administer the questionnaire in person. This mode allows for a high degree of control over the survey environment and can result in higher response rates, but it is also more expensive and time-consuming than other modes.

- Mixed-mode surveys: Researchers use a combination of two or more modes to administer the questionnaire, such as using online questionnaires for initial screening and following up with telephone interviews for more detailed information. This mode can help overcome some of the limitations of individual modes, but it requires careful planning and coordination.

Example of Questionnaire

Title of the Survey: Customer Satisfaction Survey

Introduction:

We appreciate your business and would like to ensure that we are meeting your needs. Please take a few minutes to complete this survey so that we can better understand your experience with our products and services. Your feedback is important to us and will help us improve our offerings.

Instructions:

Please read each question carefully and select the response that best reflects your experience. If you have any additional comments or suggestions, please feel free to include them in the space provided at the end of the survey.

1. How satisfied are you with our product quality?

- Very satisfied

- Somewhat satisfied

- Somewhat dissatisfied

- Very dissatisfied

2. How satisfied are you with our customer service?

3. How satisfied are you with the price of our products?

4. How likely are you to recommend our products to others?

- Very likely

- Somewhat likely

- Somewhat unlikely

- Very unlikely

5. How easy was it to find the information you were looking for on our website?

- Somewhat easy

- Somewhat difficult

- Very difficult

6. How satisfied are you with the overall experience of using our products and services?

7. Is there anything that you would like to see us improve upon or change in the future?

…………………………………………………………………………………………………………………………..

Conclusion:

Thank you for taking the time to complete this survey. Your feedback is valuable to us and will help us improve our products and services. If you have any further comments or concerns, please do not hesitate to contact us.

Applications of Questionnaire

Some common applications of questionnaires include:

- Research : Questionnaires are commonly used in research to gather information from participants about their attitudes, opinions, behaviors, and experiences. This information can then be analyzed and used to draw conclusions and make inferences.

- Healthcare : In healthcare, questionnaires can be used to gather information about patients’ medical history, symptoms, and lifestyle habits. This information can help healthcare professionals diagnose and treat medical conditions more effectively.

- Marketing : Questionnaires are commonly used in marketing to gather information about consumers’ preferences, buying habits, and opinions on products and services. This information can help businesses develop and market products more effectively.

- Human Resources: Questionnaires are used in human resources to gather information from job applicants, employees, and managers about job satisfaction, performance, and workplace culture. This information can help organizations improve their hiring practices, employee retention, and organizational culture.

- Education : Questionnaires are used in education to gather information from students, teachers, and parents about their perceptions of the educational experience. This information can help educators identify areas for improvement and develop more effective teaching strategies.

Purpose of Questionnaire

Some common purposes of questionnaires include:

- To collect information on attitudes, opinions, and beliefs: Questionnaires can be used to gather information on people’s attitudes, opinions, and beliefs on a particular topic. For example, a questionnaire can be used to gather information on people’s opinions about a particular political issue.

- To collect demographic information: Questionnaires can be used to collect demographic information such as age, gender, income, education level, and occupation. This information can be used to analyze trends and patterns in the data.

- To measure behaviors or experiences: Questionnaires can be used to gather information on behaviors or experiences such as health-related behaviors or experiences, job satisfaction, or customer satisfaction.

- To evaluate programs or interventions: Questionnaires can be used to evaluate the effectiveness of programs or interventions by gathering information on participants’ experiences, opinions, and behaviors.

- To gather information for research: Questionnaires can be used to gather data for research purposes on a variety of topics.

When to use Questionnaire

Here are some situations when questionnaires might be used:

- When you want to collect data from a large number of people: Questionnaires are useful when you want to collect data from a large number of people. They can be distributed to a wide audience and can be completed at the respondent’s convenience.

- When you want to collect data on specific topics: Questionnaires are useful when you want to collect data on specific topics or research questions. They can be designed to ask specific questions and can be used to gather quantitative data that can be analyzed statistically.

- When you want to compare responses across groups: Questionnaires are useful when you want to compare responses across different groups of people. For example, you might want to compare responses from men and women, or from people of different ages or educational backgrounds.

- When you want to collect data anonymously: Questionnaires can be useful when you want to collect data anonymously. Respondents can complete the questionnaire without fear of judgment or repercussions, which can lead to more honest and accurate responses.

- When you want to save time and resources: Questionnaires can be more efficient and cost-effective than other methods of data collection such as interviews or focus groups. They can be completed quickly and easily, and can be analyzed using software to save time and resources.

Characteristics of Questionnaire

Here are some of the characteristics of questionnaires:

- Standardization : Questionnaires are standardized tools that ask the same questions in the same order to all respondents. This ensures that all respondents are answering the same questions and that the responses can be compared and analyzed.

- Objectivity : Questionnaires are designed to be objective, meaning that they do not contain leading questions or bias that could influence the respondent’s answers.

- Predefined responses: Questionnaires typically provide predefined response options for the respondents to choose from, which helps to standardize the responses and make them easier to analyze.

- Quantitative data: Questionnaires are designed to collect quantitative data, meaning that they provide numerical or categorical data that can be analyzed using statistical methods.

- Convenience : Questionnaires are convenient for both the researcher and the respondents. They can be distributed and completed at the respondent’s convenience and can be easily administered to a large number of people.

- Anonymity : Questionnaires can be anonymous, which can encourage respondents to answer more honestly and provide more accurate data.

- Reliability : Questionnaires are designed to be reliable, meaning that they produce consistent results when administered multiple times to the same group of people.

- Validity : Questionnaires are designed to be valid, meaning that they measure what they are intended to measure and are not influenced by other factors.

Advantage of Questionnaire

Some Advantage of Questionnaire are as follows:

- Standardization: Questionnaires allow researchers to ask the same questions to all participants in a standardized manner. This helps ensure consistency in the data collected and eliminates potential bias that might arise if questions were asked differently to different participants.

- Efficiency: Questionnaires can be administered to a large number of people at once, making them an efficient way to collect data from a large sample.

- Anonymity: Participants can remain anonymous when completing a questionnaire, which may make them more likely to answer honestly and openly.

- Cost-effective: Questionnaires can be relatively inexpensive to administer compared to other research methods, such as interviews or focus groups.

- Objectivity: Because questionnaires are typically designed to collect quantitative data, they can be analyzed objectively without the influence of the researcher’s subjective interpretation.

- Flexibility: Questionnaires can be adapted to a wide range of research questions and can be used in various settings, including online surveys, mail surveys, or in-person interviews.

Limitations of Questionnaire

Limitations of Questionnaire are as follows:

- Limited depth: Questionnaires are typically designed to collect quantitative data, which may not provide a complete understanding of the topic being studied. Questionnaires may miss important details and nuances that could be captured through other research methods, such as interviews or observations.

- R esponse bias: Participants may not always answer questions truthfully or accurately, either because they do not remember or because they want to present themselves in a particular way. This can lead to response bias, which can affect the validity and reliability of the data collected.

- Limited flexibility: While questionnaires can be adapted to a wide range of research questions, they may not be suitable for all types of research. For example, they may not be appropriate for studying complex phenomena or for exploring participants’ experiences and perceptions in-depth.

- Limited context: Questionnaires typically do not provide a rich contextual understanding of the topic being studied. They may not capture the broader social, cultural, or historical factors that may influence participants’ responses.

- Limited control : Researchers may not have control over how participants complete the questionnaire, which can lead to variations in response quality or consistency.

About the author

Muhammad Hassan

Researcher, Academic Writer, Web developer

You may also like

Triangulation in Research – Types, Methods and...

Observational Research – Methods and Guide

Mixed Methods Research – Types & Analysis

Descriptive Research Design – Types, Methods and...

Research Methods – Types, Examples and Guide

Focus Groups – Steps, Examples and Guide

How to Design Effective Research Questionnaires for Robust Findings

As a staple in data collection, questionnaires help uncover robust and reliable findings that can transform industries, shape policies, and revolutionize understanding. Whether you are exploring societal trends or delving into scientific phenomena, the effectiveness of your research questionnaire can make or break your findings.

In this article, we aim to understand the core purpose of questionnaires, exploring how they serve as essential tools for gathering systematic data, both qualitative and quantitative, from diverse respondents. Read on as we explore the key elements that make up a winning questionnaire, the art of framing questions which are both compelling and rigorous, and the careful balance between simplicity and depth.

Table of Contents

The Role of Questionnaires in Research

So, what is a questionnaire? A questionnaire is a structured set of questions designed to collect information, opinions, attitudes, or behaviors from respondents. It is one of the most commonly used data collection methods in research. Moreover, questionnaires can be used in various research fields, including social sciences, market research, healthcare, education, and psychology. Their adaptability makes them suitable for investigating diverse research questions.

Questionnaire and survey are two terms often used interchangeably, but they have distinct meanings in the context of research. A survey refers to the broader process of data collection that may involve various methods. A survey can encompass different data collection techniques, such as interviews , focus groups, observations, and yes, questionnaires.

Pros and Cons of Using Questionnaires in Research:

While questionnaires offer numerous advantages in research, they also come with some disadvantages that researchers must be aware of and address appropriately. Careful questionnaire design, validation, and consideration of potential biases can help mitigate these disadvantages and enhance the effectiveness of using questionnaires as a data collection method.

Structured vs Unstructured Questionnaires

Structured questionnaire:.

A structured questionnaire consists of questions with predefined response options. Respondents are presented with a fixed set of choices and are required to select from those options. The questions in a structured questionnaire are designed to elicit specific and quantifiable responses. Structured questionnaires are particularly useful for collecting quantitative data and are often employed in surveys and studies where standardized and comparable data are necessary.

Advantages of Structured Questionnaires:

- Easy to analyze and interpret: The fixed response options facilitate straightforward data analysis and comparison across respondents.

- Efficient for large-scale data collection: Structured questionnaires are time-efficient, allowing researchers to collect data from a large number of respondents.

- Reduces response bias: The predefined response options minimize potential response bias and maintain consistency in data collection.

Limitations of Structured Questionnaires:

- Lack of depth: Structured questionnaires may not capture in-depth insights or nuances as respondents are limited to pre-defined response choices. Hence, they may not reveal the reasons behind respondents’ choices, limiting the understanding of their perspectives.

- Limited flexibility: The fixed response options may not cover all potential responses, therefore, potentially restricting respondents’ answers.

Unstructured Questionnaire:

An unstructured questionnaire consists of questions that allow respondents to provide detailed and unrestricted responses. Unlike structured questionnaires, there are no predefined response options, giving respondents the freedom to express their thoughts in their own words. Furthermore, unstructured questionnaires are valuable for collecting qualitative data and obtaining in-depth insights into respondents’ experiences, opinions, or feelings.

Advantages of Unstructured Questionnaires:

- Rich qualitative data: Unstructured questionnaires yield detailed and comprehensive qualitative data, providing valuable and novel insights into respondents’ perspectives.

- Flexibility in responses: Respondents have the freedom to express themselves in their own words. Hence, allowing for a wide range of responses.

Limitations of Unstructured Questionnaires:

- Time-consuming analysis: Analyzing open-ended responses can be time-consuming, since, each response requires careful reading and interpretation.

- Subjectivity in interpretation: The analysis of open-ended responses may be subjective, as researchers interpret and categorize responses based on their judgment.

- May require smaller sample size: Due to the depth of responses, researchers may need a smaller sample size for comprehensive analysis, making generalizations more challenging.

Types of Questions in a Questionnaire

In a questionnaire, researchers typically use the following most common types of questions to gather a variety of information from respondents:

1. Open-Ended Questions:

These questions allow respondents to provide detailed and unrestricted responses in their own words. Open-ended questions are valuable for gathering qualitative data and in-depth insights.

Example: What suggestions do you have for improving our product?

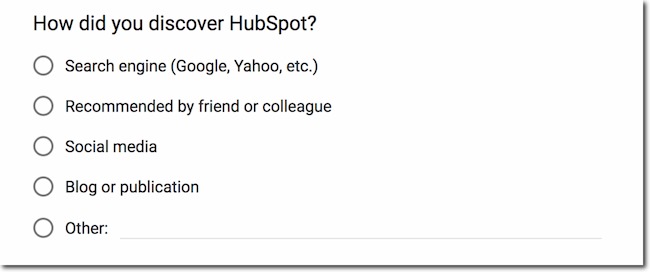

2. Multiple-Choice Questions

Respondents choose one answer from a list of provided options. This type of question is suitable for gathering categorical data or preferences.

Example: Which of the following social media/academic networking platforms do you use to promote your research?

- ResearchGate

- Academia.edu

3. Dichotomous Questions

Respondents choose between two options, typically “yes” or “no”, “true” or “false”, or “agree” or “disagree”.

Example: Have you ever published in open access journals before?

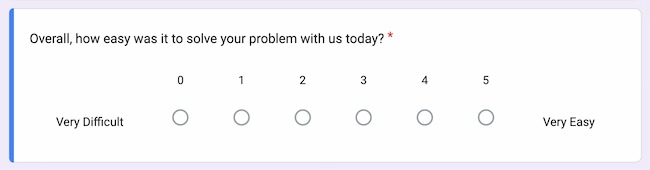

4. Scaling Questions

These questions, also known as rating scale questions, use a predefined scale that allows respondents to rate or rank their level of agreement, satisfaction, importance, or other subjective assessments. These scales help researchers quantify subjective data and make comparisons across respondents.

There are several types of scaling techniques used in scaling questions:

i. Likert Scale:

The Likert scale is one of the most common scaling techniques. It presents respondents with a series of statements and asks them to rate their level of agreement or disagreement using a range of options, typically from “strongly agree” to “strongly disagree”.For example: Please indicate your level of agreement with the statement: “The content presented in the webinar was relevant and aligned with the advertised topic.”

- Strongly Agree

- Strongly Disagree

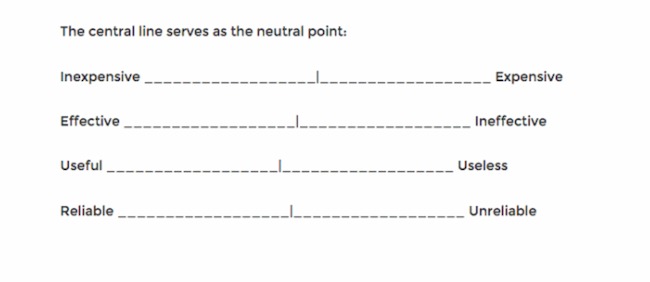

ii. Semantic Differential Scale:

The semantic differential scale measures respondents’ perceptions or attitudes towards an item using opposite adjectives or bipolar words. Respondents rate the item on a scale between the two opposites. For example:

- Easy —— Difficult

- Satisfied —— Unsatisfied

- Very likely —— Very unlikely

iii. Numerical Rating Scale:

This scale requires respondents to provide a numerical rating on a predefined scale. It can be a simple 1 to 5 or 1 to 10 scale, where higher numbers indicate higher agreement, satisfaction, or importance.

iv. Ranking Questions:

Respondents rank items in order of preference or importance. Ranking questions help identify preferences or priorities.

Example: Please rank the following features of our app in order of importance (1 = Most Important, 5 = Least Important):

- User Interface

- Functionality

- Customer Support

By using a mix of question types, researchers can gather both quantitative and qualitative data, providing a comprehensive understanding of the research topic and enabling meaningful analysis and interpretation of the results. The choice of question types depends on the research objectives , the desired depth of information, and the data analysis requirements.

Methods of Administering Questionnaires

There are several methods for administering questionnaires, and the choice of method depends on factors such as the target population, research objectives , convenience, and resources available. Here are some common methods of administering questionnaires:

Each method has its advantages and limitations. Online surveys offer convenience and a large reach, but they may be limited to individuals with internet access. Face-to-face interviews allow for in-depth responses but can be time-consuming and costly. Telephone surveys have broad reach but may be limited by declining response rates. Researchers should choose the method that best suits their research objectives, target population, and available resources to ensure successful data collection.

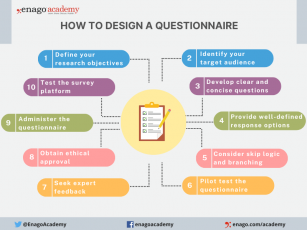

How to Design a Questionnaire

Designing a good questionnaire is crucial for gathering accurate and meaningful data that aligns with your research objectives. Here are essential steps and tips to create a well-designed questionnaire:

1. Define Your Research Objectives : Clearly outline the purpose and specific information you aim to gather through the questionnaire.

2. Identify Your Target Audience : Understand respondents’ characteristics and tailor the questionnaire accordingly.

3. Develop the Questions :

- Write Clear and Concise Questions

- Avoid Leading or Biasing Questions

- Sequence Questions Logically

- Group Related Questions

- Include Demographic Questions

4. Provide Well-defined Response Options : Offer exhaustive response choices for closed-ended questions.

5. Consider Skip Logic and Branching : Customize the questionnaire based on previous answers.

6. Pilot Test the Questionnaire : Identify and address issues through a pilot study .

7. Seek Expert Feedback : Validate the questionnaire with subject matter experts.

8. Obtain Ethical Approval : Comply with ethical guidelines , obtain consent, and ensure confidentiality before administering the questionnaire.

9. Administer the Questionnaire : Choose the right mode and provide clear instructions.

10. Test the Survey Platform : Ensure compatibility and usability for online surveys.

By following these steps and paying attention to questionnaire design principles, you can create a well-structured and effective questionnaire that gathers reliable data and helps you achieve your research objectives.

Characteristics of a Good Questionnaire

A good questionnaire possesses several essential elements that contribute to its effectiveness. Furthermore, these characteristics ensure that the questionnaire is well-designed, easy to understand, and capable of providing valuable insights. Here are some key characteristics of a good questionnaire:

1. Clarity and Simplicity : Questions should be clear, concise, and unambiguous. Avoid using complex language or technical terms that may confuse respondents. Simple and straightforward questions ensure that respondents interpret them consistently.

2. Relevance and Focus : Each question should directly relate to the research objectives and contribute to answering the research questions. Consequently, avoid including extraneous or irrelevant questions that could lead to data clutter.

3. Mix of Question Types : Utilize a mix of question types, including open-ended, Likert scale, and multiple-choice questions. This variety allows for both qualitative and quantitative data collections .

4. Validity and Reliability : Ensure the questionnaire measures what it intends to measure (validity) and produces consistent results upon repeated administration (reliability). Validation should be conducted through expert review and previous research.

5. Appropriate Length : Keep the questionnaire’s length appropriate and manageable to avoid respondent fatigue or dropouts. Long questionnaires may result in incomplete or rushed responses.

6. Clear Instructions : Include clear instructions at the beginning of the questionnaire to guide respondents on how to complete it. Explain any technical terms, formats, or concepts if necessary.

7. User-Friendly Format : Design the questionnaire to be visually appealing and user-friendly. Use consistent formatting, adequate spacing, and a logical page layout.

8. Data Validation and Cleaning : Incorporate validation checks to ensure data accuracy and reliability. Consider mechanisms to detect and correct inconsistent or missing responses during data cleaning.

By incorporating these characteristics, researchers can create a questionnaire that maximizes data quality, minimizes response bias, and provides valuable insights for their research.

In the pursuit of advancing research and gaining meaningful insights, investing time and effort into designing effective questionnaires is a crucial step. A well-designed questionnaire is more than a mere set of questions; it is a masterpiece of precision and ingenuity. Each question plays a vital role in shaping the narrative of our research, guiding us through the labyrinth of data to meaningful conclusions. Indeed, a well-designed questionnaire serves as a powerful tool for unlocking valuable insights and generating robust findings that impact society positively.

Have you ever designed a research questionnaire? Reflect on your experience and share your insights with researchers globally through Enago Academy’s Open Blogging Platform . Join our diverse community of 1000K+ researchers and authors to exchange ideas, strategies, and best practices, and together, let’s shape the future of data collection and maximize the impact of questionnaires in the ever-evolving landscape of research.

Frequently Asked Questions

A research questionnaire is a structured tool used to gather data from participants in a systematic manner. It consists of a series of carefully crafted questions designed to collect specific information related to a research study.

Questionnaires play a pivotal role in both quantitative and qualitative research, enabling researchers to collect insights, opinions, attitudes, or behaviors from respondents. This aids in hypothesis testing, understanding, and informed decision-making, ensuring consistency, efficiency, and facilitating comparisons.

Questionnaires are a versatile tool employed in various research designs to gather data efficiently and comprehensively. They find extensive use in both quantitative and qualitative research methodologies, making them a fundamental component of research across disciplines. Some research designs that commonly utilize questionnaires include: a) Cross-Sectional Studies b) Longitudinal Studies c) Descriptive Research d) Correlational Studies e) Causal-Comparative Studies f) Experimental Research g) Survey Research h) Case Studies i) Exploratory Research

A survey is a comprehensive data collection method that can include various techniques like interviews and observations. A questionnaire is a specific set of structured questions within a survey designed to gather standardized responses. While a survey is a broader approach, a questionnaire is a focused tool for collecting specific data.

The choice of questionnaire type depends on the research objectives, the type of data required, and the preferences of respondents. Some common types include: • Structured Questionnaires: These questionnaires consist of predefined, closed-ended questions with fixed response options. They are easy to analyze and suitable for quantitative research. • Semi-Structured Questionnaires: These questionnaires combine closed-ended questions with open-ended ones. They offer more flexibility for respondents to provide detailed explanations. • Unstructured Questionnaires: These questionnaires contain open-ended questions only, allowing respondents to express their thoughts and opinions freely. They are commonly used in qualitative research.

Following these steps ensures effective questionnaire administration for reliable data collection: • Choose a Method: Decide on online, face-to-face, mail, or phone administration. • Online Surveys: Use platforms like SurveyMonkey • Pilot Test: Test on a small group before full deployment • Clear Instructions: Provide concise guidelines • Follow-Up: Send reminders if needed

Thank you, Riya. This is quite helpful. As discussed, response bias is one of the disadvantages in the use of questionnaires. One way to help limit this can be to use scenario based questions. These type of questions may help the respondents to be more reflective and active in the process.

Thank you, Dear Riya. This is quite helpful.

Great insights there Doc

Rate this article Cancel Reply

Your email address will not be published.

Enago Academy's Most Popular Articles

- Promoting Research

Graphical Abstracts Vs. Infographics: Best practices for using visual illustrations for increased research impact

Dr. Sarah Chen stared at her computer screen, her eyes staring at her recently published…

- Publishing Research

10 Tips to Prevent Research Papers From Being Retracted

Research paper retractions represent a critical event in the scientific community. When a published article…

- Industry News

Google Releases 2024 Scholar Metrics, Evaluates Impact of Scholarly Articles

Google has released its 2024 Scholar Metrics, assessing scholarly articles from 2019 to 2023. This…

![how to make a questionnaire for a research What is Academic Integrity and How to Uphold it [FREE CHECKLIST]](https://www.enago.com/academy/wp-content/uploads/2024/05/FeatureImages-59-210x136.png)

Ensuring Academic Integrity and Transparency in Academic Research: A comprehensive checklist for researchers

Academic integrity is the foundation upon which the credibility and value of scientific findings are…

- Reporting Research

How to Optimize Your Research Process: A step-by-step guide

For researchers across disciplines, the path to uncovering novel findings and insights is often filled…

Choosing the Right Analytical Approach: Thematic analysis vs. content analysis for…

Comparing Cross Sectional and Longitudinal Studies: 5 steps for choosing the right…

Research Recommendations – Guiding policy-makers for evidence-based decision making

Sign-up to read more

Subscribe for free to get unrestricted access to all our resources on research writing and academic publishing including:

- 2000+ blog articles

- 50+ Webinars

- 10+ Expert podcasts

- 50+ Infographics

- 10+ Checklists

- Research Guides

We hate spam too. We promise to protect your privacy and never spam you.

- AI in Academia

- Career Corner

- Diversity and Inclusion

- Infographics

- Expert Video Library

- Other Resources

- Enago Learn

- Upcoming & On-Demand Webinars

- Peer Review Week 2024

- Open Access Week 2023

- Conference Videos

- Enago Report

- Journal Finder

- Enago Plagiarism & AI Grammar Check

- Editing Services

- Publication Support Services

- Research Impact

- Translation Services

- Publication solutions

- AI-Based Solutions

- Thought Leadership

- Call for Articles

- Call for Speakers

- Author Training

- Edit Profile

I am looking for Editing/ Proofreading services for my manuscript Tentative date of next journal submission:

Which among these features would you prefer the most in a peer review assistant?

Creating a Questionnaire

Create the perfect questionnaire and collect actionable data using our online guide!

Table of Contents

- How to Create

Questionnaire Types

- Collecting Responses

- Analyzing Results

- Getting Started

What is a Questionnaire?

Definition: A questionnaire is a convenient way to collect feedback. A questionnaire can be used to measure customer satisfaction, capture employee feedback, or even conduct product research. Responses can be collected via email, web link, QR code, or using a survey panel.

The term "survey" and "questionnaire" are commonly used interchangeably. A questionnaire refers to the questions used to collect feedback (the form itself). A survey relates to the entire research process, including summarizing and analyzing questionnaire data.

Getting Started + Tips

How to make a questionnaire: Keep questions short and focused on one topic at a time. Use multiple-choice questions to fit answers into a specific category. Use an open-ended question to capture comments. A Likert scale or MaxDiff question can be used for market research. Collect responses for your questionnaire using an email collector, an anonymous link, or even a QR code.

The following 6 tips will help you create the perfect questionnaire:

1) Use 10 Questions or Less

The shorter you keep your survey, the higher your completion rates. Longer questionnaires usually tend to have a high drop-off percentage. Keeping your surveys to 10 questions or fewer forces you to draft a study that only includes important questions; you should remove trivial questions during the draft process.

2) One Idea Per Question

Make sure each question only covers one topic. Try to include only one topic at a time. For example, in an employee survey, you would not want to ask, "Do you feel satisfied with your compensation and career advancement?". Instead, you would like to separate "compensation" and "career advancement" into two questions or use a Likert scale , putting each question on a separate row.

3) Group Similar Questions Together

Suppose the survey is more than ten questions; similar questions should be grouped on separate pages. If you don't want to use more than one page, add extra spacing between groups of the question; extra white space can increase the increase the readability of your questionnaire.

4) Use Skip/Display Logic

If you have questions that only apply to certain people, consider using skip or display logic to show those questions conditionally. This will help reduce the length of your survey and boost response rates.

If you have questions that only apply to certain people, consider using skip or display logic to show those questions conditionally. This will help reduce the length of your survey and boost response rates. For example, if you asked, "Are you currently looking for new employment opportunities?". If the answer were "yes," a follow-up question would ask, "Why?"

5) Use Research Questions Like MaxDiff

Research questions are an excellent tool for customer or product questionnaires. Instead of asking multiple questions on which features are essential or what price is desirable, question types like MaxDiff and Conjoint will provide you with high-quality, actionable data that can be used for feature prioritization and product pricing. In addition, these question types will reduce the length of your questionnaire.

6) Keep the Audience in Mind

An employee questionnaire should use an anonymous link to collect responses; this will help boost trust and increase honest answers. If doing a customer study, consider adding custom data to the weblink to help identify responses. A survey panel and current customers can lend fresh perspectives for general market research.

Questionnaire Templates

Adding customer surveys to your Google review strategy will add additional data points to improve customer satisfaction. In addition, surveys are a valuable tool to identify ways to improve, establish internal benchmarks, and conduct pricing and product research to improve your company's products.

While there are numerous types of questionnaires (or survey types), these are the five most common general categories:

1) Customer Satisfaction

Capturing customer feedback is one of the most common uses of questionnaires. A good customer satisfaction survey will always revolve around a Net Promoter Score question. When the Net Promoter Score question results are tallied, one number from -100 is 100 is displayed. This number is ideal for benchmarks. Net Promoter provides quick and actionable feedback when combined with an open-ended text question.

2) Customer Effort

Measuring how easily customers can complete a purchase or take a specific action is crucial for the customer experience strategy. A customer effort score question is a rating scale from 1 to 7 (disagree to agree). Results for this question are averaged; the higher the score, the easier it is for your customers to complete tasks.

3) Employee Satisfaction & Engagement

Employee satisfaction and engagement are often used interchangeably but measure different things. Both types of surveys often use opinion scales to ask questions.

Employee satisfaction measures how satisfied employees are with their job and work environment. Standard measures of employee satisfaction include salary, benefits, and co-worker relationships.

Employee engagement relates to the emotional commitment employees have to an organization. It goes beyond simple satisfaction. Standard measures of engagement include belief in the company mission, opportunities for career growth, and being inspired to perform at a high level.

4) Employee Exit Interviews

When employees leave for new opportunities, sending a questionnaire is a great way to understand why that employee is leaving. The feedback obtained here can be used to improve the workplace and reduce employee turnover.

5) Product Research

MaxDiff is used to identify what is most important to your audience. For example, if building a new mobile application, asking a group of users what they think is least and most important will help guide product strategy; your team should only focus on the important areas.

For pricing a new product, Van Westendorp will give you a range of prices the market is willing to expect. You could price your product too high or too low without a question like this, reducing your market penetration.

Collecting Responses For Your Questionnaire

There are a few different ways to collect feedback for questionnaires. Depending on your needs, each one could have an advantage.

With email distribution, you would upload a list of email addresses, and the platform would automatically place a link to your questionnaire inside the email body. One advantage is sending email reminders to respondents who still need to complete your survey. In addition, the email links are unique for each respondent, so you can track email open and click rates. As a result, email surveys are ideal for customer research.

A web link is a convenient way to collect feedback at your convenience. You can place a web link on social media, your website, or even inside your CRM email program (instead of an email collector with a unique link to each person). Custom data can be included in the link, such as store location. This custom data can be used to segment and filter results.

Anonymous Link

When you want to protect your respondents' identities, you use an anonymous link . Anonymous inks do not store respondent information, IP address, or email address. Because of this, anonymous survey links are perfect for employee surveys.

QR code Surveys

QR code surveys can be placed on paper receipts, product packaging, or flyers. In addition, QR codes are a great way to collect feedback after or during an event or even during in-person focus groups.

Survey Panels

If you're conducting market research and need access to a customer base, using a survey panel will get you the responses required. A good survey panel will allow you to target specific demographics, job titles, or interest levels (such as car enthusiasts). When using survey panels, you'll want to double-check and clean your data for low-quality responses. People who speed through your survey or mark the first answer for all questions should be removed.

How to Analyze Questionnaire Data

When analyzing the data from a questionnaire, consider a few advanced techniques like the ones below. These techniques will give you better insights than just simple graphs and charts.

Creating a segment or a cross-tabulation is the easiest way to dive deeper into your results. For example, if you conducted an employee satisfaction survey, the overall scores for the company could be high. But that might only tell part of the story. For example, if your company has multiple departments, you should create a cross-tabulation for each department. You might notice that there is one department with low scores. or one department with high scores.

If your company conducted its first Net Promoter Score survey and the results were -10, that score would be your benchmark. Each subsequent customer survey you run should be compared against that initial number to improve it each time.

TURF Analysis

This is an advanced research technique but very valuable. TURF analysis analysis stands for "Total Unduplicated Reach and Frequency" and is used to find the combination of items that would provide the highest reach level. For example, suppose you ask, "Which of the following flavor of ice cream would you buy?" If you run a TURF analysis on the results, you could find the top 3 or 4 combinations of flavors that would result in the highest sales.

Unsure Where to Start?

Creating a questionnaire can be a challenging process. However, these three suggestions can help you with the perfect questionnaire strategy.

1) Talk With Your Team

Some departments might want to conduct pricing research and do simple Net Promoter Score surveys. Having your organization aligned on strategy will simplify the process and eliminate any possibility of re-work. An aligned strategy will also mean a shorter study with fewer overlapping questions.

2) Start with a Template

A pre-made template will show you how to format and word questions. Next, try multiple templates to understand the various question types.

3) Look at Competitor Surveys

You might notice competitors asking specific questions - this would be a sign that those questions provide valuable metrics. If you can incorporate the great things your competition does while making it more efficient for respondents, your questionnaire campaigns will have a greater chance of success.

Get Started Now

We have you covered on anything from customer surveys, employee surveys, to market research. Get started and create your first survey for free.

Imperial College London Imperial College London

Latest news.

Developing a new test to improve sepsis outcomes

NHS using Imperial spinout’s advanced prescription software to improve safety

Work starts on world’s most sensitive ultra-rare particle detector

- Centre for Higher Education Research and Scholarship

- Research and Innovation

- Education evaluation toolkit

- Tools and resources for evaluation

- Questionnaires

Best practice in questionnaire design

The following guide to developing questionnaire items and organising the questionnaire is based on best practice (Gehlbach & Brinkworth, 2011; Gehlbach & Artino Jr., 2018). These best practices have been tested across over 40 years of research (Krosnick & Presser, 2010; Schwarz, 1999).

Best practice for creating items

Word items as questions rather than statements and avoid 'agree-disagree' response options.

Agree-disagree response options may introduce acquiescence bias, which is the tendency to agree with an item regardless of its content (Wright, 1975). Asking respondents to rate their level of agreement to different statements can be cognitively demanding, which increases respondent error and reduces respondent effort (Fowler, 2009). Instead, use verbally labelled response options that reinforce the underlying topic (e.g., the responses for “How happy are you?” would be not at all happy, slightly happy, somewhat happy, quite happy, extremely happy). Empirical evidence demonstrates that agree-disagree response options diminish item quality (Saris, Revilla, Krosnick, Schaeffer, & Shaeffer, 2010), and are among the “worst ways to present items” (Gehlbach & Artino Jr., 2018, p. 361).

Use verbal labels for each response option

Use verbal labels for each response option, rather than labelling only the end points of the response options or labelling with both numbers and verbal labels. This helps to focus the attention of the respondent and reduce measurement error (Artino, Jr. & Gehlbach, 2012).

Ask about one idea at a time

Ask about one idea at a time rather than using double-barrelled items, which ask about two or more ideas in the same question (e.g., instead of asking, “How happy and engaged are you?” ask two questions, one about happiness and one about engagement). If you use double-barrelled items, you risk students responding to only one part of that item (Dillman, Smyth, & Christian, 2014)

Phrase questions with positive language

Phrase questions with positive language rather than using reverse scored or negative language, which students tend to have trouble understanding. Negative words are more difficult to process cognitively, which leads these items to take longer to answer and leads to misresponses (Swain, Weathers, & Niedrich, 2008).

Use at least five response options per scale

Use at least five response options per scale to capture a wider range of perceptions. Research indicates that the “sweet spot” of the number of response anchors is about five (Weng, 2004; Nielsen, Makransky, Vang, & Danmeyer, 2017). A five-item scale that assesses a representative cross-section of a student’s experience should improve measurement (Gehlbach & Artino Jr., 2018).

Maintain equal spacing between repsonse options. Use additional space to visually separate non-substansive response options

Maintain equal spacing between response options, and use additional space to visually separate non-substantive response options. This will reinforce the notion that conceptually, there is equal distance between each response option, which yields less biased responses. Moreover, this will help align the visual midpoint with the conceptual midpoint, reducing measurement error (Artino, Jr. & Gehlbach, 2012). This is especially important if you are administering your questionnaire on paper. Electronic questionnaire administrators such as Qualtrics will space response options equally, and you will have to be aware to add an extra space to separate non-substantive response options (e.g., ‘N/A’). To see some examples, check out the resources for evaluating self-efficacy and take a look at this visual guide ).

Best practice for organising the whole questionnaire

This guidance has been summarised from Gehlbach and Artino (2018).

Ask the more important items earlier in the questionnaire

This will increase the likelihood that respondents will answer these questions whilst they are focused and have energy.

Ensure each item applies to each respondent

Make sure that item content applies to each respondent and is worded accessibly, or you risk alienating respondents to whom the item does not apply (Dillman, Smyth, & Christian, 2014).

Use scales rather than single items

Scales bolster accuracy, with each question addressing a representative cross-section of the experience.

Maintain a consistent visual layout of the questionnaire

This helps maintain clarity for the respondent, who can then complete the questionnaire more efficiently.

Place sensitive items (e.g. demographic questions) later in the questionnaire

Respondents will feel more comfortable sharing this information later on in the questionnaire.

Artino, Jr., A. R., & Gehlbach, H. (2012). AM Last Page: Avoiding Four Visual-Design Pitfalls in Survey Development. Academic Medicine, 87 (10), 1452. Retrieved from https://www.researchgate.net/profile/Hunter_Gehlbach/publication/231210670_AM_Last_Page_Avoiding_Four_Visual-Design_Pitfalls_in_Survey_Development/links/5a835de6aca272d6501eb6a3/AM-Last-Page-Avoiding-Four-Visual-Design-Pitfalls-in-Survey-Development.pdf

Dillman, D. A., Smyth, J. D., & Christian, L. M. (2014). Internet, Phone, Mail, and Mixed-Mode Surveys: The Tailored Design Method (4th ed.). Hoboken, New Jersey: John Wiley & Sons, Inc.

Gehlbach, H., & Artino Jr., A. R. (2018). The survey checklist (manifesto). Academic Medicine, 93 (3), 360-366. Retrieved from https://journals.lww.com/academicmedicine/fulltext/2018/03000/The_Survey_Checklist__Manifesto_.18.aspx#pdf-link

Gehlbach, H., & Brinkworth, M. E. (2011). Measure twice, cut down error: A process for enhancing the validity of survey scales. Review of General Psychology, 15 (4), 380-387. Retrieved from https://dash.harvard.edu/bitstream/handle/1/8138346/Gehlbach%20-%20Measure%20twice%208-31-11.pdf?sequence=1&isAllowed=y

Krosnick, J. A., & Presser, S. (2010). Question and questionnaire design. In P. V. Marsden, & J. D. Wright (Eds.), Handbook of Survey Research. Bingley, England: Emerald Group Publishing.

Nielsen, T., Makransky, G., Vang, M. L., & Danmeyer, J. (2017). How specific is specific self-efficacy? A construct validity study using Raschmeasurement models. Studies in Educational Evaluation, 53 , 87-97.

Saris, W. E., Revilla, M., Krosnick, J. A., Schaeffer, E. M., & Shaeffer, E. M. (2010). Comparing questions with agree/disagree response options to questions with item-specific response options. Survey Research Methods, 4 , 61-79.

Schwarz, N. (1999). Self-reports: how the questions shape the answers. American Psychology, 54 , 93-105.

Swain, S. D., Weathers, D., & Niedrich, R. W. (2008). Assessing three sources of misreponse to reversed Likert items. Journal of Marketing Research, 45 , 116-131.

Weng, L. -J. (2004). Impact of the number of response categories and anchor labels on coefficient alpha and test-retest reliability. Educational and Psychological Measurement, 64 , 956-972. Retrieved from https://journals.sagepub.com/doi/pdf/10.1177/0013164404268674

Wright, J. D. (1975). Does acquiescence bias the 'Index of Political Efficacy?'. The Public Opinion Quarterly, 39 (2), 219-226.

- Utility Menu

Harvard University Program on Survey Research

- Questionnaire Design Tip Sheet

This PSR Tip Sheet provides some basic tips about how to write good survey questions and design a good survey questionnaire.

| 40 KB |

PSR Resources

- Managing and Manipulating Survey Data: A Beginners Guide

- Finding and Hiring Survey Contractors

- How to Frame and Explain the Survey Data Used in a Thesis

- Overview of Cognitive Testing and Questionnaire Evaluation

- Sampling, Coverage, and Nonresponse Tip Sheet

- Introduction to Surveys for Honors Thesis Writers

- PSR Introduction to the Survey Process

- Related Centers/Programs at Harvard

- General Survey Reference

- Institutional Review Boards

- Select Funding Opportunities

- Survey Analysis Software

- Professional Standards

- Professional Organizations

- Major Public Polls

- Survey Data Collections

- Major Longitudinal Surveys

- Other Links

Root out friction in every digital experience, super-charge conversion rates, and optimize digital self-service

Uncover insights from any interaction, deliver AI-powered agent coaching, and reduce cost to serve

Increase revenue and loyalty with real-time insights and recommendations delivered to teams on the ground

Know how your people feel and empower managers to improve employee engagement, productivity, and retention

Take action in the moments that matter most along the employee journey and drive bottom line growth

Whatever they’re are saying, wherever they’re saying it, know exactly what’s going on with your people

Get faster, richer insights with qual and quant tools that make powerful market research available to everyone

Run concept tests, pricing studies, prototyping + more with fast, powerful studies designed by UX research experts

Track your brand performance 24/7 and act quickly to respond to opportunities and challenges in your market

Explore the platform powering Experience Management

- Free Account

- Product Demos

- For Digital

- For Customer Care

- For Human Resources

- For Researchers

- Financial Services

- All Industries

Popular Use Cases

- Customer Experience

- Employee Experience

- Net Promoter Score

- Voice of Customer

- Customer Success Hub

- Product Documentation

- Training & Certification

- XM Institute

- Popular Resources

- Customer Stories

- Artificial Intelligence

Market Research

- Partnerships

- Marketplace

The annual gathering of the experience leaders at the world’s iconic brands building breakthrough business results, live in Salt Lake City.

- English/AU & NZ

- Español/Europa

- Español/América Latina

- Português Brasileiro

- REQUEST DEMO

How to create an effective survey in 15 simple tips

Updated August 22, 2024

You don’t have to be an expert to create a survey, but by following a few survey best practices you can make sure you’re collecting the best data possible.

Access 50+ expert-designed survey templates with a free Qualtrics Surveys account

From working out what you want to achieve to providing incentives for respondents, survey design can take time.

But when you don’t have hours to devote to becoming a survey-creation guru, a quick guide to the essentials is a great way to get started.

In this article, we’re going to reveal how to create a survey that’s easy to complete, encourages collecting feedback, hits the research questions you’re interested in, and produces data that’s easy to work with at the analysis stage .

15 Tips when creating surveys

1. define the purpose of the survey.

Before you even think about your survey questions , you need to define their purpose.